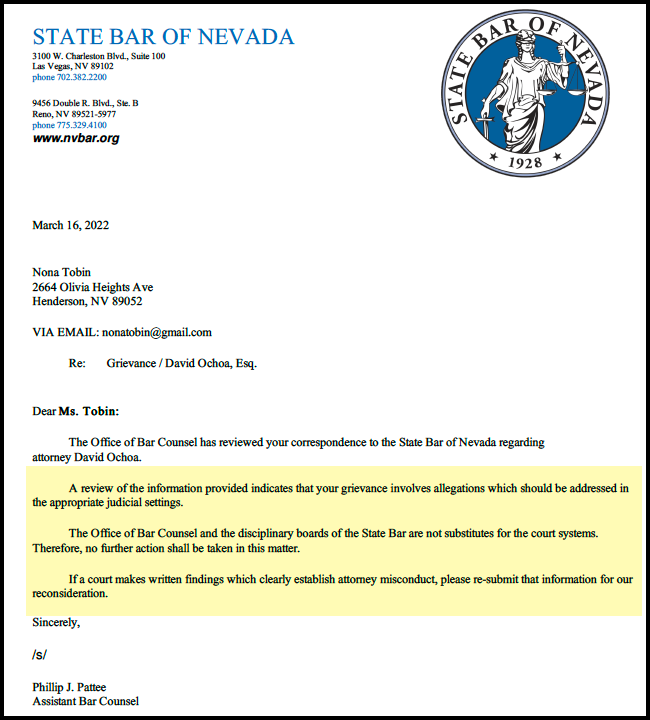

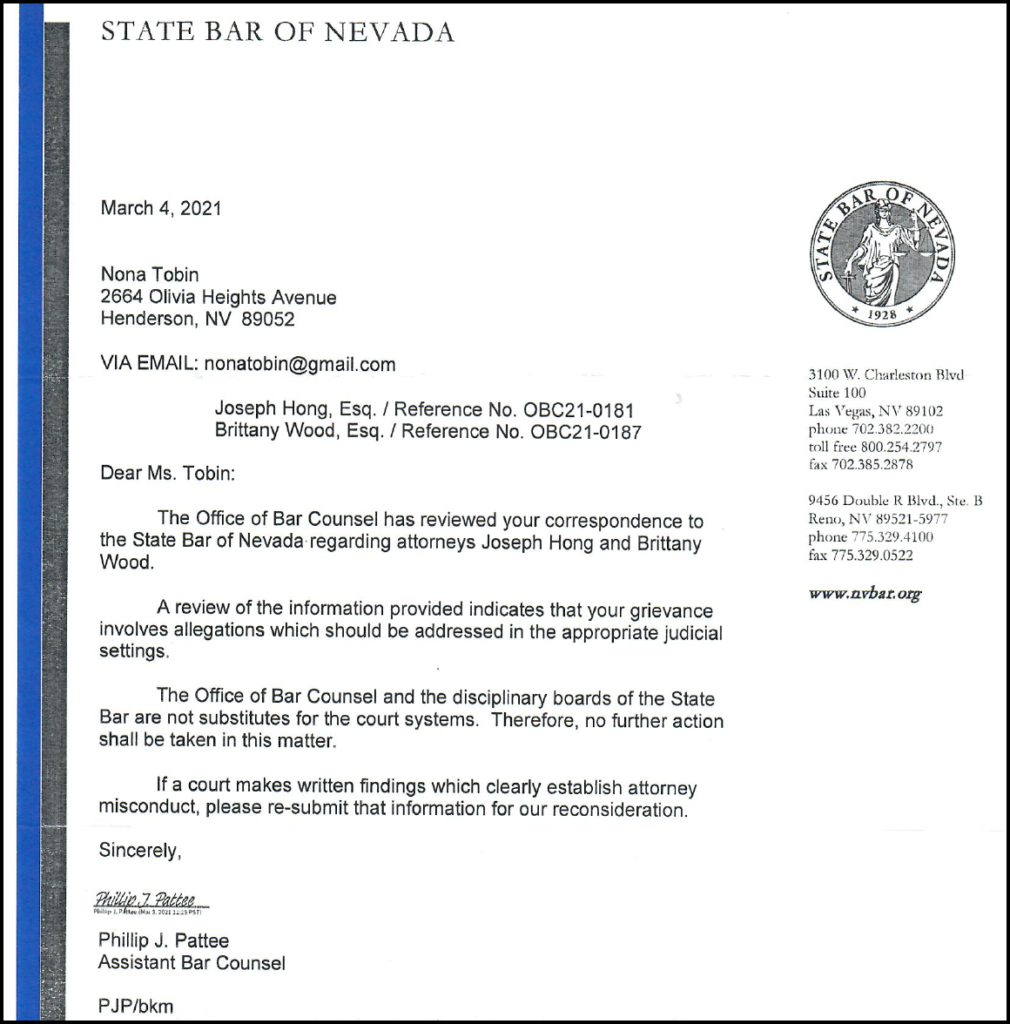

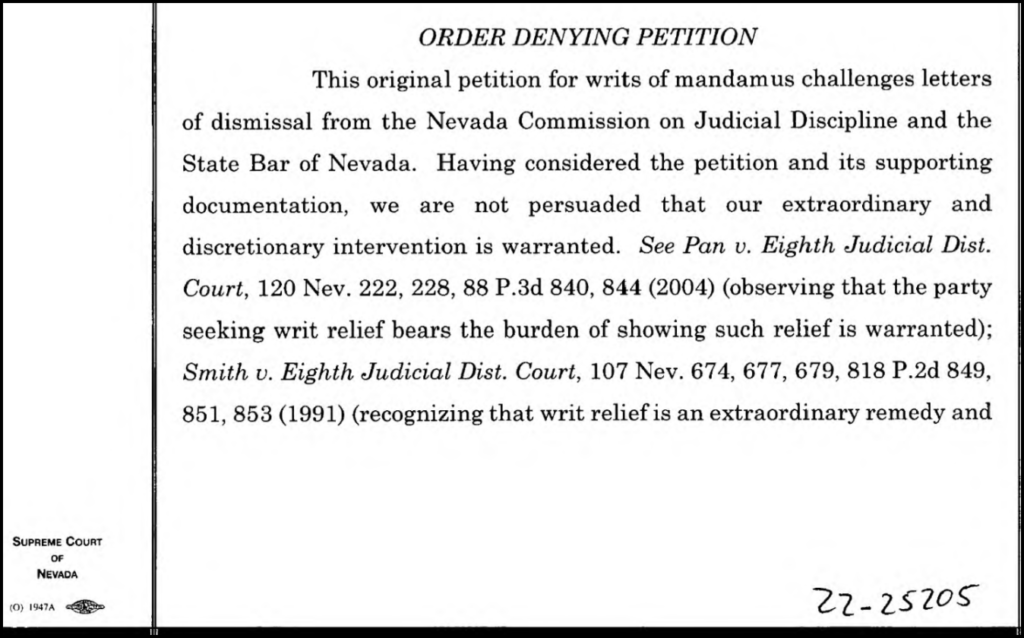

On 12/19/22, I filed a motion for an order to show cause why written findings of attorney misconduct should not be forwarded to the State Bar because the State Bar would not investigate complaints without it. Below is my statement of intent.

