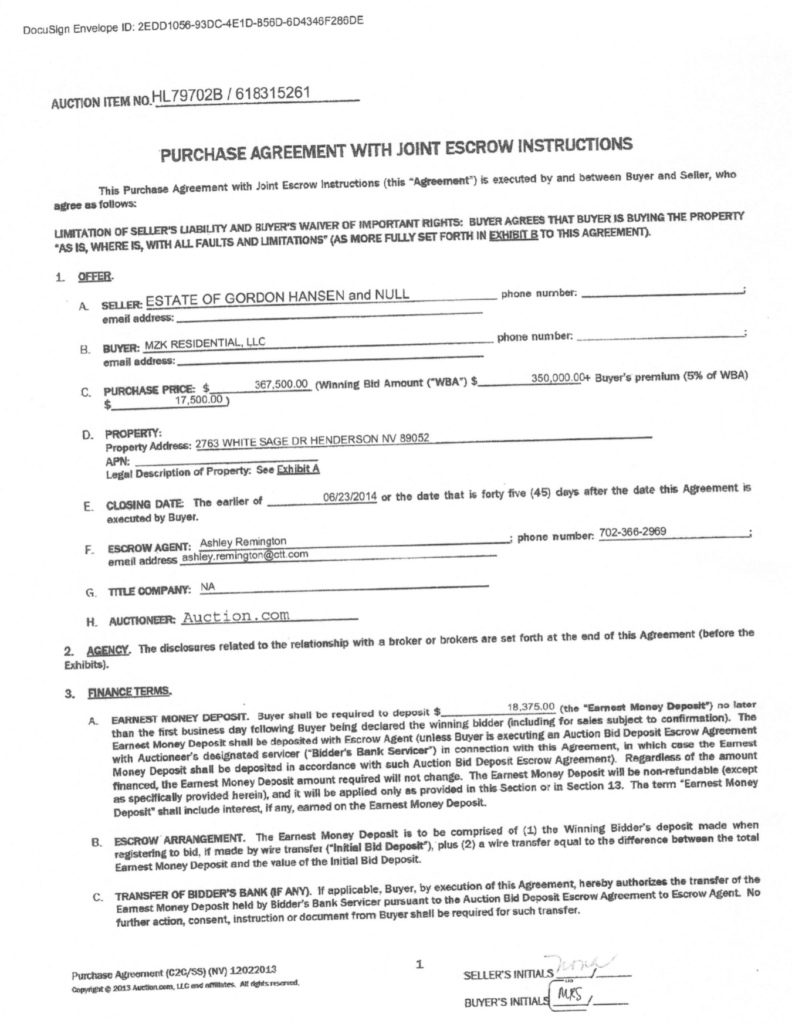

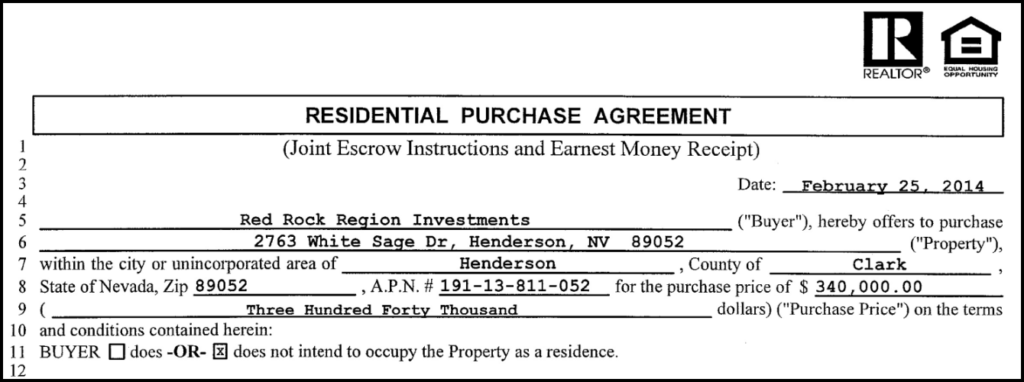

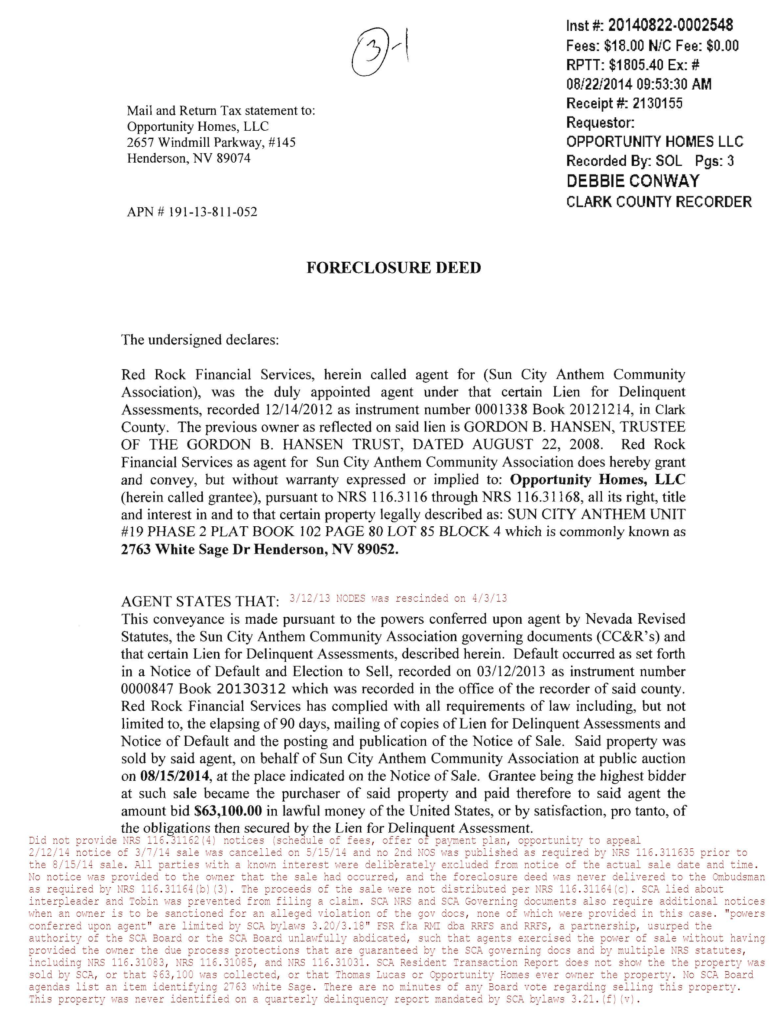

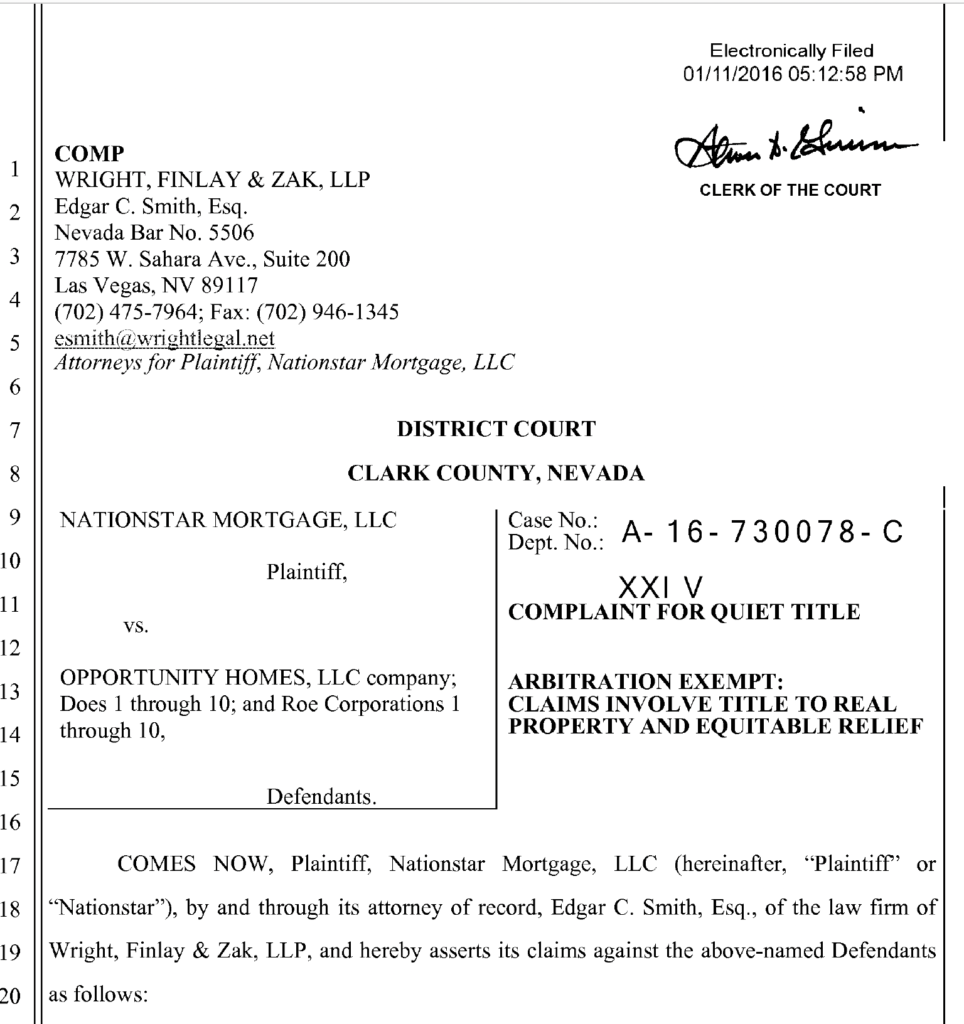

1/11/16 Nationstar started by filing to quiet title vs. the wrong buyer.

