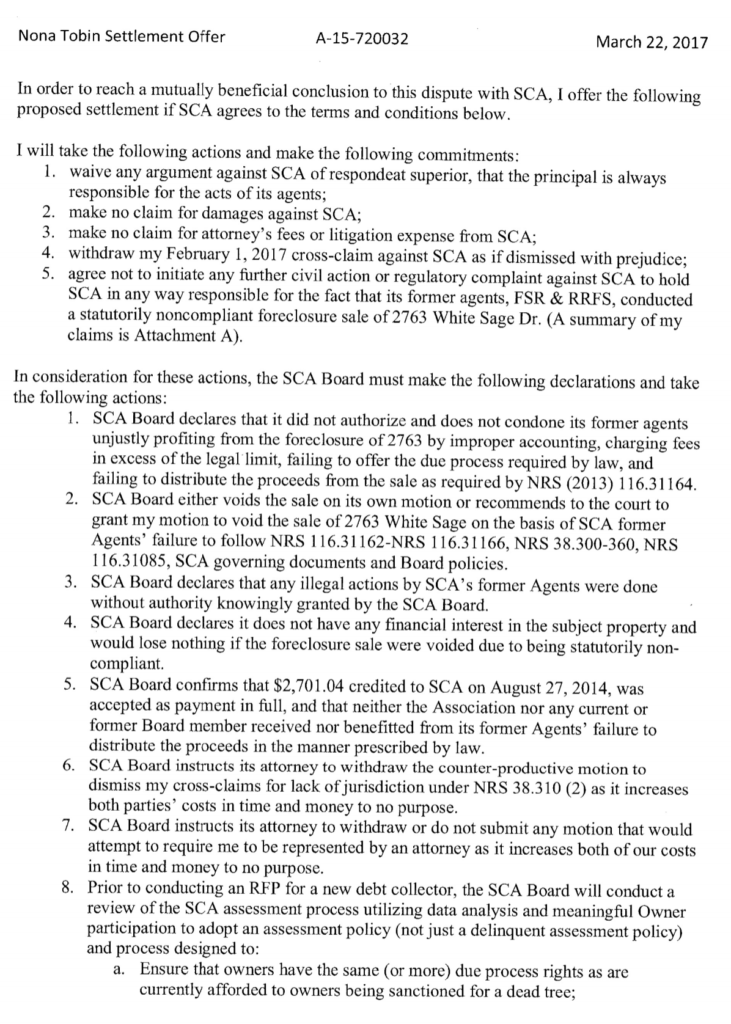

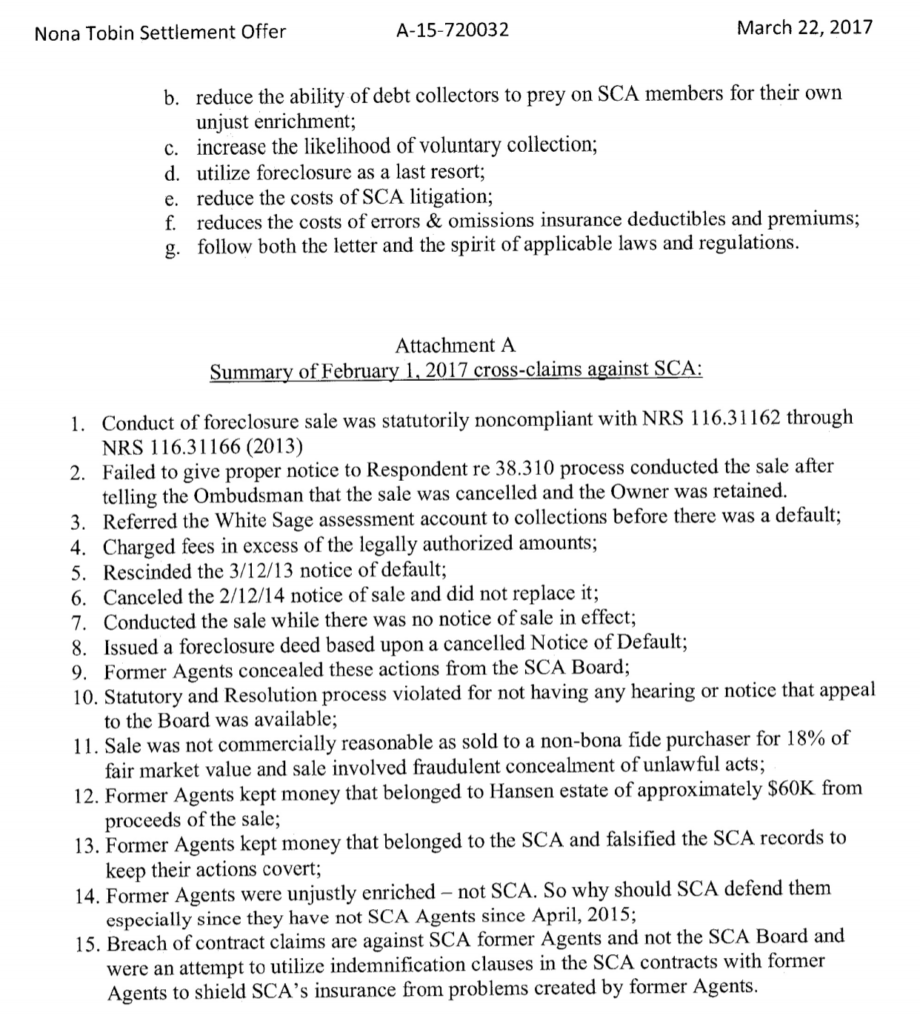

HOA attorneys refused ADR and a no-cost settlement offer and litigation has continued into 2023

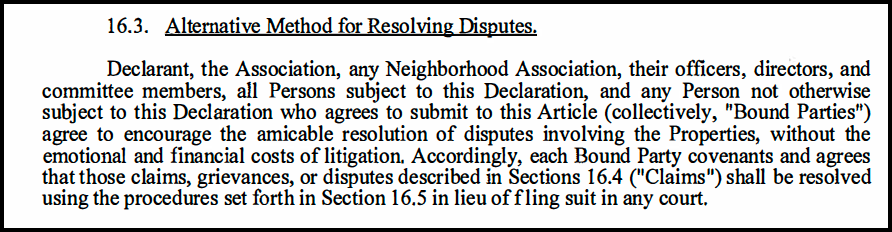

SCA CC&Rs require Alternate Dispute Resolution – but the attorneys blocked it

Owners should ALWAYS come first!

| 12/31/11 | Balance due Dec 31, 2011 was zero. See annotated Resident Transaction Report Page 1335. |

| 1/1/12 | $275 Jan 2012 Qtr Assessment (1/1/12-3/31/12) |

| 1/31/12 | $25 Late Fee Assessed. See 1/31/12 RMI Quarterly statement. Upon information and belief, the 1/31/12 statement assessments due and late fees due was the last such statement distributed to owners. |

| 2/14/12 | Tobin’s Check 112, dated 2/14/12, paid $275 for quarter ending 3/31/12 plus $25 late fee |

| 4/1/12 | $275 Assessments due for 4/1/12-6/30/12 |

| 4/24/12 | Tobin’s Check 127, dated 4/24/12, paid for quarter ending 6/30/12, so no late fee became due on 4/30/12. |

| 6/30/12 | Page 1335 Resident transaction report shows assessments were current to 6/30/12. |

| 7/1/12 | Foreclosure deed recitals falsely claim that no payments were made after 7/1/12. See 8/22/14 annotated foreclosure deed. See 3/12/13 rescinded NODES, |

| 7/1/12 | $275 Assessments due for 7/1/12-9/30/12 |

| 7/31/12 | $25 Late fee assessed for 7/1/12-9/30/12 quarter |

| 8/17/12 | Tobin’s check 143, dated 8/17/12, paid $275 Assessments due for 7/1/12-9/30/12 and $25 Late fee assessed on 7/31/12, for 2763 White Sage Drive. See annotated Resident Transaction Report Page 1335. |

| 8/17/12 | Tobin’s check 143, dated 8/17/12, paid $275 Assessments due for 7/1/12-9/30/12 and $25 Late fee assessed on 7/31/12, for 2664 Olivia Heights. See Resident Transaction Report Page 12859 |

| 9/13/12 | SCA’s managing agent RMI referred the account to its subsidiary RRFS to initiate collections per RRFS log in SCA 415, RRFS’s log of “homeowner progress” |

| 9/17/12 | On unsent 9/17/12 RRFS notice of intent to lien, RRFS claimed $617.94 was due when only $275 assessments and a $25 late fee were authorized for 7/1/12-9/30/12 quarter. See SCA 642 and SCA 643. |

| 9/17/12 | RRFS reported to the Board that the account was a potential write off of $321.51 SCA removed the RRFS collection reports from the SCA website after Tobin downloaded them in 2018. See RRFS potential write off as of 9/30/12 for 2763 White Sage, RRFS account #808634 |

| 9/20/12 | SCA 628 and SCA 635 are the sender’s copy of certified letters, item number 71603901984964087011. Both sender’s copies are stamped as received by RRFS on 10/8/12. SCA/RRFS did not disclose any proofs of service for SCA 628 and SCA 635. Tobin has no record or recollection of ever receiving it. SCA alleged in its MSJ that Tobin had sent it to RRFS with a 10/3/12 letter she sent to SCA transmitting check 143 and Hansen’s death certificate. No evidence supports this claim. All evidence supports that RMI sent SCA 628 and SCA 635 to RRFS at which time RRFS stamped them received. The effect of this was to unfairly impose unauthorized and unnecessary collection fees on the estate of a deceased homeowner without the executor’s knowledge. |

