HOAGOV reprint

Owners should ALWAYS come first!

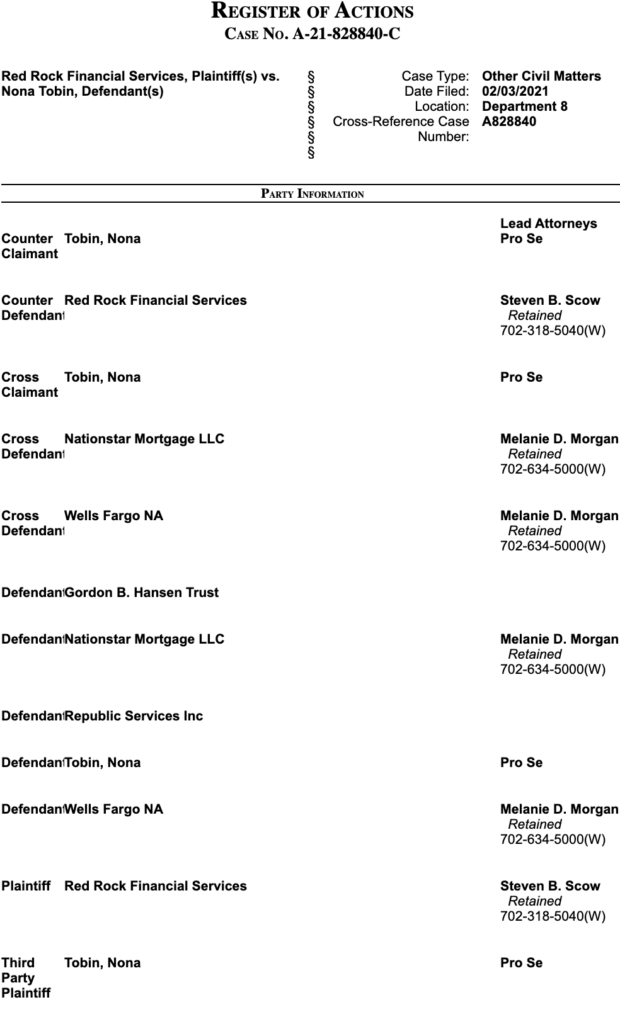

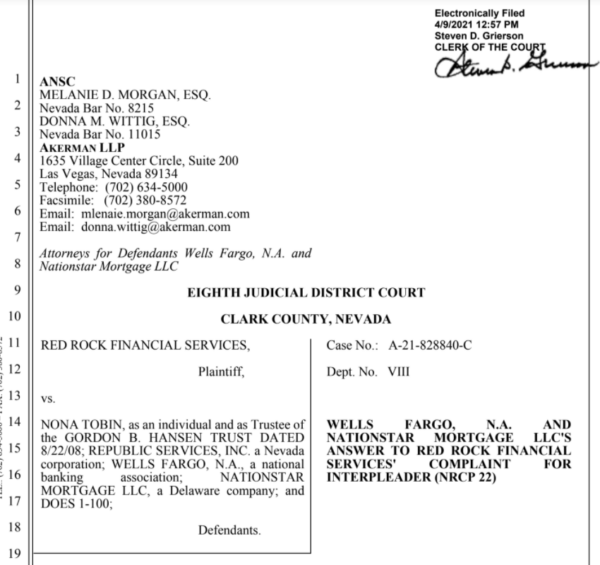

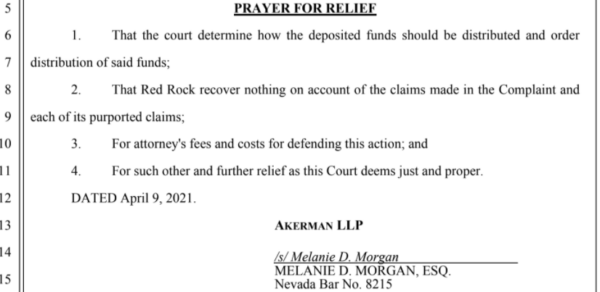

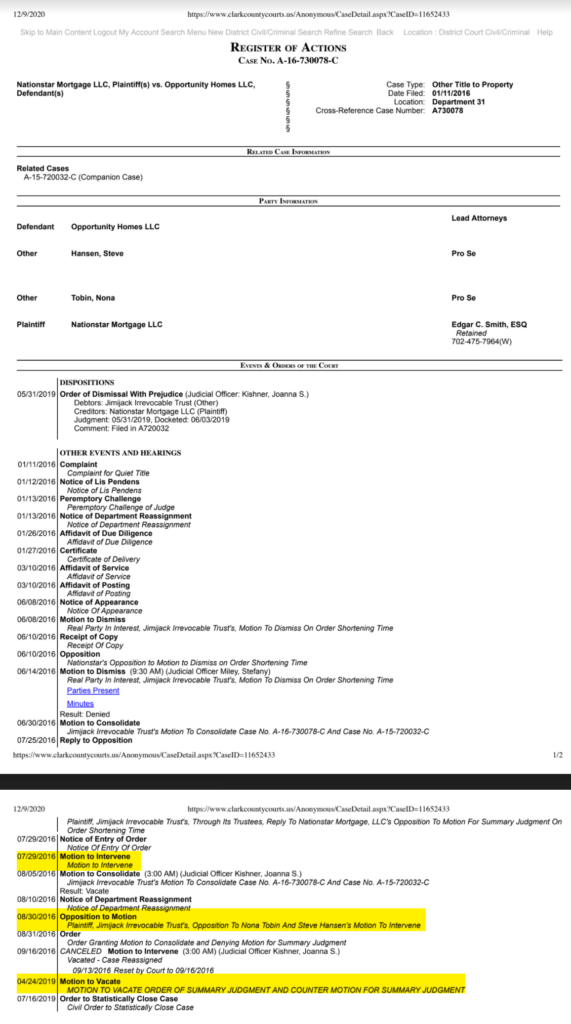

On 7/7/22, Judge Peterson heard Nona Tobin’s 2nd motion to distribute the interpleaded proceeds to her as the sole claimant with interest and penalties, -1½ years after she failed to hear Tobin’s 1st motion and a year after she granted non-party Red Rock LLC’s Tobin to dismiss Tobin’s unheard, unopposed claims of Conversion, Racketeering, and Fraud with prejudice on the grounds of res judicata.

Judge Peterson also heard Tobin’s motion to correct three prior orders to accurately identify the names of the parties and to attach Tobin’s opposition to factual inaccuracies in the orders.

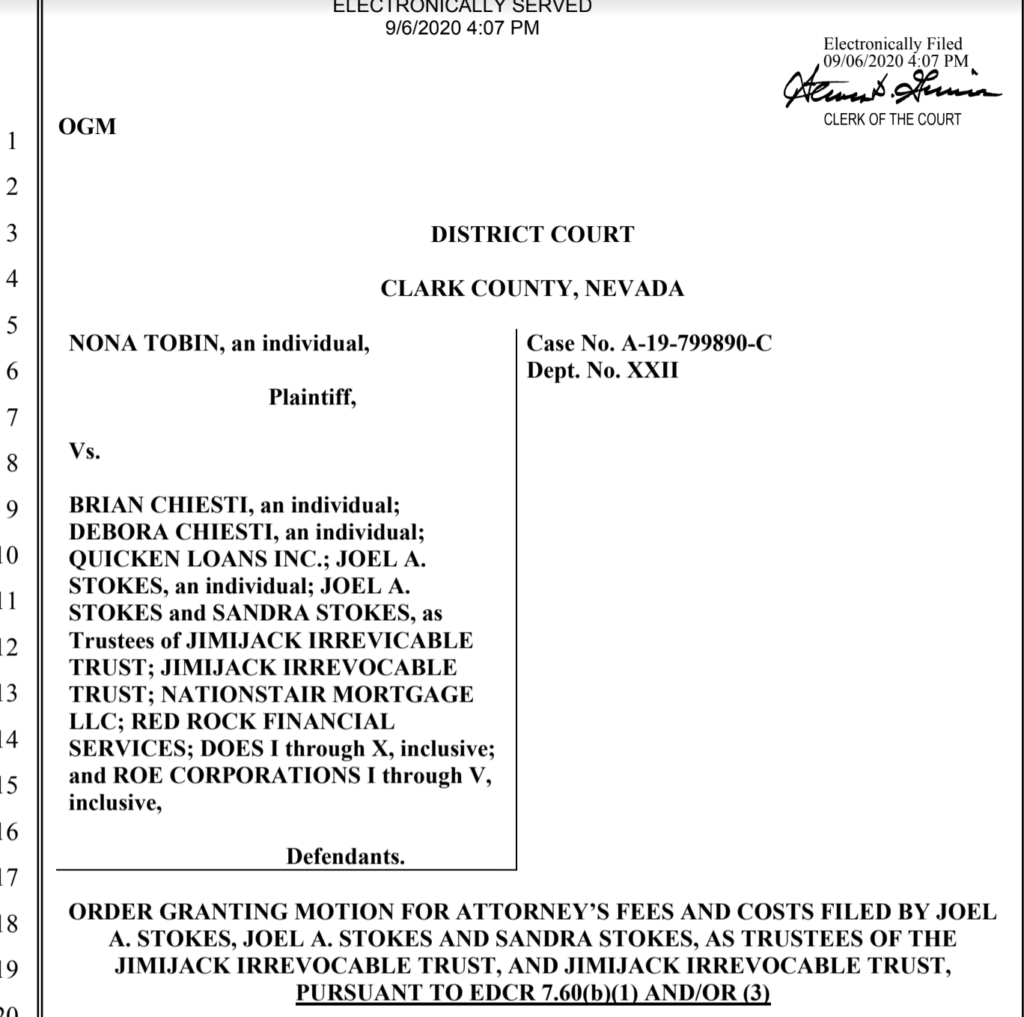

The judge also accepted and granted the rogue motion of non-party Red Rock LLC’s for attorney fees, and granted the improper renewed motion for a vexatious litigant restrictive order against Tobin.

Judge Peterson granted non-party Red Rock LLC’s motion for attorney’s fees, denied Tobin’s unopposed motions.

Judge Peterson told Tobin that nothing Tobin said (in her unopposed proposed order has any merit by misconstruing the 6/30/22 appellate court ruling of the prior action in this dispute where the dismissal with prejudice of Tobin’s 2nd civil claim for these proceeds was affirmed on the grounds of res judicata and privity, bound this court to preclude all Tobin’s claims of Conversion, Fraud, and Racketeering). The court decided Tobin has no claims except for the interpleaded funds, had no right to interest or penalties, and that Steven Scow did nothing wrong by withholding her money for 8+years and because he held it in trust so it was harmless error.

I contend that Judge Peterson violated NCJC 2.6 by

Fact finding is the “basic responsibility” of trial courts “rather than appellate courts.” Pullman-Standard v. Swint, 456 U.S. 273, 291 (1982) (quoting DeMarco v. United States, 415 U.S. 449, 450 n.22 (1974)); see also Zenith Radio Corp. v. Hazeltine Research, Inc., 395 U.S. 100, 123 (1969) (“appellate courts must constantly have in mind that their function is not to decide factual issues”).

Myers v. Haskins, 138 Nev. Adv. Op. 51, 8-9 (Nev. App. 2022) (“evidentiary hearings are designed with this purpose in mind: to resolve disputed questions of fact. See DCR 13(6) (recognizing that disputed factual points may be resolved at evidentiary hearings); EDCR 5.205(g) (providing that exhibits attached to motions do not constitute substantive evidence unless admitted); cf. Nev. Power Co. v. Fluor III., 108 Nev. 638, 644-45, 837 P.2d 1354, 1359 (1992) (recognizing that conducting an evidentiary hearing is the only way to properly resolve questions of fact concerning whether to dismiss a party’s suit as a discovery sanction)”)

Milam v. Stealth Holdings, LLC, 381 P.3d 641 (Nev. 2012) (“NC–DSH, Inc. v. Garner,125 Nev. 647, 657, 218 P.3d 853, 860–61 (2009)(providing that “[i]t is only after a proper hearing in which the fraud [upon the court] has been established by clear and convincing evidence that relief can be granted.” (citations omitted) (internal quotations omitted));”)

The list is long because, I believe, Judge Peterson unfairly refused to allow me to assert my actual claims. She kept insisting that all my claims were precluded and nothing was before her but the question of who the interpleaded funds belonged to.

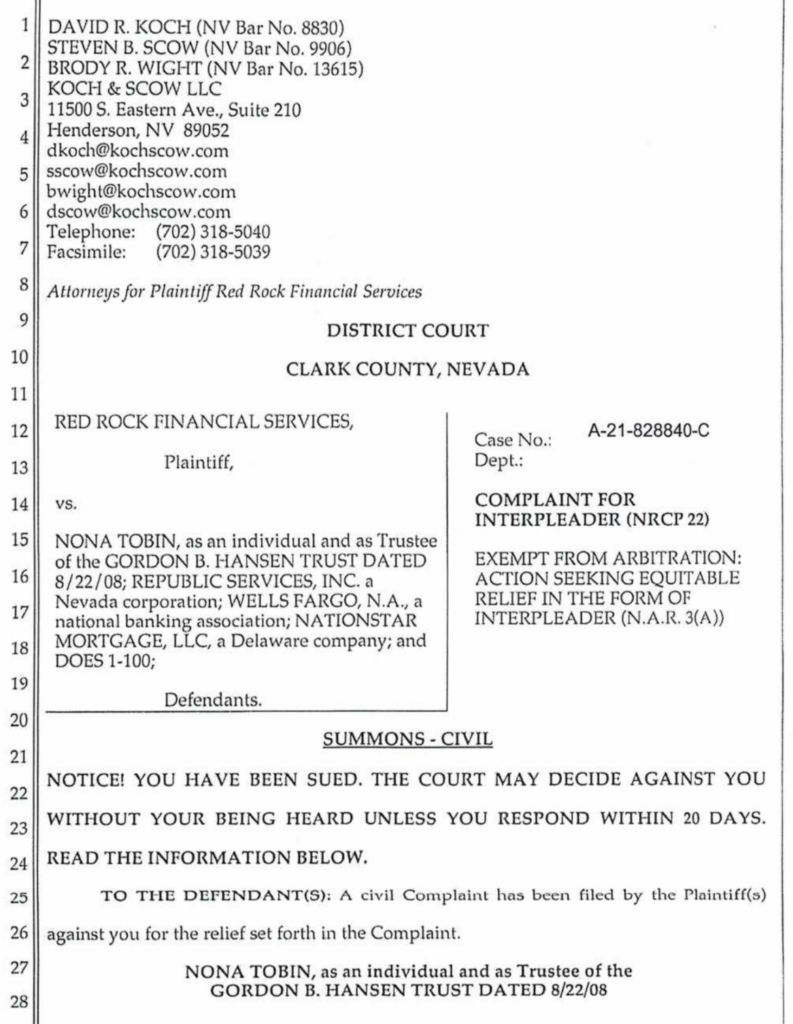

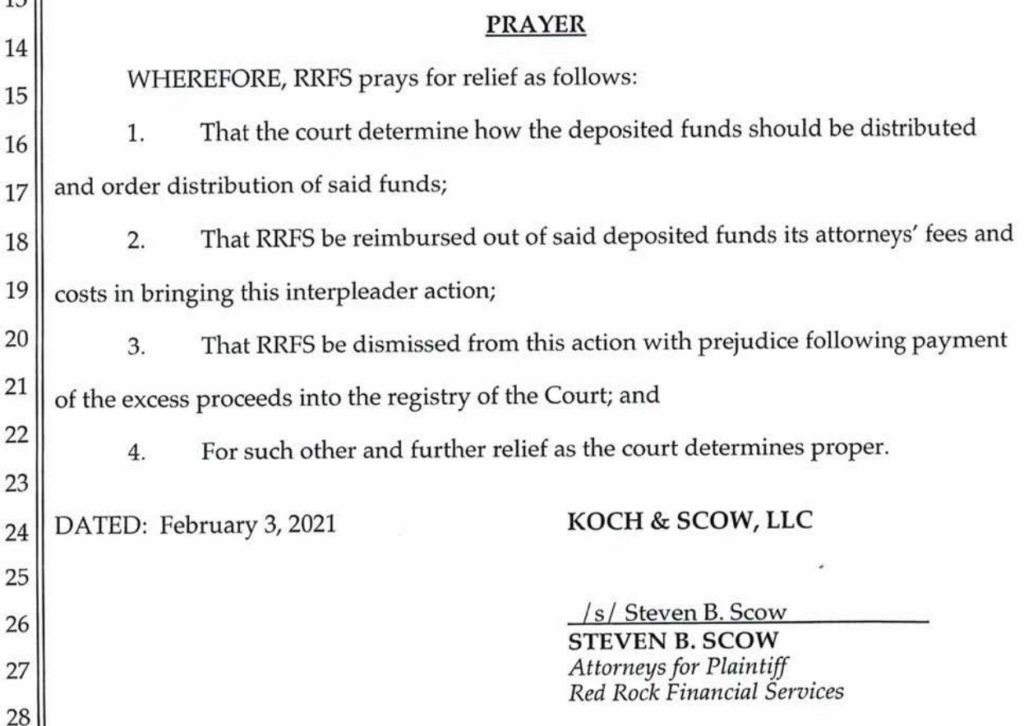

I say that Steven Scow filed the interpleader action in bad faith, knowing that it was meritless and unwarranted and that neither Plaintiff Red Rock nor non-party Red Rock LLC had standing to either pursue and interpleader action nor oppose the court ordering interpleaded funds being distributed to me with interest and penalties for being wrongfully withheld for 8+ years.

