Cross-claim VS. NATIONSTAR MORTGAGE & WELLS FARGO

Comes now, Defendant NONA TOBIN, AN INDIVIDUAL by and through her attorney of record, Thomson Law PC, through attorney John W. Thomson, Esq., and hereby files her CROSSCLAIM VS, NATIONSTAR MORTGAGE LLC AND WELLS FARGO, N.A. AND MOTION FOR SANCTIONS PURSUANT TO NRCP 11 (b)(1)(2)(3)(4), NRS 207.407(1), NRS 42.005[1].

JURISDICTION, VENUE

- The real property which is the subject of this civil action is a residence commonly known as the 2763 White Sage Drive, Henderson, NV 89052, APN 191-13-811-052, (hereinafter “Property”).

- This action is within the jurisdictional limits of this Court and this venue is appropriate because the real property is located within the jurisdiction of this Court.

- The Court has the authority under NRS 30.030[2] to declare rights, status and other legal relations of the respective parties in this NRS 40.010[3] quiet title dispute.

- NRS 30.130[4] limits the Court’s authority to ensure that the rights of parties who are not present from being prejudiced by court actions in their absence.

- The Court’s jurisdiction in cases involving the interpretation, application or enforcement of any covenants, conditions or restrictions (CC&Rs) applicable to residential property or any bylaws, rules or regulations adopted by an association (HOA) to parties who have submitted their claims to mediation in the manner proscribed in NRS Chapter 38.

- NRS 38.310(2)[5] limits the Court’s jurisdiction to adjudicate claims that have been

- The Court’s jurisdiction in this case requires an interpretation of NRS 116.31164(3)[6] (2013) which mandated the ministerial duties Red Rock Financial Services (Herein “RRFS”) was required to perform promptly after it conducted the disputed 2014 HOA foreclosure sale.

- This Court’s jurisdiction includes the authority to impose sanctions on Red Rock Financial Services for its failure to comply, and to ensure that the HOA Board complied, with with ALL the statutory mandates for conducting a valid HOA foreclosure sale, included in NRS 116.3116-NRS 116.31168 (2013)[7], NRS 116A.640 (8), (9), (10)[8], NRS 116.31083[9], NRS 116.31085[10], NRS 116.31031[11], NRS 116.1113[12], NRS 116.31065[13], NRS 116.3102[14], NRS 116.31087[15], NRS 116.31175[16], NRS 116.31183[17], NRS 116.31184[18], NRS 116.4117[19]

- This Court’s jurisdiction includes the authority to impose sanctions on Red Rock Financial Services for its failure to provide, and its failure to ensure that the Sun City Anthem (Herein “SCA”) Board provided ALL the owner protections, notice and due process mandated by the HOA governing documents[20], SCA Board 2013 Delinquent Assessment Policy (SCA 168-175)[21], SCA Board Resolution 1/17/11 Policy and Procedure for enforcement of the governing documents (due process before imposing sanctions for alleged violations), SCA bylaws 3.21(f)(v) (owner access to quarterly delinquency reports) , SCA bylaws 3.15 (open Board meetings), SCA bylaws 3.15A (closed Board meetings permissible topics), SCA bylaws 3.18/3.20 (delegation by SCA board prohibited), SCA bylaws 3.26, SCA bylaws 6.4 (owner access to records), CC&Rs 7.4 (enforcement (due process before imposing sanctions),

- This Court’s jurisdiction includes the authority to determine the standing of the defendants named by Red Rock to assert a claim for the excess proceeds from the HOA sale.

- The court has jurisdiction to impose sanctions against parties who have recorded false claims to title as defined by NRS 205.395[22] and to consider the severity of the sanctions in terms of other statutes applicable to, and commensurate with, the frequency and seriousness Nationstar’s corrupt business practices, under the auspices of NRS 205.377[23], NRS 207.360 (9)(10)(30)(35)[24], NRS 207.400[25], NRS 207.470 (1)and (4)[26], and NRS 207.480[27]

- PARTIES

- Cross-claimant NONA TOBIN, an Individual, (Herein “Cross-claimant” or “Tobin”) was the sole successor trustee, beneficiary and surviving member of the Gordon B. Hansen Trust, dated 8/22/08, (Herein “Hansen Trust”) that held recorded title to the subject property from 8/27/08 until a foreclosure deed was recorded on August 22, 2014 transferred title to the alleged purchaser at the disputed HOA sale.

