Legal standard for interpleader was not met

“Legal Standard “In an interpleader action, the ‘stakeholder’ of a sum of money sues all those who might have claim to the money, deposits the money with the district court, and lets the claimants litigate who is entitled to the money.” Cripps v. Life Ins. Co. of N. Am., 980 F.2d 1261, 1265 (9th Cir. 1992)

Guardian Life Ins. Co. of Am. v. Pundyk, No. 2:16-cv-01196-APG-GWF, at *2-3 (D. Nev. Jan. 4, 2017) (“District courts have original jurisdiction over interpleader actions involving $500 or more in controversy if “two or more adverse claimants, of diverse citizenship…are claiming or may claim to be entitled to such money or property…” 28 U.S.C. § 1335(a).

Rule 22 of the Federal Rules of Civil Procedure allows interpleader of disputed funds where a Plaintiff is subject to double or multiple liability. Perfekt Mktg., LLC v. Luxury Vacation Deals, LLC, 2015 WL 10012987, at *2 (D. Nev. Nov. 16, 2015). The purpose of the interpleader is for the stakeholder to “protect itself against the problems posed by multiple claimants to a single fund.” Lee v. W. Coast Life Ins. Co., 688 F.3d 1004, 1009 (9th Cir. 2012).

An interpleader action typically involves two stages. Id. In the first stage, the district court decides whether the requirements for a rule or statutory interpleader action have been met by determining if there is a single fund at issue and whether there are adverse claimants to that fund. Id. If the Court finds that the interpleader action has been properly brought, it then makes a determination of the respective rights of the claimants. Id.”)

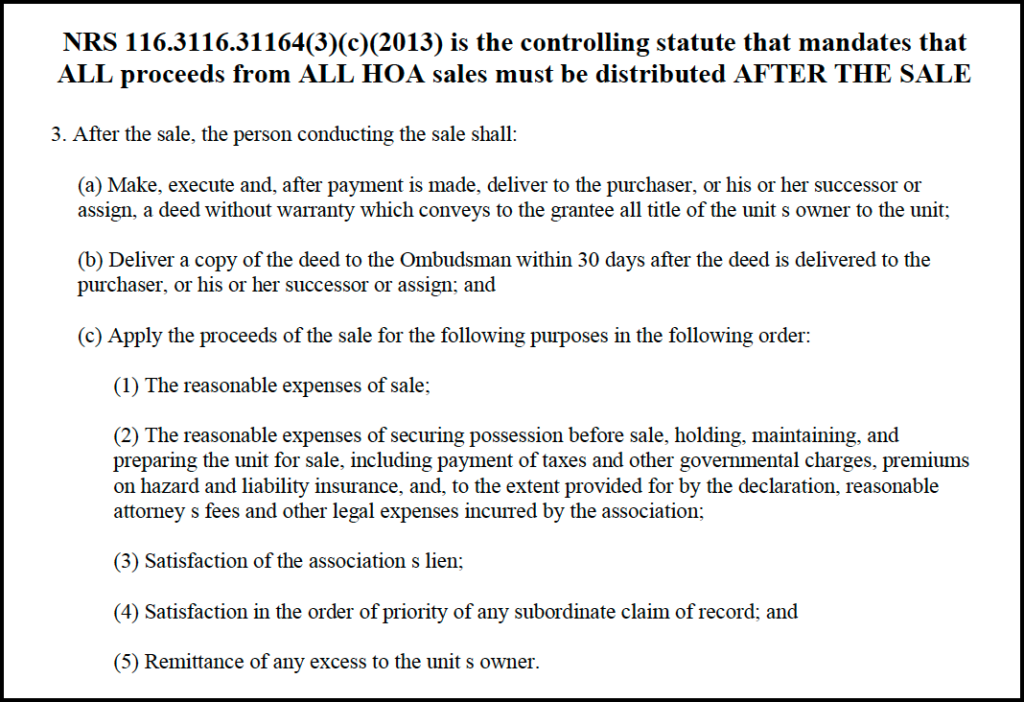

All proceeds were legally required to be distributed AFTER THE SALE in 2014.