My claims for Conversion, Fraud, and Racketeering and petitions for sanctions were compulsory counter-claims that should have been granted as unopposed because Red Rock did not file any timely responsive pleading and non-party Red Rck LLC’s motion to dismiss was rogue, untimely, and contained exhibits which the court would have to have considered to make a claims preclusion ruling which would have nessecarily converted it to an MSJ, meaning the factual disputes would have had to have been resolved on a NRCP 56 standard and it could not have been granted as a NRCP 12(b)(5). Further, she refused my motion to amend one time under NRCP 15 for no good reason and didn’t sua spinte move for a more definitive statement if she thought it wasn’t pled to 9(b) standard. She just obviously wanted to be rid of it and me.

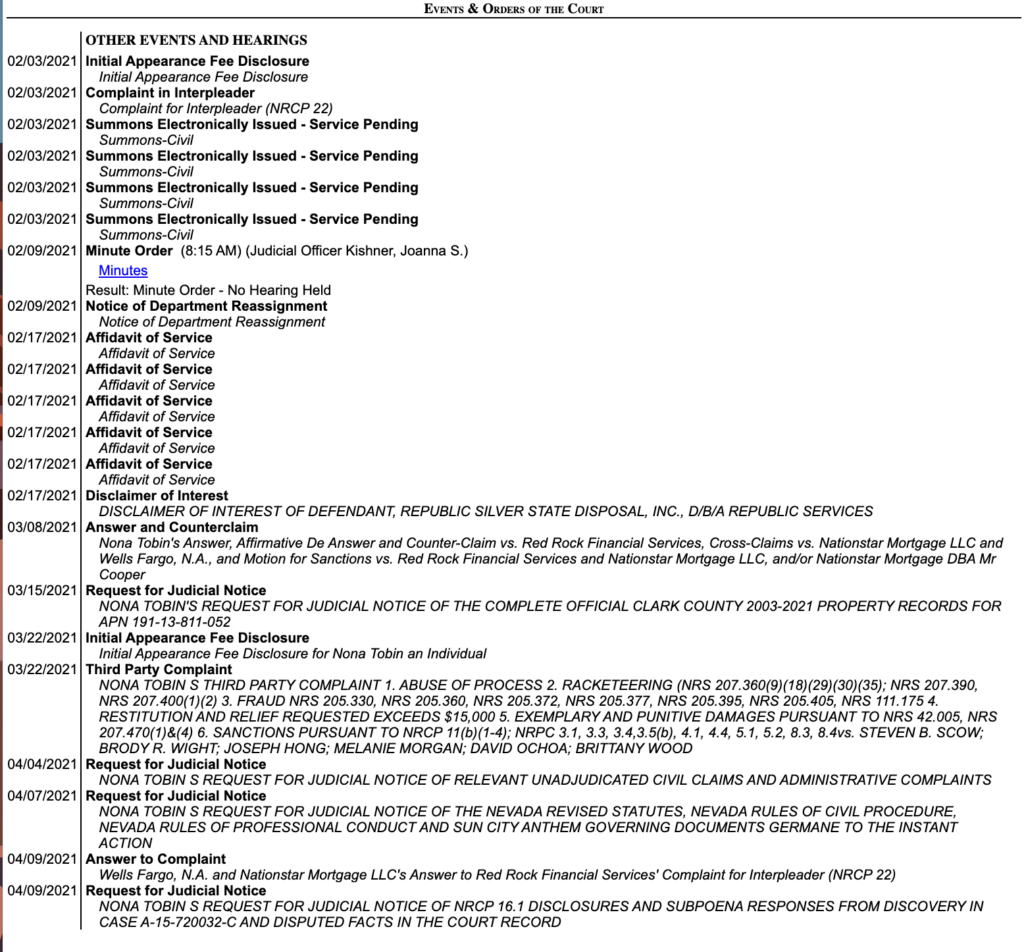

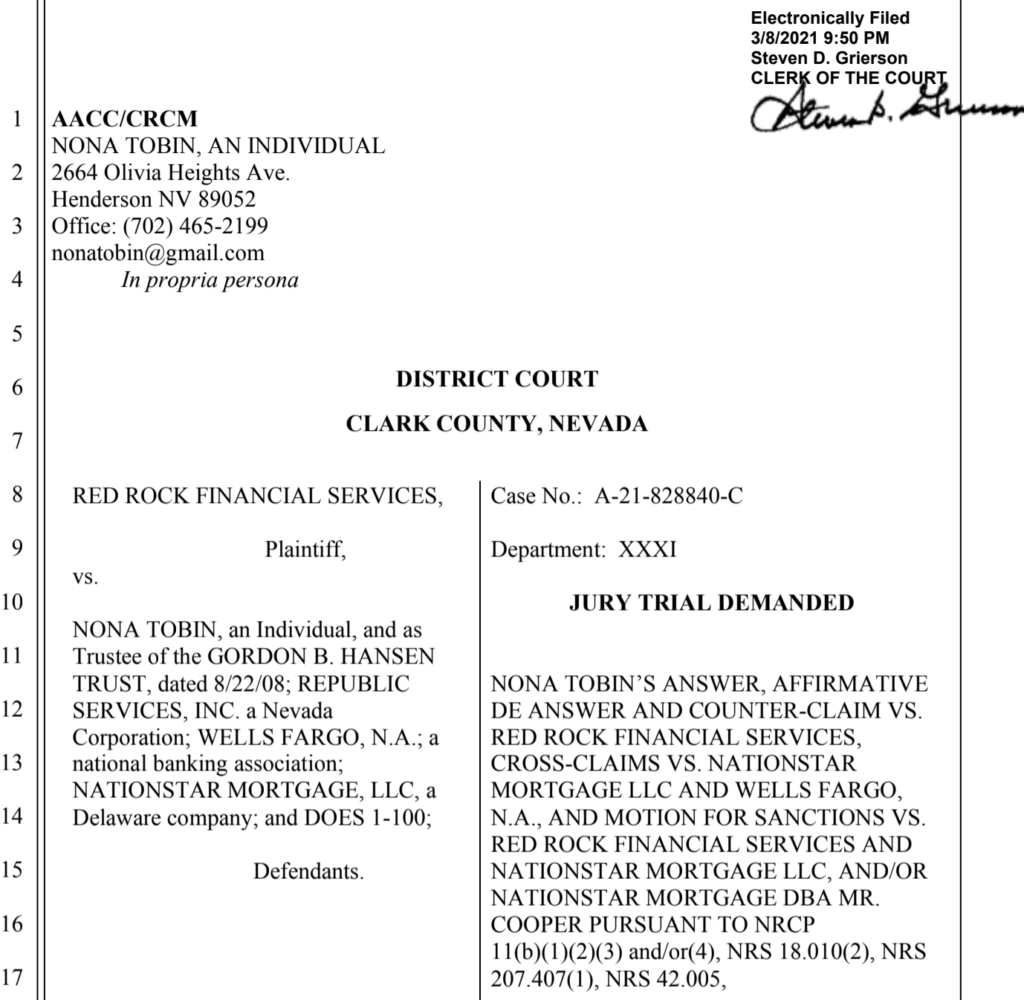

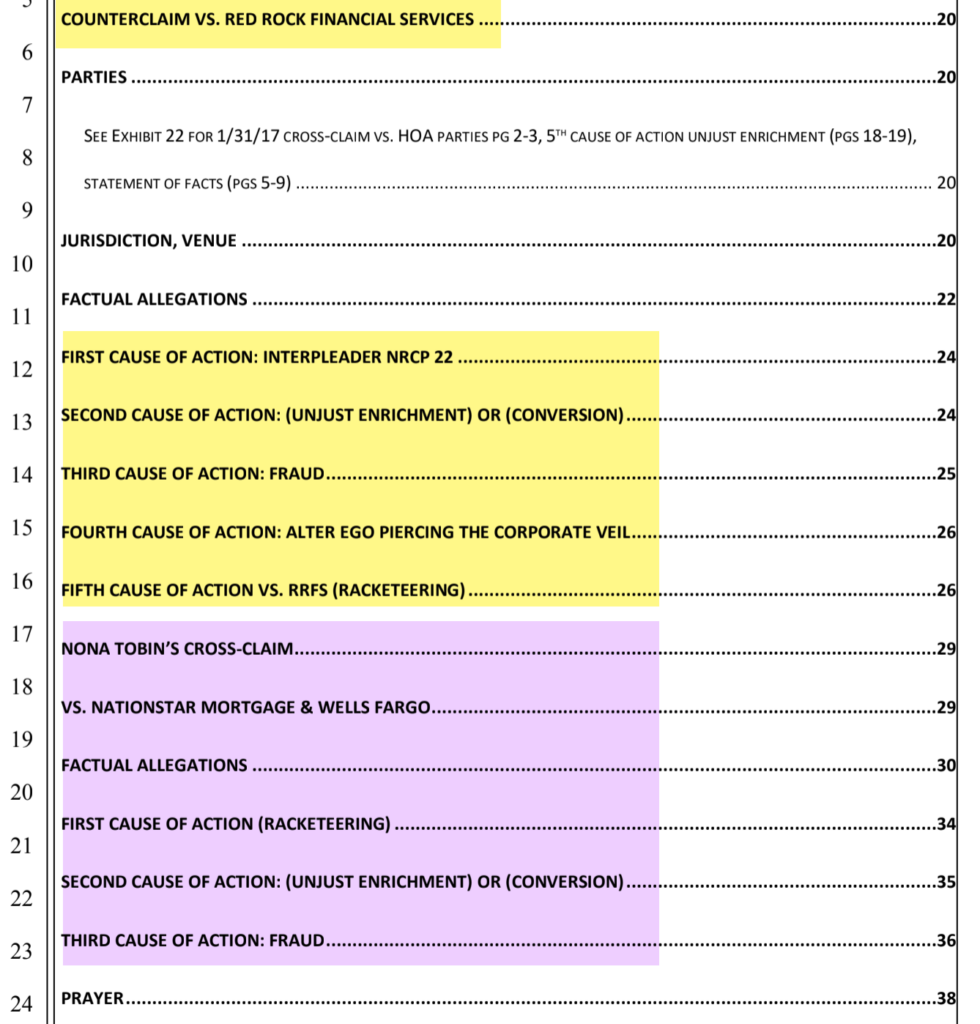

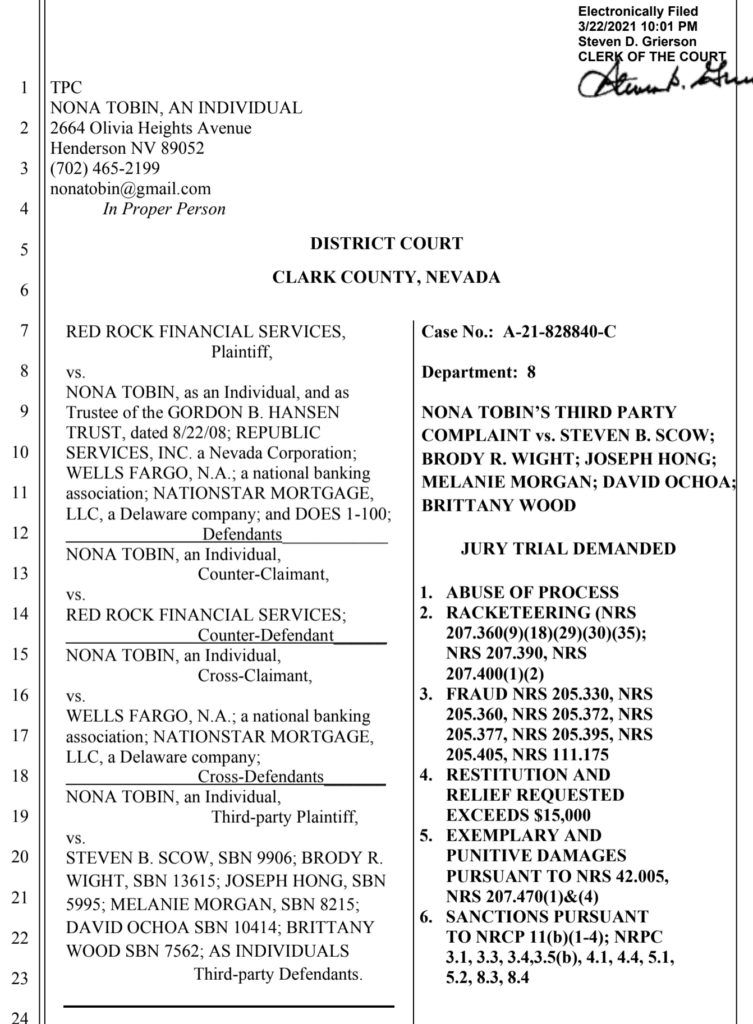

Doc ID# 14 Nona Tobin’s Answer, Affirmative Defenses, Answer And Counter-Claim vs. Red Rock Financial Services, Cross-Claims Vs. Nationstar Mortgage LLC And Wells Fargo, N.A., And Motion For Sanctions vs. Red Rock Financial Services And Nationstar Mortgage LLC, and/or Nationstar Mortgage dba Mr. Cooper Pursuant To NRCP 11(b)(1)(2)(3) and/or(4), NRS 18.010(2), NRS 207.407(1), NRS 42.005

| Doc ID# 15 Request for Judicial Notice Nona Tobin’s Request for Judicial Notice of the Complete Official Clark County 2003-2021 Property Records for APN 191-13-811-052 |

Doc ID# 18 Nona Tobin’s Request for Judicial Notice of Relevant Unadjudicated Civil Claims and Administrative Complaints

Doc ID# 19 Nona Tobin’s Request for Judicial Notice of the Nevada Revised Statutes, Nevada Rules of Civil Procedure, Nevada Rules of Professional Conduct and Sun City Anthem Governing Documents Germane To the Instant Action