The motion was made in good faith and supported by verified evidence

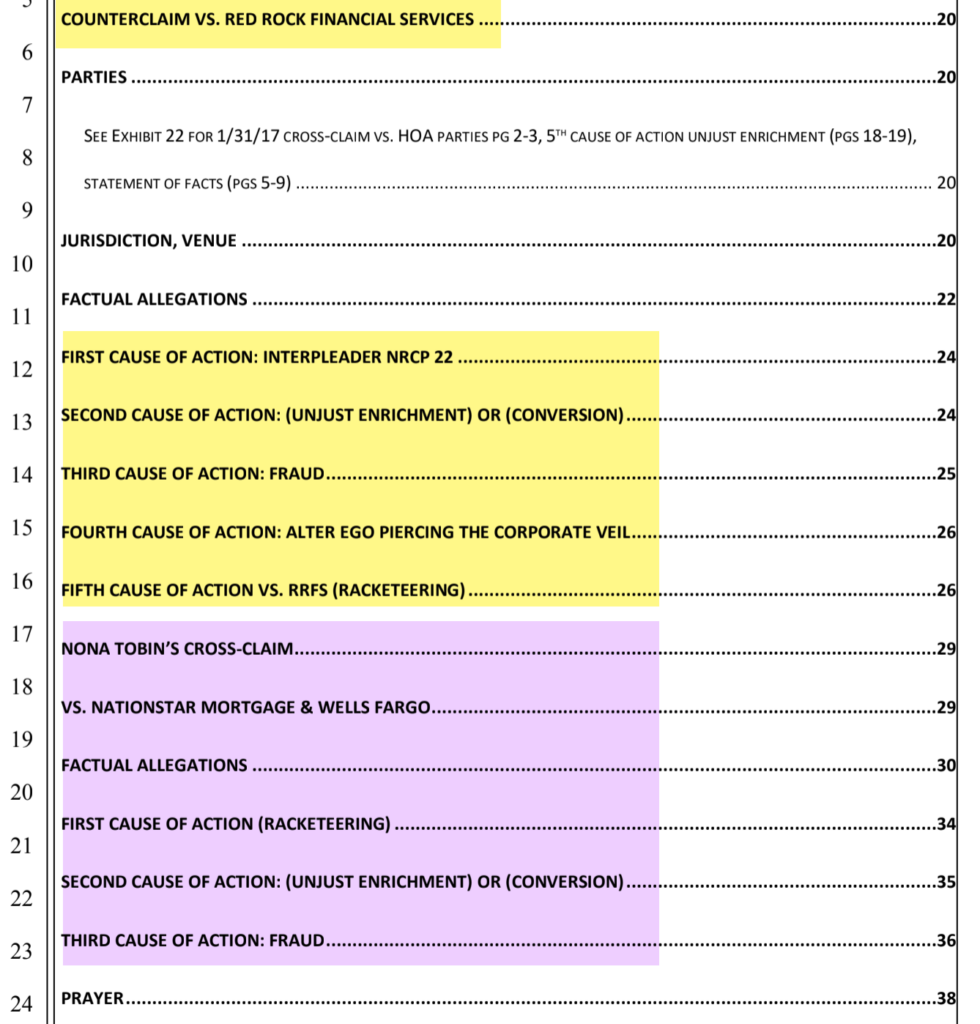

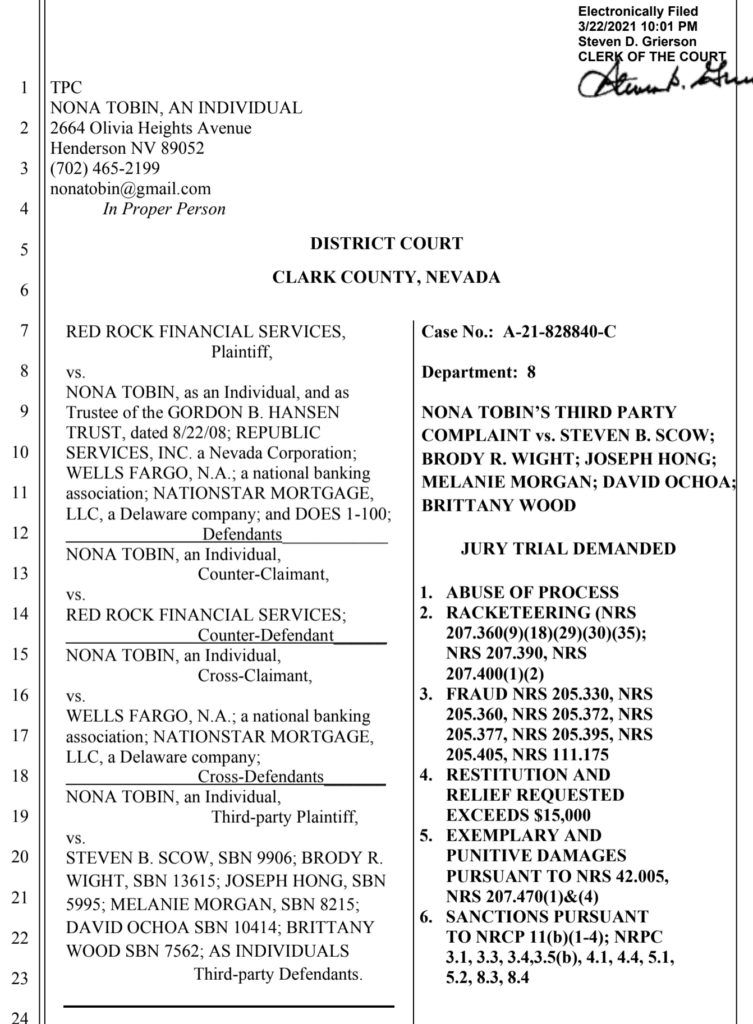

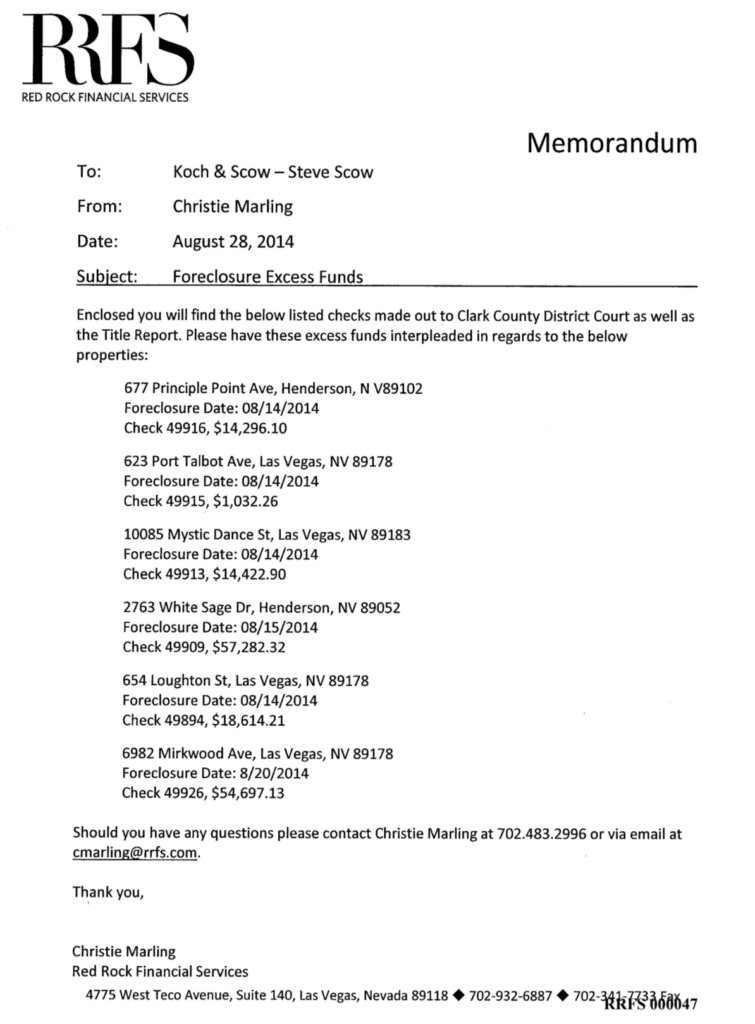

Summary of 3/1/22 complaint to the State Bar vs. Red Rock attorney Steven Scow, Koch & Scow LLC

