A-21-828840-C COURT RECORD

| Date | Doc # | Court Record |

| 4/1/23 | Register of Actions | |

| 2/3/2021 | 1 | Doc ID# 1 Initial Appearance Fee Disclosure |

| 02/03/21 | 2 | Doc ID# 2 Complaint for interpleader |

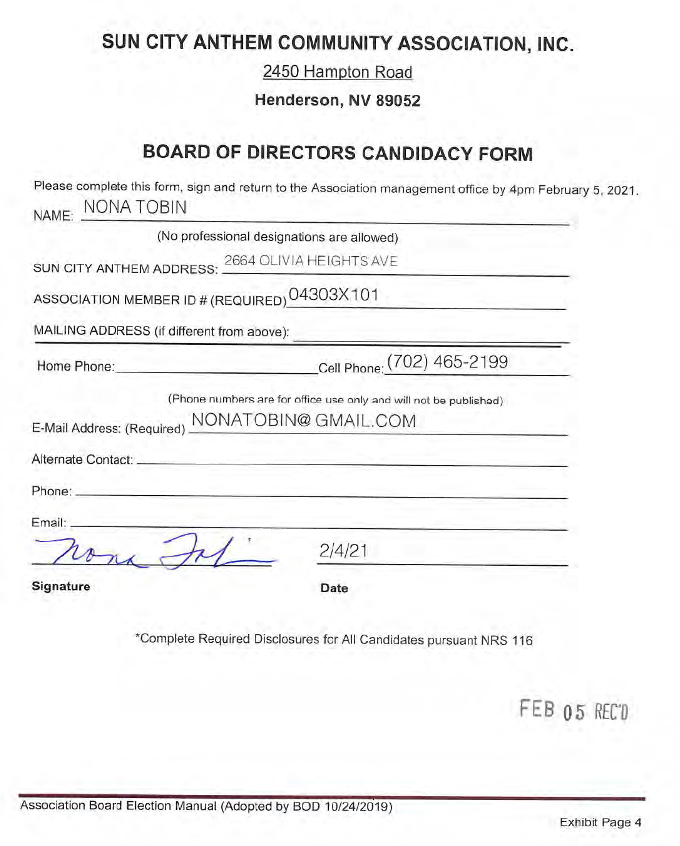

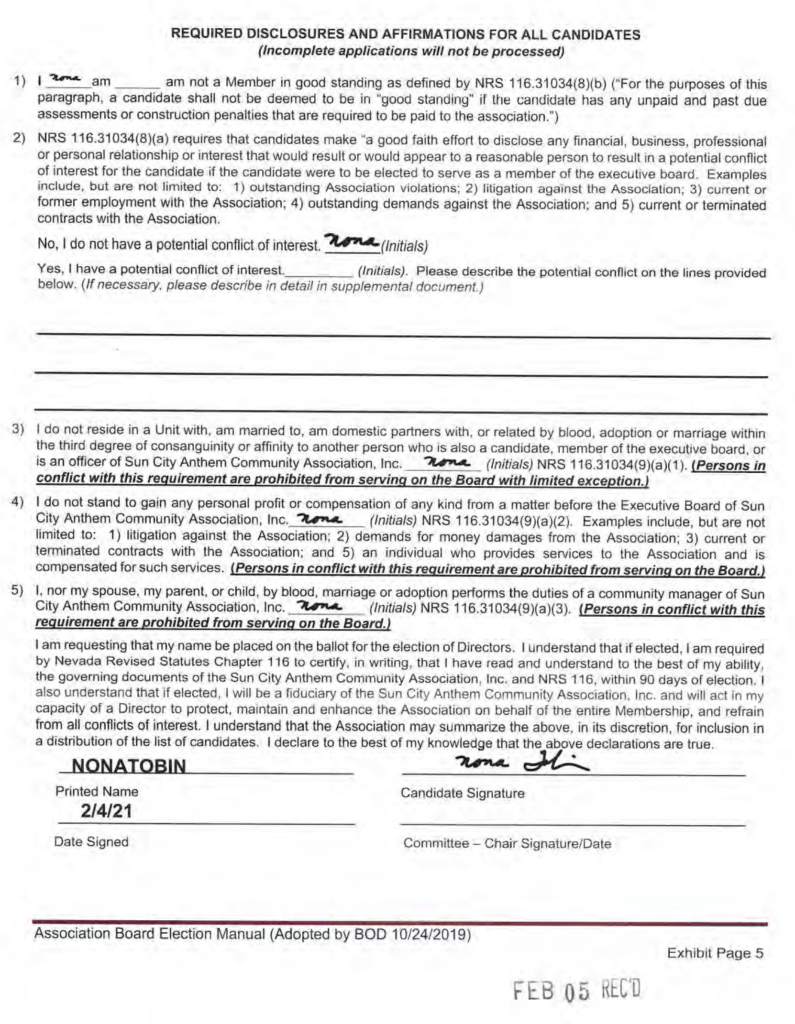

| 02/03/21 | 3 | Doc ID# 3 Electronic Summons for Nona Tobin, as an individual and as trustee for the Gordon B. Hansen Trust, dated 8/22/08 |

