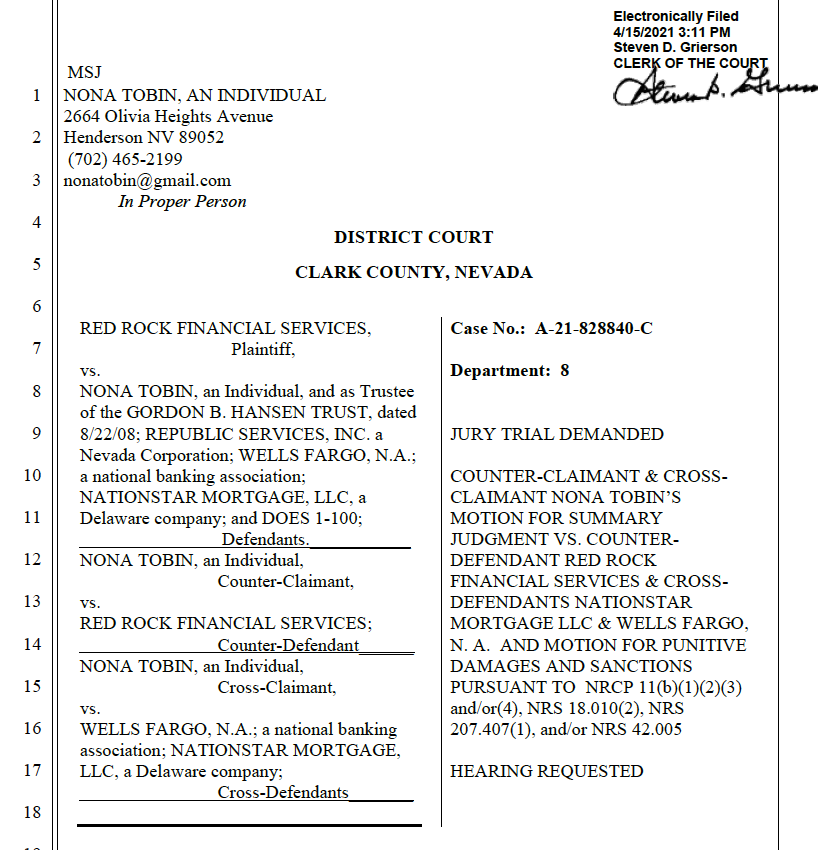

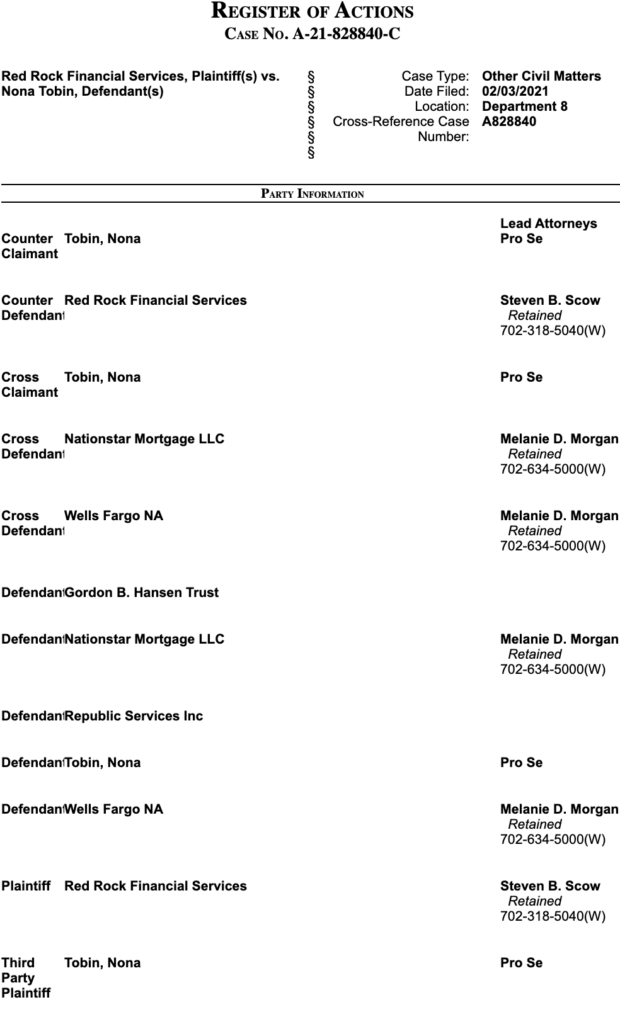

Comes now, counter-claimant/ cross-claimant Nona Tobin, an individual, in proper person, to hereby move for summary judgment vs. counter-defendant Red Rock Financial Services, a partnership, and cross-defendants Nationstar and Wells Fargo and moves that relief be granted to Nona Tobin as requested, including punitive damages and sanctions, pursuant to NRCP 11(b)(1)(2)(3) and/or(4), NRS 18.010(2), NRS 207.407(1), and/or NRS 42.005.