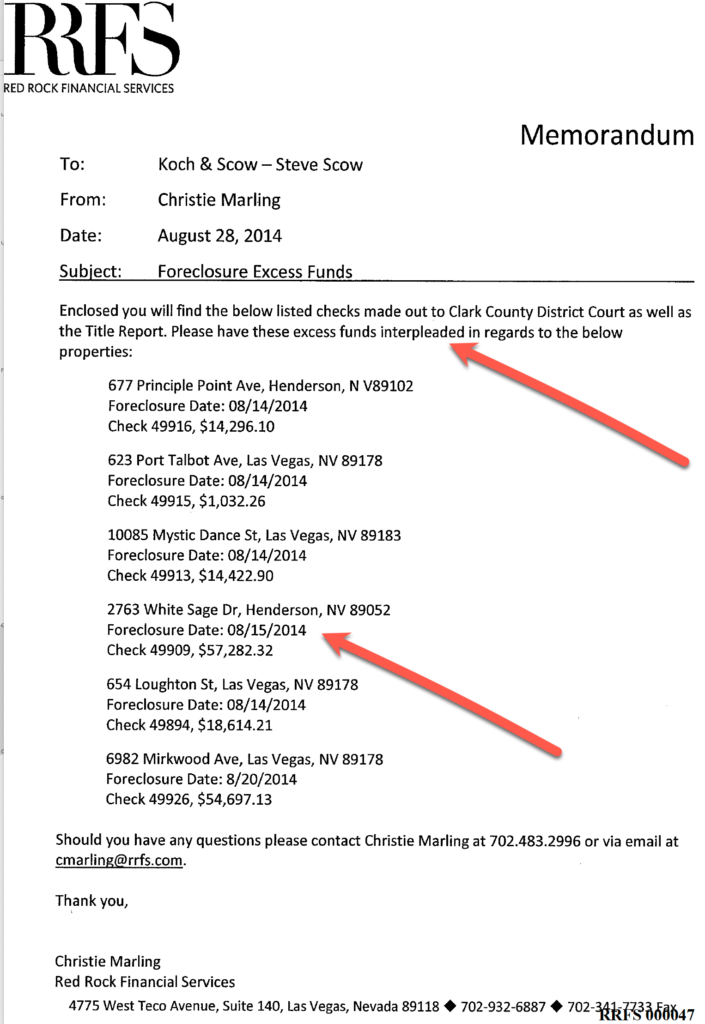

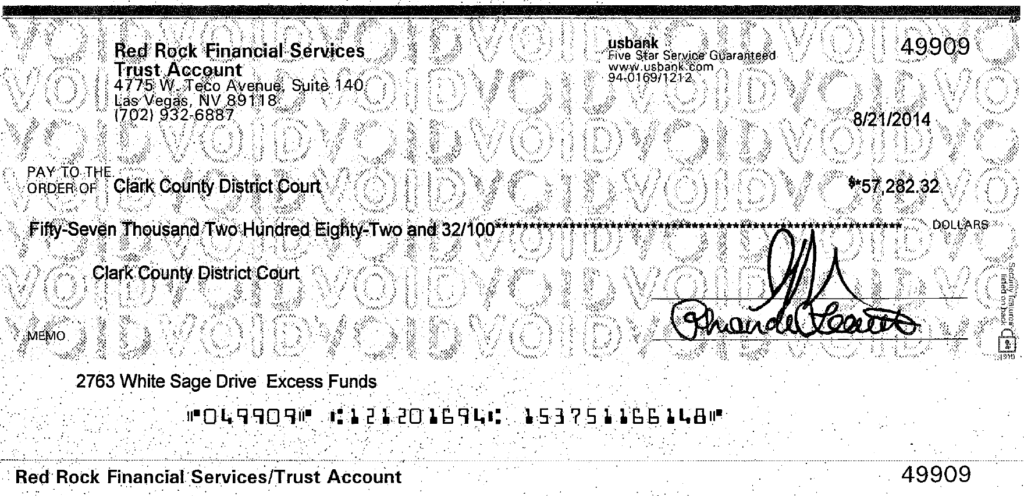

rrfs 047

The interpleader complaint in 2021 was meritless.