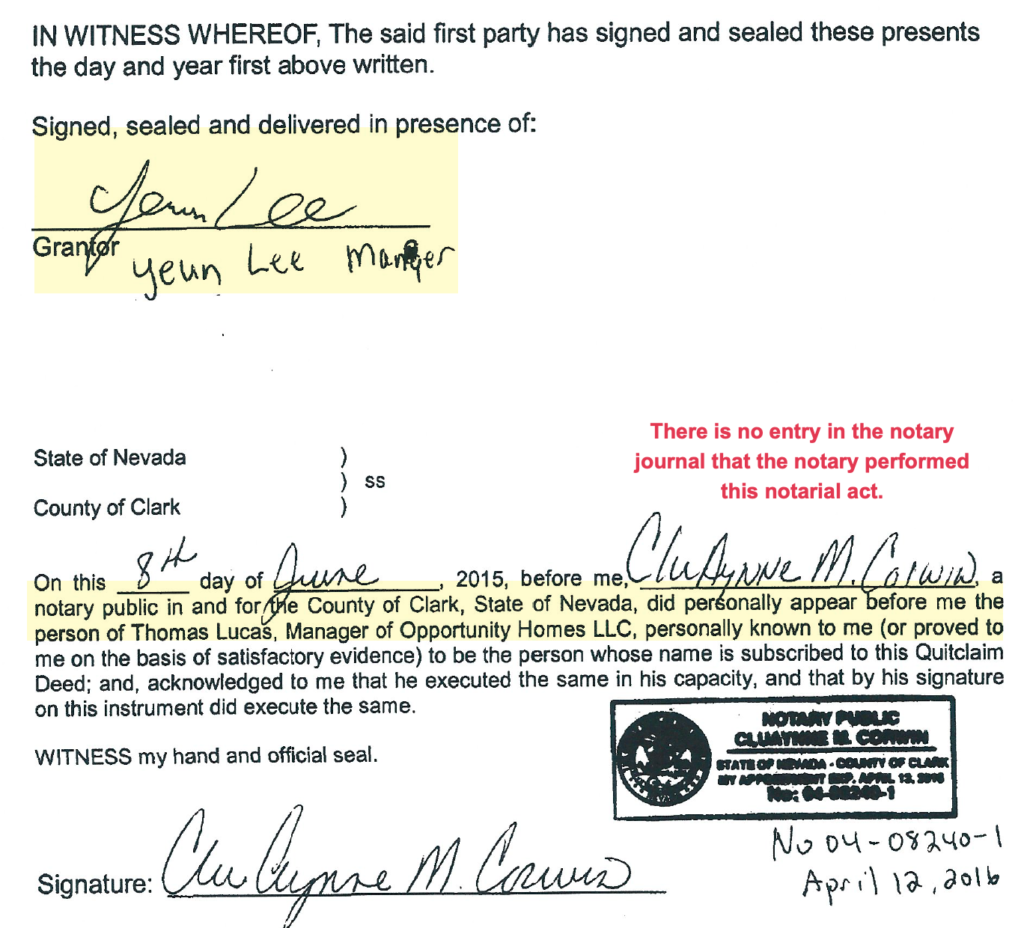

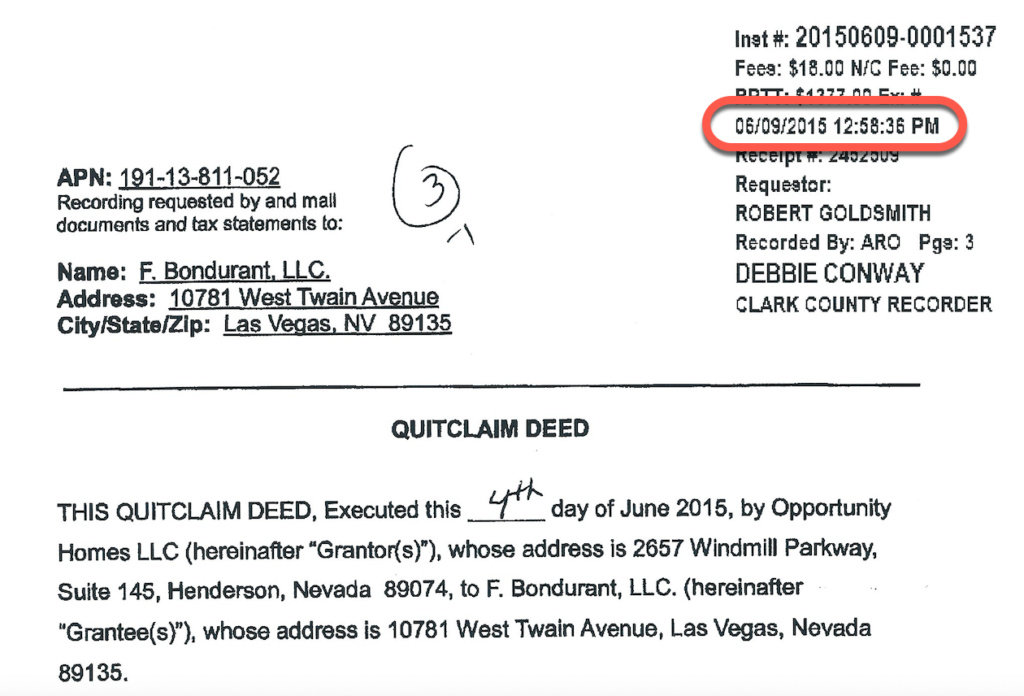

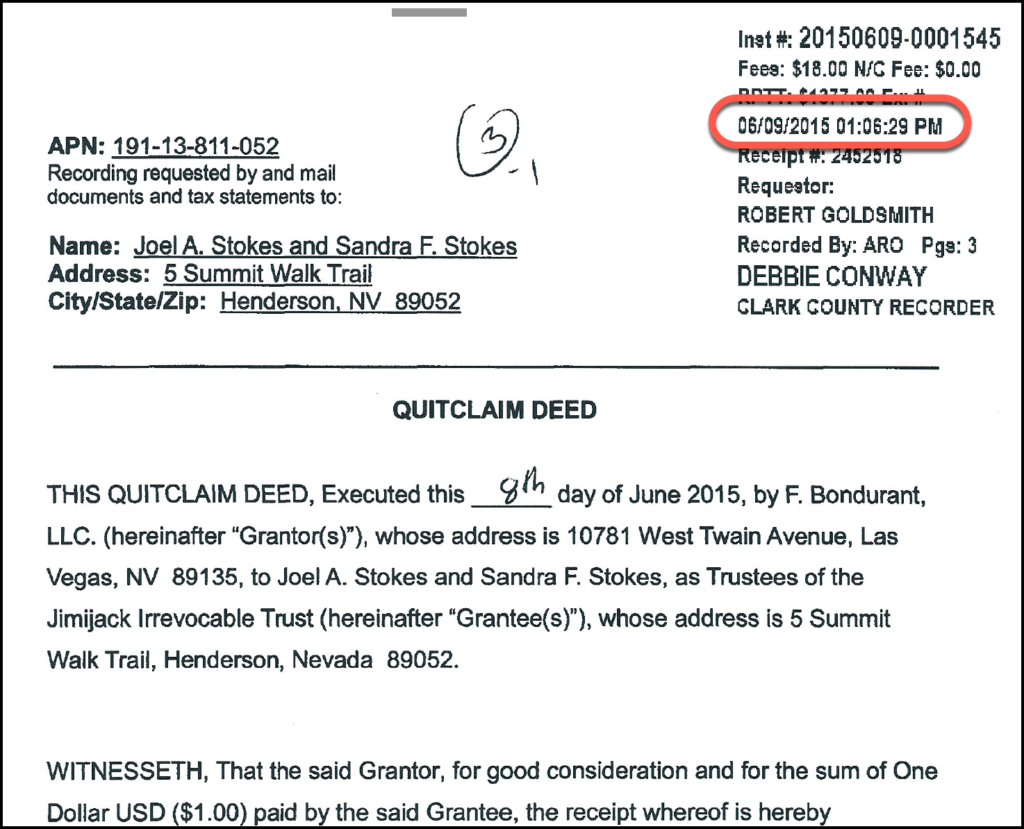

Opportunity Homes LLC was disinterested. Two others had recorded deeds on 6/9/15

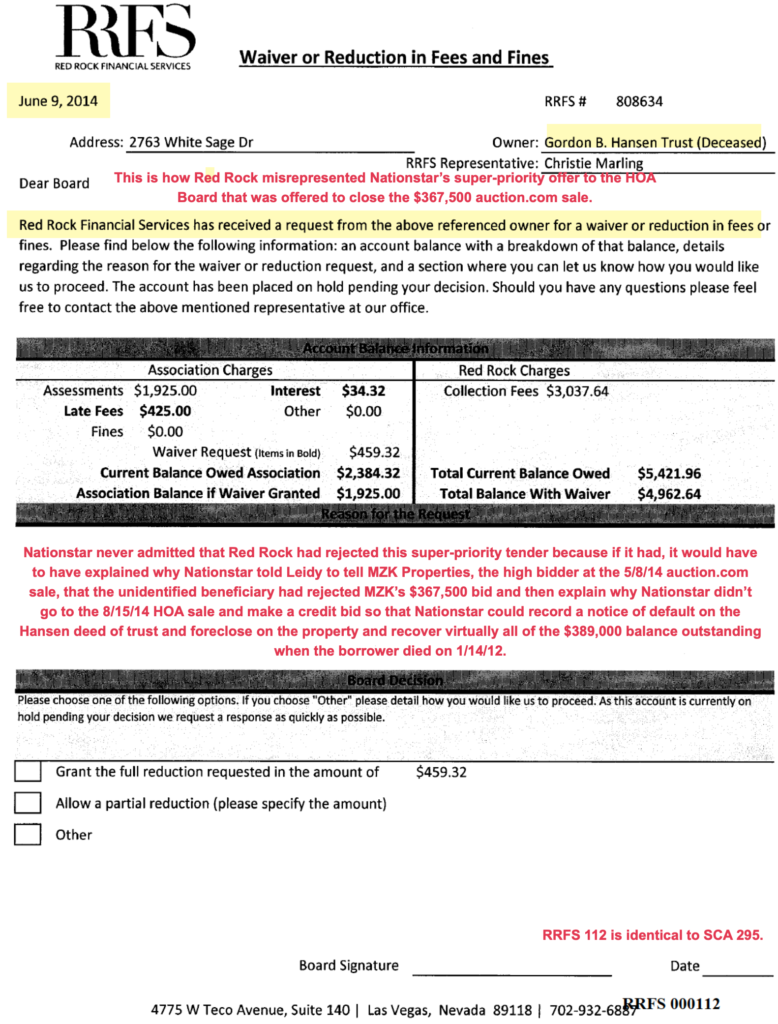

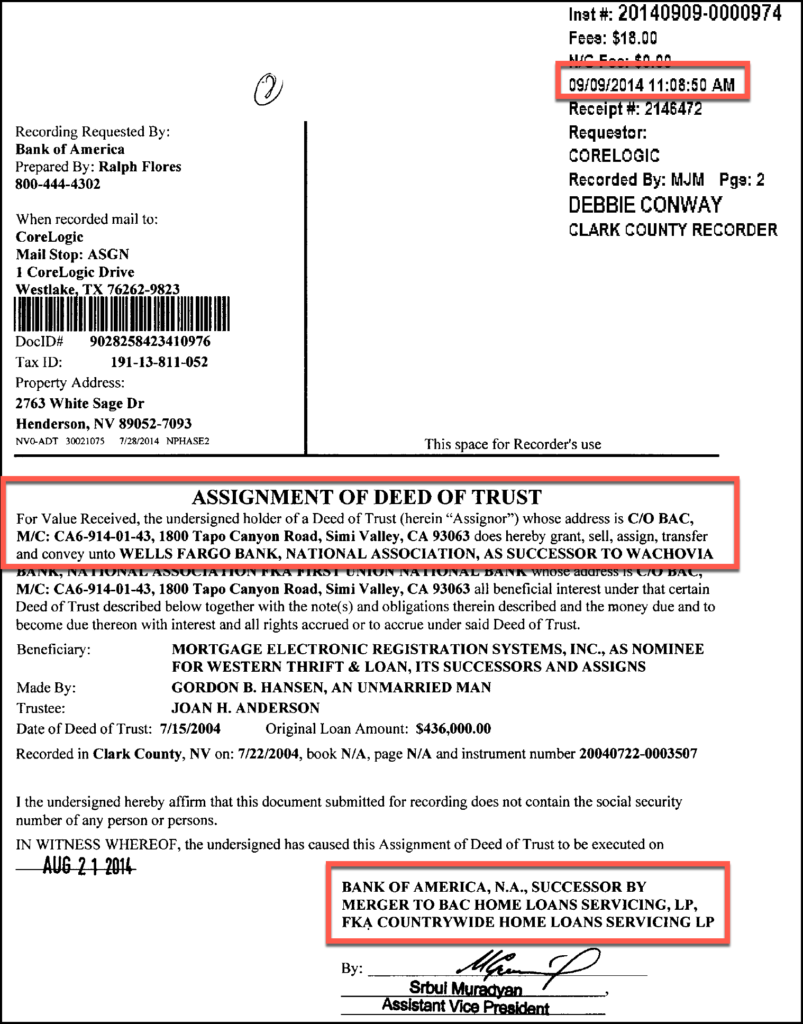