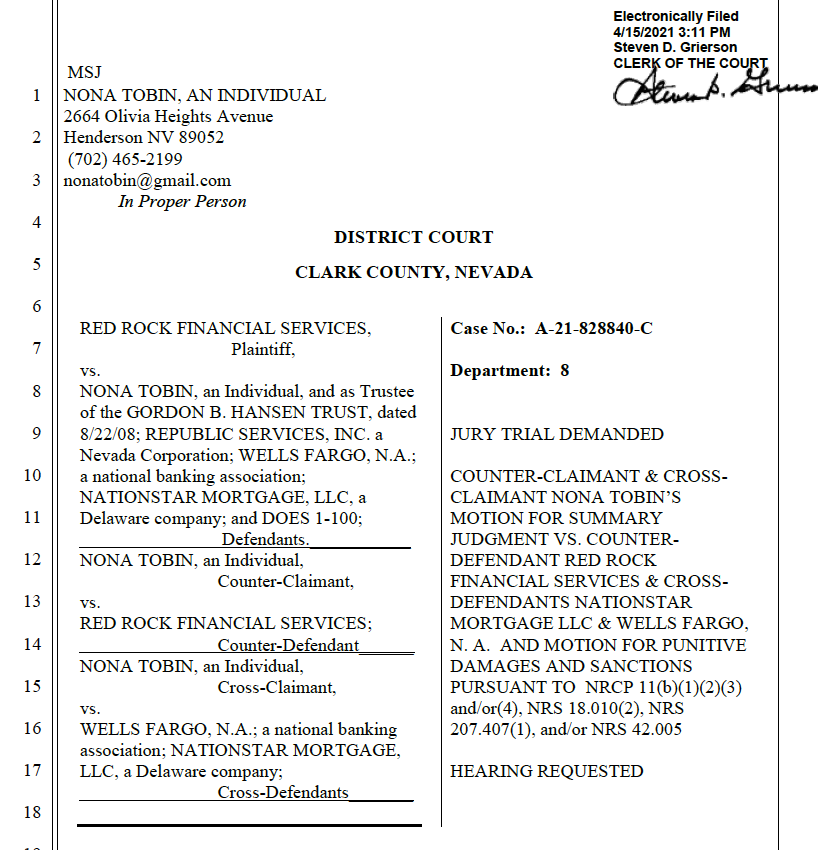

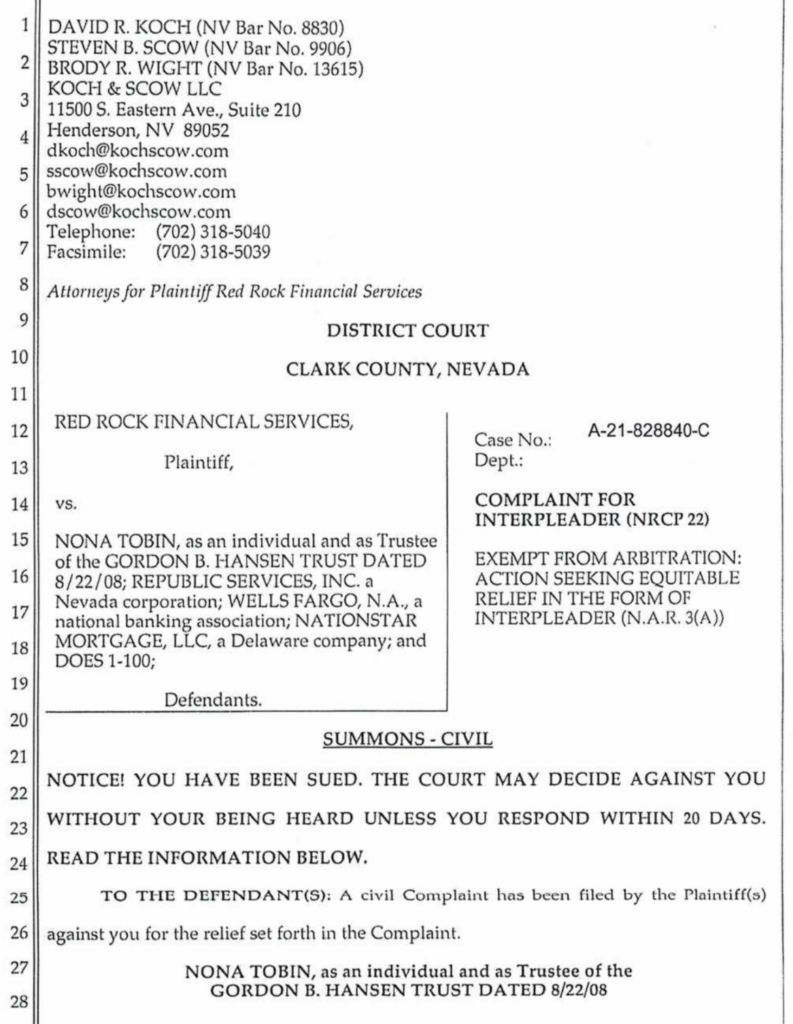

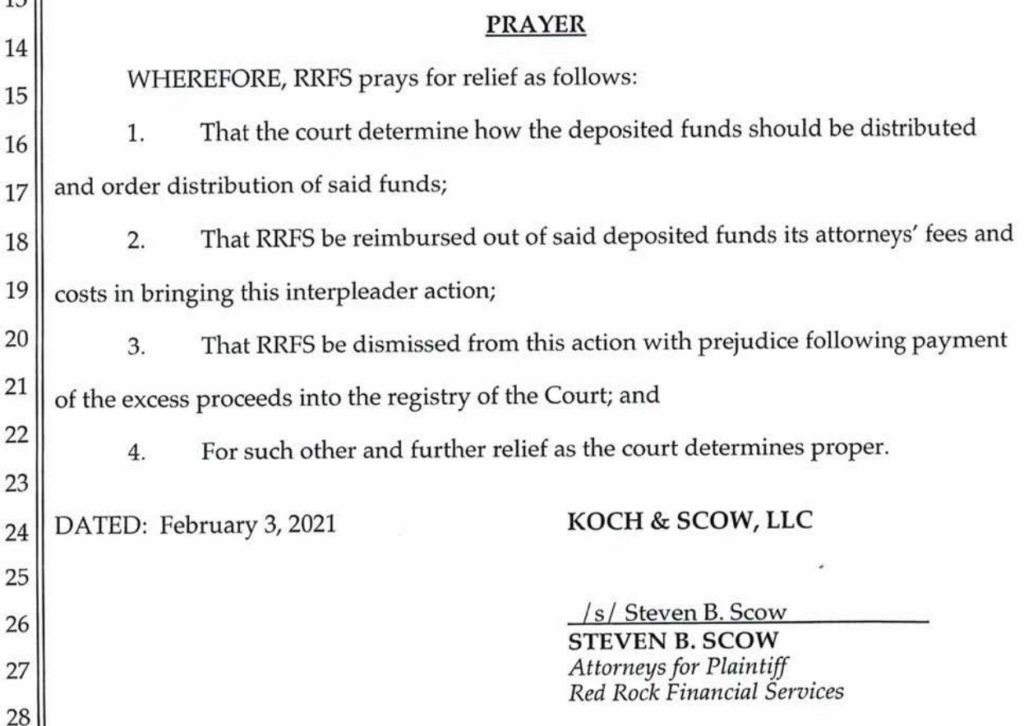

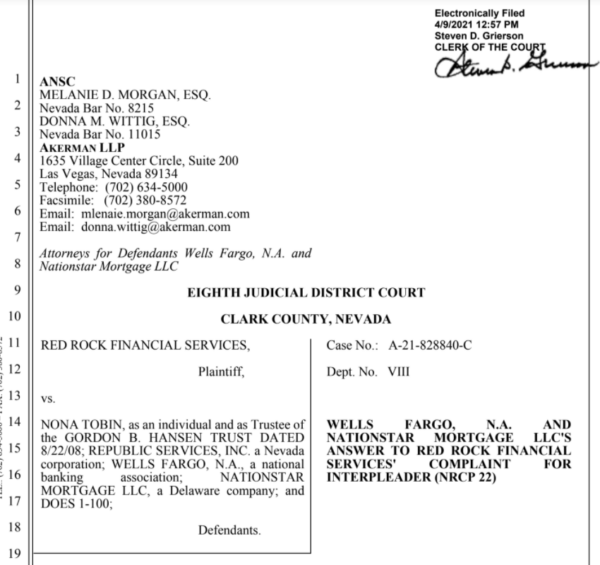

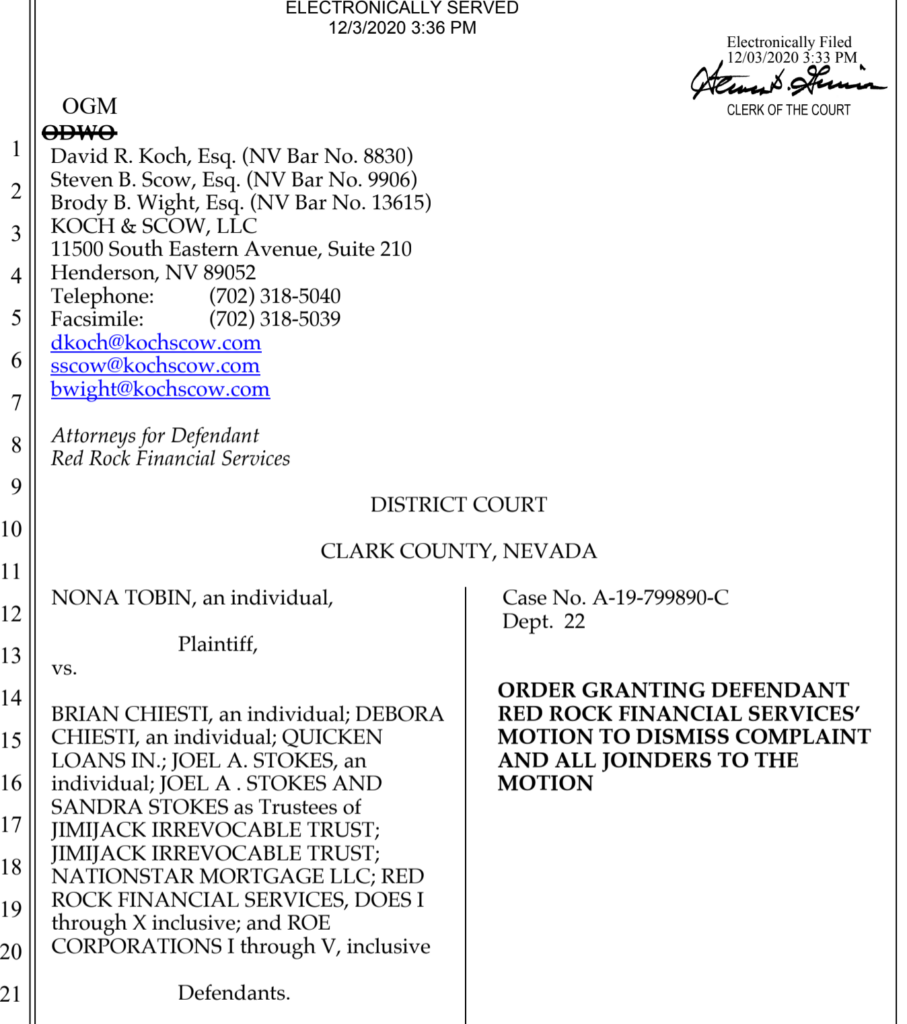

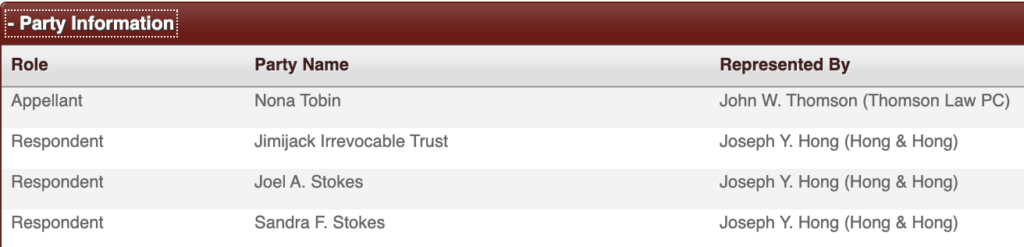

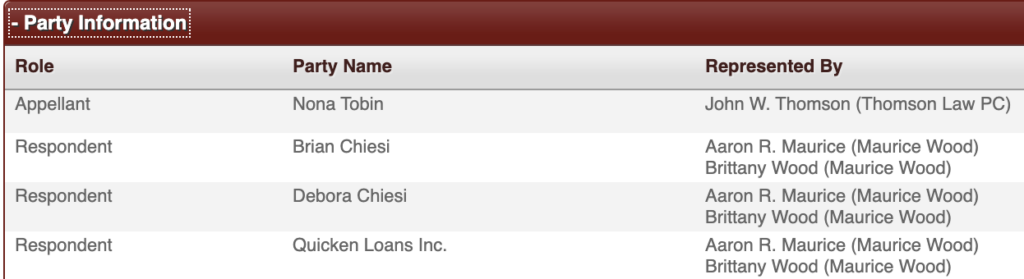

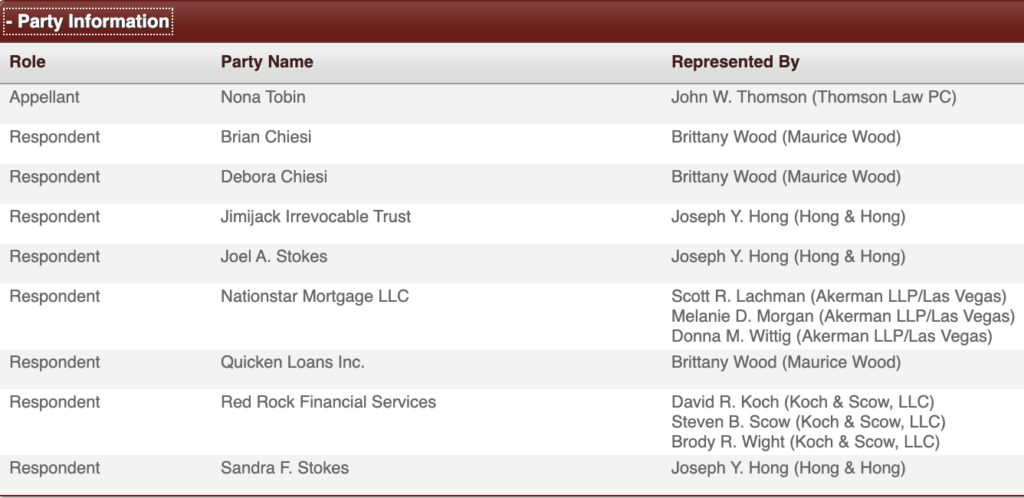

- Steven Scow, Koch & Scow LLC is the attorney for Red Rock Financial Services, a partnership (EIN 88-0358132) that conducted the disputed HOA foreclosure sale usurping the statutory authority of the HOA.