Steven Scow filed for interpleader in 2021 when his client FirstService Residential dba Red Rock Financial Services (EIN 88-0358-132) instructed him to remit a check designated as excess proceeds to the court as the law required.

In 2021 Steven Scow did not deposit the stale 2014 check to the court nor did he admit he had defied the law and his client’s instructions for seven years.

2/3/21 Scow filed the complaint knowing Red Rock did not have standing to file for interpleader in 2021 when he had been instructed to remit the funds to court on 8/28/14.

“Legal Standard “In an interpleader action, the ‘stakeholder’ of a sum of money sues all those who might have claim to the money, deposits the money with the district court, and lets the claimants litigate who is entitled to the money.” Cripps v. Life Ins. Co. of N. Am., 980 F.2d 1261, 1265 (9th Cir. 1992)

Guardian Life Ins. Co. of Am. v. Pundyk, No. 2:16-cv-01196-APG-GWF, at *2-3 (D. Nev. Jan. 4, 2017) (“District courts have original jurisdiction over interpleader actions involving $500 or more in controversy if “two or more adverse claimants, of diverse citizenship…are claiming or may claim to be entitled to such money or property…” 28 U.S.C. § 1335(a).

Rule 22 of the Federal Rules of Civil Procedure allows interpleader of disputed funds where a Plaintiff is subject to double or multiple liability. Perfekt Mktg., LLC v. Luxury Vacation Deals, LLC, 2015 WL 10012987, at *2 (D. Nev. Nov. 16, 2015). The purpose of the interpleader is for the stakeholder to “protect itself against the problems posed by multiple claimants to a single fund.” Lee v. W. Coast Life Ins. Co., 688 F.3d 1004, 1009 (9th Cir. 2012).

An interpleader action typically involves two stages. Id. In the first stage, the district court decides whether the requirements for a rule or statutory interpleader action have been met by determining if there is a single fund at issue and whether there are adverse claimants to that fund. Id. If the Court finds that the interpleader action has been properly brought, it then makes a determination of the respective rights of the claimants. Id.”)

High Noon at Arlington Ranch Homeowners Ass’n, Nonprofit Corp. v. Eighth Judicial Dist. Court of State, 402 P.3d 639, 645-46 (Nev. 2017) (“Under Nevada law, an action must be commenced by the real party in interest—”one who possesses the right to enforce the claim and has a significant interest in the litigation.” Szilagyi v. Testa , 99 Nev. 834, 838, 673 P.2d 495, 498 (1983) ; see NRCP 17(a). Generally, a party has standing to assert only its own rights and cannot raise the claims of a third party not before the court. Deal v. 999 Lakeshore Ass’n , 94 Nev. 301, 304, 579 P.2d 775, 777 (1978)”)

Stockmeier v. State, Dep’t of Corrections, 122 Nev. 385, 393 (Nev. 2006) (“This court has a “long history of requiring an actual justiciable controversy as a predicate to judicial relief.” In cases for declaratory relief and where constitutional matters arise, this court has required plaintiffs to meet increased jurisdictional standing requirements. However, where the Legislature has provided the people of Nevada with certain statutory rights, we have not required constitutional standing to assert such rights but instead have examined the language of the statute itself to determine whether the plaintiff had standing to sue.”)