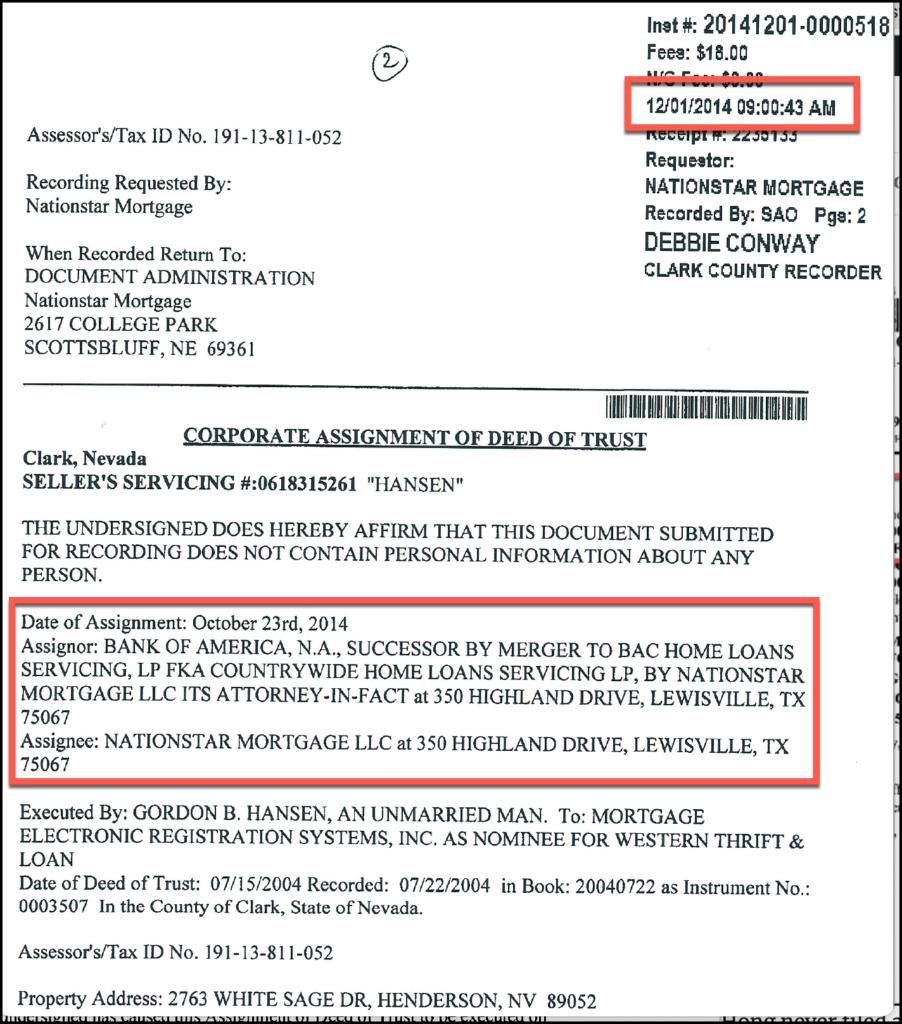

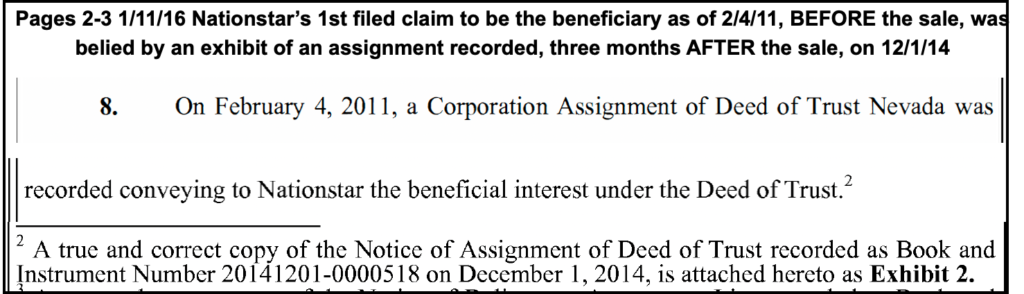

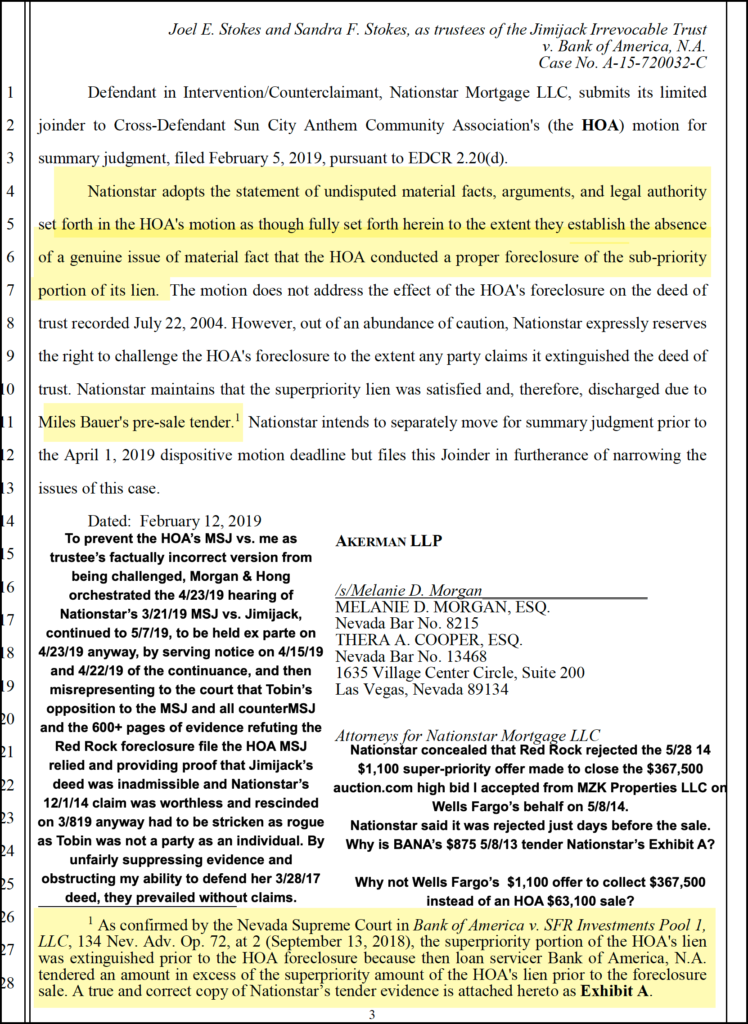

1/11/16 Nationstar also lied about how it became the beneficiary of the 1st deed of trust that was extinguished by the 8/15/14 HOA foreclosure sale.