- Scow knew that this critical case-concluding phrase in the 4/18/19 order was false, “The totality of the facts evidence that the HOA properly followed the processes and procedures in foreclosing upon the Property”.

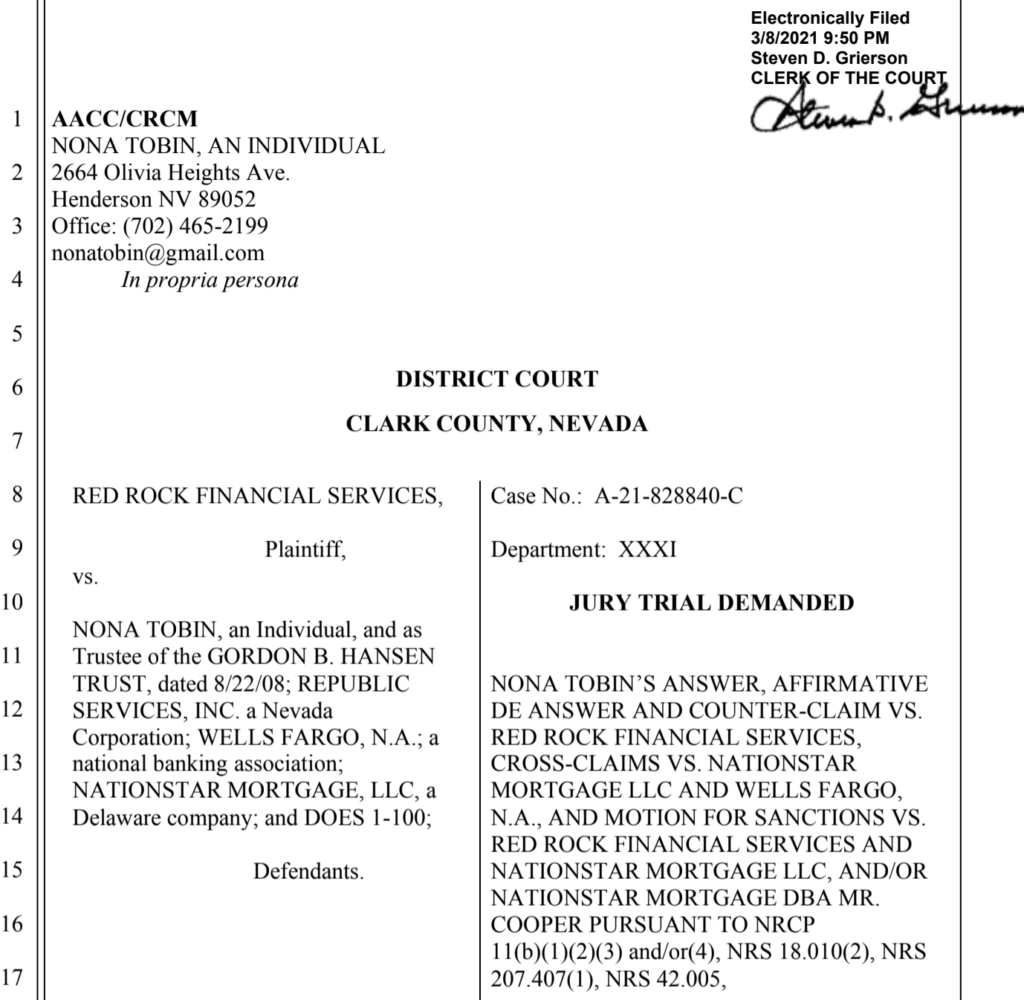

- Despite knowing the order was based on the false evidence Scow himself produced, Scow and/or other attorneys under his direction, repeatedly relied on it in meritless filings and court hearings that succeeded in obstructing a fair adjudication of Tobin’s claims based solely on verified evidence on at least these dates: 6/23/20, 8/3/20, 8/11/20, 4/16/21, 4/27/21, 4/29/21, 5/11/21, 8/19/21, 10/22/21, 11/16/21, 12/28/21, 1/19/22, 5/25/22, 6/13/22.

- The 3/1/22 complaint overview to the Bar vs. Scow and table of contents of exhibits are quoted here:

- 3/1/22 complaint to the State Bar vs. Steven Scow (SBN 9906) is quoted/summarized here:

- Steven Scow, the subject of this instant complaint, represents Red Rock Financial Services, a partnership (EIN 88-0358132), that secretly sold my late fiancé’s house allegedly at a properly noticed and conducted HOA sale.

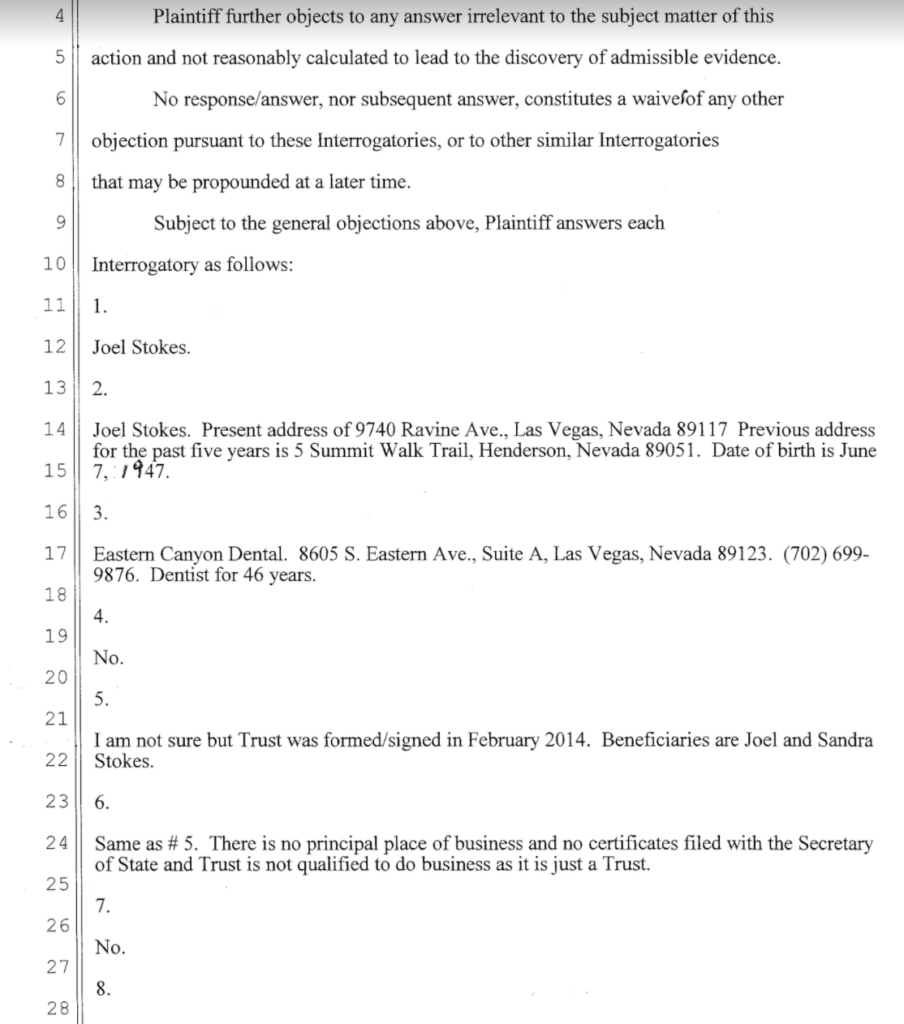

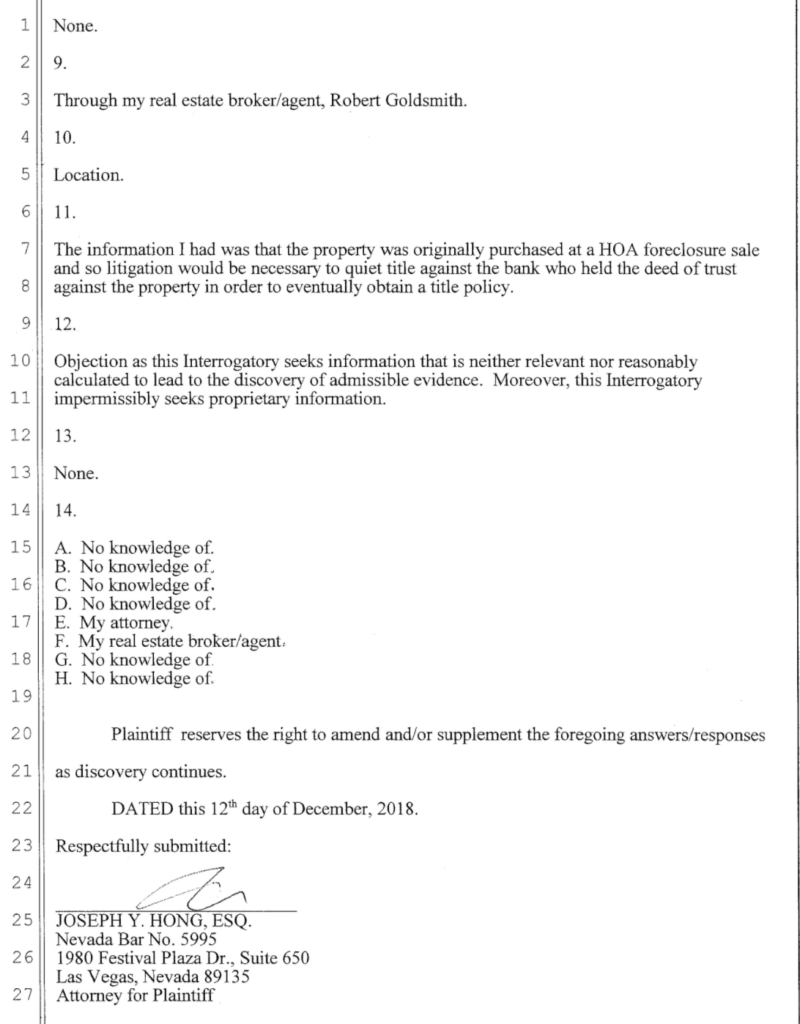

- Steven Scow produced false evidence and concealed inculpatory evidence in response to my 2/4/19 subpoena that was relied on by the court to grant a meritless motion for summary judgment for quiet title by the HOA (even though the HOA had no interest in the title to protect). Upon information and belief, the HOA filed the motion for improper purposes, i.e., to cover up the fraudulent conduct of the sale and/or to retaliate against me for being a whistleblower.

