Court records show that the interpleader action was meritless as it was filed when I was the sole party with a recorded claim after June 3, 2019.

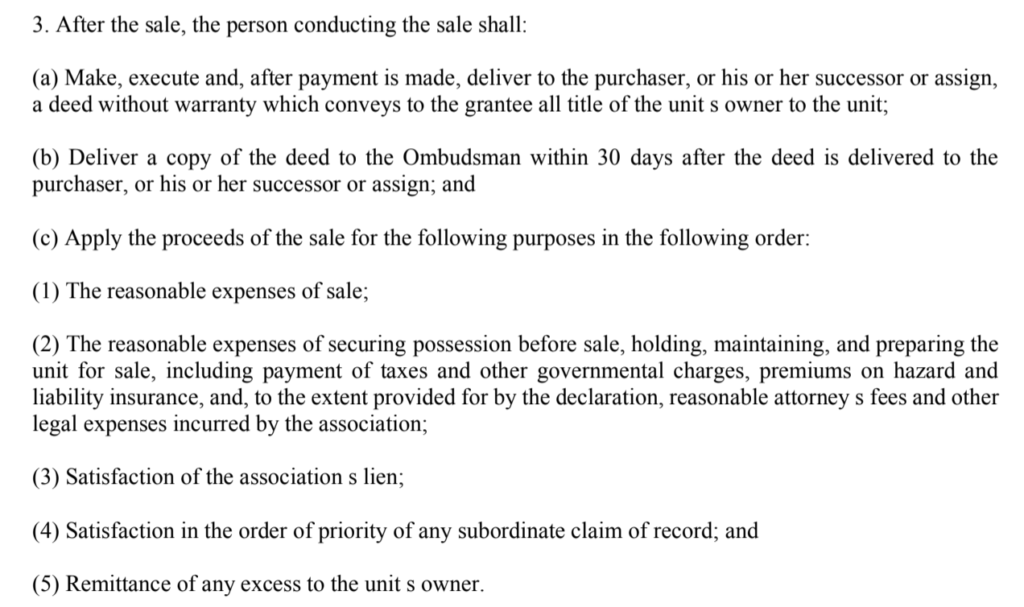

The statute NRS 116.31164(3)(c)(2013) required that all the proceeds from the August 15, 2014 HOA foreclosure sale be distributed in a specified manner by the person conducting the sale.

Red Rock’s attorney’s failure to comply with the law and Red Rock’s instructions caused years of litigation and enabled bank fraud.

The law required all the proceeds to be distributed after the sale in 2014, but Red Rock didn’t do that and forced years of litigation to claim money that was rightfully mine and enabled massive fraud on the court by other parties as a result. When Red Rock sued me in a meritless interpleader action, I fought back with fraud, racketering and conversion claims. No party answered so I filed a motion for summary judgment, but then a nonparty filed a motion to dismiss per res judicata which the court granted while denying my motion for summary judgment on the grounds that there were disputed facts and my claims were precluded anyway and she didn’t need to address my claim for the proceeds as long as I was attempting to unwind the sale on appeal.

Red Rock filed a successful motion to dismiss my claim for those proceeds on June 23, 2020 on the grounds of NRCP 12(b)(5) (res judicata) (even though the excess funds from the 2014 sale had not been distributed as required by the statute NRS 116.31164(3)(c)(2013) and NRCP 12(b)(6)(failure to join the HOA as a necessary party to protect its interest in the excess proceeds (despite the fact that Red Rock had paid the HOA in full $2,701.04 on 8/21/04 (according to HOA records that Red Rock falsified in discovery).