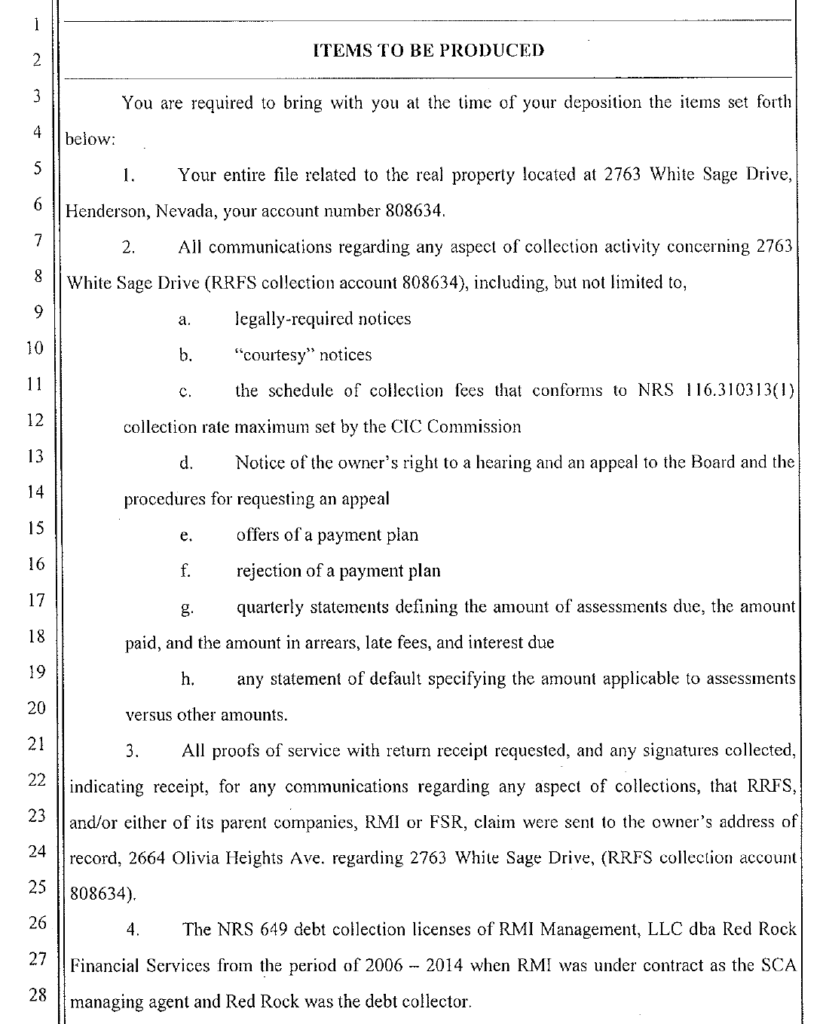

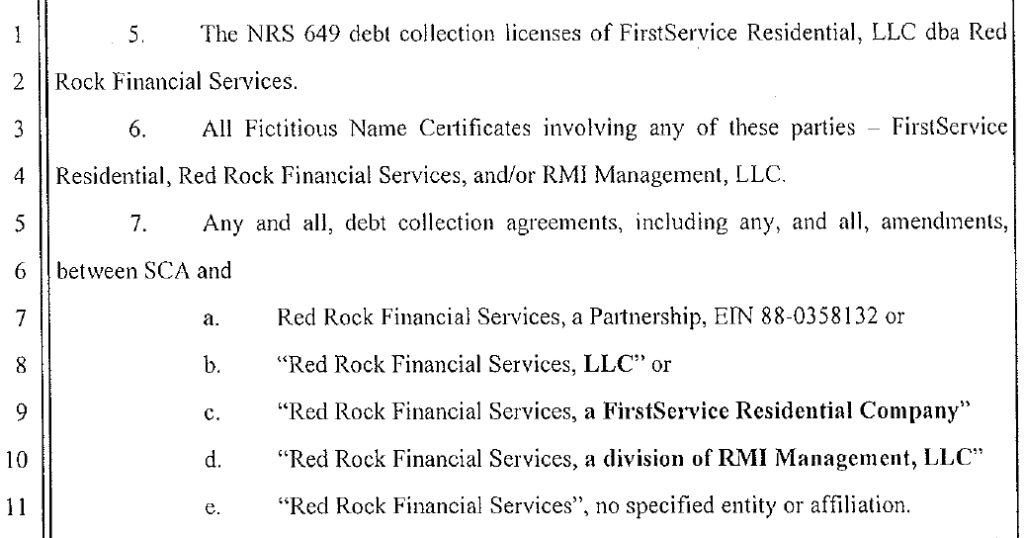

| Doc ID# 21 Nona Tobin’s Request for Judicial Notice of NRCP 16.1 Disclosures /Subpoena Responses from Discovery in Case A-15-720032-C and Disputed Facts in the Court Record |

| Doc ID# 75 Nona Tobin’s Motion for an Evidentiary Hearing to Set Aside Orders and for Sanctions Pursuant to NRCP 60(B)(3) and (D)(3), NRS 18.010(2) and EDCR 7.60 (1) and (3) |

Doc ID# 80 Nona Tobin’s Reply to Red Rock Financial Services LLC’s Opposition to Nona Tobin’s Motion for an Evidentiary Hearing to Set Aside September 10, 2021 Order and November 30, 2021 Orders Pursuant to NRCP 60(b)(3) (Fraud) and NRCP 60(b)(3) (Fraud on the Court) and Motion for Attorneys’ Fees and Cots Pursuant to EDCR 7.60(1) and (3), NRS 18.010(2); and, Countermotion for Abuse of Process for a Vexatious Litigant Restrictive Order Against Nona Tobin and for Attorney Fees and Costs

Doc ID# 81 Nona Tobin’s Reply To Nationstar’s And Wells Fargo’s Joinder And Countermotions For Attorney Fees And A Vexatious Litigant Order

Doc ID# 103 Tobin Motion for An Order to Show Cause Why Written Findings of Attorney Misconduct Should Not Be Forwarded To The State Bar of Nevada

Doc ID# 108 Corrected Motion for an Order to Show Cause Why Written Findings of Attorney Misconduct Should Not be Forwarded to the State Bar

Doc ID# 102 Request for Judicial Notice Verified Complaints of Attorney Misconduct filed with the State Bar of Nevada vs. Brittany Wood

Doc ID# 104 Request for Judicial Notice Verified Complaint of Attorney Misconduct Filed with The State Bar of Nevada Vs. Steven Scow

Doc ID# 105 Request for Judicial Notice Verified Complaints of Attorney Misconduct Filed with the State Bar of Nevada vs. Melanie Morgan, Esq. (SBN 8215), Akerman, LLP; and Wright, Finlay, Zak, LLP, and Draft Alternative Civil Action

| Doc ID# 106 Request for Judicial Notice Verified Complaint of Attorney Misconduct Filed With The State Bar of Nevada Vs. Joseph Y. Hong |

Doc ID# 107 Request for Judicial Notice Verified Complaints of Attorney Misconduct Filed With The State Bar of Nevada Vs. David Ochoa, Esq. (SBN 10414) and Adam Clarkson, Esq.

Nevada courts generally defer to the district court’s findings of fact unless they are clearly erroneous. However, a final judgment order may be unfairly entered if the court does not allow one side to present its opposition, misapplies the law, or makes findings not supported by evidence.

Several of the cases I found emphasize the importance of allowing both sides to present their cases in order to ensure a fair trial. For example, in Milam v. Stealth Holdings, LLC, the court discusses the requirement that parties be “fully heard” on an issue before a district court can grant a motion for judgment as a matter of law.

Similarly, in Solinger v. Solinger, the court reiterates that a district court abuses its discretion when its decision is clearly erroneous, and that substantial evidence is required to sustain a judgment. Other cases I found highlight the importance of correctly applying the law in order to avoid an unfair judgment. For example, in Long Valley L. D. Co. v. Hunt, the court held that a judgment must be reversed when the court misapplies a rule of law or erroneously places the burden of proof on the losing party. In KY Invs. NV v. King of Condos, Inc., the court discusses the importance of a district court providing a statement of reasons when granting summary judgment, in order to allow for meaningful appellate review.

Finally, a few cases I found emphasize the deference given to district court findings of fact on appeal. For example, in Pickens v. McCarran Mansion, LLC, the court notes that appellate courts are bound by the district court’s findings unless they are clearly erroneous. Similarly, in Bonnell v. Lawrence, the court reiterates that the remedy for legal error is by timely motion or appeal, not by independent action for relief from judgment.

Link to Transcript

In December 2021 I filed a motion for an evidentiary hearing because I had been in litigation since July 2016 and no judge had looked at the evidence yet.

A hearing was held on January 19, 2022 to decide my motion for an evidentiary hearing to set aside previous orders on the grounds that the orders had been obtained by fraud, false evidence, attorney and judicial misconduct.

A rogue counter-motion made by a non-party, Red Rock Financial Services LLC, to issue a vexatious litigant restrictive order against me was filed, and the date and purpose of the hearing changed so no evidentiary hearing was held (again).

The same date change and the same failure to hold an evidentiary hearing happened for the 8/19/21 hearing that had the date changed inexlicably from 8/18/21 to 8/19/21.

I am requesting your help to get some investigative assistance, and meaningful access to Nevada’s formal complaint procedures, to address this problem of HOA debt collectors and banks ripping us all off.

Specifically, the two issues I am raising I also raised in a letter to the R-J “HOAs, foreclosures, and property rights” published on 9/18/16.

1. HOA debt collectors use abusive debt collection practices to foreclose for trivial delinquent assessments, and then unlawfully retain the proceeds of the sales.

2. Banks lie to the court in HOA foreclosure litigation for quiet title so they can foreclose on deeds of trust/mortgages that they don’t actually own.

Can you assist in ensuring that these possibly criminal complaints are addressed by the proper enforcement authorities?

The NV Real Estate Division and CICC Ombudsman should ensure that HOA foreclosures are compliant with state law, but they have failed. Enforcement officials have been cowed, co-opted, or corrupted into being completely ineffective at any enforcement of NRS116, NRS116A, or NAC116, or NAC 116A.

Link to outline of the corruption “HOA debt collectors wield an unlawful level of power”

This systemic problem can’t be effectively incorporated in my individual civil action, but must be addressed statewide.

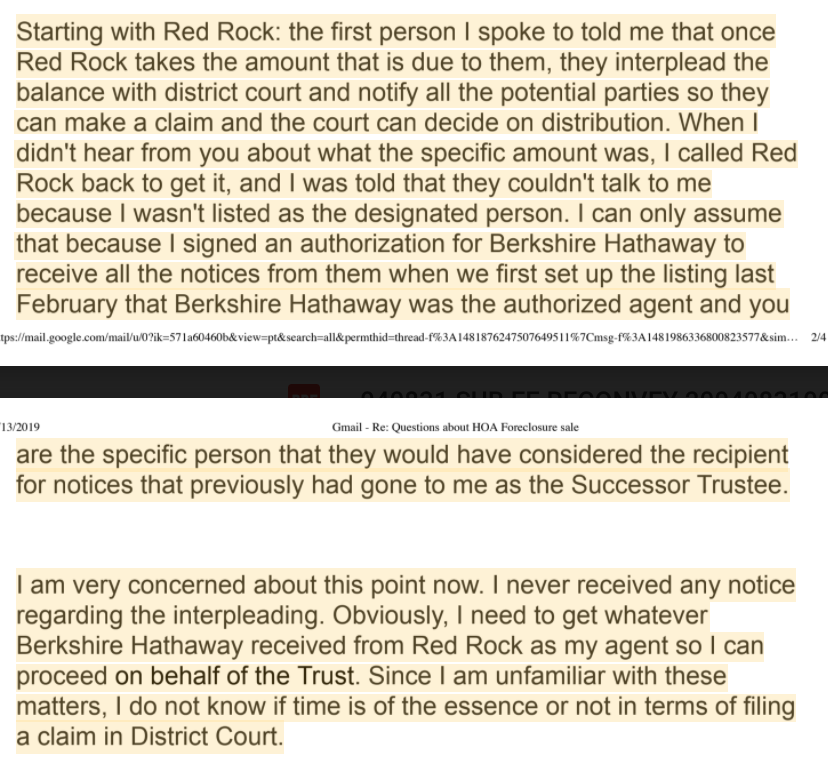

This email describes a pattern of unjust enrichment and fraudulent concealment that (I have been told) cannot be addressed in the quiet title litigation I have over my late fiance’s house (also described herein) because my case is not a class action.

This fraud is larger than last big HOA corruption case where more than 40 were indicted and four died suspiciously.

This problem involves so much more money than the last HOA corruption scam by Benzar and Nancy Quon manipulating HOA board elections and channeling construction defect cases to themselves that it should not be ignored by authorities.

I need to know how to get the appropriate enforcement agency staff to talk to me personally and to prioritize reviewing the investigative research already done.

The scale of this fraud is astounding, but it is so big because it is one way banks are trying to dodge accountability for creating worthless securities that exist in the aftermath of the 2008 collapse of the mortgage securities market.

Taxpayers bailed out the banks after the crash. The TARP program made banks virtually whole despite their misdeeds. None of the investment banker perpetrators went to jail for bringing down the world economy.

The specific situation here is a new twist on the mortgage servicing fraud, robo-signing problem that led to Nevada’s 2011 anti-foreclosure fraud law AB 284 and the 2012 National Mortgage Settlement. Here, the un-indicted co-conspiritors that destroyed the entire housing market a decade ago are trying to cut their losses by getting title to HOA-foreclosed houses even though they don’t actually own the mortgages.

It is very common for houses foreclosed by HOAs – in Nevada and nationwide – to have mortgages/deeds of trust that were securitized out of existence – broken up into synthetic derivatives, collateral debt swaps and tranched instruments, so esoteric and exotic that the ownership of the note is nearly impossible to accurately ascertain.

Banks’ attorneys’ legal sleight of hand – razzle, dazzle ’em!

The banks, and their extremely high paid and competent, albeit ethically-challenged attorneys, have figured out one way to foreclose when they had no legal right to do so and have no legal way of proving who owns the mortgage. Getting quiet title after an HOA foreclosure is one way they pull this magic trick off.

They (meaning either the banks or the banks’ attorneys on their own initiative, hard to say given all the smoke and mirrors) record false affidavits against the title (banned by AB284 in 2011) claiming that the owner of the home owes it a debt. Further, the bank’s Constitutional protections are abridged if the bank loses the owner’s home as security for a debt owed to someone, but the owner’s property rights and protections against seizure without due process can be abridged with impunity.

Then, probably no one challenges the banks’ claim (the owner that lost the house for a trivial debt is usually either dead or devastated by debt).

The bank then is free to sue the purchaser at the HOA for quiet title. The bank blithely lies to the court, claiming falsely that it holds the debtor’s IOU, i.e., the original note where the debtor promised to pay back the mortgage to the originating lender.

The court will probably buy the bank’s story because the documents produced seem very official and incomprehensible.

Brilliant, unscrupulous bank! The fraud is not obvious to the naked eye. A forensic examination is needed to discern it. Further, nobody is around to contradict the bank that’s pretending to be owed a debt.The bank can then foreclose on the property with impunity without ever having to prove that the debt was ever really owed to it.

The HOA debt collectors are rewarded by nobody noticing that they unlawfully keep nearly all of many HOA sale proceeds for years.

No worries.

The bank can’t make a claim for the proceeds if the HOA sale extinguishes the security instrument.

And, it’s really easy for the debt collector block owners who attempt to make a claim for a portion of the proceeds — as has been amply demonstrated iboth n my case and in the Spanish Trail case in the forwarded email below.

The scam works for HOA foreclosures between 2011-2015 before the 2015 law changes.

Speculators-in-the-know have bought almost all of Nevada’s HOA foreclosures. These clever guys have gotten huge windfalls by buying HOA liens for pennies on the dollar virtually without competition from bona fide, arms-length purchasers. The vulture investor rents the properties they got free and clear for years while the wrongful foreclosure is litigated.

Note: the HOA debt collectors unlawfully get approval for these sales from the HOA Boards in secret meetings so the HOA homeowners can’t buy houses in their own HOA by paying a few bucks to cover delinquent dues. These great deals are reserved for speculators. All SCA foreclosures have gone to parties who own multiple HOA foreclosures from two to over 600 house. For example, two Sun City Anthem properties sold in 2014 for under $8,000, and 11 of 12 SCA foreclosures that year sold for under $100,000. I estimate this averages at less than one-third market value.