| 2/9/2021 | 7 | Doc ID# 7 Notice of Department Reassignment |

| 2/17/2021 | 8 | Doc ID# 8 Affidavit of service-Republic Services |

| 2/17/2021 | 9 | Doc ID# 9 Affidavit of service- Wells Fargo |

| 2/17/2021 | 10 | Doc ID# 10 Affidavit of service Nona Tobin, as an individual served via attorney John Thomson |

| 2/17/2021 | 11 | Doc ID# 11 Affidavit of service-Nona Tobin as trustee of the Hansen Trust served via attorney John Thomson |

| 2/17/2021 | 12 | Doc ID# 12 Affidavit of service-Nationstar |

| 2/17/2021 | 13 | Doc ID# 13 Disclaimer of interest – Republic Services |

| 3/8/2021 | 14 | Doc ID# 14 Nona Tobin’s Answer, Affirmative Defenses, And Counter-Claim vs. Red Rock Financial Services, Cross-Claims vs. Nationstar Mortgage LLC And Wells Fargo, N.A., And Motion For Sanctions vs. Red Rock Financial Services And Nationstar Mortgage LLC, and/or Nationstar Mortgage dba Mr. Cooper Pursuant To NRCP 11(b)(1)(2)(3) and/or(4), NRS 18.010(2), NRS 207.470(1), NRS 42.005 |

| 3/15/2021 | 15 | Doc ID# 15 Request for Judicial Notice Nona Tobin’s Request for Judicial Notice of the Complete Official Clark County 2003-2021 Property Records for APN 191-13-811-052 |

| 3/22/2021 | 16 | Doc ID# 16 Initial Appearance Fee Disclosure for Nona Tobin an Individual |

| 3/22/2021 | 17 | Doc ID# 17 Nona Tobin’s Third-Party Complaint 1. Abuse Of Process; 2. Racketeering (NRS207.360(9)(18) (29)(30) (35); NRS 207.390, NRS 207.400(1)(2); 3. Fraud NRS 205.330, NRS 205.360, NRS 205.372, NRS 205.377, NRS 205.395, NRS 205.405, NRS 111.175; 4. Restitution And Relief Requested Exceeds $15,000 5. Exemplary And Punitive Damages Pursuant To NRS 42.005, NRS 207.470(1) & (4) 6. Sanctions Pursuant To NRCP 11(b)(1-4); NRPC 3.1, 3.3, 3.4,3.5(b), 4.1, 4.4, 5.1, 5.2, 8.3, 8.4 vs. Steven B. Scow; Brody R. Wight; Joseph Hong; Melanie Morgan; David Ochoa; Brittany Wood |

| 4/4/2021 | 18 | Doc ID# 18 Nona Tobin’s Request for Judicial Notice of Relevant Unadjudicated Civil Claims and Administrative Complaints |

| 4/7/2021 | 19 | Doc ID# 19 Nona Tobin’s Request for Judicial Notice of the Nevada Revised Statutes, Nevada Rules of Civil Procedure, Nevada Rules of Professional Conduct and Sun City Anthem Governing Documents Germane To the Instant Action |

| 4/9/2021 | 20 | Doc ID# 20 Wells Fargo, N.A. and Nationstar Mortgage LLC’s Answer to Red Rock Financial Services’ Complaint for Interpleader (NRCP 22) |

| 4/9/2021 | 21 | Doc ID# 21 Nona Tobin’s Request for Judicial Notice of NRCP 16.1 Disclosures and Subpoena Responses from Discovery in Case A-15-720032-C and Disputed Facts in the Court Record |

| 4/12/2021 | 22 | Doc ID# 22 Nona Tobin’s Amended Motion for an Order to Distribute Interpleaded Proceeds with Interest to Sole Claimant Nona Tobin |

| 4/14/2021 | 23 | Doc ID# 23 CNONCD Clerk’s Notice of Nonconforming Document (failed to say whether hearing was requested) |