MEMORANDUM OF POINTS AND AUTHORITIES

INTRODUCTION

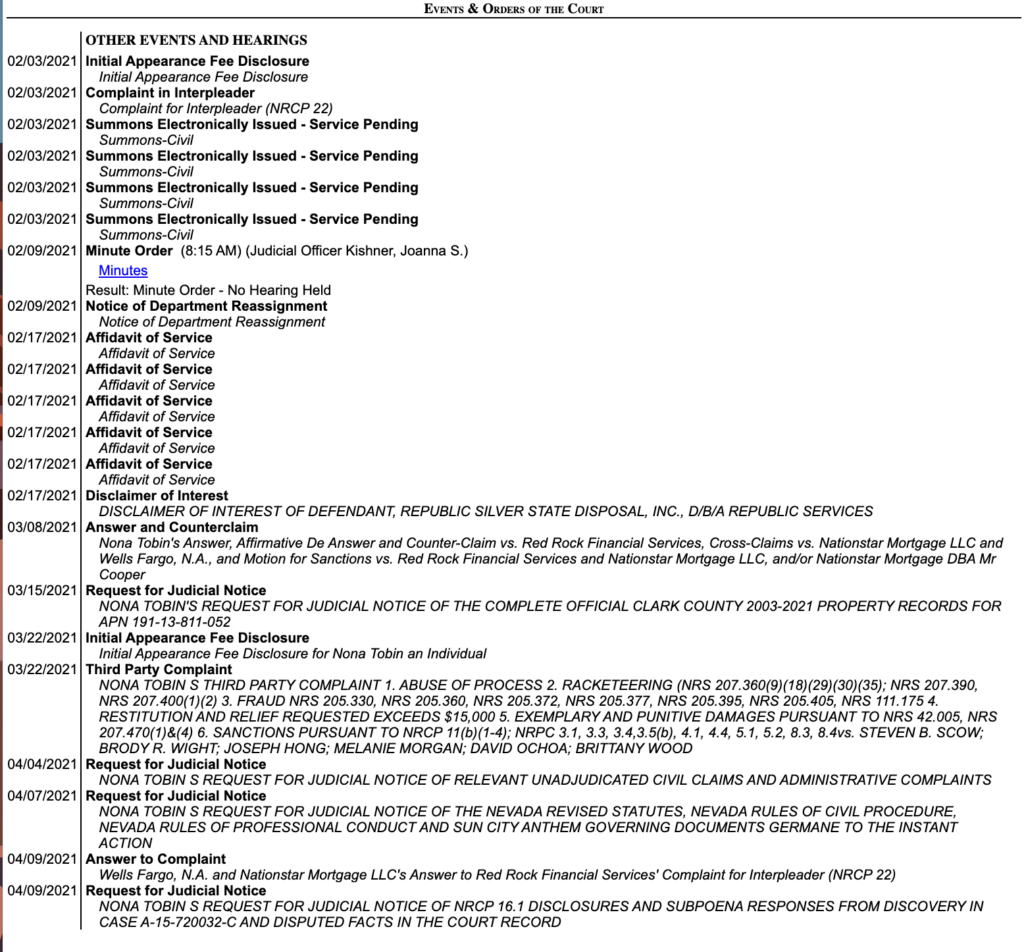

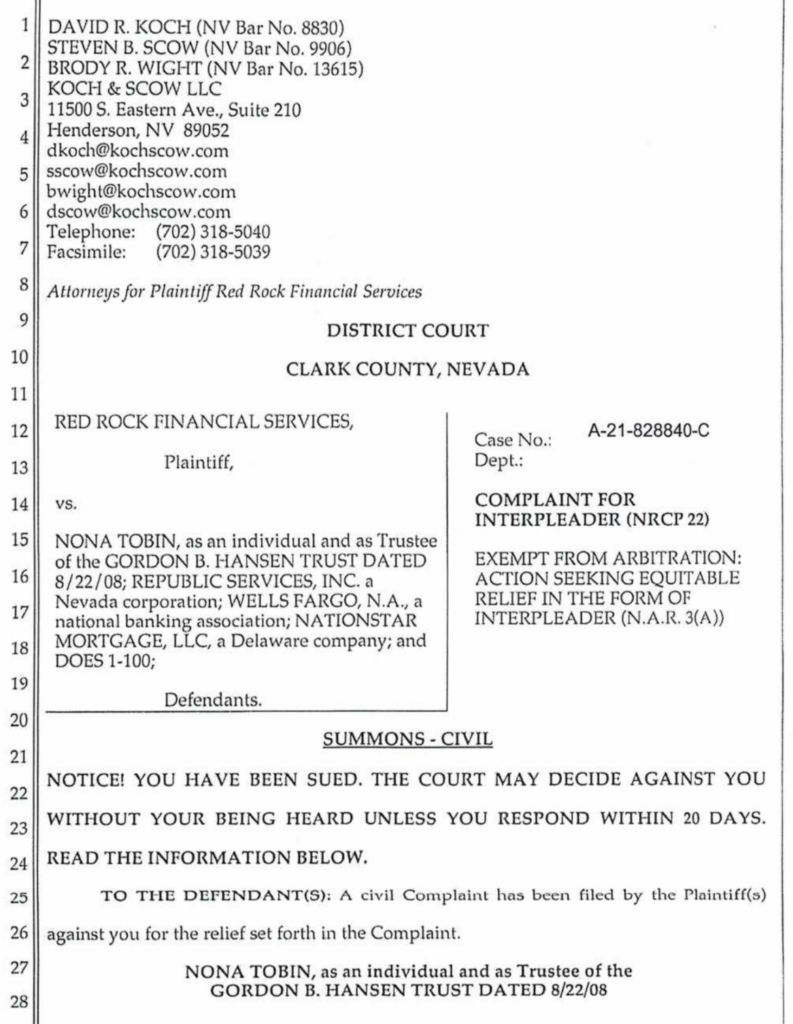

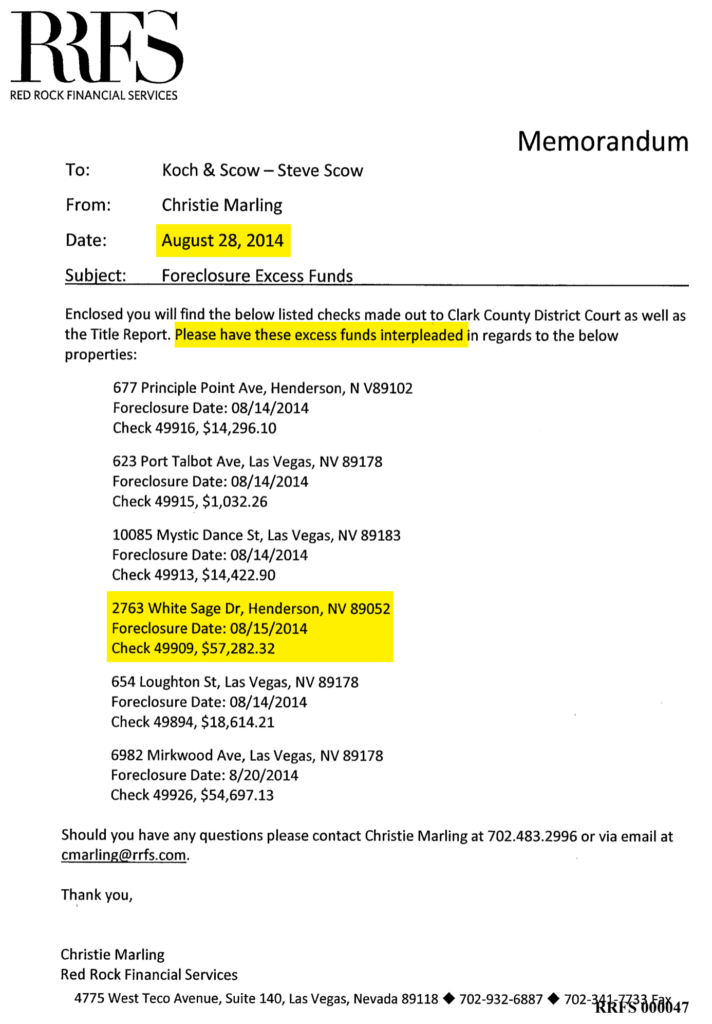

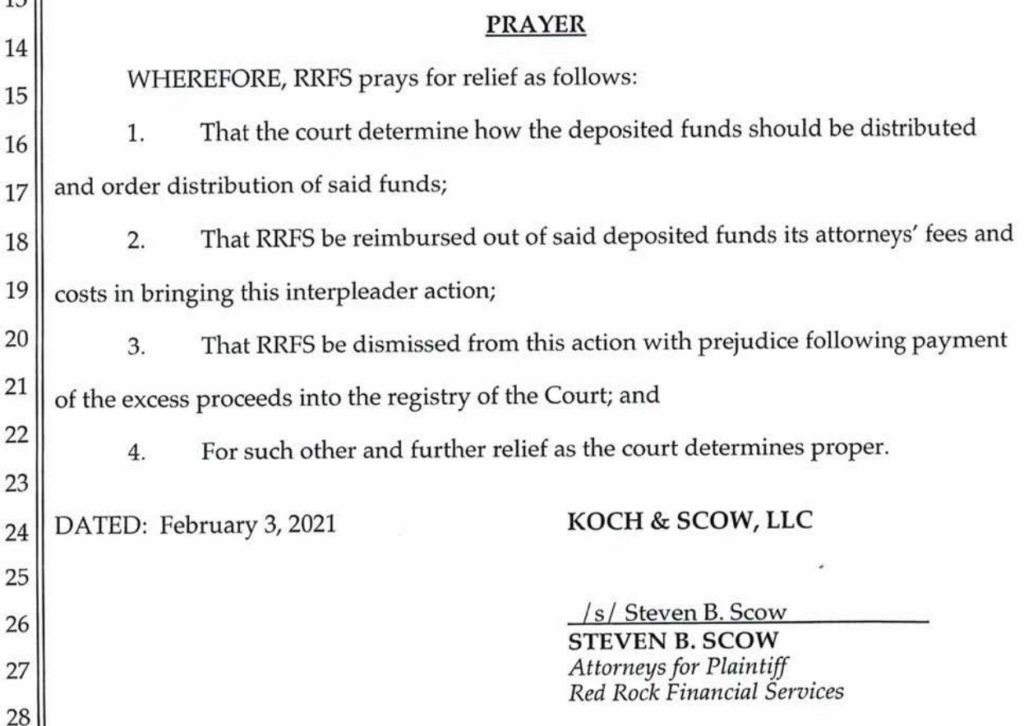

- On 2/16/21 Red Rock served its complaint with one cause of action: interpleader to distribute the proceeds of the 8/15/14 sale of 2763 White Sage.