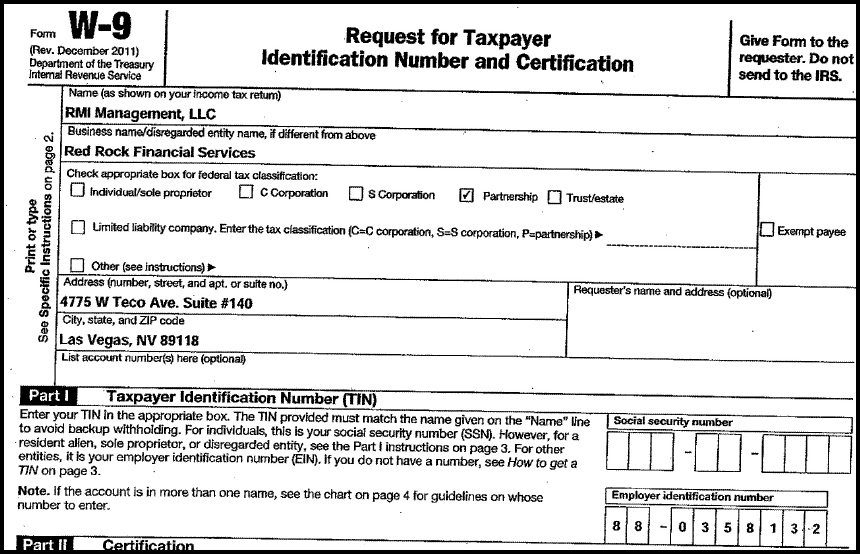

Plaintiff Red Rock did not have standing to file 2/3/21 interpleader complaint

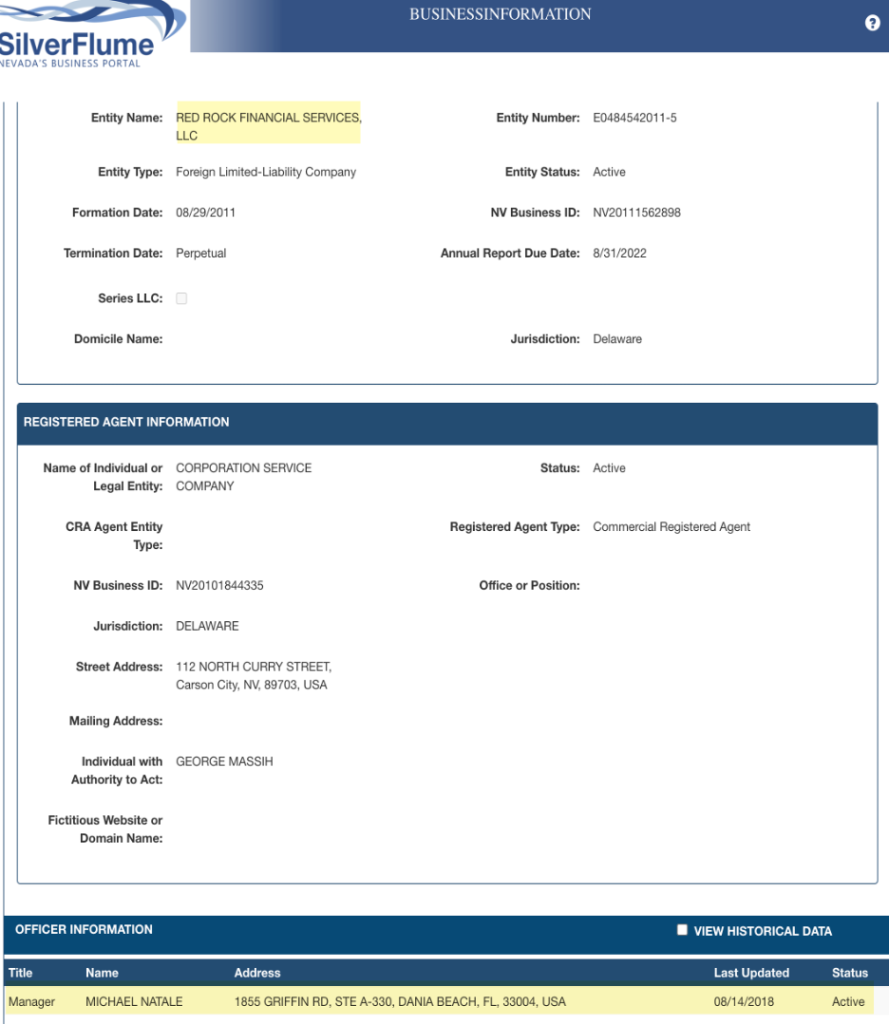

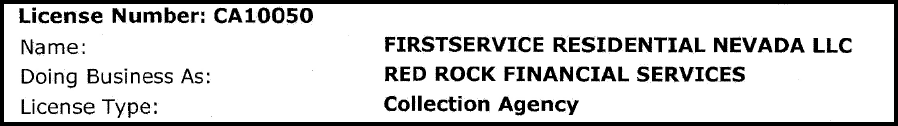

Plaintiff Red Rock Financial Services was referred to as “RRFS” in the complaint, but as “Red Rock” elsewhere throughout the case, and as “RRFS was contracted by the Association to collect debts for unpaid homeowners assessments owed to the Association by defendant Nona Tobin as the trustee for the Gordon Hansen Trust for the property located at 2763 White Sage Drive, Henderson, Nevada 89052”. This “RRFS” was a partnership subsidiary of FirstService Residential Nevada, LLC (EIN 88-0358132). The relevant debt collection contract, also concealed in discovery by Red Rock, was signed with Sun City Anthem on 4/27/12.

Judge Peterson did not require my opponents to have standing

The Plaintiff Red Rock is a different legal entity from Red Rock Financial Services, LLC, is a disinterested non-party utilized by their shared attorney to improperly file rogue documents into these proceedings. Judge Peterson’s 7/7/22 declaration that Red Rock LLC was a party is factually and legally incorrect. Red Rock LLC never had a contract