A 2017 study conducted by the UNLV Lied School of Real Estate, commissioned by the Nevada Association of Realtors, studied 611 HOA foreclosures between 2011-2015.

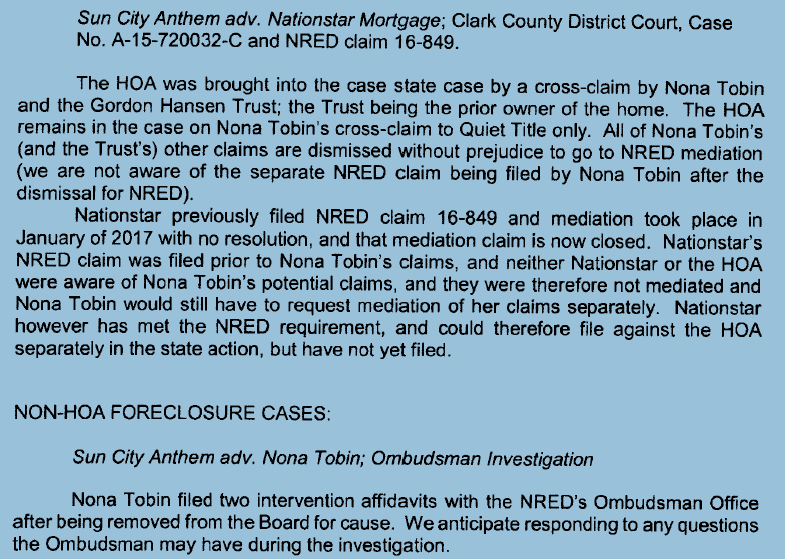

SCA’s 2014 Foreclosures WERE NOT IDENTIFIED in the UNLV Study

Somehow the professionals conducting the study missed ALL of SCA’s 13 foreclosures between 2011 and 2015.

Ten HOAs had 1/6 of the 611 foreclosures UNLV studied.

Why didn’t UNLV know about SCA’s 13 sales Red Rock conducted?

SCA had 13 foreclosures in 2014, but SCA is not in the UNLV HOA foreclosure study’s list of HOAs that had more than five foreclosures from 2011-2015.

Notice a pattern?

ALL SCA foreclosure buyers were knowledgeable speculators.

Some would call them “vulture investors”.

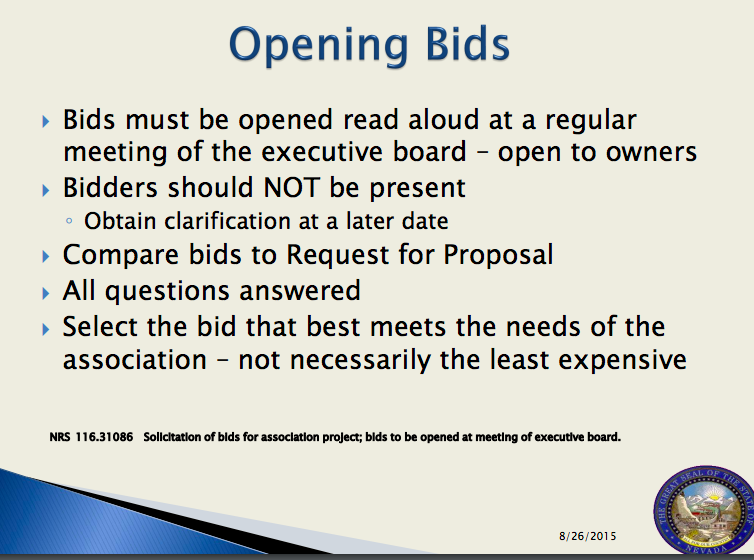

This pattern – selling for a dime on a dollar to a few wise guys – would never have happened if bidding had not been suppressed by a few unsavory practices:

- Convince the HOA Board that they must keep everything about foreclosure secret,