| 4/16/2021 | 24 | Doc ID# 24 Counter-Claimant & Cross-Claimant Nona Tobin’s Motion for Summary Judgment vs. Counter-Defendant Red Rock Financial Services and Cross- Defendants Nationstar Mortgage LLC & Wells Fargo, N.A. and Motion for Punitive Damages and Sanctions Pursuant to NRCP 11(b)(1)(2)(3) and/or(4), NRS 18.010(2), NRS 207.401(1) and/or NRS 42.005 |

| 4/16/2021 | 25 | Doc ID# 25 Clerk’s notice of hearing Tobin’s amended motion (22) for an order to distribute on 5/18/21 |

| 4/16/2021 | 26 | Doc ID# 26 Clerk’s Notice of Nonconforming Document and Curative Action |

| 4/16/2021 | 27 | Doc ID# 27 Clerk’s 7:39AM notice of hearing Tobin MSJ (24) and petition for sanctions on 5/18/21 |

| 4/16/2021 | 28 | Doc ID# 28 Non-party Red Rock Financial Services, LLC’s Motion to Dismiss Counterclaimant Nona Tobin’s Counterclaim and Petition for Sanctions (14) |

| 29 | Doc ID# 29 Clerk’s notice of hearing on 5/18/21 Non-party Red Rock LLC’s untimely motion (28) to dismiss Tobin’s Counterclaim and Petition for Sanctions (14) | |

| 4/26/2021 | 30 | Doc ID# 30 Nona Tobin’s Opposition to Red Rock Motion to Dismiss (28) Tobin’s Counter-Claims and Motion for Sanctions (14) Pursuant to NRCP 11(b)(1)(2)(3) and/or (4), NRS 18.010(2), NRS 207.40(1), NRS 42.005 |

| 4/26/2021 | 31 | Doc ID# 31 Wells Fargo, N.A. and Nationstar Mortgage LLC’s Limited Opposition to Defendant Nona Tobin’s Motion for an Order (22) to Distribute Interpleaded Proceeds |

| 4/27/2021 | 32 | Doc ID# 32 Non-party Red Rock Financial Services, LLC’s rogue Joinder to Wells Fargo, N.A. and Nationstar Mortgage LLC’s Limited Opposition (31) to Defendant Nona Tobin’s Motion for an Order to Distribute Interpleaded Proceeds (22) |

| 4/29/2021 | 33 | Doc ID# 33 Red Rock Financial Services’ Opposition to Nona Tobin’s Motion for Summary Judgment (24) |

| 5/3/2021 | 34 | Doc ID# 34 Wells Fargo, N.A. And Nationstar Mortgage LLC’s untimely Joinder To Red Rock Financial Services, LLC’s rogue Motion To Dismiss (28) Counter-claimant Nona Tobin’s Counter-claim And Petition For Sanctions (14) |

| 5/4/2021 | 35 | Doc ID# 35 Nona Tobin’s Reply To Nationstar’s & Wells Fargo’s Opposition To Tobin’s Motion To Distribute Proceeds (22) And To Their Untimely Joinder (31) To Red Rock’s rogue Motion To Dismiss (28) And Tobin’s Reply To Support Tobin’s Motion For Summary Judgment Vs. Nationstar & Wells Fargo (24) |

| 5/5/2021 | 36 | Doc ID# 36 Wells Fargo, N.A. And Nationstar Mortgage LLC’s Joinder To Red Rock Financial Services’ Opposition To Nona Tobin’s Motion For Summary Judgment (24) |

| 5/9/2021 | 37 | Doc ID# 37 Nona Tobin’s Reply To Red Rock’s Joinder To Nationstar’s & Wells Fargo’s Opposition To Tobin’s Motion To Distribute Proceeds |

| 5/9/2021 | 38 | Doc ID# 38 Nona Tobin’s Reply To Red Rock’s Opposition To Motion For Summary Judgment And Motion To Amend Third Party Complaint |

| 5/11/2021 | 39 | Doc ID# 39 Non-Party Red Rock LLC’s Rogue Reply In Support Of Its Motion To Dismiss Counterclaimant Nona Tobin’s Counterclaim And Petition For Sanctions |

| 6/22/2021 | 40 | Doc ID# 40 NOTICE OF APPEARANCE – JOHN THOMSON FOR NONA TOBIN |

| 6/26/2021 | 41 | Doc ID# 41 STIPULATION AND ORDER – MOVE EVIDENTIARY HEARING TO 8/18/21by stipulation, changed manually by the court to 8/19/21 |