- Tobin claims an individual interest in this property as all the GBH Trust’s claims to title were transferred to Tobin as an individual via a quit claim deed, recorded on 3/28/17.

- Also on 3/28/17 the Hansen Trust was closed as it was insolvent when its sole asset was transferred out of the trust. NONA TOBIN claims the proceeds of the sale unlawfully retained by Koch & Scow, with interest, penalties and sanctions.

- Tobin files this cross-claim against Nationstar Mortgage LLC for treble damages for the loss of the property at 2763 White Sage, along with interest, penalties and sanctions, for Nationstar’s fraud on the court, abuse of process, mortgage servicing fraud, recording false claims to title, and misrepresenting material facts and the law in order to steal Nona Tobin’s property.

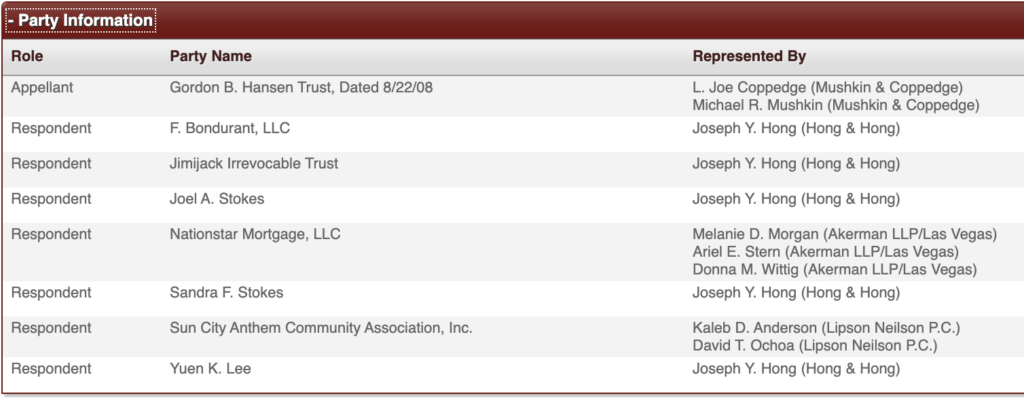

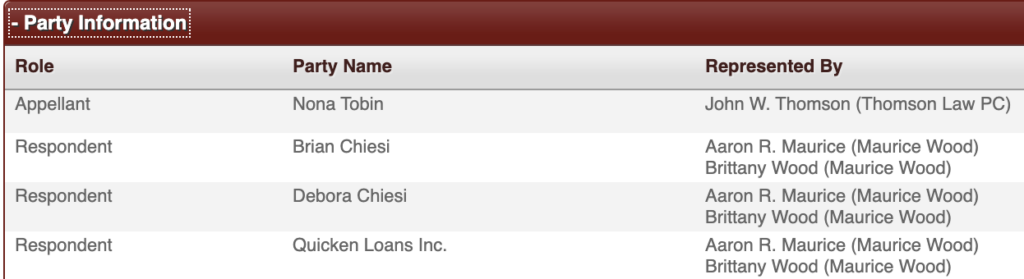

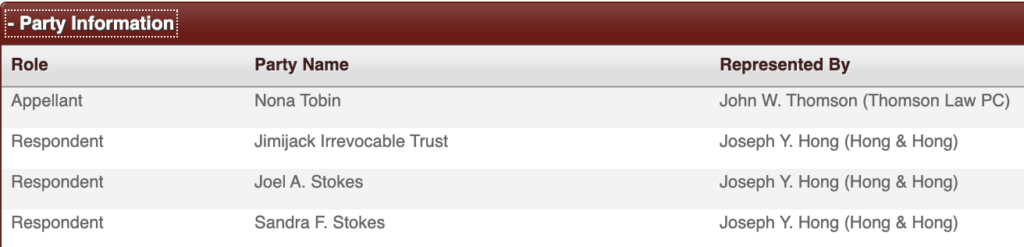

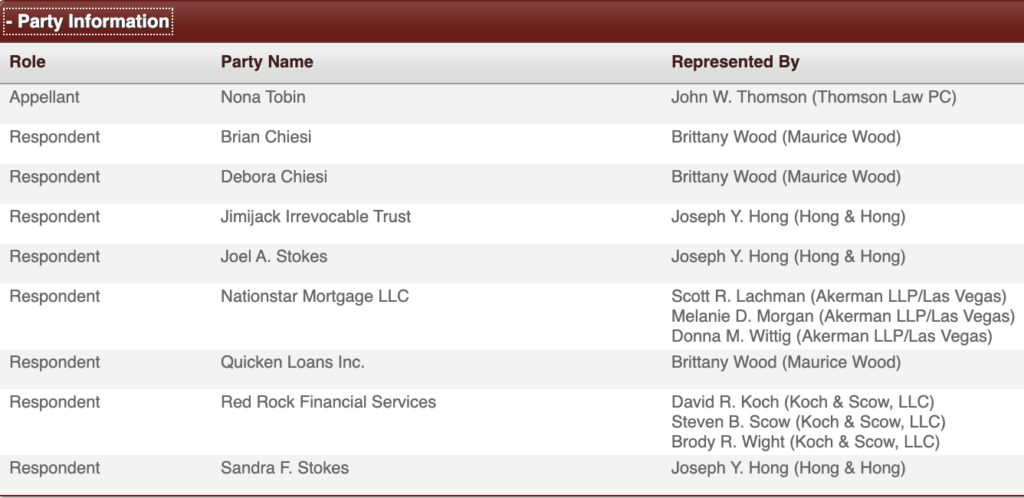

- Defendant NATIONSTAR MORTGAGE, LLC (Herein “NSM” or “Nationstar”) is an entity of unknown origin whose false claims to own the beneficial interest of the disputed Hansen deed of trust have been without merit filed into district court cases A-16-730078-C, A-15-720032-C, and A-19-799890-C and into Supreme Court appeals 79295 and 82294.

