On 12/19/22, I filed a motion for an order to show cause why written findings of attorney misconduct should not be forwarded to the State Bar because the State Bar would not investigate complaints without it.

Below is my statement of intent which was to clearly show that my claims had been obstructed and never fully heard due to the misconduct of my opponents.

The motion was made in good faith and supported by verified evidence

Summary of 2/23/22 and 2/28/22 Bar complaints against Nationstar’s attorneys

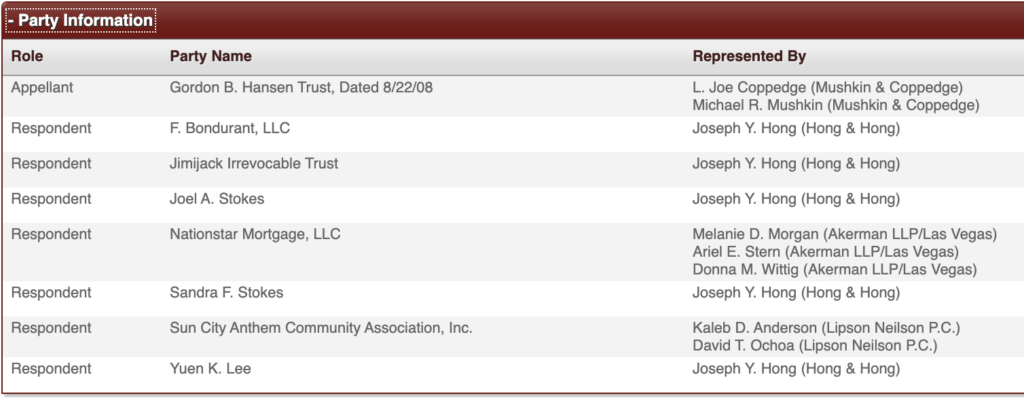

Nationstar’s attorneys: Wright, Finlay, Zak, LLP

Melanie Morgan (SBN 8215) Akerman LLP

2/28/22 Complaint to State Bar vs. Nationstar’s attorneys: Wright, Finlay, Zak, LLP and

2/23/22 Complaint to Bar vs. Nationstar attorneys Melanie Morgan (SBN 8215) Akerman

Nationstar’s attorneys: Melanie Morgan, Managing Partner Akerman LLP and Wright Finlay Zak, LLP lied about Nationstar being owed a debt; lied about Nationstar having any standing to file a quiet title claim. Abused the HOA quiet title litigation process multiple times as a corrupt business model, representing different lenders who did not NRS 104.3301 standing to foreclose on the 1st deeds of trust they were lying about owning.

- The most critical material facts knowingly misrepresented by all of Nationstar’s attorneys related to the assignments and reconveyance of the 1st deed of trust that was extinguished by the 8/15/14 HOA sale: 7/22/04 Hansen deed of trust

- 4/12/12 ASSIGN MERS to BANA by BANA – could not transfer interest:

- 1) assignment to BANA was void as it was robo-signed days after BANA signed a 4/4/12 consent decree agreeing not to robo-sign documents to fake ownership of loans that basically had been securitized out of existence;

- 2) also void because there is no notary record of it (NRS 111.240);

- 3) also void because non-compliant with Nevada’s anti-foreclosure fraud law (AB 284 (2011)

- 9/9/14 ASSIGN BANA to Wells Fargo by BANA – could not transfer interest:

- 1) assignment is void as BANA’s 4/12/12 assignment to itself above was void;

- 2) assignment was recorded almost a month after the deed of trust was extinguished by the 8/15/14 HOA sale;

- 3) servicing banks BANA’s and Nationstar’s failure to record a notice of default on the 7/22/04 deed of trust constitutes a waiver of any right it may have to use the property as security for the Hansen promissory note;

- 4) servicers’ failure to record a notice of default was the direct and proximate cause of the HOA sale because an HOA is prohibited from foreclosing if a lender has recorded a notice of default on the 1st deed of trust (NRS 116.31162(6)(2013)

