What is the dispute with Nationstar?

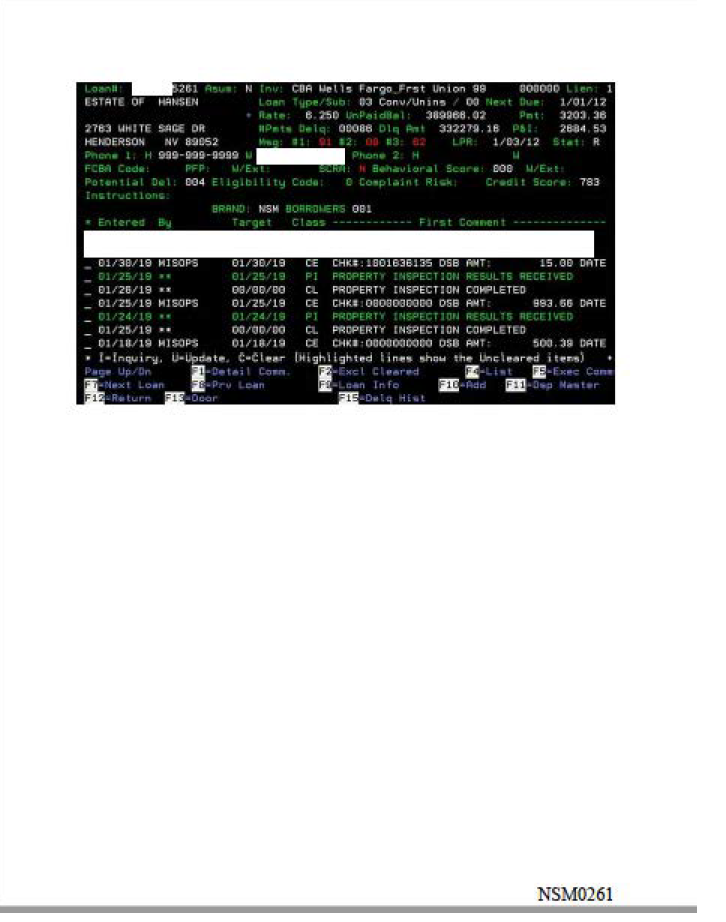

The dispute is over a $436,000 Western Thrift & Loan Deed of Trust (DOT) executed by Gordon Hansen on 7/15/04. Nationstar serviced the loan beginning on 12/1/13 on behalf of an investor NSM refused to identify.

On 12/1/14, Nationstar recorded a claim that Nationstar was owed the $389,000 balance that remained outstanding after the borrowerʼs death.

Link to Nationstar’s 12/1/14 claim

Link to Nationstar’s 3/8/19 rescission of its 12/1/14 claim

That Nationstar rescinded its provably false, opportunistic claim didn’t stop Nationstar from stealing a house for a debt it was not owed.

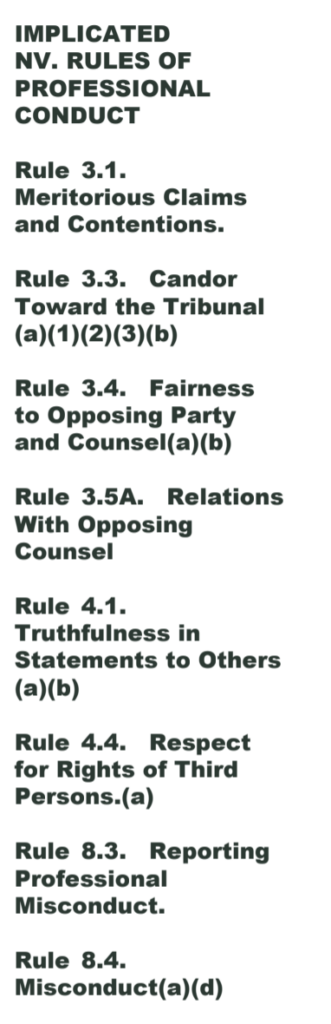

Laws implicated when considering appropriate sanctions for Nationstar and its attorneys

BANK FRAUD/RACKETEERING/RECORDING FALSE CLAIMS

- NRS 205.330 Fraudulent conveyances.