Real estate speculators bought HOA liens for delinquent assessments in the thousands after the market crash when the baks wouldn’t protect the properties from deterioration causing whole neighborhoods to be blighted. These cognoscenti bought often, sometimes in bulk, either directly from the HOA debt collector or at some poorly noticed “public” foreclosure sale. See Irma Mendez affidavit regarding Joel Just, former-President of red rock.

Link to one 2012 speculator’s description of how he did it.

Link to UNLV Lied Institute for Real Estate 2017 study , commissioned by Nevada Association of Realtors, documenting 611 HOA foreclosures and the super-priority lien, that shows a cost to the Nevada real estate market exceeding over $1 billion between 2011-2015.

HOA debt collectors win by putting virtually ALL the proceeds of the sales in their attorney trust funds (except the actual delinquent assessments plus interest and late fees (chump change) that go to the HOA.

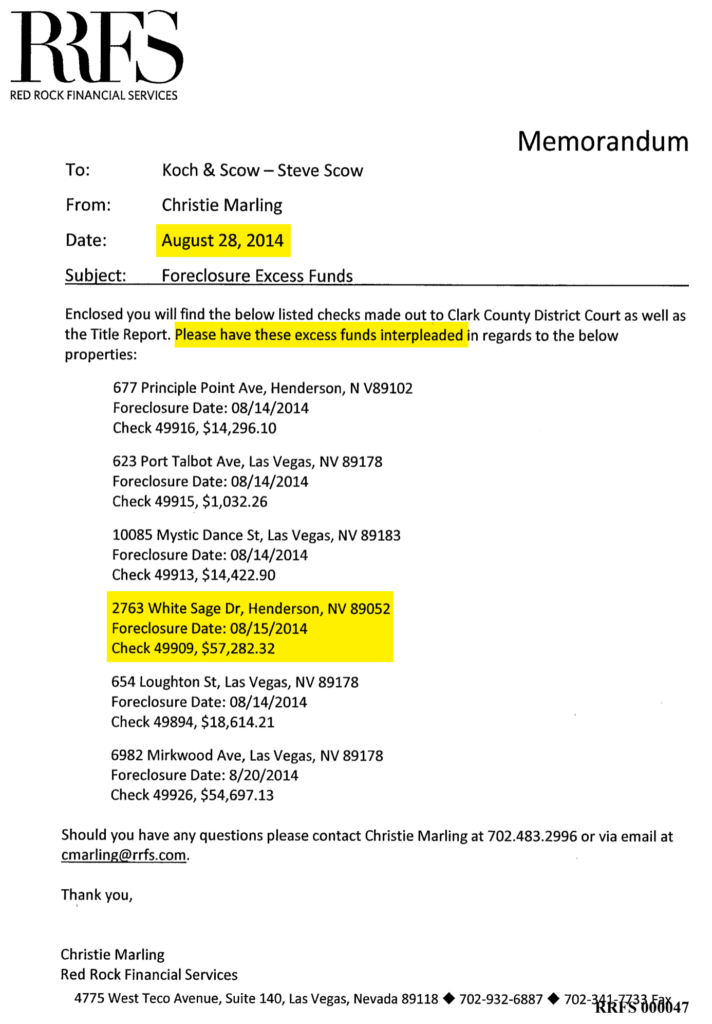

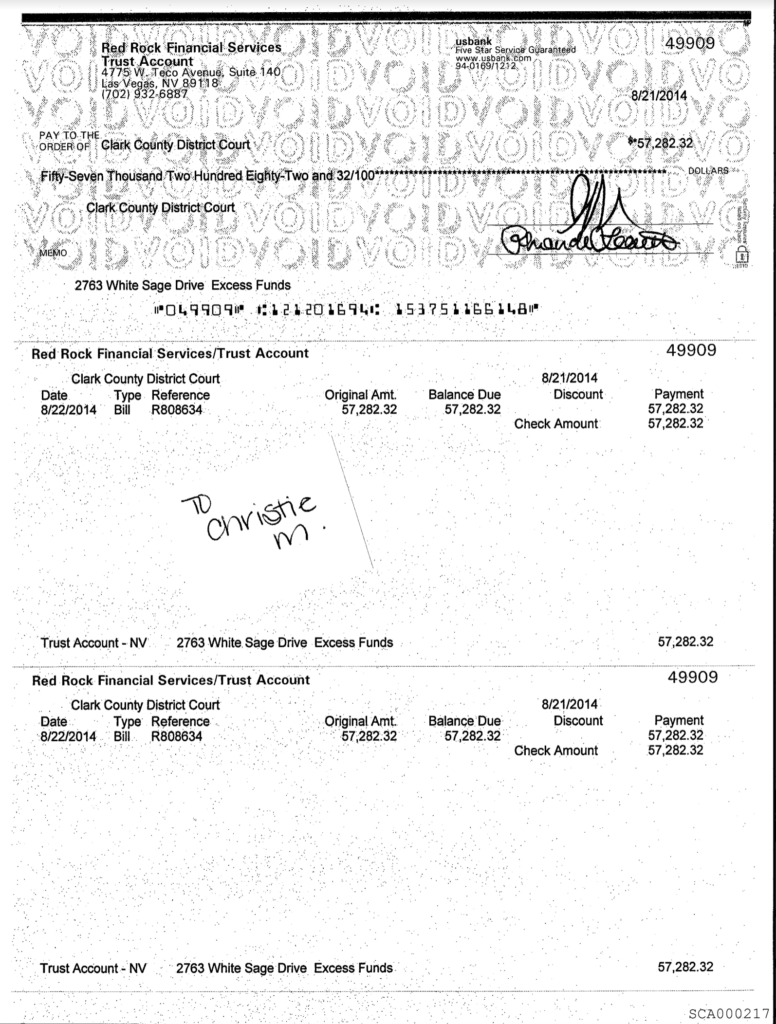

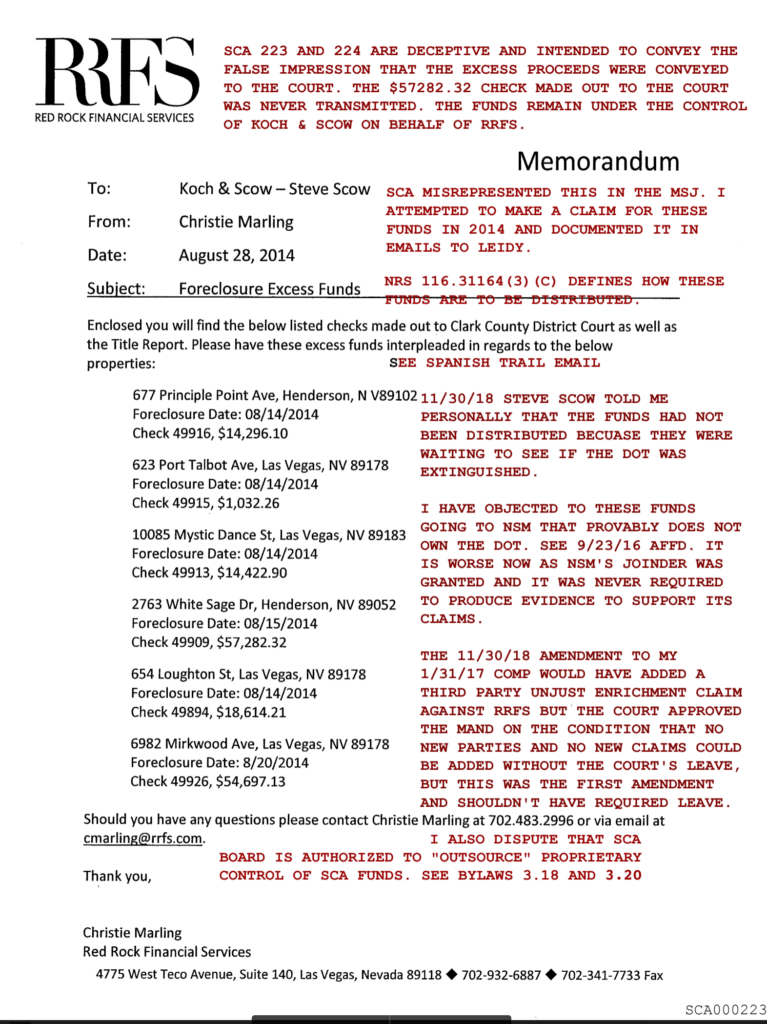

In my case, RRFS kept $57,282 in “excess” proceeds and paid the HOA $2,701.04 as payment in full. What a deal! Seems like a disproportionate sanction to me, but probably it’s in the bottom quartile of all the David Copperfield RRFS has conjured up to rip off HOA homeowners further after stealing their houses.

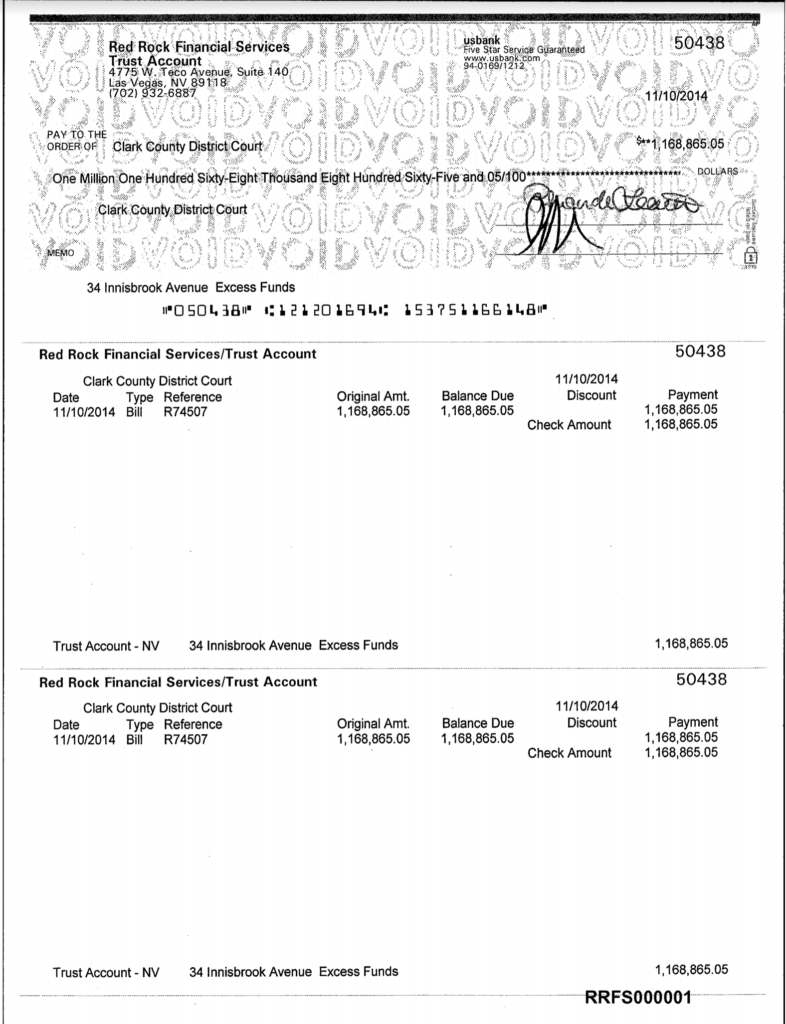

In this Spanish Trails case RRFS has been holding a whopping $1.1 million+ since 2014. One question is “Will the 90- year-old former owner get a fair shake in court to claim those proceeds or will the debt collectors and the banks (and maybe the judge) postpone until the bank wins by default?

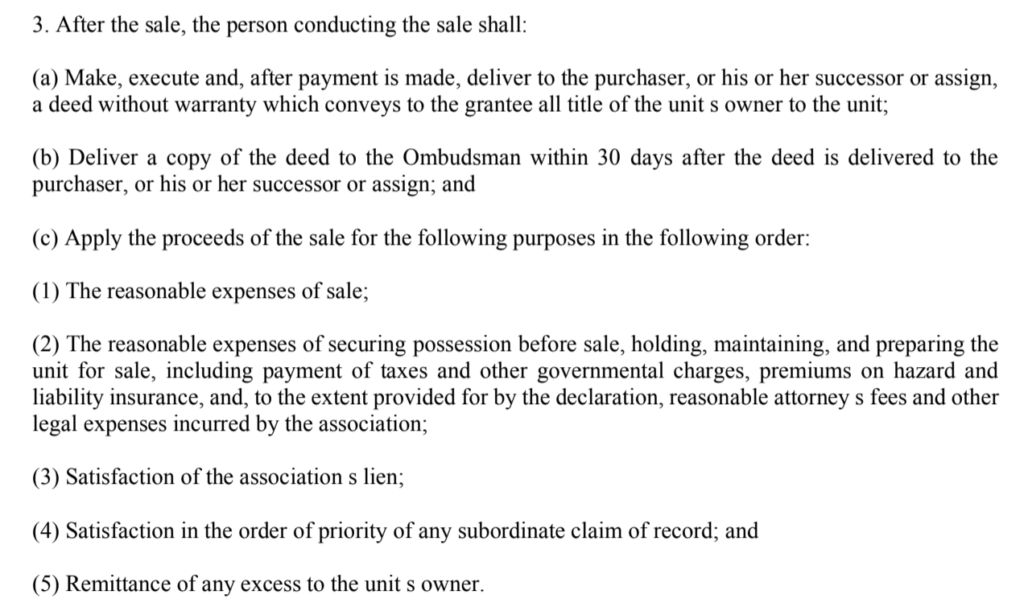

NRS 116.31164(3)(c) (2013) requires that the funds be distributed in a certain order – to pay reasonable foreclosure costs, pay the HOA delinquent assessments, then pay off liens, last, pay the owner. The owner only gets something if the sale extinguished the mortgage.

The debt collector’s attorney is not supposed to retain indefinitely the “excess” proceeds. The attorney is supposed to file a complaint in district court called interpleader and SHALL distribute the funds in the manner defined by NRS, but they just pretended to do it.

It’s almost a state-sanctioned form of embezzlement.

This windfall is potentially in the tens of millions, and there is a pretty small crew of individuals that do this – HOA debt collectors with NRS 649 licenses and attorneys who don’t need a license and so are even less regulated.

There is no accounting of the sale proceeds by the HOA. In fact, the HOA has no record even that a property was foreclosed using the HOA’s power of sale or how much the house was sold for or any accounting. The attorneys and debt collectors tell the HOA -WRONGLY – that it is not the HOA’s money so they effectively block any independent accounting of the proceeds.

I haven’t found any interpleader filed for the court to distribute the proceeds of any of the Sun City Anthem foreclosures conducted in SCA’s name by any of SCA debt collectors, but it’s hard to be sure since they withhold, conceal or misrepresent any records they do have.

and 99% of the time the homeowner who lost the house is not in the case. The court fight is usually just between the bank and the buyer at the sale. The attorneys try to keep the HOA out of it except for the HOA homeowners to pay the litigation costs.

Chapter 7 as an easy way to fraudulently abscond with all the proceeds from many HOA sales held indefinitely in attorney trust funds

The proceeds of these sales can just disappear in a morass of sham LLCs that Nevada is so good at producing while so poor at regulating.

David Alessi was not licensed to practice law in Nevada but passed himself off as an licensed attorney anyway so A&K didn’t have an NRS 649 debt collection license.

A&K dissolved the LLC, hid its assets, filed chapter 7 bankruptcy and morphed into HOA Lawyers Group. Alessi only admitted in the bankruptcy proceedings as retaining $2.9 million after having conducted at least 800 HOA “public” auctions out of their offices between 2011-2015, 500 of which per David Alessi’s deposition, had named A&K as a party to wrongful foreclosure litigation. They had one racketeering, bid rigging judgment (Melinda Ellis) against them that they skipped on.