with Sun City Anthem, never had the proceeds, never had anything to do with this case until Steven Scow started adding the LLC designation in the caption or filing rogue documents in when the plaintiff or the counter-defendant had not filed a responsive pleading or a written opposition or filed a motion.

Judge Peterson gave preferential treatment to my opponents

The interpleader action was a meritless abuse of process.

Judge Peterson assumed without support of evidence or law that ALL the proceeds didn’t have to be distributed after the sale

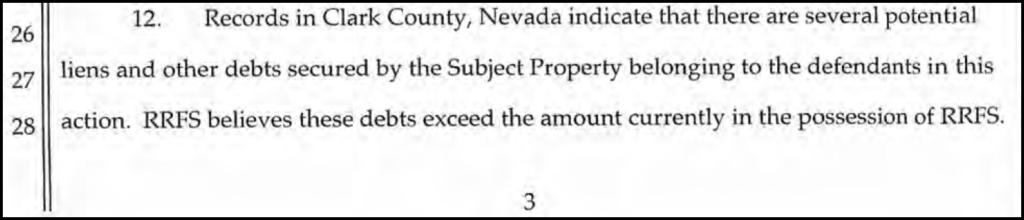

Red Rock misrepresented in the complaint that it faced multiple liabilities.

I presented evidence that this was false and Judge Peterson did not distribute the funds to me for over yet and almost all the funds are gone in fees.

How Plaintiff Red Rock is identified

The funds that the court was asked to distribute were the excess proceeds of an HOA sale conducted by FirstService Residential Nevada LLC (Formerly RMI Management LLC) dba Red Rock Financial Services, a partnership (EIN 88-0358132) that was under a 4/27/12 debt collection contract and the NRS 649 debt collection license with Sun City Anthem that was terminated in April, 2015.