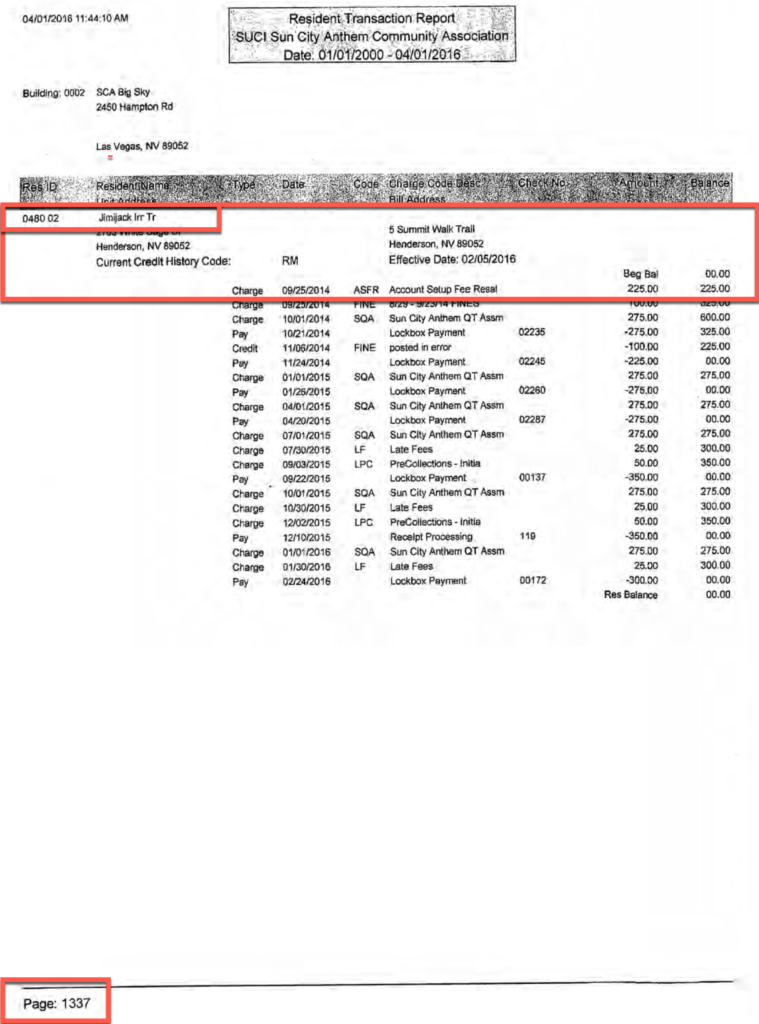

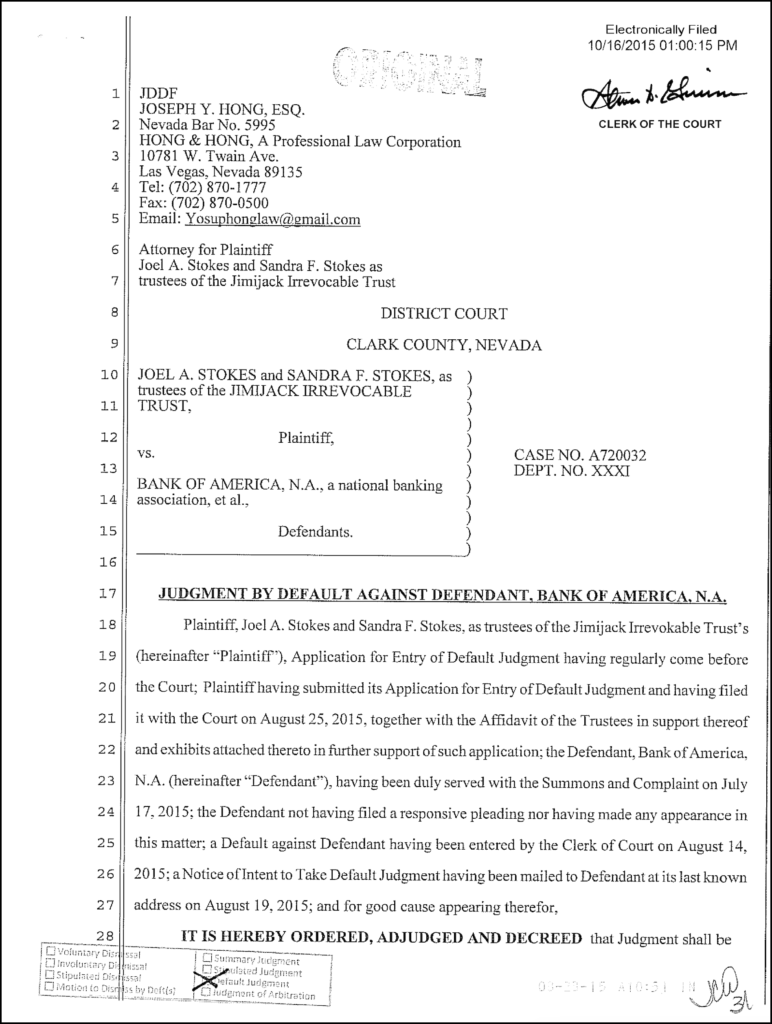

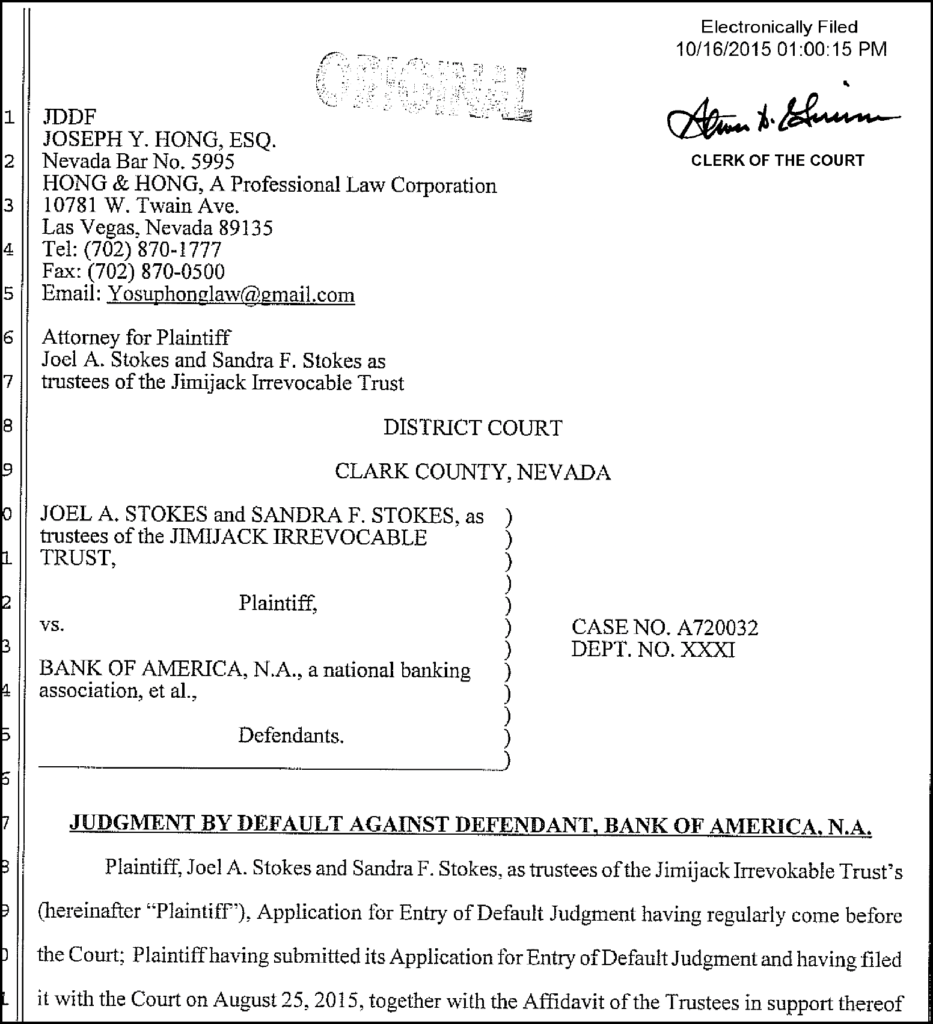

Jimijack somehow already had a default judgment by suing disinterested Bank of America.

How could that happen?