- have no agendas or minutes of HOA Board actions to foreclose

- give no notice to the owner whose house is being sold

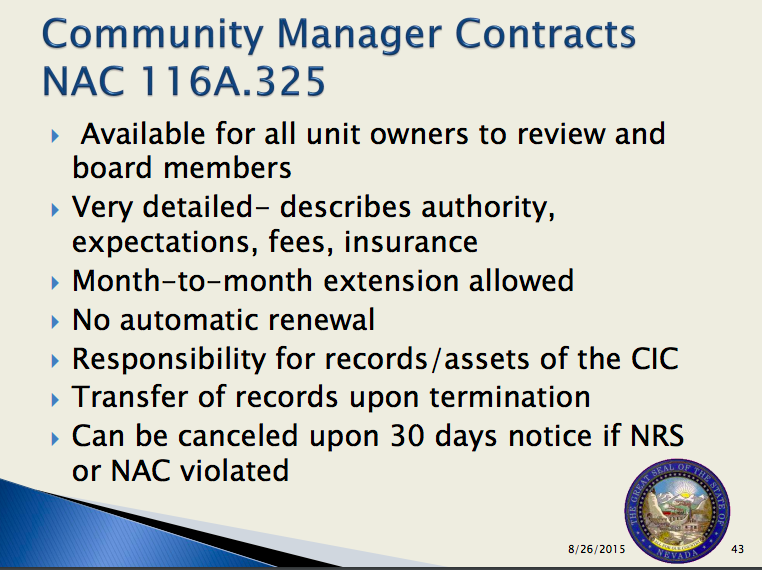

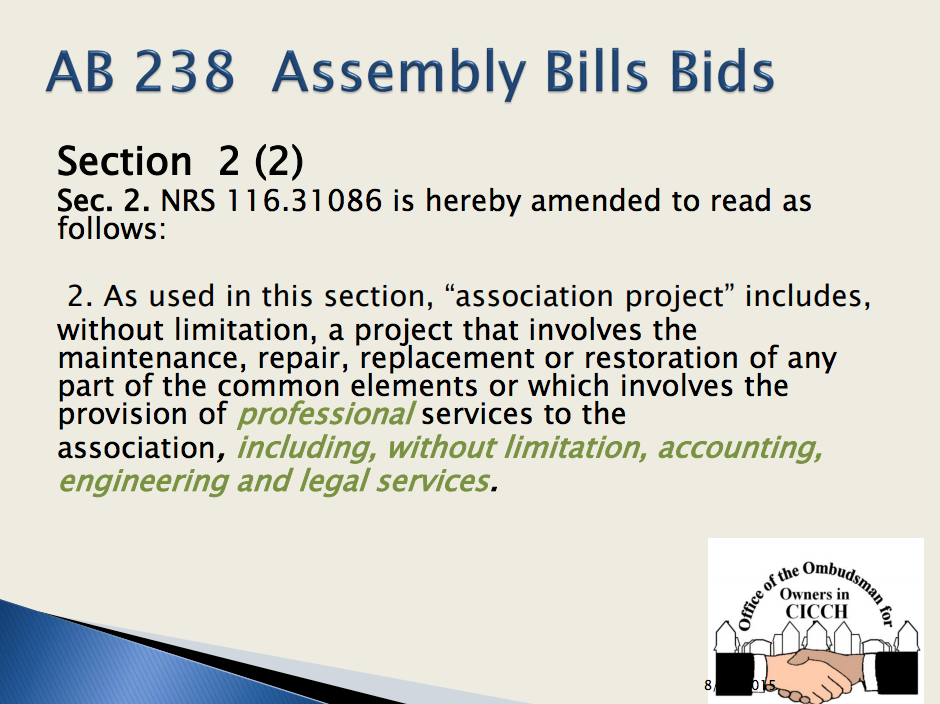

- Allow the manager to be the debt collector and control EVERYTHING about the money that’s collected for the benefit of the HOA members

- Allow the debt collector full, unilateral, unsupervised proprietary control all the records and processes, so the HOA has no independent records;

- give away signatory control over bank accounts of HOA money collected,

- allow the debt collector to use the HOA attorneys against a homeowner who complains

- allow the debt collector to lie about notices that were given.