| 7/27/2021 | 42 | Doc ID# 42 NOTICE OF ENTRY OF STIPULATION AND ORDER – MOVE EVIDENTIARY HEARING TO 8/19/21 |

| 9/10/2021 | 43 | Doc ID# 43 “ORDER & JUDGMENT ON PLAINIFF (SIC) RED ROCK FINANCIAL SERVICES, LLC’S MOTION TO DISMISS COUNTERCLAIMANT NONA TOBIN’s COUNTERCLAIM AND PETITION FOR SANCTIONS AND DEFENDANTS/ COUNTERCLAIMANT NONA TOBIN’s MOTION FOR SUMMARY JUDGEMENT AND MOTION FOR SANCTIONS” |

| 9/10/2021 | 44 | Doc ID# 44 Notice of Entry of Order & Judgment granting non-party Red Rock LLC’S rogue Motion to Dismiss Tobin’s Counterclaim, Petition For Sanctions And Tobin’s Motion For Summary Judgement against counter-defendant Red Rock |

| 9/15/2021 | 45 | [45] Substitution of Attorneys for Tobin from John Thomson to Taylor Simpson, Suzanne Carver, P. Kerr Sterling |

| 10/8/2021 | 46 | [46] Motion for Reconsideration |

| 10/11/2021 | 47 | [47] Notice of Hearing Motion for Reconsideration |

| 8/19/2021 | 48 | [48] Transcript of Proceedings 8/19/21 |

| 10/12/2021 | 49 | [49] Notice of Voluntary Dismissal of Third-Party Claims Without Prejudice |

| 10/13/2021 | 50 | Doc ID# 50 Notice of Voluntary Dismissal Without Prejudice |

| 10/13/2021 | 51 | Doc ID# 51 Notice of Entry of Order |

| 10/21/2021 | 52 | Doc ID# 52 Wells Fargo, N.A. and Nationstar Mortgage LLC’s Opposition to Nona Tobin’s Motion for Reconsideration |

| 10/22/2021 | 53 | Doc ID# 53 Non-party Red Rock Financial Services LLC’s rogue Opposition to Motion for Reconsideration of Order Dismissing Nona Tobin’s Counterclaim and Petition for Sanctions |

| 10/29/2021 | 54 | Doc ID# 54 Tobin Reply in Support |

| 11/9/2021 | 55 | Doc ID# 55Notice of Change of Hearing (from 10 AM to 8 AM |

| 11/9/2021 | 56 | Doc ID# 5611/09/2021 Motion for Withdrawal |

| 11/9/2021 | 57 | Doc ID# 57 DECLARATION OF NONA TOBIN IN SUPPORT OF MOTION TO RECONSIDER ORDER ENTERED SEPTEMBER 10, 2021 |

| 11/10/2021 | 58 | Doc ID# 58 Ex Parte Application for an Order Shortening Time |

| 11/10/2021 | 59 | Doc ID# 59 Clerk’s Notice of Hearing |

| 11/10/2021 | 60 | Doc ID# 60 Nona Tobin’s Three-Day Notice of Intent to Take Default vs. Wells Fargo, N.A. as to Tobin’s Cross-Claims Filed on March 8, 2021 |

| 11/10/2021 | 61 | Doc ID# 61 Notice of Intent to Take Nationstar’s Default |

| 11/11/2021 | 62 | Doc ID# 62 Motion to Withdraw As Counsel |

| 11/12/2021 | 63 | Doc ID# 63 Clerk’s Notice of Hearing |

| 11/14/2021 | 64 | Doc ID# 64 Declaration |

| 11/15/2021 | 65 | Doc ID# 65 Clerk’s Notice of Hearing |

| 11/15/2021 | 66 | Doc ID# 66 Motion to Strike |

| 11/15/2021 | 67 | Doc ID# 67 Clerk’s Notice of Hearing |

| 11/17/2021 | 68 | Doc ID# 68 Order to Withdraw as Attorney of Record |

| 11/19/2021 | 69 | Doc ID# 69 Notice of Entry of Order |

| 11/30/2021 | 70 | Doc ID# 70 Order Clarifying Sept. 10th, 2021 Order and Mooting Notice of Default and Motion to Strike |

| 11/30/2021 | 71 | Doc ID# 71 Order Denying Nona Tobin’s Motion to Reconsider of Order Dismissing Nona Tobin’s Counterclaim and Petition for Sanctions and Defendant/Counterclaimant Nona Tobin’s Motion for Summary Judgment and Motion for Sanctions |

| 11/30/2021 | 72 | Doc ID# 72 Notice of Entry of Order Clarifying September 10, 2021 Order And Mooting Notice of Default and Motion to Strike |