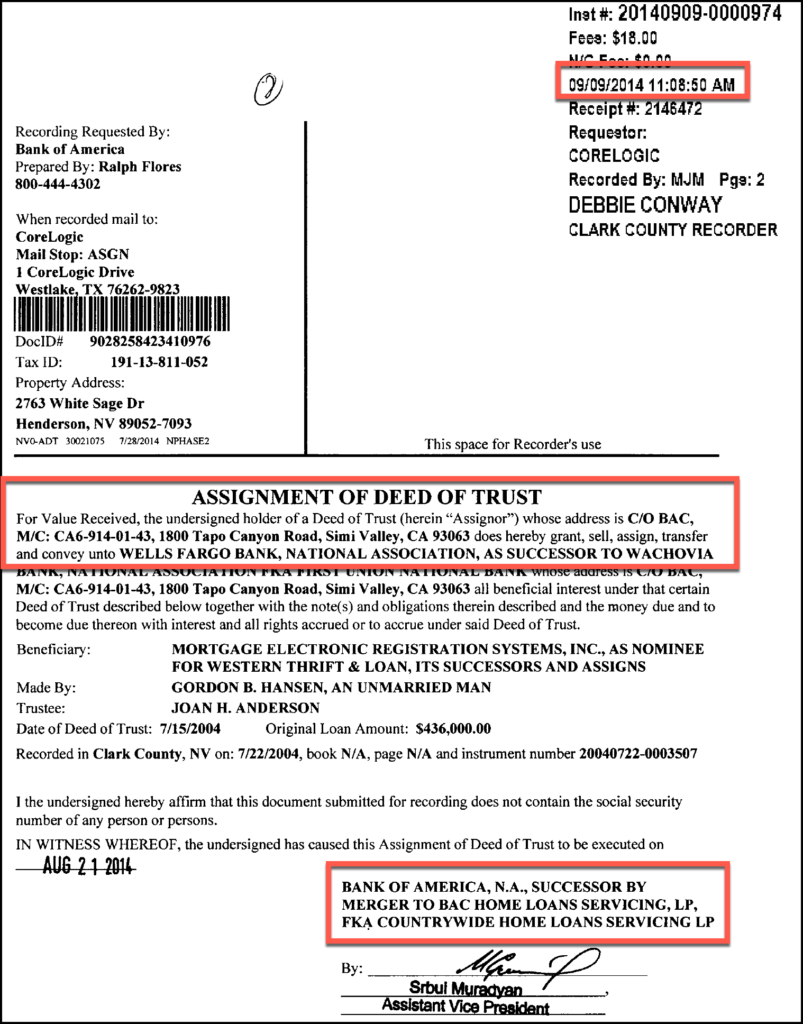

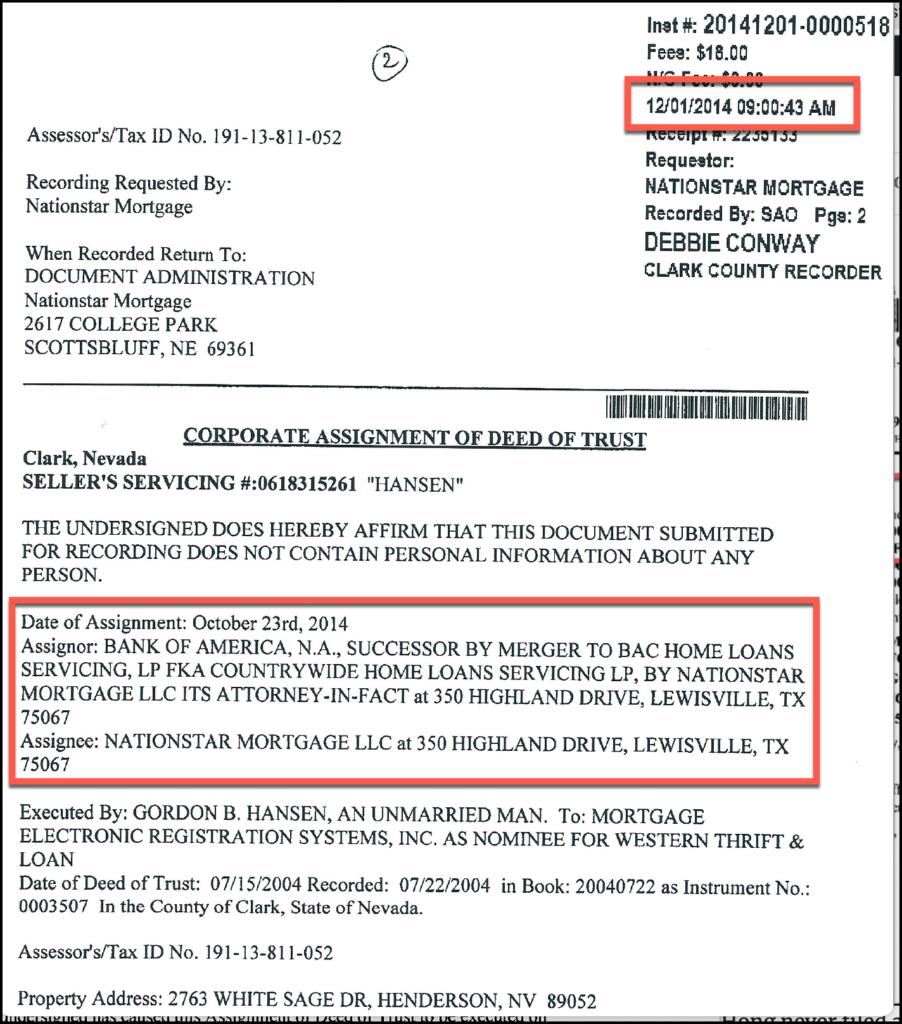

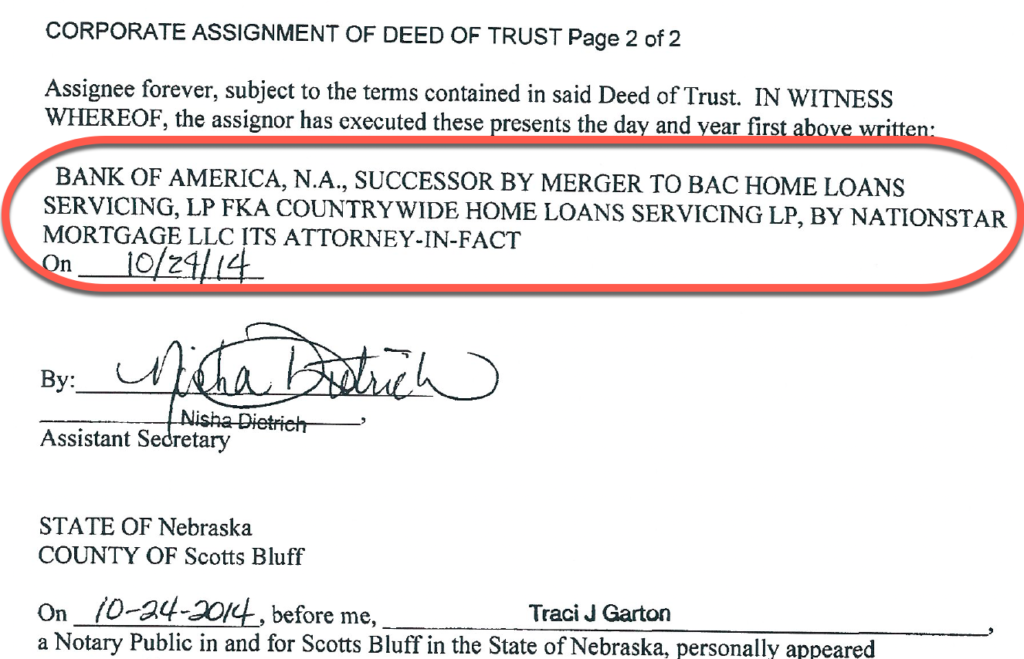

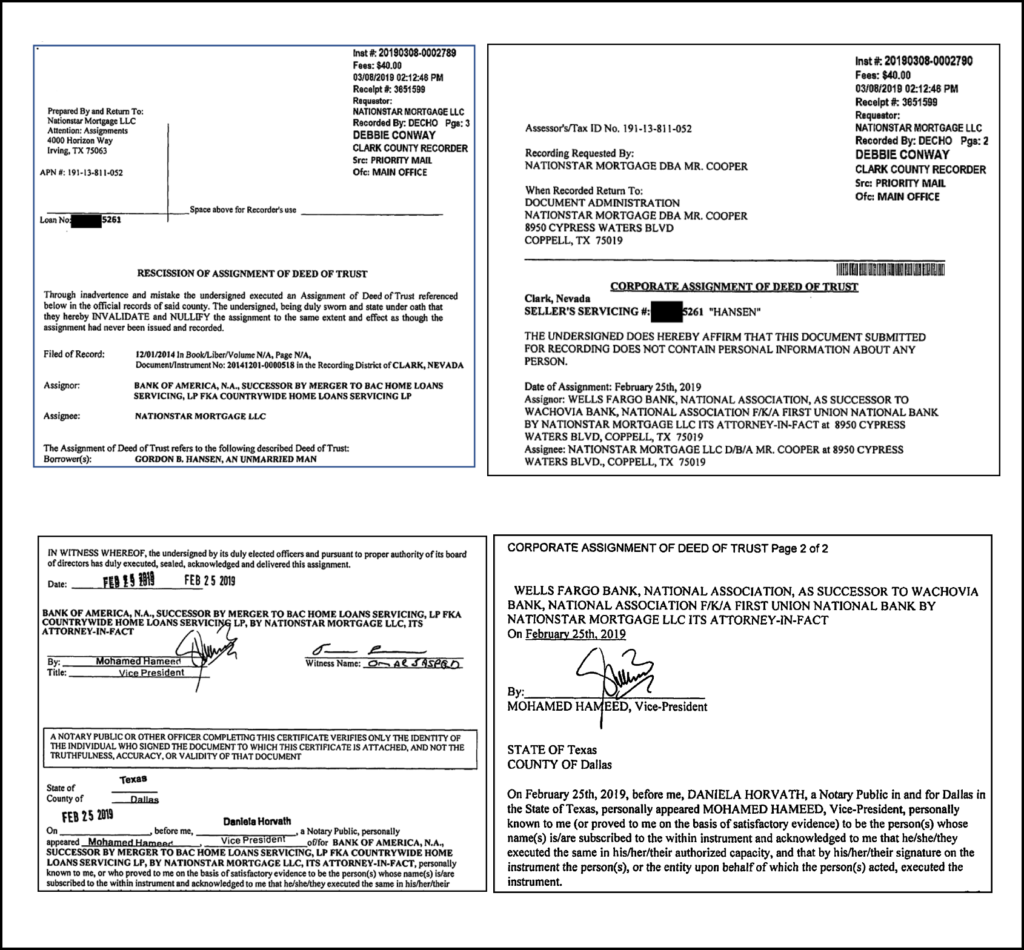

There were TWO banks with recorded claims that BANA gave its beneficial interest to it:

9/9/14 BANA recorded it assigned its interest, if any, to Wells Fargo on 8/21/14

12/1/14 Nationstar recorded it had BANA’s unrecorded power of attorney to assign BANA’s interest, if any, to itself on 10/23/14

Nationstar didn’t file any claims against me as the trustee of the Gordon B. Hansen Trust or as an individual .