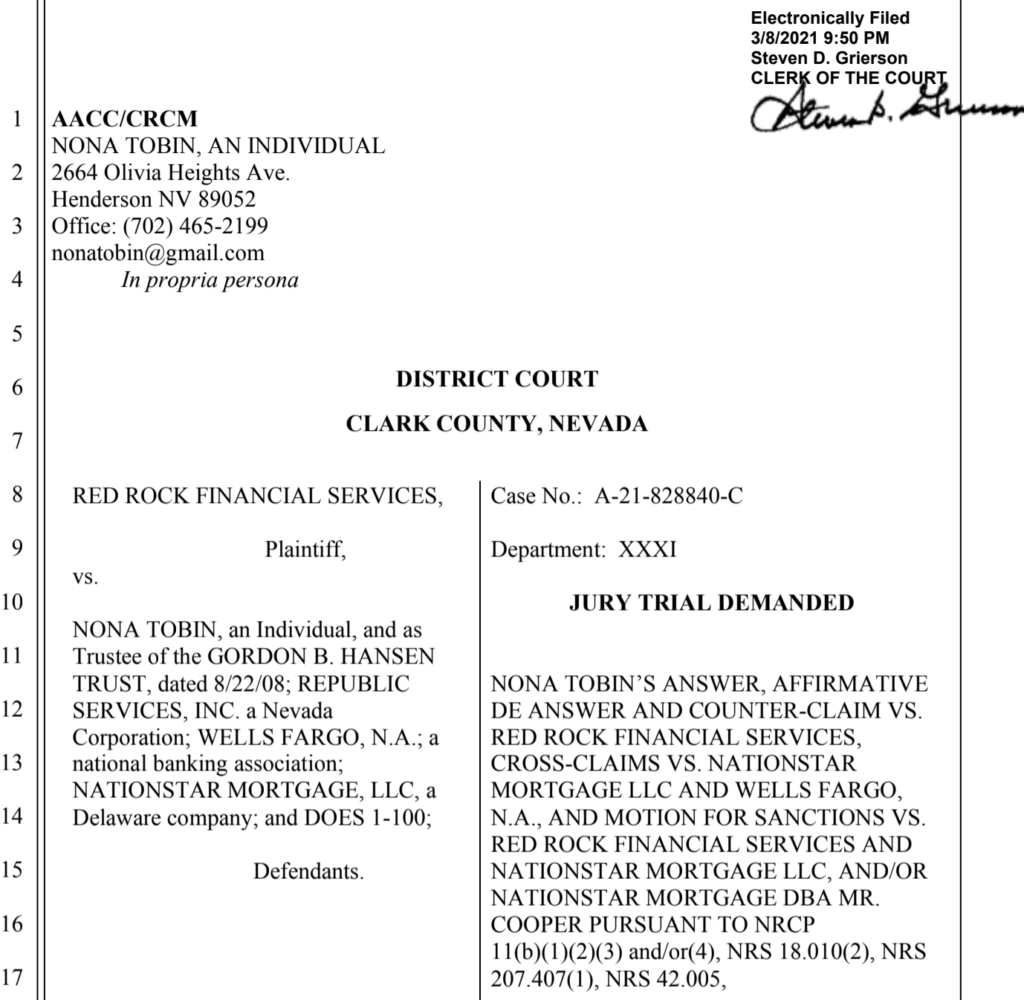

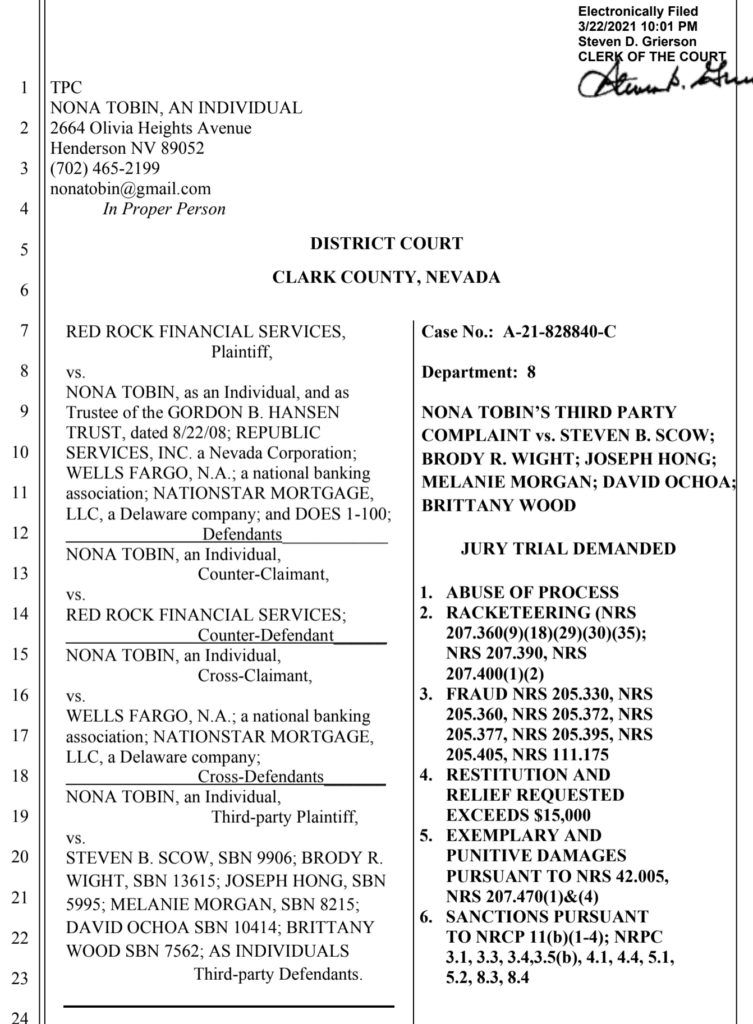

- On 3/8/21 counter-claimant/ cross-claimant Nona Tobin filed NONA TOBIN’S (Herein “AACC’) ANSWER, AFFIRMATIVE DEFENSES AND COUNTER-CLAIM VS. RED ROCK FINANCIAL SERVICES, CROSS-CLAIMS VS. NATIONSTAR MORTGAGE LLC AND WELLS FARGO, N.A., AND MOTION FOR SANCTIONS VS. RED ROCK FINANCIAL SERVICES AND NATIONSTAR MORTGAGE LLC, AND/OR NATIONSTAR MORTGAGE DBA MR. COOPER PURSUANT TO NRCP 11(b)(1)(2)(3) and/or(4), NRS 18.010(2), NRS 207.407(1), NRS 42.005. JURY TRIAL DEMANDED.

- As there has been no timely responsive pleading from Red Rock, Nationstar, or Wells Fargo denying Tobin’s allegations, the court has the discretion to deem their silence as admission.

- However, out of an abundance of caution, Tobin moves herein for summary judgment and sanctions to obtain relief instead of filing a notice of intent to take default.

- Due to the seriousness of the allegations and the high level of declaratory relief, sanctions and punitive damages sought, counter-claimant/ cross-claimant Nona Tobin requests a hearing to allow defendants an opportunity to reply and to show cause why the relief, sanctions and punitive damages requested should not be imposed.

“Under NRCP 7(a) a reply to a counterclaim is a required responsive pleading. Because of his failure to reply, appellant admitted the allegations of the counterclaim. NRCP 8(d).”

Bowers v. Edwards, 79 Nev. 384, 389 (Nev. 1963)

“If the plaintiff fails to demur or reply to the new matter, contained in the answer, constituting a defense, the same shall be deemed admitted.”

Nevada-Douglas Co. v. Berryhill, 58 Nev. 261, 268 (Nev. 1938)

“Every defense, in law or fact, to a claim for relief in any pleading, whether a claim, counterclaim, cross-claim, or third-party claim, shall be asserted in the responsive pleading thereto if one is required…)

Danning v. Lum’s, Inc., 86 Nev. 868, 0 (Nev. 1971)

REQUESTS FOR JUDICIAL NOTICE

- Counter-claimant/cross-claimant Nona Tobin requests the court judicially notice the Requests for Judicial Notice Tobin filed into this case on 3/15/21 (APN 191-13-811052 Clark County complete property record), 4/4/21 (unadjudicated administrative complaints and civil claims), 4/7/21 (relevant laws, regulations and HOA governing document provisions) and 4/9/21 (NRCP 16.1 disclosures and subpoena responses from discovery in case A-15-720032-C and disputed facts in the court record).

- NRS 47.130(2) (b) permits courts to judicially notice facts “capable of accurate and ready determination by resort to sources whose accuracy cannot reasonably be questioned, so that the fact is not subject to reasonable dispute.”

- Pursuant to NRS 47.150, a “judge or court shall take judicial notice if requested by a party and supplied with the necessary information.”

- Pursuant to NRS 47.160 “A party is entitled upon timely request to an opportunity to be heard as to the propriety of taking judicial notice and the tenor of the matter to be noticed.”

Nona Tobin’s Requests for Judicial Notice, filed into this case on 3/15/21, 4/4/21, 4/7/21 and 4/9/21, are proper for judicial notice because they were 1) recorded against the property and are part of the Clark County Recorder’s Office records, or 2) were filed at some point into the court records of prior proceedings, or 3) fit the definition of NRS 47.140 (matters of law), and 4) are timely pursuant to NRS 47.150. Mack v. S. Bay Beer Distrib., 798 F.2d 1279, 1282 (9th Cir. 1986).

STATEMENT OF UNDISPUTED FACTS

- The HOA sale was invalid to remove Tobin’s rights to title as it was non-compliant with foreclosure statutes, did not comply with the HOA governing documents, did not provide mandated due process, and involved fraud. Red Rock, Nationstar and Sun City Anthem withheld, concealed, misrepresented and/or falsified records to conceal the fraud.

- Defendants, acting alone or in conspiracy with others, covered up the fraud and successfully suppressed Tobin’s evidence so the courts acted on false evidence to rule against her and deny her access to the appellate courts.

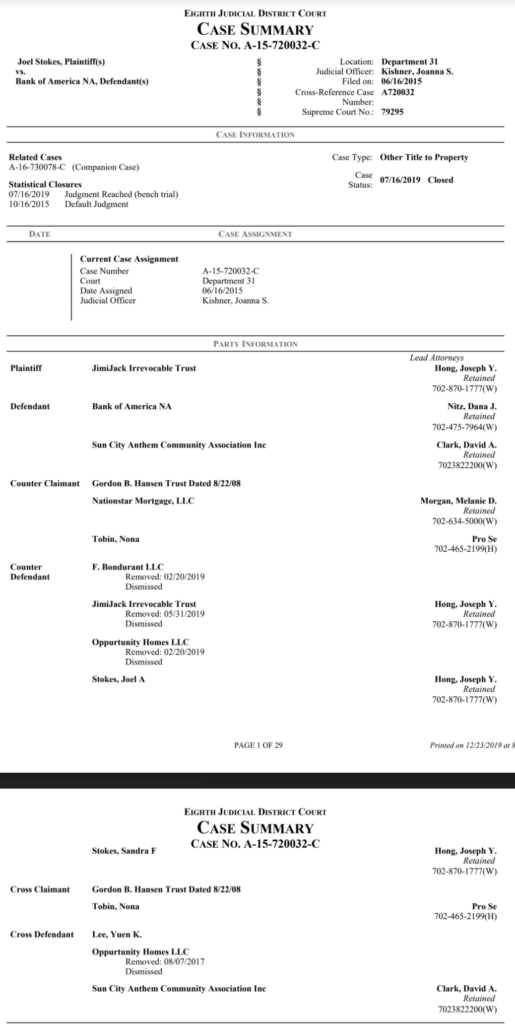

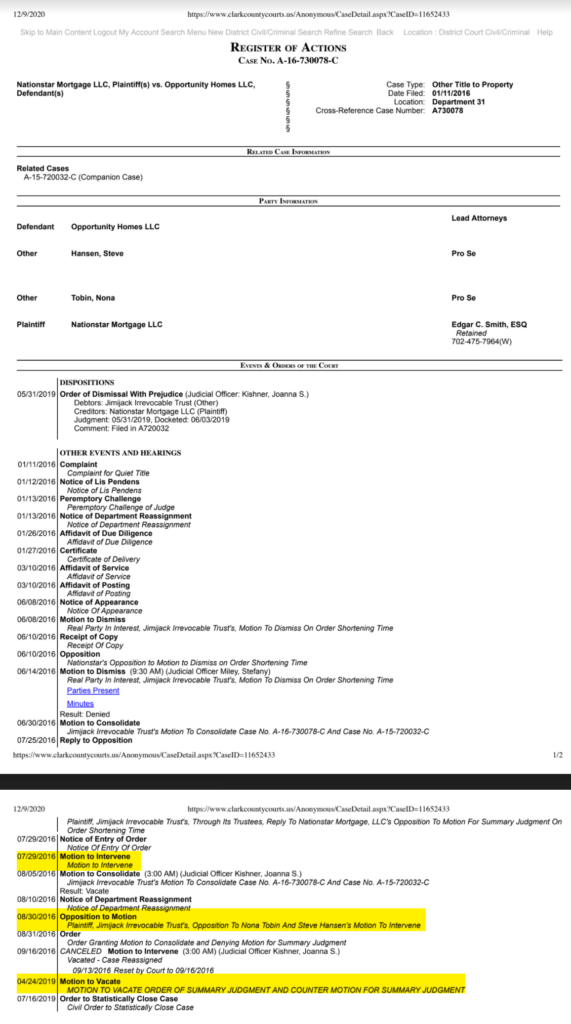

- On 6/24/19 she lost title by being denied access to the trial and all documentary evidence excluded. See A-15-720032-C case summary without stricken documents vs. annotated summary and annotated 5/4/19 case info file.

- On 9/10/19 the Supreme Court denied her individual right to appeal.

