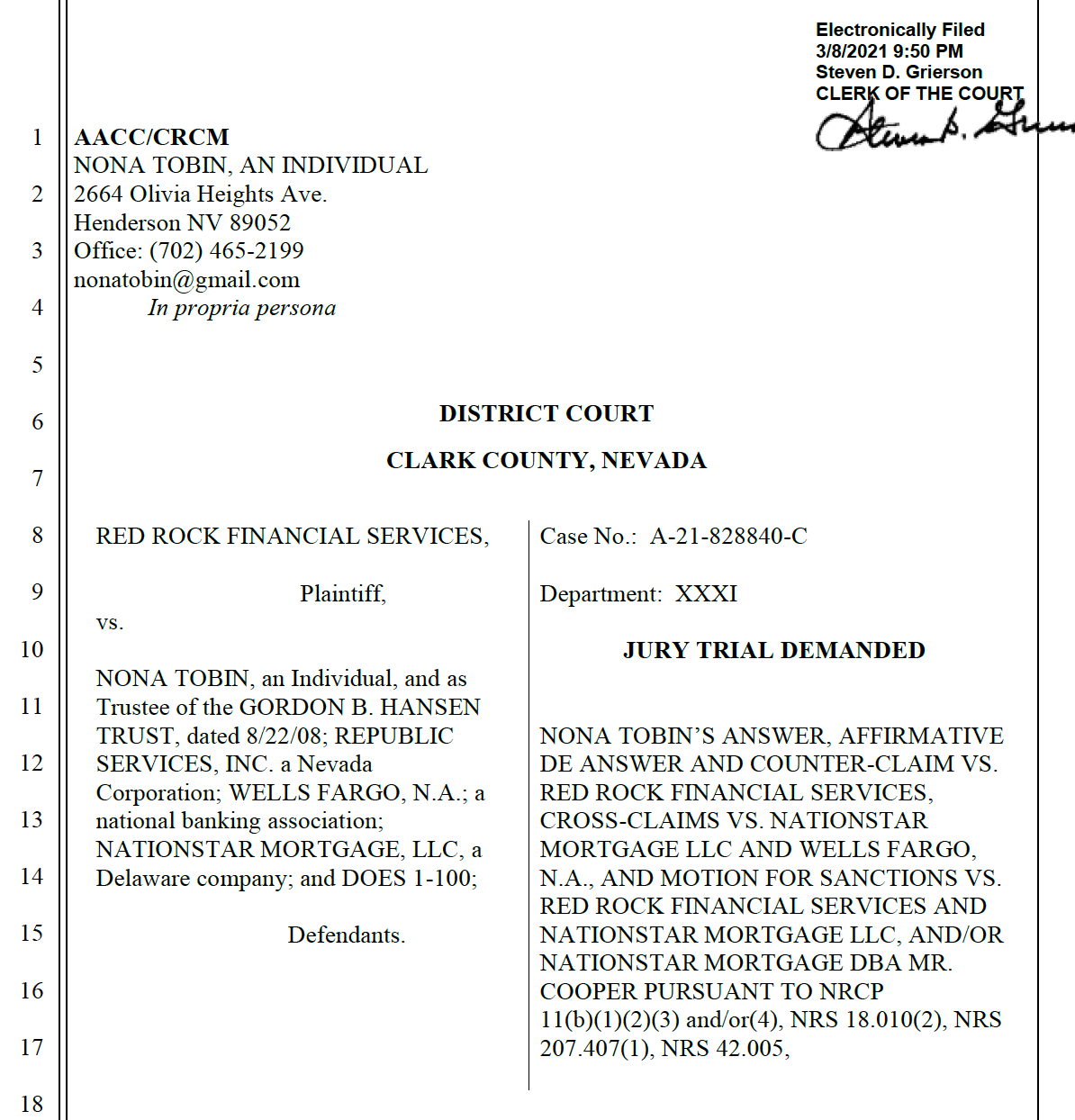

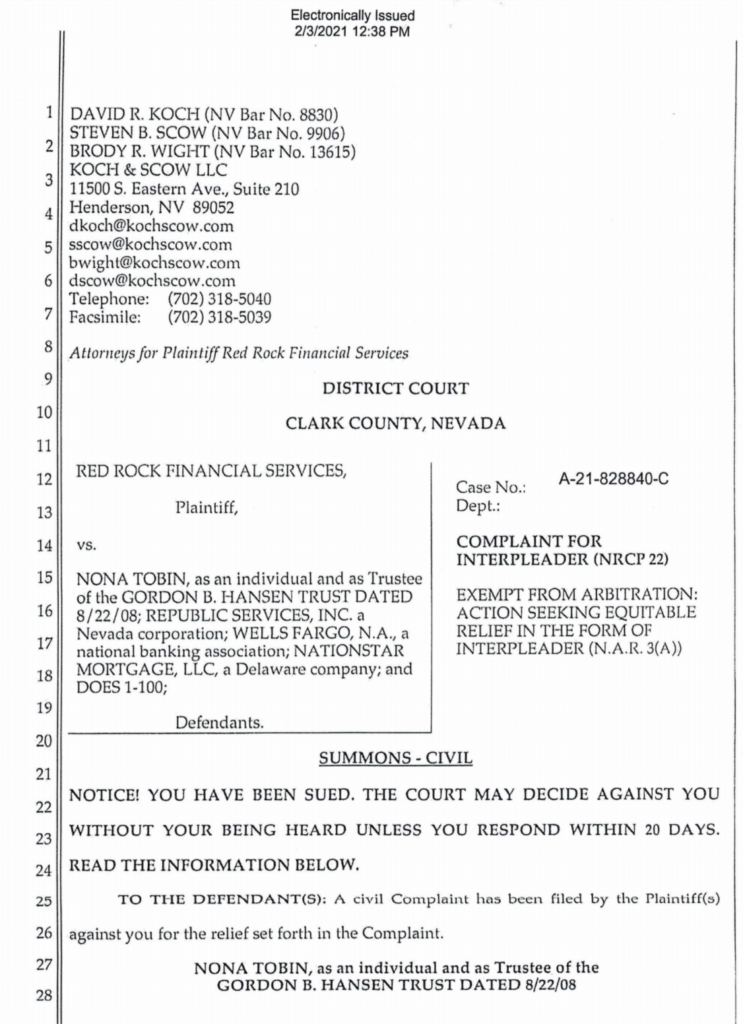

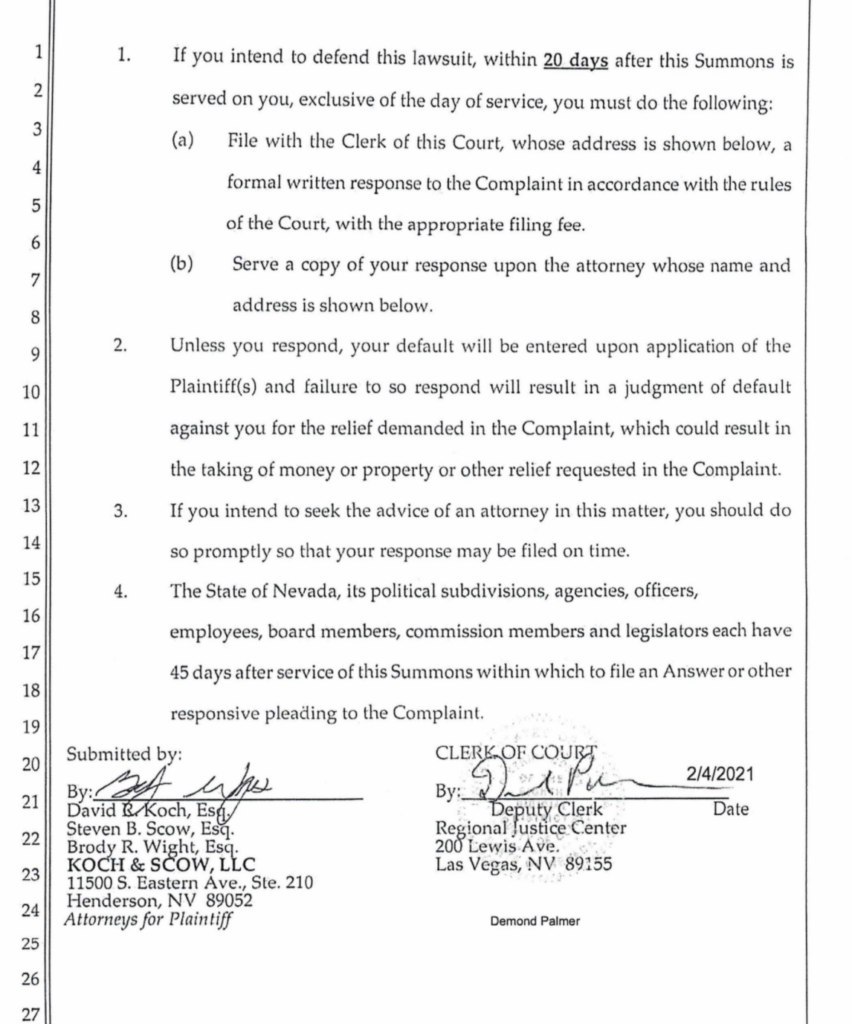

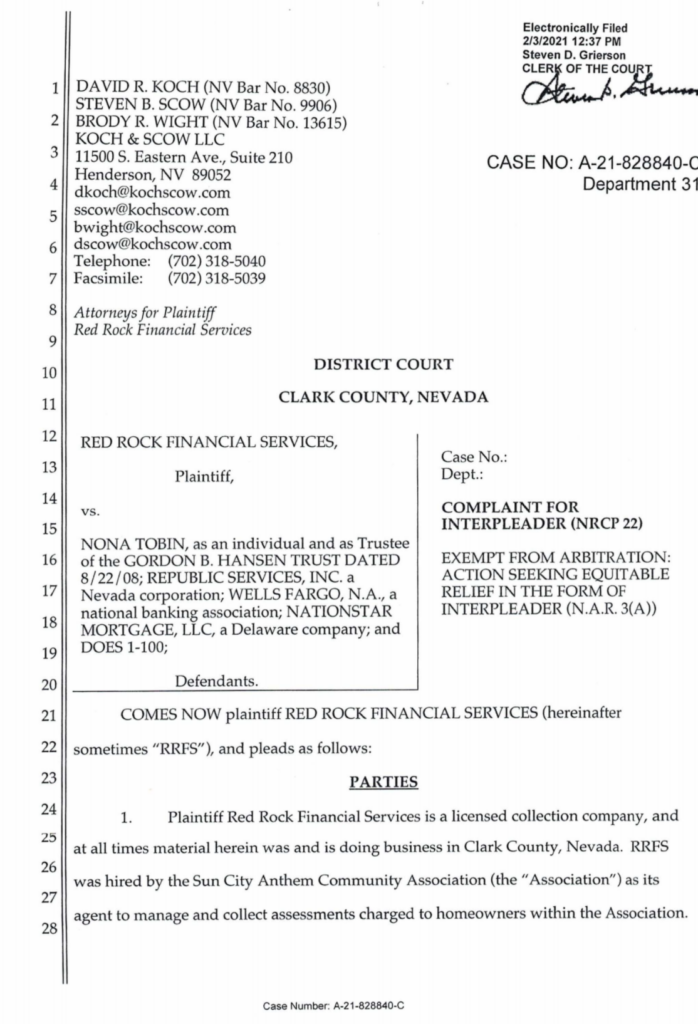

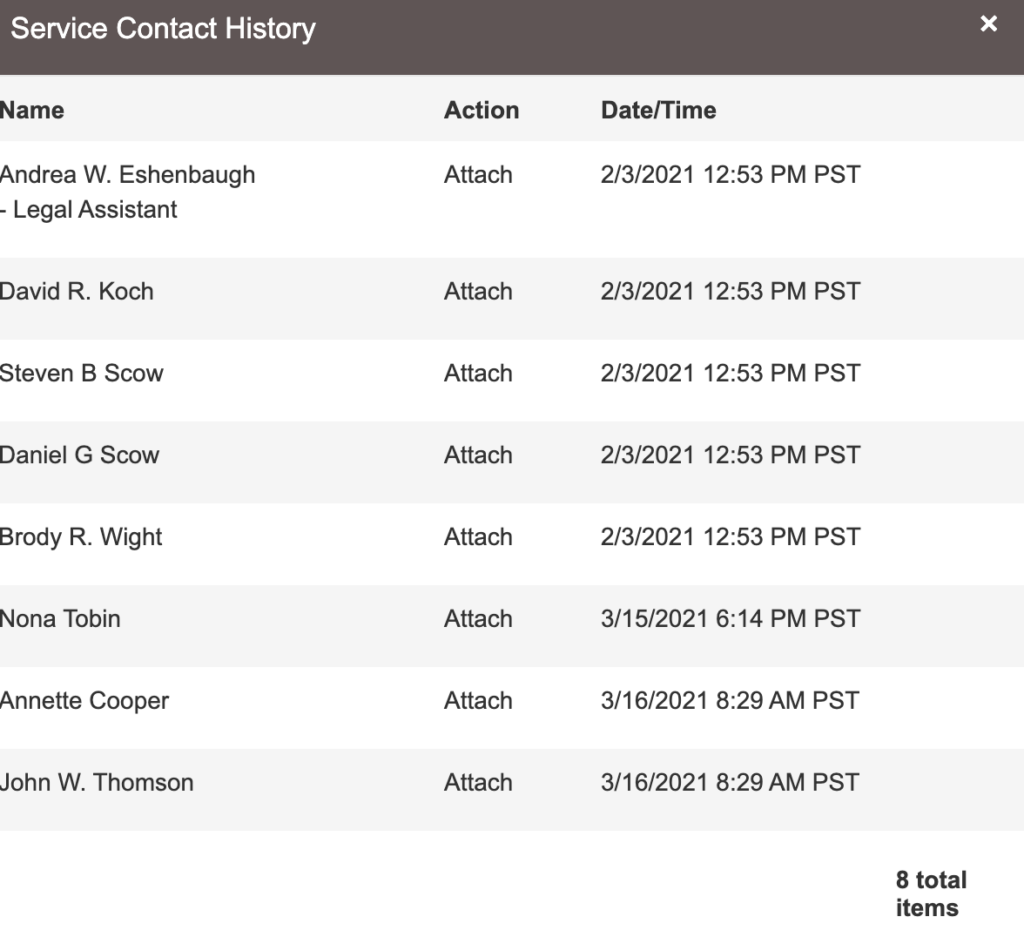

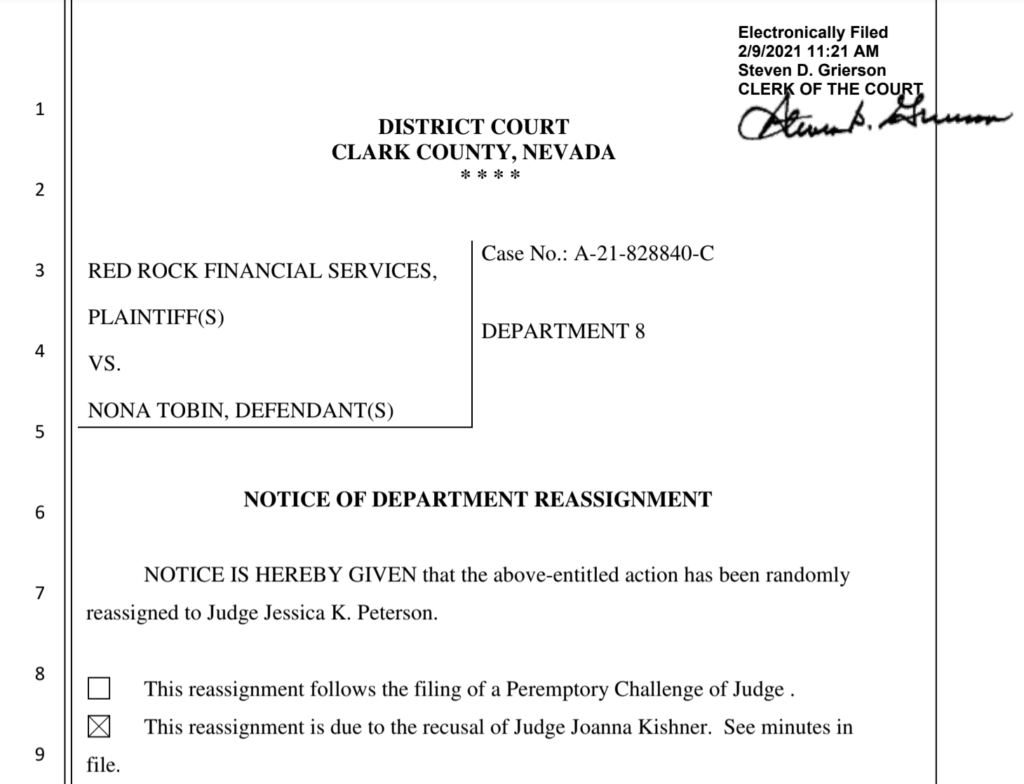

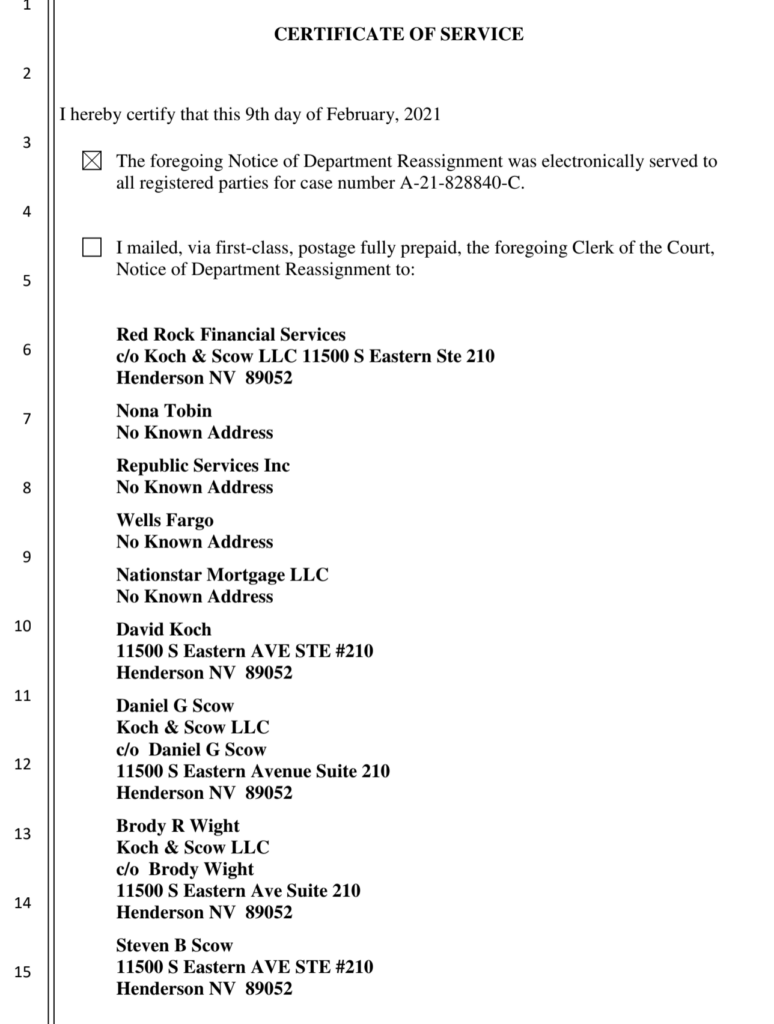

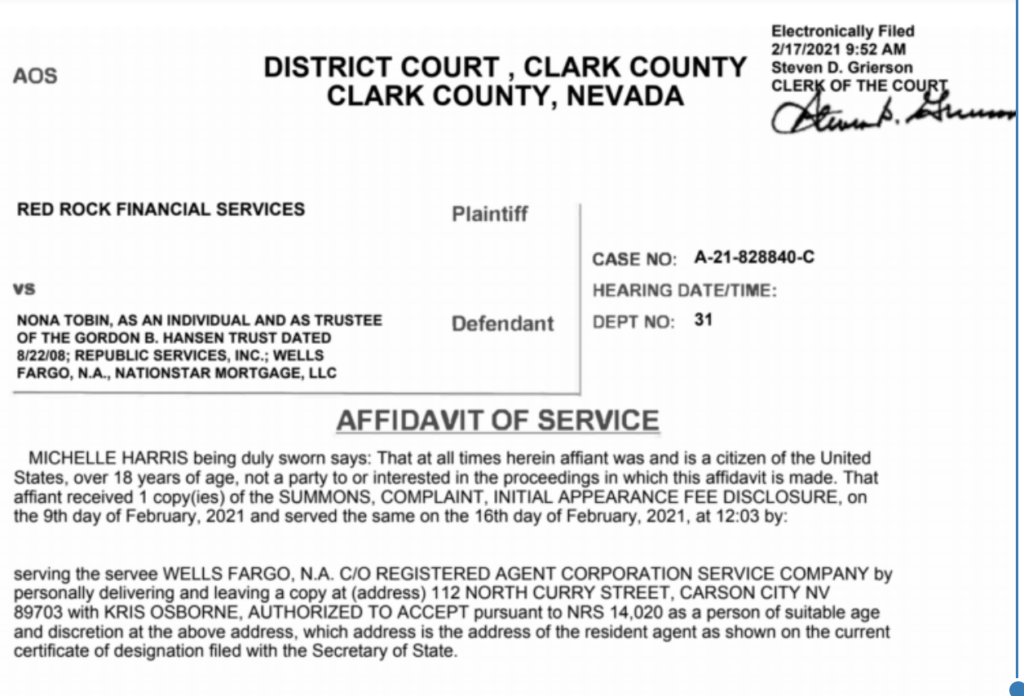

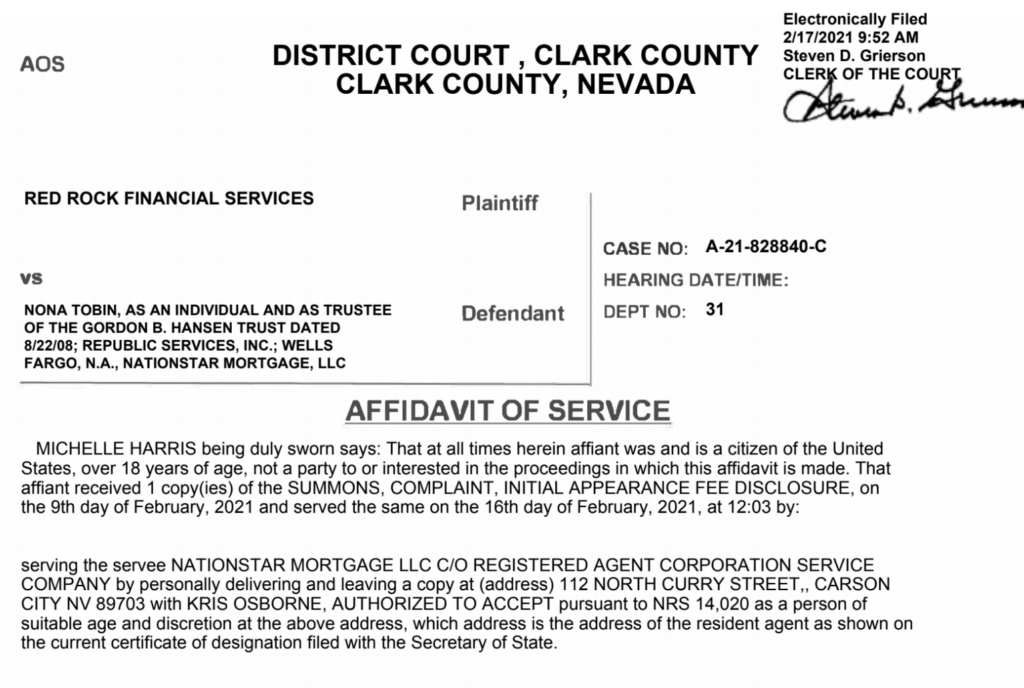

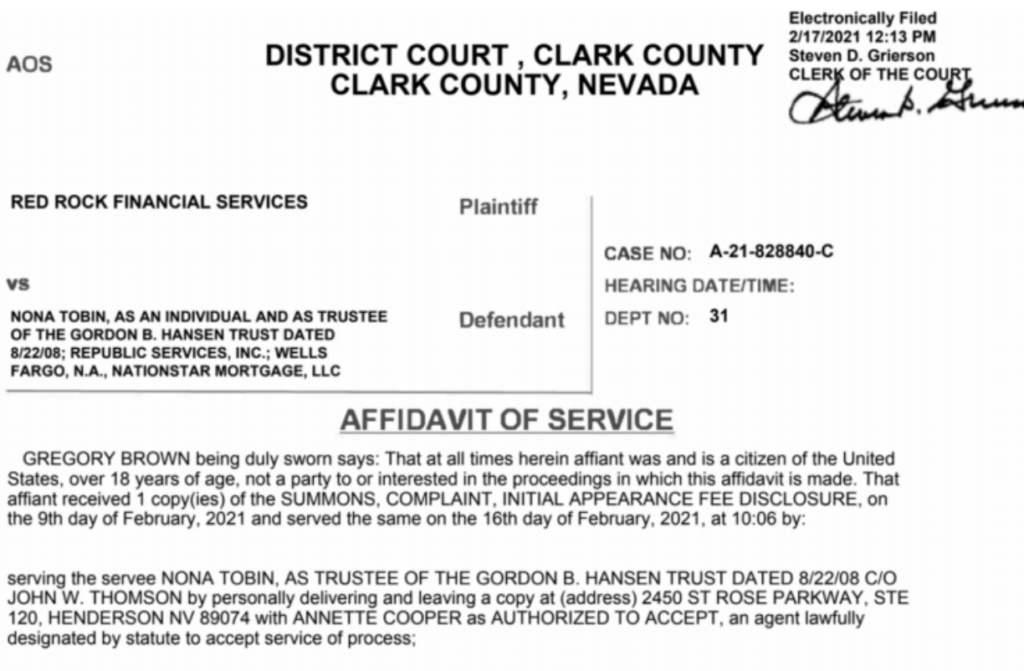

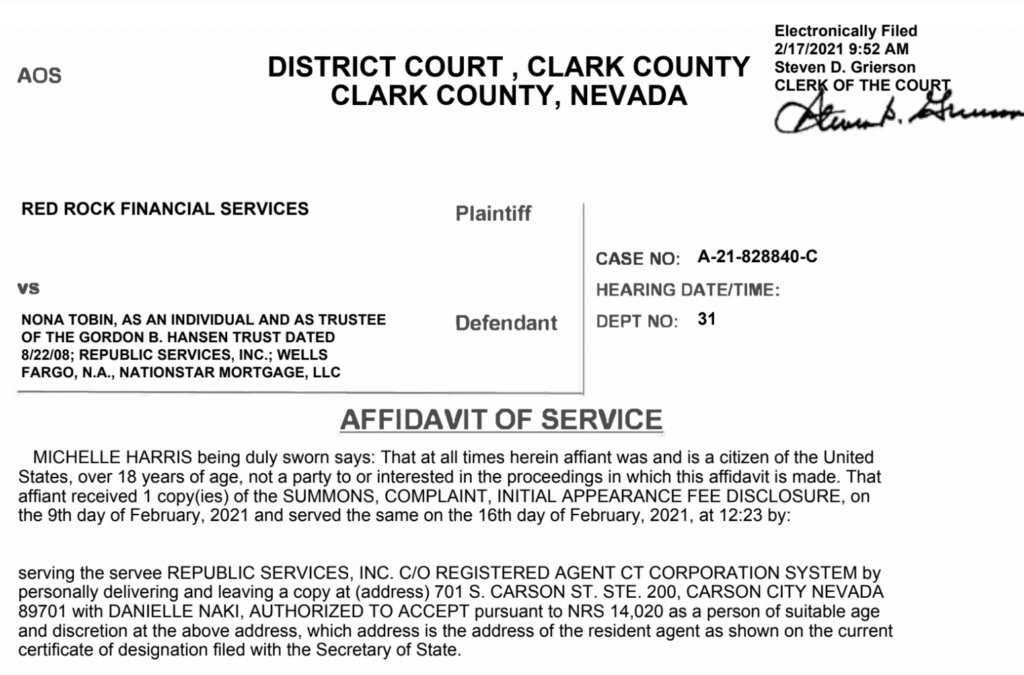