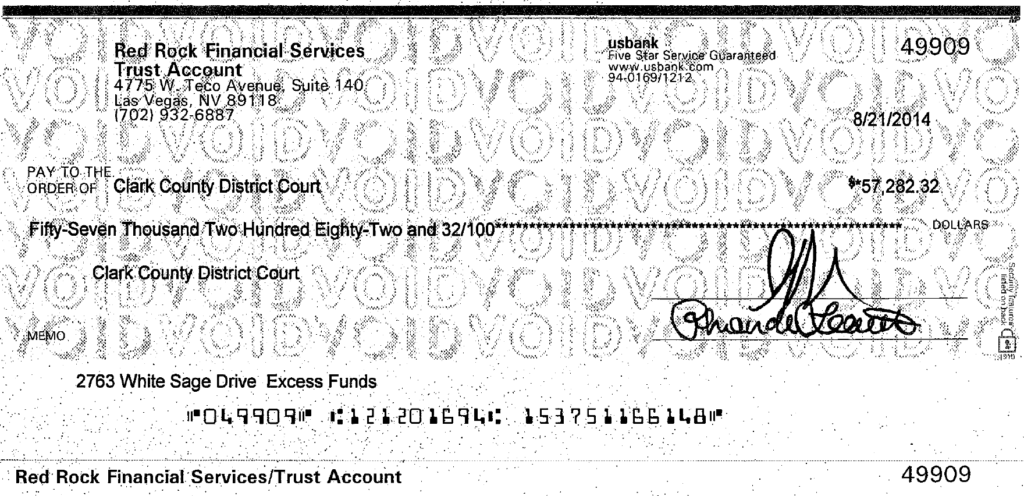

Plaintiff Red Rock wrote a check to the court on its collection account

Shown below is the check for the interpleaded proceeds that Red Rock agent gave to Steven Scow on 8/28/14 with instructions to remit it to court. That check is written on a co-mingled collection account that is under the control of Scow’s client FirstService Residential dba Red Rock Financial Services, a partnership (EIN 88-0358132) who is the Plaintiff in this case.

Why Scow refusing to distribute the funds is harassment, maybe conversion

This is significant because the interpleader action was meritless because Scow was supposed to deposit the money with the court in 2014 as his client Red Rock instructed, but he failed to do so. I have spent over $300,000 trying to get my huse back and these funds and Scow has fought me every step of the way.

The cover up – why they fight so hard to silence me

He has filed false evidence in response to subpoena to cover up that Red Rock sold my house without notice, that included files and accounts that had been doctored and he acted in concert with the Nationstar and HOA attorneys to cover up that the sale was void in its entirety because Red Rock conducted the sale after it had rejected assessments that cured the default three times.

It would have been over BUT FOR

The sale should have been voided in the 1st action, and it would have been BUT FOR the misconduct of the opposing parties that met ex parte with Judge Kishner and convinced her that I had never been granted leave to intervene as an individual, and therefore that all of my verified evidence and me, a necessary party under Rule 19, were excluded from the trial.

As a result, I was never permitted to defend my 3/28/17 deed.

There never was the evidentiary hearing mandated by NRS 40.110.

Judge Kishner awarded quiet title to Jimijack on 6/24/19 who had no deed at all to protect after Jimijack had fraudulently reconveyed its defective inadmissible deed on 5/1/19 to non-party Joel A Stokes.