- 12/1/14 ASSIGN BANA to Nationstar by Nationstar – could not transfer interest:

- 1) void because BANA had no interest to assign on 12/1/14;

- 2) void because it was actually a self-assignment executed without authority by Nationstar;

- 3) void because Nationstar did not record or disclose a properly executed power of attorney from BANA;

- 4) void because Nationstar rescinded it a week after the end of discovery in the 1st action

- 3/8/19 ASSIGN Wells Fargo to Nationstar by Nationstar – could not transfer interest:

- 1) void because Wells Fargo had no interest to assign to Nationstar;

- 2) void because Nationstar’s robo-signer executed it without authority;

- 3) void because Nationstar recorded it after the end of discovery in the 1st action;

- 4) void because Nationstar prevailed in the 1st action by filing a non-meritorious joinder on 2/12/19 claiming to be BANA’s successor in interest and then two weeks later rescinding that claim and then after the end of discovery recording a new robo-signed claim to be Wells Fargo’s successor in interest;

- 5) Nationstar is judicially estopped from claiming that either it or Wells Fargo is the beneficiary due to its repeated conflicting claims regarding when and from whom it acquired its claimed interest;

- 6) Nationstar admitted i n discovery two days after this robo-signed assignment was executed on 2/25/19 that Nationstar was then, and always had been since 12/1/13, only the servicer, never the beneficiary.

- 3/8/19 RESCIND 12/1/14 BANA to Nationstar by Nationstar – could not transfer interest as it was rescinding a void assignment:

- 1) this rescission was done in bad faith a week after discovery ended after Nationstar learned that Tobin could prove that it was lying about being the beneficiary as BANA’s successor in interest; 2) this was executed by Nationstar robo-signer Mohamed Hammed posing as if he were the V-P of BANA;

- 3) In the months following this rescission, Nationstar persisted in its false claim that the sale was valid to extinguish Tobin’s interest by was void to extinguish the interest Nationstar was lying about owning as the successor of BANA

- 6/3/19 RECONVEY Hansen DOT to Joel Stokes – not to the borrower’s estate – by Nationstar

- 1) void because Nationstar did not have the legal authority to reconvey the deed of trust to anyone, let alone to a non-party two days before the quiet title trial in the 1st action;

- 2) void as Nationstar claimed to be both the trustee and the beneficiary when in fact it was neither and therefore had no legal authority to record a reconveyance (NRS 205.395);

- 3) Nationstar could not have been both the trustee and the beneficiary as NRS 107.028(2) prohibits it;

- 4) void as it was a fraudulent transfer (NRS 111.175) to consummate the $355,000 devil’s pact between Nationstar and Jimijack recorded on 5/23/19;

- 5) underlying deal with Joel Stokes is void as the attorneys misrepresented it as the Nationstar-Jimijack settlement of all claims to the court to gain its imprimatur fraudulently;

- 5) void as the Nationstar-Joel Stokes deal excluded Tobin as a necessary party (NRCP 19, NRS 30.130) as she was denied the opportunity to defend her 3/28/17 deed;

- 6) void as the lien was released as a quid pro quo to steal Tobin’s property by obstructing her claims from being heard on their merits;

- 7) void as this was recorded when Tobin as an individual and as the Hansen Trust trustee had pending quiet title claims against Jimijack to void the defective HOA sale subject to the deed of trust, i.e., Jimijack’s deed was defective and inadmissible as evidence of title (NRS 111.345) and so if Tobin’s claims had been heard on the merits, Jimijack would have lost. Nationstar knew that Tobin knew it did not have standing to foreclose on her if the title was unwound to put her and Nationstar back as if the sale had never happened. The ONLY way they could both win was to obstruct Tobin’s case from being heard and tell the court that they settled the title dispute out of court.