Administrative Complaints have been rejected for lack of jurisdiction or deferred pending adjudication of A-21-828840-C by Judge Jessica K. Peterson

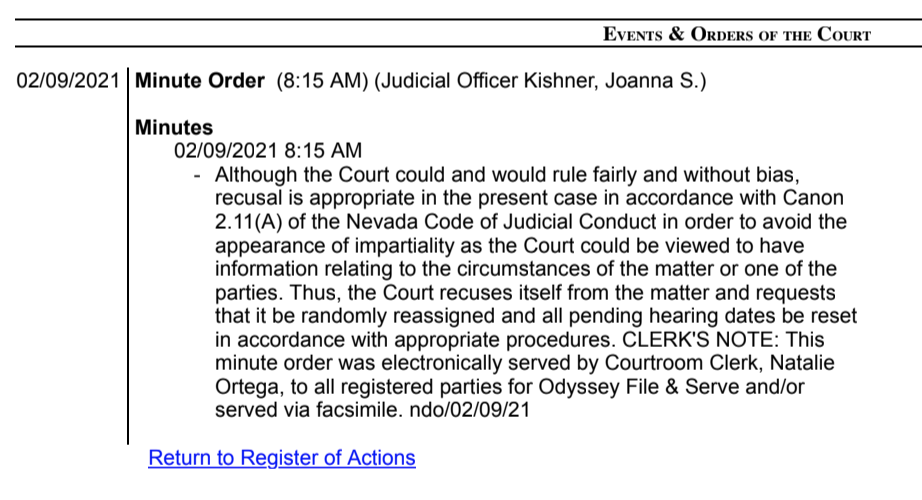

Link to 1/28/21 NCJD complaint to the Nevada Commission on Judicial Discipline vs. Judge Joanna Kishner

Link to 3/14/19 AG complaint vs. Nationstar & Jimijack Irevocable Trust

Link to 11/10/20 2nd AG complaint vs Nationstar; Akerman; Wright Finley Zak; Bank of America

Link to 12/16/20 complaint to the Mortgage Lending Division vs. Nationstar; Akerman; Wright Finley Zak; Bank of America

Link to 2/14/21 complaint to the State Bar of Nevada vs. Joseph Hong

Link to 2/16/21 complaint to the State Bar of Nevada vs. Brittany Wood

Prior district court civil actions did not adjudicate filed claims based on evidence

Link to Register of Actions A-16-730078-C Nationstar vs. Opportunity Homes LLC

Link to Case Summary A-15-720032-C Jimijack Irrevocable Trust vs. Bank of America and Sun City Anthem Community Association, Inc.