- On 11/22/19 Tobin’s 7/22/19 motion for a new trial pursuant to NRCP 54b and NRCP 59a(1)ABCDF and 7/29/19 motion to dismiss for lack of jurisdiction pursuant to NRS 38.310 were stricken unheard along with all her pro se filings and motions stricken by 4/23/19 ex parte bench order

- On 4/30/20 the Supreme Court denied her access to appeal anything as an individual into appeal 79295.

- On 7/1/20 Sun City Anthem, Nationstar and Jimijack filed a joint respondents’ brief that was based on the false evidence from the Red Rock foreclosure file (RRFS 001-425) and (SCA 176-643 ignoring SCA 168-175) in response to the Gordon B. Hansen 12/19/19 opening brief.

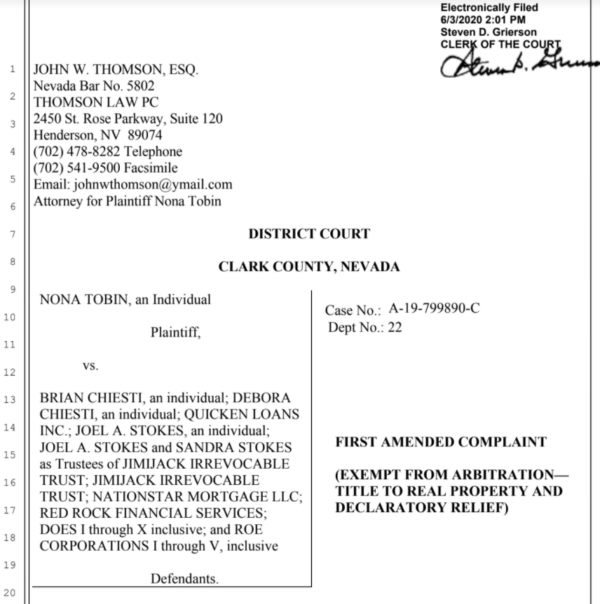

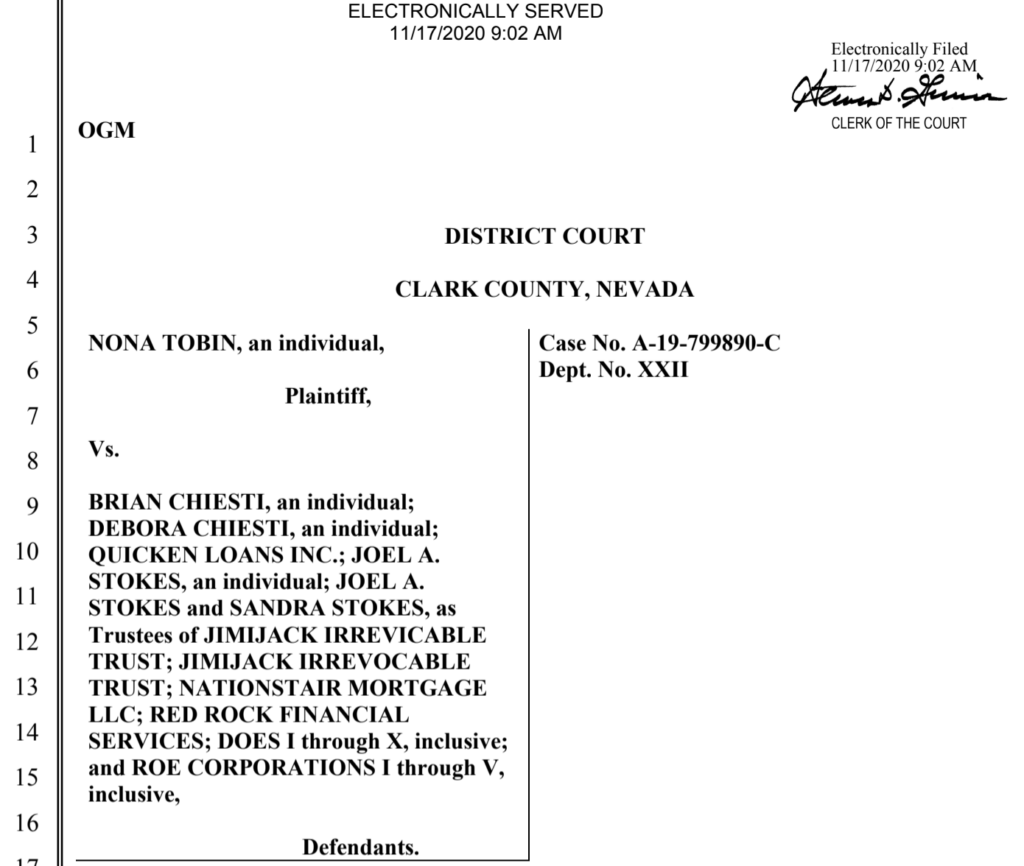

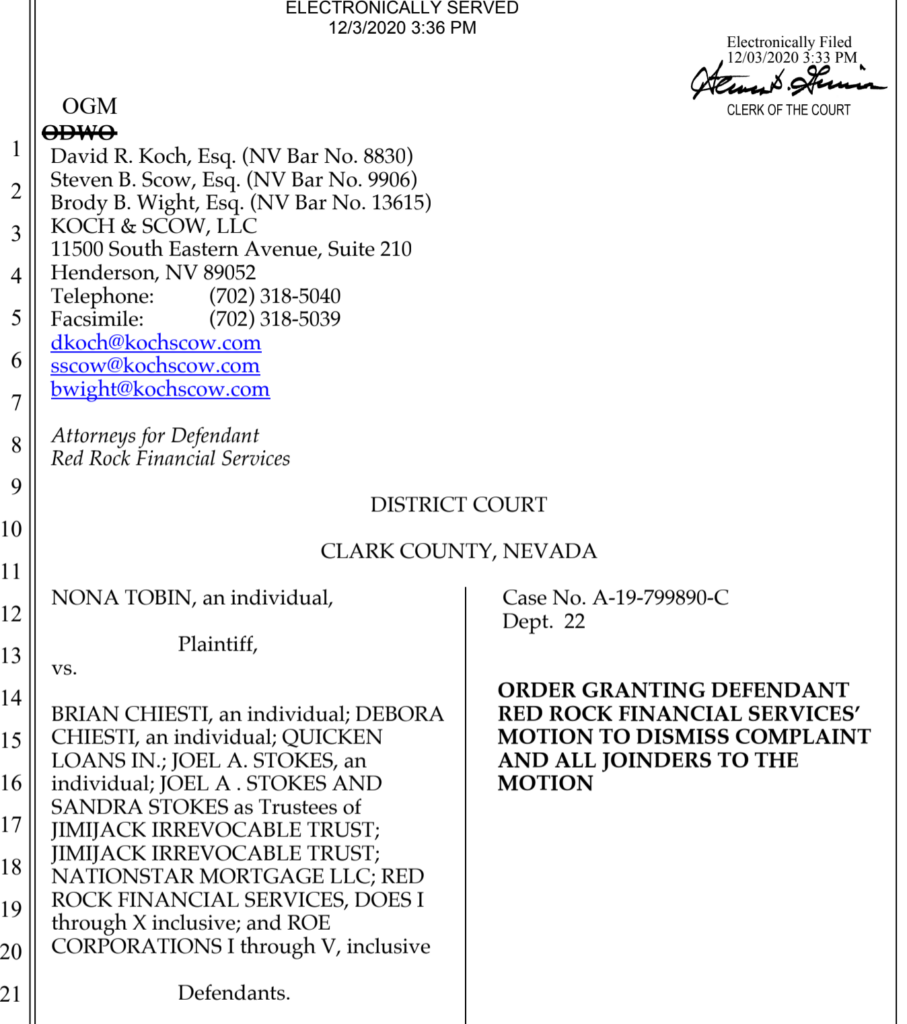

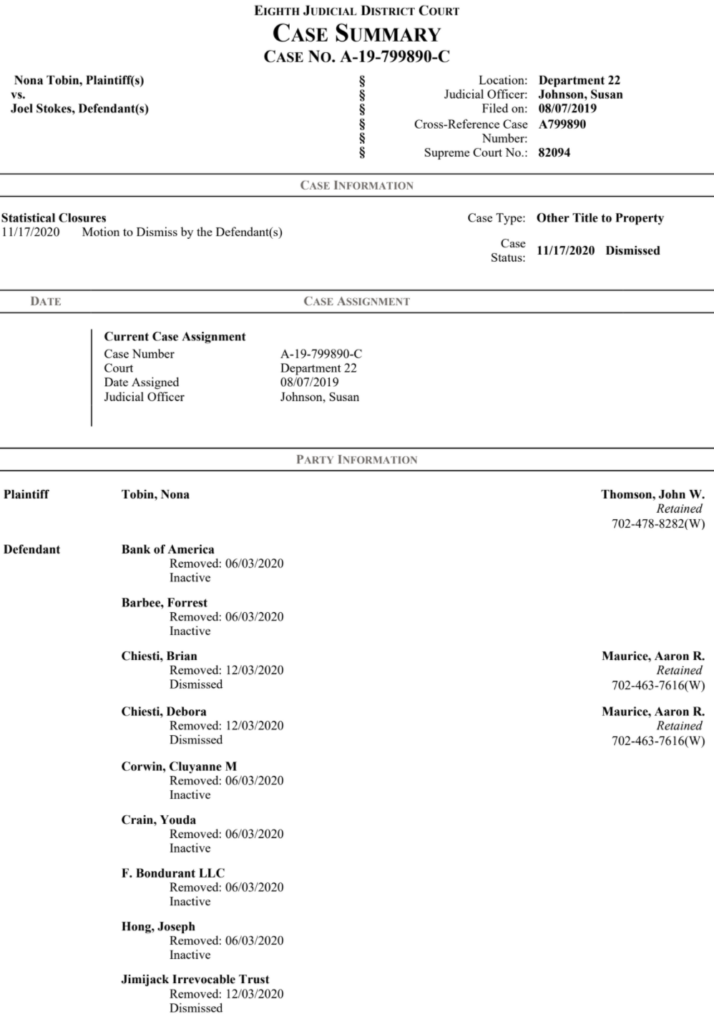

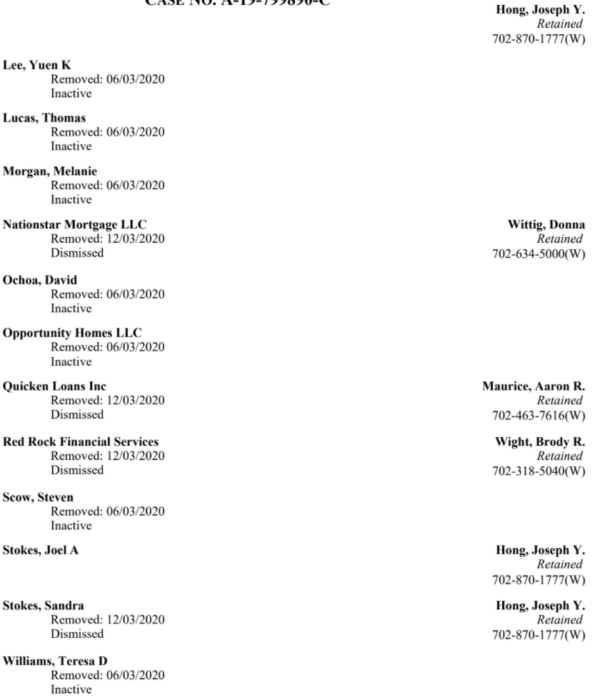

- On 12/3/20 her A-19-799890-C complaint was dismissed with prejudice on the grounds of res judicata/non-mutual claims preclusion and three of her lis pendens (recorded on 8/7/14, 8/14/19, and 8/14/19) were expunged as if they had never been recorded.

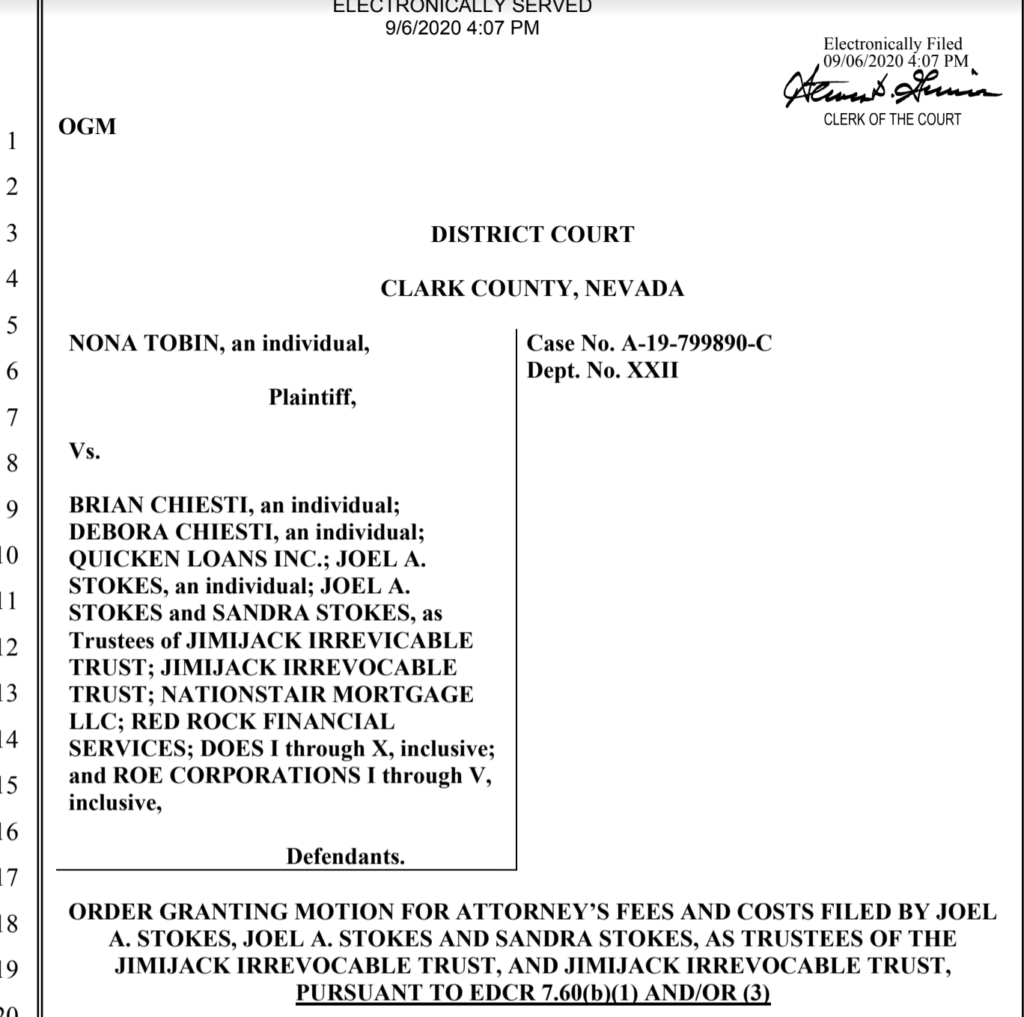

- Dismissal of her A-19-799890-C complaint occurred after two order imposing sanctions on her for filing a quiet title complaint as an individual, , had been entered on 10/8/20 and 11/17/20 ($3,455 to Joseph Hong pursuant to EDCR 7.60(1) &/or (3) and $12,849 to Brittany Wood per NRS 18.010(2))

- On 3/8/21 NONA TOBIN filed her ANSWER, AFFIRMTIVE DEFENSES, COUNTER-CLAIMS & CROSS-CLAIMS the are summarized and expanded on below.

ANSWER

- Tobin’s AACC ANSWER basically denied that Red Rock had any proper purpose for filing a claim for interpleader after holding the funds, without legal authority, all the while obstructing Tobin’s multiple efforts for over the six years to stake a claim.