- NRS 205.372 Mortgage lending fraud; penalties; civil action.

- NRS 205.377 Multiple transactions involving fraud or deceit in course of enterprise or occupation; penalty.

- NRS 205.380 Obtaining money, property, rent or labor by false pretenses.

- NRS 205.395 False representation concerning title; penalties; civil action.

- NRS 205.405 Falsifying accounts.

- Racketeering

- NRS 207.360 “Crime related to racketeering” defined.

- NRS 207.400 Unlawful acts; penalties.

- NRS 207.470 actions for damages resulting from racketeering.

- NRS 207.480 Order of court upon determination of civil liability.

- NRS 207.520 Limitation of actions.

CONFISCATION OF PROPERTY WITHOUT FORECLOSING

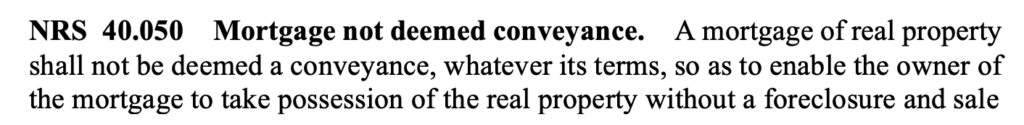

- NRS 40.050 Mortgage not deemed conveyance.

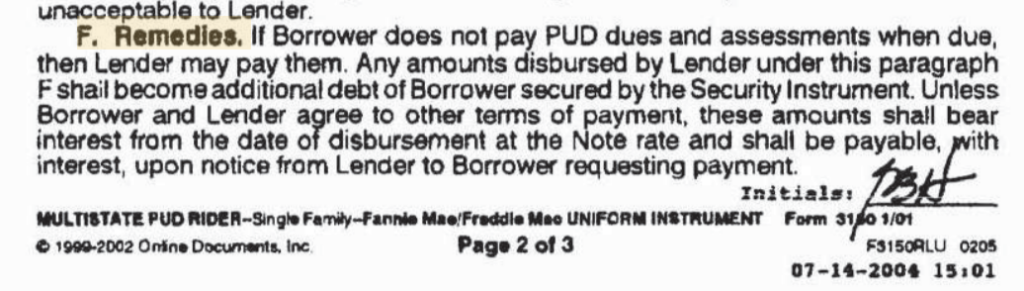

- PUD Rider F. Remedies

Attorney sanctions

NRCP 11

(b) Representations to the Court. By presenting to the court a pleading, written motion, or other paper — whether by signing, filing, submitting, or later advocating it — an attorney or unrepresented party certifies that to the best of the person’s knowledge, information, and belief, formed after an inquiry reasonable under the circumstances:

(1) it is not being presented for any improper purpose, such as to harass, cause unnecessary delay, or needlessly increase the cost of litigation;

(2) the claims, defenses, and other legal contentions are warranted by existing law or by a nonfrivolous argument for extending, modifying, or reversing existing law or for establishing new law;

(3) the factual contentions have evidentiary support or, if specifically so identified, will likely have evidentiary support after a reasonable opportunity for further investigation or discovery; and

(4) the denials of factual contentions are warranted on the evidence or, if specifically so identified, are reasonably based on belief or a lack of information.

Link to Nevada Rules of Professional Conduct

No bank foreclosure was ever initiated on the Hansen deed of trust. Nationstar just stole it.

Neither servicing bank, (Nationstar succeeded Bank of America as servicing on 12/1/13) foreclosed on the Hansen DOT even though it was in default after Hansen died on 1/14/12.

Had Nationstar been the beneficiary of the DOT, it would have foreclosed or collected the debt by allowing the property to be sold at fair market value. NSM did not record a notice of default on the Hansen DOT.

Nationstar did not allow the property to be sold to MZK for $367,500 on 5/8/14. Nationstar did not complain when RRFS rejected its 5/28/14 super-priority offer of $1100 to close the MZK escrow.

Nationstar allowed the property to be sold for $63,100 while a $358,800 was pending lender approval .

Then, three months after the HOA foreclosed to collect $2,000 in delinquent HOA dues, NSM claimed that Bank of America gave NSM the Hansen DOT on 10/23/14.