| 9/20/12 | SCA 628 and SCA 635 are the same notice of hearing on 10/8/12 for temporary suspension of Gordon Hansen’s privileges for the alleged violation of the governing documents of delinquent assessments. SCA may have sent this notice. However, Tobin did not receive it. There never was a hearing on 10/10/12. Tobin’s check 143, dated 8/17/12, paid assessments through 9/30/12 are rendered it moot. |

| 9/30/12 | $275 Assessments due for 7/1/12 – 9/30/12 quarter plus $25 late fee assessed on 7/31/12 were paid by $300 check 143 |

| 9/30/12 | In SCA 618, RRFS Allocation detail shows that check 143 was applied to pay the assessments and late fees due and payable through 9/30/12. |

| 9/30/12 | Check 143 paid the account in full for the quarter 7/1/12-9/30/12. See SCA 618 which shows |

| 9/30/12 | 9/30/12 RRFS reported to the SCA Board that as of 9/30/12, account 808634 was a potential write off of $351.21. See RRFS potential write off as of 9/30/12 for 2763 White Sage, RRFS account #808634 |

| 10/1/12 | $275 Assessments due for quarter 10/1/12-12/31/12 |

| 10/3/12 | Per SCA 631, Tobin gave notice to SCA that the owner had died. Enclosed were 1) 1/14/12 death certificate and 2) “Check for $300 HOA dues” Tobin’s notice was sent to the HOA. She indicated the late payment of the deceased owner’s assessments was an error, that the property was in escrow, that the prospective purchasers were moving in shortly, that further payments would be made out of escrow, and that the HOA should work with Doug/Proudfit Realty or new owners to collect future assessments. SCA’s claims that Tobin acted in bad faith, had “unclean hands” and that she was “barred by equitable principles from recovering” for not knowing or remembering that check 143 was not delivered on 8/17/12 when it was written. Tobin had no recollection of writing the 10/3/12 letter and only became aware of it on 12/26/18 when PDFs of documents disclosed by SCA on 5/31/18 as a picture of a CD, were given to her by attorney Joe Coppedge. |

| 10/3/12 | Page 1335 Resident Transaction Report does not have an entry to acknowledge that check 143 for $300 was submitted to pay the assessments for the quarter from 7/1/12 – 9/30/12 as was reported in SCA 618.. |

| 10/8/12 | RRFS stamped on a paper with a picture of check 143 as received by RRFS on 10/8/12. There is no date stamp on check 143 to indicate when SCA received it or when RRFS received it. It is more probable, given the many alterations/ misrepresentations of other documents RRFS/SCA disclosed, that Tobin’s recollection that she submitted check 143 with check 142 on 8/17/12 was correct. and RRFS altered the date on the transmittal letter from 8/17/12 to 10/3/12 to conceal that FSR forwarding the account to collections on 9/13/12 was an error. |

| 10/8/12 | SCA 628 and SCA 635 are the same SCA compliance letter, dated 9/20/12, to Gordon Hansen, at 2664 Olivia Heights. SCA/RRFS did not disclose any proofs of service for SCA 628 and SCA 635. Tobin has no record or recollection of ever receiving it. SCA/RRFS did not disclose any letter to 2763 White Sage which would have been required it this was supposed to be the first step of the due process required before imposing a penalty on the homeowner for delinquent assessments. |

| 10/10/12 | The 10/10/12 hearing noticed allegedly by the 9/20/12 letter in SCA 628 and SCA 635 did not occur. No notice of sanction followed it equivalent to the 8/13/14 Notice of Fines Tobin received after a hearing was held to give notice of a $25 fine for dead plants. |

| 10/18/12 | RRFS ledger did not apply check 143 to pay the 7/1/12-9/30/12 quarter. On 10/18/12 RRFS ledger entered that check 143 left a balance $369.15 instead of the $275 that was actually due and payable for the quarter of 10/1/12-12/31/12 |

| 10/18/12 | SCA 618 PAY ALLOCATION shows check 143 was both allocated as payment of the quarter 7/1/12-9/30/12 or was a partial payment that left a balance as of 10/18/12 comprised of all RRFS-added charges. |

| 10/18/12 | RRFS ledger SCA 623-625 called check 143 a partial payment |

| 10/31/12 | $25 late fee for 10/1/12-12/31/12 delinquent installment was assessed. As of 10/31/12, amount due and owing was $300. |

| 10/31/12 | Balance due on 10/31/12 as listed in SCA resident transaction report instead of the $275 assessments and $25 late fee actually authorized and due and payable as of 10/31/12. |

| 10/31/12 | On 11/5/12 RRFS ledgeer sent to 2763 White Sage and forwarded by Proudfit Realty to Ticor Title claimed $495.36 was due when $300 would have paid through 12/31/12 the $300 assessment and late fee authorized for the quarter 10/1/12-12/31/12 |

| 10/31/12 | RRFS reported to the Board that account 808634, 2763 White Sage Dr. was a potential write off of $382.26 as of 10/31/12 |

| 11/1/12 | SCA Board published a schedule of fees that conformed to the NRS 116.310313(2) limits set by the CIC Commission except for the sentence “Fees and costs may change without notice. Schedule of fees may not be all inclusive.” |

| 11/5/12 | SCA 620 11/5/12 “Correspondence Response Sent to Homeowner” “(RRFS) is in receipt of the correspondence that the homeowner has passed away. Our records have been updated…” RRFS claimed $495.36 was due as of 10/31/12 instead of the $300 actually due. |

| 11/9/12 | Per 11/9/12 into SCA resident transaction report after a $300 collection payment was credited from check 143, there was a $351.21 balance reported on Page 1335 because two unauthorized monthly late fees had been added. $300 was due, $275 for assessments for the 10/1/12-12/31/12 quarter plus the $25 late fee due on 10/31/12.) |

| 11/9/12 | Page 1335 Resident Transaction Report has an entry, dated 11/9/13, that shows the HOA received a collection payment of $300 on 11/6/12. |

| 11/9/12 | SCA 617 “Payment Allocation 11/9/12” information as of 10/18/12. Check 143 for $300 was received as a “partial payment”. “Association Allocation detai”l: $300 check was allocated to $275 assessments due 7/1/12.and 7/31/12 to $25 late fee assessed.. |

| 12/5/12 | On 12/14/12, RRFS recorded a lien the falsely stated $925.76 was due and payable. RRFS recited on the lien that the HOA had verified that $925.76 was due and payable as of 12/5/12. As of 12/5/12, $275 for assessments for the 10/1/12-12/31/12 quarter were delinquent and a $25 late fee was authorized t be imposed on 10/31/12. All other charges were unnecessary as the account should have not been sent to collections when the only delinquent assessments were for a quarter that had not even ended. Once check 143 was paid, the account should have been removed from collections. Once the HOA received notice that future assessments would be paid out of escrow, adding $625.76 in collection fees over what was due and payable was predatory and unfair. |

| 12/20/12 | On 12/2012, Ticor Title requested payoff figures from RRFS to be paid out of Sparkman 8/10/12 escrow |

| 1/1/13 | Balance due per FSR on SCA resident transaction report to bring account current to 3/31/13 |

| 1/1/13 | According to the HOA Resident Transaction Report, on 1/1/13, there was an outstanding balance of $677.31. This is a variance of $102.31 over what was due and payable on 1/1/13, i.e, $275 assessments for 10/1/12-12/31/12 + $25 late fee plus $275 for 1/1/13-3/31/13 quarter. Note that $575 was due. RMI, as SCA’s managing agent, recorded in SCA’s oficial accounting records that $677.31 was due. RMI d/b/a RRFS, SCA’s debt collector, demanded $1,355.60 from the deceased owner’s estate. RMI d/b/a RRFS, SCA’s debt collector, demanded $1,451.75 from the prospective purchasers’ escrow. |

| 1/1/13 | On 1/1/13, $275 assessments came due for quarter 1/1/13-3/31/13. There was a $300 ourstanding balance for the 10/1/12-12/31/12 quarter that resulted in a $575 balance due and payable. |

| 1/3/13 | RRFS sent a notice, dated 1/3/13, the GBH Hansen estate that a lien had been recorded on 12/14/12 for $976.25, but that on 1/3/13 $1355.60 was then due. The $925.76 l12/14/12 lien overstated the amount due by $625.76. The claim that $1355.60 was due on 1//3/13 overstated the amount actually due and owing by $780.60. |

| 1/3/13 | 1/3/13 SCA 587 LIEN SENT TO OWNER |

| 1/3/13 | 1/3/13 SCA 587 “LIEN SENT TO OWNER” |

| 1/9/13 | 1/9/13 SCA P/O DEMAND RECEIVED1/16/13 SCA 578 P/O DEMAND SENT |

| 1/16/13 | On 1/16/13, RRFS responded to Ticor Title’s request for updated payoff figures with a pay off demand to the Sparkman escrow of $1451.75. This demand overstated the amount actually due and payable on 1/16/13 by $876.75. |

| 1/31/13 | $25 late fee due for the 1/1/13-3/31/13 quarter. |

| 1/31/13 | RRFS reported to the Board that account 808634, 2763 White Sage Dr. was a potential write-off of $677.31 as of 1/31/13. |

| 3/7/13 | $702.31 amount required to pay assessments, late fees, and interest to bring balance to zero through 3/31/13 per SCA resident transaction report Page 1335 |