At Sun City Anthem, not a single homeowner knew when or where RRFS was selling these houses.

NOTICE A PATTERN? FOLLOW THE MONEY

In the case of 2763 White Sage, RRFS intentionally WITHHELD notice to ALL parties with a known interest – and then lied about it in order to cover up how this scam works to enrich the chosen few..

Look at who bought the houses. Look at how much they paid, and look at what Sun City Anthem Board and owners were told. It’s quite a lucrative scam for a lucky few.

One way the debt collector runs the con

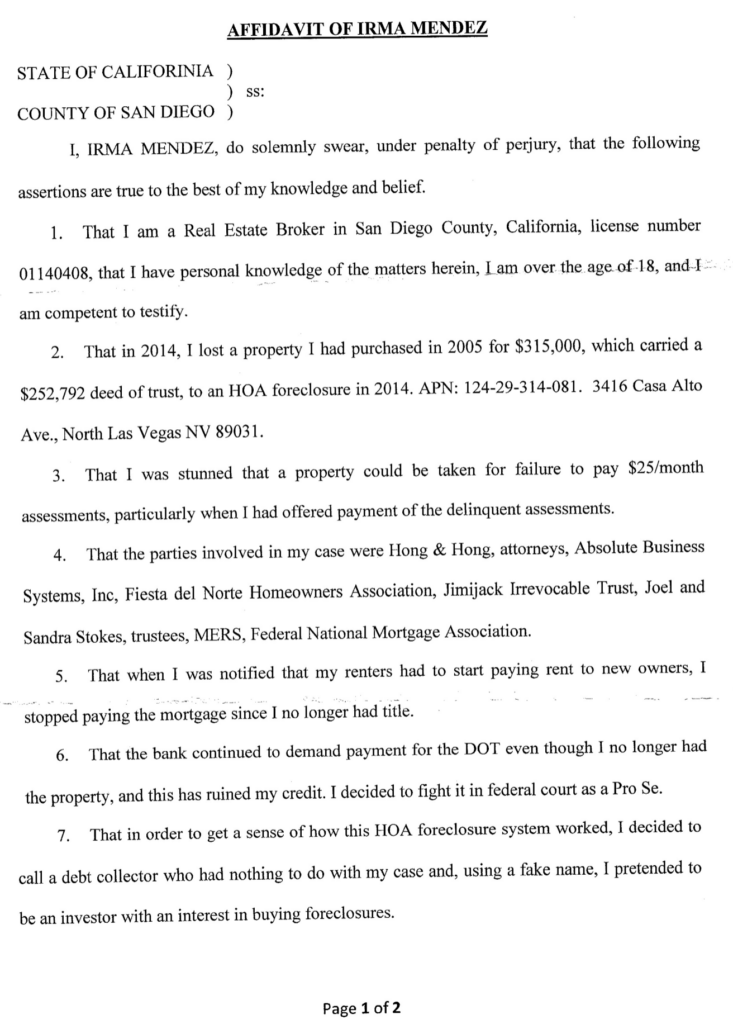

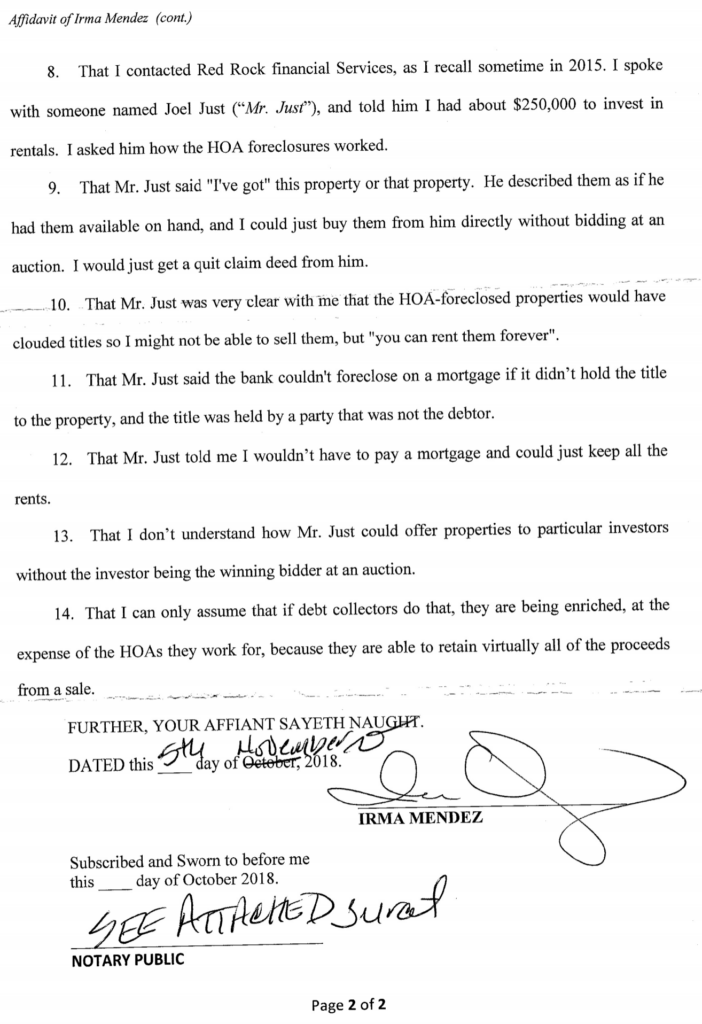

See Irma Mendez’ 11/12/18 sworn affidavit regarding Joel Just, former RRFS President, and his selling foreclosures direct without the inconvenience of a public auction.