Nationstar recorded and filed false claims and dismissed all its claims without adjudication

Link to Plaintiff Nationstar’s 1/11/16 complaint

Link to Nationstar’s 2/20/19 stipulation to dismiss its claims

Link to Nationstar’s 4/12/16 motion to substitute as real party in interest, set aside default and intervene

Link to Nationstar’s only other filed claims: 6/2/16 AACC claims against Jimijack

Link to Counter-claimant Nationstar’s 5/31/19 stipulation to dismiss its 6/2/16 claims

Nationstar did not file any claims against Nona Tobin or against the Hansen Trust

Nationstar never refuted any of the claims Nona Tobin asserted against Nationstar, but got away with it by lying to the court

Link to 4/10/19 Nona Tobin opposition to Nationstar’s motion for summary judgment vs Jimijack and motions for summary judgment that was stricken from the record unheard due to Nationstar’s attorney Melanie Morgan’s ex parte misrepresentations to Judge Kishner

Link to 4/17/19 Nona Tobin reply in support of joinder to Nationstar’s motion for summary judgment vs Jimijack and motions for summary judgment that was stricken from the record unheard due to Nationstar’s attorney Melanie Morgan’s ex parte misrepresentations to Judge Kishner

Link to 7/22/19 Nona Tobin motion for a new trial pursuant to NRCP (b) and NRCP 59(a)(1)(A)(B)(C)(F) that was stricken from the record unheard due to ALL opposing counsels’ misrepresentations to Judge Kishner

Link to 7/29/19 Nona Tobin motion to dismiss Judge Kishner’s orders for lack of jurisdiction for Nationstar’s and Jimijack’s noncompliance with NRS 38.310 that was stricken from the record unheard due to ALL opposing counsels’ misrepresentations to Judge Kishner

Link to unheard 4/24/19 MVAC & MSJ Nona Tobin motion to vacate Judge Kishner’s 4/18/19 order that granted Nationstar’s limited joinder to the HOA’s unwarranted motion for summary judgment pursuant to NRCP 60(b)(3) fraud on the court and motion for summary judgment vs. all parties that languishes on the record unheard due to ALL opposing counsels’ misrepresentations to Judge Kishner about Nona Tobin’s right to represent herself.

Nationstar prevailed despite ALL declarations under penalty of perjury support Nona Tobin and not Nationstar, by tricking the court into ignoring all the evidence, such as…

EXHIBITS TO 5/23/19 TOBIN RPLY TO

SCA 5/2/19 OPPM TO TOBIN MOTION TO RECONSIDER AND

JIMIJACK’S 5/3/19 JOINDER TO SCA AND

NSM’S 5/3/19 JOINDER TO SCA OPPM

Exhibit “1”; April 20, 2019 Tobin declaration

Exhibit “2”May 11, 2018 and May 13, 2019 Leidy declaration

Exhibit “3” May 20, 2019 Proudfit declaration

Exhibit “4″ Resident Transaction Reports for 2763 White Sage 2664 Olivia Heights

Exhibit “5” No valid Board authorization for sale

Exhibit “6” Proposed Findings of Fact

Exhibit “7” Authenticated OMBUDSMAN NOS records for 17 foreclosures

Exhibit “8” 2nd NOS for two sales but not for 2763

Exhibit “9” March 22, 2019 Tobin DECL opposing NSM MSJ vs. Jimijack

Exhibit “10” April 12, 2019 MSJ v. Jimijack

No affidavits support Nationstar’s claims, but so what?

In its 3/27/17 OMSJ, Nationstar claimed that on 12/1/14 Wells Fargo had given NSM the DOT. This was supported by a duplicitous declaration regarding business records.

Link to 3/8/19 Nationstar rescission of its 12/1/14 claim that Bank of America assigned its interest to Nationstar

Link to 3/8/19 Nationstar claim Wells Fargo assigned its interest to Nationstar

In February 2019, Nationstar refused to produce any documents in response to Tobinʼs RFDs and interrogatories to prove any of its claims.