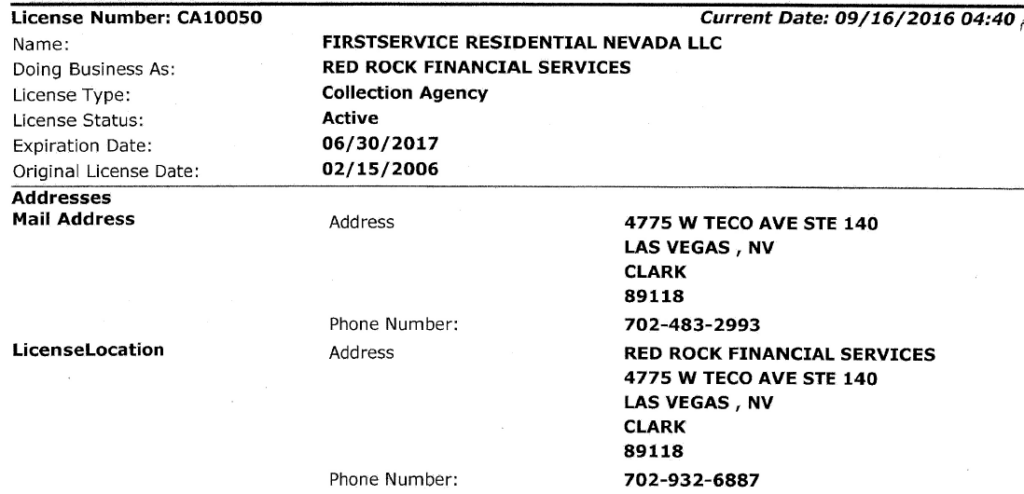

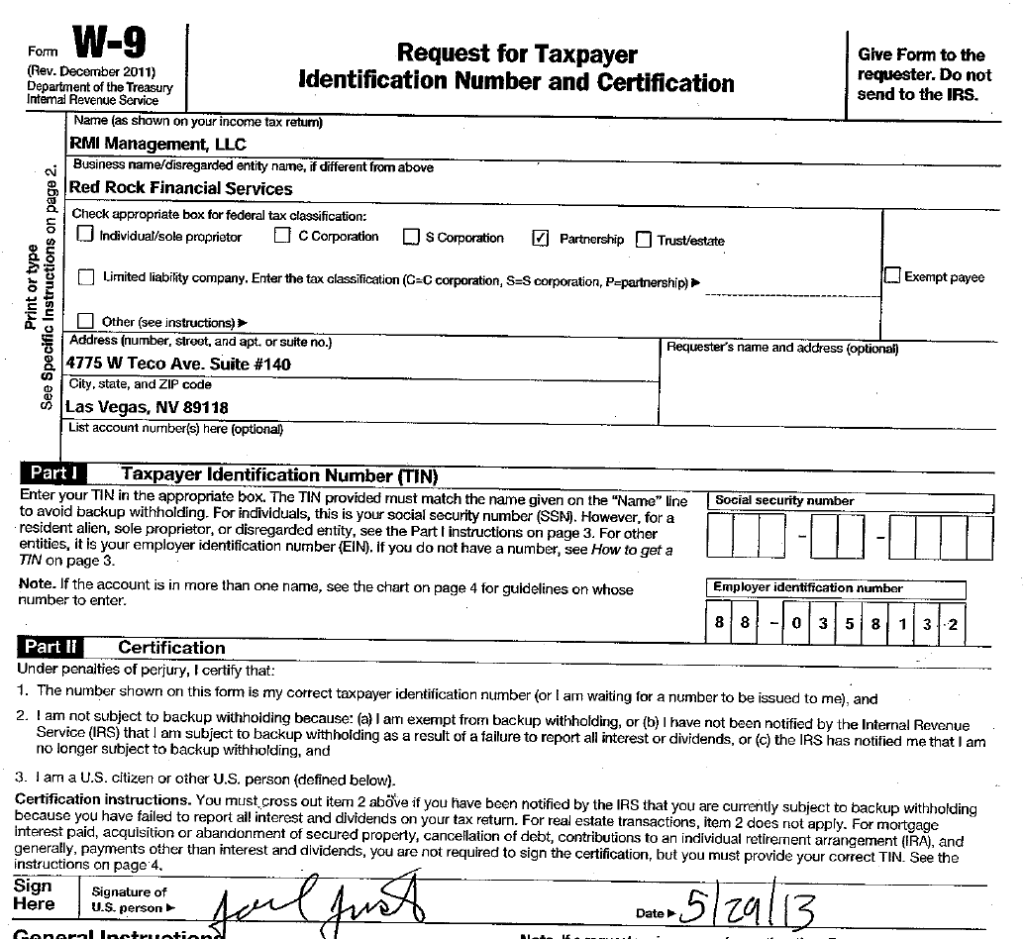

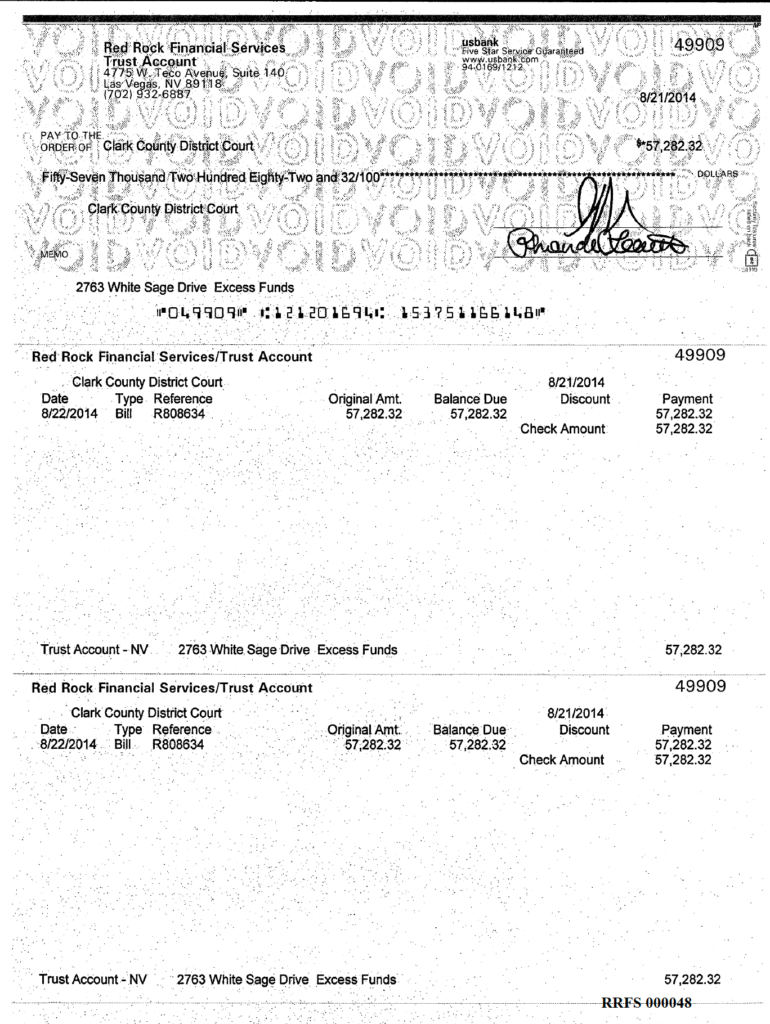

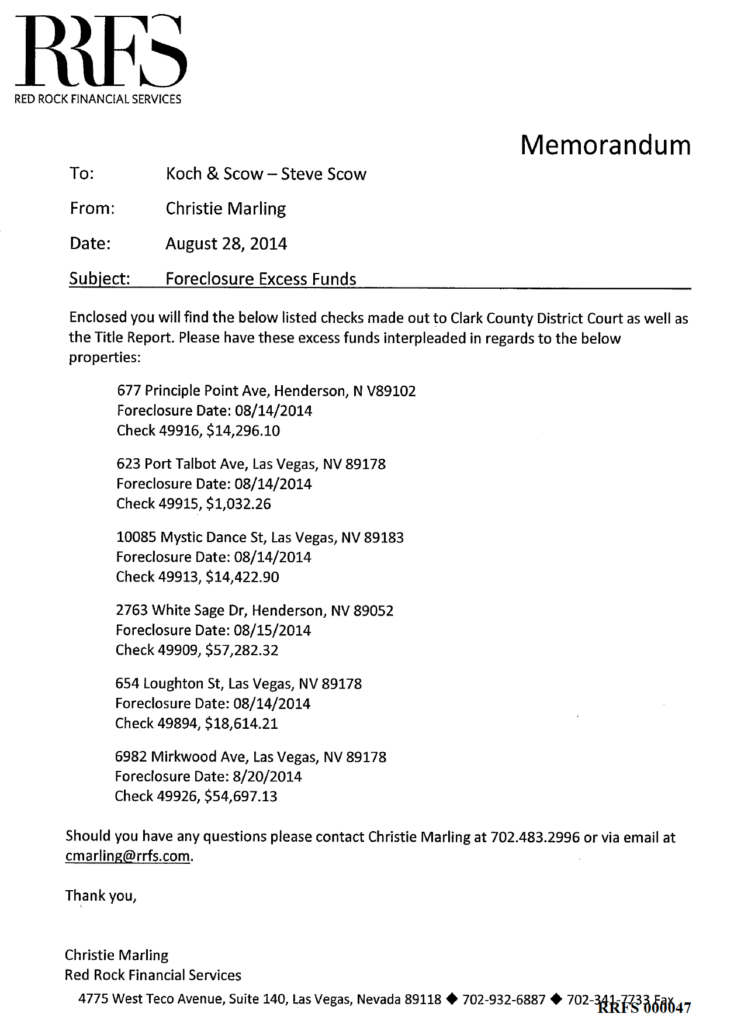

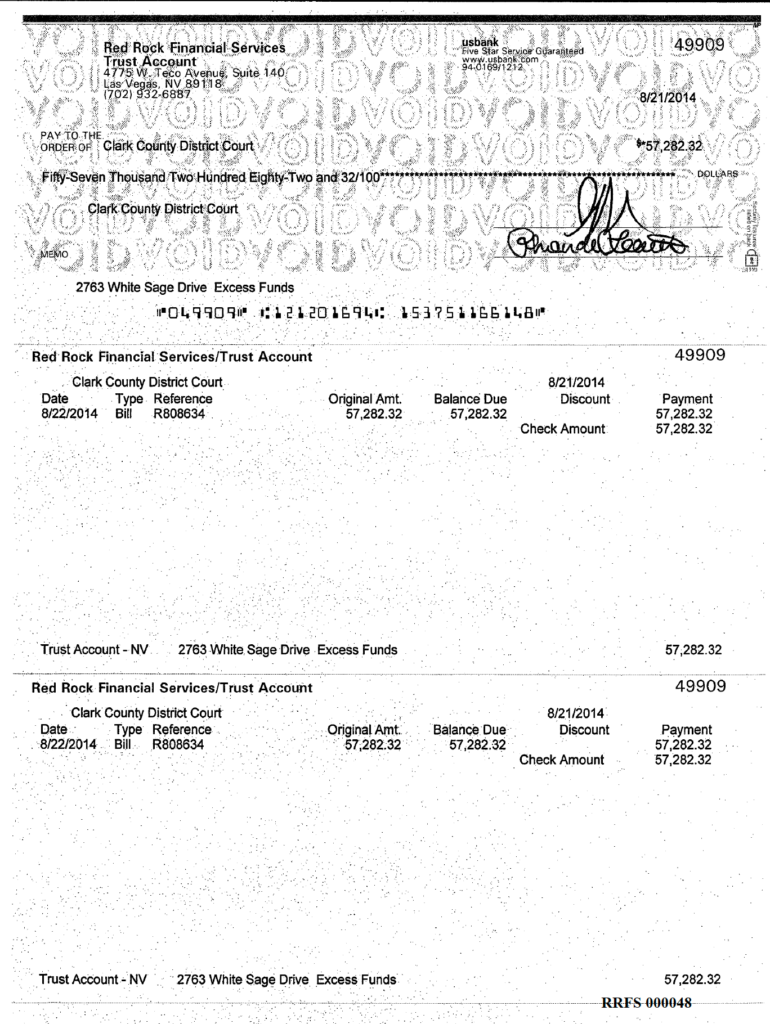

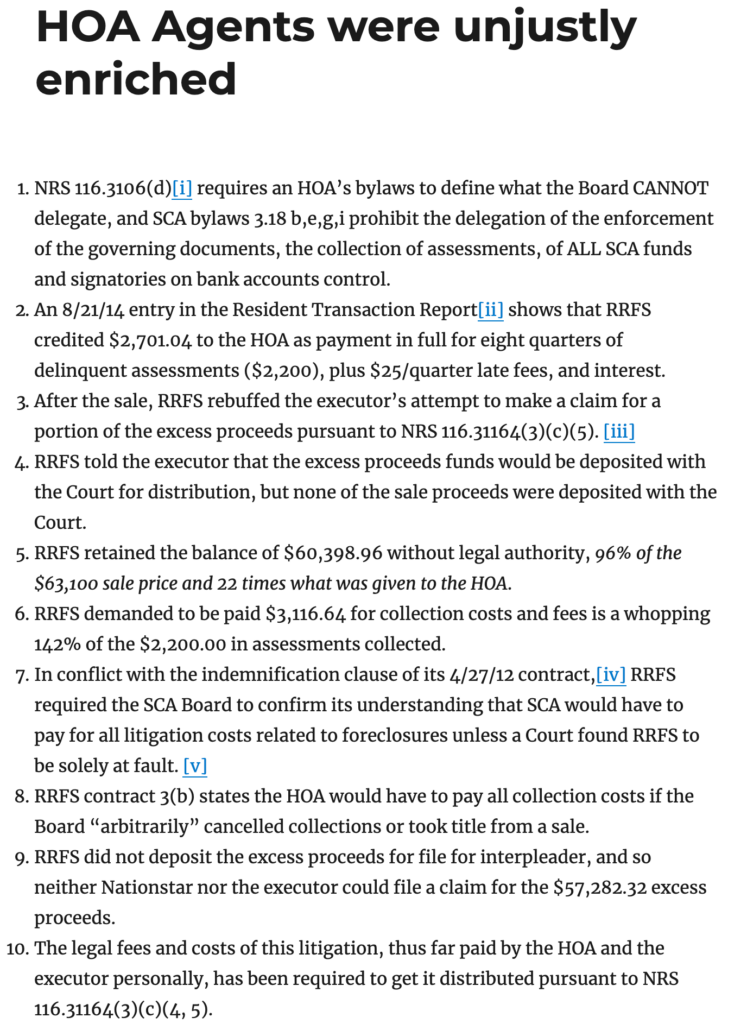

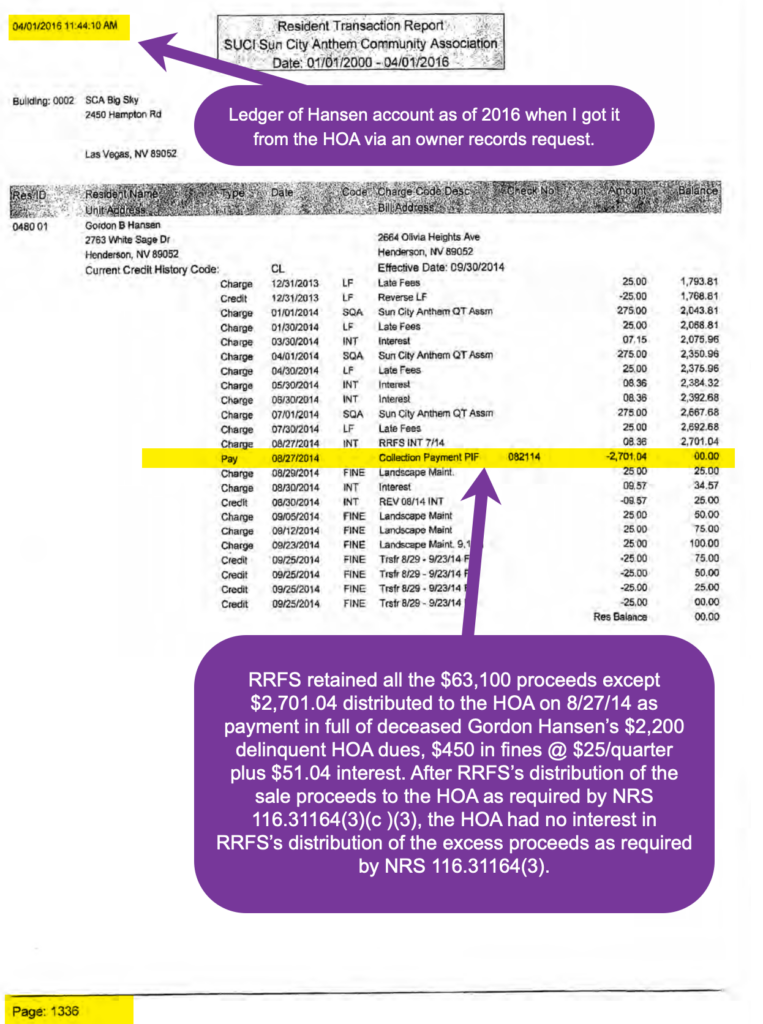

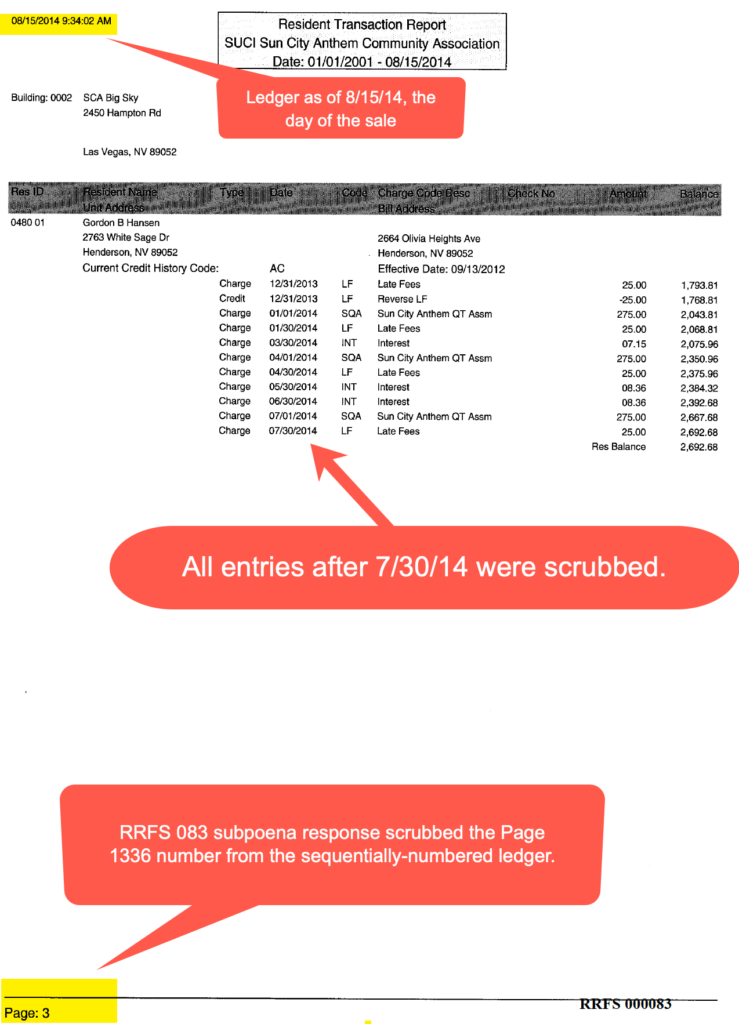

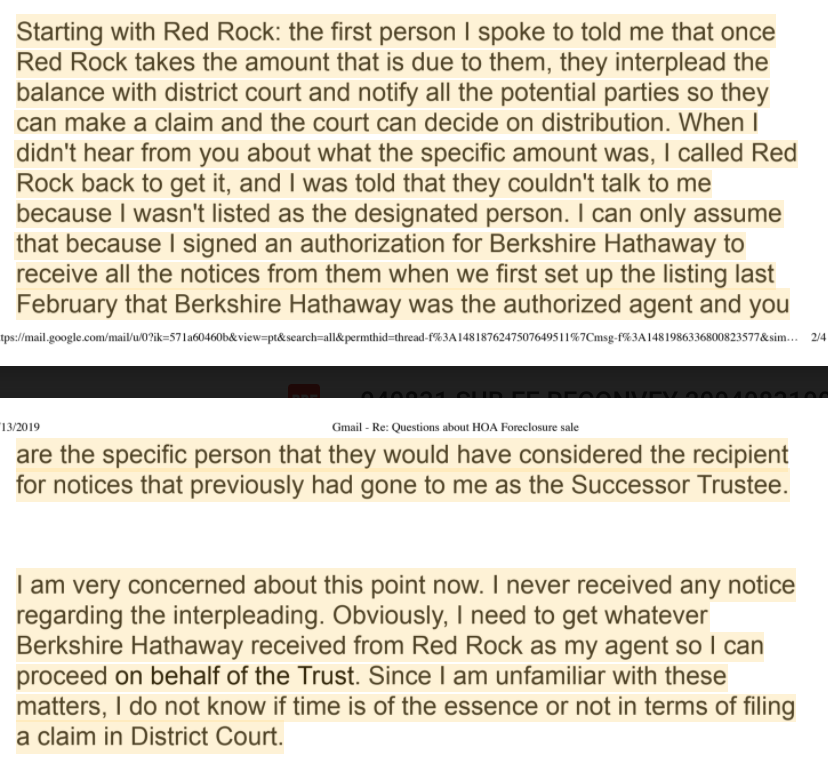

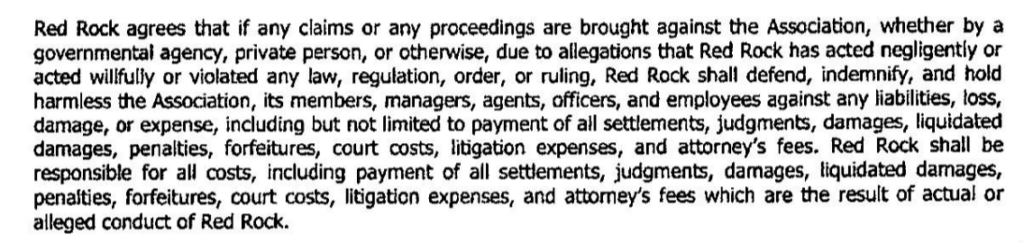

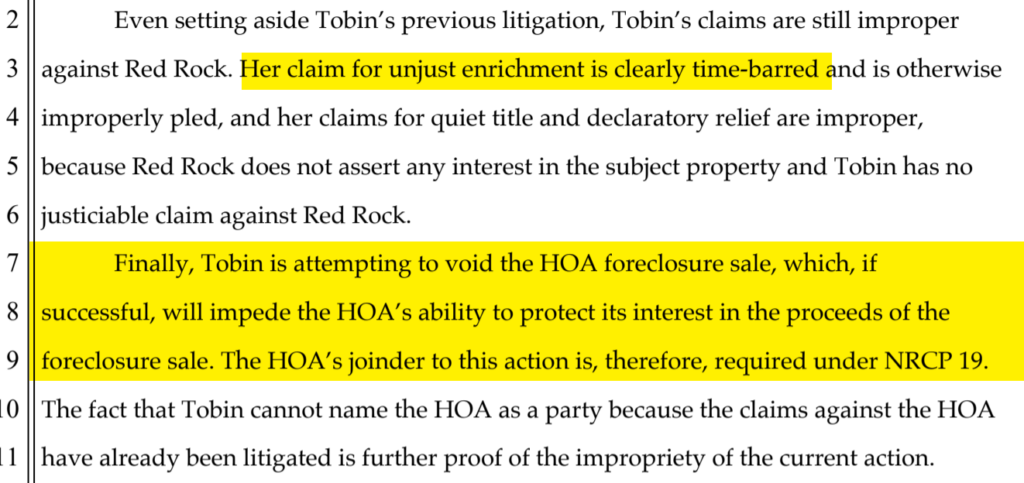