| 3/7/13 | $2,475.35 was due and payable as of 3/7/13 per RRFS on 3/12/13 NODES |

| 3/12/13 | RRFS claimed on the rescinded 3/12/13 (NODES) Notice of Default and election to Sell that, as of 3/7/13, $2,475.35 was due, not the $702.31 reported on the SCA resident transaction report Page 1335 |

| 3/27/13 | Effective 3/27/13, RRFS rescinded the 3/12/13 notice of default. |

| 4/1/13 | $275 Assessments due for quarter 4/1/13-6/30/13 |

| 4/3/13 | SCA 553 RRFS on 4/3/13 recorded the rescission of the 3/12/13 NODES. No notice of the rescission was mailed to the owner or to the property. |

| 4/4/13 | As of 4/4/13, $2752.66 Due and payable per RRFS on the recorded 4/8/13 NODES vs. $825 assessments ($275 x 3 quarters from 10/1/12-6/30/13) and $50 for late fees ($25 for the 4/1/13-6/30/13 quarter was not due until the for the 4/1/13-6/30/13 quarterly installment was 30 days past due on 4/30/13. |

| 4/16/13 | SCA 525 4/16/13 “Payoff Demand Received”. See SCA 415-416 for RRFS work log entries related to RRFS refusal of Miles Bauer tender. |

| 4/17/13 | SCA 527 4/17/13 Request reviewed |

| 4/30/13 | $25 late fee was assessed for 4/1/13-6/30/13 delinquent installment |

| 4/30/13 | SCA 254 RRFS acct detail 4/4/13 – 12/31/13 shows RRFS charged the Hansen account $150 to respond to Miles Bauer request for pay off figures |

| 4/30/13 | SCA 517 -519 4/30/13 “Payoff Demand Sent” RRFS letter to Miles Bauer stated that as of 4/30/13, $$2,904.26 was due. |

| 5/7/13 | Tobin faxed a letter to put BANA on notice of her intent to stop paying to protect the security interest of a lender to whom she did not owe any debt. See Tobin 5/7/13 letter to BANA and attachments disclosed as NSM 274-328. |

| 5/8/13 | SCA 513 Miles Bauer check for $825, the exact amount of assessments then delinquent. See SCA 513-530 for RRFS disclosures re rejection of the first super-priority tender. (SCA 302 was the second.) |

| 5/16/13 | 5/16/13 SCA 512 is a request for payoff figures from Proudfit Realty “We are expecting a short-sale approval letter to be issued in the name of the new buyers. Escrow is expected to close no later than June 28, 2013.” See SCA 504-512. |

| 5/29/13 | RRFS responded on 5/29/13 that $3,055.47 was due and payable instead of the $825 assessments and $75 late fees that were due and owing to bring the account paid in full to 6/30/13. |

| 5/29/13 | SCA 254 RRFS acct detail 4/4/13 – 12/31/13 shows that on 5/29/13 RRFS charged $150 for pay off demand in relation to Proudfit Realty request for pay off figures in Mazzeo’s escrow opened on 5/10/13 for a $395,000 purchase offer |

| 6/30/13 | If Miles Baur tender of $875 had been accepted and correctly applied, assessments would have been paid through 6/30/13. There were unpaid late fees for the three quarters then delinquent ($25 x 3= $75 due for the quarters from 10/1/12-6/30/13). It was unfair for Miles Bauer to tender the $825 for the nine months then delinquent after its principal, servicing bank BANA, refused to let the escrow (8/10/12-4/8/13) close on Sparkman’s FMV arms-length offer. Ticor Title had been instructed to pay the $1,451.75 RRFS had demanded on 1/16/13 on COE. It was also unfair that BANA’s agent Miles Bauer tendered the $825 super-priority directly to RRFS without notifying Ticor Title, Proudfit or Tobin. RRFS did not notify the SCA Board, or more importantly, request Board approval, of its rejection of the tender of 100% of the assessments then delinquent. |

| Per RTR pages 1334-1336 the amount due and owing as of 6/30/13 was $1,083.14. | |

| 7/1/13 | Per RTR pages 1334-1336 the amount due and owing as of 7/1/13 was $1,308.14 |

| 7/1/13 | $275 Assessments due for 7/1/13-9/30/13 |

| 7/1/13 | $825 delinquent through 6/30/13 +$275 assessments due for 7/1/13-9/30/13 quarter equated to $1100, one year of assessments due because of RRFS’s unilateral rejection of the Miles Bauer tender and because of BANA’s unilateral rejection of the Mazzeo’s 5/10/13 $395,000 offer. |

| 7/10/13 | Tobin removed the property from the market, turned off the electricity, and initiated a deed in lieu process with BANA. See Tobin’s 2013 deed in lieu hand written notes. |

| 7/31/13 | $25 late fee due bringing to $1100 the assessments that were delinquent plus$100 in late fees that were authorized=$1,200. |

| 8/15/13 | SCA 401 is an envelope addressed to 2763 White Sage that was stamped on 8/15/13 “deceased”. There is no such envelope for the letter RRFS alleged in SCA 287 was sent to 2763 White Sage on 7/2/14. This is the 7/2/14 letter that RRFS claims was sent to notify the owner that the waiver request RRFS sent to the SCA Board on 6/9/14 was denied. See SCA 401-403 Return to Senders |

| 8/15/13 | SCA 403 is an envelope addressed to 2763 White Sage that was stamped on 8/15/13 “Return to sender Not deliverable as addressed. Unable to forward.”. There is no such envelope for the letter RRFS alleged in SCA 287 was sent to 2763 White Sage on 7/2/14. This is the 7/2/14 letter that RRFS claims was sent to notify the owner that the waiver request RRFS sent to the SCA Board on 6/9/14 was denied. |

| 10/1/13 | Balance due per FSR on SCA resident transaction report to bring account current to 12/31/13 |

| 10/1/13 | Balance per RRFS account detail in SCA 254 |

| 10/1/13 | Assessments due for 10 /1/13-12/31/13 |

| 10/16/13 | 10/16/13 SCA 450 Followed Up POP |

| 10/16/13 | SCA 468 RRFS “Homeowner Progress Report” to 10/16/13 does not show any BOD approval |

| 10/31/13 | $25 late fee due |

| 1/1/14 | Balance due per FSR on SCA resident transaction report to bring account current to 3/31/14 |

| 1/1/14 | Balance per RRFS account detail in SCA 254 |

| 1/1/14 | Assessments due for 1/1/14-3/31/14 |

| 1/31/14 | $25 late fee due |

| 2/11/14 | Effective 2/11/14, RRFS claimed that $5,081.45 was due and payable on the Notice of Sale published on 2/12/14 (cancelled on 5/15/14 and not replaced). Note that RRFS did not ever update the 2/11/14 $5,081.45 figure a a second published NOS. RRFS concealed its 3/28/14 payoff demand to Chicago Title in which RRFS stated that as of 3/28/14 $4,962.24 was due as of 3/28/14. The discrepancy ($5,081.45 on 2/11/14 vs. $4,962.24 on 3/28/14 is explained on page 6 of the 3/28/14 demand. RRFS and SCA obfuscated that on 3/28/14 the SCA BOD instructed RRFS to reduce $400 in late fees and $18.81 in interest of the $5,083.45 RRFS claimed was due on 2/11/14.) Note that SCA 275-SCA 315 includes significant alterations of the RRFS accounts and records to obfuscate this action by the SCA BOD and to misrepresent the 5/28/14 NSM offer (one year of assessments ($1100) to close the MZK 5/8/14 auction.com sale) as a fee waiver request from the owner. Further, SCA 254, RRFS’s 8/15/14 Account Detail fails to accurately account for the 3/28/14 fee and interest waiver authorized by the SCA BOD. |

| 2/11/14 | $4,240.10 |

| 2/12/14 | Published 2/12/14 Notice of Sale (NOS) alleged that $5,081.45 was due as of 2/11/14. |

| 2/28/14 | $4,962.64 RRFS response to payoff demand requested by Chicago Title |

| 3/18/14 | 3/18/14 payoff demand received Note that the 3/6/14 Chicago Title Preliminary Title Report was concealed in discovery. |

| 3/18/14 | SCA 312 -313 shows that Chicago Title requested pay-off figures from RRFS. |

| 3/18/14 | SCA 310 contains two emails dated 3/18/14 which clearly indicate RRFS received a request for payoff figure on 3/18/14, but the SCA BOD was scheduled to review Leidy’s requests at the 3/27/14 meeting. Note RRFS and SCA both failed to disclose the 3/28/14 RRFS response to Chicago Title in which the ledger shows that the SCA BOD approved a $400 fee waiver. This fee waiver is not included in SCA 255, RRFS account detail from 2/11/14-8/15/14 |

| 3/28/14 | On 3/28/14 RRFS demanded $3,055.47 was due in response to Chicago Title’s 3/18/14 request for pay off figures found in SCA 312 -313. RRFS, NSM, and SCA concealed RRFS’s 3/28/14 demand. On 10/14/14, Leidy provided it to Tobin. Leidy informed Tobin on 10/14/14 that it was the only ledger he had ever received. |

| 3/28/14 | RRFS concealed payoff demand of $3,055.47 in response to Chicago Title (concealed in discovery) |