- Given that Nationstar was never required to produce evidence to support its claim to be the beneficial owner of the Hansen deed of trust, in this case, the court must determine Nationstar’s standing based on an examination of the Clark county official record for the subject property, APN 191-13-811-052 which is included in Exhibit 1

- Factual Allegations

- All Wells Fargo’s recorded liens have been released.

- Wells Fargo’s only lien was an open-ended deed of trust recorded on 5/10/07 as instrument number 200705100001127, which has no BATES number as it was intentionally omitted in Plaintiff RRFS’s response (RRFS 001-425) to Nona Tobin’s 2/4/19 subpoena.

- Wells Fargo’s release of its 5/10/07 lien by its Substitution of Trustee and reconveyance, recorded on 3/12/15 as instrument number 201503120002285, which has no BATES number as it was omitted in Steven Scow’s response to the 2/4/19 subpoena.

- Wells Fargo never claimed an interest in the Hansen deed of trust and has never been a party in any of the quiet title cases related to this property.

- Wells Fargo’s only claim was a $15,000 outstanding balance on the open-ended deed of trust, recorded on 5/10/07. Wells Fargo issued an IRS 1099-C cancelation of debt in 2012. On Gordon Hansen’s final 2012 tax return, Nona

- Nationstar does not have standing to assert a claim for the proceeds of the sale.

- Nationstar filed false and conflicting claims to own the Hansen deed of trust on at least these dates: 1/11/16 COMP, 4/12/16 DECL, 4/12/16 MSUB/MINV, 5/10/16 Reply, 6/2/16 AACC, 6/3/16, 6/10/16, 3/27/17 DECL , 3/27/17, 11/9/17, 2/9/18.