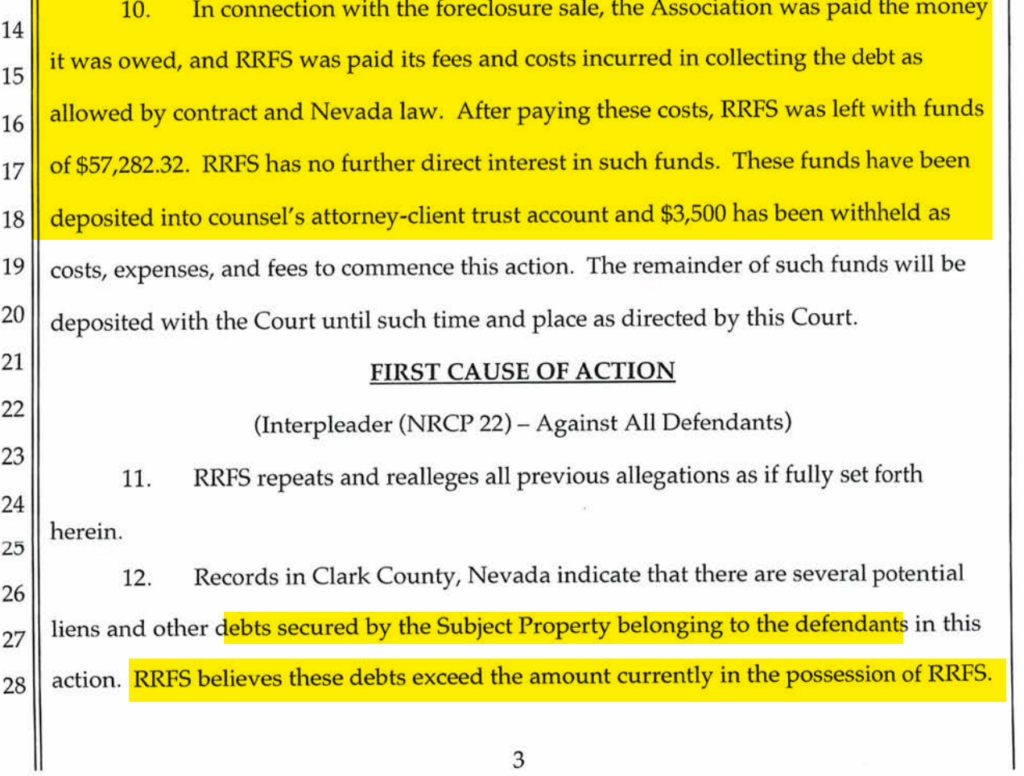

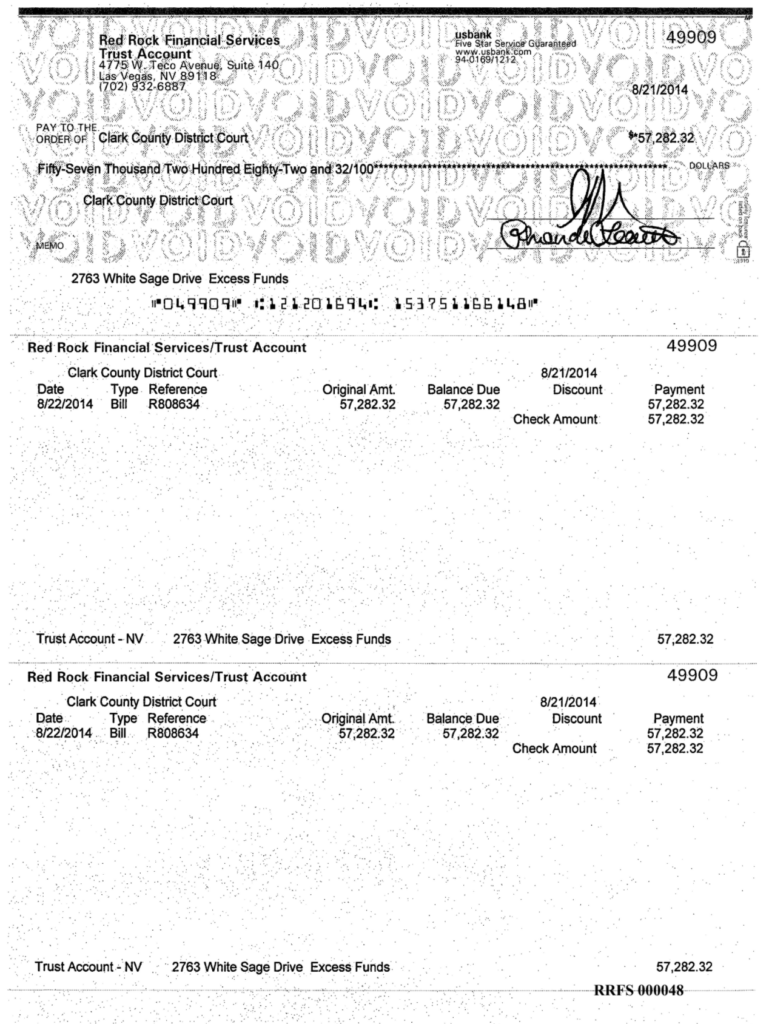

Link to case summary A-19-799890-C Nona Tobin vs. Red Rock Financial Services, Joel & Sandra Stokes as trustees of Jimijack, Jimijack Irrevocable Trust & Joel A. Stokes, an individual, Quicken Loans LLC and/or Inc. & Brian & Deborah Chiesi

The minutes of all hearings in the case summaries show that there were no evidentiary hearings and that neither Plaintiff, nationstar nor Jimijack, met their burden of proof.