| 3/28/14 | $4,687.64 was shown as due and payable on |

| 3/28/14 | See Page 6 of the 3/28/14 RRFS ledger concealed from discovery by RRFS, SCA, BHHS, and NSM. 3/28/14 Page 6 shows a $400 fee reduction was approved by the SCA board pursuant to Leidy’s 3/7/14 only fee reduction request found buried in SCA . 6/9/14 Page 6 of RRFS 6/9/14 ledger scrubs the $400 Board approved reduction and reports that RRFS billed no collection costs from 2/11/14 to 5/30/14 (See SCA 301). A further accounting discrepancy in found in SCA 250 |

| 4/1/14 | Balance due per FSR on SCA resident transaction report to bring account current to 6/30/14 |

| 4/1/14 | $275 Assessments due for 4/1/14-6/30/14 |

| 4/24/14 | |

| 4/30/14 | $25 late fee due for delinquent 4/1/14-6/30/14 installment |

| 4/30/14 | SCA 254 RRFS acct detail 4/4/13 – 12/31/13 shows on 4/30/13 RRFS claimed $2,876.95 was due as of 4/30/13 in response to Miles Bauer’s request for pay off figures. SCA 254. On |

| 5/6/14 | SCA 307 |

| 5/15/14 | No BOD approval of postponed 5/15/14 sale date |

| 5/15/14 | SCA 307 is an unsigned approval form to conduct the sale on 5/15/14. No signed BOD approval was disclosed in SCA 176-643 or exists in the 4/26/14 minutes of Board approval to conduct the sale on 5/15/14. On 5/15/14, the Ombudsman received notice that the 5/15/14 sale was cancelled as the owner was retained. |

| 5/15/14 | SCA 308 is another email alleging final approval of the 5/15/14 sale from which the date has been scrubbed and there is no signature |

| 5/28/14 | SCA 302 NSM 5/28/14 super-priority offer |

| 6/2/14 | Ombudsman employee, Ann Moore, logged that the Ombudsman had received notice that the 5/15/14 sale date had been cancelled, the 2/12/14 notice of sale process and the “trustee sale: were cancelled and the “owner retained”. See authenticated Ombudsman Notice of Sale Compliance Record (OMB-NOS) |

| 7/1/14 | Balance due per FSR on SCA resident transaction report Page 1336 to bring account current to 9/30/14 was $2,692.68. See Resident Transaction report, Pages 1334-1336 |

| 7/1/14 | Assessments due for 7/1/14-6/30/14 |

| 7/2/14 | SCA 277 Undated email RRFS to Leidy “Please see response regarding the settlement request for $1000.00” (Note there was no settlement request for $1000. Leidy did not receive this. Not clear what was supposedly attached as it does not relate to the 6/5/14 email Leidy sent to RRFS to forward the NSM 5/28/14 offer that is on the bottom of the page SCA 277 |

| 7/2/14 | unsent RRFS ledger falsely alleged to have been sent to 2664 OH and 2763 WS |

| 7/31/14 | $25 late fee due. |

| 7/31/14 | Per RTR pages 1334-1336 the amount due and owing on 7/31/14 $2,692/68. |

| 8/13/14 | Notice of Fines was sent after a hearing was held prior to the imposition of a $25 fine for a dead tree at 2763 White Sage |

| 8/15/14 | RRFS sold 2763 White Sage without notice to any party with a known interest. |

| 8/15/14 | SCA 255 2/11/14 – 8/15/14 RRFS account detail does not have an entry of 3/28/14 SCA BOD $400 fee waiver and does not include any charges for the 3/28/14 pay off demand to Chicago Title and does not report SCA 302, NSM’s 5/28/14 super-priority tender. It also shows RRFS was charging late fees monthly when payments were in quarterly installments and $25 per installment was authorized. |

| 8/27/14 | Collection payment entered to pay Gordon Hansen’s account in full on Page 1336 |

| 9/25/14 | Page 1337 Resident Transaction Report shows an entry on 9/25/14 that Jimijack Irr Tr paid $225.00 new owner setup fee. Jimijack’s Resident ID was 0480-02. SCA’s ownership record shows Jimijack was the second owner of the property. |

| 9/25/14 | Page 1337 Resident Transaction Report 9/25/14-3/31/16 and SCA owner record 4/1/16-5/9/16 shows Jimijack was the only owner after Hansen. SCA refused to provide the SCA ownership records requested from 8/15/14 date of the sale to 2/28/19 end of discovery. |

| 4/1/16 | 2763 White Sage payments for all owners 1/1/06-5/9/16 |

| 10/14/14 | Tobin to Leidy email demanding answers |

| 10/14/14 | Leidy response |

| 10/14/14 | Leidy emailed to Tobin the 3/28/14 ledger that RRFS concealed in discovery that shows how RRFS falsified the ledgers. |

(b) Representations to the Court. By presenting to the court a pleading, written motion, or other paper — whether by signing, filing, submitting, or later advocating it — an attorney or unrepresented party certifies that to the best of the person’s knowledge, information, and belief, formed after an inquiry reasonable under the circumstances:

(1) it is not being presented for any improper purpose, such as to harass, cause unnecessary delay, or needlessly increase the cost of litigation;

(2) the claims, defenses, and other legal contentions are warranted by existing law or by a nonfrivolous argument for extending, modifying, or reversing existing law or for establishing new law;

(3) the factual contentions have evidentiary support or, if specifically so identified, will likely have evidentiary support after a reasonable opportunity for further investigation or discovery; and

(4) the denials of factual contentions are warranted on the evidence or, if specifically so identified, are reasonably based on belief or a lack of information.

NRCP 11(b)

(1) In General. If, after notice and a reasonable opportunity to respond, the court determines that Rule 11(b) has been violated, the court may impose an appropriate sanction on any attorney, law firm, or party that violated the rule or is responsible for the violation. Absent exceptional circumstances, a law firm must be held jointly responsible for a violation committed by its partner, associate, or employee.

(2) Motion for Sanctions. A motion for sanctions must be made separately from any other motion and must describe the specific conduct that allegedly violates Rule 11(b). The motion must be served under Rule 5, but it must not be filed or be presented to the court if the challenged paper, claim, defense, contention, or denial is withdrawn or appropriately corrected within 21 days after service or within another time the court sets. If warranted, the court may award to the prevailing party the reasonable expenses, including attorney fees, incurred for presenting or opposing the motion.

(3) On the Court’s Initiative. On its own, the court may order an attorney, law firm, or party to show cause why conduct specifically described in the order has not violated Rule 11(b).

(4) Nature of a Sanction. A sanction imposed under this rule must be limited to what suffices to deter repetition of the conduct or comparable conduct by others similarly situated. The sanction may include nonmonetary directives; an order to pay a

penalty into court; or, if imposed on motion and warranted for effective deterrence, an order directing payment to the movant of part or all of the reasonable attorney fees and other expenses directly resulting from the violation.

(5) Limitations on Monetary Sanctions. The court must not impose a monetary sanction:

(A) against a represented party for violating Rule 11(b)(2); or

(B) on its own, unless it issued the show cause order under Rule 11(c)(3) before voluntary dismissal or settlement of the claims made by or against the party that is, or whose attorneys are, to be sanctioned.

(6) Requirements for an Order. An order imposing a sanction must describe the sanctioned conduct and explain the basis for the sanction.

NRCP 11(c)

2. In addition to the cases where an allowance is authorized by specific statute, the court may make an allowance of attorney’s fees to a prevailing party:

(b) Without regard to the recovery sought, when the court finds that the claim, counterclaim, cross-claim or third-party complaint or defense of the opposing party was brought or maintained without reasonable ground or to harass the prevailing party. The court shall liberally construe the provisions of this paragraph in favor of awarding attorney’s fees in all appropriate situations. It is the intent of the Legislature that the court award attorney’s fees pursuant to this paragraph and impose sanctions pursuant to Rule 11 of the Nevada Rules of Civil Procedure in all appropriate situations to punish for and deter frivolous or vexatious claims and defenses because such claims and defenses overburden limited judicial resources, hinder the timely resolution of meritorious claims and increase the costs of engaging in business and providing professional services to the public

NRS 18.010(2)(b)

1. Except as otherwise provided in NRS 42.007, in an action for the breach of an obligation not arising from contract, where it is proven by clear and convincing evidence that the defendant has been guilty of oppression, fraud or malice, express or implied, the plaintiff, in addition to the compensatory damages, may recover damages for the sake of example and by way of punishing the defendant. Except as otherwise provided in this section or by specific statute, an award of exemplary or punitive damages made pursuant to this section may not exceed:

(a) Three times the amount of compensatory damages awarded to the plaintiff if the amount of compensatory damages is $100,000 or more;

3. If punitive damages are claimed pursuant to this section, the trier of fact shall make a finding of whether such damages will be assessed. If such damages are to be assessed, a subsequent proceeding must be conducted before the same trier of fact to determine the amount of such damages to be assessed. The trier of fact shall make a finding of the amount to be assessed according to the provisions of this section. The findings required by this section, if made by a jury, must be made by special verdict along with any other required findings. The jury must not be instructed, or otherwise advised, of the limitations on the amount of an award of punitive damages prescribed in subsection 1.

NRS 42.005 (1) (3)

1. Except as otherwise provided in subsection 3, if an older person or a vulnerable person suffers a personal injury or death that is caused by abuse or neglect or suffers a loss of money or property caused by exploitation, the person who caused the injury, death or loss is liable to the older person or vulnerable person for two times the actual damages incurred by the older person or vulnerable person.

2. If it is established by a preponderance of the evidence that a person who is liable for damages pursuant to this section acted with recklessness, oppression, fraud or malice, the court shall order the person to pay the attorney’s fees and costs of the person who initiated the lawsuit.

