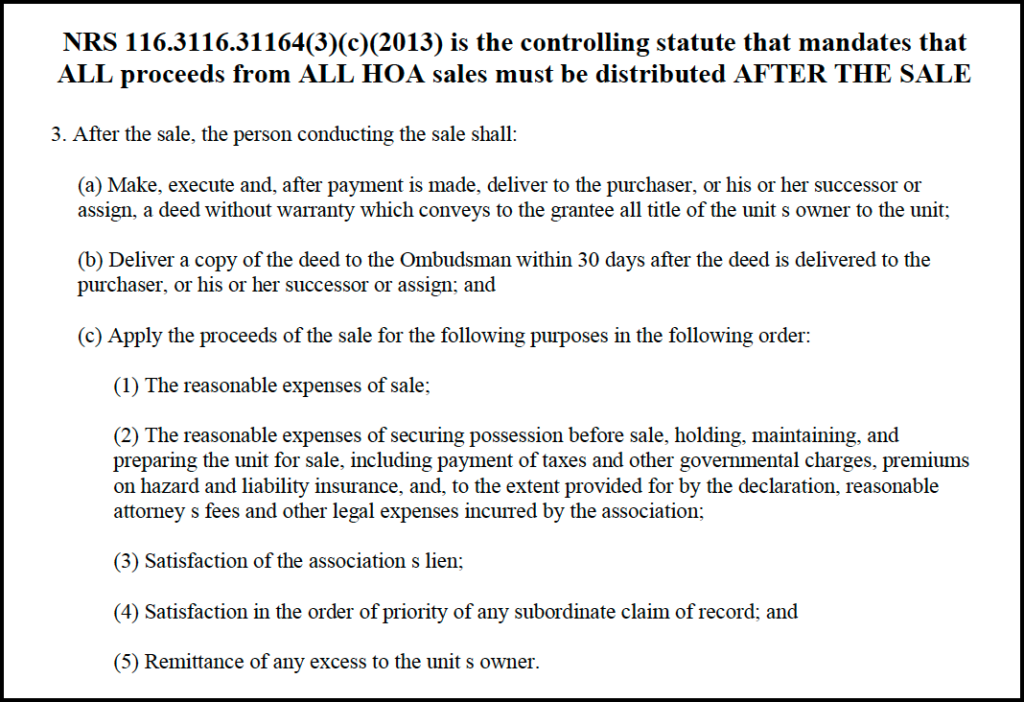

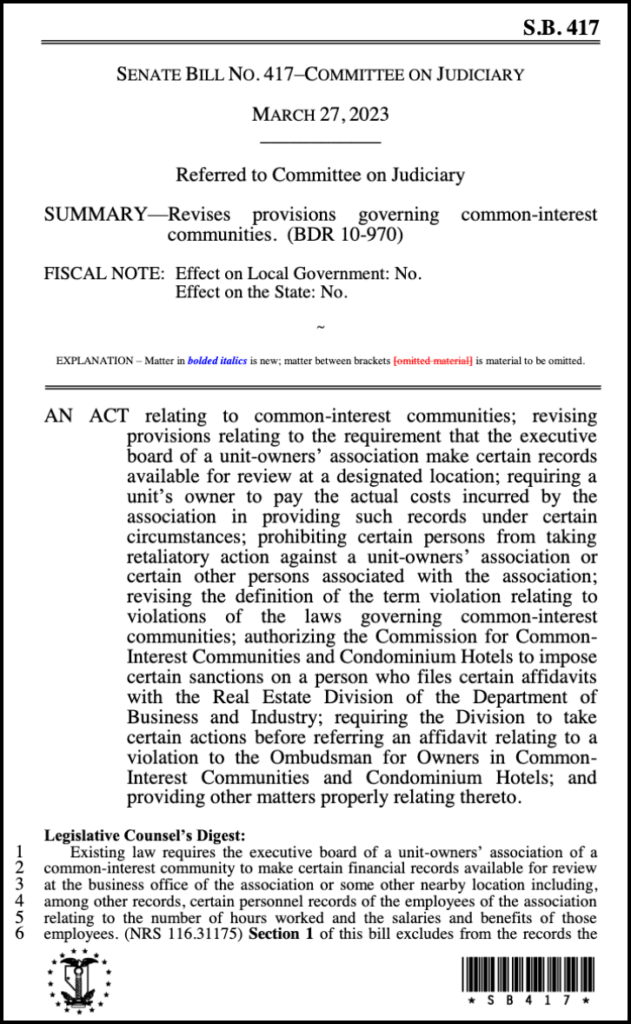

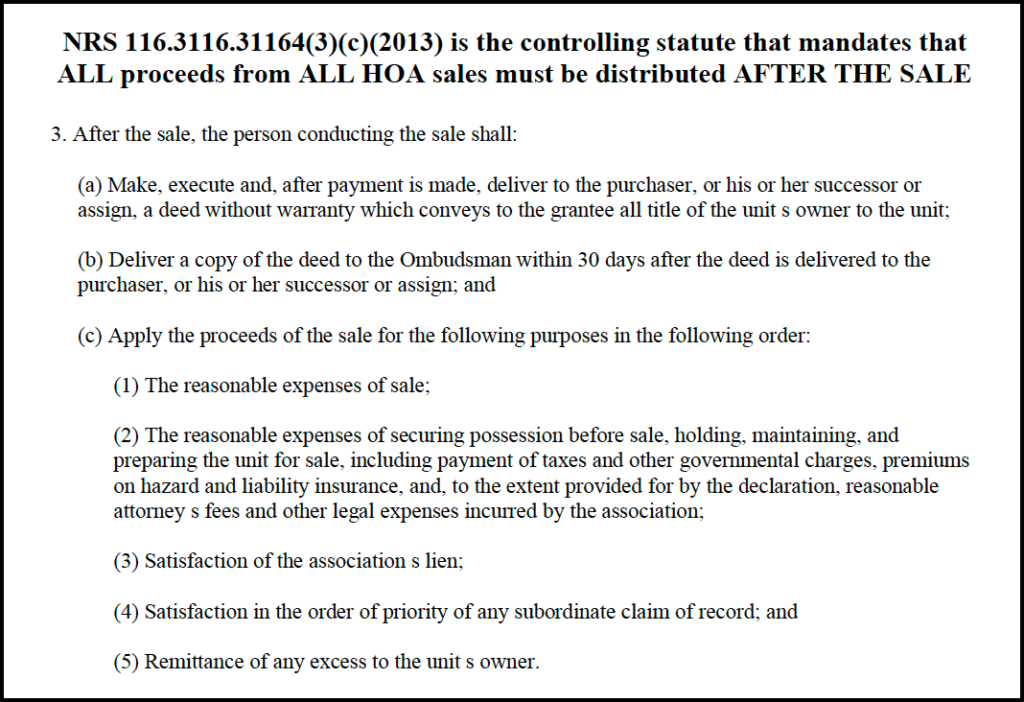

What the law requires

What interpleader standard is

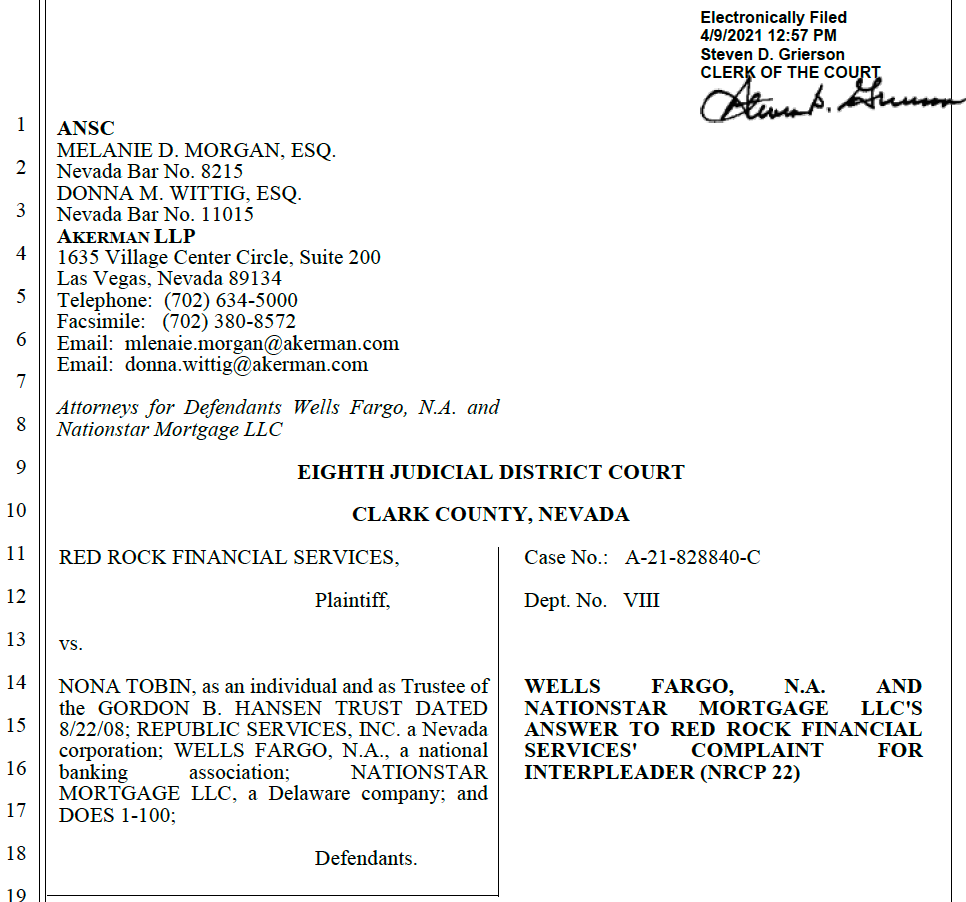

“Legal Standard “In an interpleader action, the ‘stakeholder’ of a sum of money sues all those who might have a claim to the money, deposits the money with the district court, and lets the claimants litigate who is entitled to the money.” Cripps v. Life Ins. Co. of N. Am., 980 F.2d 1261, 1265 (9th Cir. 1992)

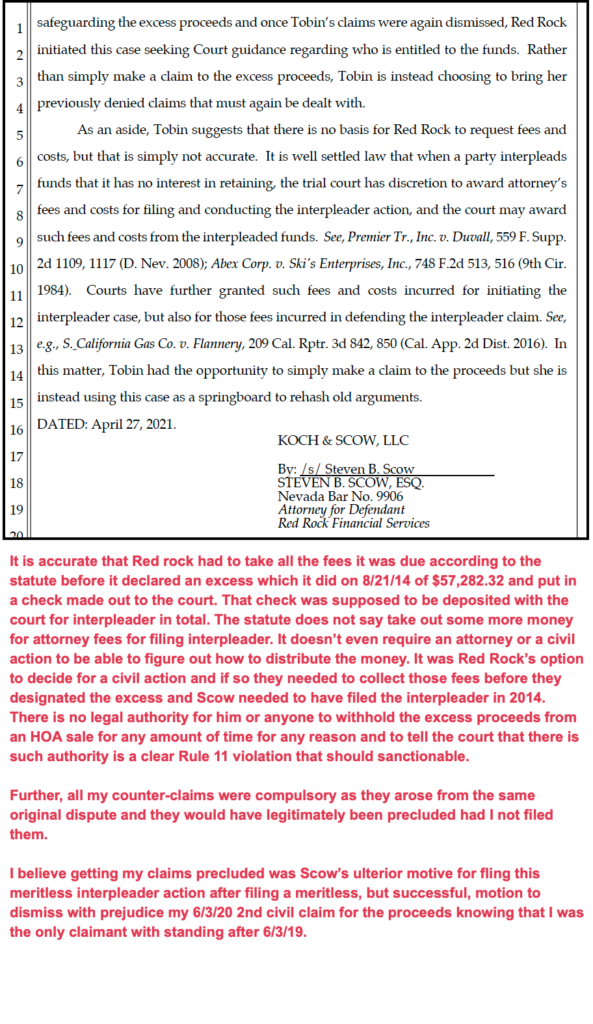

“Accordingly, many courts have held that those who have acted in bad faith to create a controversy over the stake may not claim the protection of interpleader. See, e.g., Kent v. N. Cal. Reg’l Office of Am. Friends Serv. Comm., 497 F.2d 1325, 1328 (9th Cir.1974) (“Interpleader, which is an equitable remedy, is not available to one who has voluntarily accepted funds knowing they are subject to competing claims.”) (citations omitted); Farmers Irrigating Ditch & Reservoir Co. v. Kane, 845 F.2d 229, 232 (10th Cir.1988) (“It is the general rule that a party seeking interpleader must be free from blame in causing the controversy, and where he stands as a wrongdoer with respect to the subject matter of the suit or any of the claimants, he cannot have relief by interpleader.”) (collecting cases); see also44B Am. Jur. 2d Interpleader § 7 (“The equitable doctrine of ‘clean hands’ applies to interpleader actions.”

Rule 22 of the Federal Rules of Civil Procedure allows interpleader of disputed funds where a Plaintiff is subject to double or multiple liability. Perfekt Mktg., LLC v. Luxury Vacation Deals, LLC, 2015 WL 10012987, at *2 (D. Nev. Nov. 16, 2015). The purpose of the interpleader is for the stakeholder to “protect itself against the problems posed by multiple claimants to a single fund.” Lee v. W. Coast Life Ins. Co., 688 F.3d 1004, 1009 (9th Cir. 2012).