- Nationstar recorded false claims to title into the Clark County official property record for APN 191-13-811-052 recorded claims on these dates 12/1/14, 1/22/15, 8/17/15, 1/13/16, 6/7/16, 3/8/19 rescind and 3/8/19 assign, and 6/3/19. See Exhibit 1.

- None of Nationstar’s recorded claims wherein Nationstar claimed to be authorized as some other entity’s “attorney in fact” were accompanied by recorded powers of attorney, sworn affidavits, and/or proper acknowledgements compliant with NRS 107 as amended by AB 284 (2011)[28]. See Exhibit 20.

- Nationstar Wright, Finley, & Zak LLP (Herein “WFZ”) attorneys[29] were well aware of the requirements of the 2011 anti-foreclosure fraud amendments to NRS Chapter 107 and NRS Chapter 205, particularly in terms of the requirement of sworn affidavits to prove the standing to exercise the power of sale.[30]

- Nationstar replaced its WFZ attorneys on 4/10/18[31] with Melanie Morgan (NV Bar # 8215) and Karen Whelan (NV Bar # 10466) of Akerman LLP.

- Akerman LLP replaced Karen Whelan (NV Bar # 10466) with Donna Wittig NV Bar # 11015) on 12/10/18[32] after Karen Whelan ignored Nona Tobin’s attorney’s attempt to get Nationstar to join with Tobin on a motion for summary judgment by providing Whelan with declarations under penalty of perjury[33] that established the sale had been conducted without notice to the owner or the listing agent who had sold the property on auction.com three months before the surprise sale.

- Nona Tobin filed a verified complaint against Nationstar for recording false claims to title and abusing the quiet title HOA foreclosure process in A-15-720032-C and A-16-730078-C with the Office of the Attorney General of Nevada on 3/14/19.[34]

- Nona Tobin filed a verified complaint against Nationstar for recording false claims to title and abusing the quiet title HOA foreclosure process in A-15-720032-C and A-16-730078-C with the Office of the Attorney General of Nevada on 11/10/20.[35]

- Nona Tobin filed a verified complaint against Nationstar and its Akerman and Wright Finley Zak LLP attorneys with the Nevada Mortgage Lending Division on 12/16/20[36] for recording false claims to title into the Clark County official property record for APN 191-13-811-052 and for abusing the quiet title HOA foreclosure process in A-15-720032-C, A-16-730078-C, A-19-799890-C, and appeals 79295, 82234, 82094, and 82294.[37]

- Nationstar recorded into the Clark County property record false, unauthorized, unverified, and conflicting assignments, substitution of trustee, reconveyances of the Hansen deed of trust on at least these dates:

- The Clark County property record for the subject property, APN 191-13-811-052, are included in Exhibit 1.

- Nationstar evaded detection of its fraud by voluntarily dismissing its claims without any evidence being subjected to judicial scrutiny and without putting on a case and without meeting its Plaintiff’s burden of proof.

- Nationstar and Jimijack made an ex parte out of court agreement to steal the house from Tobin.

- Nationstar and Jimijack conspired, concealed and misrepresented material facts and law, met ex parte with Judge Kishner, with the corrupt intent of stealing Tobin’s property.

- Multiple declarations under penalty of perjury have been entered into the court records show that Nationstar’s claims to own the beneficial interest of the Hansen deed of trust are demonstrably false.

- Nona Tobin has filed multiple motions into A-15-720032-C in a futile attempt to prevent Nationstar’s succeeding in its fraud upon the court that have been stricken from the record unheard[38] based on the misrepresentations[39] made by Nationstar at an ex parte meeting with Judge Kishner

Prayer

RECOVERY OF ATTORNEY FEES AS SPECIAL DAMAGES

- Counter-claimant Nona Tobin repeats, realleges, and incorporates herein by this reference the allegations hereinabove inclusively as though set forth at length and in full herein.

- This counterclaim has been necessitated by the Defendants’ bad faith conduct.