4. For the purposes of this section:

(b) “Exploitation” means any act taken by a person who has the trust and confidence of an older person or a vulnerable person or any use of the power of attorney or guardianship of an older person or a vulnerable person to:

(1) Obtain control, through deception, intimidation or undue influence, over the money, assets or property of the older person or vulnerable person with the intention of permanently depriving the older person or vulnerable person of the ownership, use, benefit or possession of that person’s money, assets or property; or

(2) Convert money, assets or property of the older person with the intention of permanently depriving the older person or vulnerable person of the ownership, use, benefit or possession of that person’s money, assets or property.

(d) “Older person” means a person who is 60 years of age or older.

NRS 41.1395

A 2017 study conducted by the UNLV Lied School of Real Estate, commissioned by the Nevada Association of Realtors, studied 611 HOA foreclosures between 2011-2015.

SCA’s 2014 Foreclosures WERE NOT IDENTIFIED in the UNLV Study

Somehow the professionals conducting the study missed ALL of SCA’s 13 foreclosures between 2011 and 2015.

SCA had 13 foreclosures in 2014, but SCA is not in the UNLV HOA foreclosure study’s list of HOAs that had more than five foreclosures from 2011-2015.

Some would call them “vulture investors”.

This pattern – selling for a dime on a dollar to a few wise guys – would never have happened if bidding had not been suppressed by a few unsavory practices:

In the case of 2763 White Sage, RRFS intentionally WITHHELD notice to ALL parties with a known interest – and then lied about it in order to cover up how this scam works to enrich the chosen few..

Look at who bought the houses. Look at how much they paid, and look at what Sun City Anthem Board and owners were told. It’s quite a lucrative scam for a lucky few.

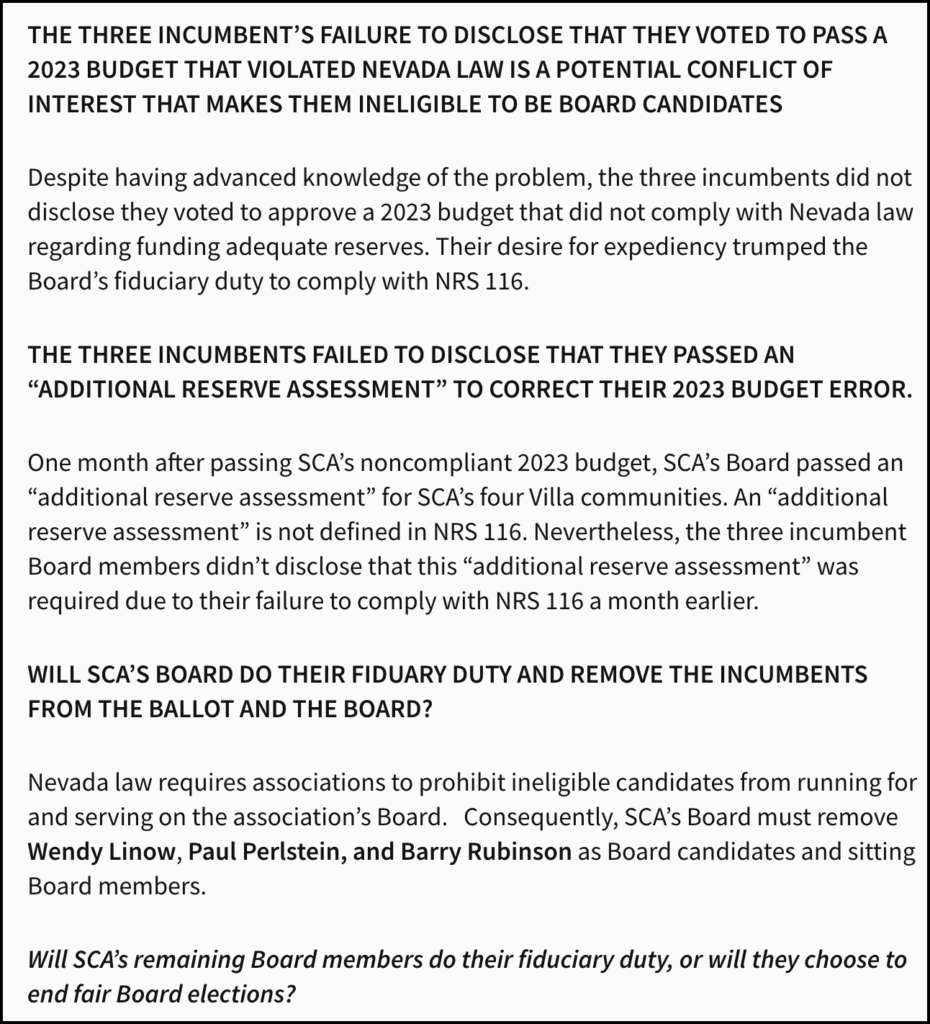

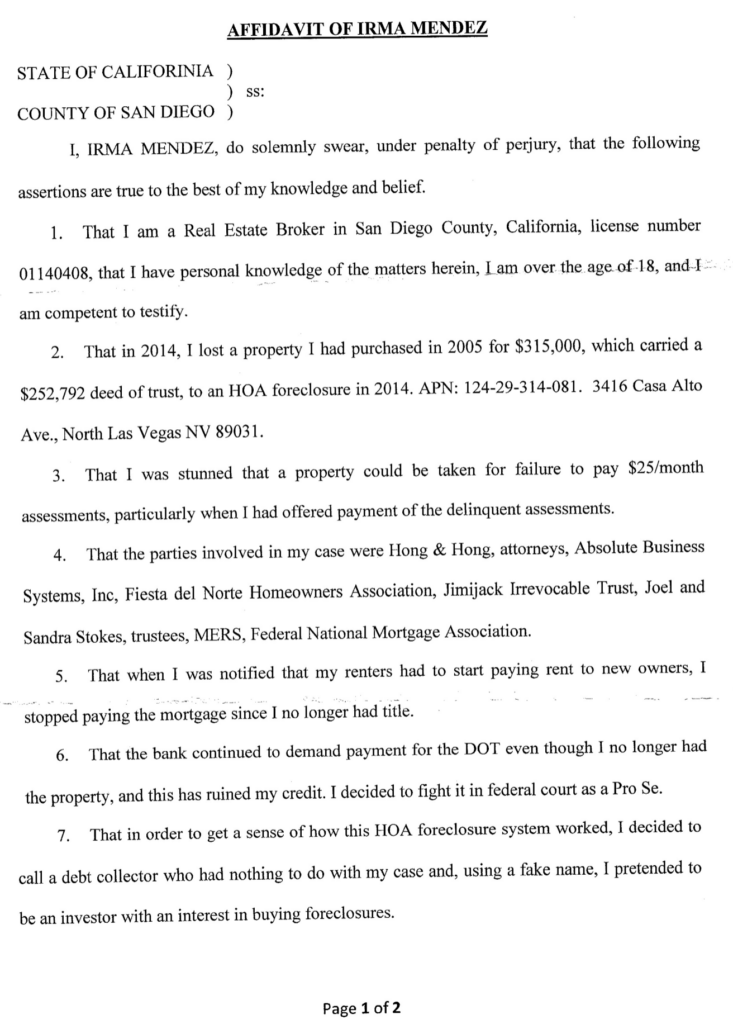

See Irma Mendez’ 11/12/18 sworn affidavit regarding Joel Just, former RRFS President, and his selling foreclosures direct without the inconvenience of a public auction.

FSR and FSR dba RRFS told the HOA Board falsely that everything about HOA sales had to be kept secret.

TRP Fund IV LLC bought four SCA properties at unnoticed sales @ an average price of $52,125, 80% below fair market value. I, and many other Sun City Anthem homeowners, were prevented from attending these sales and bidding because RRFS explicitly withheld notice.

Two sham LLCs, using the property address as the corporate name, bought houses for $6,500 & $7,600.

SCA did not enforce the 4/27/12 contract indemnification clause that would have shifted this expense to RRFS. TRP FUND IV v. HSBC Bank A-16-735894-C

There is no SCA record that the SCA Board approved the sale of this property.

Nationstar Mortg., LLC vs. Saticoy Bay LLC Series 2227 Shadow Canyon 133 Nev. Advance Opinion 91, 405 P.3d 641 (Nev. 2017).

There is no SCA record that the SCA Board approved the sale of this property. SCA was not identified AT ALL in the litigation as the HOA under whose statutory authority this sale occurred.

Neither SCA nor RRFS were named parties to the litigation.