FSR and FSR dba RRFS told the HOA Board falsely that everything about HOA sales had to be kept secret.

How the vulture investors unjustly profited

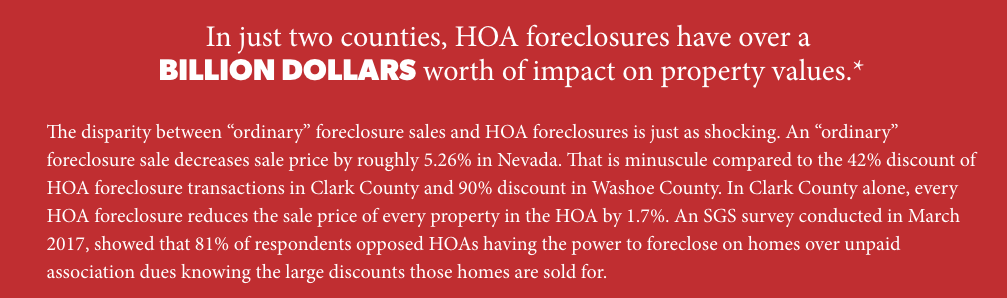

TRP Fund IV LLC bought four SCA properties at unnoticed sales @ an average price of $52,125, 80% below fair market value. I, and many other Sun City Anthem homeowners, were prevented from attending these sales and bidding because RRFS explicitly withheld notice.

Two sham LLCs, using the property address as the corporate name, bought houses for $6,500 & $7,600.

All 13 houses COMBINED were sold for $734,900 to a few people “in the know”, and not a single one to an SCA owner.