Link to “Nationstar’s evidence was not examined“

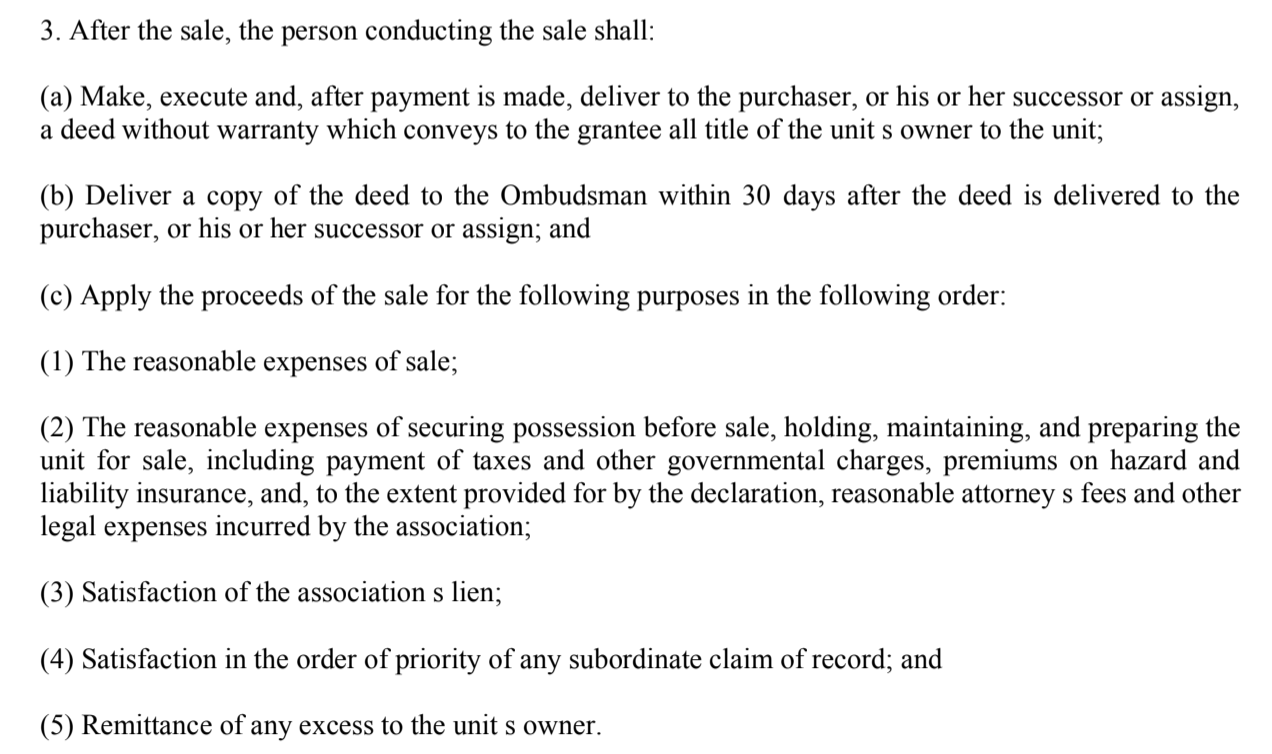

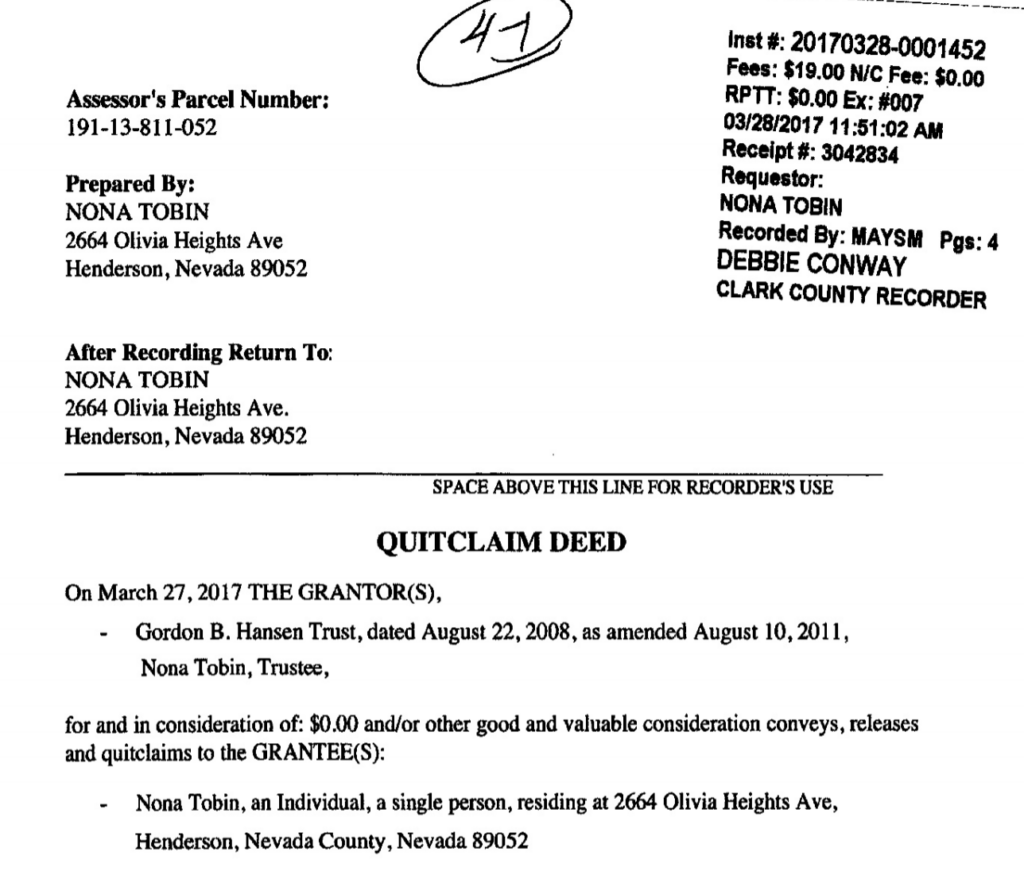

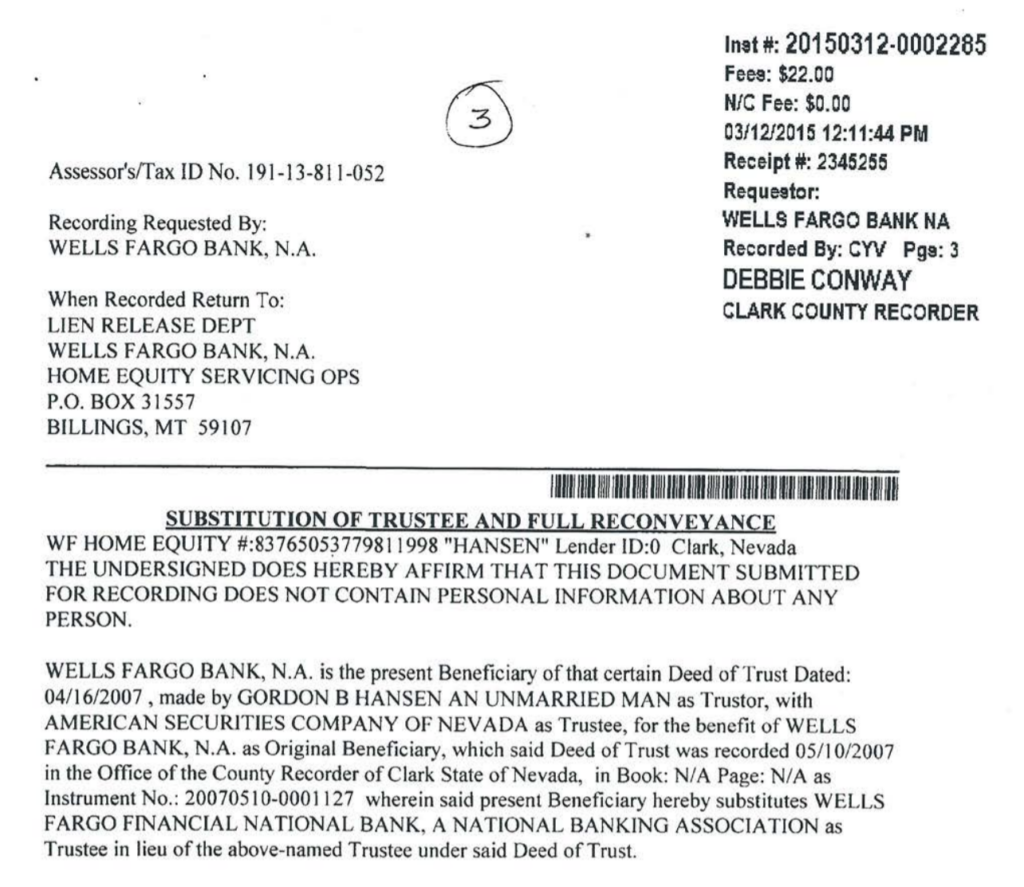

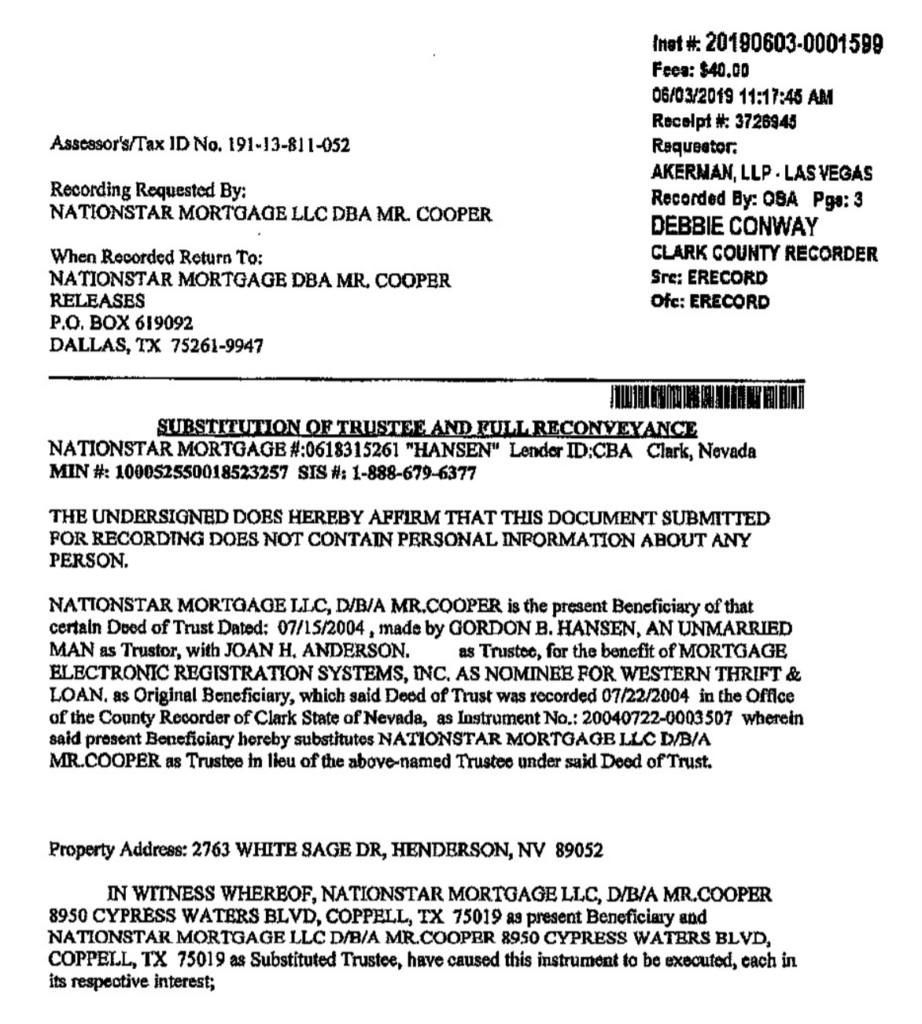

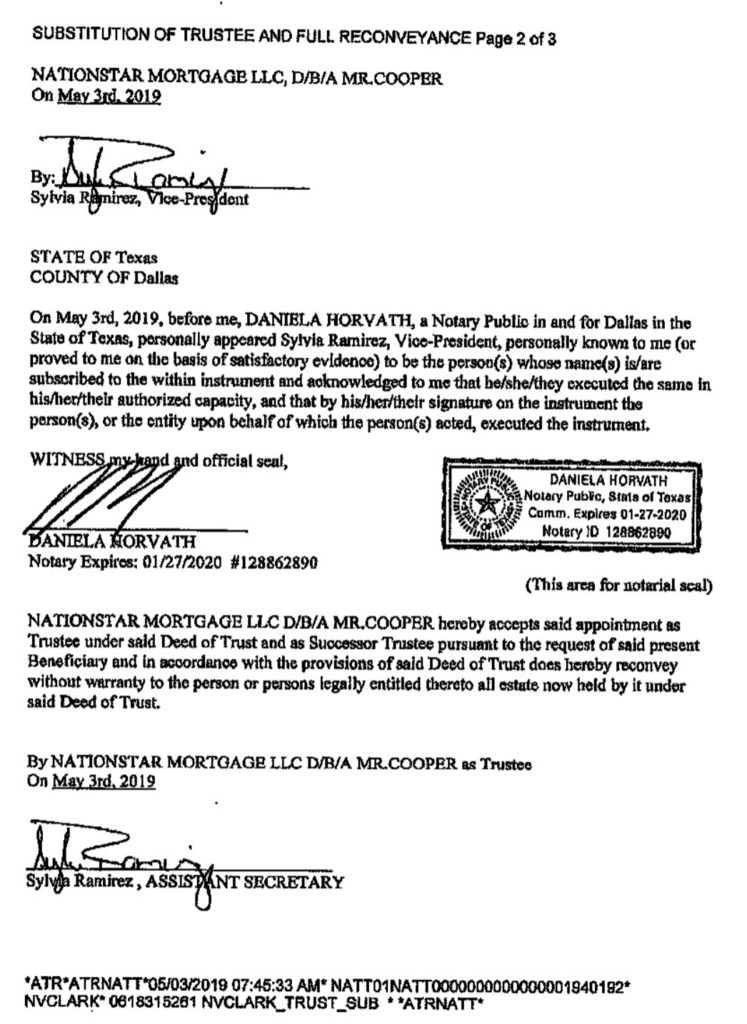

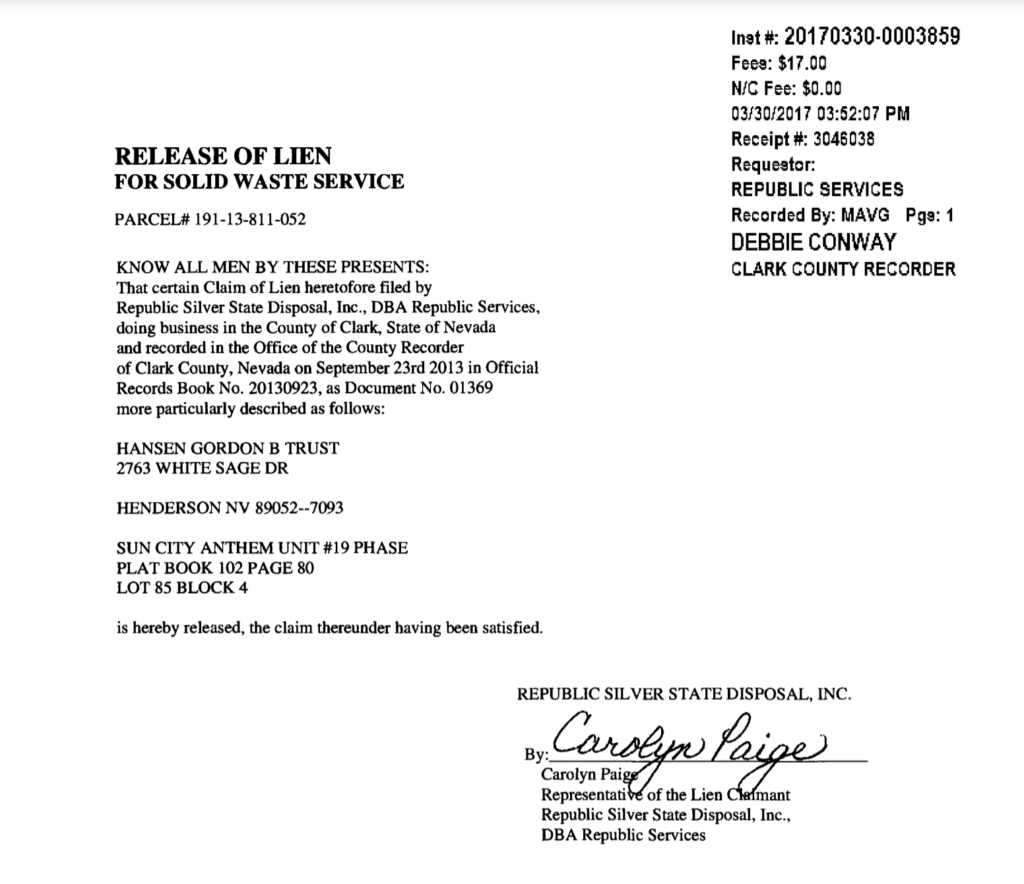

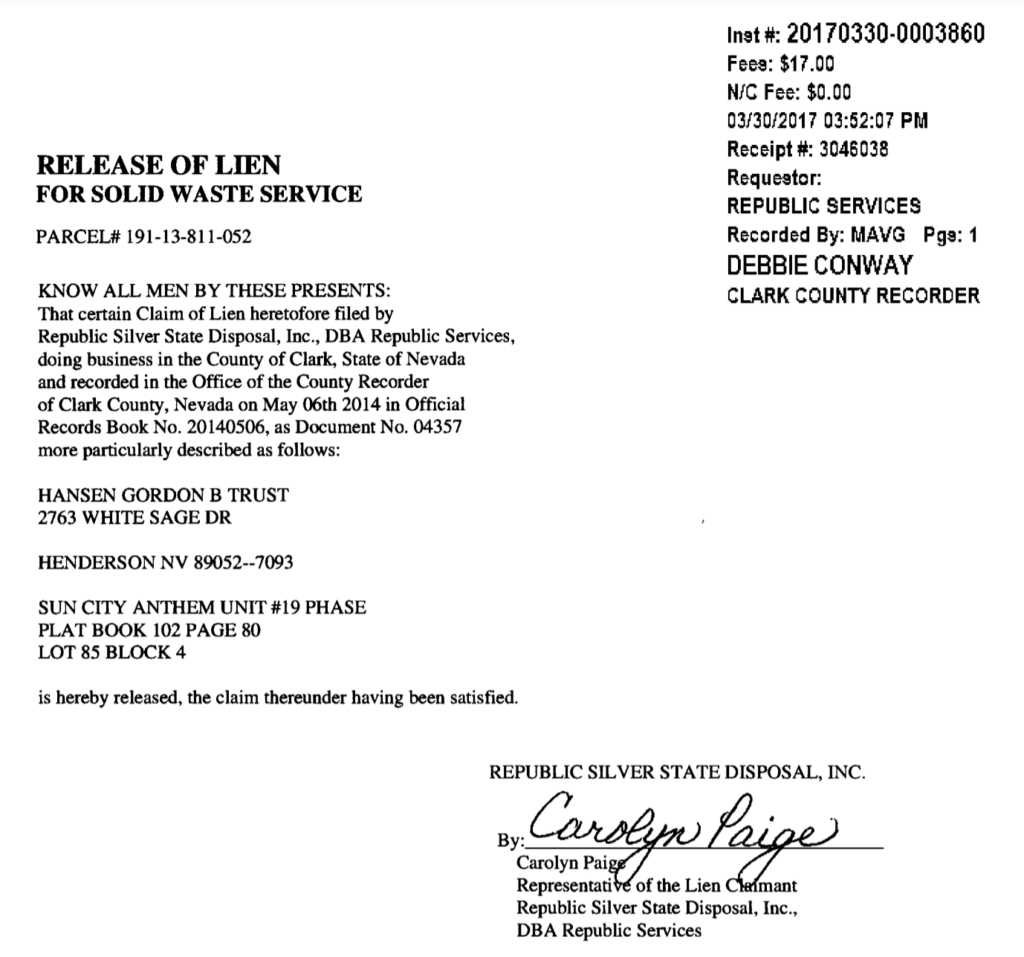

Link to 3/8/21 Request for Judicial Notice of the Clark County official property records for APN 191-13-811-052 that shows the fraudulent claims that were recorded by Nationstar, Red Rock Financial Services, Joel A. Stokes, Jimijack Irrevocable Trust, Bank of America, Quicken Loans, Brian & Debora Chiesi.

Nationstar’s pleadings were unadjudicated

Nationstar voluntarily dismissed all its claims for quiet title and equitable relief without ever presenting a case or meeting its burden of proof that it owned any interest in the disputed Hansen deed of trust.

Nationstar’s only filed claims

Link to Nationstar’s 1/11/16 A-16-730078-C complaint Nationstar vs. Opportunity Homes

Link to Nationstar’s 6/2/16 AACC answer, affirmative defenses and counter-claim vs. Jimijack

Nationstar’s stipulations to dismiss disposed of ALL its claims

Link to 2/20/19 Nationstar’s stipulation to voluntarily dismiss all its filed claims except against Jimijack.

Link to 5/31/19 Nationstar’s stipulation to voluntarily dismiss all its filed claims against Jimijack.

Nona Tobin’s unadjudicated pleadings

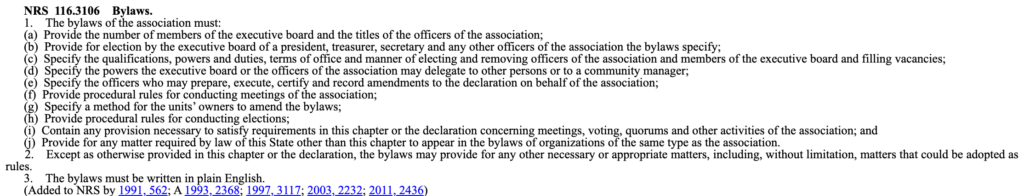

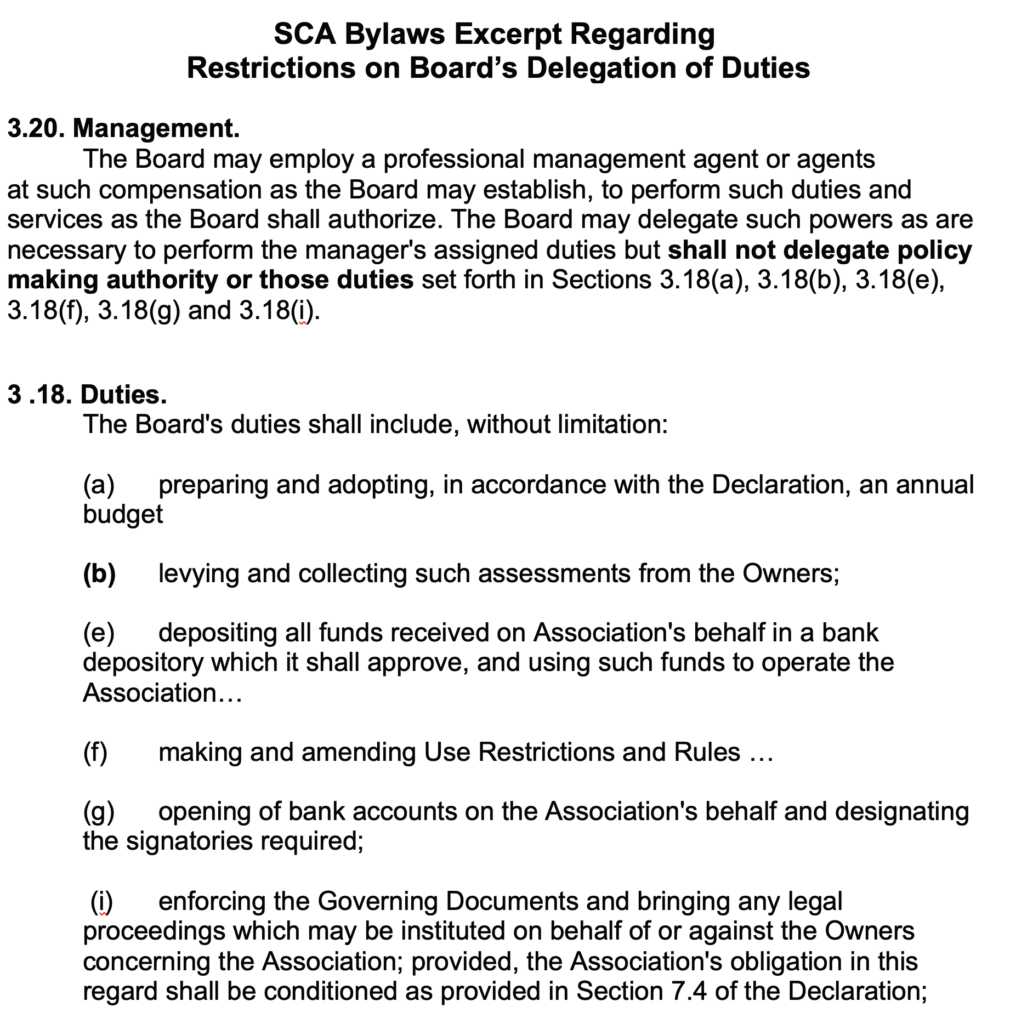

Link to Nona Tobin’s unadjudicated claims vs. Sun City Anthem

Link to Nona Tobin’s unadjudicated claims vs. Jimijack unadjudicated claims

Link to Nona Tobin’s unadjudicated claims vs. Yuen K. Lee dba F. Bondurant LLC