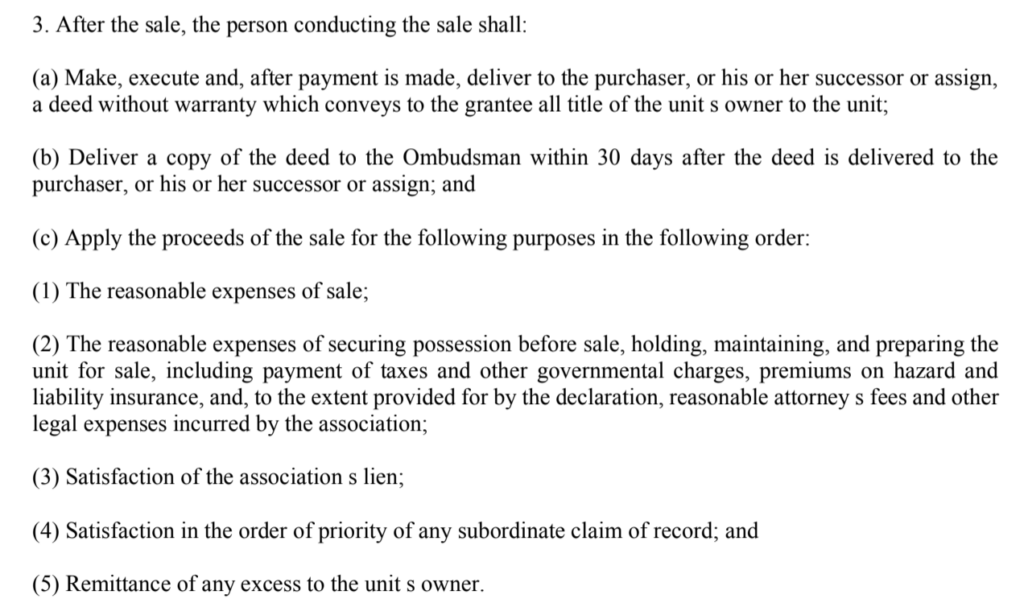

There is no SCA record that the SCA Board approved the sale of this property. There is no court record that Red Rock interpleaded the proceeds. Upon information and belief, RRFS did not distribute the proceeds after the sale as mandated by NRS 116.31164(3)(2013).

There is no SCA record that the SCA Board approved the sale of this property. There are no SCA records to ascertain what happened to the proceeds of the sale. Upon information and belief, RRFS did not distribute the proceeds after the sale as mandated by NRS 116.31164(3)(2013).

TRP Fund IV LLC v. Bank of Mellon et al, A-15-724233-C

SCA did not enforce the 4/27/12 contract indemnification clause that would have shifted this expense to RRFS. There is no court record that RRFS interpleaded the proceeds.

There is no SCA record that the SCA Board approved the sale of this property. There are no SCA records to ascertain what happened to the proceeds of the sale. Upon information and belief, RRFS did not distribute the proceed of the sale as mandated by NRS 116.31164(3)(2013).

There is no SCA record that the SCA Board approved the sale of this property. There are no SCA records to ascertain what happened to the proceeds of the sale. Upon information and belief, RRFS did not distribute the proceed of the sale as mandated by NRS 116.31164(3)(2013).

There is no SCA record that the SCA Board approved the sale of this property. There are no SCA records to ascertain what happened to the proceeds of the sale. Upon information and belief, RRFS did not distribute the proceed of the sale as mandated by NRS 116.31164(3)(2013).

There is no SCA record that the SCA Board approved the sale of this property. There are no SCA records to ascertain what happened to the proceeds of the sale. Upon information and belief, RRFS did not distribute the proceed of the sale as mandated by NRS 116.31164(3)(2013).

There is no SCA record that the SCA Board approved the sale of this property.

Bank of NY Mellon v. SCA 2:17-cv-02161-APG-PAL, ADR 17-91. SCA did not enforce the 4/27/12 contract indemnification clause that would have shifted this expense to RRFS.

There is no SCA record that the SCA Board approved the sale of this property. There are no SCA records to ascertain what happened to the proceeds of the sale. Upon information and belief, RRFS did not distribute the proceed of the sale as mandated by NRS 116.31164(3)(2013).

LN Mgt LLC series 2584 Pine Prairie v. Deutsche Bank A-14-707237-C. SCA did not enforce the 4/27/12 contract indemnification clause that would have shifted this expense to RRFS.

There is no SCA record that the SCA Board approved the sale of this property. There are no SCA records to ascertain what happened to the proceeds of the sale. Upon information and belief, RRFS did not distribute the proceed of the sale as mandated by NRS 116.31164(3)(2013).

There is no SCA record that the SCA Board approved the sale of this property. there are no SCA records to ascertain what happened to the proceeds of the sale.

Upon information and belief, RRFS did not distribute the proceed of the sale as mandated by NRS 116.31164(3)(2013).

The sale was cancelled by a Citi Mortgage temporary restraining order. Citimortgage Inc v. SCA A-14-702071 NV Supreme court case # 71942.

On 12/7/17, the SCA Board authorized paying $55,000 to Citi to settle the case. SCA did not enforce the 4/27/12 RRFS contract indemnification clause that would have shifted this expense to RRFS.

The Board President’s report of the settlement does not match the court records.

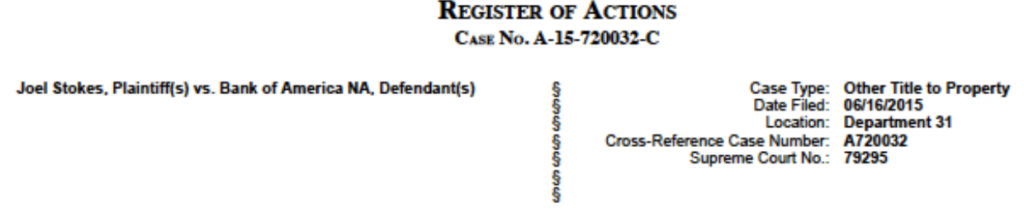

The sale was conducted without notice. The buyer was a realtor in the BHHS listing office that was under contract with Nona Tobin. Jimijack vs BANA & SCA (A-15-720032-C); Nationstar vs Opportunity Homes (A-16-730078-C), Nona Tobin vs Joel Stokes et al A-19-799890-C, Supreme Court appeals #79295, 82094, 832234 and 82294. SCA did not enforce the 4/27/12 contract indemnification clause that would have shifted this expense to RRFS.

There is no SCA record that the SCA Board approved the sale of this property. There are no SCA records to ascertain what happened to the proceeds of the sale. RRFS did not distribute the proceed of the sale as mandated by NRS 116.31164(3)(2013). Instead, more than six years later, after refusing to distribute the proceeds to Nona Tobin, RRFS sued five defendants for interpleader, knowing that no one had a recorded claim except Nona Tobin.

FNMA v SCA 2:17-cv-1800-JAD-GWF. SCA did not enforce the 4/27/12 contract indemnification clause that would have shifted this expense to RRFS.

There is no SCA record that the SCA Board approved the sale of this property. There are no SCA records to ascertain what happened to the proceeds of the sale. Upon information and belief, RRFS did not distribute the proceed of the sale as mandated by NRS 116.31164(3)(2013).

My Global Village LLC v BAC Home Servicing A-15-711883-C . SCA did not enforce the 4/27/12 contract indemnification clause that would have shifted this expense to RRFS.

There is no SCA record that the SCA Board approved the sale of this property. There are no SCA records to ascertain what happened to the proceeds of the sale. Upon information and belief, RRFS did not distribute the proceed of the sale as mandated by NRS 116.31164(3)(2013).

(m) May impose reasonable fines for violations of the governing documents of the association only if the association complies with the requirements set forth in NRS 116.31031.

NRS 116.3102(m)

With certain exceptions defined in NRS 116.31085, Board actions must occur at duly called Board meetings, compliant with the provisions of NRS 116.31083, i.e.,

SCA board did not take any valid votes to authorize the sale of 2763 White Sage in any open meeting with agendas and minutes that complied with the requirements in NRS 116.31083 (2013) and NRS 116.31085 (2013).

Therefore, the decision and the sale are voidable.

(a) A clear and complete statement of the topics scheduled to be considered during the meeting, …

(b) A list describing the items on which action may be taken and clearly denoting that action may be taken on those items. In an emergency, the units’ owners may take action on an item which is not listed on the agenda as an item on which action may be taken.

(c) A period devoted to comments by units’ owners regarding any matter affecting the common-interest community or the association and discussion of those comments. Except in emergencies, no action may be taken upon a matter raised under this item of the agenda until the matter itself has been specifically included on an agenda as an item upon which action may be taken pursuant to paragraph (b).

NRS 116.3108(4)

No minutes of any SCA Board meeting, compliant with NRS 116.31083 and NRS 116.31085, document a Board action to authorize the foreclosure of 2763 White Sage Drive was ever taken, and therefore the decision is voidable.

8. Except as otherwise provided in subsection 9 (Section 9 allows the Board to “establish reasonable limitations on materials, remarks or other information to be included in the minutes of its meetings.”) and NRS 116.31085, the minutes of each meeting of the executive board must include:

(a) The date, time and place of the meeting;

(b) Those members of the executive board who were present and those members who were absent at the meeting;

c) The substance of all matters proposed, discussed or decided at the meeting;

(d) A record of each member s vote on any matter decided by vote at the meeting; and

e) The substance of remarks made by any unit s owner who addresses the executive board at the meeting if the unit s owner requests that the minutes reflect his or her remarks or, if the unit s owner has prepared written remarks, a copy of his or her prepared remarks if the unit s owner submits a copy for inclusion.

3. An executive board may meet in executive session only to:

(a) Consult with the attorney for the association on matters relating to proposed or pending litigation if the contents of the discussion would otherwise be governed by the privilege set forth in NRS 49.035 to 49.115, inclusive.

(b) Discuss the character, alleged misconduct, professional competence, or physical or mental health of a community manager or an employee of the association.

(c) Except as otherwise provided in subsection 4, discuss a violation of the governing documents, including, without limitation, the failure to pay an assessment.

(d) Discuss the alleged failure of a unit’s owner to adhere to a schedule required pursuant to NRS 116.310305 if the alleged failure may subject the unit’s owner to a construction penalty.