- Related to Tobin’s opinion of Red Rock’s motives, Tobin published on her blog SCAstrong.com: “Interpleader complaint was filed with an ulterior motive” and “Cause of Action: Abuse of Process” and “NRS 116.31164(3)(2013) vs. NRCP 22: Interpleader vs. HOA bylaws prohibiting delegation”

AFFIRMATIVE DEFENSES

Tobin’s AACC had nineteen affirmative defenses:

- Failure to state a claim

- Estoppel

- Fraud NRS 207.360 (9)(30)(35), NRS 205.395, NRS 205.377, NRS 205.330, NRS 205.405, NRS 111.175,

- Illegality NRS 207.230

- Waiver

- Failure to join a necessary party

- General and equitable defenses

- Priority

- False claims to title (NRS 205.395, NRS 205.377)

- Violation of Covenant of good faith (NRS 116.1113)

- Equitable doctrines (unclean hands, NRS 207.360 (9)(30)(35)

- Acceptance (distribution of proceeds)

- Waiver and Estoppel (Red Rock & Nationstar)

- Fraudulent Misrepresentation and fraudulent concealment NRS 205.405, NRCP 11(b)

- Failure to mitigate damages

- Unconstitutional (Due process clauses)

- Statutory violations (NRS 116.31031, NRS 116.31162 – NRS 116.31168 (2013), NRS 116.3102, NRS 116.31083, NRS 116.31085, NRS 38.310

- Rejection of two super-priority payments (SCA 513 and SCA 302)

- Violations of HOA CC&Rs owner protections (CC&Rs 7.4 Compliance & Enforcement; CC&Rs 16: Dispute Resolution and Limitation on Litigation

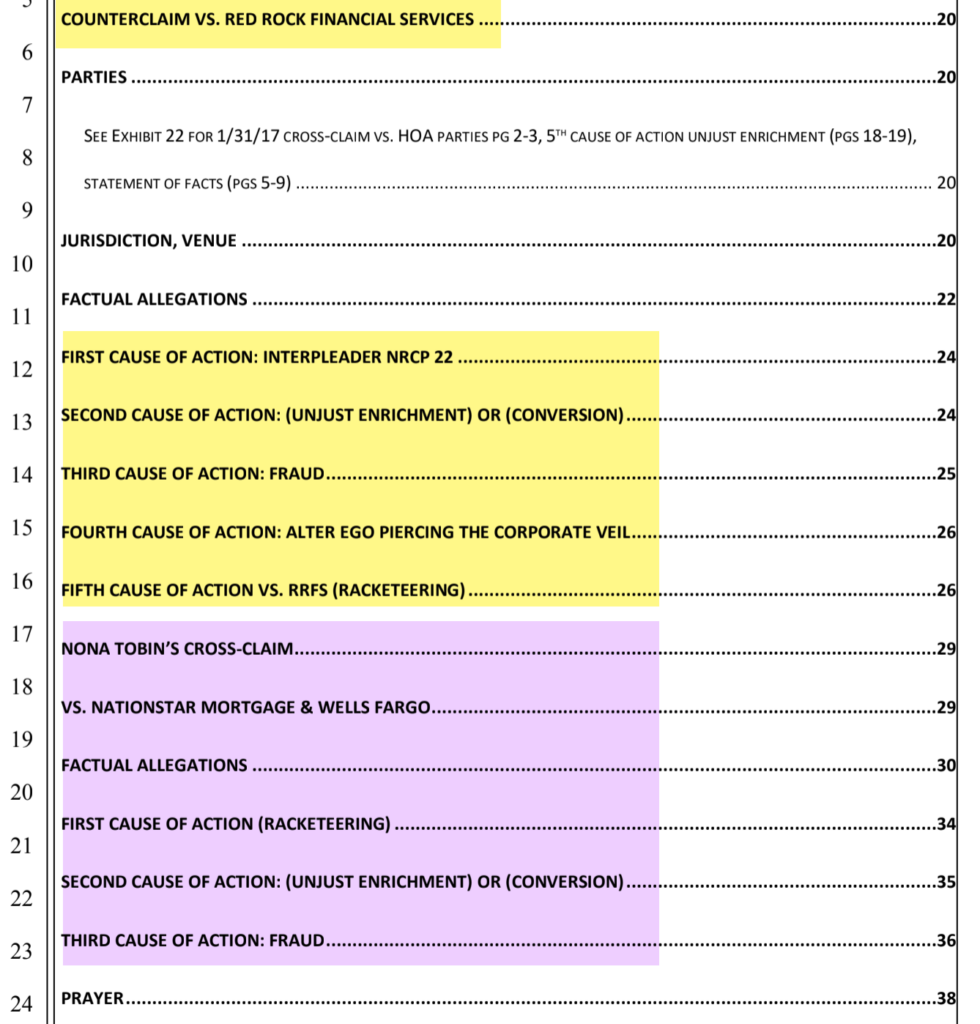

COUNTER-CLAIMS

Tobin’s AACC had five causes of action in the counter-claim vs. RRFS: 1) Interpleader: distribution of the proceeds plus penalties and interest; 2) Unjust enrichment and/or conversion; 3) Fraud; 4) Alter-ego piercing the corporate veil; and 5) Racketeering. See also published “Nona Tobin’s claims against Red Rock Financial Services”.