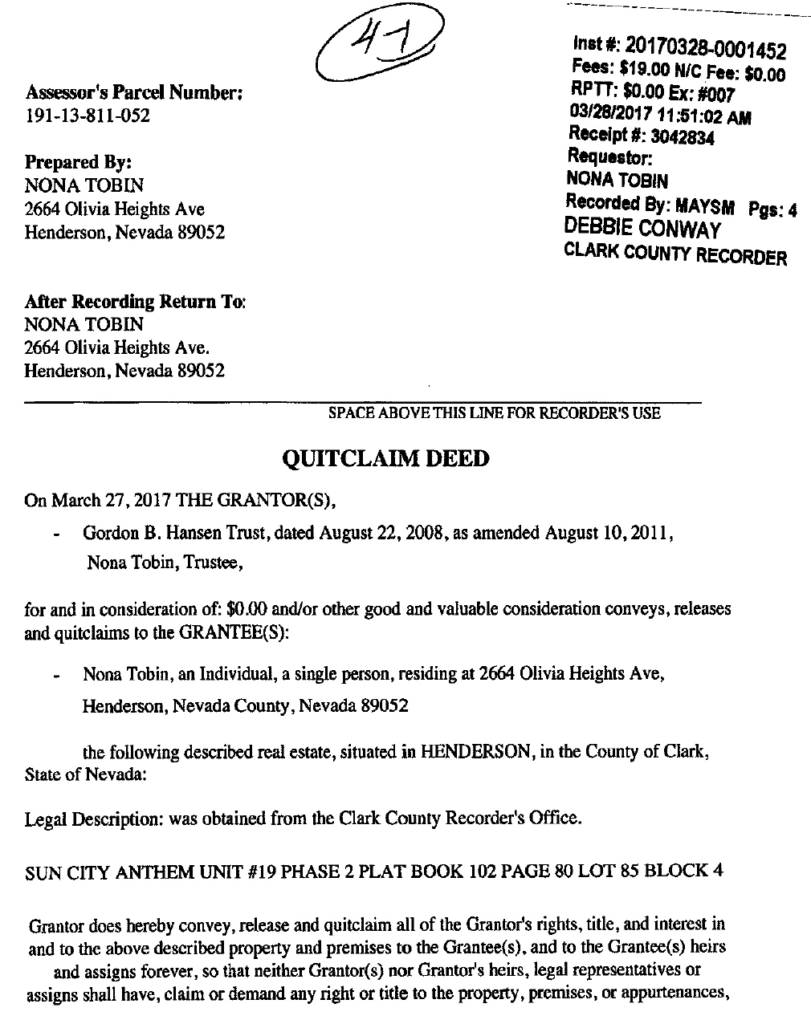

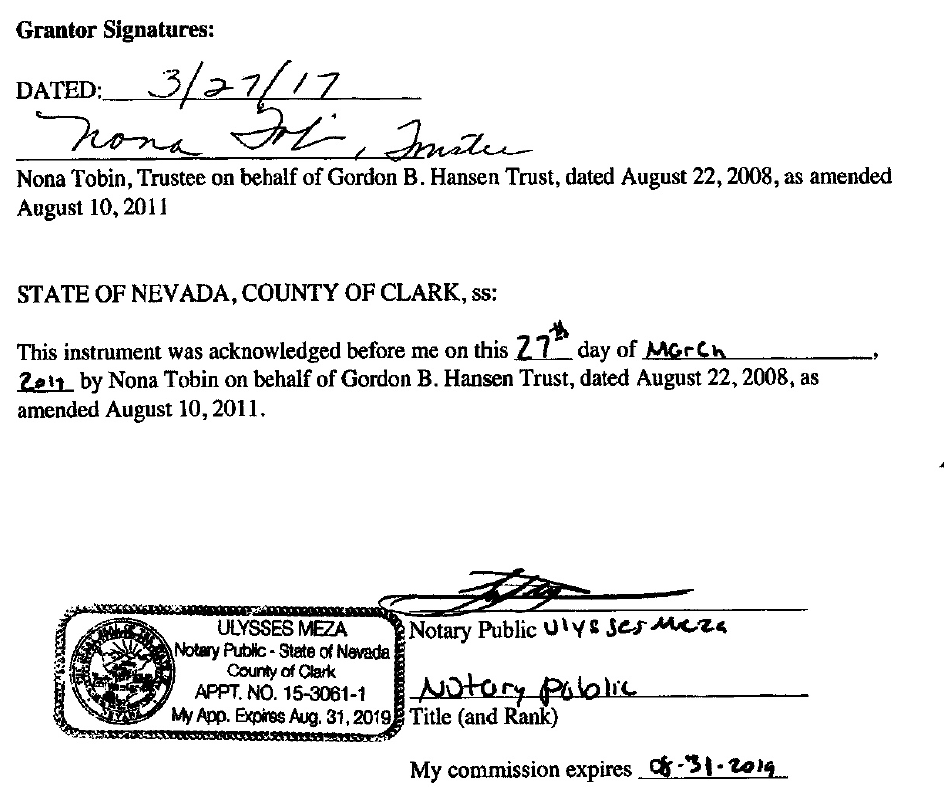

My 3/28/17 deed made me the only one with with standing to assert a claim for the proceeds as all other liens were released by mid-2019 before the 1st action was decided.