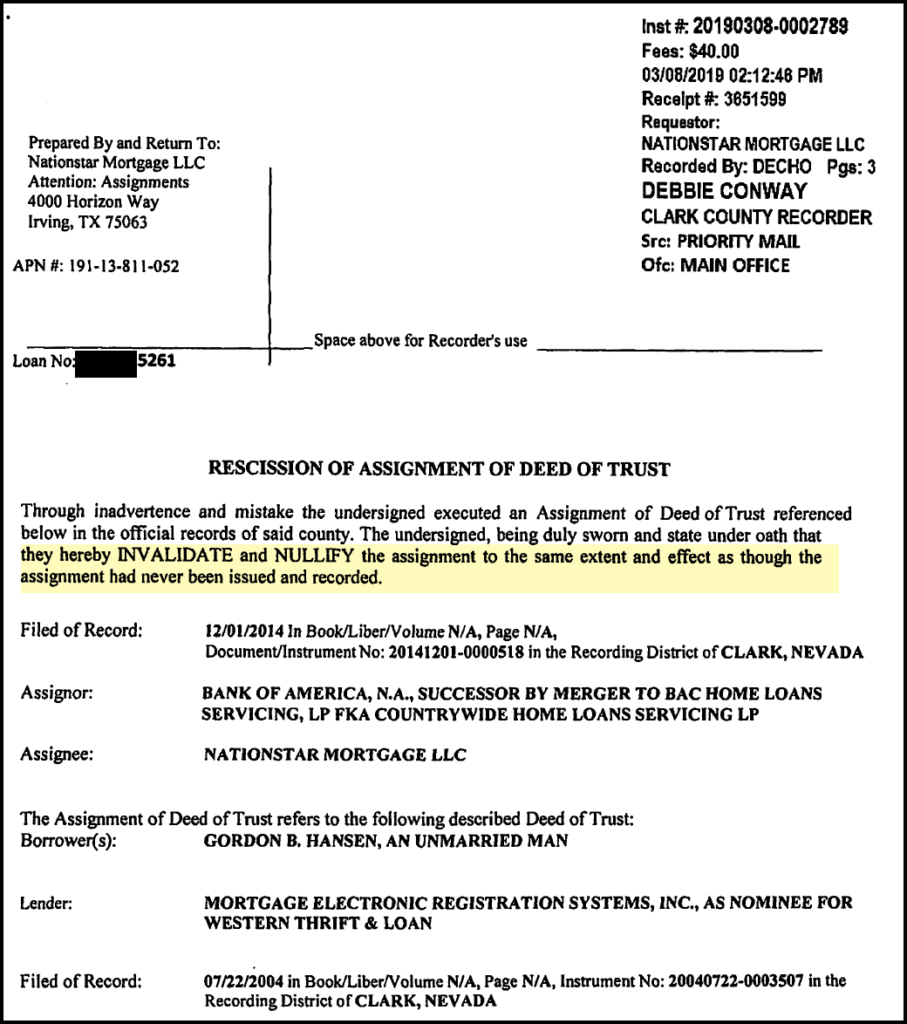

Nationstar didn’t have to go to trial to prove anything because the court didn’t know that the lien it released on 6/3/19 had already been rescinded on 3/8/19 as if it had never existed.

My claim of conversion and my claim for interest and penalties stems from the fact that I have been forced to litigate over and over to get money that he was supposed to deposit with the court in 2014 and not obstruct

I assert that his successful manipulation of the court got my claims unfairly precluded and got me unfairly declared a vexatious litigant. Scow tricked the court into not looking at the evidence by repeatedly saying that the evidence had been examined before when it had not been.