What interpleader asks the court to do

An interpleader action typically involves two stages. Id. In the first stage, the district court decides whether the requirements for a rule or statutory interpleader action have been met by determining if there is a single fund at issue and whether there are adverse claimants to that fund. Id. If the Court finds that the interpleader action has been properly brought, it then makes a determination of the respective rights of the claimants. Id.”)

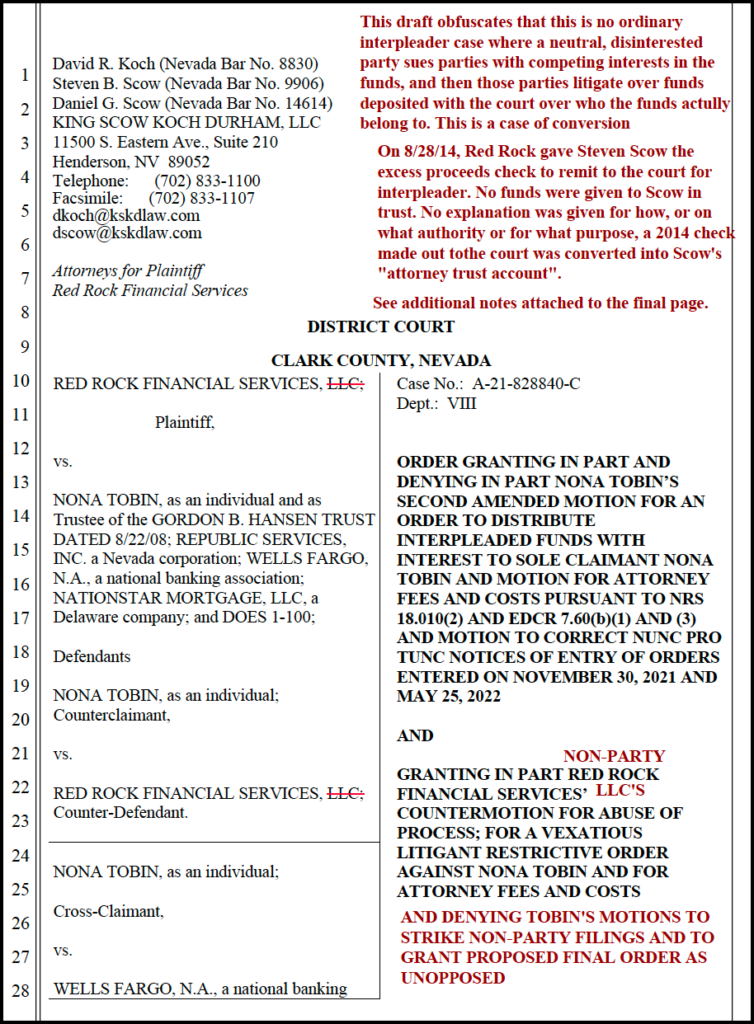

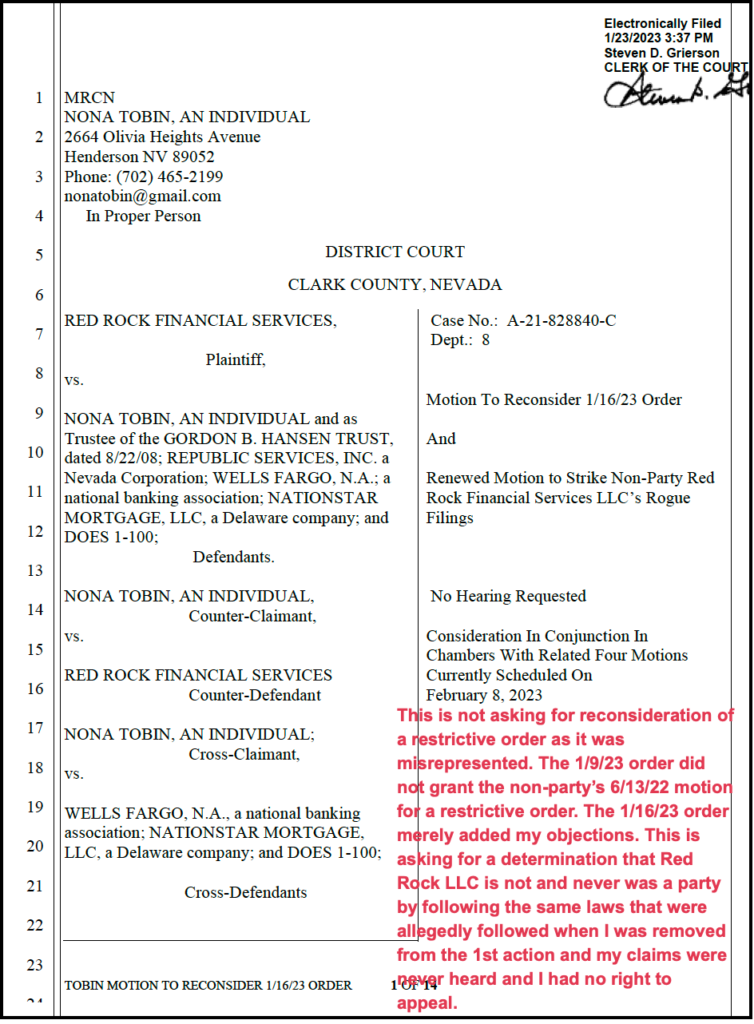

What the facts here are

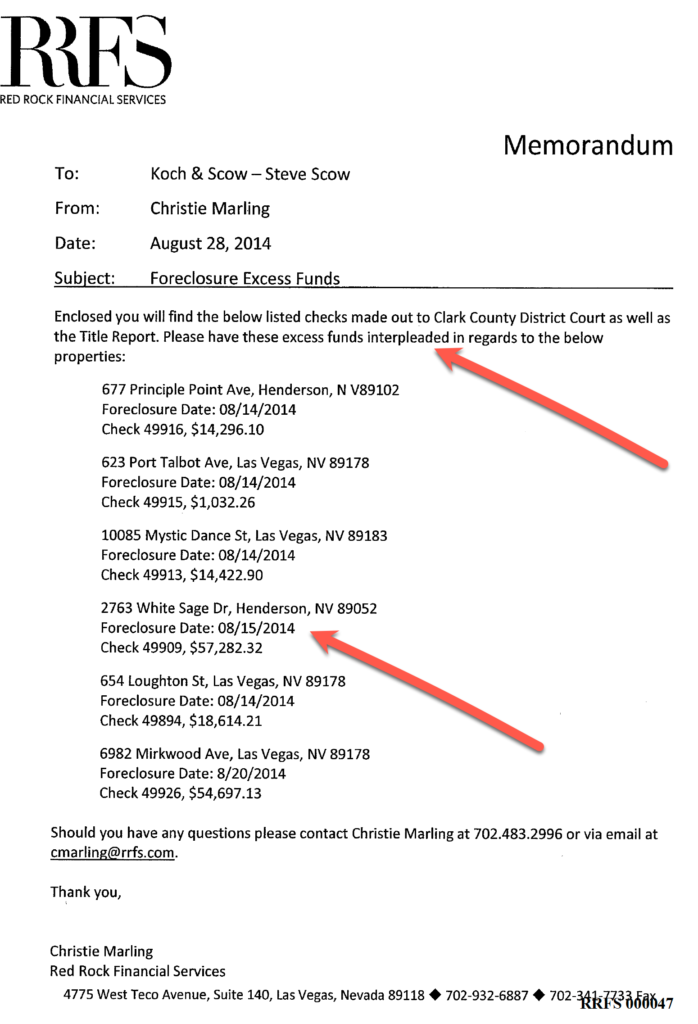

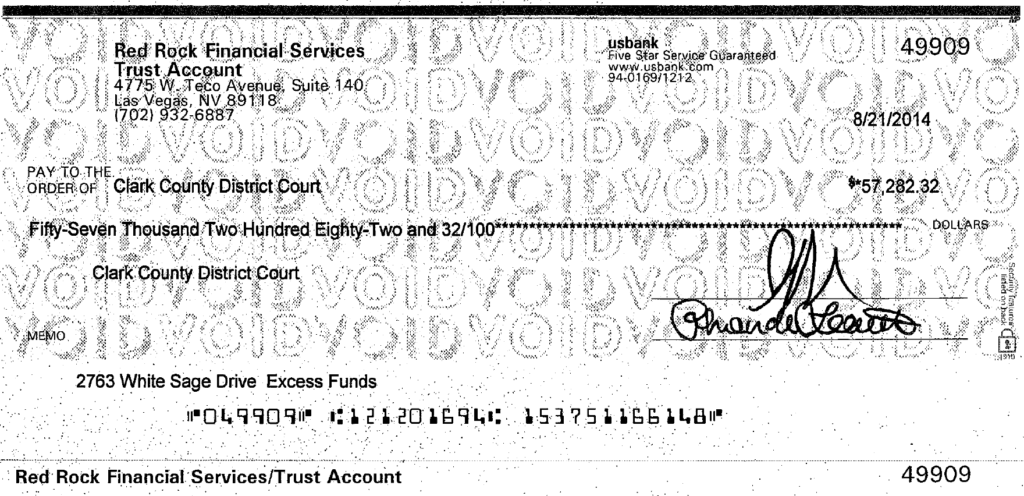

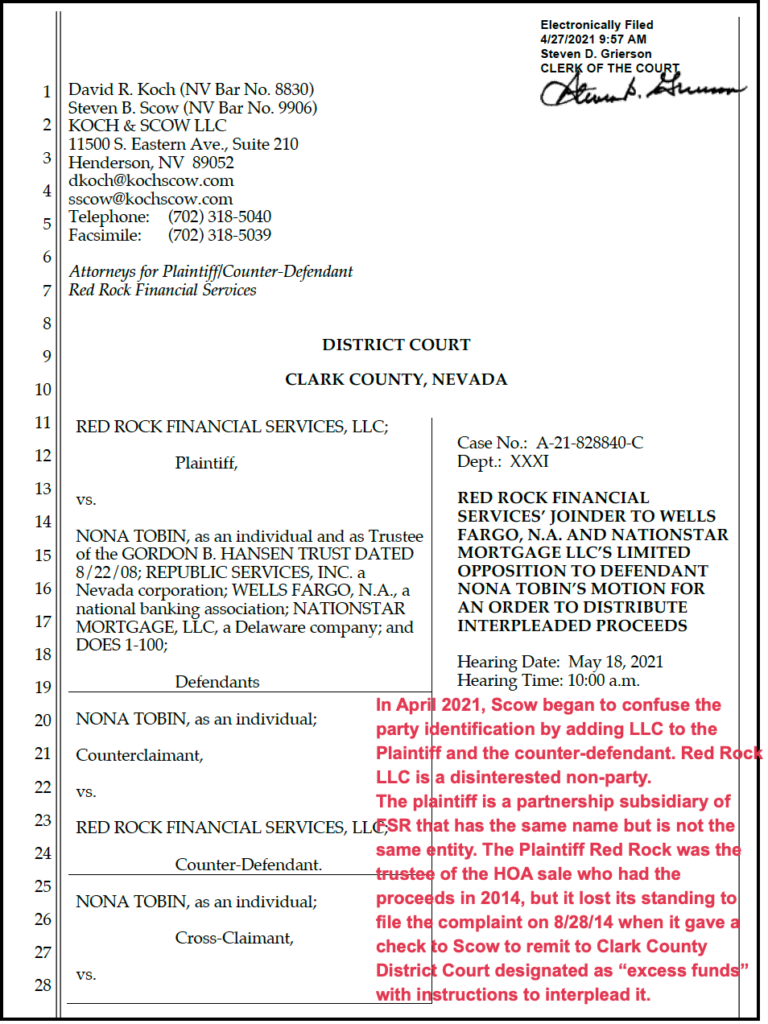

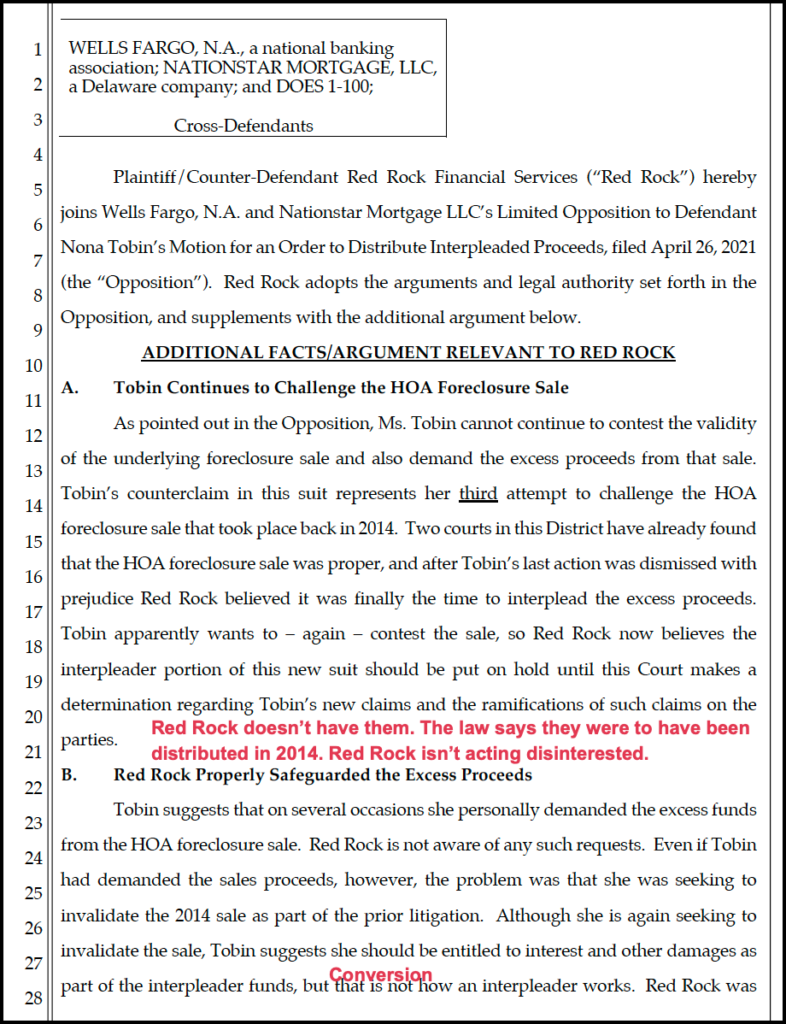

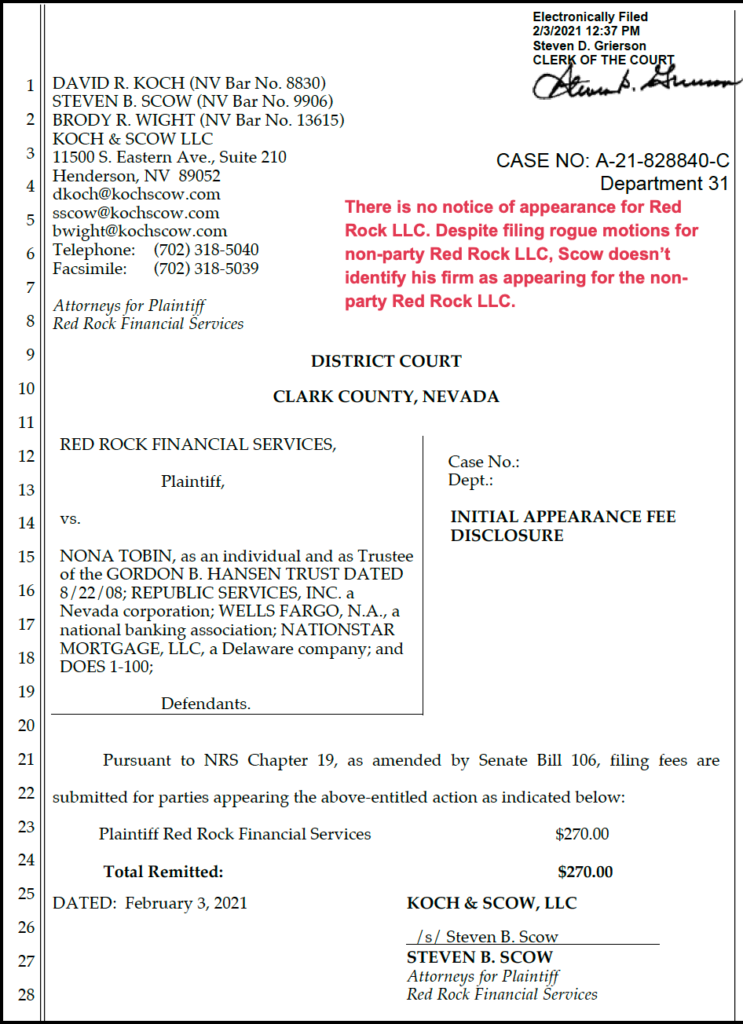

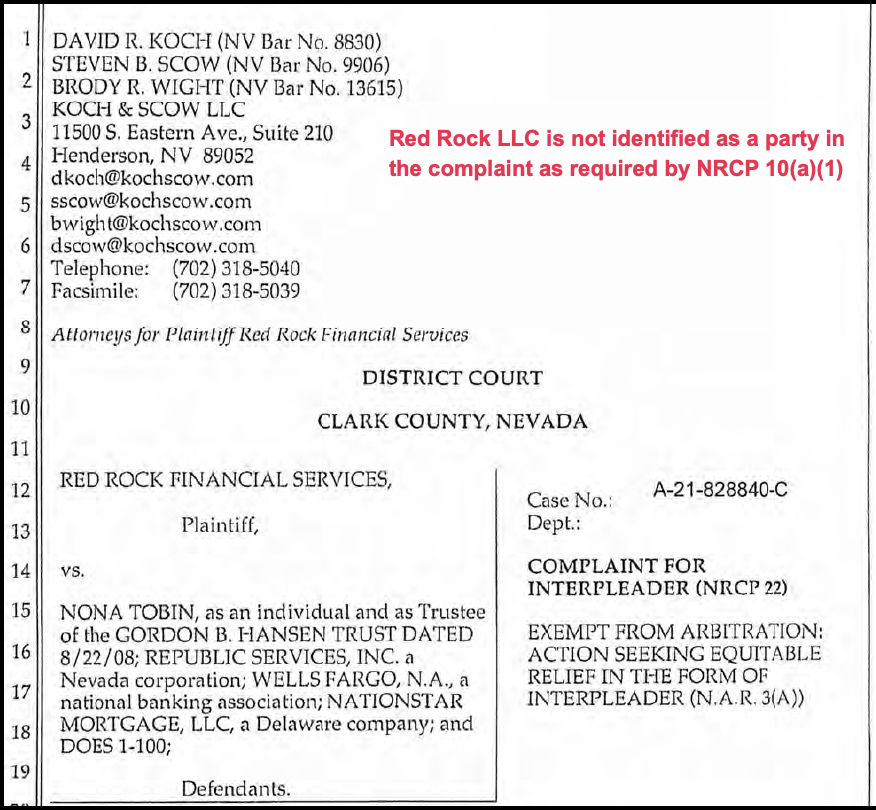

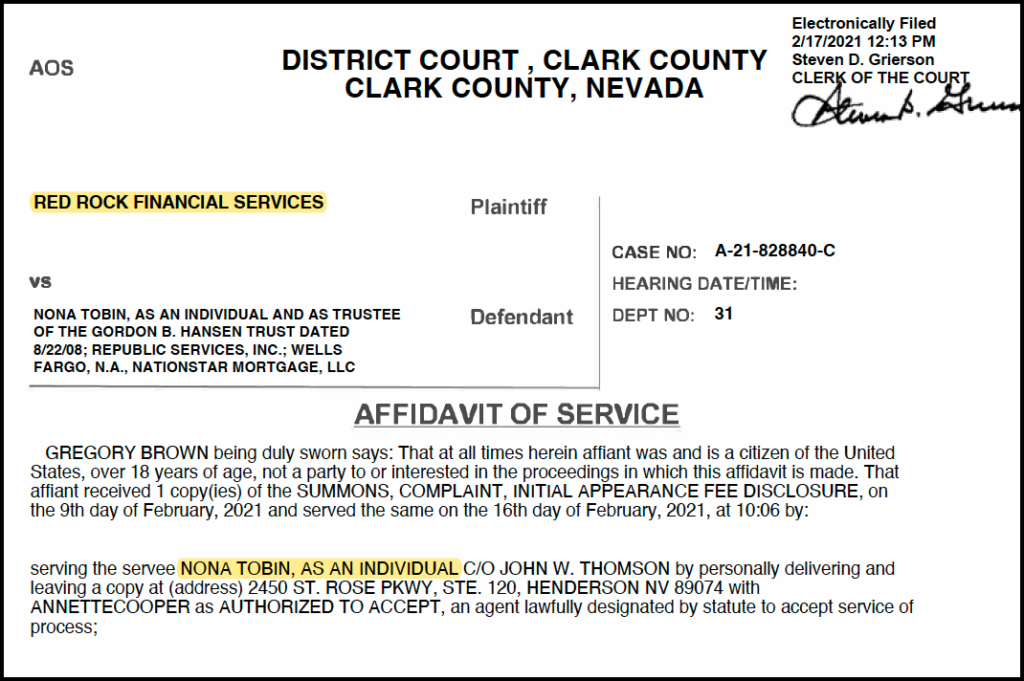