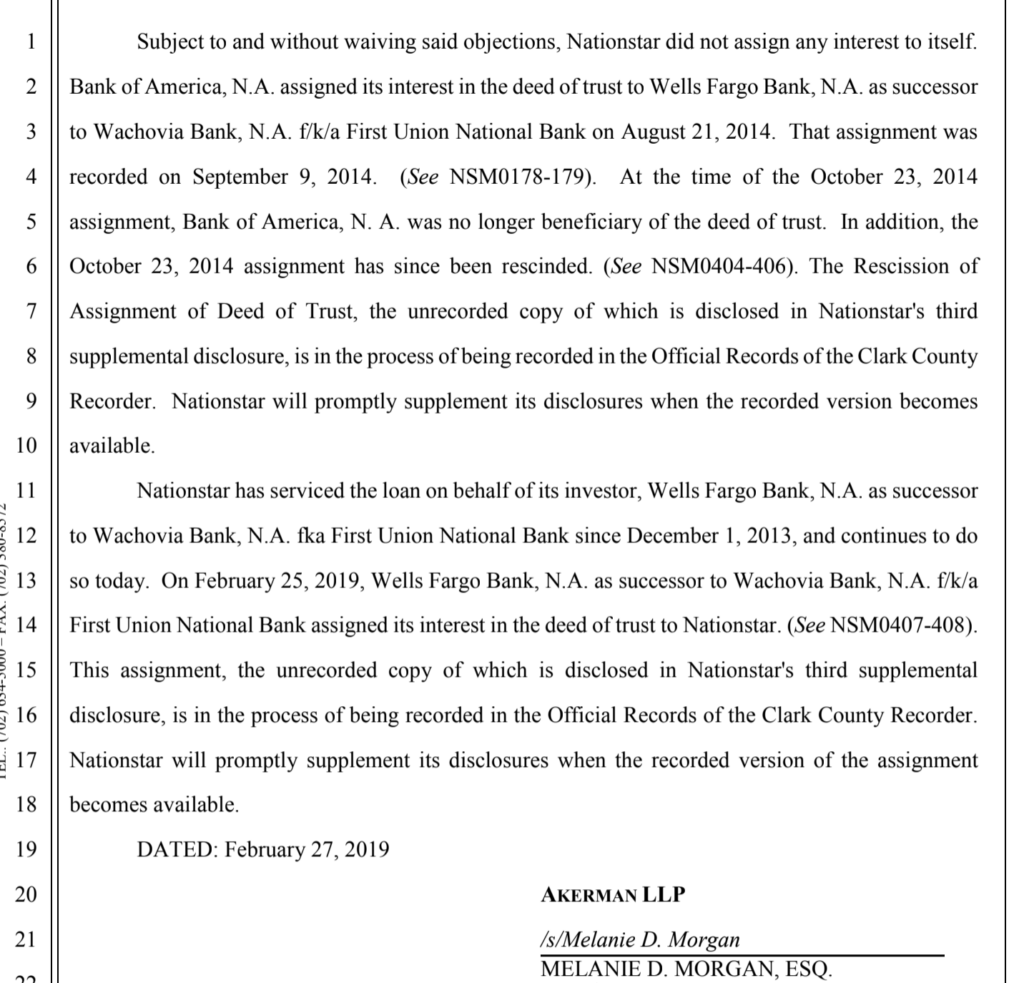

On 3/8/19, Nationstar recorded that it rescinded its 12/1/14 claim that it got its interest from Bank of America, and then two hours later recorded that it had Wells Fargoʼs undisclosed power of attorney to give Nationstar the authority to assign Wells Fargoʼs non-existent interest to Nationstar.

Nationstar produced no proof that it owned the Hansen DOT during two lawsuits over the validity of the HOA sale.

All the evidence Nationstar entered into the record actually proved the opposite, but it was never subjected to judicial scrutiny Nationstar.

The real owner of the Hansen DOT would have supported Tobinʼs efforts to void the sale so the DOT would not have survived as it the sale had never happened.

Tobin and Nationstar were initially aligned to get the court to void the HOA sale until Nationstar learned that it would be impossible to foreclose on Tobin since Tobin had put it into the record that she had documents that could prove NATIONSTAR did not have the standing to foreclose.

Nationstarʼs covert deal with Joel Stokes was solely to prevent the Court from conducting an evidentiary hearing that would have exposed the inconvenient truth that neither Nationstar nor Stokes could prove their claims.