- 7) void as Nationstar never produced any evidence that it had any legal right to collect $355,000 in exchange for releasing a lien it did not own;

- 7) underlying deal with Joel Stokes is void as Nationstar dismissed all its quiet title claims without adjudication;

- 8) void as Nationstar essentially confiscated Tobin’s property without foreclosure and without adjudication, by lying about being the beneficiary and abusing the HOA quiet title litigation process to collect on a debt it was not owed.

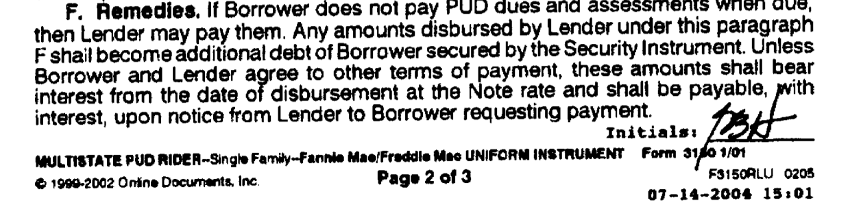

- 9) void as Nationstar circumvented the restrictions of the PUD Rider Remedies (F) to turn the alleged payment of delinquent HOA assessments into a de facto foreclosure without notice of due process required by NRS 107.080.

Summary of Bar Complaint against Melanie Morgan

- 1. Met ex parte with Judge Kishner on 4/23/19 after serving notice on all parties through the court’s e-file Odyssey system on 4/15/19 and 4/22/19 that the hearing was continued to 5/7/19 (NCJC 2.9, NRPC 8.4 and ABA standard 6.31(b))

- 2. As the managing partner over multiple subordinate attorneys, and as the successor of Nationstar’s and BANA’s prior attorneys, Wright, Finley, Zak, perpetrated fraud on the court

- by misrepresenting to the court the material facts, (e.g., 1) that Nationstar was owed a debt from the 7/22/04 deed of trust that was extinguished by the disputed 8/15/14 HOA sale,

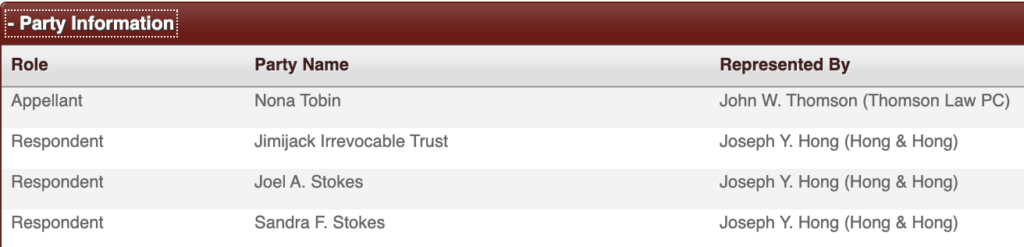

- 2) that Nona Tobin had not been granted leave to intervene as an individual

- 3) that Tobin’s 3/28/17 deed did not give her NRS 40.010 standing anyway

- 4) that the HOA sale was valid for the sub-priority portion of the lien),

- 5) changed attorneys to create plausible deniability, e.g., removed Karen Whelan after Joe Coppedge asked Nationstar in 2018 to join Tobin in an MSJ to void the sale in its entirety

- 6) in A-21-828840-C when Nationstar was going to have to respond to Tobin’s claim that it was judicially estopped from claiming to be owed a debt from the Hansen 7/22/04 deed of trust),

- 7) concealed inculpatory evidence (e.g., all Equator records, communications between Nationstar and Tobin or Nationstar and Red Rock or Nationstar and Wells Fargo) on these dates: 5/15/18, 12/10/18, 2/7/19, 2/12/19, 2/12/19, 2/20/19, 2/21/19, 2/21/19, 2/27/19, 2/28/19, 2/28/19, 3/7/19, 3/12/19, 3/12/19, 3/18/19, 3/21/19, 3/26/19 RTRAN, 4/12/19, 4/15/19, 4/19/19, 4/22/19, 4/23/19, 4/23/19 RTRAN, 4/25/19 RTRAN, 5/3/19, 5/21/19 RTRAN, 5/29/19 RTRAN, 5/31/19, 6/24/19, 6/24/19, 6/25/19, 7/1/19, 7/22/19, 6/25/20, 8/11/20, 4/9/21, 4/26/21, 5/3/21, 5/5/21, 8/19/21, 11/9/21, 11/15/21, 11/16/21, 11/23/21, 11/30/21.