| 11/30/2021 | 73 | Doc ID# 73 Denial of Motion to Reconsider |

| 11/16/2021 | 74 | Doc ID# 74 Recorders Transcript of Hearing Re: Defendant/ Counterclaimant’s Motion for Reconsideration 11/16/21 |

| 12/14/2021 | 75 | Doc ID# 75 Nona Tobin’s Motion for an Evidentiary Hearing to Set Aside Orders and for Sanctions Pursuant to NRCP 60(B)(3) and (D)(3), NRS 18.010(2) and EDCR 7.60 (1) and (3) |

| 12/14/2021 | 76 | Doc ID# 76 Notice of Hearing |

| 12/28/21 | 77 | Doc ID# 77 Non-party Red Rock Financial Services LLC’s rogue Opposition to Nona Tobin’s Motion for an Evidentiary Hearing to Set Aside September 10, 2021 Order and November 30, 2021 Orders Pursuant to NRCP 60(b)(3) (Fraud) and NRCP 60 (d)(3) (Fraud on the Court) and Motion for Attorneys’ Fees and Costs Pursuant to EDCR 7.60(b)(1) and (3), NRS 18.010(2); and, Countermotion for Abuse of Process; For a Vexatious Litigant Restrictive Order Against Nona Tobin and for Attorney Fees and Costs |

| 12/29/2021 | 78 | Doc ID# 78 Notice of Appearance “Aaron D. Lancaster, Esq., of Troutman Pepper LLP, will appear as Counsel for Defendant, Wells Fargo, N.A. and Nationstar Mortgage LLC.” No IAFD. No SUBT. No Signature from Wells Fargo, Nationstar, or Akerman. “Gary Schnitzer, of Kravitz Schnitzer Johnson Watson & Zeppenfeld, Chtd., the office of which is located within the State of Nevada at 8985 S. EasternAvenue, Suite 200, Las Vegas, Nevada 89123, has agreed to serve as the Designated Attorney forservice of papers, process, or pleadings required to be served on the attorney, Aaron D. Lancaster, Esq., including service by hand delivery or facsimile transmission, as Troutman Pepper LLP does not maintain an office in the State of Nevada.” |

| 12/29/2021 | 79 | Doc ID# 79 Wells Fargo and Nationistar’s Joinder to Defendant Red Rock Financial Services LLC’s Opposition to Nona Tobin’s Motion for an Evidentiary Hearing to Set Aside September 10, 2021 Order and November 30, 2021 Orders Pursuant to NRCP 60 (b)(3) (Fraud) and NRCP 60 (b)(3) (Fraud on the Court) and Motion for Attorneys’ Fees and Costs Pursuant to EDCR 7.60 (1) and (3) NRS 18.010 (2); and Countermotion for Abuse of Process; for a Vexatious Litigant Restrictive Order Against Nona Tobin and for Attorney Fees and Costs |

| 1/10/2022 | 80 | Doc ID# 80 Nona Tobin’s Reply to Red Rock Financial Services LLC’s Opposition to Nona Tobin’s Motion for an Evidentiary Hearing to Set Aside September 10, 2021 Order and November 30, 2021 Orders Pursuant to NRCP 60(b)(3) (Fraud) and NRCP 60(b)(3) (Fraud on the Court) and Motion for Attorneys’ Fees and Cots Pursuant to EDCR 7.60(1) and (3), NRS 18.010(2); and, Countermotion for Abuse of Process for a Vexatious Litigant Restrictive Order Against Nona Tobin and for Attorney Fees and Costs |

| 1/10/2022 | 81 | Doc ID# 81 Nona Tobin’s Reply To Nationstar’s And Wells Fargo’s Joinder And Countermotions For Attorney Fees And A Vexatious Litigant Order |

| 1/11/2022 | 82 | Doc ID# 82 Notice of Change of Hearing |

| 1/14/2022 | 83 | Doc ID# 83 Order Granting Akerman s Motion to Withdraw as Counsel for Wells Fargo, N.A. and Nationstar Mortgage LLC |

| 1/19/2022 | 84 | Doc ID# 84 Notice of Entry of Order Granting Akerman s Motion to Withdraw as Counsel for Wells Fargo, N.A. and Nationstar Mortgage LLC |

| 1/19/2022 | 85 | Doc ID# 85 Recorders Transcript of Hearing Re: 01/19/22 |

| 4/26/2022 | 86 | Doc ID# 86 Notice of Appearance No IAFD. No SUBT. No authorization by nationstar or Wells Fargo. Aaron Lancater notices begin “VANESSA M. TURLEY, of Troutman Pepper LLP, is admitted and authorized to practice in this Court, and will appear as Counsel for Defendant, Wells Fargo, N.A. and Nationstar Mortgage LLC.” |

