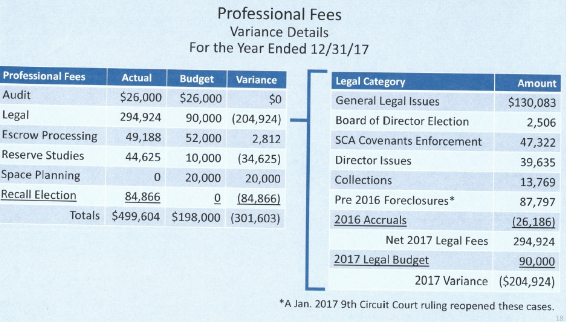

The GM is to blame for the big bill – not the SCA owners who must pay it

This huge expense is still climbing, but it was totally unnecessary, not legally authorized by the Board, and did not serve the best interests of SCA.

Both the GM and the attorney should be fired for spending our money to interfere with the integrity of the removal election.

This unauthorized expenditure is sufficiently egregious to warrant the termination of both the GM and attorney, but that won’t happen because the beneficiaries of the election interference by SCA’s agents included a majority of the Board which was apparently important enough to them to stand by and let SCA owners foot the huge and unnecessary bill.

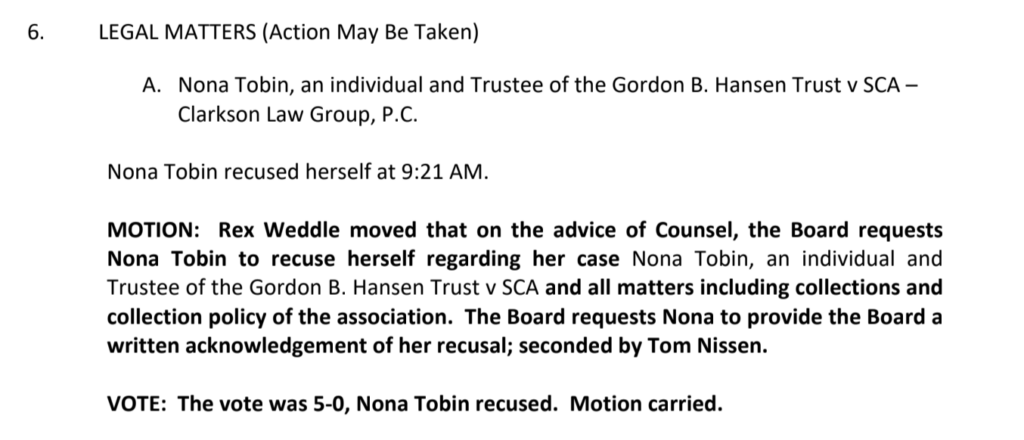

While I was on the Board I aggressively attempted to protect the independence of the Election Committee, but alone and constrained by ethical boundaries, I was no match for the abuse of power by the Board President and SCA’s agents who were not so constrained.

A well-documented contributing factor to my unlawful removal from the Board was that I informed the Ombudsman on July 24 of my concerns about the need to protect the independence of the Election Committee (and also to protect owners lawfully collecting petition signatures) from the significant GM/CAM/attorney/Board interference I observed.

Berman’s constant improper placement of blame

David Berman continues to perpetuate the myth that these unnecessary and unauthorized costs were caused by the petitioners who (legally) called for the removal election.

This targeting of unit owners is obviously wrong. Owners don’t have enough power to be culpable.

Think about it.

- If 1,200 unit owners had wanted the Election Committee to conduct the removal election, but the GM did not want it, would they have been able to make their wishes happen over her objections?

- If any of the petitioners had come to the Board meeting and begged to have SCA fork out over $73,000 to pay an unknown CPA and the attorney to do the Election Committee’s job, would SCA have spent one dime?

Both the GM and the Board President had to want SCA money to be spent on agents of their choosing to run the removal election (incompetently or, more likely, unethically), or OUR money would still be safely in the bank.

The Spin Doctor at work

Yet, despite all evidence to the contrary, David Berman persists in promulgating this almost laughable propaganda that unit owners could make the GM do something that doesn’t serve her interests. Smug in this delusion, today he blogged with a melodramatic and an almost audible sigh that this big $73,000 number would still be bigger when the attorney and CPA bills all come in:

Sad. SCA deserves so much better.

Sad. SCA deserves so much better.

But, wait, hope may be on the horizon:

CIC Commission recently held a GM accountable despite HOA attorney advice that action was OK under NRS.

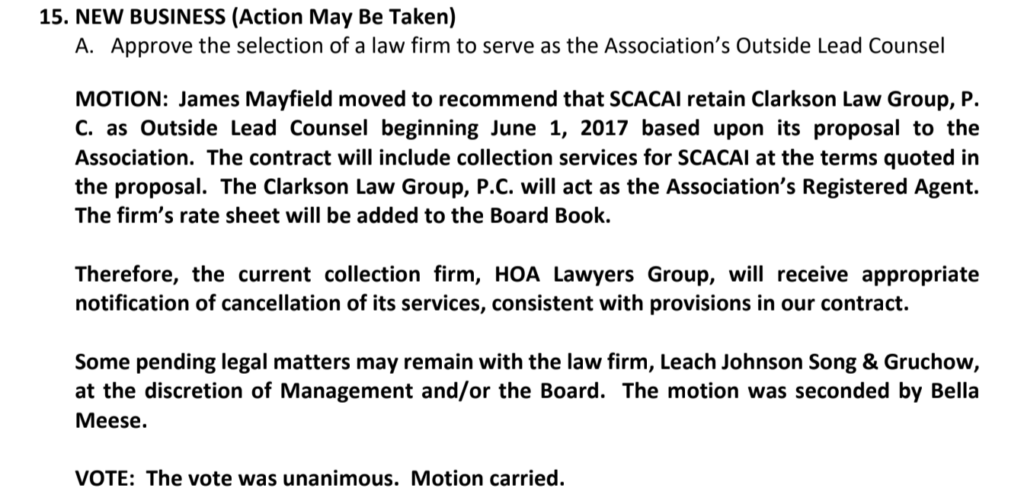

If Rex and Sandy having Clarkson on speed dial is no longer as good an excuse as “the dog ate my homework”, then maybe…

AnthemOpinions blogspot reported about a case that was heard at the recent CIC Commission meeting which seemed to demonstrate the Commission’s repudiation of the “the attorney said I could” defense.

The Zeitgeist

Perhaps, we are reaching a tipping point.

In the whole country, the public conversation has shifted seismically around sexual harassment. Suddenly, society-at-large is not just standing silently by while men in power abuse vulnerable people with impunity.

Maybe the tide is turning here at SCA too.

Now, owners no longer seem so resigned and no longer seem willing to tolerate inexcusable behavior or poor leadership. A critical mass is forming, and this is a necessary step to creating a healthier balance of power in our community.

As formerly discouraged and disenfranchised owners are more willing to speak up and stand up to bullies, SCA’s bullies will predictably face a Come to Jesus reckoning. A tectonic power shift will occur that, in retrospect, we will be surprised at how long it took us to take our power back.