Link to Nona Tobin’s unadjudicated claims vs. Thomas Lucas dba Opportunity Homes LLC

Link to Nona Tobin’s unheard 8/7/19 quiet title & equitable relief, unjust enrichment & abuse of process complaint

Nona Tobin’s unadjudicated district court motions

Link to 3/3/17 Nona Tobin’s unheard motion to void the sale for statutory non-compliance

Link to Nona Tobin’s unheard 4/10/19 motion for summary judgment vs. Jimijack Irrevocable Trust

Link to Nona Tobin’s unheard 4/10/19 motion for summary judgment vs. all parties

Link to Nona Tobin’s unheard 4/24/19 motion to vacate 4/18/19 order pursuant to NRCP 60(b)(3) and motion for summary judgment

Link to Nona Tobin’s unheard 6/17/19 motion to intervene as an individual

Link to Nona Tobin’s unheard 7/22/19 motion for a new trial pursuant to NRCP 54(b) and NRCP 59(a)(1)(A)(B)(C)(F)

Link to Nona Tobin’s unheard 7/29/19 motion to dismiss for lack of jurisdiction pursuant to NRS 38.310(2)

Orders that disposed Nona Tobin’s claims did not consider any evidence

Link to 8/11/17 order granting Opportunity Homes’s motion for summary judgment vs Nona Tobin and the Hansen Trust that was filed after order denying Opportunity Homes’s motion for summary judgment vs. Nationstar was entered on 6/22/17.

Link to 5/31/19 order denying motion to reconsider 4/18/19 order

Link to 9/4/19 order that denied Nona Tobin the right to appeal as an individual

Link to the 10/8/20 order that sanctioned Nona Tobin $3,455 to Joel A. Stokes’s attorney pursuant to EDCR 7.60 (1) and/or (3) for filing the A-19-799890-C complaint on 8/7/19, one week before the five-year statute of limitations, after being denied access to the A-15-720032-C 6/5/19 trial.