- The HOA’s motion, and Nationstar’s equally meritless joinder, were granted by the order entered on 4/18/19 by the court’s relying solely on Steven Scow-produced Red Rock’s unverified, uncorroborated, and sometimes blatantly falsified, foreclosure record.

- Steven Scow’s and David Ochoa’s fraudulent misrepresentation to the court of the Red Rock unverified file as the HOA’s official records, is the proximate and direct cause of three more years of litigation for which I have accrued $317,532.76 in attorneys’ fees and much more in personal and financial cost.

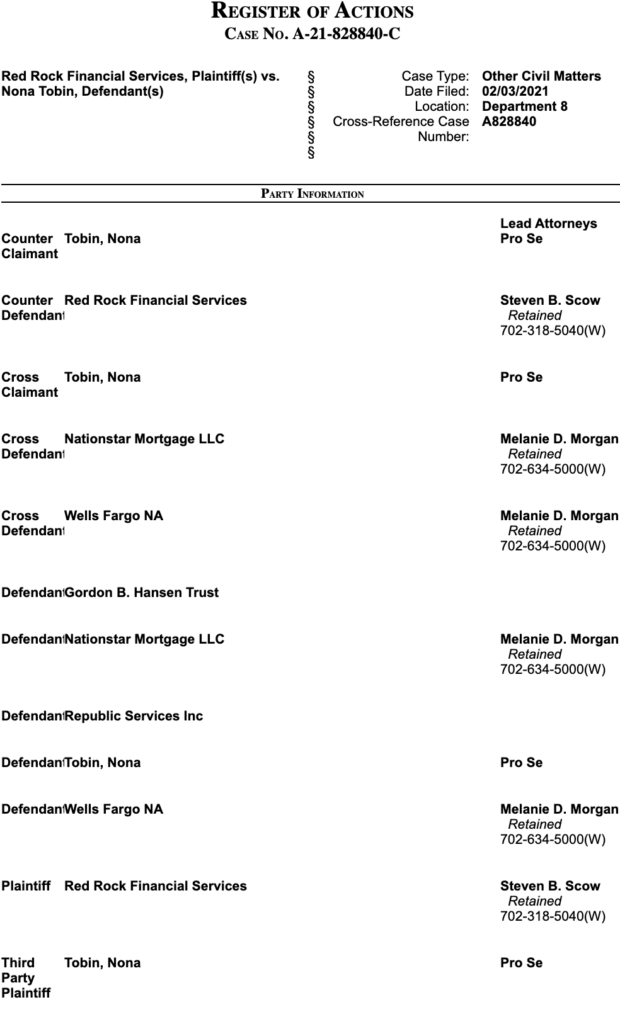

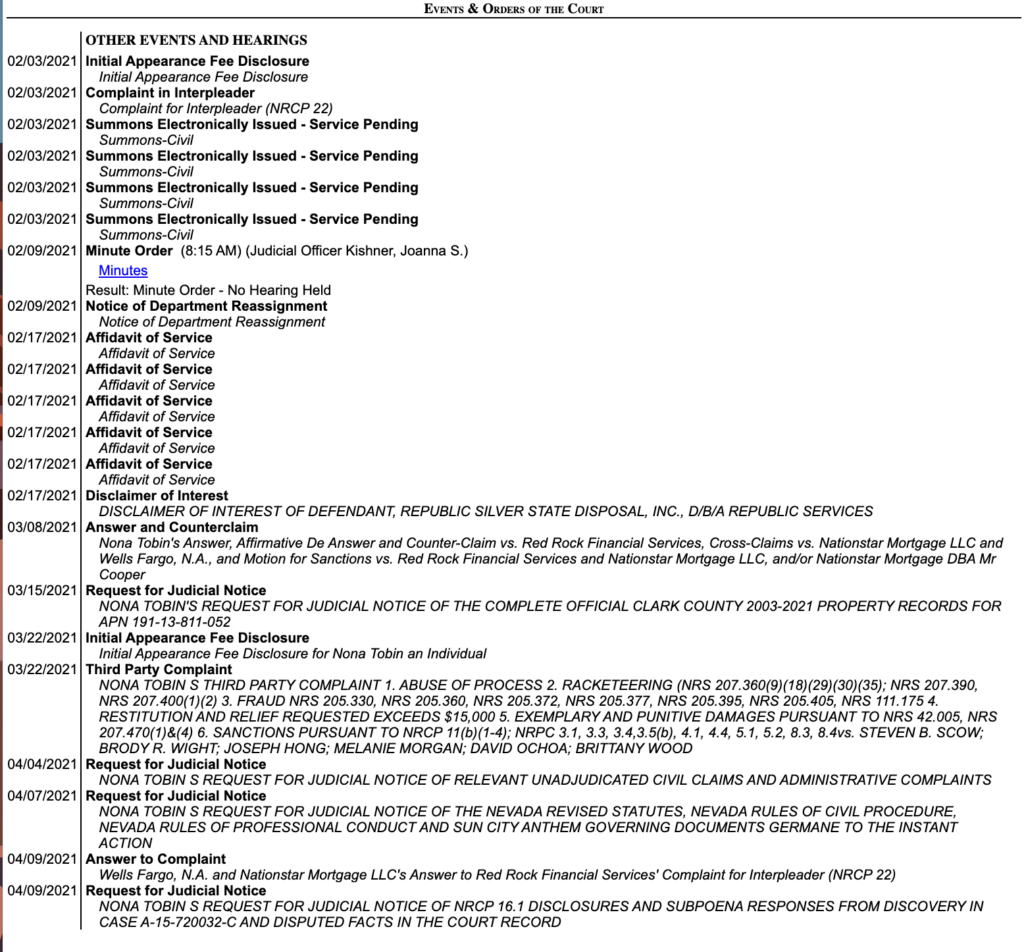

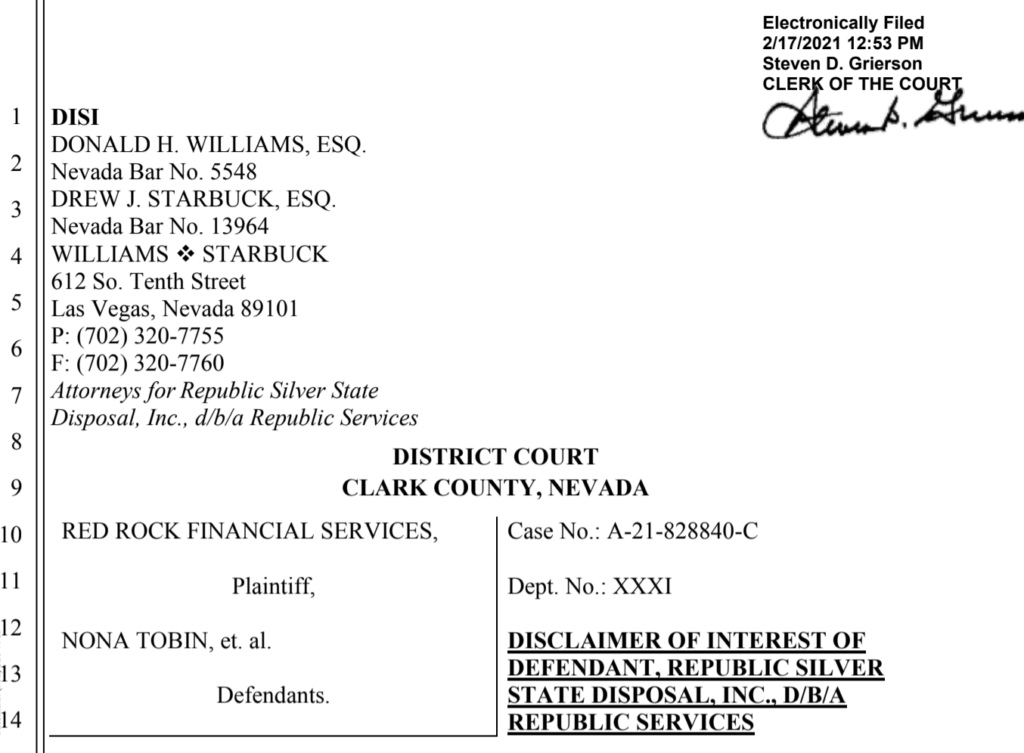

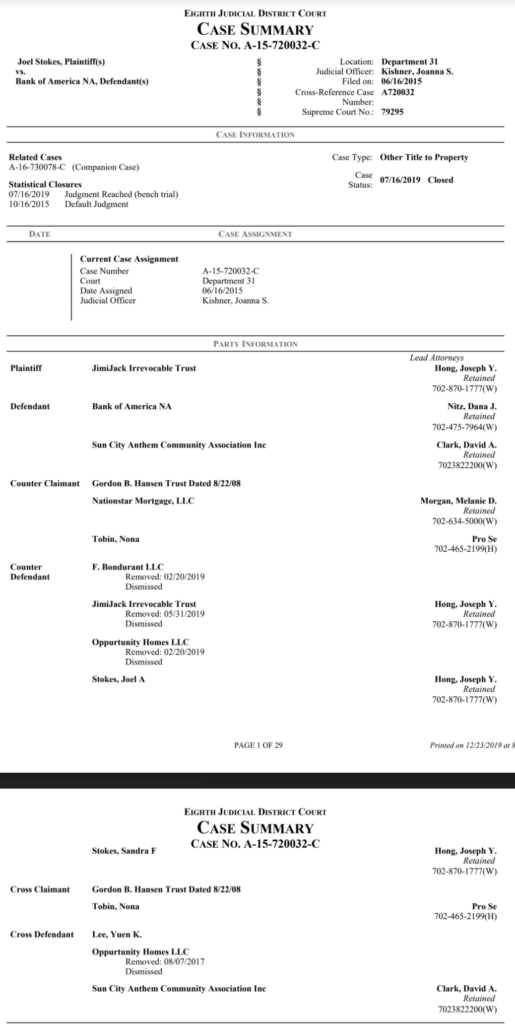

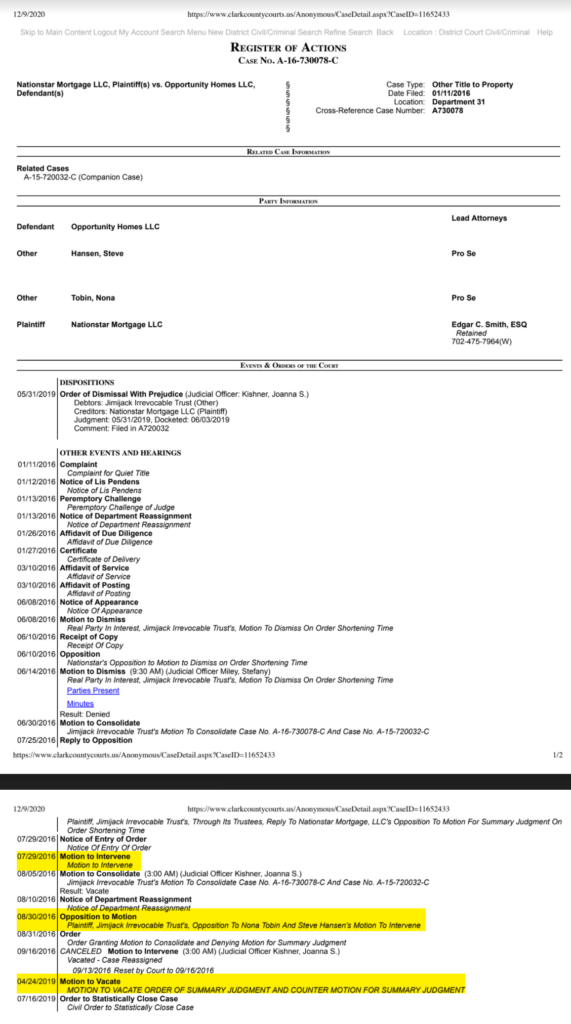

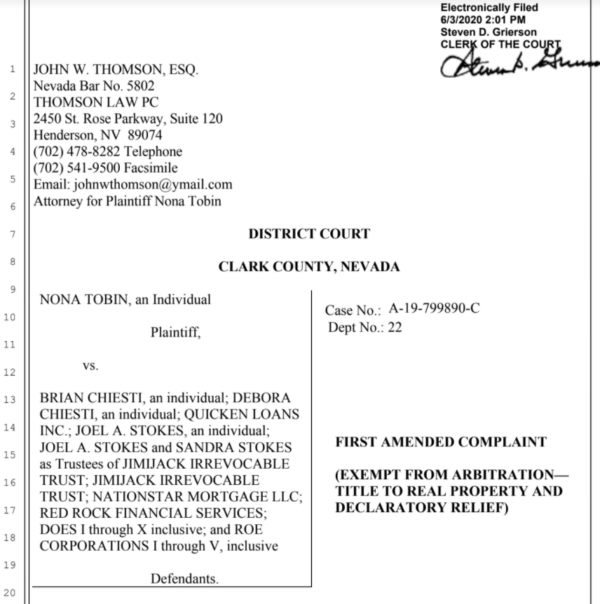

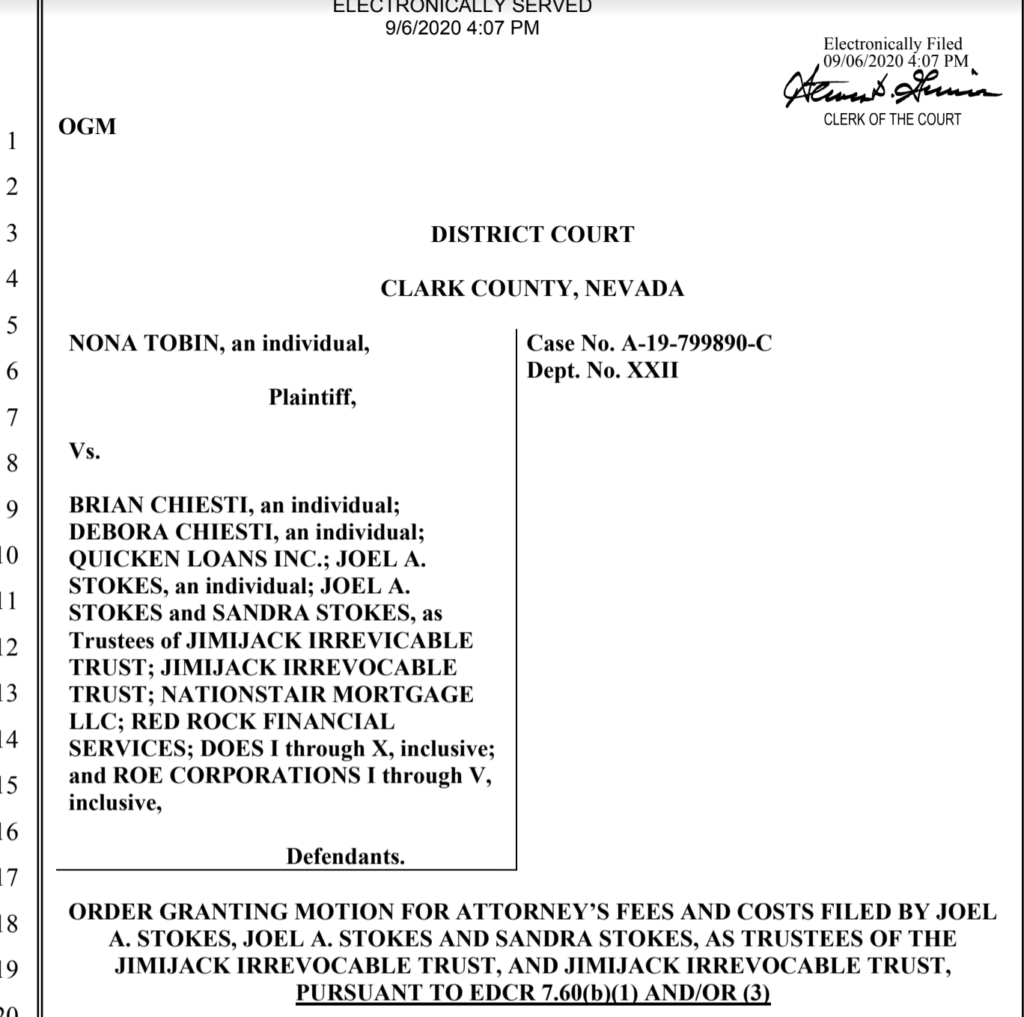

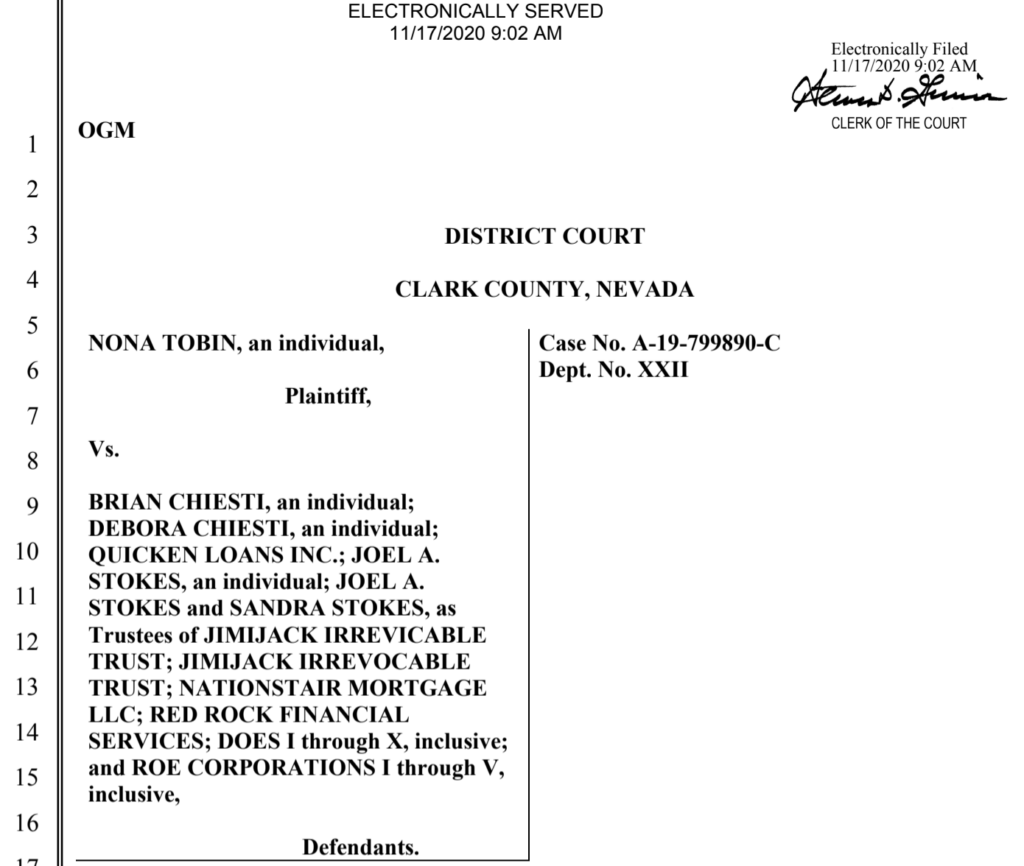

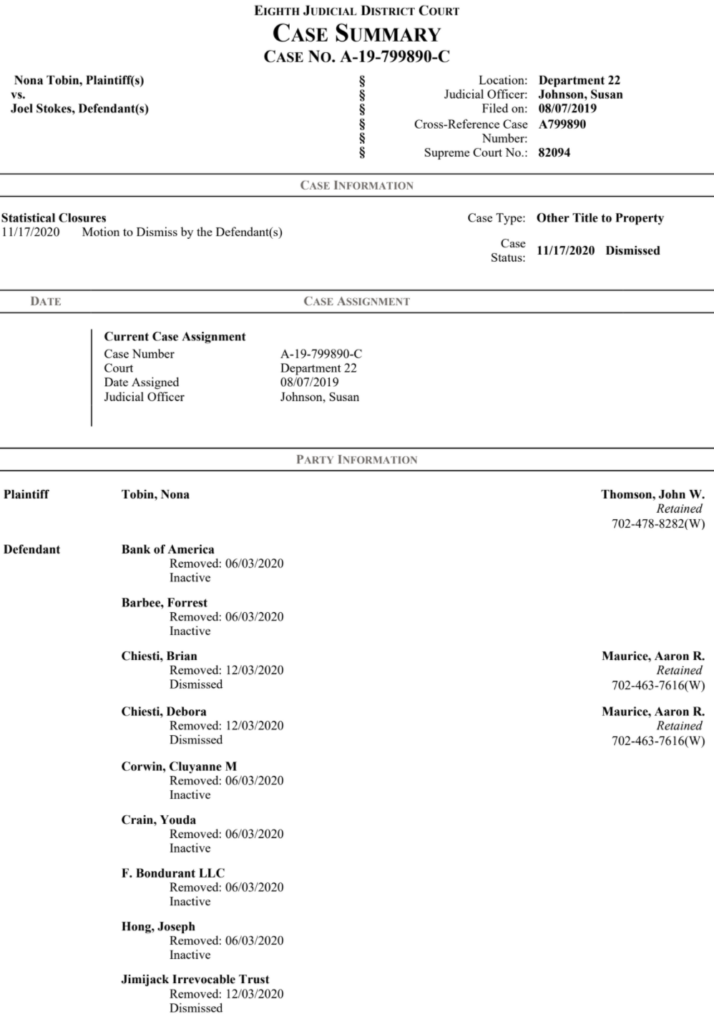

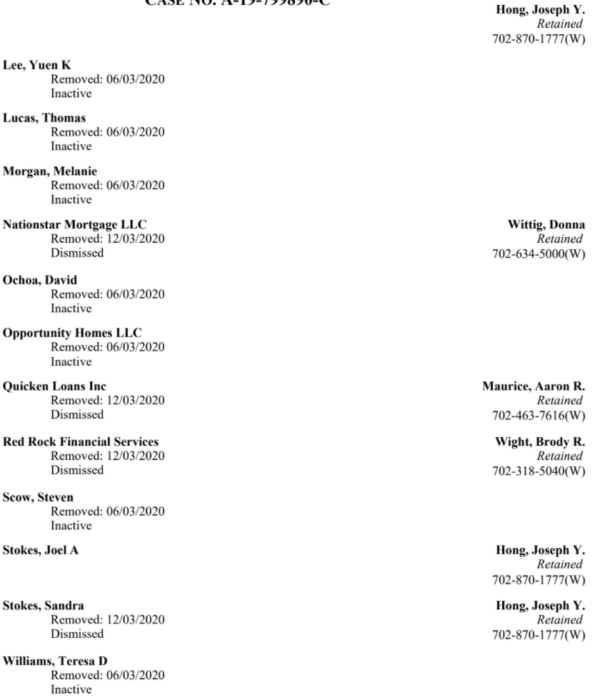