First Cause of Action: Interpleader

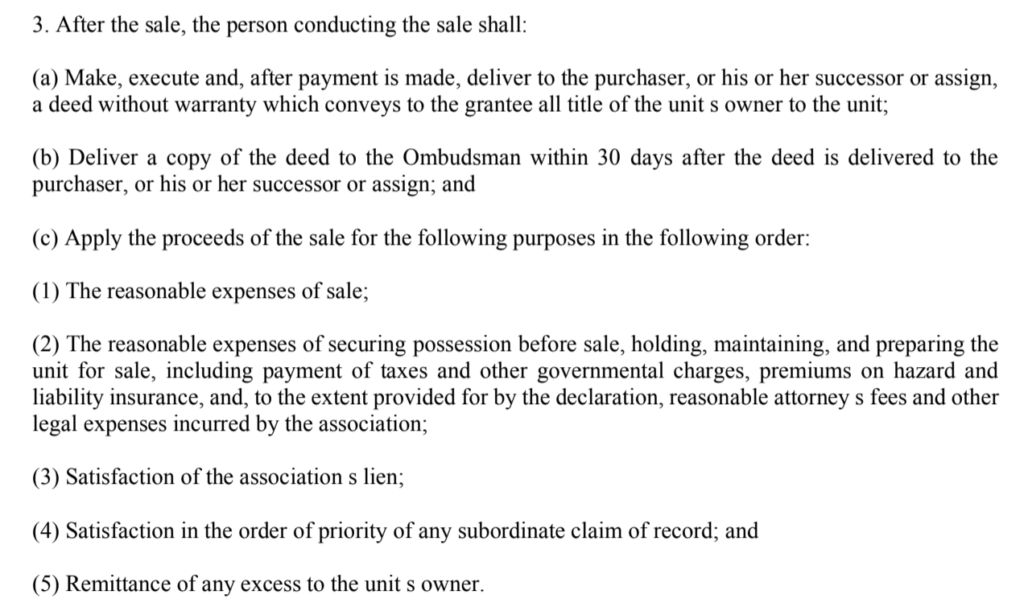

- The controlling statute for the distribution of proceeds is NRS116.31164(3) (2013) which defines the after-sale ministerial duties of the person who conducted the sale.

- There is no legal authority in the controlling statute for Red Rock Financial Services to claim $3500 in fees for filing this interpleader action.

- Using the Nevada legal rate of interest table, total amount due to Nona Tobin is $87,115.31, of which $57,282.32 was the original principal that Red Rock identified as “excess proceeds”

- Alternatively, if the calculation is done based on the amount of the proceeds Red Rock actually unlawfully retained, the amount due to Tobin presently is $91,855.11, of which $60,398.96 is the total undistributed portion of the $63,100 proceeds from the 8/15/14 sale. See Interest calculation on both principal amounts.

- Tobin’s 3/28/17 deed is the sole current recorded claim.

- No other defendant filed a claim into interpleader for a portion of the proceeds.

Second COA: Conversion

See the published “Cause of Action: Conversion” and “Cause of Action: Misappropriation of money” and “Cause of Action: Civil Conspiracy”

Third COA: Fraud

- See the published “Cause of Action: Fraud” and “What’s being human got to do with it?”

- See the published “SCA Board secretly sold a dozen houses in 2014”

- See the published “SCA Board did not properly authorize any foreclosure conducted by Red Rock”

- See the published “Red Rock foreclosure file is false, falsified and fraudulent”

- See the published “Deceptive disclosures: 12/5/13 meeting vs. SCA 315 & RRFS 148”

- See the published “SCA Board did not comply with HOA meeting laws”

- See the published Ombudsman’s Notice of Sale records for 17 foreclosures )

- See the published “Due process is required before a person’s property can be confiscated”

Fourth Cause of Action: Alter-ego piercing the corporate veil

See Exhibit 22 Excerpts of 1/31/17 cross-claim vs. HOA and its agents

Fifth COA: Racketeering

- See the published “Cause of Action: RICO damages pursuant to NRS 207.470 Racketeering”

- Red Rock’s response to subpoena (RRFS 001-425) was unverified, incomplete, inaccurate, and contained some falsified documents.

- Sun City Anthem disclosed the same unverified, uncorroborated Red Rock foreclosure file (SCA 176-643) and misrepresented it to the court as the HOA’s official records of the collection and foreclosure process.

- Sun City Anthem concealed all the HOA’s records of what actually occurred, including but not limited to all the SCA Board agendas and minutes, un-doctored Resident Transaction Reports for 2763 White Sage, and all the HOA’s compliance and enforcement records for the foreclosures conducted by Red Rock under the HOA statutory authority.

- See 4/9/21 Request for Judicial Notice (NRCP 16.1 disclosures and subpoena responses from discovery in case A-15-720032-C and disputed facts in the court record) which contains:

EXHIBIT 3: DAVID OCHOA PROFFERED FOR SUN CITY ANTHEM

- 5/31/18 SCA Initial disclosures

- SCA 001-116 Sun City Anthem CC&Rs 2008 3rd restatement

- SCA 117-145 Sun City Anthem bylaws 2008 3rd restatement

- SCA 146-163 Sun City Anthem Rules and Regulations

- SCA 164-167 Sun City Anthem 2007 Red Rock Financial Services Debt Collection contract

- SCA 168-175 Sun City Anthem 2013 Delinquent Assessment Policy

- SCA 176-643 Red Rock Financial Services Foreclosure File redacted

- 2/11/19 SCA 1st supplemental disclosures

- 2/26/19 SCA response to Tobin interrogatories

- 2/26/19 SCA Response to Tobin Request for Documents

- 2/26/19 SCA response to Tobin Request for documents annotated

- In addition to refusing to provide HOA records of probative value to Tobin’s case, Sun City Anthem attorney/debt collector Adam Clarkson required Nona Tobin, as an elected, sitting member of the HOA Board to recuse herself from all SCA collection matters, past or present, instead of relying on NRS 116.31084 (Voting by member of executive board; disclosures; abstention from voting on certain matters.) See 6/5/17 recusal acknowledgement.

- Because Tobin was a party to this quiet title litigation, Sun City Anthem attorney/debt collector Adam Clarkson deemed her elected Board seat vacant “by operation of law” and removed her from her elected Board seat without an NRS 116.31036 removal election.

- See 8/24/17 Clarkson letter that accused Nona Tobin of profiting from her elected seat on the Board by being party to this quiet title litigation.

- See 8/16/17 Complaint to the Nevada State Bar vs. Clarkson and 9/12/17 rejection letter.

- See the 9/7/17 Complaint to NRED Ombudsman and 8/9/18 rejection letter.

- See the published “Why can’t I be a candidate for the Board?” and “HOA collection practices cost us all more than you think” and “Fire the debt collector” and “Elder Abuse: Part II – SCA Agents” and “On the advice of counsel is no defense”.

- SCA attorney/debt collector has ruled without legal authority (NRS that Nona Tobin is ineligible to run for election or return to her elected Board seat as long as the quiet title litigation is in the appellate courts, even if Sun City Anthem is not a party. See Clarkson “notice(s) of ineligibility” dated 2/9/18, 2/12/19, 2/06/20, and 2/12/21. See also 11/9/20 Tobin email to the HOA Board to fill vacant Board seat with 2017-2020 timeline and links. See the published “No 2021 Board election”

- SCA attorneys Adam Clarkson and David Ochoa published quarterly litigation reports that falsely claimed that Nona Tobin had been removed from her elected Board seat “for cause”.

- See also the published “Election committee was inhospitable, angry even. Nevertheless I persisted”

- SCA disclosed, and RRFS provided in response to Tobin’s subpoena, misleading and falsified documents to deceive the court into concluding that the sale had been fair and properly noticed and the proceeds properly handled, including but not limited to SCA 276, SCA 277, SCA 278, SCA 286, SCA 635, SCA 642 , SCA 643. SCA 277, SCA 628, RRFS 071-083 (SCA 250-262), RRFS 047-048 (SCA 223-224), RRFS 119 (SCA 302), RRFS 128 (SCA 315), RRFS 238-244, RRFS 218-219 (SCA 415-416), RRFS 298-299, RRFS 312-326 (SCA 513-530), RRFS 398-399; RRFS 402 (SCA 618), RRFS 409-423, RRFS 424-425, RRFS 123, RRFS 124,

CROSS-CLAIMS VS. NATIONSTAR & WELLS FARGO

- Tobin’s AACC had three causes of action vs. cross-defendants Nationstar and Wells Fargo: 1) Racketeering; 2) Unjust enrichment and/or conversion; and 3) Fraud.