Link to the 11/17/20 order that sanctioned Nona Tobin $8,849 pursuant to NRS 18.010(2) on the grounds that her filing the A-19-799890-C complaint on 8/7/19, one week before the five-year statute of limitations, was unwarranted and for the sole purpose of harassing Quicken Loans & Brian & Debora Chiesi who recorded claims adverse to Tobin on 12/27/19 while Tobin had two recorded lis pendens.

Lik to 12/3/20 order that dismissed all Nona Tobin’s claims unheard pursuant to NRCP 12(b) (5), on the grounds of non-mutual claims preclusion, and NRCP 12(b)(6) for failure to join the HOA as a necessary party regarding the distribution of the excess proceeds.

Nona Tobin’s pending appeals to the Nevada Supreme Court

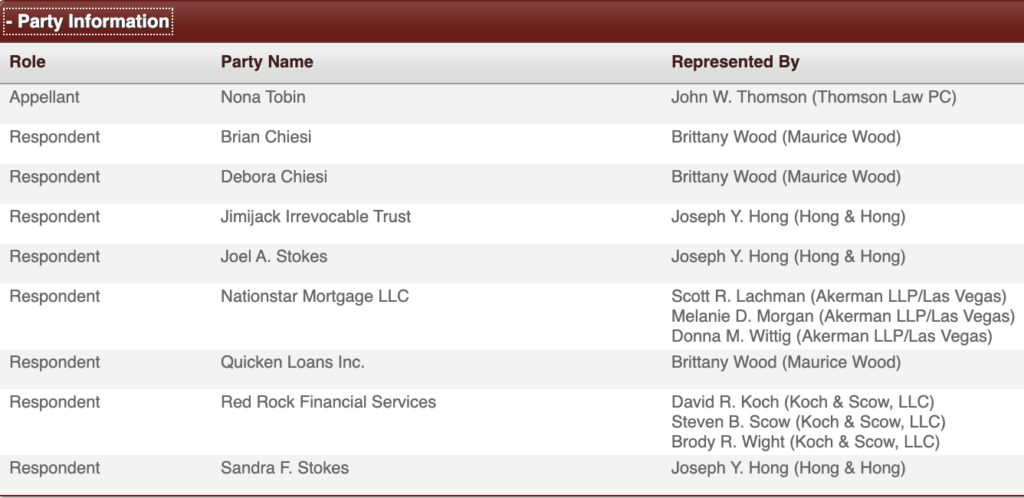

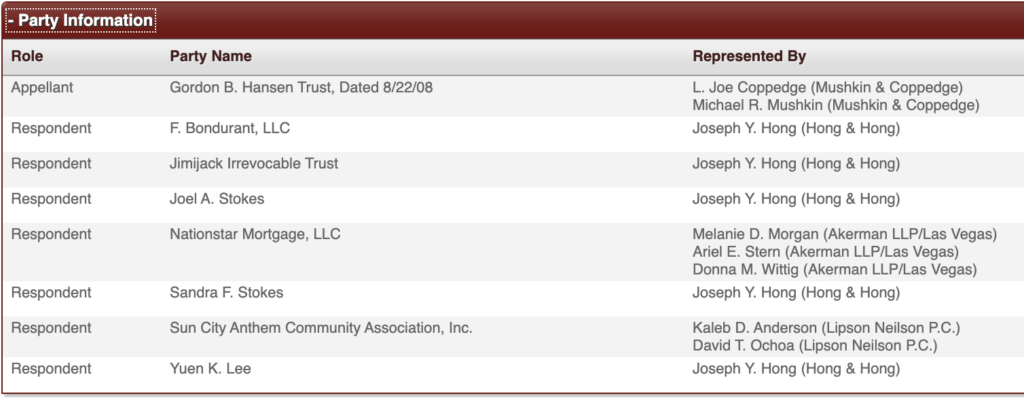

79295 Gordon B. Hansen Trust vs. Jimijack, Nationstar, Sun City Anthem, Yuen K. Lee dba F. Bondurant LLC

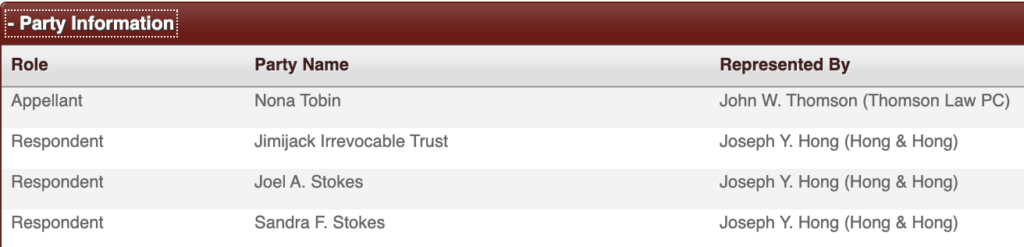

82094 Nona Tobin vs. Joel & Sandra Stokes as trustees of Jimijack, Jimijack Irrevocable Trust & Joel A. Stokes, an individual

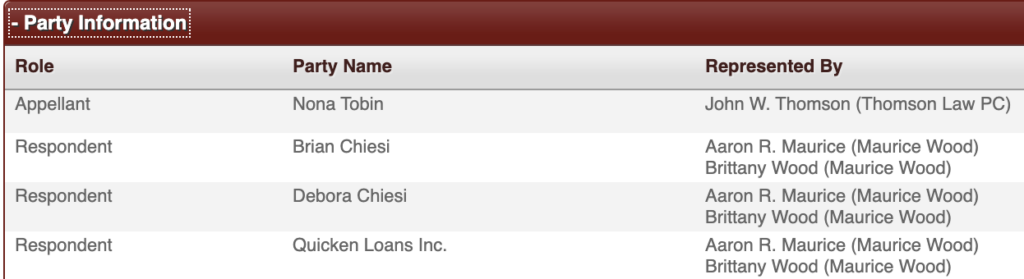

82234 Nona Tobin vs. Quicken Loans LLC and/or Inc. & Brian & Deborah Chiesi

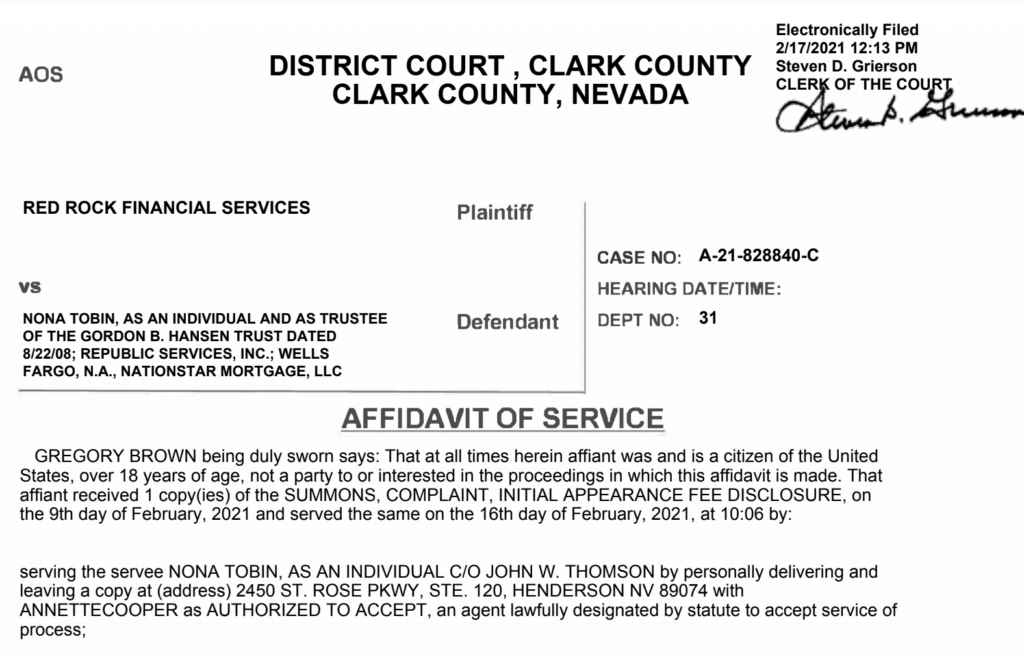

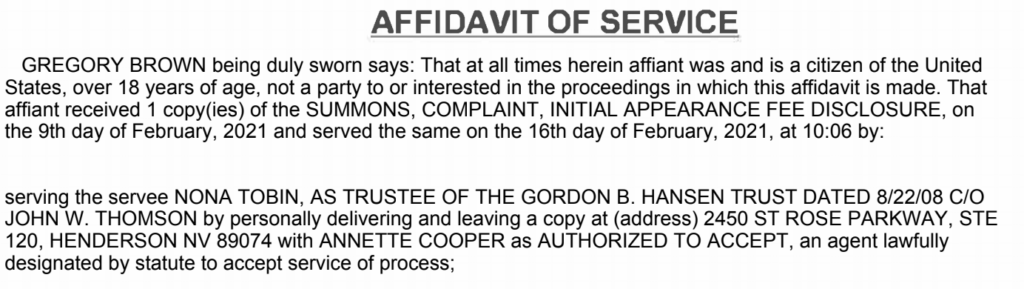

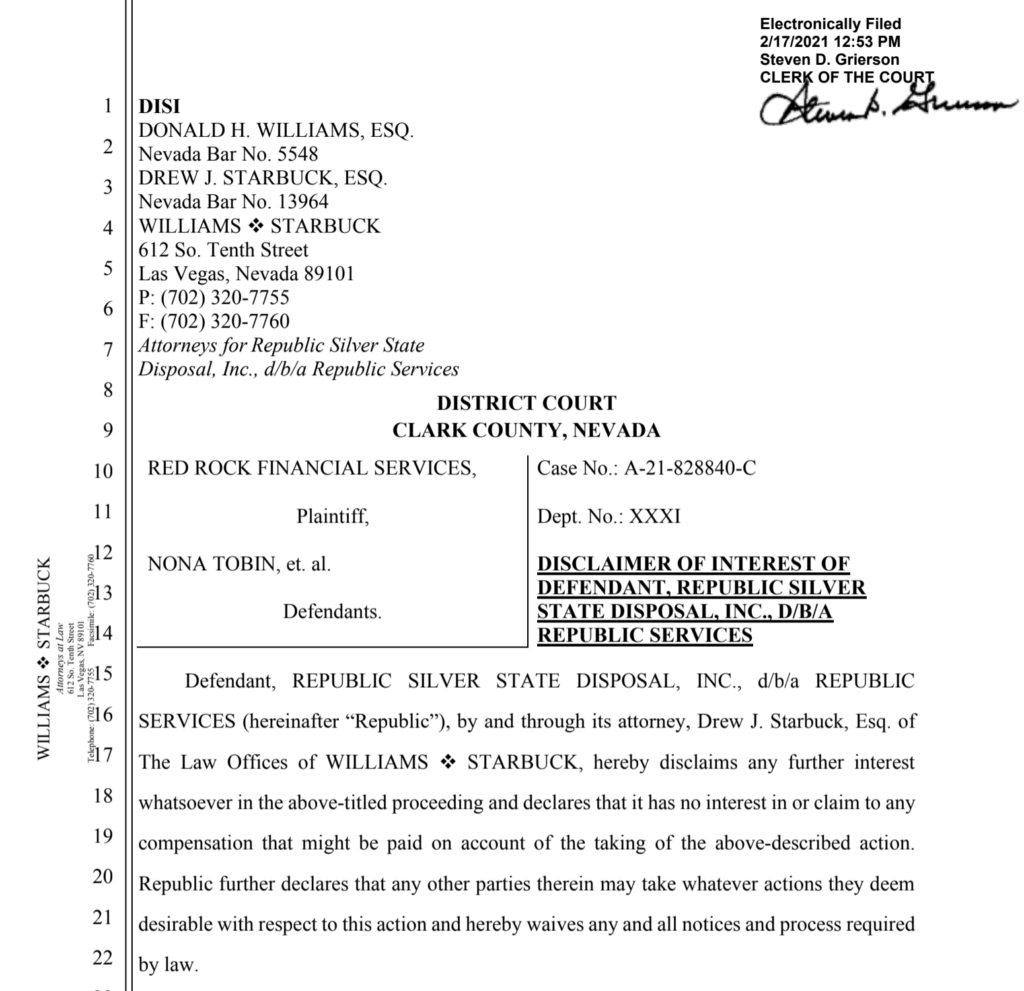

82294 Nona Tobin vs. Red Rock Financial Services, Joel & Sandra Stokes as trustees of Jimijack, Jimijack Irrevocable Trust & Joel A. Stokes, an individual, Quicken Loans LLC and/or Inc. & Brian & Deborah Chiesi