- Pursuant to Nevada law, Plaintiff may recover her attorney fees as special damages because she was required to file this suit as a result of Defendants’ intentional conduct.[40]

Prayer

- CROSS CLAIMANT NONA TOBIN repeats, realleges, and incorporates herein by this reference the allegations hereinabove inclusively as though set forth at length and in full herein.

- This cross-claim has been necessitated by the CROSS-DEFENDANT NATIONSTAR’s bad faith conduct.

- Pursuant to Nevada law, CROSS CLAIMANT NONA TOBIN’s may recover her attorney fees as special damages because she was required to file this suit as a result of CROSS-DEFENDANT NATIONSTAR’s intentional conduct.[41] CROSS CLAIMANT NONA TOBIN petitions the Court for the following declaratory relief: to declare

- to declare that the disputed HOA sale is void due to fraud in the execution by Red Rock Financial Services;

- to declare that the disputed HOA sale did not extinguish the GBH Trust’s, nor its successor in interest’s rights to title;

- to declare that Nona Tobin is entitled to the $57,282.32 RRFS claims are the undistributed proceeds and that CROSS-DEFENDANT NATIONSTAR is entitled to none of it

- to declare that sanctions are appropriate vs. CROSS-DEFENDANT NATIONSTAR for its abuse of the HOA quiet title process in order to gain standing it does not have in fact or in law to confiscate CROSS CLAIMANT NONA TOBIN’s property without complying with NRS 107 foreclosure requirements;

- to declare that sanctions pursuant to NRS 205.395, NRS 205.377, NRS 207.470(1) are appropriate vs. CROSS-DEFENDANT NATIONSTAR for its false claims recorded against the APN 191-13-811-052 title;

- that sanctions are appropriate vs. RRFS for its retention of proprietary control of the proceeds of the foreclosure of the subject property, and of approximately a dozen other Sun City Anthem 2014 foreclosures, when RRFS knew, or should have known that the HOA Board was prohibited by Sun City Anthems bylaws from delegating proprietary control over funds collected for the sole and exclusive benefit of the association;

- that sanctions are appropriate vs. RRFS for its failure distribute foreclosure proceeds timely after the sales, as mandated by NRS 116.31164(3):

- that sanctions are appropriate vs. RRFS for Koch & Scow’s unsupervised, unaudited retention of the funds of many, many HOA foreclosures allowed attorney trust fund violations to go undetected;

- Koch & Scow’s filed its unwarranted 6/23/20 motion to dismiss, its 8/3/20 reply in support, and its 12/3/20 motion to dismiss, knowing that all these filings contained many misrepresentations of material facts for which there was no factual support or evidence, defied NRCP 11 (b)(3), Nevada Rules of Professional Conduct 3.3 (candor to the tribunal), 3.4 (fairness to opposing counsel), 3.5A (relations with opposing counsel), 4.1 (truthfulness in statements to others), 4.4 (respect for the rights of third persons) and ABA (1992) Standards for Imposing Lawyer Sanctions 6.1 (False statements, fraud, and misrepresentation).

- that sanctions are appropriate vs. RRFS for its misappropriation of funds, covert rejection of assessments, falsification of records that allowed the unjust enrichment of undisclosed partners and co-conspirators;

- that Nona Tobin is entitled to treble damages for the fraudulent confiscation of the subject property, valued on 12/27/19 at $505,000 property pursuant to NRS 207.470(1) as RRFS’s actions on the dozen 2014 unnoticed foreclosures constitute racketeering;

- that sanctions are appropriate pursuant to NRS 18.010(2) vs. RRFS for its filing the improper interpleader action with penalties as all other named defendants’ liens have been released and Nationstar mortgage is judicially estopped from claiming it ever was the beneficial owner of the Hansen deed of trust;

- that Nona Tobin, an individual’s, 3/28/17 deed is the sole valid title claim;

- that Jimijack’s defective, 6/9/15 deed was inadmissible as evidence to support its title claim pursuant to NRS 111.345;

- that the Joel Stokes-Civic Financial Services “agreement”, recorded on 5/23/19, and misrepresented to Judge Kishner on 5/21/19 as the Nationstar-Jimijack settlement was fraud on the court and sanctionable conduct pursuant to ;

- that sanctions are appropriate vs. Nationstar and its Akerman attorneys pursuant to NRCP 11 (b)(1)(2)(3)(4) (misrepresentations in court filings), Nevada Rules of Professional Conduct 3.3 (candor to the tribunal), 3.4 (fairness to opposing counsel), 3.5A (relations with opposing counsel), 4.1 (truthfulness in statements to others), 4.4 (respect for the rights of third persons) and ABA (1992) Standards for Imposing Lawyer Sanctions 6.1 (False statements, fraud, and misrepresentation).