Link to the notice about this scam I sent on 1/25/17 that the SCA Board ignored. My reward came when the current SCA attorney/debt collector ordered me to recuse myself from all SCA collection matters after I was elected to the Board and prohibited me from accessing any SCA records without his approval.

The banks are usually cheating as well because they are saying that they own the mortgage when they actually don’t own it any more than I do.

Since it is unlawful for an HOA to foreclose after a bank had issued a notice of default (NRS 116.31162(6), the prime pickings for HOA foreclosures were frequently ones that the bank did not foreclose on for 2-3 years of non-payment. These houses were ripe of HOA foreclosure primarily when the banks couldn’t prove they owned the mortgage after Nevada passed AB 284, its anti-foreclosure fraud law in 2011. So the banks in these HOA foreclosure litigations unfairly get a second bite of the apple

In my case, the homeowner died.

The HOA sold the house to a Realtor in the listing office after the bank blocked four legitimate sales of the property.

The bank now claims the HOA sale was valid to get rid of my (the estate’s) property rights, but that the HOA sale was not valid to extinguish the deed of trust the bank is lying about owning.

Obviously, the highest priority to fraudulent banks is to get mortgages on their books that had been securitized out of existence. The proceeds of the HOA sale are second priority.

So the banks in these HOA foreclosure litigations have a chance to get quiet title just by beating the speculator in court so they can foreclose without meeting the stringent stands of AB 284. Obviously it is much more worth it to those kinds of fraudulent banks to get mortgages on their books that had been securitized out of existence than to worry about the proceeds of the HOA sale.

The HOAs get nothing from a sale but the few assessment dollars they certainly could have gotten easier if they had taken title by deed in lieu or had offered the property up to their own HOA owners.

Instead of the HOA (or some of its owners) getting the windfall of a house with no mortgage, the homeowners get a big, fat legal bill to pay for the fight between the HOA sale purchaser and the bank for wrongful foreclosure. In SCA’s dozen 2014 foreclosures owners have paid, several hundred thousand bucks in attorney fees, settlements, insurance deductibles, and other costs have accrued to collect because SCA has totally abdicated to the debt collectors and .

The homeowner, in this case, me, got screwed by losing the house at a surprise sale for a trivial delinquency, 8th amendment anyone?

I, for one, would easily have corrected a $2,000 delinquency had I thought, in a million years , that the bank – the same bank, mind you, that claimed $389,000 was owed to it — wouldn’t stop the HOA from selling the house for $63,100 when a $358,800 offer from a bona fide purchaser was on the table.

Oh well…current status of my one little stolen house case

There will be a hearing on March 26 on motions for summary judgment. The trial is set for May 28, 2019.

Here is a link to a counter-motion I drafted yesterday that I am sure my attorney will choose not to file after because my draft is focused on the bank’s duplicity and not exclusively on the (considerable) statutory deficiencies of the HOA sale per se.

However, it shows how the banks’ attorneys are trying to use the HOA foreclosure quiet title proceeding to unfairly gain title to a property when its claim to be owed around $400,000 is provably false.

In this case, the debt collector should have stopped the HOA sale when the bank tendered nine months of assessments, the super-priority, but instead, it carried on in secret meetings (of which there are no agendas and no minutes) to get the SCA Board to approve an unnecessary sale without telling me. The debt collectors unlawfully refused the banks’ tender of the super-priority amount twice, and each one should have stopped the HOA sale, but the debt collector never told the Board what it did.

It’s simply a low percentage game.

It has cost me over $30,000 in attorney fees already and trial isn’t until May in this four-year long case. My attorney has been very generous with reducing fees and looking at my work, but most attorneys won’t represent a homeowner because the chance of recovery is so small and the banks’ resources so formidable.

Here’s the minutes of the February 5 hearing in the Spanish Trail case that was continued to March 5. Link to the March 1 minutes of the hearing that inexplicably occurred on March 1 and not March 5.

The email I am forwarding was my attempt to articulate the nuances of this scam to my attorney which he probably didn’t read. I don’t think he charges me for reading my long descriptions of the systemic deficits and scams because he is already not billing me for all the time it takes just to deal with trying to get quiet title to Bruce’s house,

All proceeds of HOA sales must be accounted for by SCA, but the SCA Board has been told that once the account goes to the debt collector it’s not their problem.

….probably collecting the interest, not filing interpleader, and keeping what nobody notices. This is much more money, RRFS kept $1,168,865 is excess proceeds after the 11/10/14 sale.

It looks just like the RRFS trust fund check to the court for $57,282 excess proceeds check from excess proceeds after the 8/15/14 sale that Koch & Scow never filed for interpleader. When I attempted to make a claim for those funds in September 2014, I was rebuffed.

The owner, not in the case, gets the proceeds if the sale extinguished the loan

Here are the minutes of a 2/5/19 hearing where attorney Akin (not on efile list) was waiting for outcome so his 90-year-old client (former owner?) could see about the excess proceeds. Continued to 3/5/19. Will Akerman attorney even go to interpleader or will she let the old owner have it?

Order granting MSJ to the bank 12/5/18

But the court finds that the HOA could only foreclose on the sub-priority portion of the lien This is what Ackerman is trying to do in the 2763 case, only representing a different bank.

Ackerman got quiet title for Thornberg, the bank who I suspect is fraudulent and claims to have gotten the beneficial ownership from MERS. This is like 2763 DOT. I say this because in 10/1/11, Nevada legislature passed AB 284 which made it a felony for to banks to use robo-signers to execute notarized false assignments of mortgages.

In this case, the owner defaulted in 2011 on the DOT and the HOA filed a NODES in late-2011, why didn’t the bank foreclose for over three years until the HOA sold it in late-2014?

Bank MSJ: Foreclosure only sub-priority piece is valid

The Ackerman MSJ is what they will be arguing about 2763. Bank made super-priority tender. It was refused. Sale did not extinguish the loan because HOA only foreclosed on sub-priority portion. Argues that it doesn’t matter if Saticoy is a bona fide purchaser. Shadow Wood applies as sale was commercially unreasonable and unfair.

The fact that both banks tendered the super-priority amount is supported by the RRFS/SCA disclosures, and it is a strong reason well briefed by Ackerman for protecting the DOT, so we have to show that because BANA and Nationstar were provably engaged in mortgage fraud, they were complicit in preventing the estate from paying the assessments by BANA’s refusing to close two escrows out of which the HUD-1s show the assessments would have been paid, and by Nationstar’s refusing to close two escrows from bona fide CASH purchasers at market value and not responding to the

$375,000 offer i signed on 8/1/14.

John Leach was SCA’s attorney until 2017 when Clarkson took over. His OPPC shows the same attitude SCA has showed to me.

The HOA doesn’t belong in the case. RRFS did everything right

The fight is rightly just between the bank and purchaser in possession The owner is just a loser, not the HOA’s problem

Here’s where our case has to differentiate itself. We have to hold the HOA Board accountable for letting the debt collector/manager/attorney use the HOA power to foreclose to screw the HOA and ALL the owners. Doing collections and foreclosures in secret keeps the chance of compliance low, keeps neighbors from helping a neighbor in trouble, or an out of state executor that doesn’t get proper notice from knowing what to do. Not publishing that a house is going to be foreclosed to the owners prevents any owner from bidding.

The Board can’t wash its hands. It’s wrong for them to blindly listen only to RRFS without having to listen to the owner. FSR/RRFS set the owner up to get the property into foreclosure for way more ways to make money than just charging usurious fees.

The volunteer Directors have been tricked by self-serving agents into doing what the agents say they HAVE TO DO.

In this case, the Board was handling collections and foreclosures such that it made money for the agents, but were actually against the law or SCA governing docs: Here is a link to emails where the former Board President told me how the Board handled foreclosures in 2014 – all in closed BOD meetings under RRFS control.

Our case is unique in arguing violations of due process guaranteed by NRS 116.31031 and NRS 116.31085, SCA CC&Rs 7.4.

(“We first hold that each party in a quiet title action has the burden of demonstrating superior title in himself or herself.”)

Res. Grp., LLC v. Nev. Ass’n Servs., Inc., 437 P.3d 154, 156 (Nev. 2019)

A foreclosure sale generally terminates a party’s legal title to the property. See Bldg. Energetix Corp. v. EHE, LP,129 Nev. 78, 86, 294 P.3d 1228, 1234 (2013) ; Charmicor, Inc. v. Bradshaw Fin. Co.,92 Nev. 310, 313, 550 P.2d 413, 415 (1976). This general rule is subject to certain limited exceptions, such as where the sale is void. See Energetix , 129 Nev. at 86, 294 P.3d at 1234 (noting that a lack of substantial compliance with the relevant statutes and a lack of proper notice are exceptions to the general rule); see also Bank of Am., N.A. v. SFR Invs. Pool 1, LLC, 134 Nev. ––––, ––––, 427 P.3d 113, 121 (2018), as amended on denial of reh’g (2018) (holding that a foreclosure sale on a lien is void where that lien has been satisfied prior to the sale “as the lien is no longer in default”); Henke v. First S. Props., Inc.,586 S.W.2d 617, 619-20 (Tex. Civ. App. 1979) (concluding that the payment of past-due installments cured a loan’s default such that the subsequent foreclosure on the property was void); 1 Grant S. Nelson, Dale A. Whitman, Ann M. Burkhart & R. Wilson Freyermuth, Real Estate Finance Law § 7:21 (6th ed. 2014) (noting that a trustee’s sale is void where there is no authorization to foreclose, and that there is no authorization to foreclose when the loan is not in default). To complete a valid foreclosure sale for unpaid assessments in Nevada, a UOA must comply with the provisions set forth in NRS Chapter 116. Relevant to the present case, the UOA must mail and record a notice of delinquent assessment, NRS 116.31162(1)(a), “a notice of default and election to sell,” NRS 116.31162(1)(b), and a notice of foreclosure sale, NRS 116.311635(1)(a).

Res. Grp., LLC v. Nev. Ass’n Servs., Inc., 437 P.3d 154, 158 (Nev. 2019)

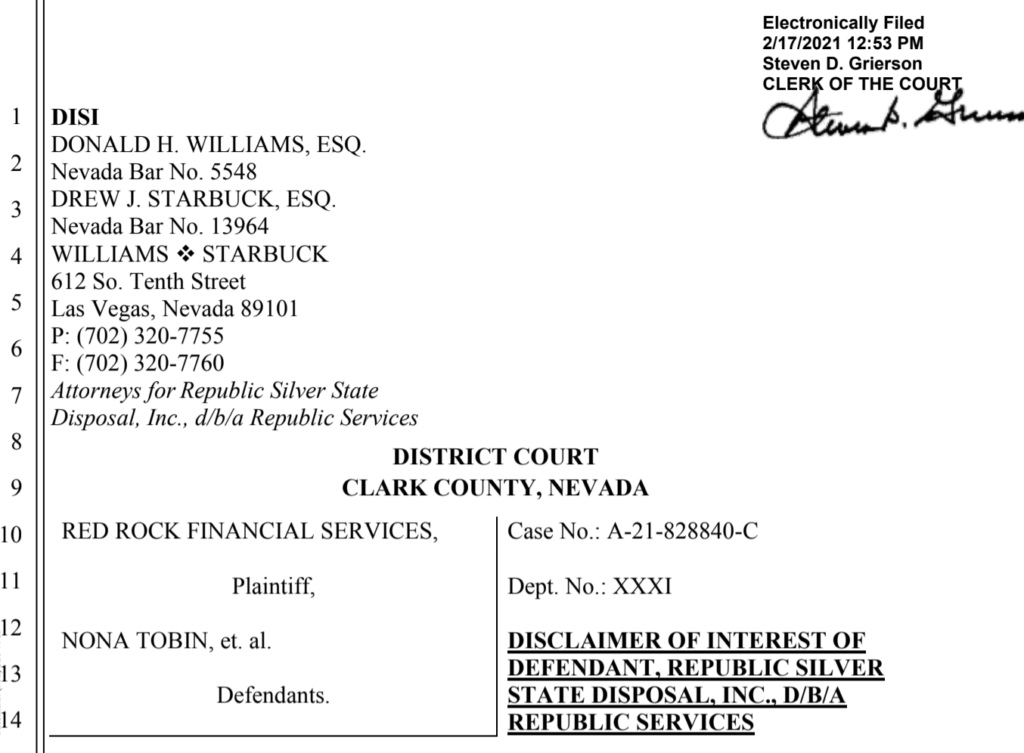

2/17/21 Republic Services Disclaimer of Interest

No defendant timely answered Red Rock or filed any counter-claims or cross-claims except Nona Tobin as an individual

COUNTER-CLAIMANT AND CROSS CLAIMANT NONA TOBIN repeats, realleges, and incorporates herein by this reference the allegations hereinabove inclusively as though set forth at length and in full herein.

This counterclaim has been necessitated by the COUNTER-DEFENDANT RRFS’s AND CROSS-DEFENDANT NATIONSTAR’s bad faith conduct.

Pursuant to Nevada law, COUNTER-CLAIMANT AND CROSS CLAIMANT NONA TOBIN’s may recover her attorney fees as special damages because she was required to file this suit as a result of COUNTER-DEFENDANT RRFS AND CROSS-DEFENDANT NATIONSTAR’ intentional conduct. (Sandy Valley Assocs. v. Sky Ranch Estates Owners Ass’n, 117 Nev. 948, 958, 35 P.3d 964, 970 (2001), citing American Fed. Musicians v. Reno’s Riverside, 86 Nev. 695, 475 P.2d 220 (1970).