| 5/25/2022 | 88 | Doc ID# 88 Order Denying Nona Tobin’s Motion For An Evidentiary Hearing To Set Aside 9/10/21 Order And 11/30/21 Orders Pursuant To NRCP 60(b)(3)(Fraud) And NRCP 60(d)(3)(Fraud On The Court) And Motion For Attorneys’ Fees And Costs Pursuant To EDCR 7.60(1) And (3), NRS 18.010(2); And, Denying non-party Red Rock LLC’s 12/28/21 Countermotions For Abuse Of Process and Denying non-party Red Rock LLC’s motion For A Vexatious Litigant Restrictive Order Against Nona Tobin And denying For Attorney Fees And Costs |

| 5/25/2022 | 89 | [89] Notice of Entry of Order Denying Nona Tobin’s Motion For An Evidentiary Hearing To Set Aside 9/10/21 Order And 11/30/21 Orders Pursuant To NRCP 60(b)(3)(Fraud) And NRCP 60(d)(3)(Fraud On The Court) And Motion For Attorneys’ Fees And Costs Pursuant To EDCR 7.60(1) And (3), NRS 18.010(2); And, Denying non-party Red Rock LLC’s 12/28/21 Countermotions For Abuse Of Process and Denying non-party Red Rock LLC’s motion For A Vexatious Litigant Restrictive Order Against Nona Tobin And denying For Attorney Fees And Costs |

| 5/30/2022 | 90 | [90] Second Amended Motion for an Order to Distribute Interpleaded Funds with Interest to Sole Claimant Nona Tobin and Motion for Attorney Fees and Costs Pursuant to NRS 18.010(2) and EDCR 7.60(b)(1) and (3) and Motion to Correct Nunc Pro Tunc Notices of Entry of Orders Entered on November 30, 2021 and May 25, 2022 |

| 5/30/2022 | 91 | Doc ID# 91 Exhibits To Second Amended Motion For An Order To Distribute Interpleaded Funds With Interest To Sole Claimant Nona Tobin And Motion For Attorney Fees And Costs Pursuant To NRS18.010(2) And EDCR7.60(b)(1) And (3) And Motion To Correct Nunc Pro Tunc Notices Of Entry Of Orders Entered On 11/30/21 And 5/25/22 |

| 5/31/2022 | 92 | Doc ID# 92 Clerk’s Notice of Hearing |

| 6/13/2022 | 93 | Doc ID# 93 Non-party Red Rock Financial Services LLC’s Opposition to Nona Tobin’s Second Amended Motion for An Order to Distribute Interpleaded Funds With Interest to Sole Claimant Nona Tobin and Motion for Attorney Fees and Costs Pursuant toNRS 18.010(2) and EDCR 7.60(b)(1) and (3) and Motion to Correct Nunc Pro Tunc Notices of Entry of Orders Entered on November 30, 2021 and May 25, 2022; and Renewed Countermotion for Abuse of Process; For a Restrictive Order Against Nona Tobin and for Attorney Fees and Costs |

| 6/21/2022 | 94 | Doc ID# 94 Reply To Non-Party Red Rock LLC’s Opposition To Tobin’s Second Amended Motion For An Order To Distribute Interpleaded Funds With Interest To Sole Claimant Nona Tobin and Motion for Attorney Fees and Costs Pursuant to NRS 18.010(2) and EDCR 7.60(B)(1) and (3) |

| 6/22/2022 | 95 | Doc ID# 95 Nona Tobin’s Reply To Non-Party Opposition To Motion To Correct Notices Of Entry Of Three Orders |

| 6/27/2022 | 96 | Doc ID# 96 Reponse to Non-Party Red Rock Financial Services, LLC’s Countermotion for a Restrictive Vexatious Litigant Order Against Nona Tobin and Motion for Attorney Fees and Costs and Nona Tobins Counter-Motion to Adopt Tobins Proposed Final Judgment Order |

| 6/30/2022 | 97 | Doc ID# 97 Notice of Appellate Decision 07/07/2022 Motion (10:00 AM) (Judicial Officer Peterson, Jessica K.) |

| 8/29/2022 | 98 | Doc ID# 98 Notice Of Tobin Petition For Writ Of Prohibition And Or Mandamus |

| 9/23/2022 | 99 | Doc ID# 99 Amended Notice of the Filing of a NRAP 40 Motion for Rehearing of Petition for a Writ of Prohibition and/or Mandamus |