Nationstar was excused from trial by saying all claims had been resolved by Nationstar-Jimiack settlement.

Link to Nationstar-Jimijack “settlement which was really a $355,000 deal between Civic Financial services and Joel Stokes

The HOA wrongly foreclosed, but not without Nationstarʼs assistance.

The banks could have stopped the HOA from foreclosing by recording a Notice of Default (NRS 116.31162(6)).

The HOA sale should have been cancelled when BANAʼs agent tendered $825 on 5/9/13 to cure the nine months that were then delinquent.

The HOA sale would have been avoided if the serving banks had not prevented four escrows from closing as escrows instructions were to pay the HOA whatever it demanded.

The HOA sale would have been avoided if Nationstar had not rejected the 5/8/14 $367,500 www.auction.com sale to MZK Properties.

Nationstar, the servicing bank that is supposed to be a fiduciary, acting on behalf of the investor, turned a blind eye to an 8/15/14 HOA sale for 18% of the $367,500 www.auction.com sale price that Nationstar had just rejected.

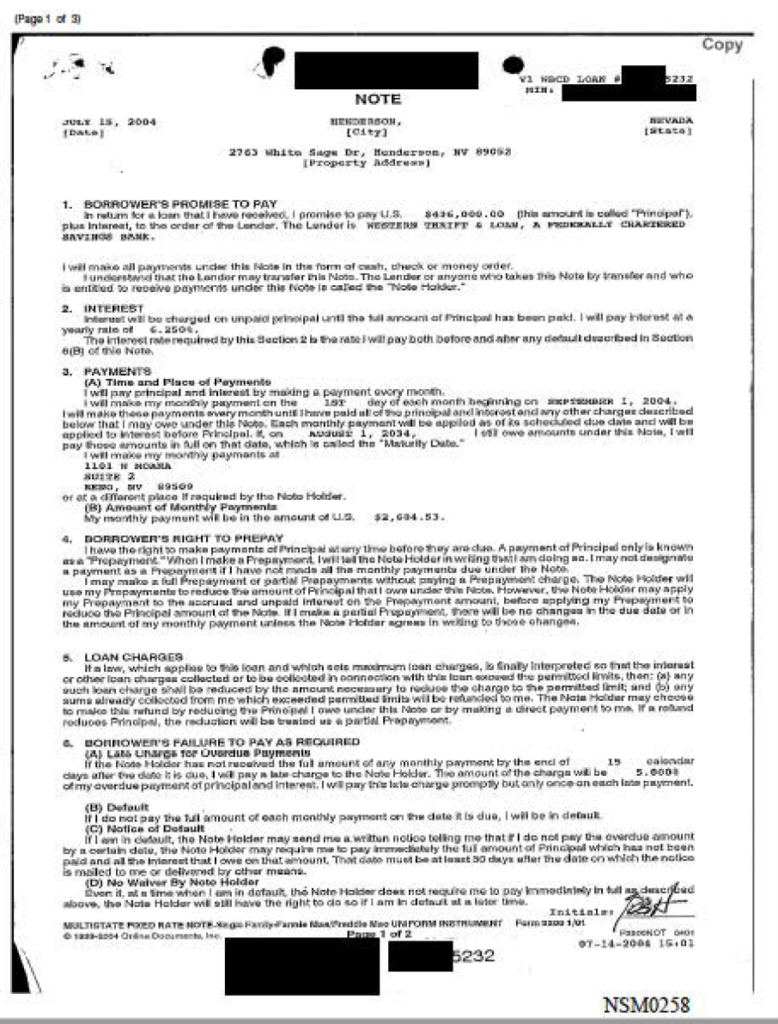

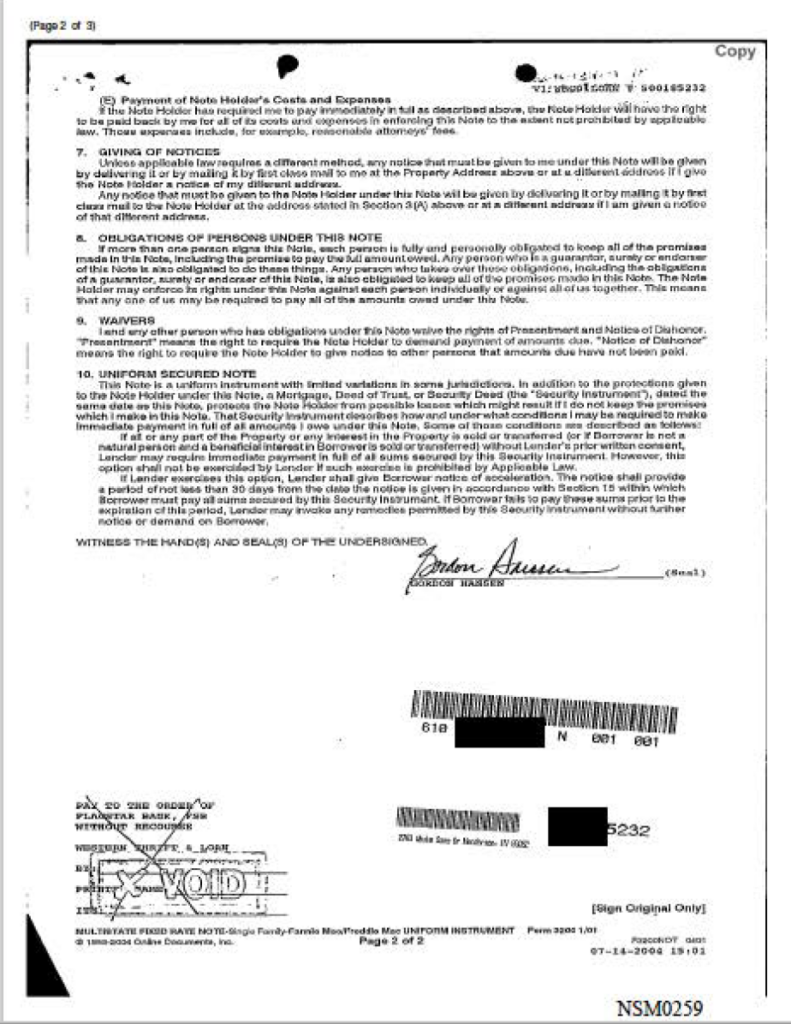

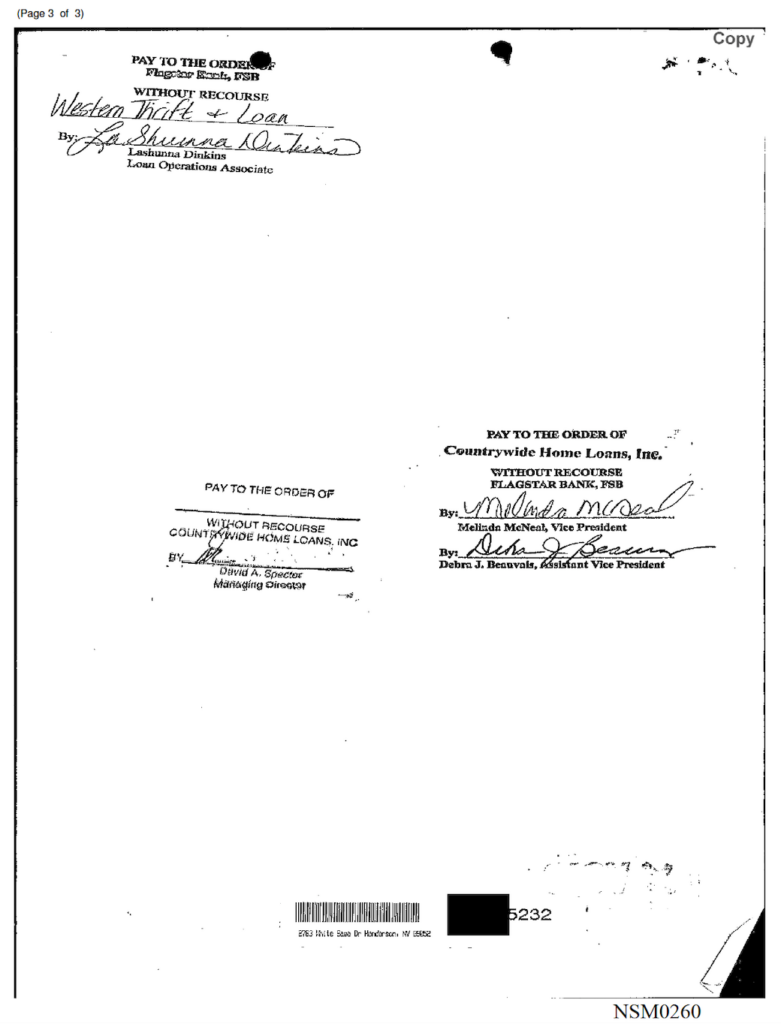

NATIONSTAR does not hold the original Hansen promissory note.

NSM 258-259 is a COPY of the Hansen promissory note that Nationstar entered into the record to trick the Court.

NSM does not have Hansenʼs original note, but NSM tried to conceal that fact by disclosing a COPY in NSM 258

NSM 260 shows no endorsement of Hansenʼs note to Nationstar or to ANY of the lenderʼs NSM claims assigned the note to Nationstar.