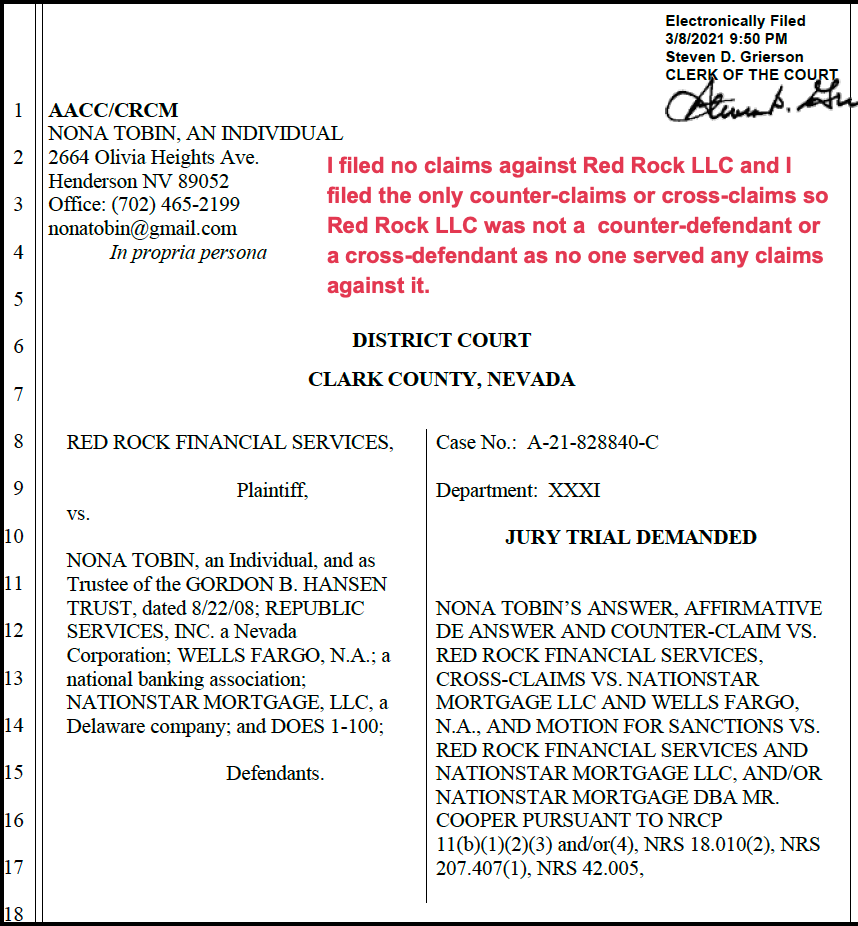

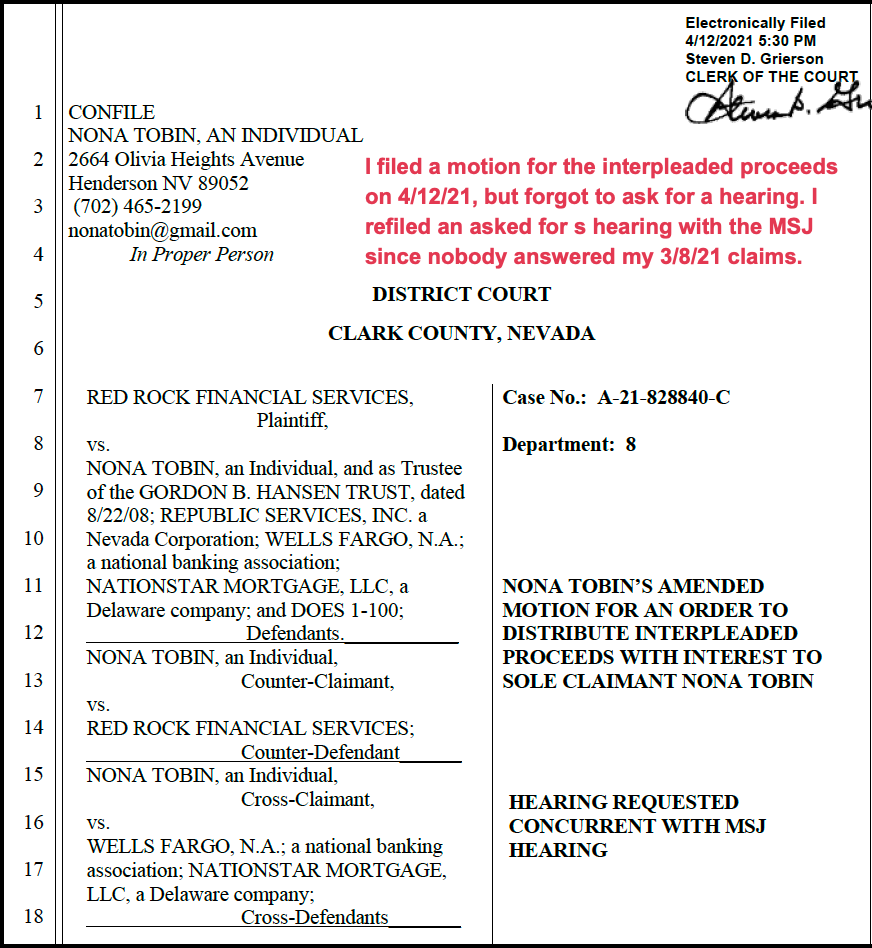

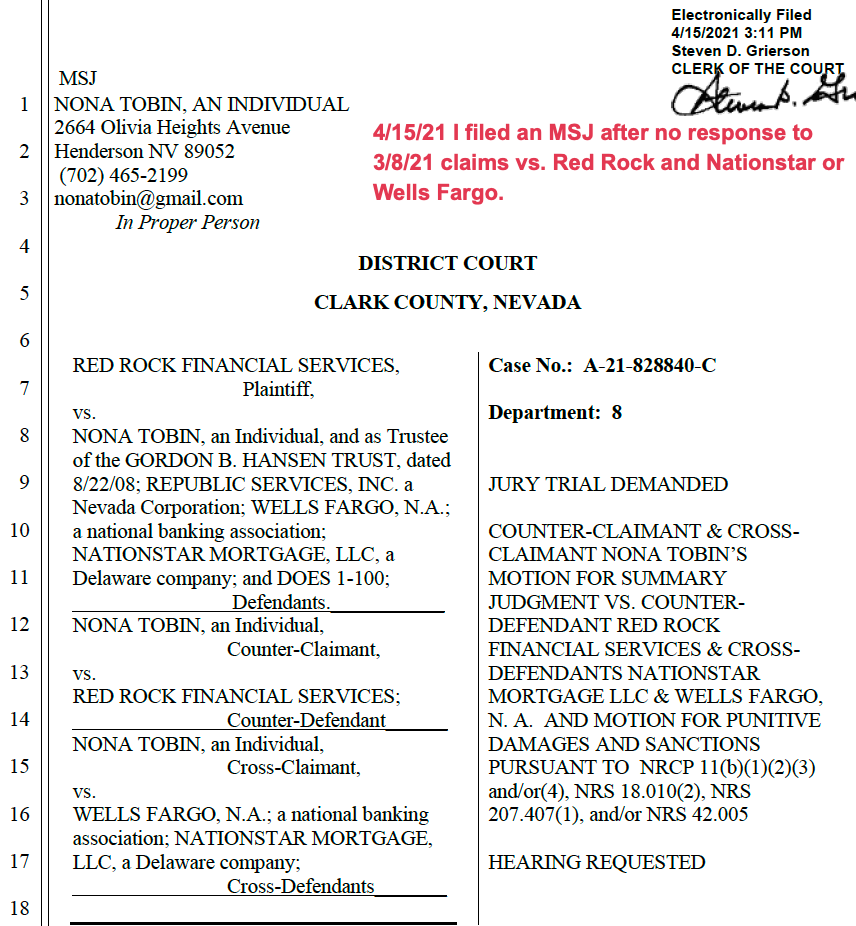

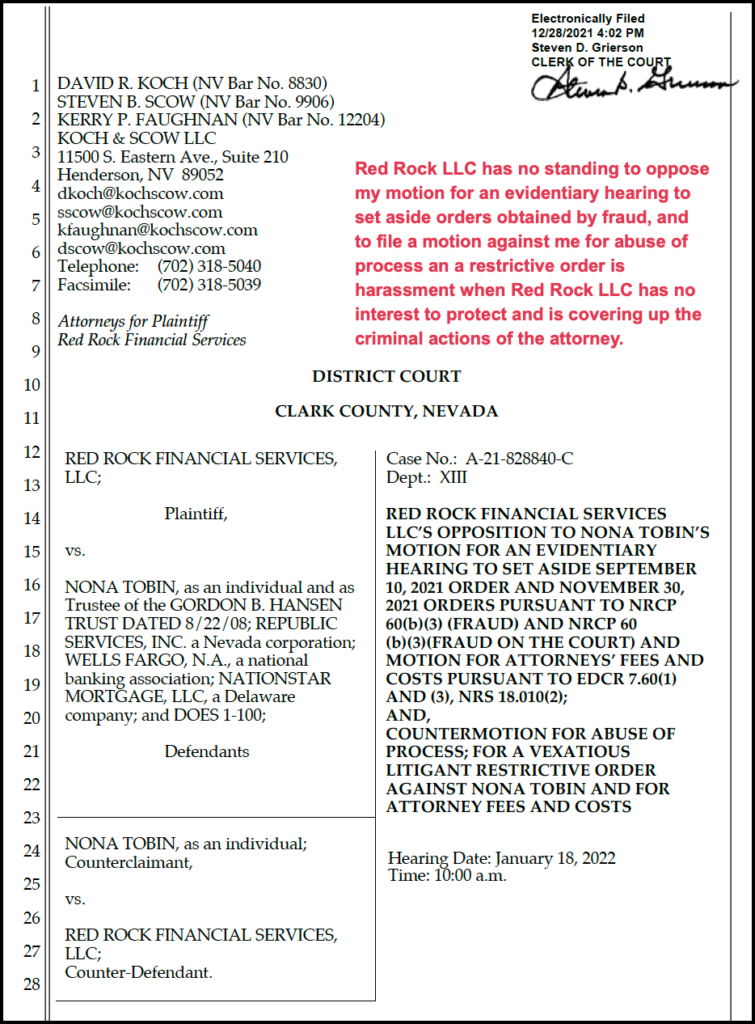

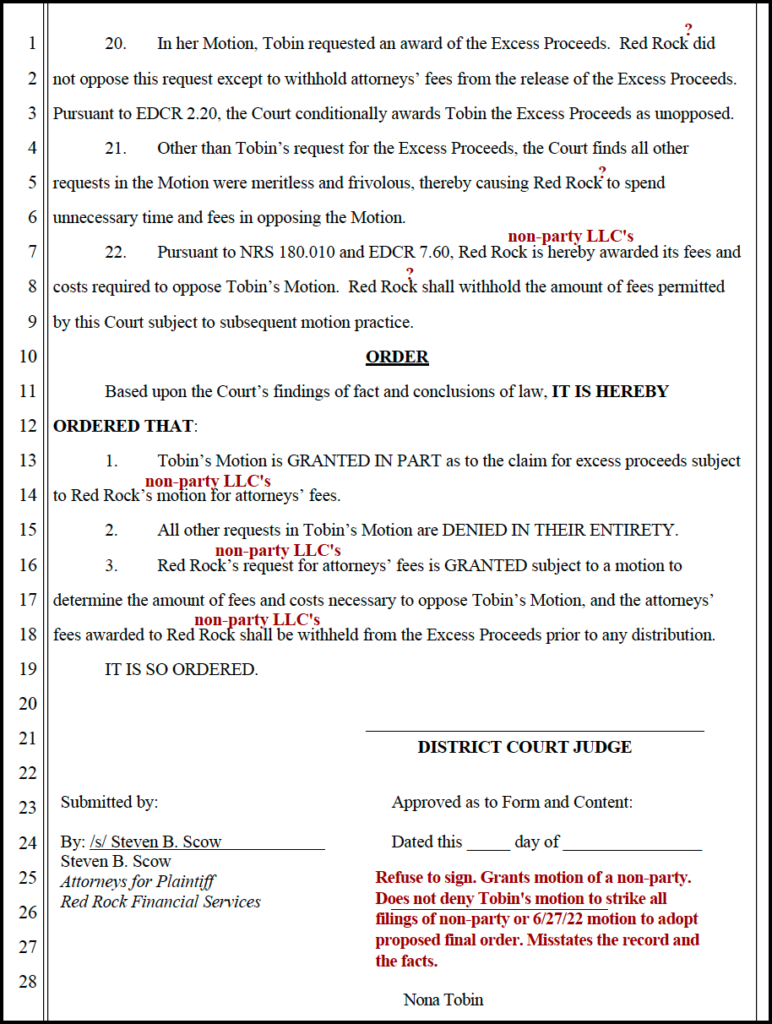

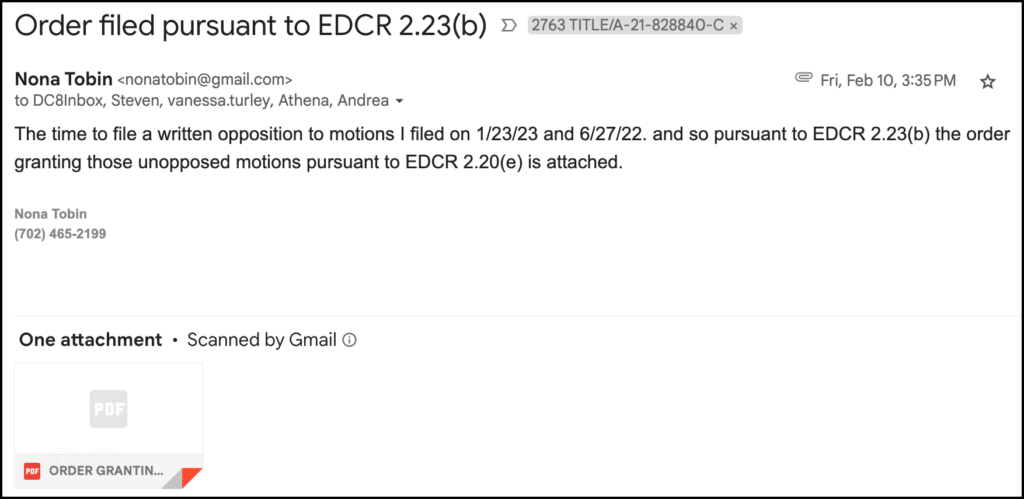

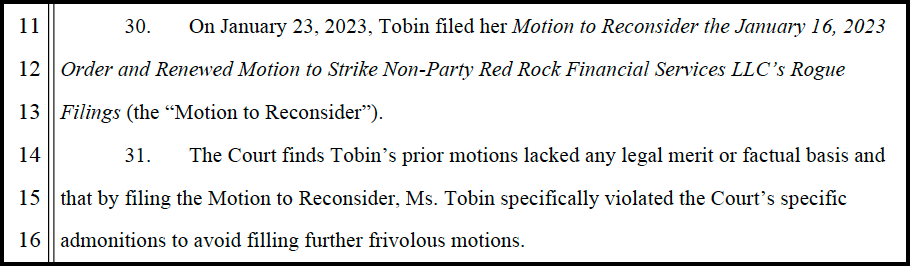

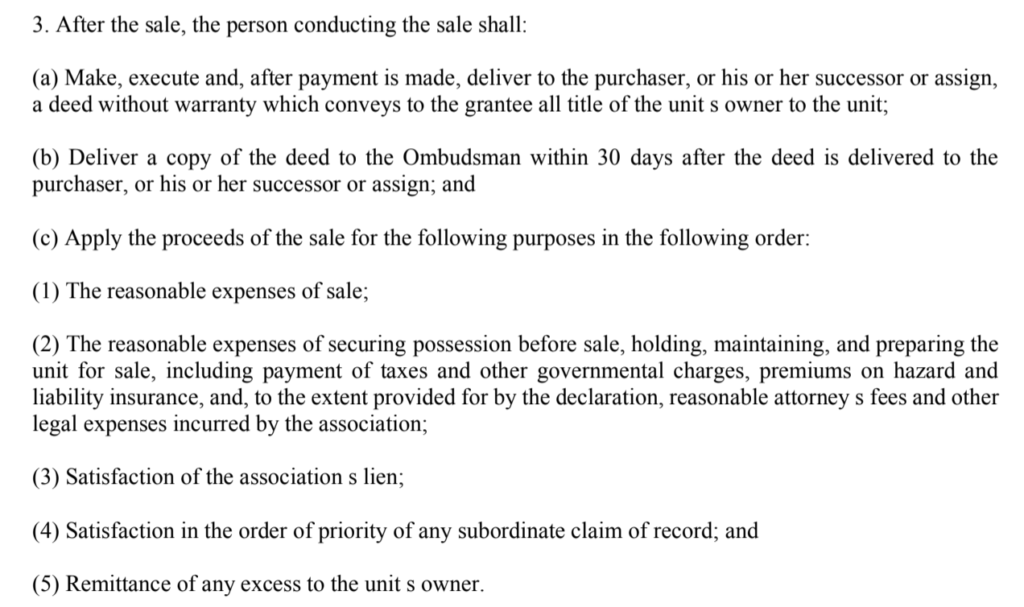

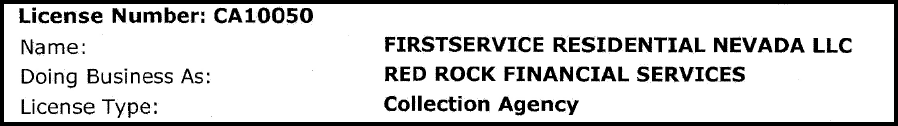

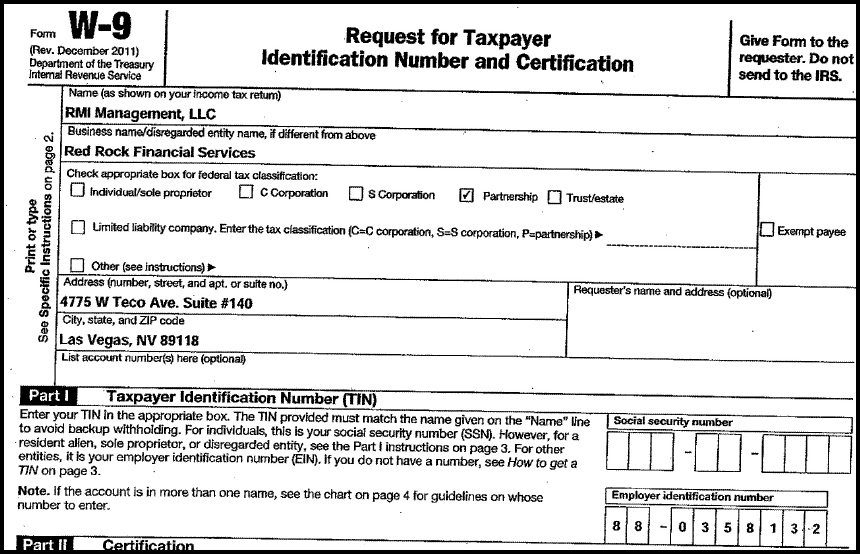