- See “Nona Tobin’s cross-claim vs. Nationstar and Wells Fargo” See “Nationstar Mortgage’s Fraud” and “Black letter law: anti-foreclosure fraud”

- See “Cause of Action: RICO damages pursuant to NRS 207.470 Racketeering”

- Cross-defendant Nationstar’s fraudulent misrepresentations and presentation of false evidence to two district courts obstructed a fair adjudication of Tobin’s claims in prior proceedings and before the Nevada Supreme Court.

- Cross-defendant Nationstar’s ex parte meeting with Judge Kishner on 4/23/19 damaged Nona Tobin and caused her pro se filings to be stricken unheard.

- See Complaint to the Nevada Commission on Judicial Discipline

- Cross-defendant Nationstar recorded false claims to steal Nona Tobin’s property.

- Cross-defendant Nationstar is judicially estopped from claiming that it ever was the beneficiary of the Hansen deed of trust. See Complaint against Melanie Morgan.

PRAYER

Nona Tobin’s AACC Prayer for relief is quoted here with links added to laws, regulations, documentary evidence or argument to support claims for relief and punitive damages. See the published “Nona Tobin’s, Red Rock’s & Nationstar’s prayers for relief”

This counterclaim has been necessitated by the COUNTER-DEFENDANT RRFS’s AND CROSS-DEFENDANT NATIONSTAR’s bad faith conduct.

Pursuant to Nevada law, COUNTER-CLAIMANT AND CROSS CLAIMANT NONA TOBIN’s may recover her attorney fees as special damages because she was required to file this suit as a result of COUNTER-DEFENDANT RRFS AND CROSS-DEFENDANT NATIONSTAR’ intentional conduct. (Sandy Valley Assocs. v. Sky Ranch Estates Owners Ass’n, 117 Nev. 948, 958, 35 P.3d 964, 970 (2001), citing American Fed. Musicians v. Reno’s Riverside, 86 Nev. 695, 475 P.2d 220 (1970).

COUNTER-CLAIMANT AND CROSS CLAIMANT NONA TOBIN petitions the Court to declare:

- that the disputed HOA sale is void due to fraud in the execution by Red Rock Financial Services;

- that the disputed HOA sale did not extinguish the GBH Trust’s, nor its successor in interest’s rights to title; See “Nona Tobin’s declaration under penalty of perjury” and Whatever happened to “equal protection under the law“?

- that Nona Tobin is entitled to the $57,282 undistributed proceeds of the sale with six+ plus years interest and exemplary penalties pursuant to NRS 42.005. (See 4/12/21 Tobin motion to distribute)

- that sanctions are appropriate vs. RRFS for its fraudulent conduct of HOA foreclosures sales; See “RRFS claims vs. actual $$ due“

- that sanctions are appropriate vs. RRFS for its falsification of records to evade detection of misappropriation of funds; See “Red Rock foreclosure file is false, falsified and fraudulent“

- that sanctions are appropriate vs. RRFS for its retention of proprietary control of the proceeds of the foreclosure of the subject property, and of approximately a dozen other Sun City Anthem 2014 foreclosures, when RRFS knew, or should have known, that the HOA Board was prohibited by Sun City Anthems bylaws from delegating proprietary control over funds collected for the sole and exclusive benefit of the association; See SCA bylaws 3.20/3.18 and “NRS 116.31164(3)(2013) vs. NRCP 22: Interpleader vs. HOA bylaws prohibiting delegation“

- that sanctions are appropriate vs. RRFS for its failure to distribute foreclosure proceeds timely after the sales, as mandated by NRS 116.31164(3): (See 4/12/21 Tobin motion to distribute)

- that sanctions are appropriate vs. RRFS for Koch & Scow’s unsupervised, unaudited retention of the funds of many, many HOA foreclosures allowed attorney trust fund violations to go undetected; See SCA bylaws 3.20/3.18

- Koch & Scow’s filed its unwarranted 6/23/20 motion to dismiss, its 8/3/20 reply in support, and its 12/3/20 order granting its motion to dismiss, knowing that all these filings contained many misrepresentations of material facts for which there was no factual support or evidence, defied NRCP 11 (b)(3), Nevada Rules of Professional Conduct 3.3 (candor to the tribunal), 3.4 (fairness to opposing counsel), 3.5A (relations with opposing counsel), 4.1 (truthfulness in statements to others), 4.4 (respect for the rights of third persons) and ABA (1992) Standards for Imposing Lawyer Sanctions 6.1 (False statements, fraud, and misrepresentation). (See 4/7/21 request for judicial notice.)

- that sanctions are appropriate vs. RRFS for its misappropriation of funds, covert rejection of assessments, falsification of records that allowed the unjust enrichment of undisclosed partners and co-conspirators; (See “SCA Board secretly sold a dozen houses in 2014” and “SCA Board did not properly authorize any foreclosure conducted by Red Rock” and “Red Rock foreclosure file is false, falsified and fraudulent” and “Deceptive disclosures: 12/5/13 meeting vs. SCA 315 & RRFS 148” and “SCA Board did not comply with HOA meeting laws” and Ombudsman’s Notice of Sale records for 17 foreclosures )

- that Nona Tobin is entitled to treble damages for the fraudulent confiscation of the subject property, valued on 12/27/19 at $505,000 property pursuant to NRS 207.470(1) as RRFS’s actions on the dozen 2014 unnoticed foreclosures constitute racketeering; (See “SCA Board secretly sold a dozen houses in 2014” and “SCA Board did not properly authorize any foreclosure conducted by Red Rock” and “Red Rock foreclosure file is false, falsified and fraudulent” and “Deceptive disclosures: 12/5/13 meeting vs. SCA 315 & RRFS 148” and “SCA Board did not comply with HOA meeting laws” and Ombudsman’s Notice of Sale records for 17 foreclosures )

- that sanctions are appropriate pursuant to NRCP 11 (b)(1)(2)(3)(4) and NRS 18.010(2) vs. RRFS for its filing the improper interpleader action with penalties as all other named defendants’ liens have been released and Nationstar mortgage is judicially estopped from claiming it ever was the beneficial owner of the Hansen deed of trust;

- that Nona Tobin, an individual’s, 3/28/17 deed is the sole valid title claim;

- that Jimijack’s defective, 6/9/15 deed was inadmissible as evidence to support its title claim pursuant to NRS 111.345; (See 1/17/17 Tobin DECL re notary fraud)

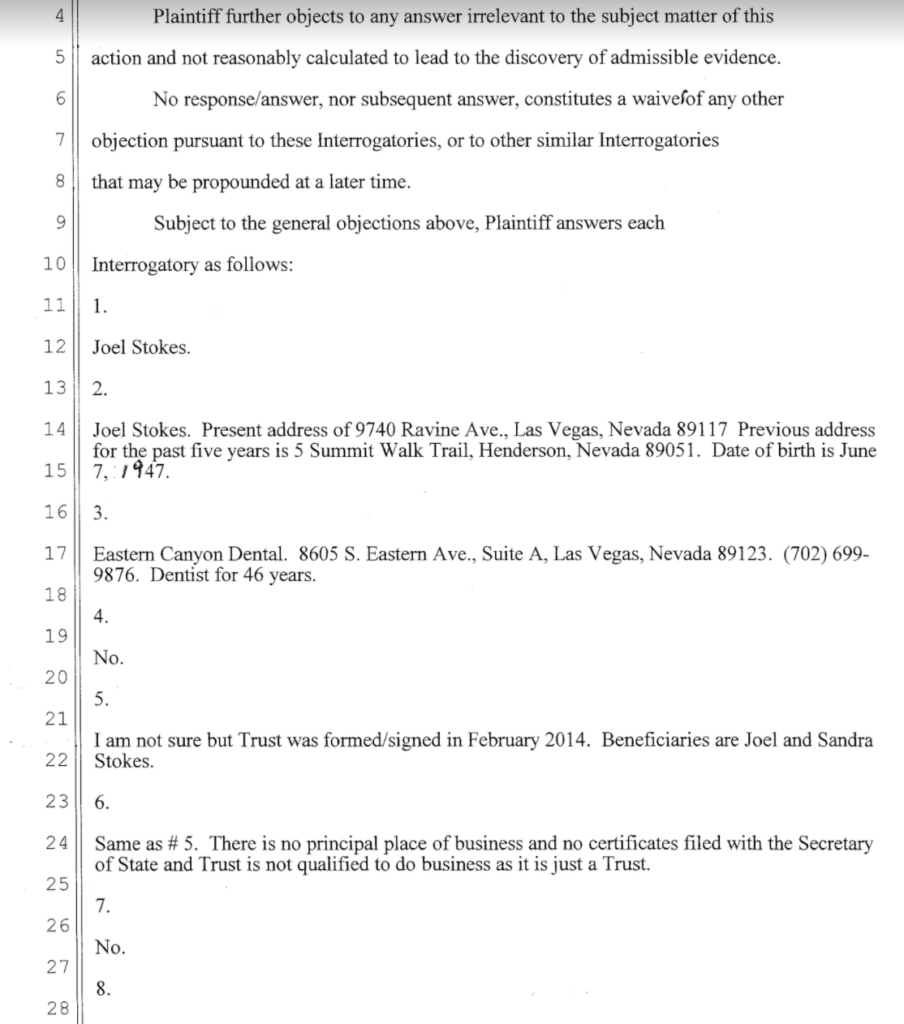

- that the Joel Stokes-Civic Financial Services “agreement”, recorded on 5/23/19, and misrepresented to Judge Kishner on 5/21/19 as the Nationstar-Jimijack settlement was fraud on the court and sanctionable conduct pursuant to NRCP 11 (b)(1)(2)(3)(4);

- that sanctions are appropriate vs. Nationstar and its Akerman attorneys pursuant to NRCP 11 (b)(1)(2)(3)(4) (misrepresentations in court filings), Nevada Rules of Professional Conduct 3.3 (candor to the tribunal), 3.4 (fairness to opposing counsel), 3.5A (relations with opposing counsel), 4.1 (truthfulness in statements to others), 4.4 (respect for the rights of third persons) and ABA (1992) Standards for Imposing Lawyer Sanctions 6.1 (False statements, fraud, and misrepresentation).