- To declare that Joel Stokes’ deed, recorded on 5/1/19, was void as Jimijack had no interest to convey and that this transfer prior to the 6/5/19 trial was for the corrupt purpose of deceiving the court into allowing Joel Stokes and Nationstar to perpetrate a fraud on the court;

- That Nona Tobin is entitled to recoup treble damages pursuant to NRS 207-470 and

- That Nona Tobin is entitled to is entitled to recoup damages, five years of rental income from Jimijack;

- that Nationstar Mortgage LLC’s (Herein “NSM” or “Nationstar”) claims to own the beneficial interest of the disputed Western Thrift Deed of Trust (Herein “DOT”) are false and sanctionable under NRS 205.395, NRS 205.377, NRS 207, 400 and that Nona Tobin is entitled to treble damages by their misconduct pursuant to NRS 207.470 and 480;

- that all instruments, encumbrances and assignments, and expungements of lis pendens that were improperly and/or unlawfully notarized, executed or recorded to create false claims, or were done for the improper purpose of abrogating Tobin’s rights during the pendency of litigation, and/or prior to the adjudication of Plaintiff’s claims in this instant action, are cancelled and declared without legal force and effect; and

- that attorneys pay Tobin’s attorney fees and costs as a sanction pursuant to NRCP 11(b)(1)(3) and/or NRS 18.010(2)

- All assignments of the Hansen deed of trust are void as they did not comply with the statutory requirements of AB 284 (2011) amendments to NRS 107 in order to provide standing and the power of sale.

- Nationstar LLC and/or Nationstar LLC dba Mr. Cooper

- 11/16/20 verified complaint vs. Nationstar to the Nevada Mortgage Lending Division provides 692 pages of evidence supporting Nona Tobin’s claim of mortgage servicing fraud and fraud on the court vs. Nationstar and its Akerman and Wright Finley Zak attorneys.

[1] NRS 42.005 Exemplary and punitive damages: In general; limitations on amount of award; determination in subsequent proceeding.

[2] NRS 30.030 Scope. Courts of record within their respective jurisdictions shall have power to declare rights, status and other legal relations whether or not further relief is or could be claimed. No action or proceeding shall be open to objection on the ground that a declaratory judgment or decree is prayed for. The declaration may be either affirmative or negative in form and effect; and such declarations shall have the force and effect of a final judgment or decree.

[3] NRS 40.010 Actions may be brought against adverse claimants. An action may be brought by any person against another who claims an estate or interest in real property, adverse to the person bringing the action, for the purpose of determining such adverse claim.

[4] NRS 30.130 Parties. When declaratory relief is sought, all persons shall be made parties who have or claim any interest which would be affected by the declaration, and no declaration shall prejudice the rights of persons not parties to the proceeding.

[5] NRS 38.310 Limitations on commencement of certain civil actions.

1. No civil action based upon a claim relating to:

(a) The interpretation, application or enforcement of any covenants, conditions or restrictions applicable to residential property or any bylaws, rules or regulations adopted by an association; or

(b) The procedures used for increasing, decreasing or imposing additional assessments upon residential property,

Ê may be commenced in any court in this State unless the action has been submitted to mediation or, if the parties agree, has been referred to a program pursuant to the provisions of NRS 38.300 to 38.360, inclusive, and, if the civil action concerns real estate within a planned community subject to the provisions of chapter 116 of NRS or real estate within a condominium hotel subject to the provisions of chapter 116B of NRS, all administrative procedures specified in any covenants, conditions or restrictions applicable to the property or in any bylaws, rules and regulations of an association have been exhausted.