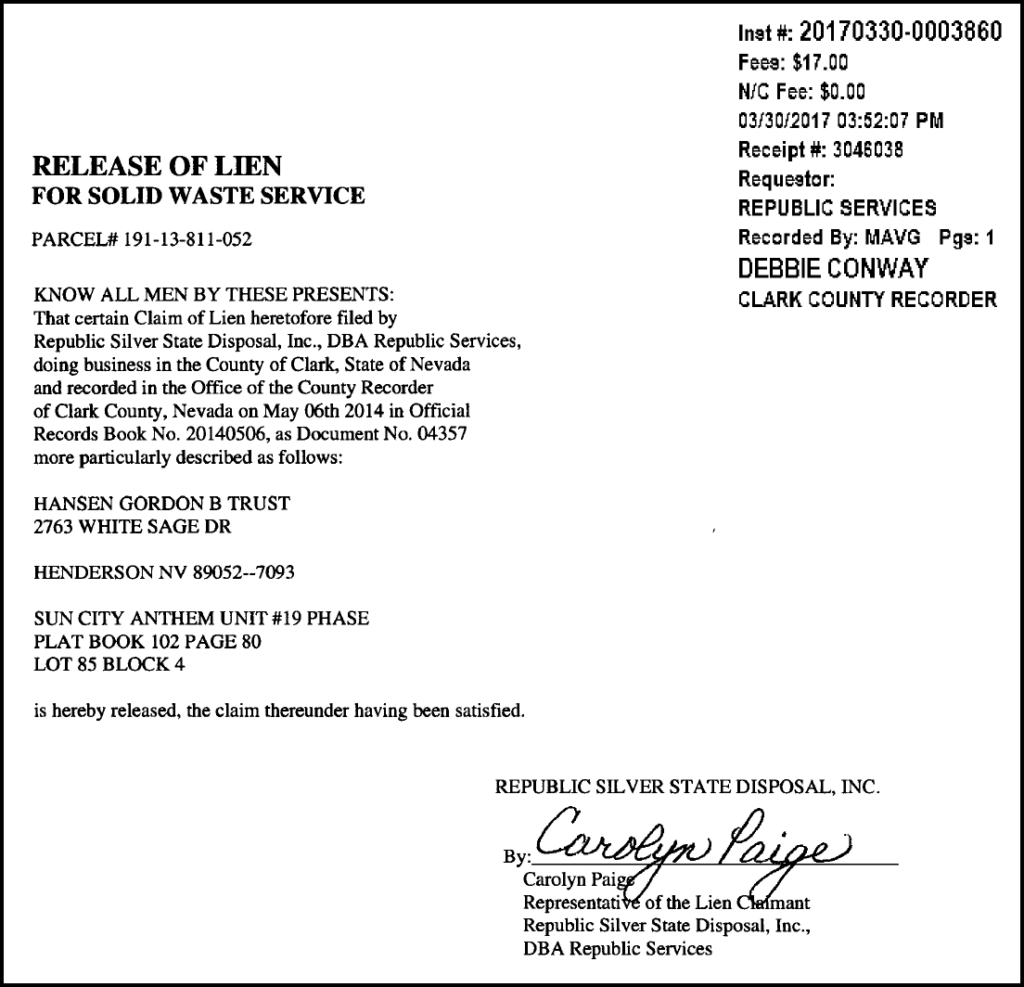

3/30/17 Republic Services released both its garbage liens due to the 3-year statute of limitations on non-enforcement.