3/27/17 NSM filed a DECL that misrepresents its servicing bank record to deceive the court that NSM had no proof it owned the DOT

All Nationstar’s and Bank of America’s recorded actions affecting the Hansen deed of trust are fraudulent

All Nationstar’s disclosures in discovery were deceptive and fraudulent

Link to 12/26/18 Nona Tobin’s statement of claims vs Nationstar

Link to 2/9/18 Nationstar Individual Case Conference Report and initial disclosures

Link to 2/7/19 Nationstar 1st supplemental disclosures

Link to 2/12/19 Nationstar 2nd supplemental disclosures

Link to 2/27/19 Nationstar 3rd supplemental disclosures

Link to 3/12/19 Nationstar 4th supplemental disclosures (served two weeks after discovery ended on 2/28/19)

Nationstar refused to produce any documents requested in discovery

Link to 2/21/19 Nationstar response to Nona Tobin’s request for documents

Link to 2/21/19 Nationstar response to Nona Tobin’s interrogatories

Link to 2/28/19 Nationstar 1st supplemental response to Nona Tobin’s request for documents

Link to 2/28/19 Nationstar 1st supplemental response to Nona Tobin’s interrogatories

Wells Fargo did not assign anything to Nationstar.

Page 7 is Morgan’s totally deceptive ploy to obfuscate the fact that Nationstar has no valid claim to be the beneficiary.

Servicing banks (those that handle the paperwork on behalf of the “beneficiary” who is the investor to whom the debt is actually owed).

The dispute with Nationstar is not because Nationstar wrongly foreclosed on the Hansen deed of trust.