2. A court shall dismiss any civil action which is commenced in violation of the provisions of subsection 1.

[7] NRS 116.3116-NRS 116.31168 (2013)

[8] NRS 116A.640 (8), (9), (10)

[20] SCA CC&Rs & bylaws, 2008 Third restatement

[21] SCA 168-175 2013 Delinquent Assessment Policy

[22] NRS 205.395 False representation concerning title; penalties; civil action.

[23] NRS 205.377 Multiple transactions involving fraud or deceit in course of enterprise or occupation; penalty.

[24] NRS 207.360 “Crime related to racketeering” defined.

[25] NRS 207.400 Unlawful acts; penalties.

[26] NRS 207.470 (1)and (4) Civil actions for damages resulting from racketeering.

[27] NRS 207.480 Order of court upon determination of civil liability.

[28] AB 284 (2011) Nevada’s 2011 anti-foreclosure fraud amendments to NRS 107 and NRS 205 summary and legislative digest

[29] WFZ attorneys represented Nationstar Mortgage from its first filing into A-16-730078-C, a complaint vs. Opportunity Homes, LLC (that held no recorded interest) for quiet title and moved into A-15-720032-C by filing a motion to substitute itself as the real party in interest, set aside the default judgment against Bank f America and intervene on the closed case by filing an AACC counter-claim vs. Jimijack who had the recorded claim when WFZ sued the disinterested Opportunity Homes. WFZ filed into these quiet title civil actions statements known to be false and disclosing false evidence on 1/11/16, 4/12/16 DECL, 4/12/16, 5/10/16, 6/2/16, 6/3/16, 6/10/16, 3/27/17 DECL , 3/27/17, 11/9/17, 2/9/18, (Dana Johnson Nitz NV Bar #0050, Edgar Smith (NV bar #5506) Michael Kelly NV Bar #10101)

[30] Robin Wright “Complying with AB284” for UTA Quarterly Winter 2011

[31] 4/10/18 SUBT switched out WFZ, Akerman LLP Morgan and Whelan came in

[32] 12/10/18 NOTA notice the entry of Wittig, but was silent on the exit of Whelan who was never seen again

[33] 5/11/18 Craig Leidy DECL and 5/11/18 Nona Tobin DECL. Note that Nona Tobin filed a sworn affidavit into A-16-730078-C, Nationstar Mortgage LLC vs Opportunity Homes, LLC stating that she wanted to JOIN Nationstar to void the defective sale so that each would be returned to whatever rights they could prove they had the day before the sale and prayed that the Court would not allow Nationstar to abuse the quiet title litigation process to gain standing that it did not have in fact or in law. 9/23/16 Nona Tobin AFFD

[35] 11/10/20 2nd AG complaint

[36] 12/16/20 complaint to the Mortgage Lending Division

Appeals to the Nevada Supreme Court

79295

82234

82094

82294

[38] Links to pro se filings stricken in absentia at ex parte 4/23/19 meeting of Melanie Morgan and Joseph Hong with Judge Kishner

[39] Nationstar attorneys deceived the court regarding Nona Tobin’s standing to assert an NRS 40.010 claim as an individual holder of a 3/28/17 deed. NSM disclosed the 3/28/17 deed as NSM 208-211. NSM named Tobin individually as a party in all the captions. NSM did not remove Nona Tobin as an individual party when reforming the caption on 3/7/19 NTSO and 3/12/19 ANEO.

Nationstar attorneys knew that Nona Tobin was a party with recorded and filed adverse interests.

Nationstar attorneys knew that to make a side deal with Jimjack in order to prevent Nationstar’s and Tobin’s adverse claims from being adjudicated was fraud.

[40] Sandy Valley Assocs. v. Sky Ranch Estates Owners Ass’n, 117 Nev. 948, 958, 35 P.3d 964, 970 (2001), citing American Fed. Musicians v. Reno’s Riverside, 86 Nev. 695, 475 P.2d 220 (1970).