SCA properties RRFS secretly sold in 2014

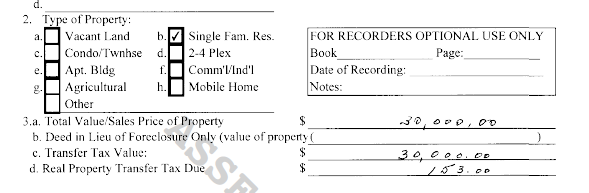

1/2/14 RRFS sold 2532 Grandville Ave for $25,500 to TRP Fund IV LLC .

SCA did not enforce the 4/27/12 contract indemnification clause that would have shifted this expense to RRFS. TRP FUND IV v. HSBC Bank A-16-735894-C

There is no SCA record that the SCA Board approved the sale of this property.

1/2/14 RRFS sold 2227 Shadow Canyon to TRP Fund IV LLC for $40,000.

Nationstar Mortg., LLC vs. Saticoy Bay LLC Series 2227 Shadow Canyon 133 Nev. Advance Opinion 91, 405 P.3d 641 (Nev. 2017).

There is no SCA record that the SCA Board approved the sale of this property. SCA was not identified AT ALL in the litigation as the HOA under whose statutory authority this sale occurred.

Neither SCA nor RRFS were named parties to the litigation.

There is no SCA record that the SCA Board approved the sale of this property. There is no court record that Red Rock interpleaded the proceeds. Upon information and belief, RRFS did not distribute the proceeds after the sale as mandated by NRS 116.31164(3)(2013).

2/18/14 RRFS sold 2721 Evening Sky for $40,000 to TRP Fund IV LLC

There is no SCA record that the SCA Board approved the sale of this property. There are no SCA records to ascertain what happened to the proceeds of the sale. Upon information and belief, RRFS did not distribute the proceeds after the sale as mandated by NRS 116.31164(3)(2013).

2/18/14 RRFS sold 2115 Sandstone Cliffs for $54,000 to TRP Fund IV LLC

TRP Fund IV LLC v. Bank of Mellon et al, A-15-724233-C

SCA did not enforce the 4/27/12 contract indemnification clause that would have shifted this expense to RRFS. There is no court record that RRFS interpleaded the proceeds.

There is no SCA record that the SCA Board approved the sale of this property. There are no SCA records to ascertain what happened to the proceeds of the sale. Upon information and belief, RRFS did not distribute the proceed of the sale as mandated by NRS 116.31164(3)(2013).

2/18/14 RRFS sold 2842 Forest Grove for $89,000 to TRP Fund IV LLC

There is no SCA record that the SCA Board approved the sale of this property. There are no SCA records to ascertain what happened to the proceeds of the sale. Upon information and belief, RRFS did not distribute the proceed of the sale as mandated by NRS 116.31164(3)(2013).

3/7/14 RRFS sold 2260 Island City for $30,000 to SFR Investment Pool

There is no SCA record that the SCA Board approved the sale of this property. There are no SCA records to ascertain what happened to the proceeds of the sale. Upon information and belief, RRFS did not distribute the proceed of the sale as mandated by NRS 116.31164(3)(2013).

3/7/14 RRFS sold 1382 Couperin Dr for $100,100 to LN Management LLC series 1382 Couperin

There is no SCA record that the SCA Board approved the sale of this property. There are no SCA records to ascertain what happened to the proceeds of the sale. Upon information and belief, RRFS did not distribute the proceed of the sale as mandated by NRS 116.31164(3)(2013).

3/14/14 RRFS sold 2167 Maple Heights for $6,500 to 2167 Maple Heights Trust

There is no SCA record that the SCA Board approved the sale of this property.

Bank of NY Mellon v. SCA 2:17-cv-02161-APG-PAL, ADR 17-91. SCA did not enforce the 4/27/12 contract indemnification clause that would have shifted this expense to RRFS.

There is no SCA record that the SCA Board approved the sale of this property. There are no SCA records to ascertain what happened to the proceeds of the sale. Upon information and belief, RRFS did not distribute the proceed of the sale as mandated by NRS 116.31164(3)(2013).