Nationstar got summary judgment by claiming BANA gifted the $389,000 loan balance to it 3 months after BANA gifted it to Wells Fargo immediately after it was extinguished by the HOA foreclosure.

How did that happen?

Neither Jimijack nor Nationstar nor the HOA have any filed claims but all got summary judgment by getting my claims precluded and my evidence stricken and their fraud undetected

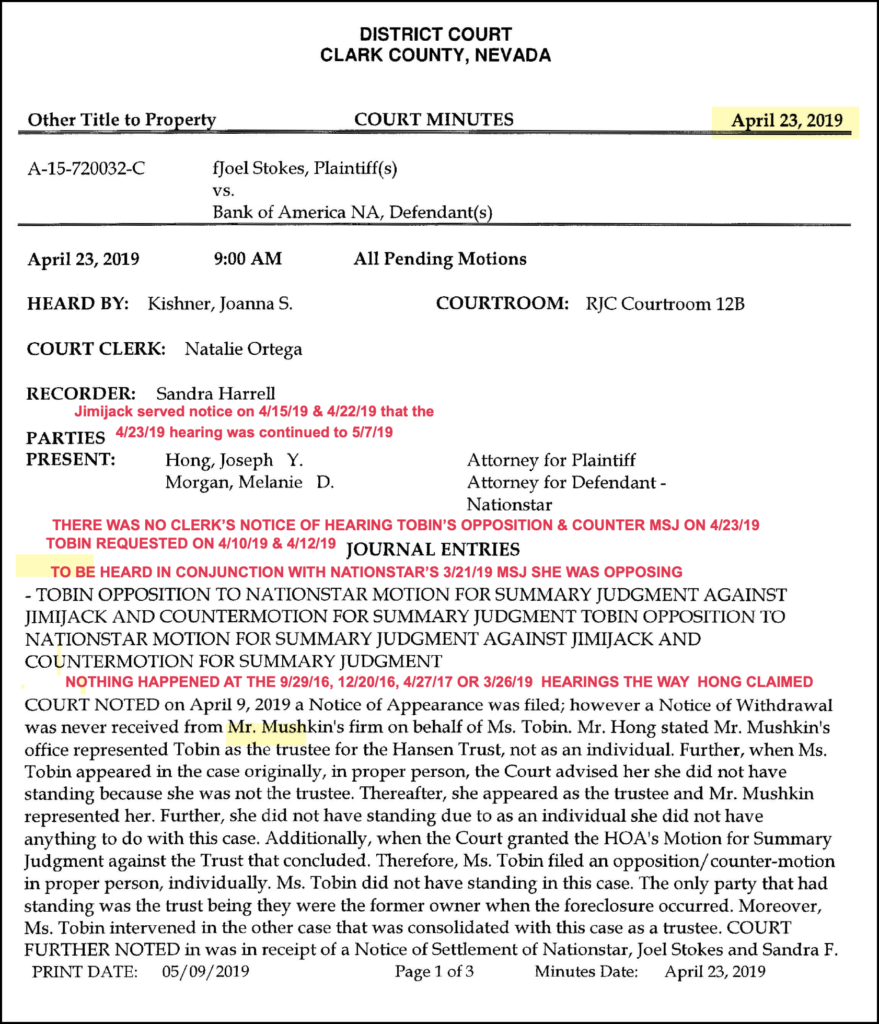

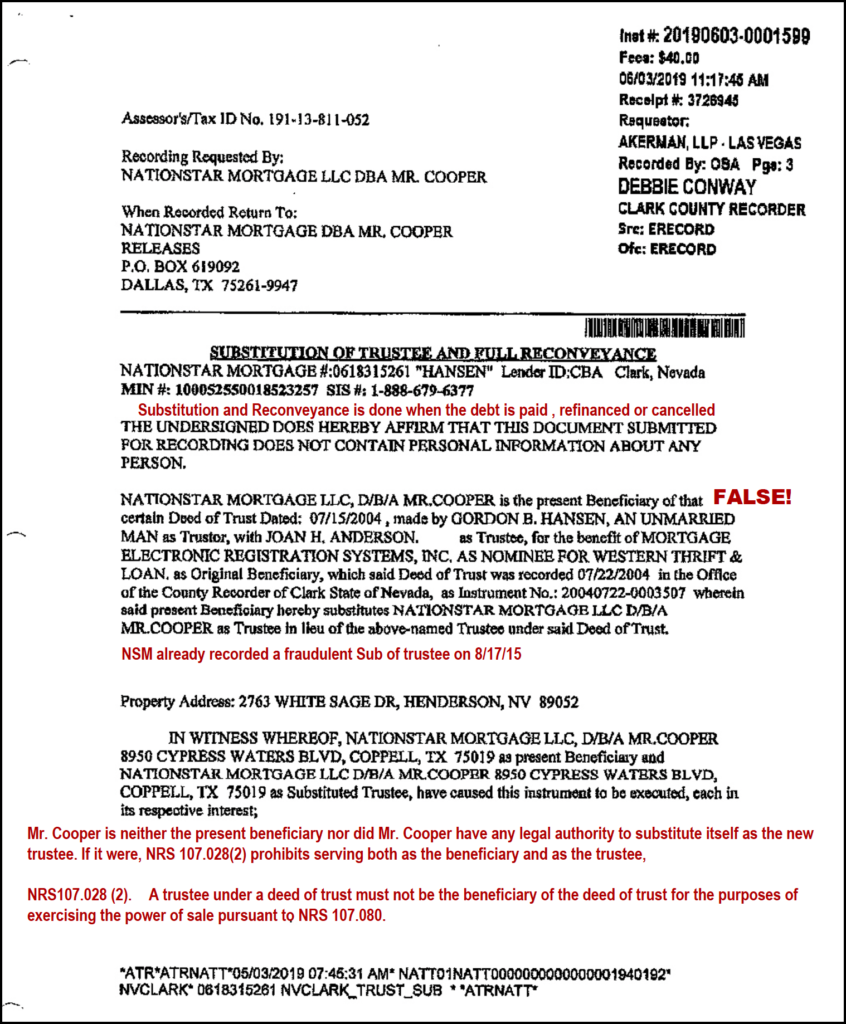

Nationstar quietly dismissed all its filed claims without adjudication on 2/20/19, 3/12/19, 4/23/19, and 5/31/19