The dispute is caused by:

- Both BANA & Nationstar obstructing multiple fair market value, arms-length sales, approved by the Hansen Estate.

- Nationstar’s letting the HOA foreclose without notice for 18% of the $367,500 www.auction.com sale that Nationstar had just rejected, and then

- After the Hansen DOT was extinguished by the HOA foreclosure, Nationstar lied on the record about being owed the $389,000 outstanding balance on Hansenʼs DOT.

- According to NRS 107.28, (2.) A trustee under a deed of trust must not be the beneficiary of the deed of trust for the purposes of exercising the power of sale pursuant to NRS 107.080, but Nationstar claimed to be both the beneficiary and the trustee – when it was neither – and reconveyed the property to Joel Stokes on 6/3/19 to steal the house from Nona Tobin

- The Clark County Recorderʼs Office Property Record shows NSM began recording conflicting claims on 12/1/14, more than three months after the HOA sale.

- Nationstar lied in its 1/11/16 complaint to say that some unspecified entity had assigned its interest to Nationstar on 2/4/11

- BANA & NSM recorded 11 claims regarding the Hansen DOT, but neither ever recorded a Notice of Default, the mandatory condition precedent to the trusteeʼs executing the power of sale on behalf of the beneficiary.

- No bank has the right to confiscate a property without foreclosing by following the notice and due process steps defined in NRS 107.080, as amneded by AB 284 (21011), Nevada’s anti-foreclosure fraud law.