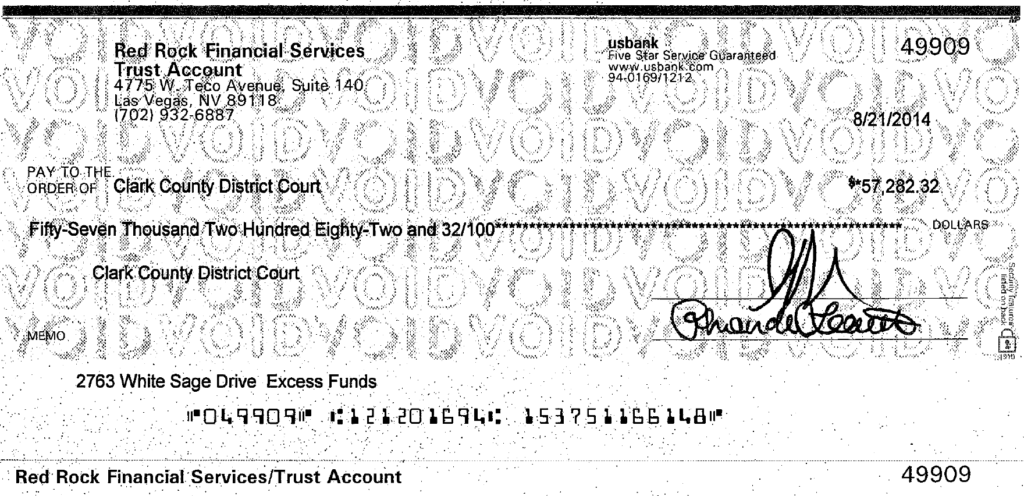

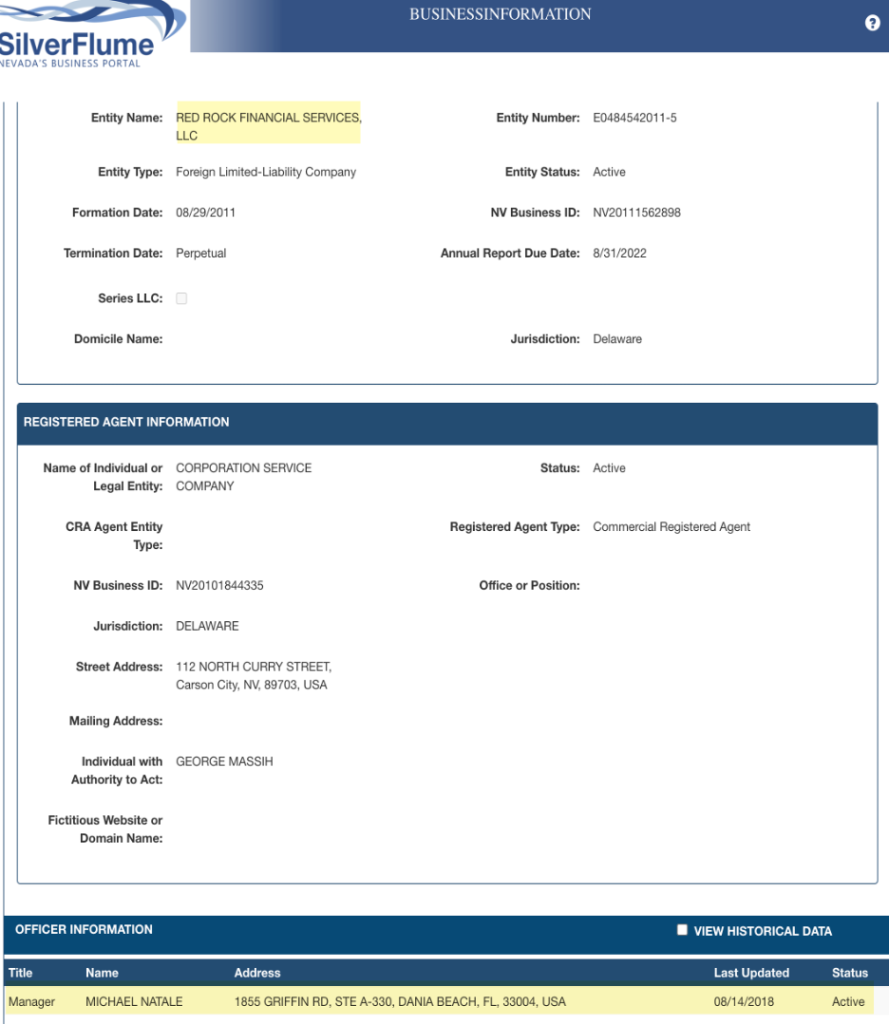

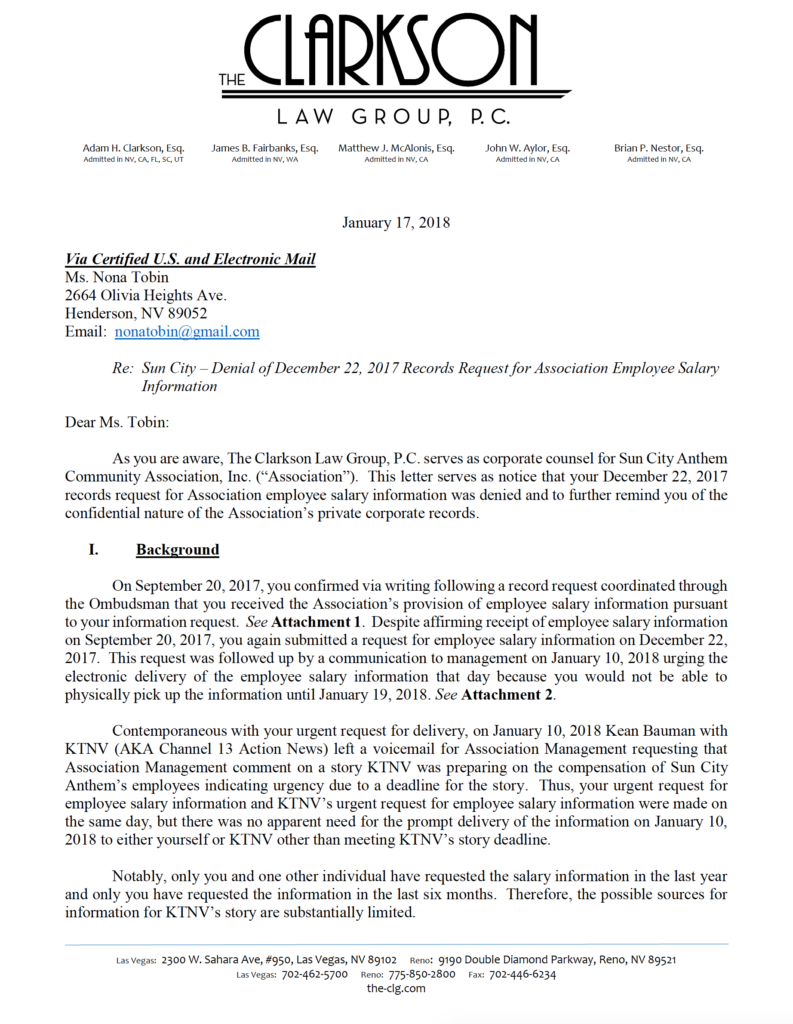

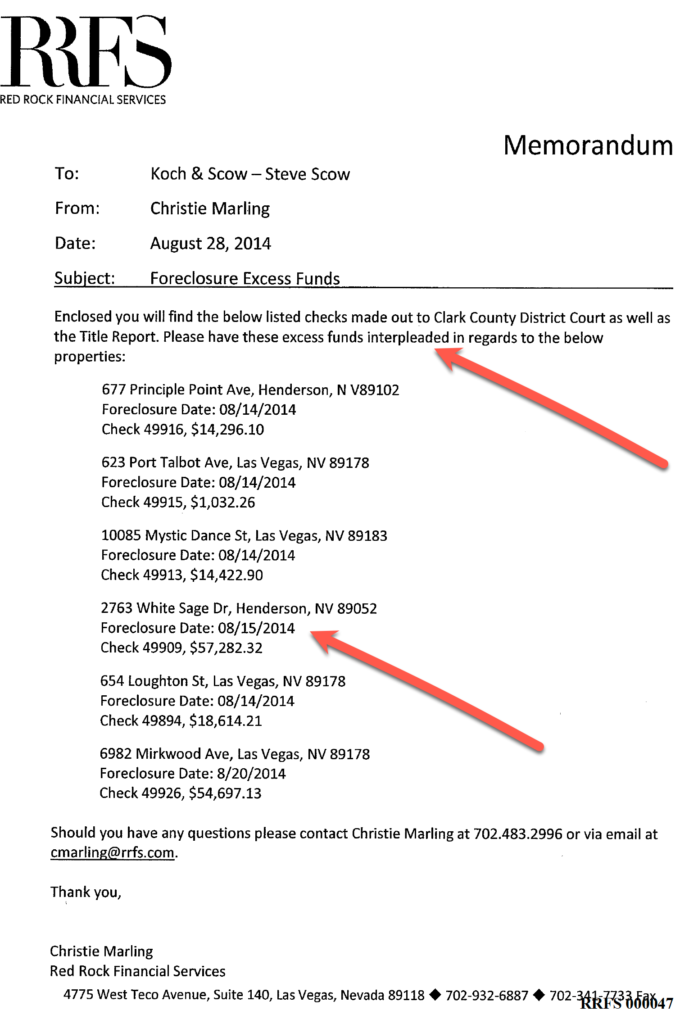

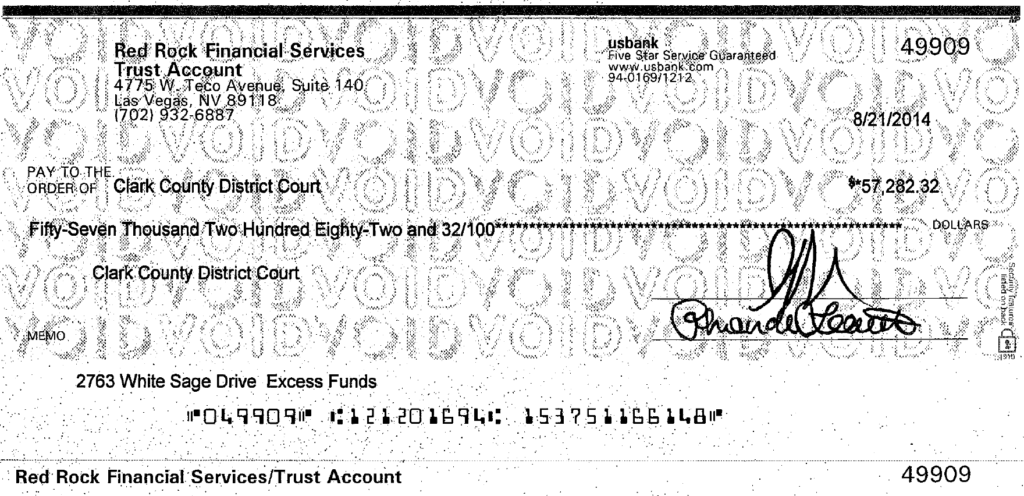

Red Rock instructed Steven Scow to interplead $57,282.32 on 8/28/14 which was declared “excess funds” after Red Rock took its fees and the HOA had been paid in full. Red Rock did not have standing in 2021 to file an interpleader action.