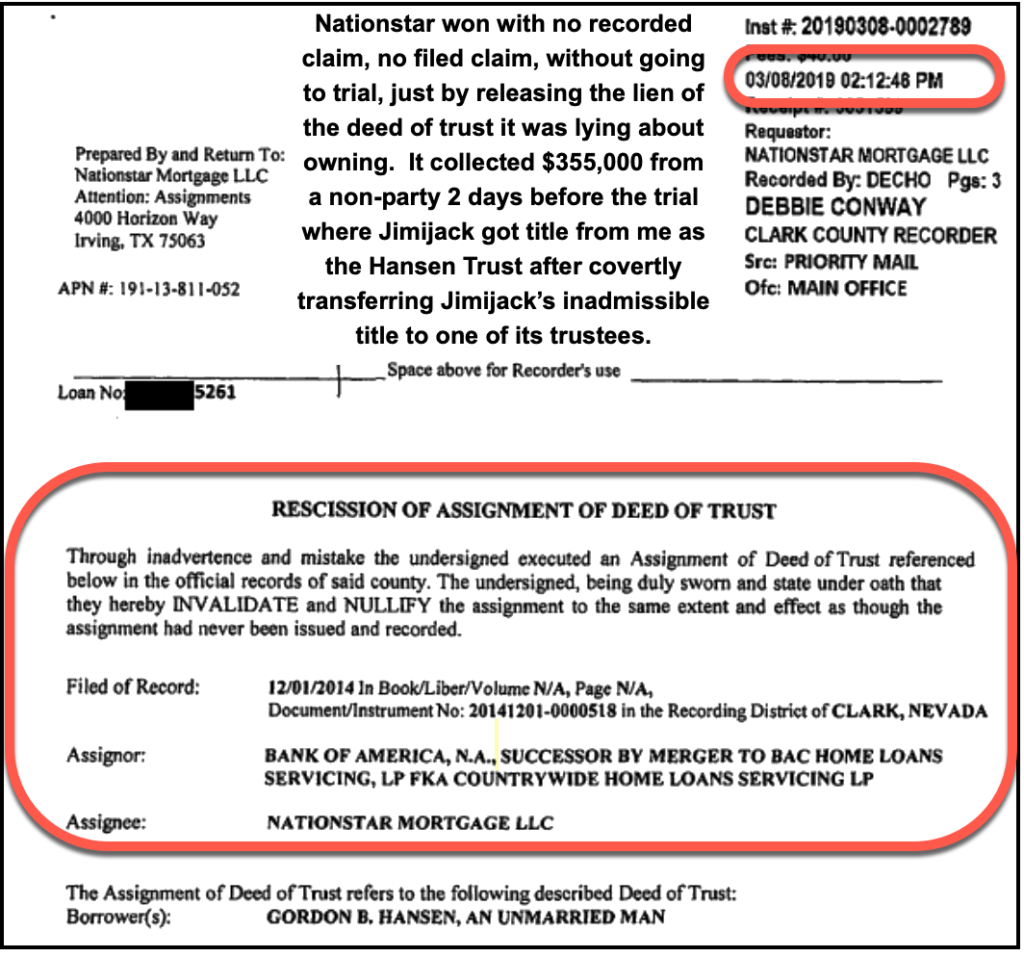

Nationstar covertly recorded a rescission of its claim to be BANA’s successor in interest

Nationstar’s attorney and Jimijack’s attorney told the judge to ignore all my evidence because I wasn’t really a party

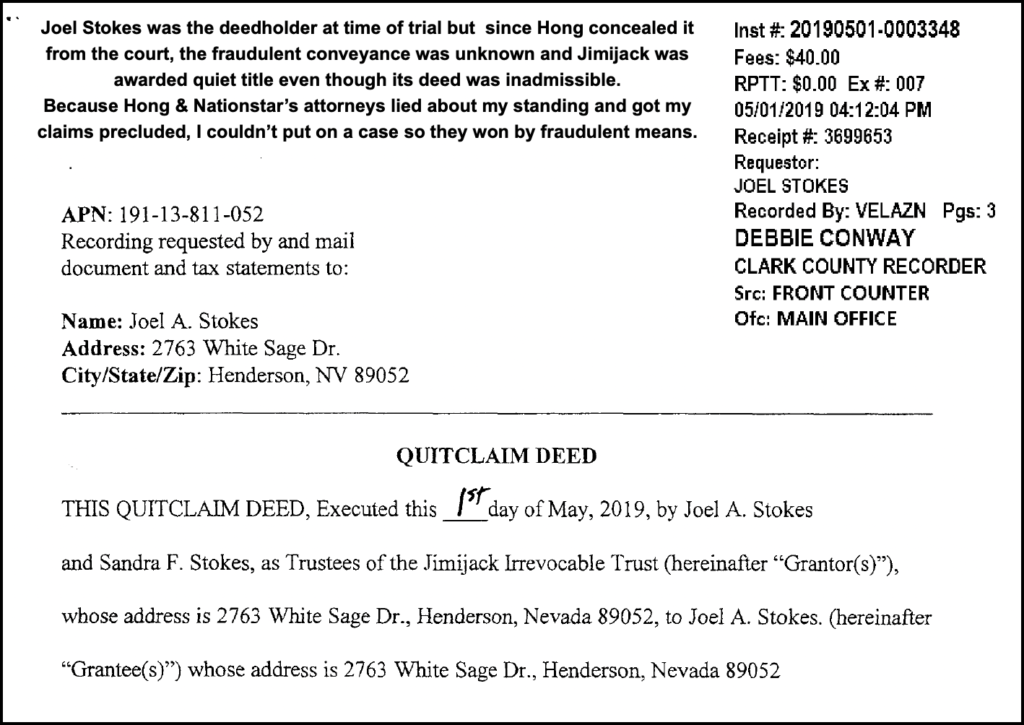

Hong concealed from the court Jimijack covertly dumped its inadmissible deed

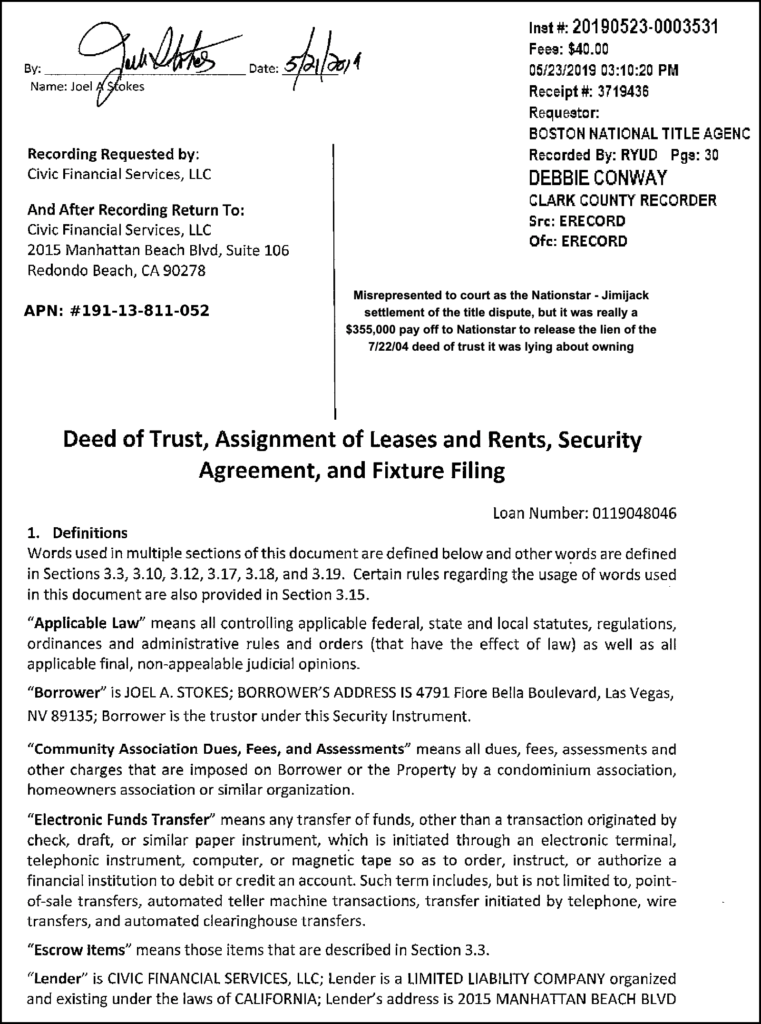

Joel Stokes encumbered the property with $355,000 CVS loan to launder Nationstar’s pay off for releasing the lien of the 1st DOT