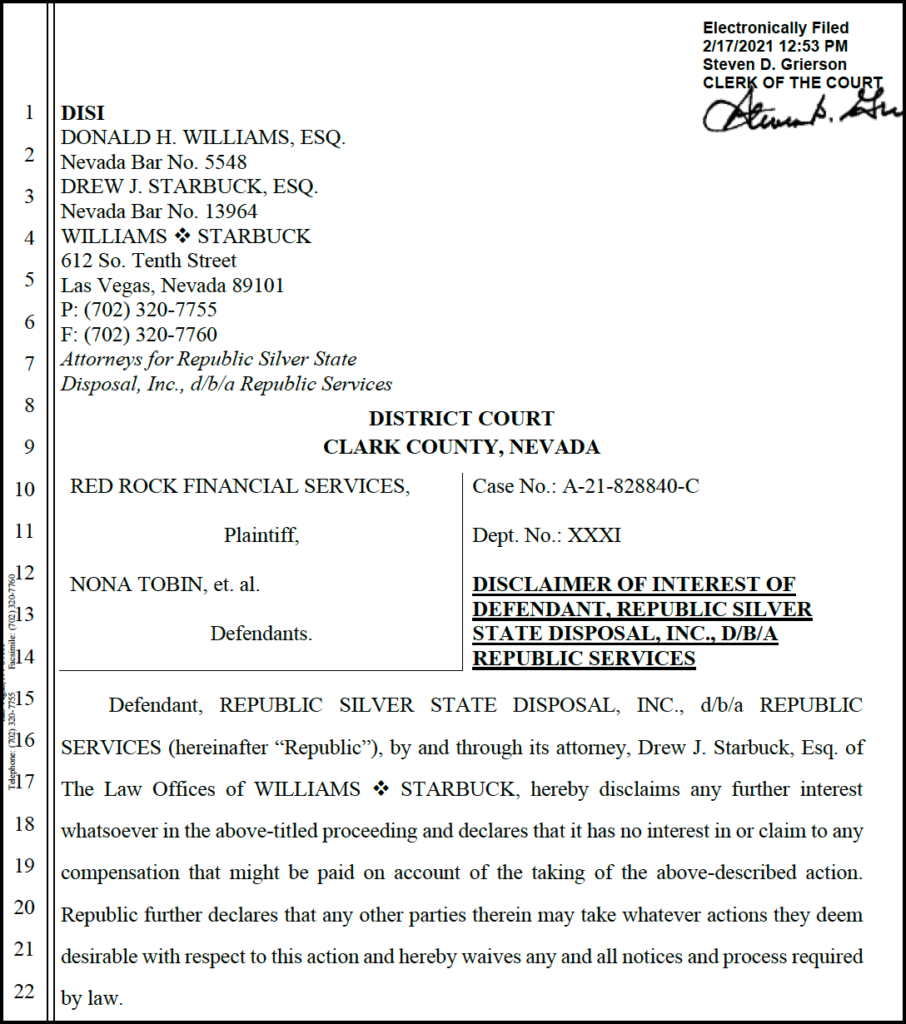

2/17/21 Republic Services filed a disclaimer of interest and withdrew from the lawsuit the day after it was served