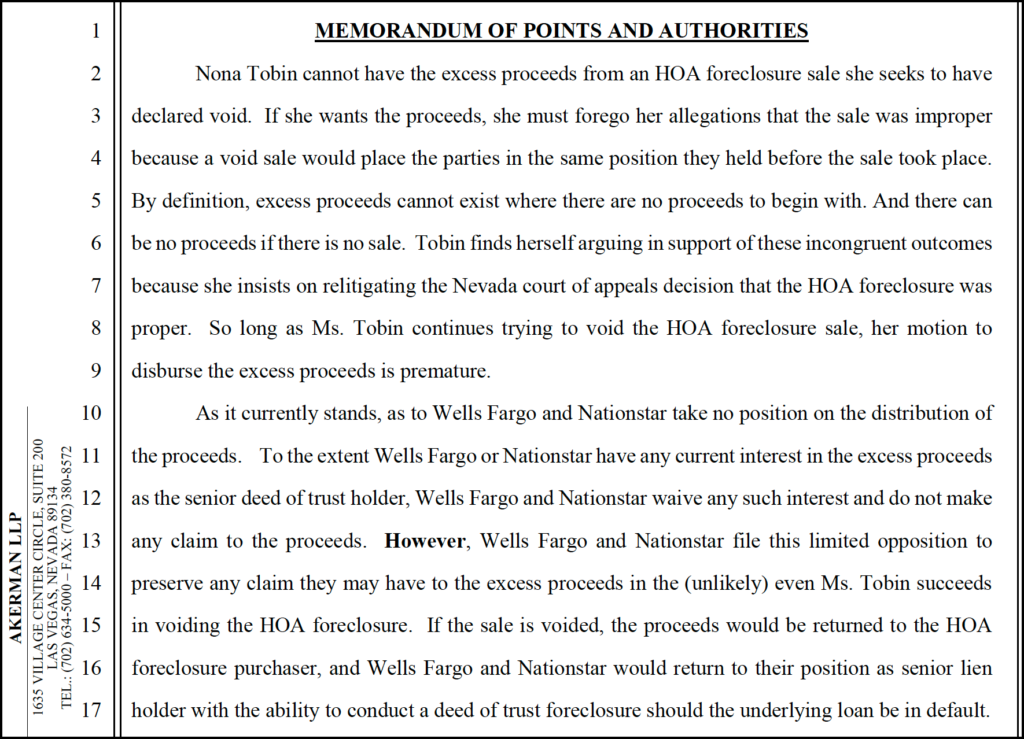

The banks should have been dismissed. The court allowed attorneys for disinterested parties and non-parties file oppositions to my claims for the proceeds because I had other claims

2/16/21 FirstService Residential dba Red Rock Financial Services, a partnership (EIN 88-0358132) served five defendants a complaint for interpleader when only one had standing to make a claim

2/17/21 Republic Services filed a disclaimer of interest and withdrew from the case

3/8/21 I, Nona Tobin, as an individual, filed the only timely counter-claim for the interpleaded proceeds, and contained the compulsory counter-claims that I had vs. Red Rock and cross-claims vs. Nationstar of Fraud, Conversion, Racketeering, and sanctions per NRCP 11, NRS 18.010(2), NRS 207.270(1)(4). NRS 42.005

The court didn’t require the banks to file NRCP 13(a)(1) counterclaim for the proceeds or answer my crossclaims

4/9/21 Nationstar and Wells Fargo filed a nonsensical answer that had NONE of the compulsory NRCP 13(a)(1) counter-claims, including for the proceeds and NO timely response to my 3/8/21 cross-claims, and NO mention of res judicata in its affirmative defenses. Further, the banks didn’t properly disclaim interest in the proceeds, and the first filing, or any filing thereafter, did not include an Initial Appearance Fee Disclosure so when considered with the affidavit supporting Akerman’s motion to withdraw, it is likely that Wells Fargo doesn’t know it was even in this case.

4/12/21. I filed a motion for an order to distribute the interpleaded funds to me as the sole claimant with interest in which I showed the property records that proved my claim and showed that the banks had no standing to oppose me

4/15/21 I filed a motion for summary judgment as no one filed a timely response to my 3/8/21 courter-claims and cross-claims

4/16/21 Non-party Red Rock Financial Services LLC, filed a motion to dismiss my 3/8/21 counter-claims.

4/26/21 Doc ID# 31 Wells Fargo, N.A. and Nationstar Mortgage LLC’s Limited Opposition to Defendant Nona Tobin’s Motion for an Order to Distribute Interpleaded Proceeds

4/27/21 Doc ID# 32 Scow listed Non-party Red Rock Financial Services, LLC as the Plaintiff and the counter-defendant to Wells Fargo, N.A. and Nationstar Mortgage LLC’s Limited Opposition to Defendant Nona Tobin’s Motion for an Order to Distribute Interpleaded Proceeds. In either case, it just manipulated and confused the court who never understood what was really going on.

Red Rock LLC has nothing to do with this case and Scow knows it