NRS 116.31085 (3)

4. An executive board shall meet in executive session to hold a hearing on an alleged violation of the governing documents unless the person who may be sanctioned for the alleged violation requests in writing that an open hearing be conducted by the executive board. If the person who may be sanctioned for the alleged violation requests in writing that an open hearing be conducted, the person:

(a) Is entitled to attend all portions of the hearing related to the alleged violation, including, without limitation, the presentation of evidence and the testimony of witnesses;

(b) Is entitled to due process, as set forth in the standards adopted by regulation by the Commission, which must include, without limitation, the right to counsel, the right to present witnesses and the right to present information relating to any conflict of interest of any member of the hearing panel; and

(c) Is not entitled to attend the deliberations of the executive board.

NRS 116.31085(4)

6. Except as otherwise provided in this subsection, any matter discussed by the executive board when it meets in executive session must be generally noted in the minutes of the meeting of the executive board.

NRS 116.31085(6)

The executive board shall maintain minutes of any decision made pursuant to subsection 4 concerning an alleged violation and, upon request, provide a copy of the decision to the person who was subject to being sanctioned at the hearing or to the person’s designated representative.

“Your request for the “minutes where actions leading to foreclosure for delinquent assessment(s) was approved for 2763 White Sage” cannot be fulfilled since those minutes are Executive Session minutes and not privy to the anyone except the Board. The only time Executive Session minutes are released to a homeowner is if a hearing was held and then, only that portion of the meeting minutes is provided.”

CAM Lori Martin’s June 1, 2016 email refusing Tobin’s request for minutes

4. The executive board may not impose a fine pursuant to subsection 1 unless:

(a) Not less than 30 days before the alleged violation, the unit’s owner and, if different, the person against whom the fine will be imposed had been provided with written notice of the applicable provisions of the governing documents that form the basis of the alleged violation; and

(b) Within a reasonable time after the discovery of the alleged violation, the unit’s owner and, if different, the person against whom the fine will be imposed has been provided with:

(1) Written notice:

(I) Specifying in detail the alleged violation, the proposed action to cure the alleged violation, the amount of the fine, and the date, time and location for a hearing on the alleged violation; and

(II) Providing a clear and detailed photograph of the alleged violation, if the alleged violation relates to the physical condition of the unit or the grounds of the unit or an act or a failure to act of which it is possible to obtain a photograph; and

(2) A reasonable opportunity to cure the alleged violation or to contest the alleged violation at the hearing.

–For the purposes of this subsection, a unit’s owner shall not be deemed to have received written notice unless written notice is mailed to the address of the unit and, if different, to a mailing address specified by the unit’s owner.

5. The executive board must schedule the date, time and location for the hearing on the alleged violation so that the unit’s owner and, if different, the person against whom the fine will be imposed is provided with a reasonable opportunity to prepare for the hearing and to be present at the hearing.

6. The executive board must hold a hearing before it may impose the fine, unless the fine is paid before the hearing or unless the unit’s owner and, if different, the person against whom the fine will be imposed:

(a) Executes a written waiver of the right to the hearing; or

(b) Fails to appear at the hearing after being provided with proper notice of the hearing.

7. If a fine is imposed pursuant to subsection 1 and the violation is not cured within 14 days, or within any longer period that may be established by the executive board, the violation shall be deemed a continuing violation. Thereafter, the executive board may impose an additional fine for the violation for each 7-day period or portion thereof that the violation is not cured. Any additional fine may be imposed without providing the opportunity to cure the violation and without the notice and an opportunity to be heard required by paragraph (b) of subsection 4.

8. If the governing documents so provide, the executive board may appoint a committee, with not less than three members, to conduct hearings on alleged violations and to impose fines pursuant to this section. While acting on behalf of the executive board for those limited purposes, the committee and its members are entitled to all privileges and immunities and are subject to all duties and requirements of the executive board and its members.

Adam Clarkson stated unironically, and apparently, with a complete lack of self-awareness, that SCA Board compliance with specific meeting laws is required for its corporate actions to be valid.

In his first legal opinion as SCA’s Legal counsel and debt collector, Clarkson stated, inter alia,

SCA CC&Rs 7.4 Compliance and Enforcement

SCA bylaws 3.26 Enforcement Procedures

11/15/12 NRED Advisory 12-05-116 Executive Session Agendas

SCA bylaws 3.15 provides that all HOA Board meetings must be open to members with specified exceptions. This provision parallels NRS 116.31083.

SCA bylaws 3.15A Executive Session defines the limited topics that can be discussed in closed meetings and define the due process required prior to the Board imposing a sanction against an owner for alleged violations of the governing documents. This provision parallels NRS 116.31085.

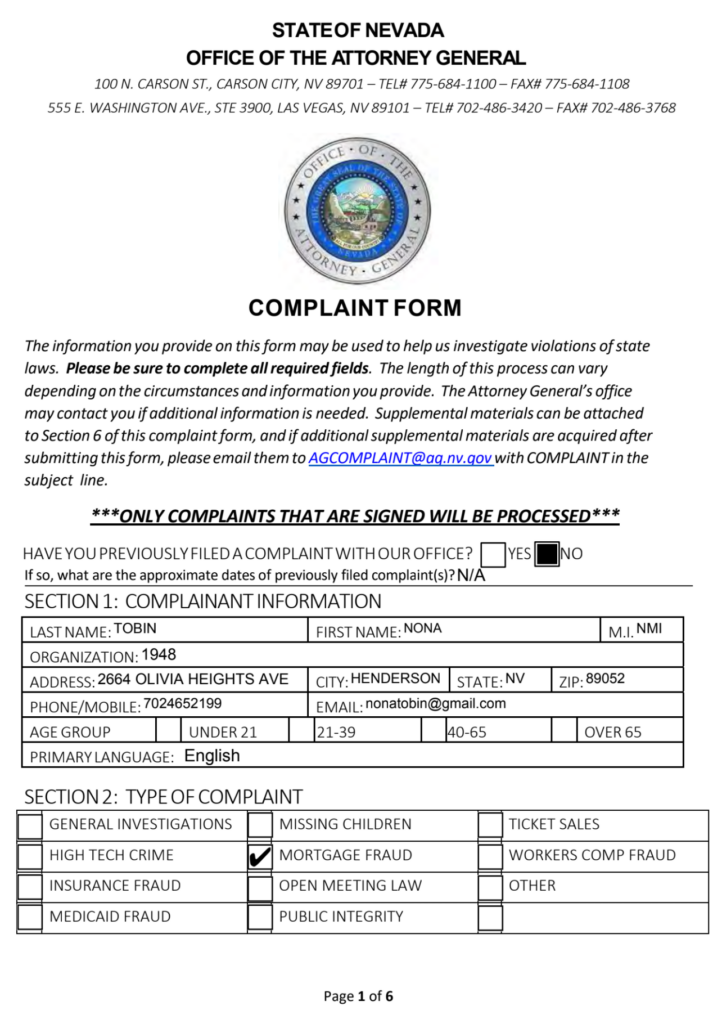

Interpleader complaint was an abuse of process because Defendant Steven Scow named parties who don’t have a claim and because it was filed to obstruct the administration of justice in other cases that were improperly filed, the wrong parties were intentionally named and the correct ones intentionally omitted.

The attorneys in all the related cases have engaged in a massive fraud on the court, involving presenting false evidence,

This interpleader complaint was filed for the corrupt purpose of continuing to obstruct a fair, evidence-based adjudication of Nona Tobin’s claims.

The defendants, jointly in concerted action and/or conspiracy, and each one separately,are utilizing this untimely, unwarranted, and harassing interpleader complaint in the corrupt attempt to moot the appeals of their non-meritorious claims in cases A-15-720032-C and A-19-799890-C.

Defendants improperly utilized this and the multiple related civil actions intended to the quiet title following a disputed 2014 HOA foreclosure. Their corrupt purpose was to get the court to bless their clients’ theft of Nona Tobin’s property, and the attorneys of those engaged in racketeering, conspired to cover it up.

Steven Scow named five defendants in the interpleader complaint when he knew that four of those defendants had already recorded releases of their claims.

Steven Scow’s allegations in the complaint were false and were for the corrupt purpose of evading detection that he misappropriated the proceeds of this 8/15/14 foreclosure sale and a dozen other Sun City Anthem foreclosures that were secretly, and without legal authority, conducted by Red Rock Financial Services in 2014.

Steven Scow has unlawfully retained the proceeds from multiple HOA foreclosures in an unauthorized, unaudited attorney trust account.

Links to NV Supreme Court cases 82294, 82234, and 82094 that the co-conspirator defendants are attempting to moot by this unwarranted and harassing interpleader complaint.