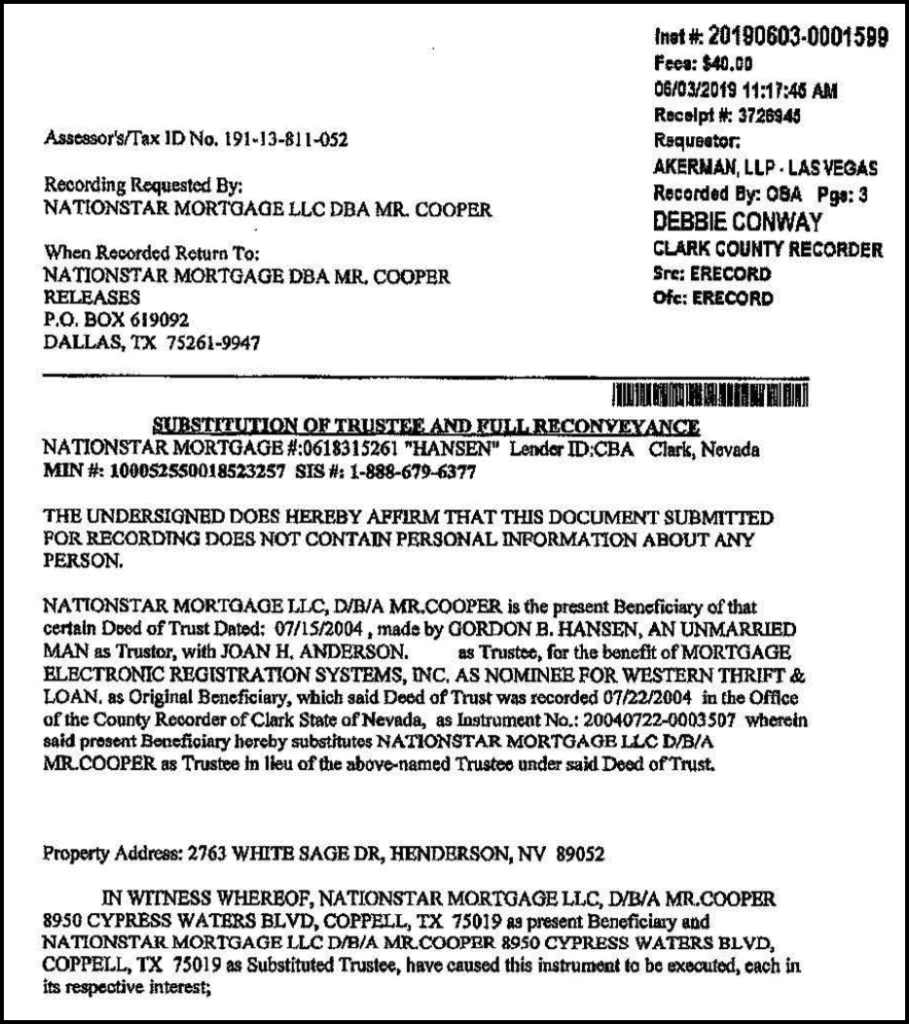

6/3/19 Nationstar released the lien of the Western Thrift & Loan 1st deed of trust

Two days before the quiet title trial in the first action, Nationstar recorded a release of the lien of the first deed of trust, delivering the property free and clear to Joel A. Stokes, a non-party individual. In return for recording this unauthorized lien release, Nationstar received $355,000. As a result, Joel A. Stokes and Sandra F. Stokes, trustees of the Jimijack Irrevocable Trust, gained quiet title in the first action’s trial, despite the fact that Jimijack’s deed, inadmissible as evidence and leqally insufficient to hold or transfer title, had been covertly quitclaimed to the non-party before the trial. The trial did not consider evidence as mandated by NRS 40.110.