| 10/5/2022 | 100 | Doc ID# 100 Motion for Rehearing Petition for Writ of Prohibition and /or Mandamus |

| 11/28/2022 | 101 | Doc ID# 101 Notice Of NRAP 40a Petition For En Banc Reconsideration 85251 |

| 12/19/2022 | 102 | Doc ID# 102 Request for Judicial Notice Verified Complaints of Attorney Misconduct filed with the State Bar of Nevada vs. Brittany Wood |

| 12/19/2022 | 103 | Doc ID# 103 Tobin Motin For An Order To Show Cause Why Written Findings of Attorney Misconduct Should Not Be Forwarded To The State Bar f Nevada |

| 12/19/2022 | 104 | Doc ID# 104 Request for Judicial Notice Verified Complaint of Attorney Misconduct Filed With The State Bar of Nevada Vs. Steven Scow |

| 12/19/2022 | 105 | Doc ID# 105 Request for Judicial Notice Verified Complaints of Attorney Misconduct Filed with the State Bar of Nevada vs. Melanie Morgan, Esq. (SBN 8215), Akerman, LLP; and Wright, Finlay, Zak, LLP, and Draft Alternative Civil Action |

| 12/19/2022 | 106 | Doc ID# 106 Request for Judicial Notice Verified Complaint of Attorney Misconduct Filed With The State Bar of Nevada Vs. Joseph Y. Hong |

| 12/19/2022 | 107 | Doc ID# 107 Request for Judicial Notice Verified Complaints of Attorney Misconduct Filed With The State Bar of Nevada Vs. David Ochoa, Esq. (SBN 10414) and Adam Clarkson, Esq. |

| 12/20/2022 | 108 | Doc ID# 108 Corrected Motion for an Order to Show Cause Why Written Findings of Attorney Misconduct Should Not be Forwarded to the State Bar |

| 12/20/2022 | 109 | Doc ID# 109 Clerk’s Notice of Hearing |

| 12/20/2022 | 110 | Doc ID# 110 Clerk’s Notice of Hearing |

| 12/20/2022 | 111 | Doc ID# 111 Clerk’s Notice of Hearing |

| 1/3/2023 | 112 | 1/3/23 Motion Doc ID# 112 1) Motion to Withdraw Tobin’s Motion for an Order to Show Cause Why Written Findings of Attorney Misconduct Should Not Be Forwarded to the State Bar And 2) Motion to Withdraw Tobin’s Counter-Claims and Cross-Claims vs. Red Rock, Nationstar and Wells Fargo 3) Motion to Modify Grounds for Tobin’s Petitions for Sanctions vs. Red rock and Nationstar to Include NRS 357.040(1(a),(b),(i), and NRS 199.210, NRS 205.0824 and NRS 205.0833, and NRS 41.1395 And 4) Motion to Adopt Tobin’s Proposed Final Judgment Order |

| 1/3/2023 | 113 | Doc ID# 113 Response to Motion for an Order to Show Cause Why Written Findings of Attorney Misconduct Should Not Be Forwarded to the State Bar |

| 1/6/2023 | 114 | 1/6/23 Clerk’s Notice of Hearing Doc ID# 114 |

| 1/9/2023 | 115 | 01/09/2023 Order Doc ID# 115 Order Granting in Part and Denying in Part Nona Tobin’s Second Amended Motion for an Order to Distribute Interpleaded Funds with Interest to Sole Claimant Nona Tobin and Motion for Attorney Fees and Costs Pursuant to NRS 18.010(2) and EDCR 7.60(b)(1) and (3) and Motin to Correct Nunc Pro Tunc Notices of Entry of Orders Entered on November 30 2021 and May 25 2022 and Granting in Part Red Rock Financial Services’ Countermotion for Abuse of Process; for a Vexatious Litigant Restrictive Order Against Nona Tobin and for Attorney Fees and Costs |

| 1/10/2023 | 116 | Notice of Entry of Order Doc ID# 116 |

| 1/16/2023 | 117 | Doc ID# 117 Order Granting in Part and Denying in Part Nona Tobin’s Second Amended Motion for an Order to Distribute Interpleaded Funds with Interest to Sole Claimant Nona Tobin and Motion for Attorney Fees and Costs Pursuant to NRS 18.010(2) and EDCR 7.60(b)(1) and (3) and Motion to Correct Nunc Pro Tunc Notices of Entry of Orders Entered on November 30 2021 and May 25 2022 and Granting in Part Red Rock Financial Services’ Countermotion for Abuse of Process; for a Vexatious Litigant Restrictive Order Against Nona Tobin and for Attorney Fees and Costs |