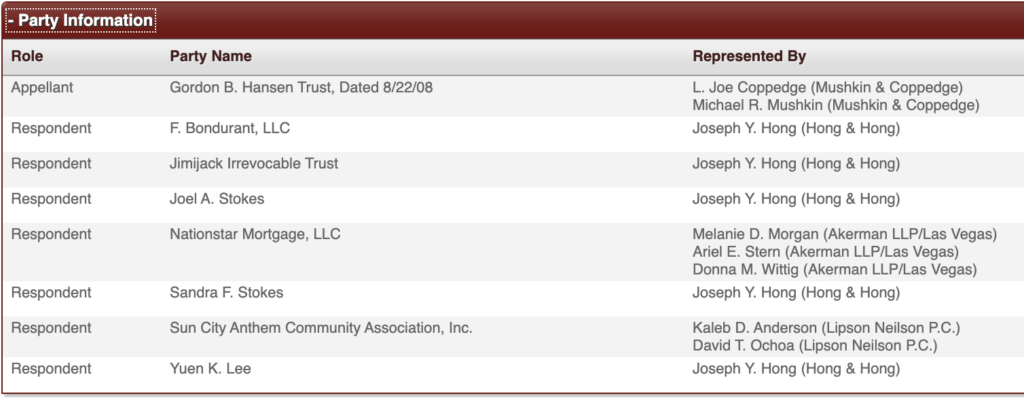

- All subsequent orders in district court cases A-15-720032-C, A-19-799890-C, A-21-828840-C and in appeals 79295 and 82294 were the fruit of this poison tree of falsified documents used to inaccurately depict the HOA sale as compliant with all legal requirements in Nevada statutes and the HOA governing documents.

- My complaint against Steven Scow is much larger than my individual case. It also focuses on his refusal to distribute the excess proceeds from this sale (despite my repeated unheard civil and administrative claims), AND from a dozen other Sun City Anthem 2014 sales, AND from an unknown number of other sales conducted by Red Rock over the years.

- 3/1/22 complaint to the State Bar vs. Steven Scow (SBN 9906was supported by the following exhibits that were rejected by the Assistant Bar Counsel without the investigation required by SCR 104(1)(a):

- Exhibit A Scow presented false evidence in response to Tobin’s 2/4/19 subpoena.