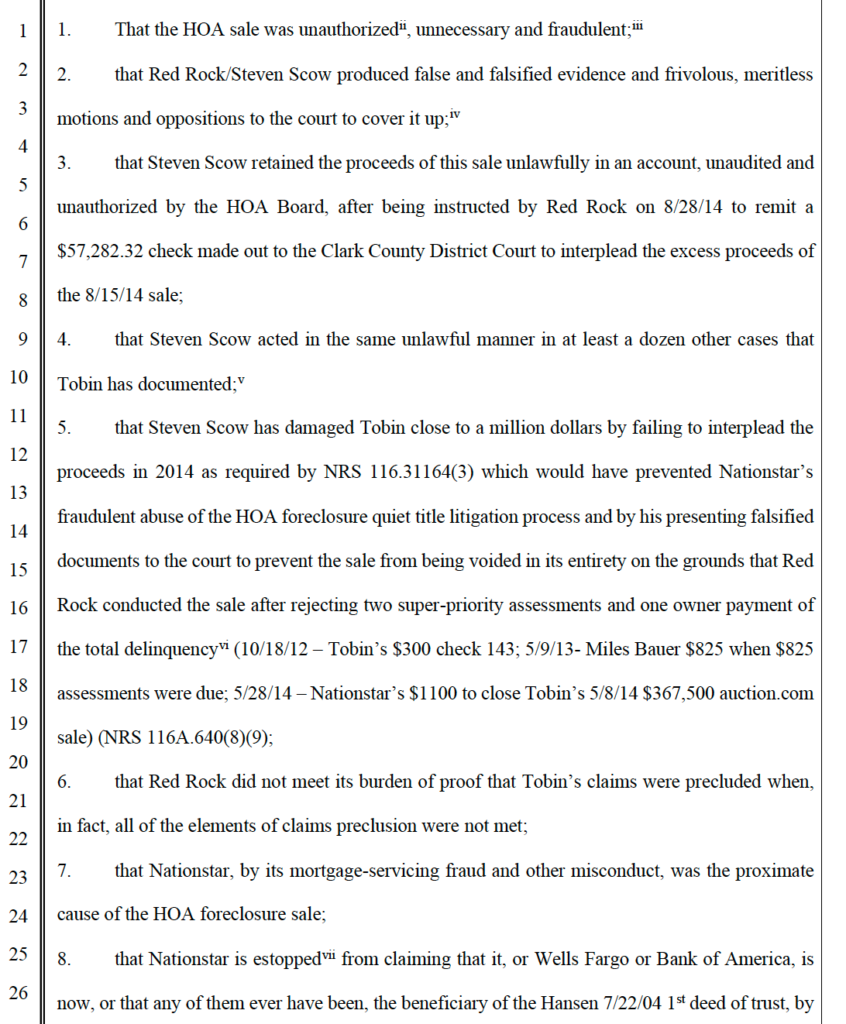

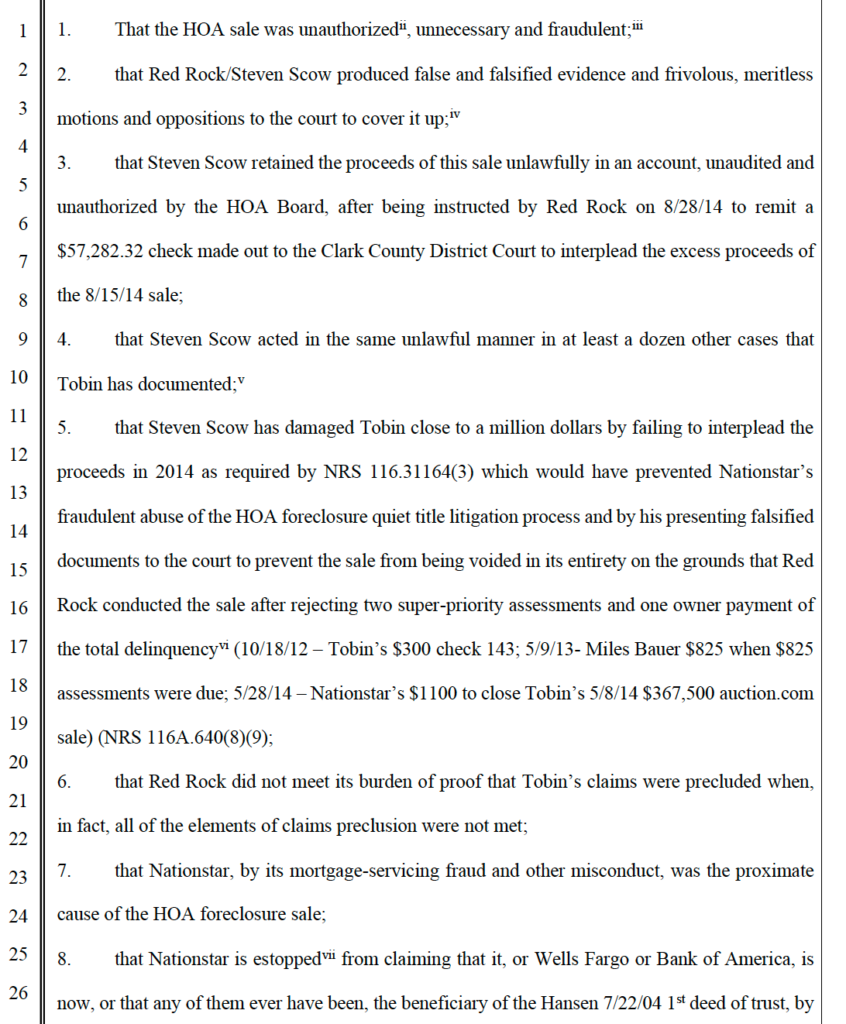

COUNTER-CLAIMANT AND CROSS CLAIMANT NONA TOBIN petitions the Court to declare:

| Instrument number | Record date | Document type description |

| 202102120001549 | 2/12/21 | DEED of trust 12/28/20 quicken LLC $355,320 loan 2 Chiesi |

| 202102050000420 | 2/5/21 | Substitution/reconveyance of quicken INC 12/27/19 $353,500 loan to switch 2 12/28/20 $355,320 dot quicken LLC 2 Chiesi |

| 202012040001097 | 12/4/20 | Order to expunge 8/8/19 LISP, 8/14/19 LISP & 8/14/19 LISP Tobin LIS pendens and to dismiss Tobin’s claims with prejudice recorded by quicken attorney maurice wood while appeals 82094, 82234, 82294 and 79295 are pending. |

| 202002060000199 | 2/6/20 | reconveyance of Joel Stokes’s $355,000 5/23/19 dot that masqueraded as Nationstar-Jimijack deal. 5/21/19 transcript Nationstar-Jimijack settlement docs status check. T Dixon v-p 1st American Title executed reconveyance 2/5/20, > 1 month after quicken recorded 12/27/19 $353,500 loan 2 Chiesi and Driggs title allegedly insured the Chiesi title. |

| 202002060000198 | 2/6/20 | Substitution of trustee on Joel Stokes 5/23/19 $355,000 dot. 2/4/20 Tyson Christensen, v-p of fay servicing as if Morgan Stanley’s attorney in fact. No recorded power of attorney. |

| 201912270001346 | 12/27/19 | DEED of trust 12/26/19 $353,500 quicken loans INC 2 Brian & Debora Chiesi |

| 201912270001345 | 12/27/19 | DEED grant, sale bargain (not quit claim) Joel Stokes, an individual, alleged he had a valid title to transfer to Brian & Debora Chiesi. Joel Stokes did not have a valid title as Jimijack had no valid title to transfer to Joel Stokes on 5/1/19. Driggs title agency, INC. 7900 w sahara #100 lv 89117-7920. Escrow #19-11-120779jh DECLaration of value |

| 201912270001344 | 12/27/19 | DEED Sandra 2 Joel Stokes, as spouses, not as Jimijack trustees. Joel and Sandra Stokes as trustees of Jimijack transferred Jimijack’s defective title to Joel Stokes, as an individual, on 5/1/19, RPTT exemption 5 |

| 201912030003152 | 12/3/19 | On 12/3/19 Hong recorded notice of 11/22/19 a-15-720032-c order that erroneously expunged Tobin 8/8/14 LIS pendens re a-19-799890-c 8/7/19 complaint and 7/23/19 appeal and 7/24/19 appeal into 79295 8/8/19 sca motion to strike Tobin’s pro se 8/7/19 nolp was granted on 9/3/19 rtran, but sua sponte 11/22/19 order was wrongly written to both expunge 8/8/19 LISP (outside judge kishner’s jurisdiction) and to strike 8/7/19 nolp from the a-15-720032-c court record 11/22/19 order, recorded 12/3/19, was unappealable per order 20-13346 wherein the nv supreme court claimed 11/22/19 order was outside its jurisdiction. 9/10/19 nv supreme court order 19-37846 denied Nona Tobin all rights to appeal any decision made by judge kishner. |

| 201908140003084 | 8/14/19 | LIS pendens Tobin recorded 39 pages with a-19-799890-c complaint attached. On 8/13/19 Tobin filed nolp into a-19-799890-c |

| 201908140003083 | 8/14/19 | LIS pendens related to Tobin/Hansen trust appeals 79295 7 pages plus receipt for recording both 8/14/19 LIS pendens |

| 201908080002097 | 8/8/19 | LIS pendens (7 pages) related to 7/23/19 Hansen trust appeal & 7/24/19 appeals & 8/7/19 a-19-799890-c |

| 201907240003355 | 7/24/19 | Judgment Hong recorded 6/24/19 order vs GBH trust on 7/24/19 after he received notice of two appeals filed on 7/23/19 and 7/24/19. 6/24/19 order expunged 56/19 LIS pendens which related to the claims of both Nona Tobin, an individual, and the Hansen trust , but Nona Tobin, an individual, ws excluded from the trial and removed as a party unfairly due to the misrepresentations joseph Hong made to judge kishner at a 4/23/19 hearing held ex parte due to Hong serving notice that the hearing was continued to 5/7/19. |

| 201907170002971 | 7/17/19 | Assignment Stokes 5/23/19 dot 2 morgan stanley No proper purpose, but served to cloud the title and attempted to cover the dirty money trail. |

| 201907100002352 | 7/10/19 | Akerman recorded (cover sheet) release of Nationstar’s 1/13/16 LISP re NSM vs op homes (ROLP page 2). Akerman did not serve any notice of the release into a-16-730078-c where my 4/24/19 motion to vacate the HOA’s MSJ and NSM’s joinder (per NRCP 60(b)(3) fraud) and motion for summary judgment vs all parties was still unheard. |

| 201906040000772 | 6/4/19 | Assignment of Joel Stokes DEED of trust had no proper purpose, but served to cloud the title and attempted to cover the dirty money trail. |

| 201906030001599 | 6/3/19 | substitution/ reconveyance release of LIEN of Hansen DEED of trust to Joel Stokes |

| 201905280002843 | 5/28/19 | LIS pendens release of Nationstar’s LIS pendens by Joel & Sandra Stokes as trustees of Jimijack |

| 201905230003531 | 5/23/19 | DEED of trust Joel Stokes-$355,000 DEED of trust from civic financial services |

| 201905060001022 | 5/6/19 | LIS pendens Hansen trust/Tobin |

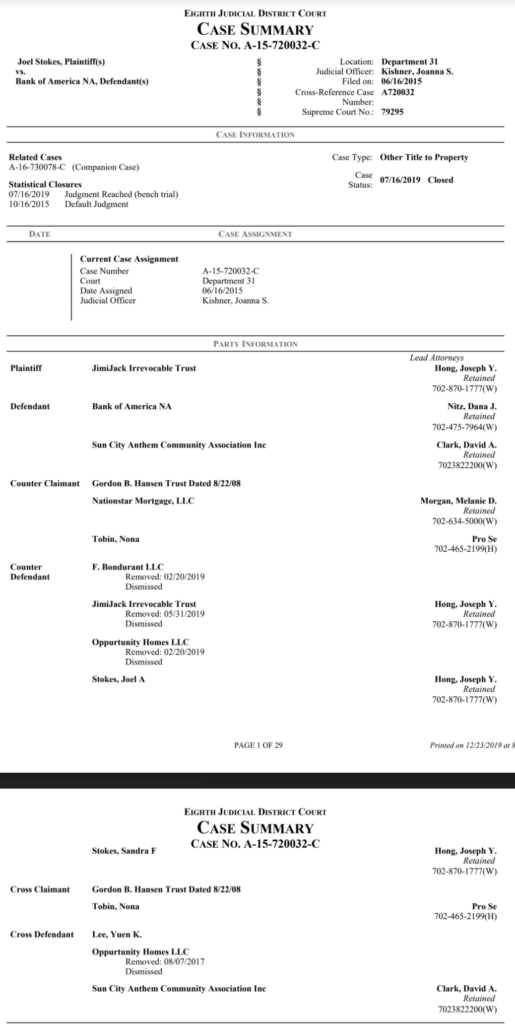

| 201905010003348 | 5/1/19 | DEED Joel a. Stokes & Sandra f. Stokes, as trustees of Jimijack irrevocable trust to Joel a. Stokes, individual. The Joel Stokes’ DEED was recorded five weeks before the 6/5/19 trial. The 6/6/19 trial allegedly adjudicated GBHt trustee Nona Tobin’s 2/1/17 counterclaim vs Jimijack for quiet title & equitable relief, fraudulent reconveyance (Jimijack’s DEED was inadmissible per NRS 111.345), unjust enrichment (collecting rent from 9/25/14, not 6/9/15 as Jimijack DEED claimed, after a fraudulent sale), civil conspiracy (bid suppression, selective notice of sale to speculators) and preliminary/permanent injunctions (prevent sale or transfer during pendency of proceedings). The 6/6/19 trial also allegedly adjudicated 2/1/17 cross claim vs. Yuen k. Lee dba f. Bondurant LLC. Jimijack did not have an admisible DEED. No Jimijack irrevocable trust instrument was ever disclosed so there is no reason to believe there was any legal authority for trustees to revoke a title from an irrevocable trust and put it in the name of Joel a. Stokes, one of the trustees. |

| 201903080002790 | 3/8/19 | Assignment Wells Fargo 2 Nationstar by Nationstar Mohamed Hameed executed as v-p of Wells Fargo On 3/12/19, two weeks after the end of discovery, akerman disclosed the rescission as NSM 409-NSM 411. |

| 201903080002789 | 3/8/19 | 3/8/19 NSM rescinded the 12/1/14 assignment of the Hansen DEED of trust from Bank of American 2 NSM by NSM. Mohamed Hameed executed it as v-p of Bank of American. No recorded power of attorney On 3/12/19, two weeks after the end of discovery, Akerman disclosed the rescission as NSM 412-NSM 413 |

| 201703310003073 | 3/31/17 | Interest disclaimer lee/f bondurant filed 3/8/17 NSM 222-227 |

| 201703310003072 | 3/31/17 | Interest disclaimer Lucas/ophomes filed 3/8/17 NSM 218-211 |

| 201703310003071 | 3/31/17 | Interest disclaimer steve Hansen filed 3/28/17 NSM 212-217 |

| 201703300003860 | 3/30/17 | Republic services released its 2nd garbage LIEN recorded 5/6/14 concealed by rrfs & NSM |

| 201703300003859 | 3/30/17 | Republic services released its 1st garbage LIEN recorded 9/23/13 |

| 201703280001452 | 3/28/17 | DEED Gordon b Hansen trust, dated 8/22/08, 2 Nona Tobin, individual, NSM 208-211 |

| 201606070001450 | 6/7/16 | LIS pendens re NSM 6/2/16 aacc vs Jimijack NSM 203-207 |

| 201605230001417 | 5/23/16 | Request notice by Tobin 4 Hansen trust not disclosed by NSM |

| 201605230001416 | 5/23/16 | Certificate of INCumbency Nona Tobin 4 Hansen trust |

| 201601130001051 | 1/13/16 | LIS pendens re 1/11/16 complaint Nationstar vs opportunity homes |

| 201512010003402 | 12/1/15 | Judgment of default vs Bank of American 10/23/15 JDDF. No notice of entry of the default judgment was served. Instead, Joseph Hong recorded the 10/23/15 unnoticed default judgment. Joseph Hong who knew, or should have known, that NRS 40.110 “Court to hear case; must not enter judgment by default” “the court shall proceed to hear the case as in other cases and shall have jurisdiction to examine into and determine the legality of plaintiff’s title and of the title and claim of all the defendants and of all unknown persons, and to that end must not enter any judgment by default, but must in all cases require evidence of plaintiff’s title and possession and receive such legal evidence as may be offered respecting the claims and title of any of the defendants and must thereafter direct judgment to be entered in accordance with the evidence and the law.” Joseph Hong knew that had the court held an evidentiary hearing, it would have been detected that Joel & Sandra Stokes as trustees of Jimijack Irrevocable Trust did not have an admissible DEED per NRS 111.345 and therefore had no standing to assert a quiet title claim against any lender. Joseph Hong knew that had the court held an evidentiary hearing, it would have been detected that two other lenders, Wells Fargo (9/9/14) and Nationstar (12/1/14), held recorded claims to be the beneficiaries of the 7/22/04 Hansen DEED of trust as Bank of America’s sole successor-in-interest. Joseph Hong knew that had the court held an evidentiary hearing, it would have been detected that Bank of America did not hold any recorded claim to the Hansen DEED of trust after 9/9/14 and that Hong’s naming BANA as a defendant was for the corrupt purpose of getting a default by a lender who had no claim. Nationstar NSM 192-194, but NSM denied knowing in 1/22/15 req notice, 4/12/15 AFFD, 4/12/16 mot |

| 201508170001056 | 8/17/15 | Substitution of trustee Joan H. Anderson to NSM co-conspirator American Trustee Servicing Solutions by Nationstar, claiming without legal authority to be “attorney-in-fact” for Wells Fargo. No recorded Power of Attorney. Nationstar disclosed as NSM 270-272 is an unrecorded, inapplicable Wells Fargo Power of Attorney. Contradicted by NSM 6/3/19 sub/reconvey. |