| 1/17/2023 | 118 | Doc ID# 118 Notice of Entry of Corrected 1/9/23 Order amended solely to correct the 1/9/23 order to state that Tobin had responded, refused to sign for the reasons identified in the opposition attached to the corrected order. |

| 1/17/2023 | 119 | Doc ID# 119 Red Rock Financial Services’ Response/Opposition to (1) Motion to Withdraw Tobins Motion for an Order to Show Cause Why Written Findings of Attorney Misconduct Should Not be Forwarded to the State Bar; (2) Motion to Withdraw Tobins Counter-Claims and Cross-Claims vs. Red Rock, Nationstar and Wells Fargo; (3) Motion to Modify Grounds for Tobins Petitions for Sanctions vs. Red Rock and Nationstar to include NRS 357.0401(a), (b), (i) and NRS 199.210, NRS 205.0824 and NRS 205.0833, and NRS 41.1395; and (4) Motion to Adopt Tobins Proposed Final Judgment Order |

| 1/23/2023 | 120 | Doc ID# 120 Tobin 1/23/23 Motion to Reconsider 1/16/23 Order and Renewed Motion to Strike Non-Party Red Rock Financial Services LLC’s Rogue Filings |

| 1/24/2023 | 121 | Doc ID# 121 Clerks’ Notice of Hearing |

| 1/24/2023 | 122 | Doc ID# 122 Wells Fargo and Nationstar’s Joinder to Red Rock Financial Services’ Response//Opposition to (1) Motion to Withdraw Tobin’s Motion for an Order to Show Cause Why Written Findings of Attorney Misconduct Should Not Be Forwarded to The State Bar; (2) Motion to WIthdraw Tobin’s Petitions For Sanctions VS. Red Rock, Nationstar to Include NRS 357.0401(A), (B), (I) and NRS 199.210, NRS 205.0824 and NRS 205.0833, and NRS 41.1395; and (4) Motion to Adopt Tobin’s Proposed Final Judgment Order |

| 1/31/2023 | 123 | Doc ID# 123 Tobin’s Reply to Red Rock’s Opposition to Tobin’s Four 1/03/23 Motions to Amend Final Order |

| 2/2/2023 | 124 | Doc ID# 124 Declaration Declaration of Steven B. Scow in Support of Attorneys’ Fees Awarded to Red Rock Financial Services |

| 2/2/2023 | 125 | Doc ID# 125 Reply to Opposition Tobin’s Reply to Nationstar’s Opposition and Vexatious Litigant Motion |

| 2/12/2023 | 126 | Doc ID# 126 Opposition to Motion Tobin Opposition To Scow Declaration ISO Attorney Fees |

| 2/16/2023 | 127 | Doc ID# 127 Memorandum of Costs and Disbursements Red Rock Financial Services’ Memorandum of Costs and Disbursements as Supplement to Declaration of Steven B. Scow |

| 2/20/2023 | 128 | Doc ID# 128 Reply to Opposition Tobin Reply in Opposition to Red Rock 2/16/23 Memo of Fees and Costs |

| 3/3/2023 | 129 | Doc ID# 129 Court Recorders Invoice for Transcript Ex parte 2/2/23 hearing 2/2/2023 recording fee and transcript |

| 3/3/2023 | 130 | Doc ID# 130 Recorders Transcript of 2/2/23 ex parte unnoticed Hearing added to court record on 3/3/23 |

| 3/28/2023 | 131 | Order Declaring Nona Tobin a Vexatious Litigant, Order Denying Defendant Nona Tobin’s: (1) Motion to Withdraw Tobin’s Motion for Order to Show Cause why Written Findings of Attorney Misconduct Should no be Forwarded to the State Bar; (2) Moton to Withdraw Tobin’s Counter- Claims and Cross-Claims vs Red Rock, Nationstar and Wells Fargo/ (3) Motion to Modify Grounds for Tobin’s Petitions for Sanctions vs Red Rock and Nationstar to Include NRS 357.404(1)(A), and NRS 199.210, NRS 205.0824 and NRS 205.0833, and NRS 41.1395 and (4) Motion to Adopt Tobin’s Proposed Final Judgment Order and Order Denying Defendant Nona Tobin’s: Motion to Reconsider 1/16/23 Order and Renewed Motion to Strike Non-Party Red Rock Financial Services LLC’s Rogue Filings |

| 3/28/2023 | 132 | Doc ID# 132 Notice of Entry of Order |

| 4/1/23 | Register of Actions |