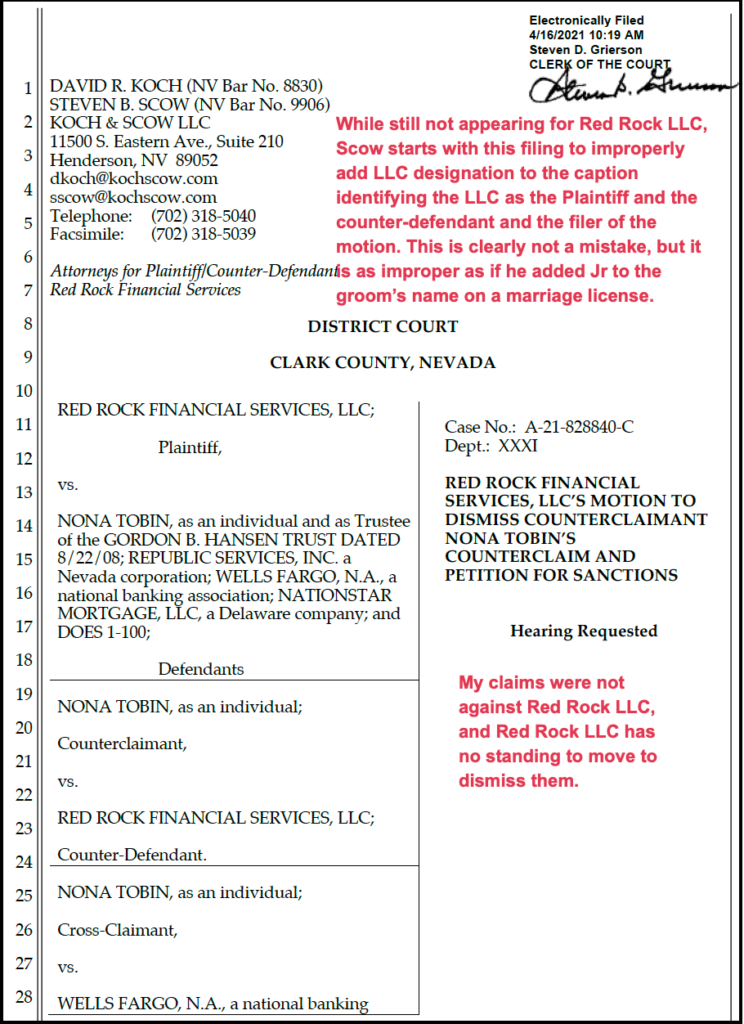

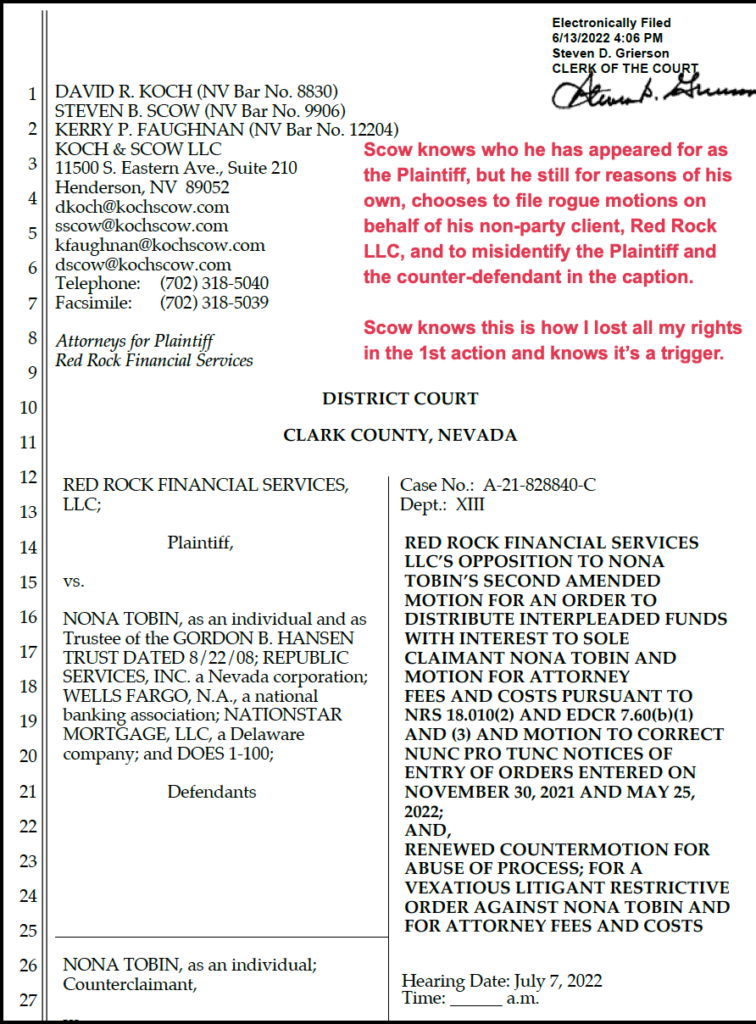

Steven Scow concealed his and other’s wrongdoing

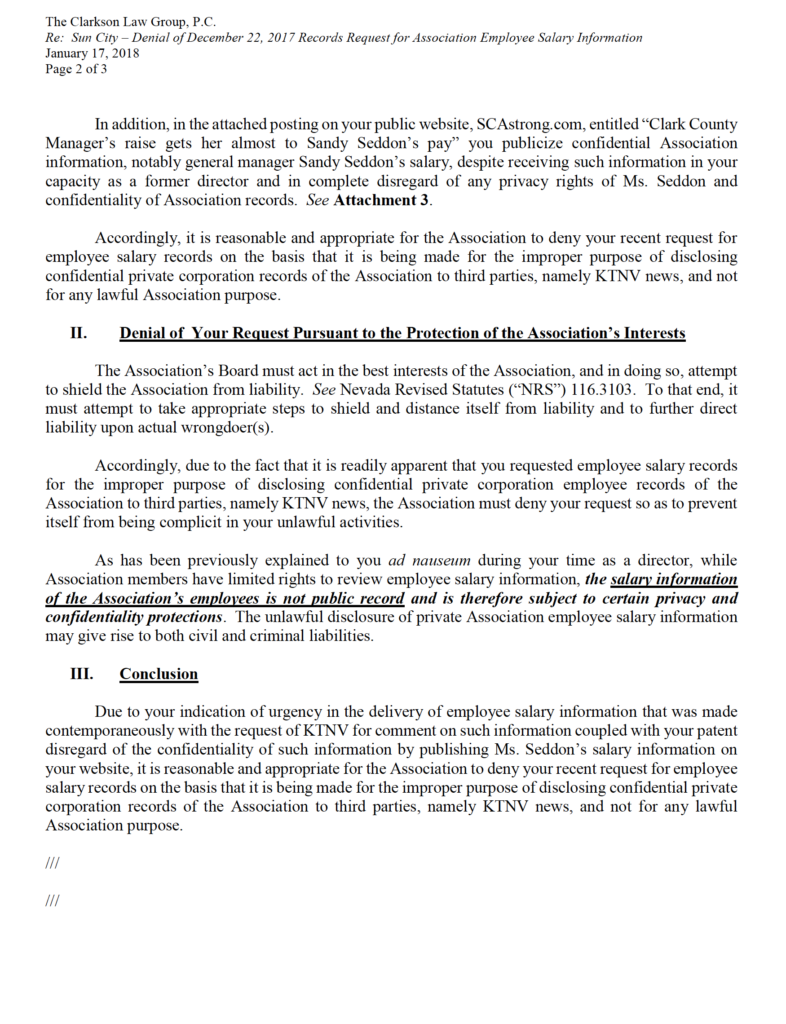

Steven Scow concealed his possession of the money and its location. He hid the fact that all named defendants had released their liens before the conclusion of the first action. Scow obscured his obstruction of my claim for the proceeds in the first action by refusing to provide them during mediation. He also hindered my second civil claim for the proceeds by filing a motion to dismiss it with prejudice, citing res judicata and the failure to include the HOA as a necessary party.

Scow further obscured his interference with my quiet title claims in the first two actions by providing inaccurate, incomplete, false, and falsified Red Rock foreclosure records. This prevented the sale from being entirely voided and allowed Nationstar and its co-conspirators to commit fraud on the court by having the sale declared valid regarding the sub-priority.

The attorneys perpetrated fraud on the court, covering up that Red Rock rejected assessments that cured the default three times, the sale would have been fairly voided in its entirety in the 1st action, and we would not be still litigating four years later without a judge ever looking at the evidence.

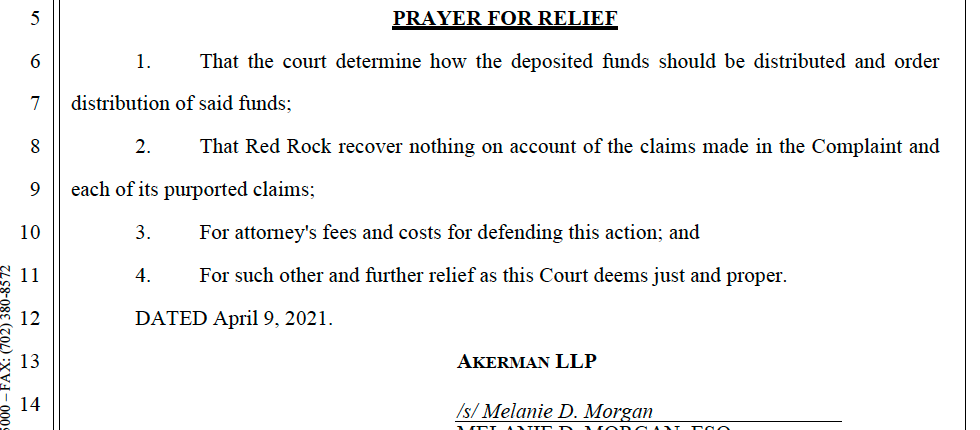

I was the sole claimant after June 3, 2019

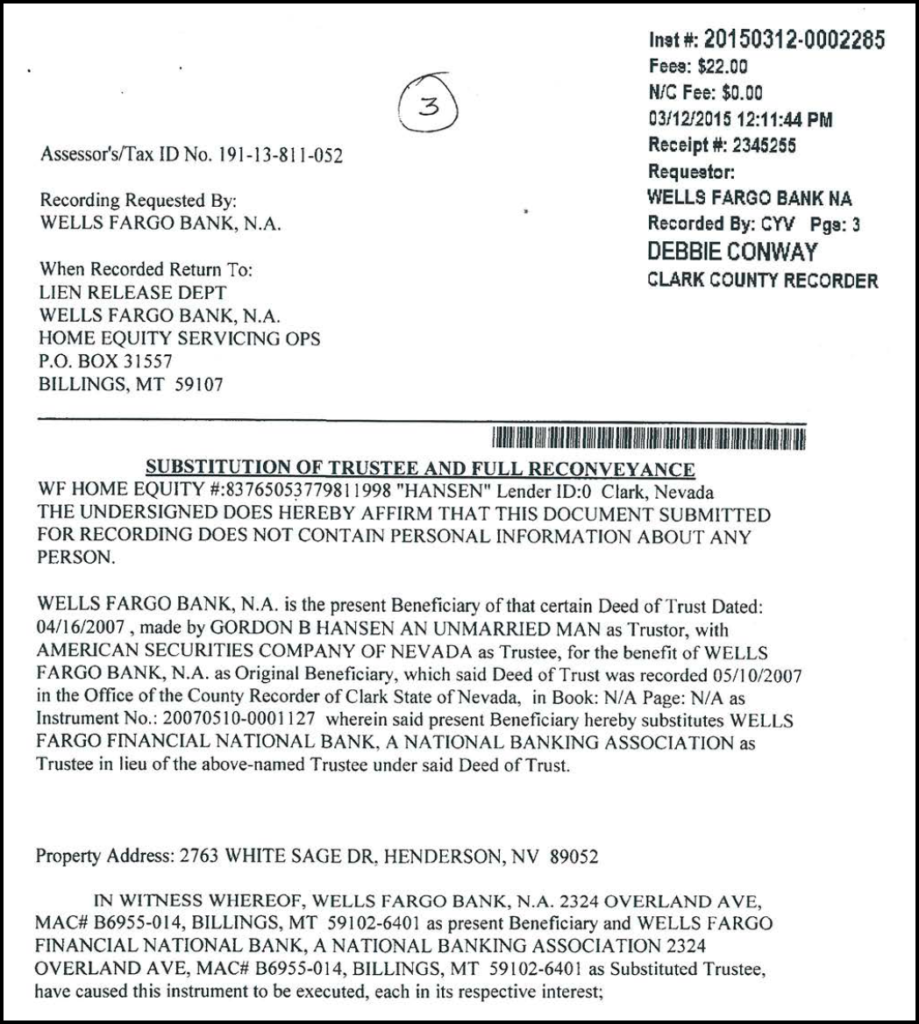

3/12/15 Wells Fargo released the lien of the 2nd deed of trust

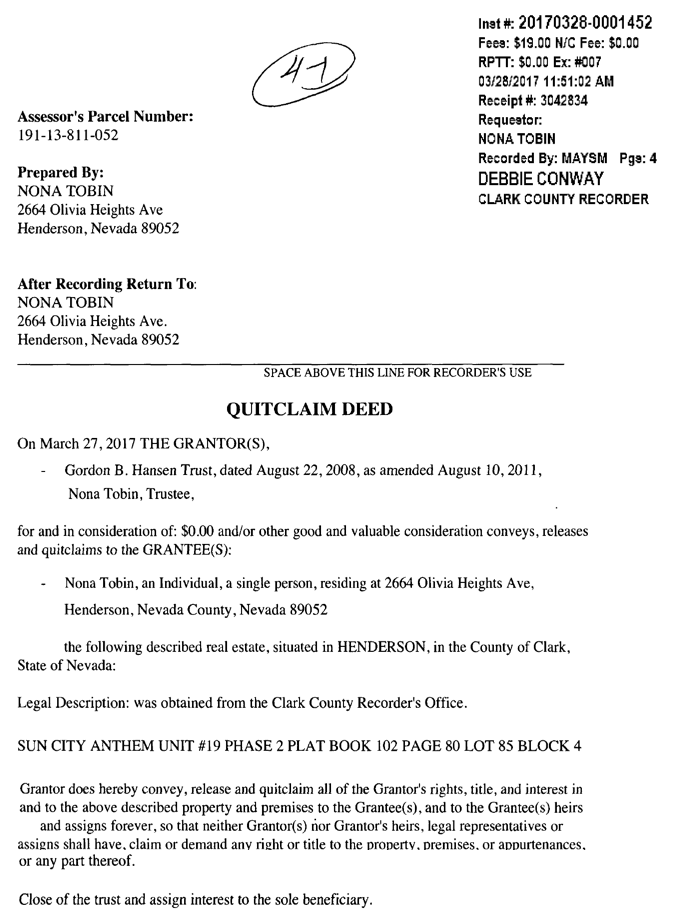

3/28/17 Gordon B. Hansen Trust closed and assigned its title interest to sole beneficiary Nona Tobin as an individual