| 201506090001545 | 6/9/15 | DEED F. Bondurant LLC to Joel and Sandra Stokes as trustees of Jimijack Irrevocable Trust Inadmissible per NRS 111.345. 1/17/17 Tobin DECL re notary violations and exhibits re notary CluAynne M. Corwin’s involvement with several other questionable subsequent transfers of HOA foreclosures involving Joseph Hong, Joel Stokes, Pam at Linear Title, and Peter Mortenson No legal capacity to transfer title to Jimijack as notary CluAynne M. Corwin “witnessed” Yuen K. Lee’s signature but used her notary stamp to affirm that Thomas Lucas, manager of Opportunity Homes No notary record that CluAynne M. Corwin witnessed any deed executed on 6/8/15. No purchase agreement was disclosed to show how, when, from whom or for how much Joel and Sandra Stokes acquired the property. NRS 240.120, NRS 240.155, NRS 240.075 violations. Incompetent acknowledgment per NRS 111.125. Jimijack had no DEED with legal capacity to hold or transfer title, but transferred to Joel Stokes, an individual on 5/1/19. Jimijack’s defective deed was disclosed as NSM 189-191. Nationstar knew that the two deeds recorded on 6/9/15 alleged title claims that replaced Opportunity Homes LLC as an interested party. For unknown reasons, Nationstar chose not to name either F. Bondurant LLC or Jimijack, who both had recorded deeds on 6/9/15, when Nationstar sued disinterested Opportunity Homes in its 1/11/16 complaint in A-16-730078-C. Nationstar voluntarily dismissed its 1/11/16 claims against Opportunity Homes and its non-existent claims vs. F. Bondurant LLC by a stipulation and order entered on 2/20/19. Neither evidence nor trial were required to prevail. Nationstar never produced any evidence to support its filed claims against Jimijack and was excused from the 6/6/19 trial at the 4/25/19 pre-trial conference after Nationstar withdrew its 3/21/19 motion for summary judgment vs. Jimijack. Nationstar’s claims against Jimijack were dismissed by stipulation and order entered on 5/31/19. Again, neither evidence nor trial were required to prevail. |

| 201506090001537 | 6/9/15 | DEED, from Opportunity Homes to F. Bondurant LLC, a sham entity controlled by Joseph Hong, was executed on 6/4/19, and witnessed by Joseph Hong’s employee, Debra Batsel. Batesel witnessed at the same time Thomas Lucas and some unknown party execute a purchase agreement to transfer title from Opportunity Homes. Joseph Hong did not participate in discovery and entered no evidence into the record at any time from 6/16/15. To the present to support any of his clients’ claims, but still won quiet title at the 6/6/19 trial from which all documentary evidence was excluded due to Hong’s misconduct. |

| 201503120002285 | 3/12/15 | Substitution/ reconveyance Wells Fargo 2nd open-ended deed of trust |

| 201502230000608 | 2/23/15 | RPTT refund 2 Thomas Lucas |

| 201501220001850 | 1/22/15 | request notice Nationstar |

| 201412010000518 | 12/1/14 | Nationstar’s assignment of the 7/22/04 Hansen deed of trust from Bank of America to Nationstar, was recorded three months after BANA had no interest to assign on 12/1/14. Nationstar refused to respond in good faith to Tobin’s interrogatories and requests for documents 12/1/14 was executed by Nationstar’s robo-signer in Nebraska and was rescinded by Nationstar’s robo-signer in Texas on 2/25/19, and recorded on 3/8/19. Nationstar disclosed the rescission two weeks after the end of discovery on 3/12/19. Because the sale was void by reasons of fraud, unfairness and oppression, neither the 8/27/08 Hansen Trust’s Deed nor the 7/22/04 Hansen Deed of Trust should have been extinguished by the fraudulent HOA sale. However, 4/18/19 order granted Nationstar’s fraudulent 2/12/19 limited joinder to order that the HOA sale was valid to extinguish the owner’s title rights, but it was not valid to extinguish Nationstar’s rescinded 12/1/14 claim to be Bank of America’s successor in interest. |

| 201409090000974 | 9/9/14 | On 9/9/14, Bank of American recorded that it had assigned its interest in the Hansen deed of trust, if any, to Wells Fargo, effective 8/21/14, the day before the foreclosure deed was recorded. |

| 201408220002548 | 8/22/14 | DEED HOA foreclosure 2 opportunity homes |

| 201405060004357 | 5/6/14 | LIEN 2nd garbage was recorded on 5/6/14 and released on 3/30/17 |

| 201402120001527 | 2/12/14 | notice of 3/7/14 HOA sale |

| 201309230001369 | 9/23/13 | LIEN 1st garbage |

| 201304080001087 | 4/8/13 | default 2nd HOA notice of default, |

| 201304030001569 | 4/3/13 | notice of rescission of HOA 1st notice of default |

| 201303120000847 | 3/12/13 | default HOA 1st notice of default |

| 201212140001338 | 12/14/12 | LIEN $ 925.76 when $300 was due & owing |

| 201204120001883 | 4/12/12 | assignment mers 2 Bank of American by Bank of American |

| 200808270003627 | 8/27/08 | DEED Gordon Hansen B. Hansen Trust, dated 8/22/08, was recorded when the GBH Trust was created. Title was extinguished by the 8/22/14 recording of a foreclosure deed as was the 7/22/04 Hansen deed of trust. Neither the 8/27/08 Hansen Trust’s Deed nor the 7/22/04 Hansen Deed of Trust should have been extinguished by the fraudulent HOA sale. The 4/18/19 order granted Nationstar’s fraudulent 2/12/19 limited joinder to order that the HOA sale was valid to extinguish the owner’s title rights, but it was not valid to extinguish Nationstar’s rescinded 12/1/14 claim to be Bank of America’s successor in interest. |

| 200705100001127 | 5/10/07 | DEED of trust 2nd open ended DEED of trust by Wells Fargo 2 Gordon Hansen, recorded on 5/10/07, was released on 3/30/17 |

| 200409010007297 | 9/1/04 | Declaration of Homestead by Gordon B. Hansen, an unmarried man |

| 200408310007563 | 8/31/04 | Sub trustee/reconveyance of paid in full 7/31/03 DEED of trust Gordon & Marilyn Hansen $310,600 1st dot assigned 2 Washington Mutual by City First Mortgage 7/31/03 lien was released on 8/31//04. |

| 200408170002284 | 8/17/04 | Reconveyance of 11/20/03 Wells Fargo $55,000 2nd DOT To Hansen . The 11/20/03 lien was released on 8/17/04 |

| 200407220003507 | 7/22/04 | DEED OF TRUST is the disputed Hansen DOT. Nationstar disclosed the Hansen deed of trust and the Planned Unit Development Rider as NSM 141-162 $436,000 loaned on 7/15/04 Due in full on 8/1/2034 Borrower: Gordon B. Hansen, an unmarried man Lender: Western Thrift & loan Trustee: Joan H. Anderson PUD rider remedies f. that lenders are contractually authorized only to add delinquent HOA assessments to the outstanding loan balance and add interest at the note rate (here 6.25%). Lenders are prohibited from using the tender of delinquent assessments, rejected or not, as a de facto foreclosure without due process. Nationstar disclosed the PUD Rider Remedies section was disclosed as NSM 160 so ignorance cannot be an excuse. Nationstar disclosed that it does not hold the origInal note by disclosing a copy as NSM 158-160. NSM’s copy of the note shows Nationstar, Wells Fargo and bank of Amercia are not in the chain of title of endorsements. All recorded assignments of the Hansen DEED of trust that culminated in Nationstar reconveying the Hansen DEED of trust to Joel stoke, an individual, on 6/3/19, were false claims to title in the meaning of NRS 205.395. National banking associations’ corrupt business practices were revealed in 12/7/20 national settlement agreement and consent order, its 8/17/18 settlement and release, the 2012 National Mortgage Settlement and consent judgment for Bank of America, the 2012 National Mortgage Settlement and consent judgment for Wells Fargo. Violations of NRS 205.395, NRS 207.360, and other statutes in this particular case are documented in 11/10/20 complaint to the Nevada Attorney General (See TOC of AG exhibits), 12/16/20 complaint to the Mortgage Servicing Division (See TOC 12/16/20 complaint), NCJD 2021-026, |

| 200406110005547 | 6/11/04 | DEED |

| 200311200004030 | 11/20/03 | DEED of trust $55,000 Wells Fargo 2nd deed of trust to Gordon & Marilyn Hansen |

| 200309100000588 | 9/10/03 | DEED of trust assign 7/31/03 dot city first mortgage 2 washington mutual |

| 200307310004444 | 7/31/03 | DEED of trust Gordon & marilyn Hansen $310,600 1st dot from city first mortgage |

| 200307310004443 | 7/31/03 | power of attorney Marilyn 2 Gordon Hansen “limited to executing loan documents for purchase of home located at 2763 white sage…power of attorney is null & void after execution.” Marilyn 2 Gordon Hansen Power of Attorney is the only recorded power of attorney in this property record from 2003 to the present. Nationstar did not record Power of Attorneys for the claims NSM recorded as “attorney-in-fact” on 12/1/14 (Bank of American), 8/17/15 (Wells Fargo), 3/8/19 (Bank of American), 3/8/19 (Wells Fargo) or 6/3/19 (American trustee servicing solutions) |

| 200307310004442 | 7/31/03 | DEED Del Webb 2 Marilyn & Gordon Hansen |

| 200307310004441 | 7/31/03 | Notice of completion |

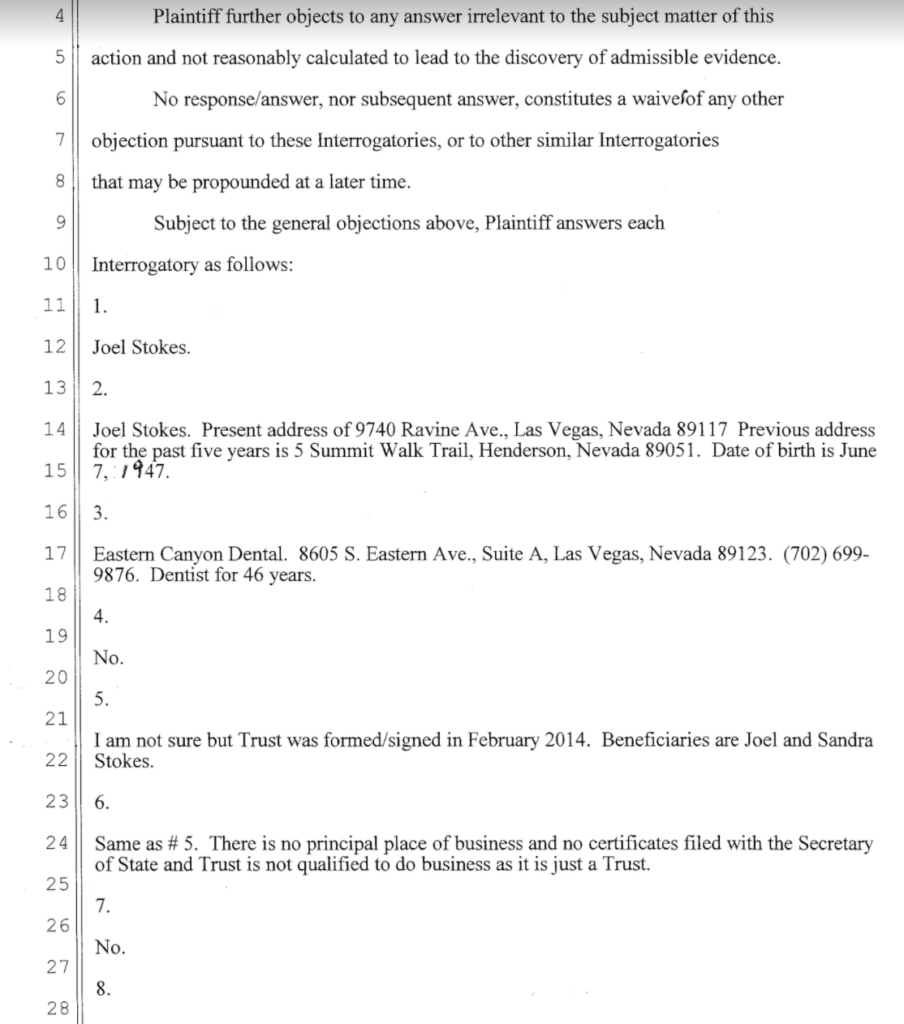

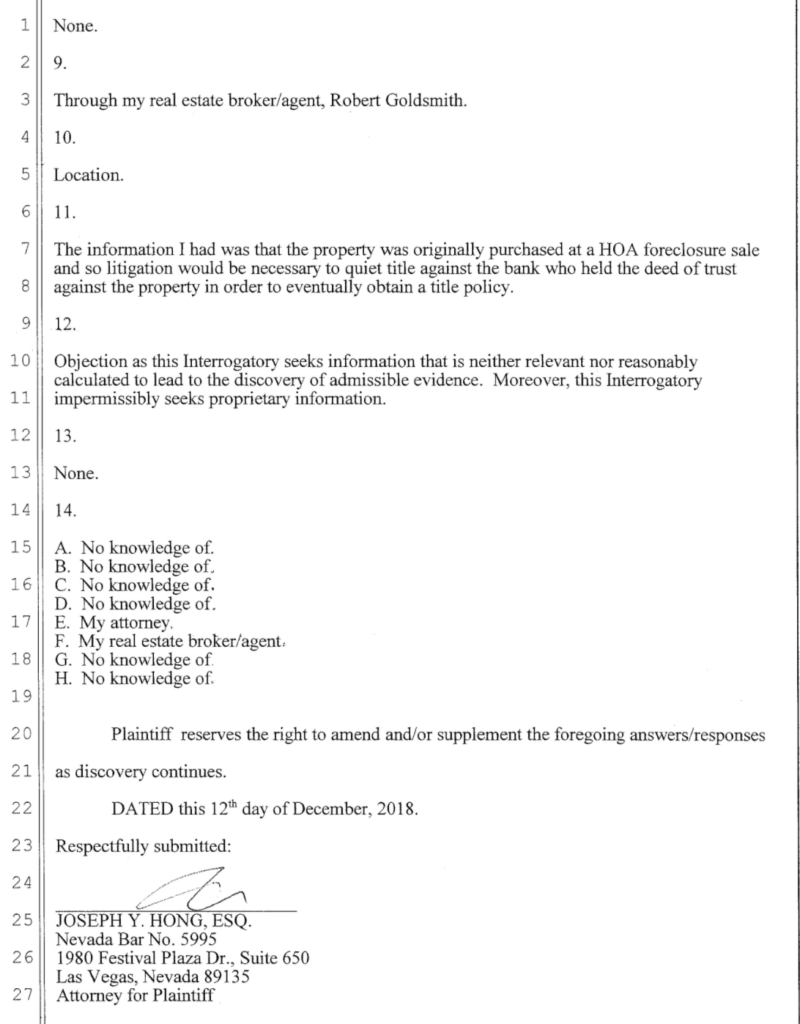

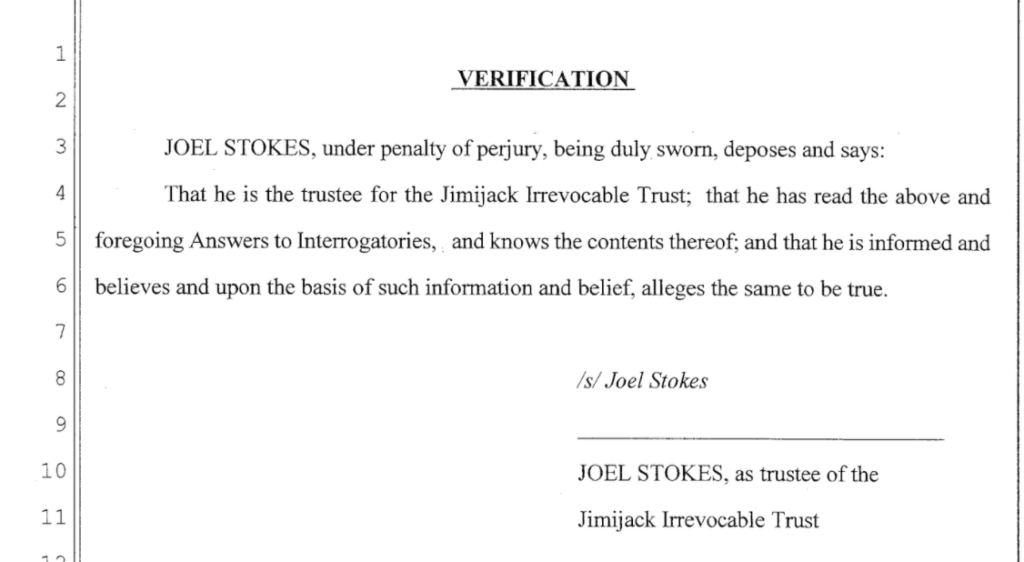

12/05/18 Hong response to Tobin interrogatories was all the evidence in the record to support Jimijack’s title claims