- To declare that Joel Stokes’ deed, recorded on 5/1/19, was void as Jimijack had no interest to convey and that this transfer prior to the 6/5/19 trial was for the corrupt purpose of deceiving the court into allowing Joel Stokes and Nationstar to perpetrate a fraud on the court;

- That Nona Tobin is entitled to recoup treble damages pursuant to NRS 207.470 and

- That Nona Tobin is entitled to recoup damages, five years of rental income from Jimijack;

- that Nationstar Mortgage LLC’s (Herein “NSM” or “Nationstar”) claims to own the beneficial interest of the disputed Western Thrift Deed of Trust (Herein “DOT”) are false and sanctionable under NRS 205.395, NRS 205.377, NRS 207.400 and that Nona Tobin is entitled to treble damages by their misconduct pursuant to NRS 207.470 and 480; See “All Declarations under penalty of perjury support Nona Tobin” and “Nationstar Mortgage’s fraud” and “Why Nationstar’s attorneys must be sanctioned and pay damages” and “Complaint against Melanie Morgan” and “1st complaint to the Nevada AG” and “2nd complaint to the Nevada Attorney General“

- that all instruments, encumbrances and assignments, and expungements of lis pendens that were improperly and/or unlawfully notarized, executed, or recorded to create false claims, or were done for the improper purpose of abrogating Tobin’s rights during the pendency of litigation, and/or prior to the adjudication of Plaintiff’s claims in this instant action, are cancelled and declared without legal force and effect; and See 4/7/21 request for judicial notice of relevant laws and “What is lis pendens?” and

- that attorneys pay Tobin’s attorney fees and costs as a sanction pursuant to NRCP 11(b)(1)(3) and/or NRS 18.010(2).

Tobin’s 3/8/21 AACC had 22 Exhibits

- APN 191-13-811-052 Clark County Property Record and allegations of fraud vs. all opposing parties

- the sale was void for rejection of assessments.

- The alleged default was cured three times,

- SCA Board did not authorize the sale by valid corporate action

- Required notices were not provided, but records were falsified to cover it up

- SCA Board imposed ultimate sanction with NO due process

- Neither BANA nor NSM ever owned the disputed DOT

- Examples of RRFS corrupt business practices

- Attorneys’ lack of candor to the tribunal

- the proceeds of the sale were not distributed pursuant to NRS 116.31164(3) (2013)

- RRFS’s fraud, oppression & unfairness

- attorney interference in the administration of justice

- lack of professional ethics and good faith

- Presented false evidence to cover up crime

- Civil Conspiracy to cover up racketeering warrants punitive damages

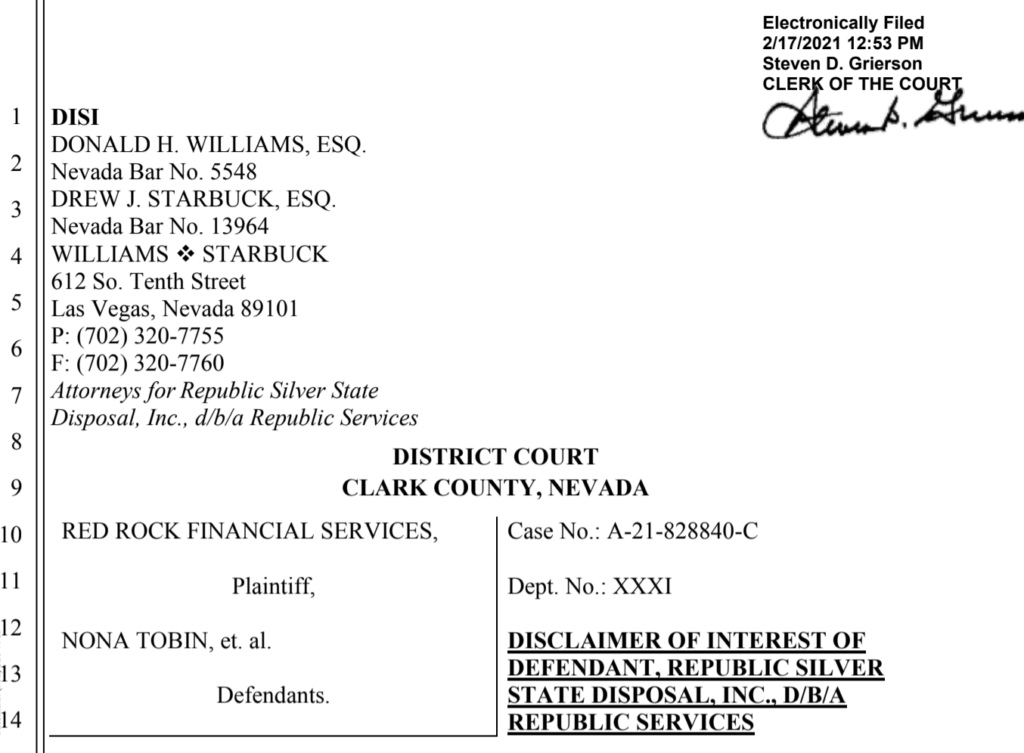

- Republic Services lien releases

- Nona Tobin’s standing as an individual

- Relevant statutes and regulations

- RELEVANT HOA GOVERNING DOCUMENTS PROVISIONS

- Administrative Complaints related to the APN 191-13-811-052 title dispute

- Nevada court cases related to the APN 191-13-811-052 title dispute

- Excerpts of 1/31/17 cross-claim vs. HOA and its agents

LEGAL STANDARD AND ARGUMENT

Motion for summary judgment

MSJ must be granted because counter and cross defendants didn’t file a responsive pleading to disput

The purpose of summary judgment is to identify and dispose of factually unsupported claims and defenses. See Celotex Corp. v. Catrett, 477 U.S. 317, 323–24, 106 S.Ct. 2548, 91 L.Ed.2d 265 (1986). Summary judgment is therefore appropriate if “the movant shows that there is no genuine dispute as to any material fact and the movant is entitled to judgment as a matter of law.” Fed.R.Civ.P. 56(a). “A party asserting that a fact cannot be or is genuinely disputed must support the assertion,” and can do so in either of two ways: by “citing to particular parts of materials in the record, including depositions, documents, electronically stored information, affidavits or declarations, stipulations (including those made for purposes of the motion only), admissions, interrogatory answers, or other materials”; or by “showing that the materials cited do not establish the absence or presence of a genuine dispute, or that an adverse party cannot produce admissible evidence to support the fact.” Fed.R.Civ.P. 56(c)(1).

“A fact is ‘material’ when, under the governing substantive law, it could affect the outcome of the case. A ‘genuine issue’ of material fact arises if ‘the evidence is such that a reasonable jury could return a verdict for the nonmoving party.’ ” Thrifty Oil Co. v. Bank of Am. Nat’l Trust & Sav. Ass’n, 322 F.3d 1039, 1046 (9th Cir.2003) (quoting Anderson v. Liberty Lobby, Inc., 477 U.S. 242, 248, 106 S.Ct. 2505, 91 L.Ed.2d 202 (1986)). Conversely, where the evidence could not lead a rational trier of fact to find for the nonmoving party, no genuine issue exists for trial. See Matsushita Elec. Indus. Co. v. Zenith Radio Corp., 475 U.S. 574, 587, 106 S.Ct. 1348, 89 L.Ed.2d 538 (1986) (citing First Nat’l Bank v. Cities Serv. Co., 391 U.S. 253, 289, 88 S.Ct. 1575, 20 L.Ed.2d 569 (1968)).

The moving party has the burden of persuading the court as to the absence of a genuine issue of material fact. Celotex, 477 U.S. at 323, 106 S.Ct. 2548;Miller v. Glenn Miller Prods., 454 F.3d 975, 987 (9th Cir.2006). The moving party may do so with affirmative evidence or by “ ‘showing’—that is, pointing out to the district court—that there is an absence of evidence to support the nonmoving party’s case.” Celotex, 477 U.S. at 325, 106 S.Ct. 2548. Once the moving party satisfies its burden, the nonmoving party cannot simply rest on the pleadings or argue that any disagreement or “metaphysical doubt” about a material issue of fact precludes summary judgment. See Celotex, 477 U.S. at 324, 106 S.Ct. 2548;Matsushita Elec., 475 U.S. at 586, 106 S.Ct. 1348;Cal. Architectural Bldg. Prods., Inc. v. Franciscan Ceramics, Inc., 818 F.2d 1466, 1468 (9th Cir.1987). The nonmoving party must instead set forth “significant probative evidence” in support of its position. T.W. Elec. Serv., Inc. v. Pac. Elec. Contractors Ass’n, 809 F.2d 626, 630 (9th Cir.1987) (quoting First Nat’l, 391 U.S. at 290, 88 S.Ct. 1575).Summary judgment will thus be granted against a party who fails to demonstrate facts sufficient to establish an element essential to his case when that party will ultimately bear the burden of proof at trial. See Celotex, 477 U.S. at 322, 106 S.Ct. 2548.

When evaluating a motion for summary judgment, the court must construe all evidence and reasonable inferences drawn therefrom in the light most favorable to the nonmoving party. See T.W. Elec. Serv., 809 F.2d at 630–31. Accordingly, if “reasonable minds could differ as to the import of the evidence,” summary judgment will be denied. Anderson, 477 U.S. at 250–51, 106 S.Ct. 2505.

Turner v. Haw. First Inc., 903 F. Supp. 2d 1037, 1042-44 (D. Haw. 2012)