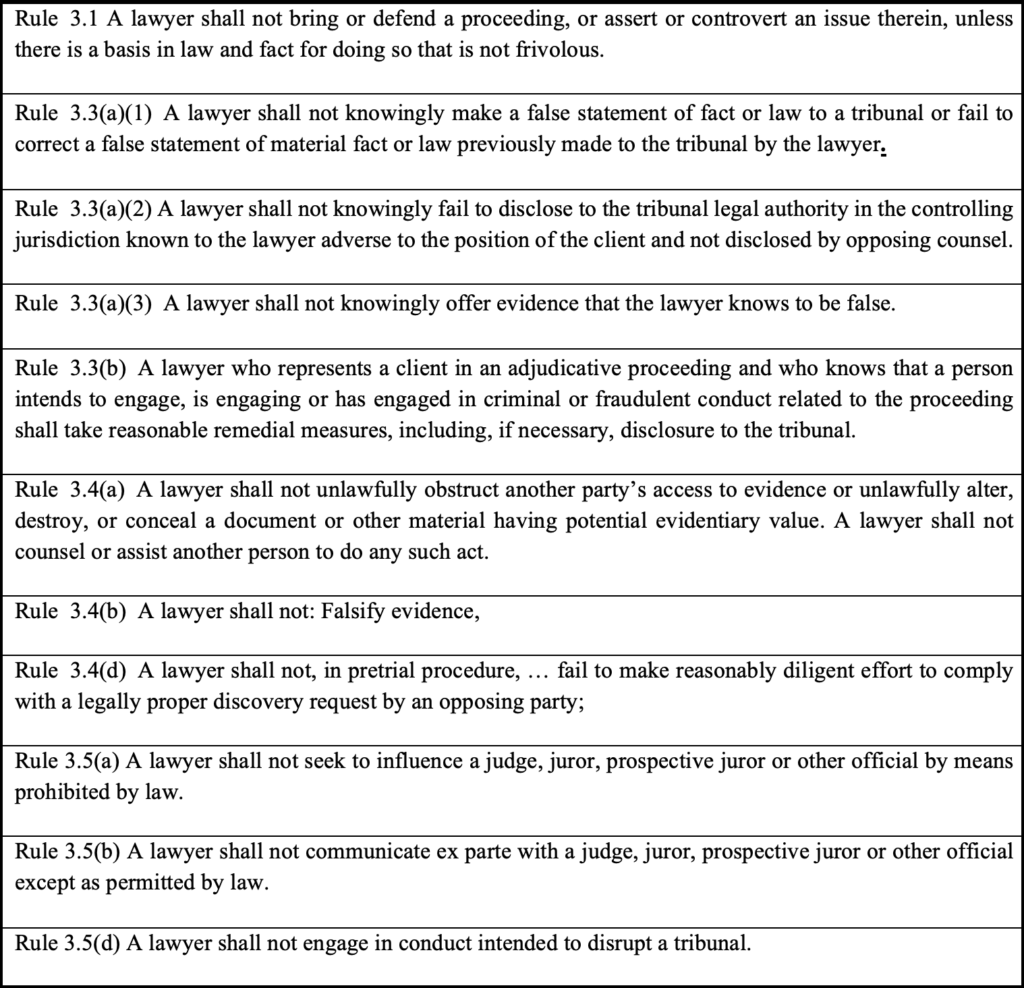

Nationstar’s attorneys knew that Nationstar rescinded its claim that got its 2/12/19 joinder granted and knew its 3/8/19 claim recorded after discovery ended was fraudulently executed by a robosigner

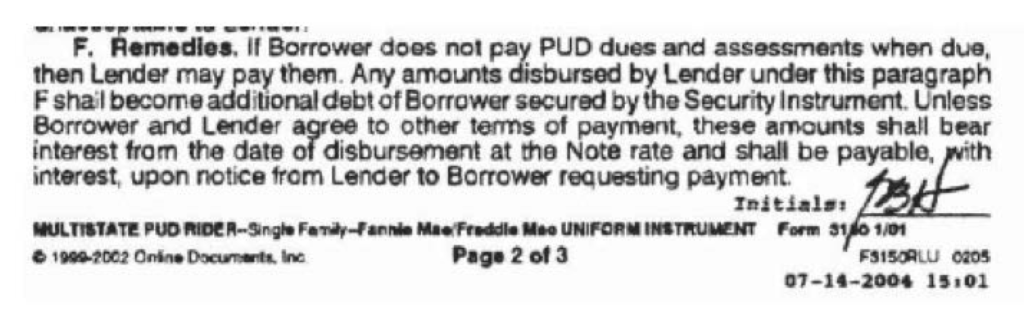

Nationstar’s attorneys knew the PUD Rider prohibited turning the rejection of assessments into a de facto foreclosure and that’s what they were doing by this trick

Akerman still went all in two days before the trial with the quid pro quo

None of the elements for quiet title were met at the 6/5/19 trial as no party was at the trial who had any interest in the title to protect, and all documentary evidence was unfairly excluded.

The necessary elements of a declaratory relief or quiet title claim are as follows:

(1) there must exist a justiciable controversy; that is to say, a controversy in which a claim of right is asserted against one who has an interest in contesting it;

(2) the controversy must be between persons whose interests are adverse;

(3) the party seeking declaratory relief must have a legal interest in the controversy, that is to say, a legally protectable interest; and

(4) the issue involved in the controversy must be ripe for judicial determination.

Kress v. Corey, 189 P.2d 352, 364 (Nev. 1948)

The elements for a claim of quiet title were NOT met in the 1st action.

No claims were properly adjudicated based on judicial scrutiny of verified evidence supporting claims by parties with STANDING.

1. Action may be brought by any person against another who claims an estate or interest in real property, adverse to him, for the purpose of determining such adverse claims. NRS 40.010;2. Complaint must be verified. NRS 40.090-1;

3. Summons must be issued within one year of filing the complaint and served per NRCP. NRS 40.100-1;

4. Lis Pendens must be filed with the county recorder within 10 days of filing of the complaint. NRS 40.090-3;

5. Copy of the Summons must be posted on the property within 30 days after the summons is issued, and an affidavit of posting must be filed with the court. NRS 40.100-2;

6. Disclaimer must be filed. NRS 40.020;

7. Affidavit to unknown heirs must be filed. NRS 14.040(3);

8. Court must hold a hearing on the evidence in order to issue judgment. NRS 40.110(1)

9. Quiet title may not be obtained through default judgment. NRS 40.110(1); and

10. Record a certified copy of the judgment quieting title. NRS 247.120(0).

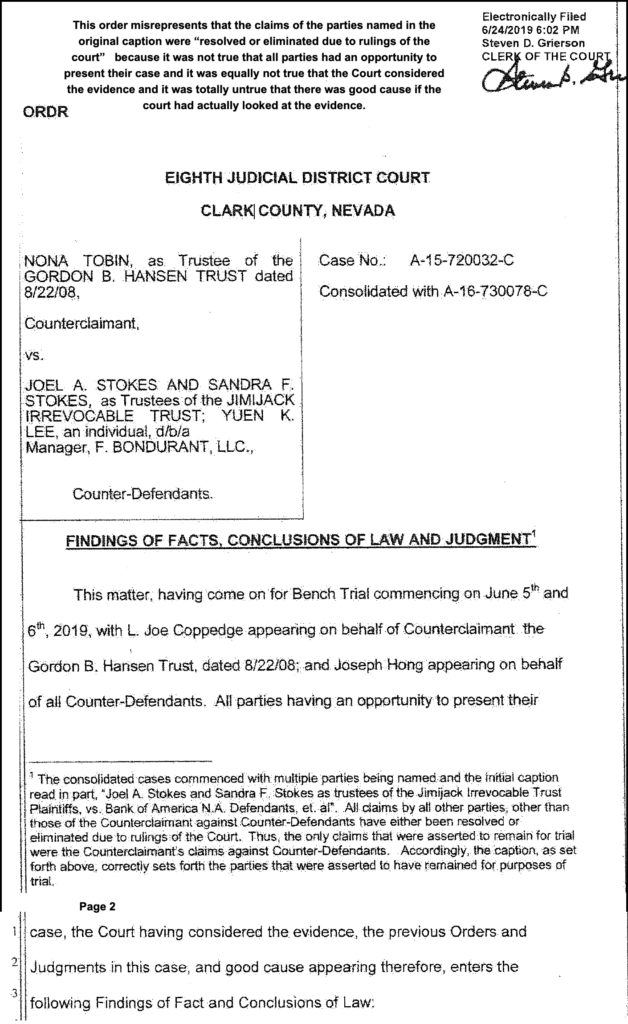

Nevertheless, the 6/24/19 order misrepresented that the decision to quiet title met the elements.