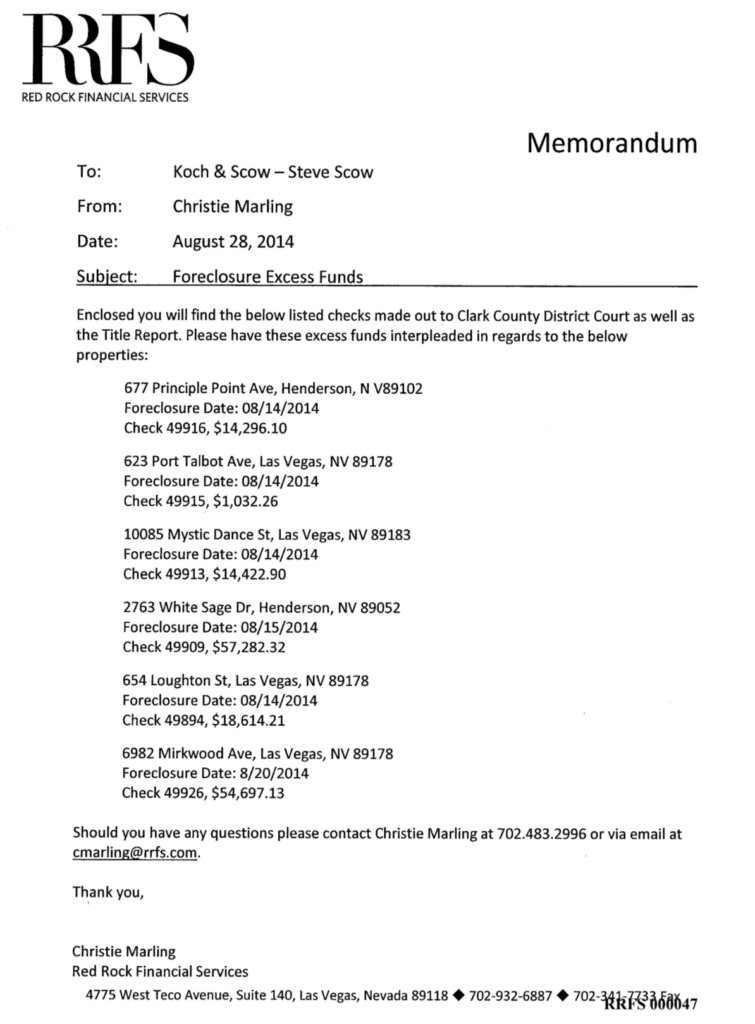

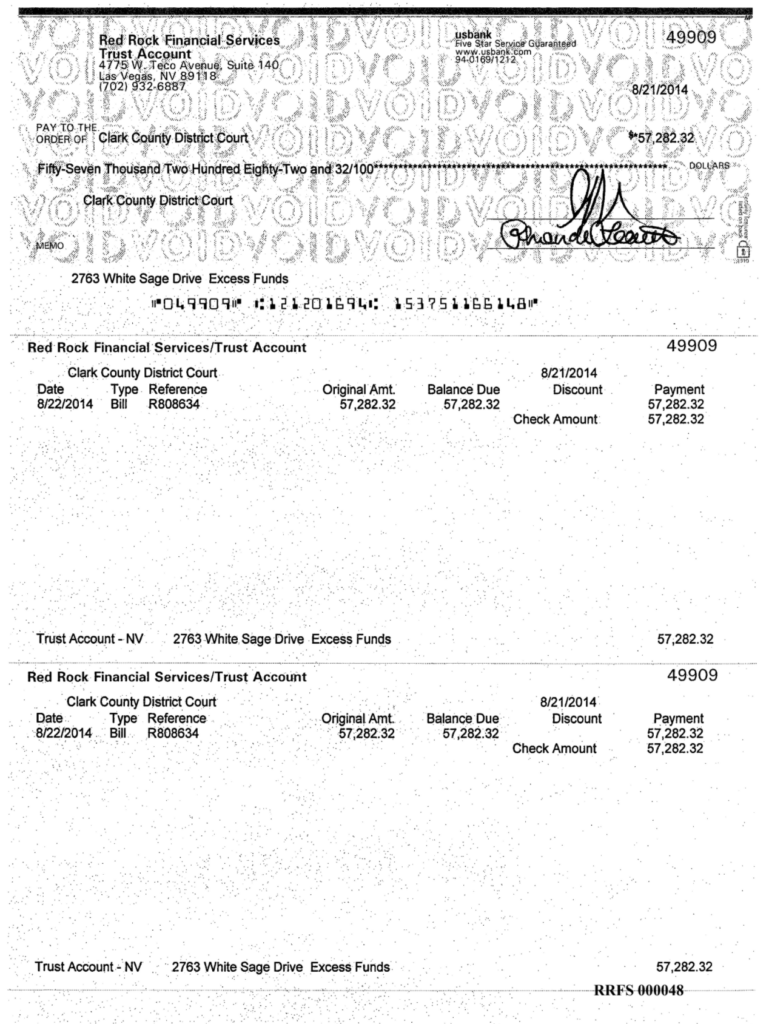

Steven Scow filed the interpleader action more than six years after he failed to distribute the $57,282.32 excess proceeds from the 8/15/14 sale

The HOA foreclosure sale was conducted on 8/15/14, and the 2013 statutes applied.

Link to NRS 116.3116-NRS 116.31168 (2013) – the applicable 2013 NRS provisions governing HOA foreclosures

Links to SCA 223-224 and RRFS 047-048 show Steven Scow was instructed to interplead the proceeds on 8/28/14.

2011 Certified fraud examiner Amicus curiae MA Supreme Court

7/15/2004 Western Thrift Deed of Trust

7/15/2004 COPY of GBH note NSM 258-260

5/14/2008 10 SCA bylaws 3.20/3.18abefgi prohibits BOD delegation

3/11/2011 2011 anti-foreclosure fraud law AB 284

10/1/2011 NV 2011 Legislative Digest re AB 284 changes

2/1/2012 2012 National Mortgage Settlement

4/12/2012 Recorded DOT assign to BANA

8/8/2012 6 Sparkman RPA $310K

8/10/2012 Tobin counter to require lender to pay seller costs

8/10/2012 7 BANA short sale addendum

8/11/2012 8 Tobin re lender is seller

9/17/2012 9 SCA MSJ exhibit 3 re intent to lien SCA628

9/20/2012 5 Hearing Notice Sanction 4 Delinquent Assessments

10/3/2012 4 Tobin letter 2 SCA w/ 8/17/12 chk 143 + death cert

1/27/2013 BANA confusion over DOT – misc docs

6/5/2013 HUD-1 draft showing $3055.47 due to HOA out of escrow

6/19/2013 Proudfit 2 Ticor: BANA rejected buyer

12/31/2013 Mortgage transfer disclosure requirements

7/1/2014 Leidy-Tobin emails 7/24/14 through 10/24/14

7/22/2014 11 SCA 280-280 BOD denial of fee waiver request

8/21/2014 RRFS trust account check $57,282.32 to CC District court

9/9/2014 BANA recorded 8/21/14 assignment to Wells Fargo

9/25/2014 2 Res Trans Rpt 1336-7 GBH 2 Jimijack

12/1/2014 NS recorded 10/23/14 assignment to itself as BANA’s “attorney-in-fact”

3/12/2015 WF recorded substitution trustee reconvey 2nd DOT 2 GBH

4/1/2015 Thomas Baynard CA bar discipline

6/9/2015 Recorded OpHomes 2 F.Bondurant 6/4/15 quit claim

6/9/2015 3 Quit claim to Jimijack -Yuen Lee signed as T Lucas

1/13/2016 NS Lis Pendens re A-730078-C

4/1/2016 Unrecorded WF power of attorney NSM 270-272

5/9/2016 Residential Transaction Report – 2763 White Sage

6/7/2016 NS Lis Pendens re A-720032-C

9/18/2016 Tobin letter to R-J editor “”HOAs, foreclosures, and property rights”

12/28/2016 Corwin notary communications

1/3/2017 Debra Batesel journal entries re 6/4/15 quit claim & RPA

3/28/2017 Recorded GBH Trust quit claim 2 Tobin

3/28/2017 Recorded Hansen Disclaimer of Interest NSM 212-217

11/5/2018 Irma Mendez affidavit re Joel Just

2/5/2019 SCA MSJ against Tobin

2/5/2019 SCAMSJ Ex5-10/8/12 receipt + false claim of 9/20 notice

2/5/2019 SCAMSJ Ex12-notices with proofs of service

2/12/2019 Joinder to the SCA motion,

2/12/2019 NS Ltd joinder 2 SCA MSJ

2/20/2019 Gmail – compare NS disclosure with my paid off note

2/20/2019 Gmail – another nail in Nationstar’s coffin

2/25/2019 NS unrecorded rescinded 10/23/14 assignment-refiled NSM 404-408

2/25/2019 NS unrecorded refile of 10/23/14 as WF attorney in fact

2/27/2019 “HOA debt collectors wield an unlawful level of power”

2/27/2019 TOC 2 Tobin disclosures

2/27/2019 Tobin 1st sup + BHHS + RRFS

3/1/2019 Hearing minutes Spanish trail A-14-710161

3/1/2019 CA SOS letter re notary complaint

3/5/2019 opposition to the SCA MSJ

3/10/2019 Tobin draft DECL OPPC NS ex 1-10

3/12/2019 CA notary violations on 4/12/12 DOT 2 BANA misc docs

8/27/2008 1 Deed GBH 2 GBH Trust

3/8/2019 Recorded rescission of 10/23/14 assignment MSN 409-411

1/17/2017 Backup for notary subpoenas- not issued

Back-to-back.

Pistols raised.

Count 10 paces.

They turn.

Both shoot Nona Tobin.

“Your work is done, Your Honor.

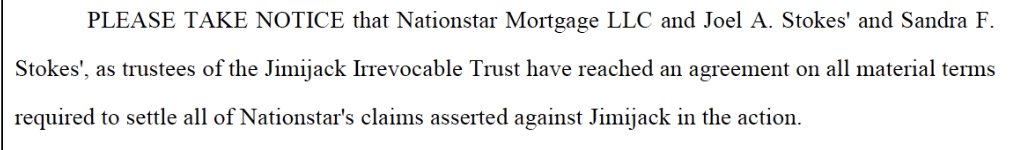

Jimijack and Nationstar have agreed.

Joel Stokes gets the title.

By the way, Nona Tobin is dead.”

Joseph Hong & Melanie Morgan, ex parte on 4/23/19