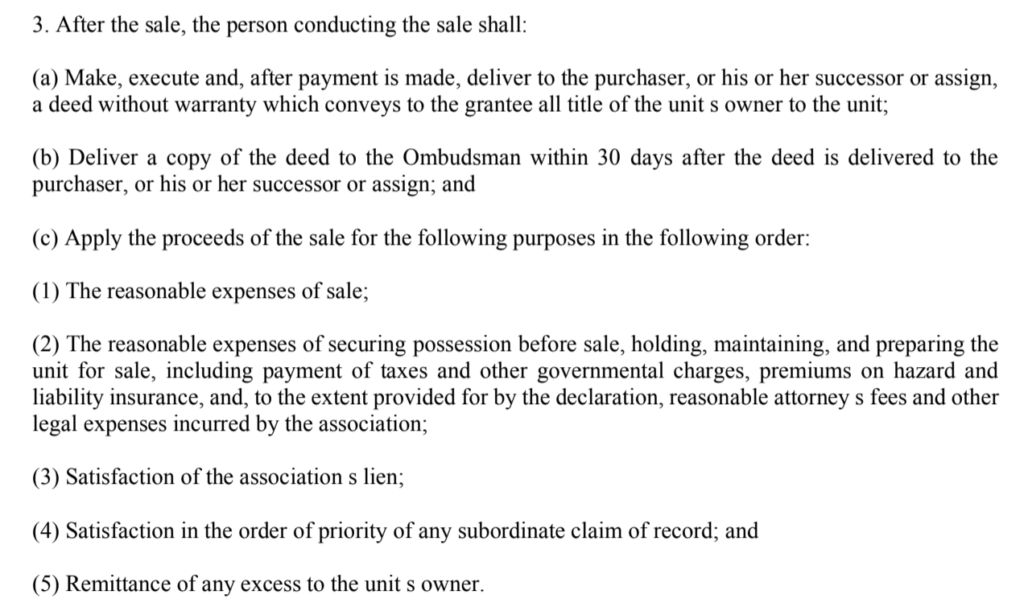

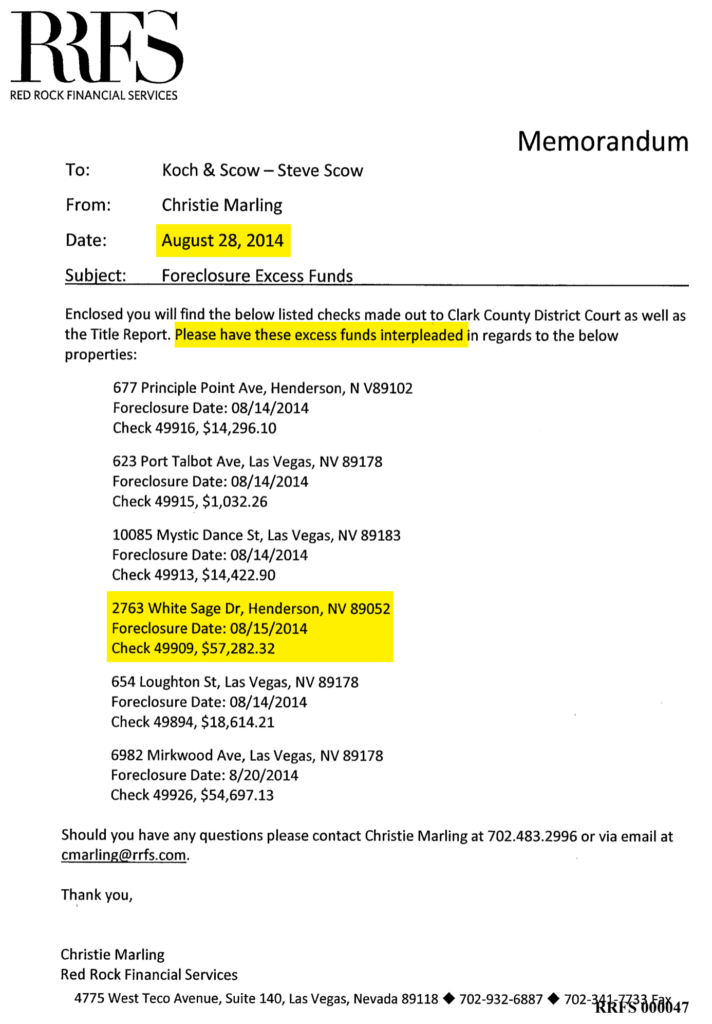

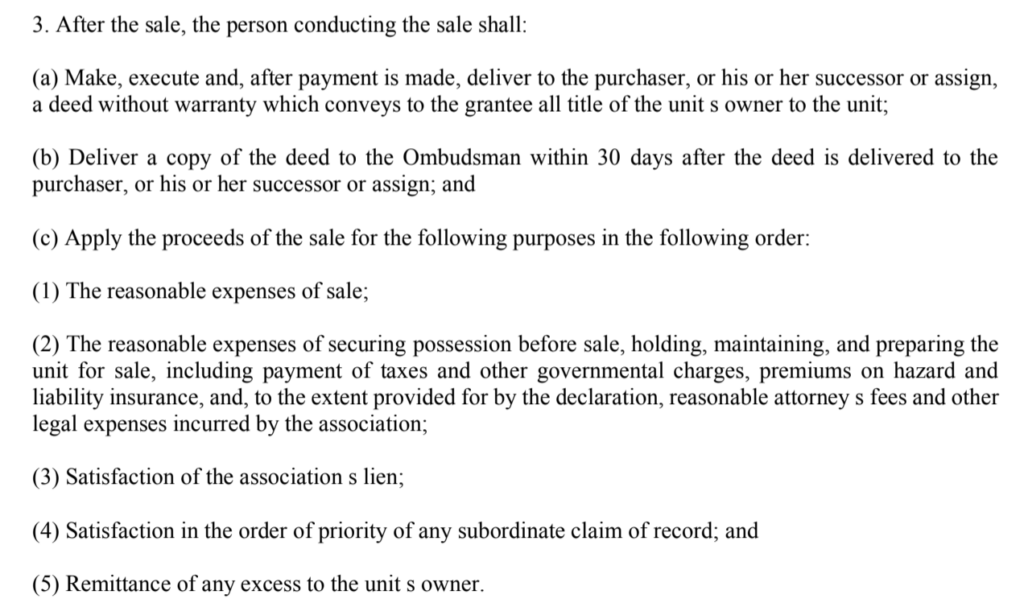

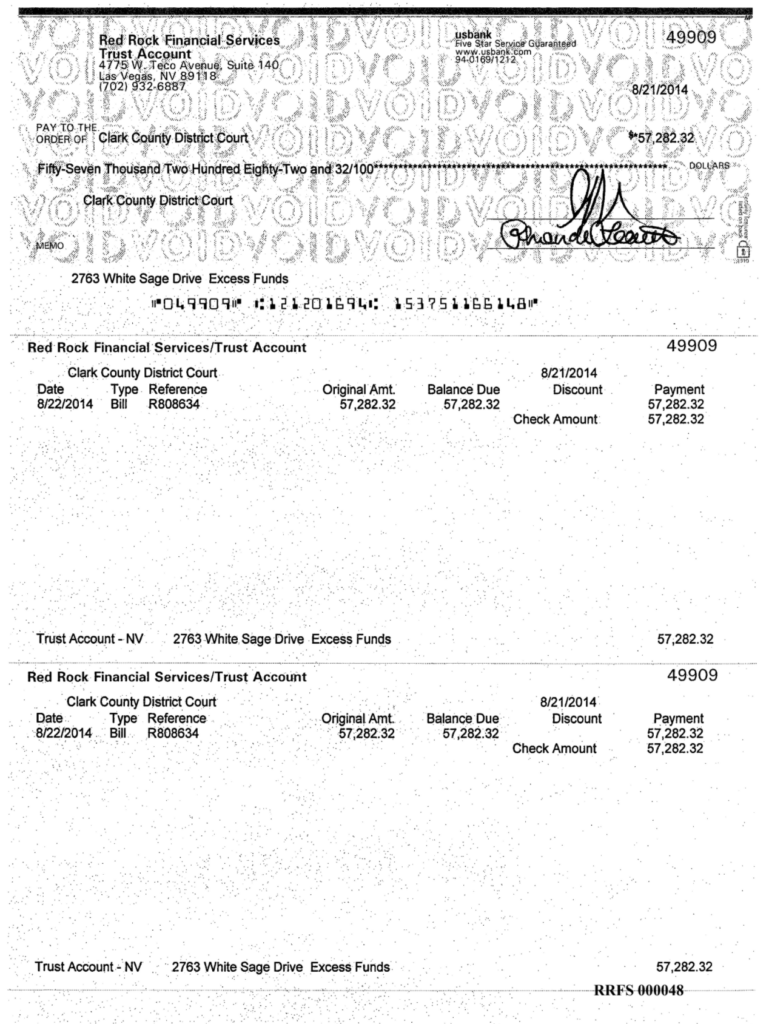

- Exhibit B Scow unlawfully (NRS116.31164(3)(c)(2013) retained, to this day, the excess proceeds of Sun City Anthem HOA foreclosure sales after Red Rock instructed him to remit checks to court for interpleader in 2014.

- Exhibit C Scow also unlawfully retained excess proceeds from foreclosures by other HOAs after Red Rock instructed him to remit checks to court for interpleader in 2014.

- Exhibit D Scow did not produce subpoenaed documents that contained inculpatory evidence without claiming privilege.

- Exhibit E Steven Scow failed to identify the partners who are unfairly profiting by these statutorily non-compliant sales and Scow’s failure to distribute the excess proceeds.

- Exhibit F Steven Scow filed meritless claims, motions, and oppositions to evade judicial scrutiny of inculpatory evidence.

- Exhibit G-1 SCA Board did not comply with HOA meeting laws after being intentionally misinformed about the law by Scow’s clients.

- Exhibit G-2 Legal limits on closed HOA meetings in SCA governing documents were disregarded because Scow’s clients intentionally misinformed the SCA Board about them.

- Exhibit H-1 “We can learn a lot from this Spanish Trail HOA case”

- Exhibit H-2 “HOA debt collectors wield an unlawful level of power”

- Exhibit H-3 “The House that took over a Life”

- Exhibit H-4 Exhibit 5 of 3/8/21 Tobin’ A-21-828840-C Answer, Affirmative Defenses, and Counter-claims that shows that required notices for the sale were not provided, but the records were falsified to cover it up and “HOA collection practices cost us all more than you think” Cost more

- Exhibit H-5 Call for an audit of the co-mingled, unaudited account(s) where Scow unlawfully (NRS116.31164(3)(c)(2013) retained the excess proceeds he was instructed to remit to the court in 2014.

- Scow knew, but concealed that Red Rock unlawfully sold the property for $63,100 without notice on 8/15/14, three months after Nona Tobin had already been accepted the high bid of $367,500 on 5/8/14 from MZK Properties on auction.com, but that Nationstar would not let escrow close on a sale that was five times higher than the Red Rock sale.

- Pages 14 to 20 of the draft complaint against Scow list and describe the specific false evidence he entered into the court record in response to subpoena.

- False evidence (partial list) was entered into the court record via the Red Rock foreclosure file (RRFS 001-425).

- RRFS 093-119 95 IS 277 119 IS 302.pdf– the date was scrubbed, Red Rock misrepresented to the Board “As of today, RRFS is unaware of any buyer that is lined up…” when Red Rock was aware the property had already been sold on auction.com three months earlier and Nationstar had sent a notice that it would pay one year of assessments to close escrow on the 5/8/14 auction.com sale.

- RRFS 095 is SCA 277..png is a doctored combination of unrelated emails to misrepresent that no notice was actually sent to the owner in response to Nationstar’s 5/28/14 $1100 offer. Annotated version – (SCA 277)

- RRFS 093-119 95 IS 277 119 IS 302.pdf is a letter that was provably never sent to 2763 White Sage on 7/2/14 as “no return to sender – deceased” was disclosed