3/28/14 RRFS sold 2584 Pine Prairie for $7,600 to LN Mgt Series LLC 2584 Pine Prairie.

LN Mgt LLC series 2584 Pine Prairie v. Deutsche Bank A-14-707237-C. SCA did not enforce the 4/27/12 contract indemnification clause that would have shifted this expense to RRFS.

There is no SCA record that the SCA Board approved the sale of this property. There are no SCA records to ascertain what happened to the proceeds of the sale. Upon information and belief, RRFS did not distribute the proceed of the sale as mandated by NRS 116.31164(3)(2013).

4/29/14 RRFS sold 2175 Clearwater Lake Dr. for $45,100 to Saticoy Bay LLC

There is no SCA record that the SCA Board approved the sale of this property. there are no SCA records to ascertain what happened to the proceeds of the sale.

Upon information and belief, RRFS did not distribute the proceed of the sale as mandated by NRS 116.31164(3)(2013).

6/10/14 RRFS scheduled the sale of 2986 Olivia Heights Ave,

The sale was cancelled by a Citi Mortgage temporary restraining order. Citimortgage Inc v. SCA A-14-702071 NV Supreme court case # 71942.

On 12/7/17, the SCA Board authorized paying $55,000 to Citi to settle the case. SCA did not enforce the 4/27/12 RRFS contract indemnification clause that would have shifted this expense to RRFS.

The Board President’s report of the settlement does not match the court records.

8/15/14 RRFS sold 2763 White Sage Dr. for $63,100 to Thomas Lucas took title as Opportunity Home, LLC.

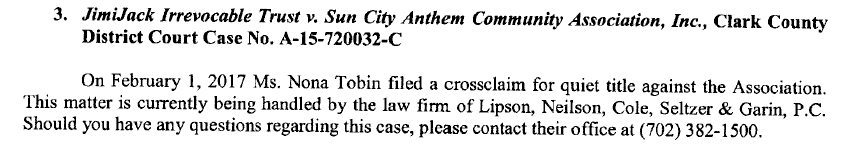

The sale was conducted without notice. The buyer was a realtor in the BHHS listing office that was under contract with Nona Tobin. Jimijack vs BANA & SCA (A-15-720032-C); Nationstar vs Opportunity Homes (A-16-730078-C), Nona Tobin vs Joel Stokes et al A-19-799890-C, Supreme Court appeals #79295, 82094, 832234 and 82294. SCA did not enforce the 4/27/12 contract indemnification clause that would have shifted this expense to RRFS.

There is no SCA record that the SCA Board approved the sale of this property. There are no SCA records to ascertain what happened to the proceeds of the sale. RRFS did not distribute the proceed of the sale as mandated by NRS 116.31164(3)(2013). Instead, more than six years later, after refusing to distribute the proceeds to Nona Tobin, RRFS sued five defendants for interpleader, knowing that no one had a recorded claim except Nona Tobin.

9/11/14 RRFS sold 2921 Hayden Creek Terrace for $100,000 to Jayem Family LP

FNMA v SCA 2:17-cv-1800-JAD-GWF. SCA did not enforce the 4/27/12 contract indemnification clause that would have shifted this expense to RRFS.

There is no SCA record that the SCA Board approved the sale of this property. There are no SCA records to ascertain what happened to the proceeds of the sale. Upon information and belief, RRFS did not distribute the proceed of the sale as mandated by NRS 116.31164(3)(2013).

11/12/14 RRFS sold 2416 Idaho Falls for $174,000 to Global Village LLC.

My Global Village LLC v BAC Home Servicing A-15-711883-C . SCA did not enforce the 4/27/12 contract indemnification clause that would have shifted this expense to RRFS.

There is no SCA record that the SCA Board approved the sale of this property. There are no SCA records to ascertain what happened to the proceeds of the sale. Upon information and belief, RRFS did not distribute the proceed of the sale as mandated by NRS 116.31164(3)(2013).

Wrong!

Wrong!