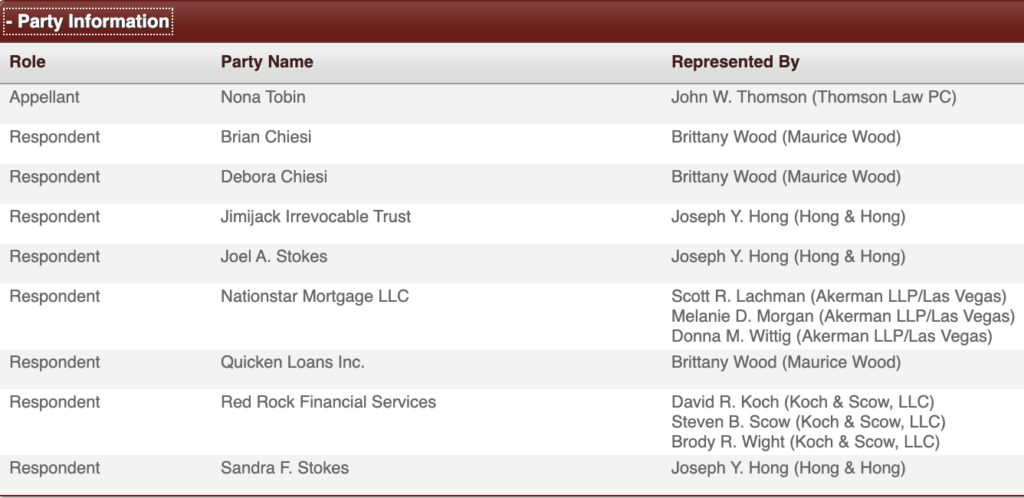

- 3. In conspiracy with Joseph Hong, made a fraudulent side deal with Joel A. Stokes, that a) was mischaracterized to the court (5/21/19 transcript) status check-settlement documents) as a “Nationstar-Jimijack settlement of all claims” that was recorded on 5/23/19, and

- b) which allowed Nationstar to be dismissed from the quiet title trial

- c) so it did not have to produce any evidence to support its quiet title claim

- and d) evaded either Nationstar or Jimijack having to refute Tobin’s quiet title claims on their merits.

- 2/23/22 Bar complaint filed against Melanie Morgan Petitioner’s 84371 appendix volume 27 (22-08189) (pages 4045-4154) was supported by exhibits of multiple unadjudicated administrative claims against Nationstar and Akerman.

- On 2/23/22, Tobin, as the President of Fight Foreclosure Fraud, Inc., filed a complaint against Nationstar’s attorney, Wright, Finlay, Zak, LLP (“WFZ”) that initiated Nationstar’s meritless quiet title complaint. The bar complaint is filed concurrently as a Request for Judicial Notice because it their duplicitous filings are the corrupt foundation of this dispute. However, they ceased to be Nationstar’s attorneys on 4/10/18 when Akerman took over.

- WFZ aided and abetted mortgage servicing fraud of both Bank of America and Nationstar Mortgage by filing into this quiet title civil dispute statements known to be false and disclosing false evidence on 1/11/16, 4/12/16 DECL, 4/12/16, 5/10/16, 6/2/16, 6/3/16, 6/10/16, 3/27/17 DECL , 3/27/17, 11/9/17, 2/9/18.

- Assisting lenders to cheat homeowners is WFZ’s business model.

- Movant requests the court determine if written findings against the WFZ attorneys separate from Nationstar are appropriate given that the four-year statute of limitations for complaints to be addressed by the Bar has passed, but the five-year statute of limitations for racketeering has not.