- RRFS 123 DATE SCRUBBED RE 140515 SCHEDULED SALE.pdf– date was scrubbed

- RRFS 124 IS 140318 REQ 4 PAYOFF .pdf– on 3/18/14 Red Rock agent Christie Marling acknowledged Chicago Title’s request for payoff figures but asked to delay response until the Board reviewed a pending request for a waiver on 3/27/14. (RRFS 129)

- RRFS 071-083 IS SCA 250-262 140815 ACCT DETAIL RES TRAN.pdf has scrubbed out the 3/18/14 Chicago Title request for payoff figures, the 3/27/14 Board approval of a $400 fee waiver, and the 3/28/14 Red Rock demand for $

- RRFS 128 IS SCA 315.pdf and SCA 315 misrepresented how the Board approved the sale. Board Resolution R005-120513 at the 12/5/13 meeting did not approve the sale of this property or any other SCA property.

- Red Rock concealed in discovery its 3/28/14 demand to Chicago Title that shows on page 6 that the board approved a $400 fee reduction and $18.81 interest reduction on 3/27/14.

- Red Rock provided falsified accounts so that the Board’s approval of a $400 fee reduction and $18.81 interest reduction did not show as an entry on 3/27/14 on future ledgers. (RRFS 076) and (SCA 255) and (SCA 303) and (RRFS 103)

- Red Rock concealed in discovery the applicable 4/27/12 debt collection contract that required Red Rock to indemnify Sun City Anthem and hold it harmless if any claims were brought alleging misconduct Red Rock’s part which caused a minimum of $150,000 in damages to the HOA.

- RRFS 093-119 95 IS 277 119 IS 302.pdf is a falsified notice that was never sent to Tobin’s address at 2664 Olivia Heights Ave. as alleged. Tobin has stated multiple times under oath that she received no notice whatsoever from Red Rock after the 2/12/14 notice of the 3/7/14 sale which was not held because the property was in escrow with a $340,000 cash offer pending lender approval.

- RRFS 189-190 RES TRAN NO PAGE NUMBERS.pdf scrubbed the sequentially-numbered page numbers 1335 and 1336 from the resident transaction report (Resident Transaction Reports for 2763 White Sage and Tobin’s address at 2664 Olivia Heights)

- RRFS 398-399 RES TRAN 376.21 121205.pdf scrubbed the sequentially numbered page numbers 1334 and 1335 from the resident transaction report

- RRFS 071-083 IS SCA 250-262 140815 ACCT DETAIL RES TRAN.pdf scrubbed the sequentially-numbered page numbers 1334 – 1336 from the resident transaction report

- RRFS 071-083 IS SCA 250-262 140815 ACCT DETAIL RES TRAN.pdf Red Rock withheld in discovery all the financial transactions on resident transaction report pages 1336 – 1337 from 7/31/14 through 9/25/14, concealing thereby that the HOA has no record that 2763 White Sage was ever sold on 8/15/14, or any other date, and shows no entry in any ledger that confirms the alleged $63,100 was collected from a sale.

- Red Rock concealed page 1337 of the Resident Transaction Report that shows that Jimijack – not Opportunity Homes – became the second owner of the property on 9/25/14 and that there is no record of Opportunity Homes LLC or F. Bondurant LLC ever owning the property.

- RRFS 305 – 311 shows that Red Rock responded to a payoff request from Ticor Title on 5/29/13 with a demand for $3,055.47 three weeks after Red Rock covertly rejected the Miles Bauer $825 tender when only $825 in assessments were then delinquent.