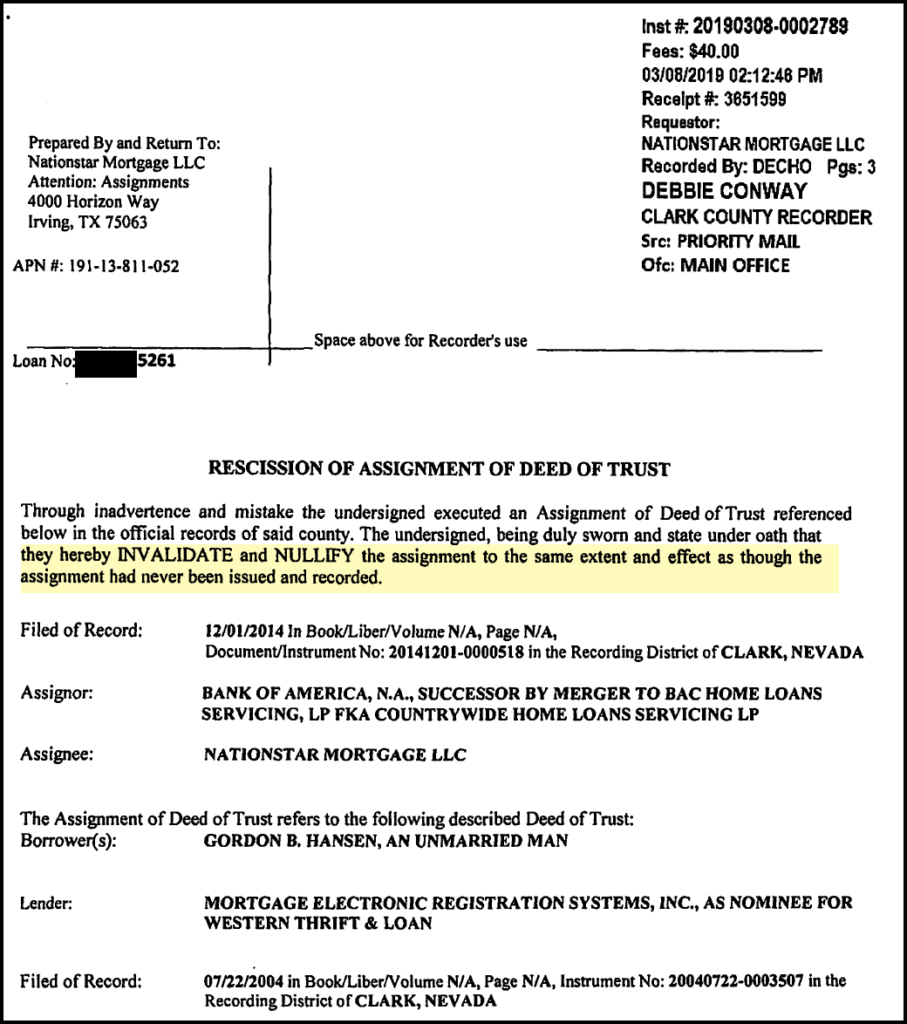

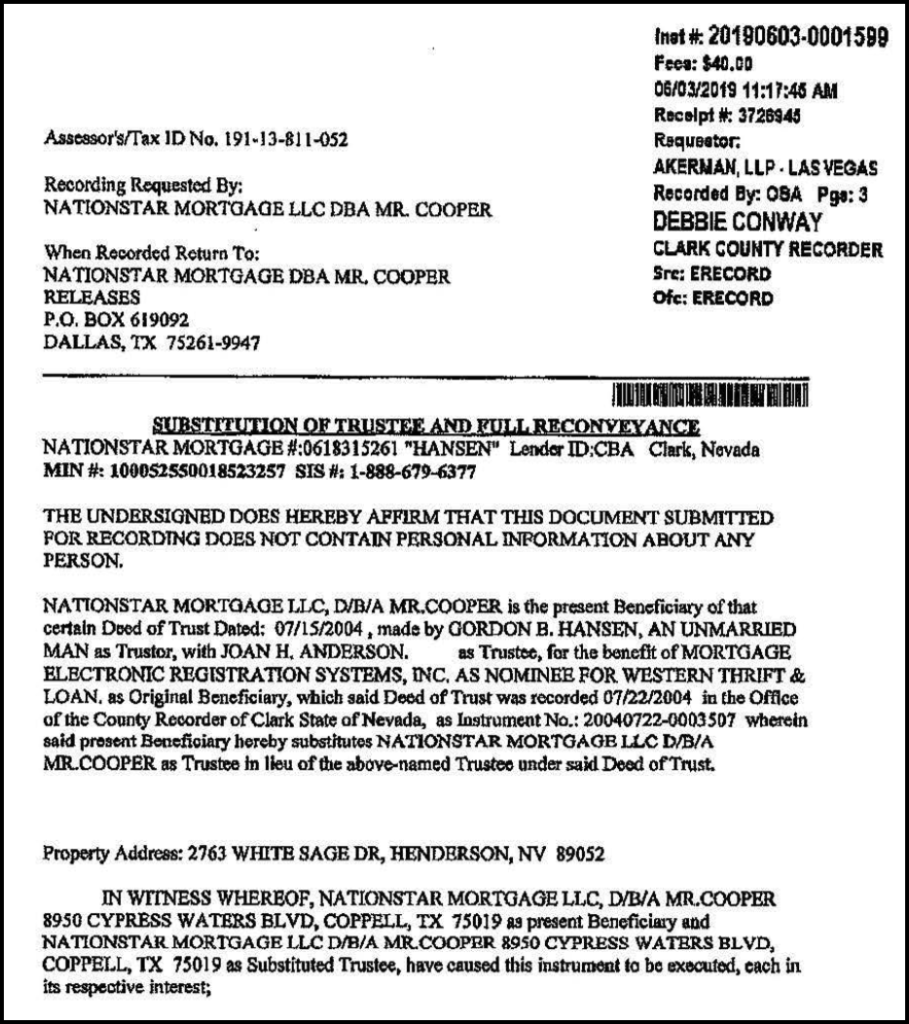

6/3/19 Nationstar released the lien of the 1st deed of trust

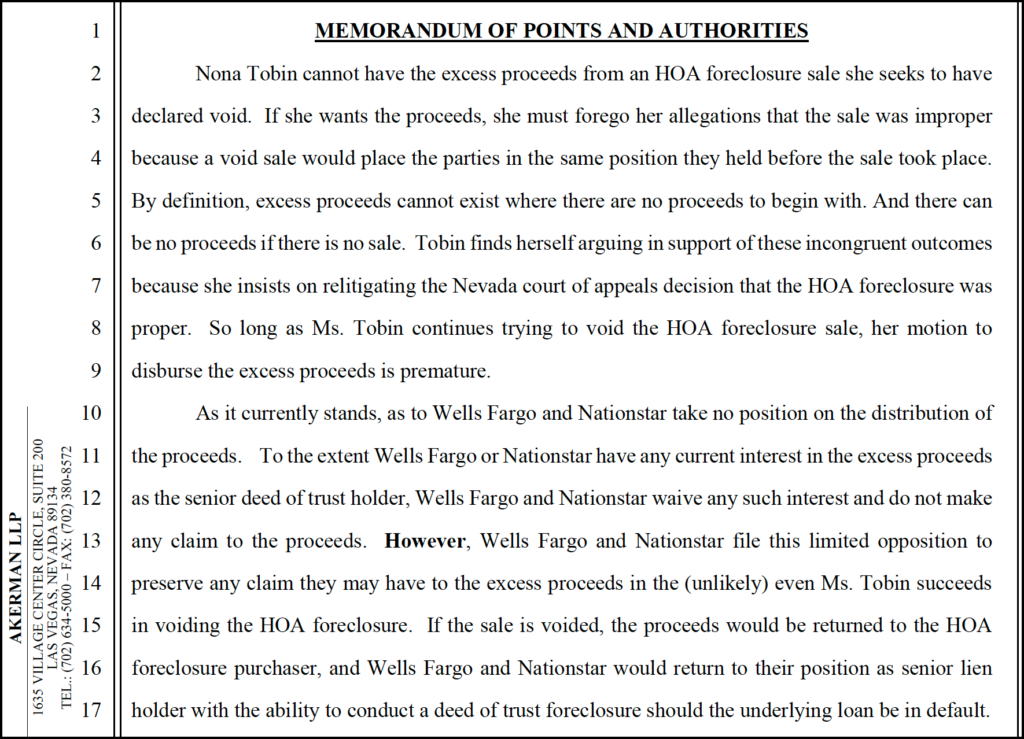

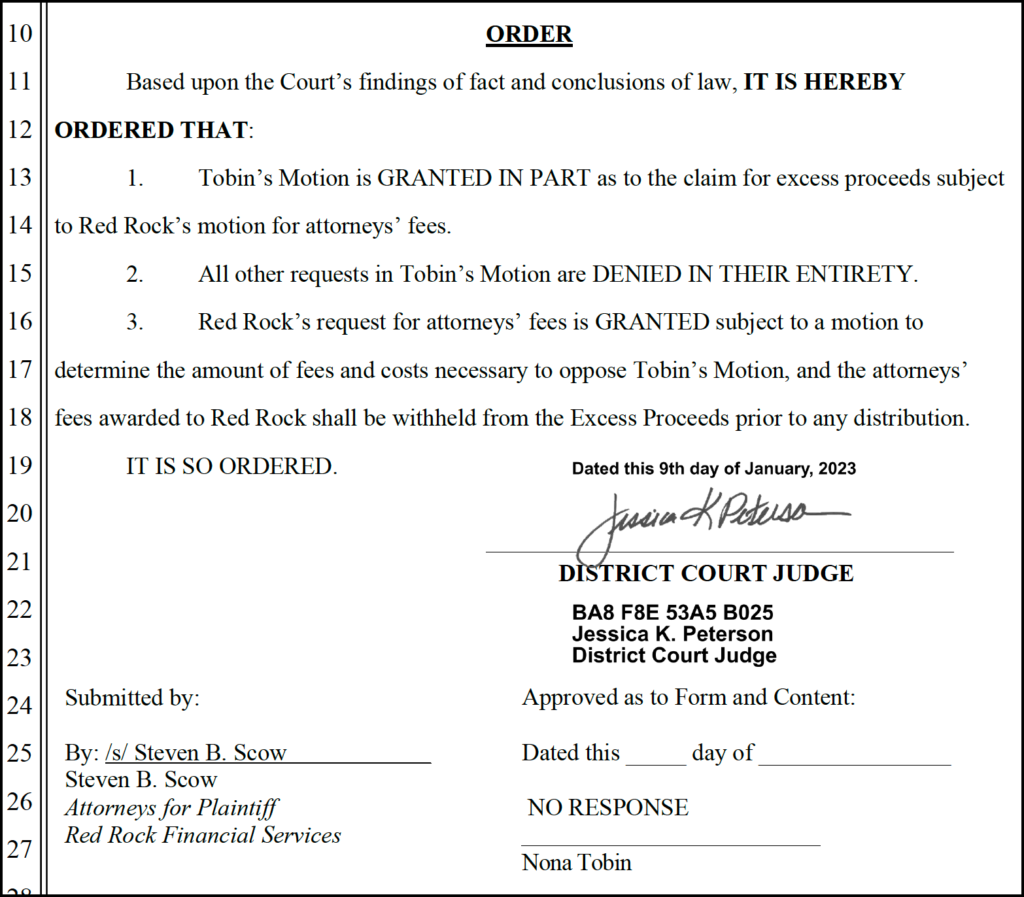

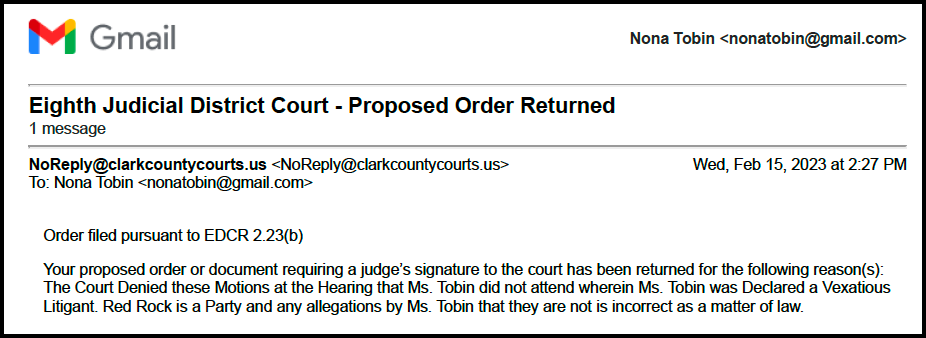

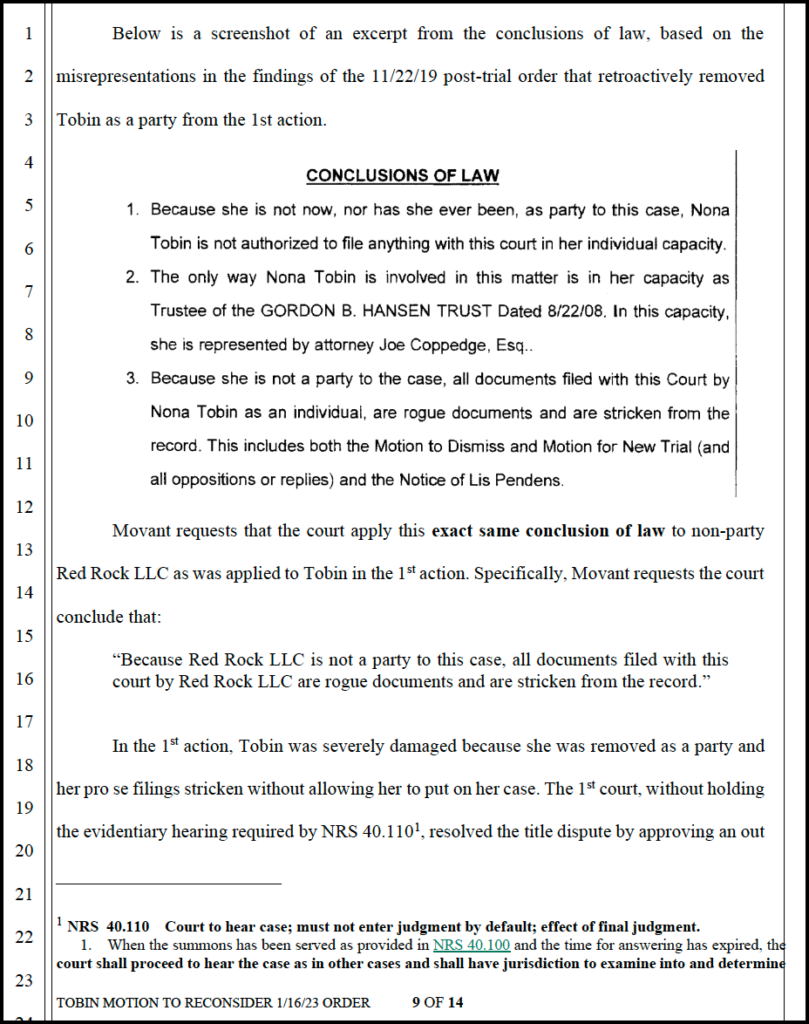

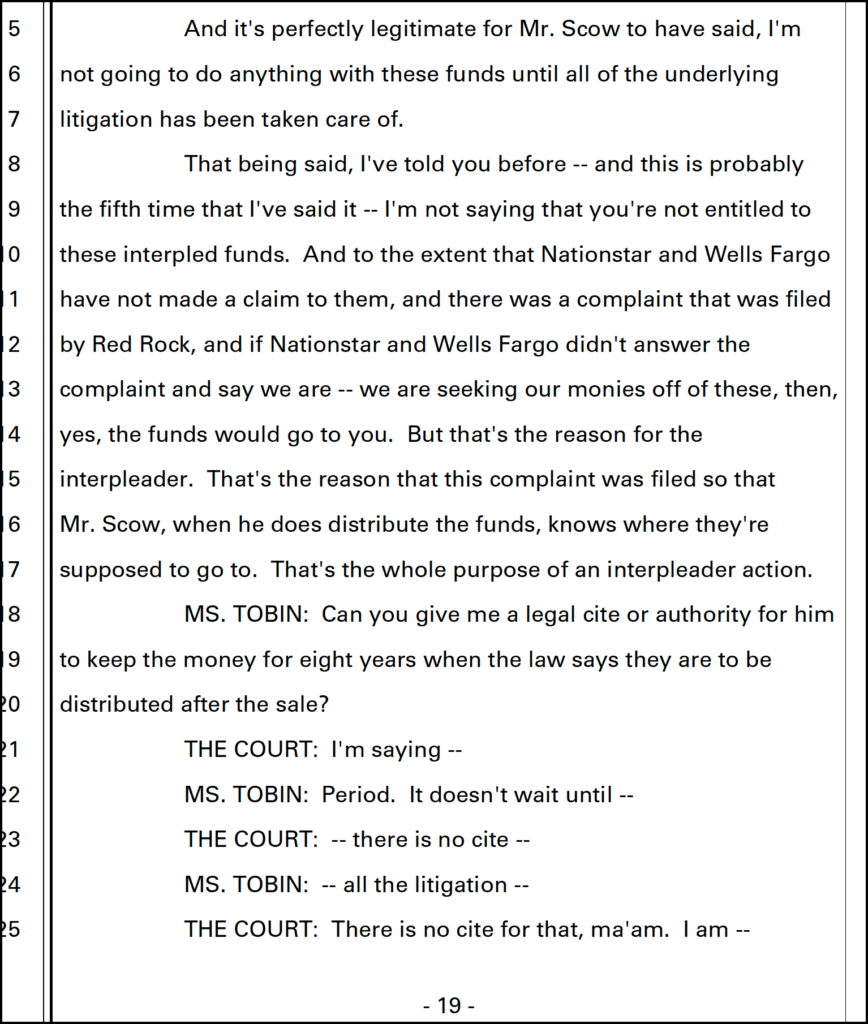

What Judge Peterson believes despite the law and the facts supported by the evidence

She believes there is some unwritten law that says Red Rock doesn’t have to distribute the proceeds after the sale if someone might try to unwind the sale years later.

Judge Peterson buys into Red Rock’s argument so much she argues for them.

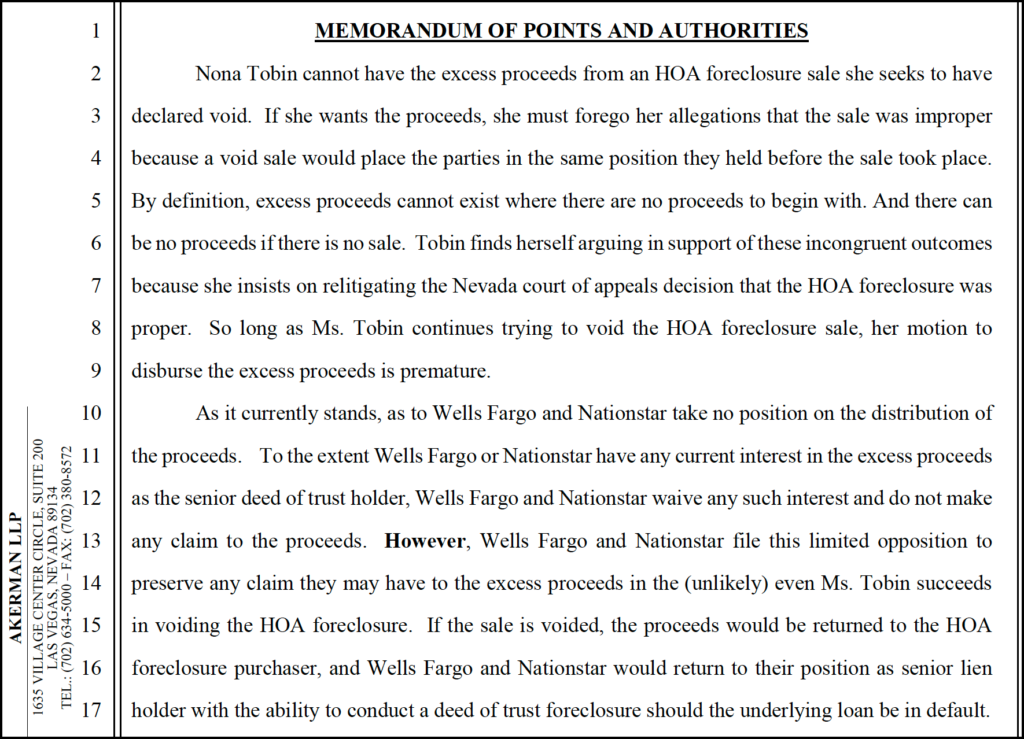

Judge Peterson’s argument matches Nationstar’s 4/26/21 argument also when she allowed multiple disinterested entities to oppose the funds being distributed to the sole claimant.

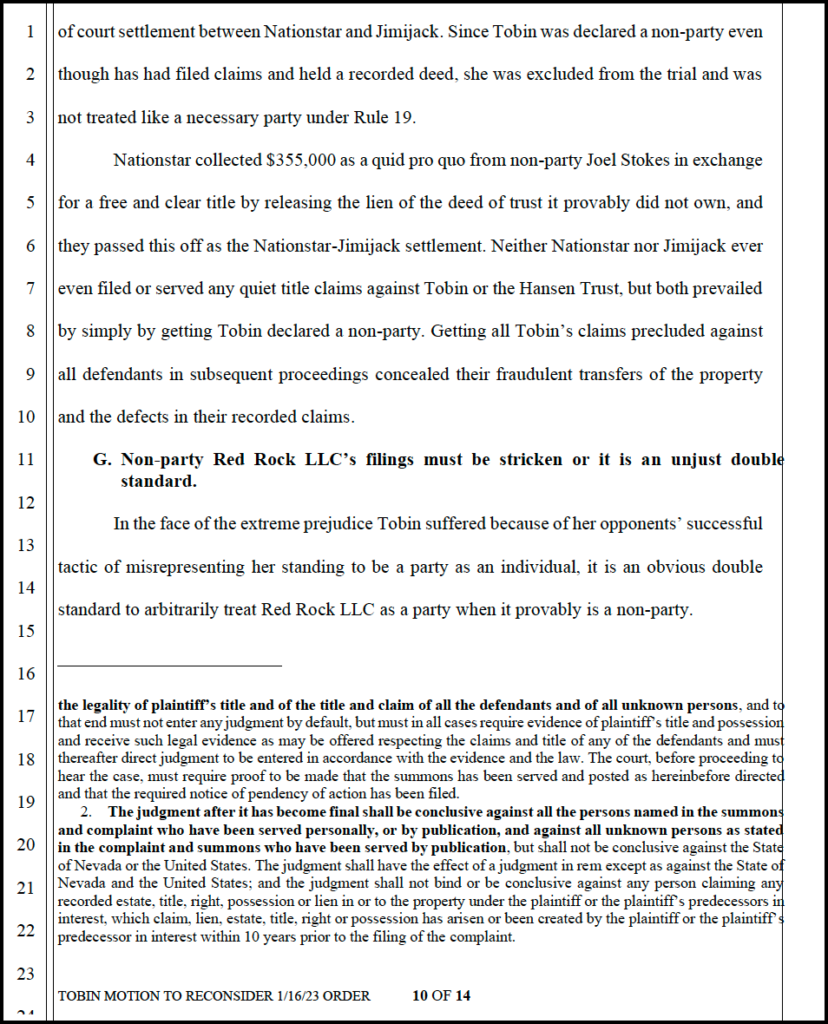

I didn’t file any quiet title claims against Nationstar in the 1st action and Nationstar didn’t file any against me.

I wanted the sale to be void to return to our respective positions. Nationstar filed for summary judgment against the Hansen trust, but not against me as an individual, met ex arte with the judge, got me removed as an individual party and got all my evidence suppressed, lied to the court to say that it was BANA’s successor in interest, then rescinded that claim a week after the end of discover, filed motion after motion to prevent me from being able to return to my pro se status to be able to represent myself or to be the real party in interest after the Hansen Trust was closed, made a fraudulent side deal with Jimijack, filed motions to have me declared a vexatious litigant, opposed the excess proceeds to be distributed to me as the sole claimant, and on and on and on.

Why? Because Nationstar had no standing to foreclose

Because if the sale were voided in its entirety, than Nationstar would have to prove based on evidence that it actually had NRS 104.3301 standing to foreclose, and we both knew it couldn’t.

Thus, by eliminating my involvement, Nationstar obtained $355,000 for releasing the lien on the 1st deed of trust, which they falsely claimed to own from non-party Joel A. Stokes, on June 3, 2019, just two days prior to the show trial in the 1st action – a trial that neither Joel Stokes nor Nationstar were required to attend, and from which I was barred – all documentary evidence and witnesses were excluded.