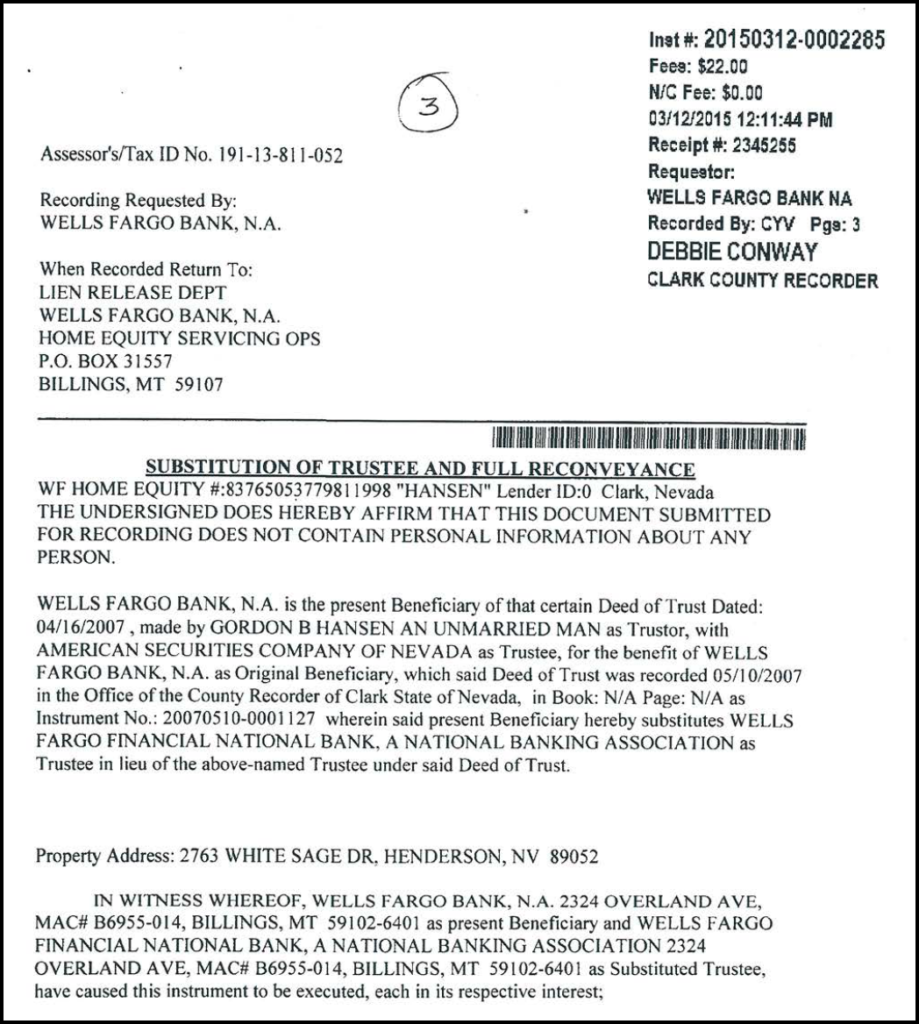

3/12/15 Wells Fargo released the lien of the Wells Fargo 2nd deed of trust

Link to 3/12/15 PDF of Wells Fargo’s 2nd deed of trust lien release

Wells Fargo was not involved in the first two actions. The bank filed an IRS Form 1099-C to cancel the outstanding $15,000 debt on the line of credit after the borrower, Gordon Bruce Hansen, passed away on January 14, 2012. However, they didn’t release the lien until a few months after the HOA sale. Wells Fargo never asserted to be the beneficiary of Hansen’s July 22, 2004, first deed of trust, and was likely unaware of Bank of America’s recorded corporate assignment of its non-existent interest.

Additionally, Wells Fargo probably didn’t know that debt buyer Nationstar intermittently claimed to service the loan on their behalf, or that Akerman LLP alleged that they were authorized to represent Wells Fargo in the A-21-828840-C interpleader action.