“Nationstar evidence was not examined”

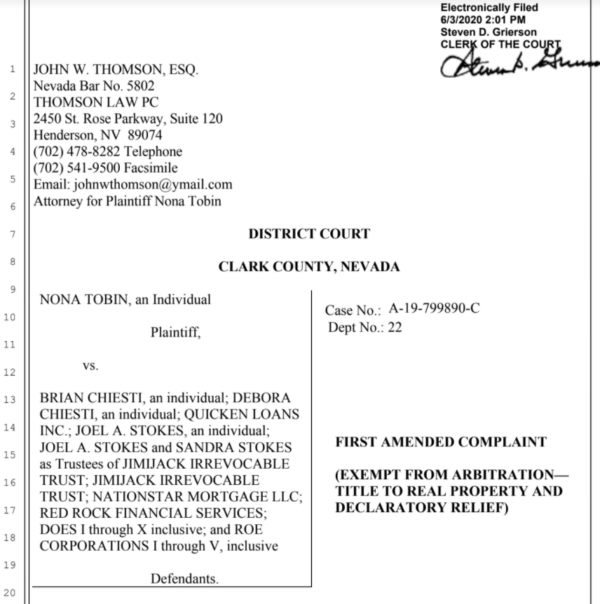

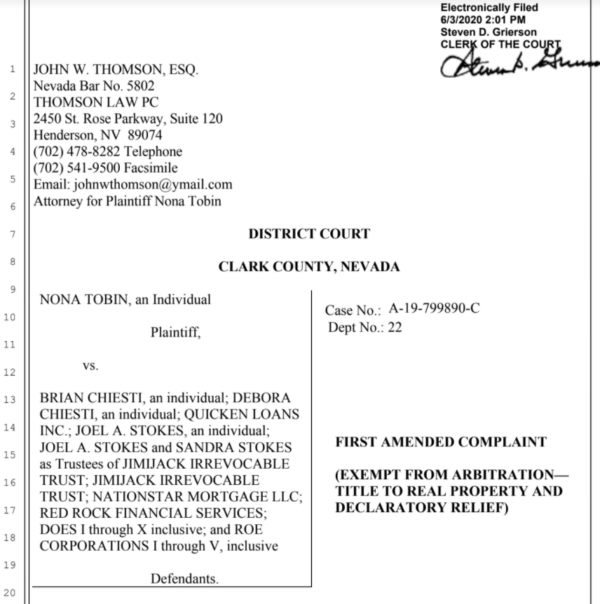

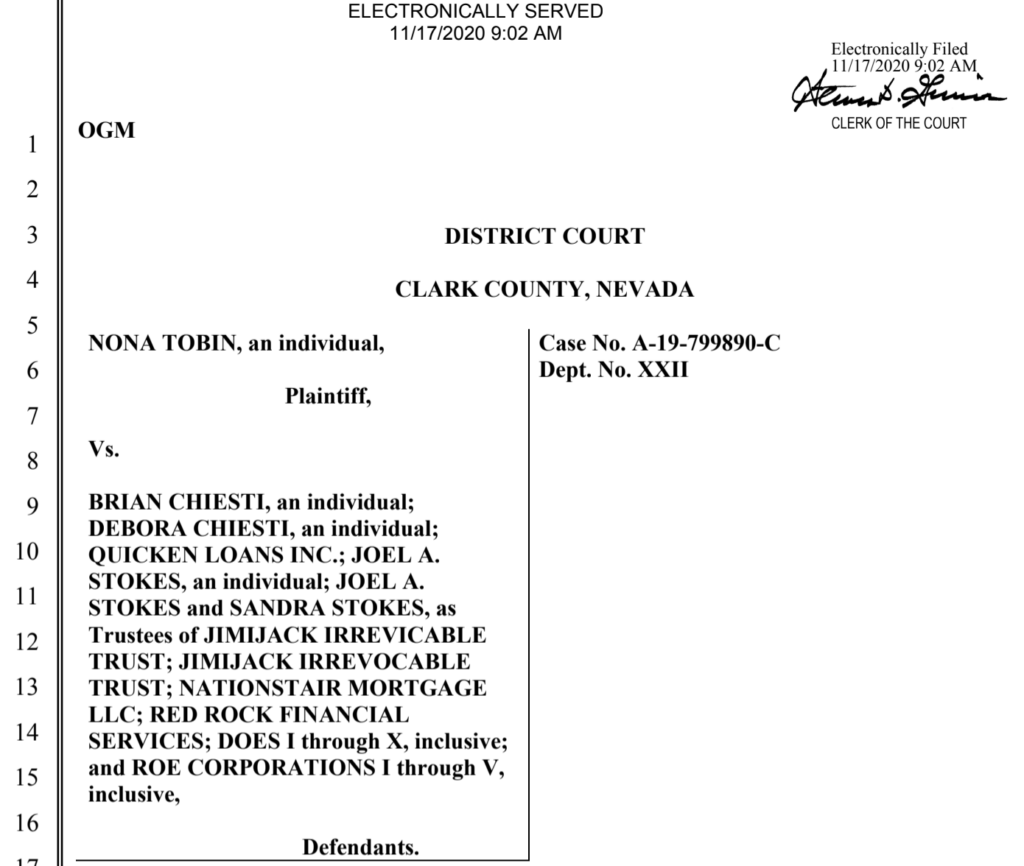

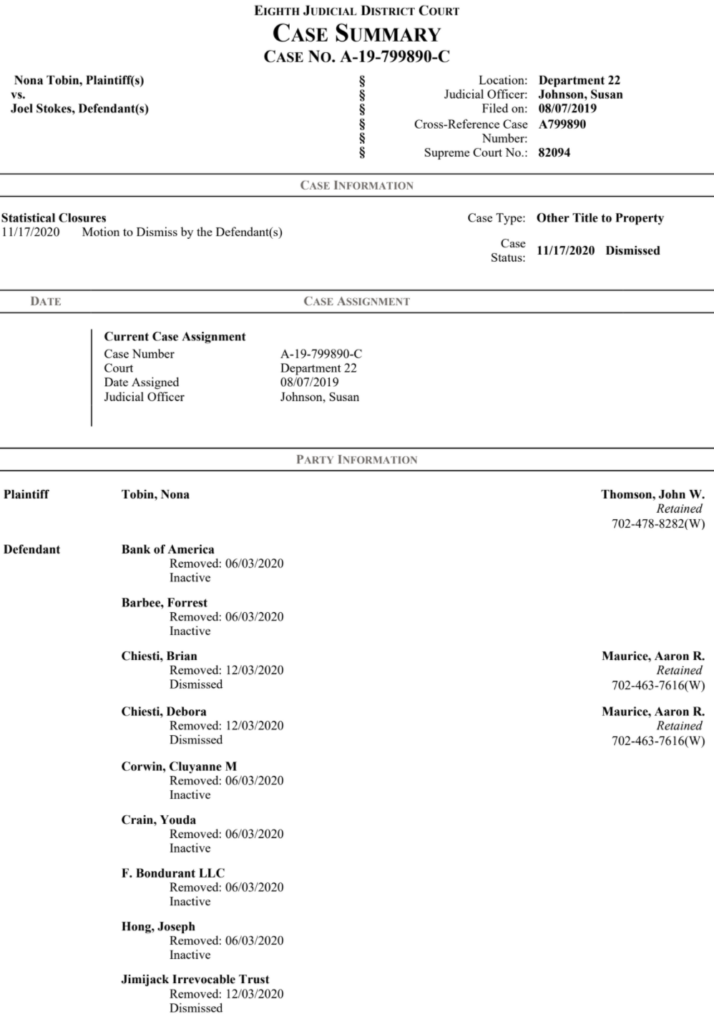

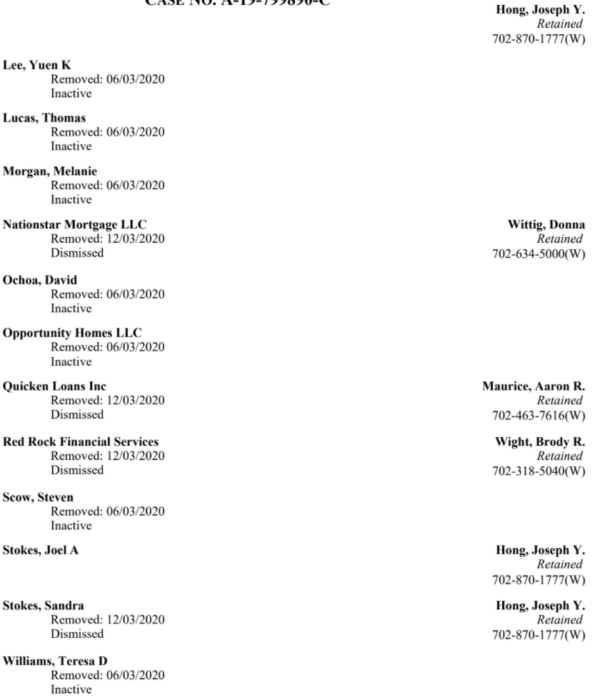

6/3/20 Nona Tobin’s 1st amended complaint

9/6/20 order (NEOJ 10/8/20) to sanction Nona Tobin $3,455 for filing the complaint payable to Joseph Hong

11/17/20 order to sanction Nona Tobin $8,949 for filing the complaint payable to Brittany Wood

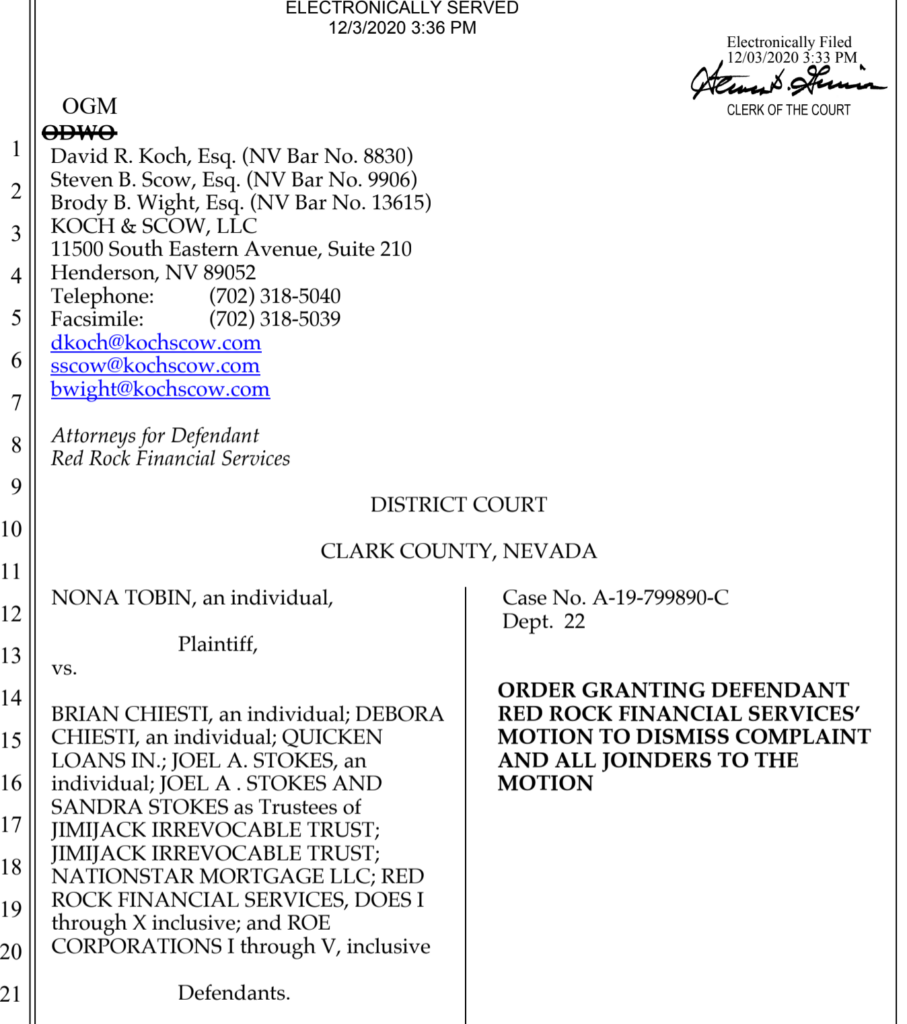

12/3/20 order of dismissal with prejudice and expungement of lis pendens as if never recorded

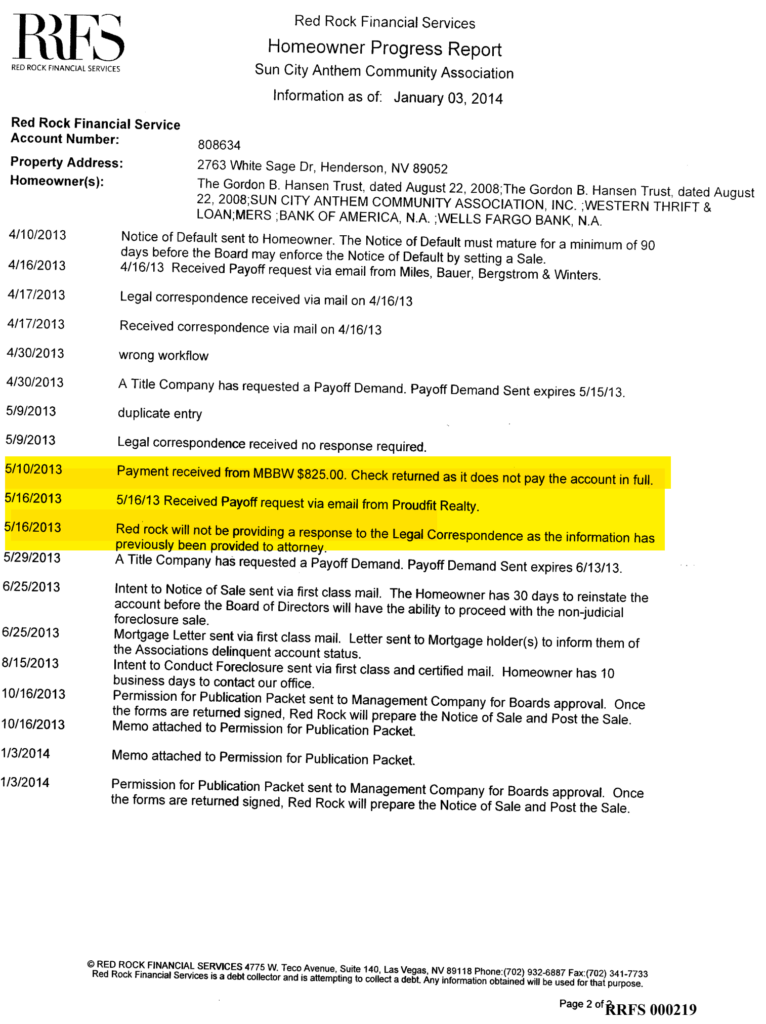

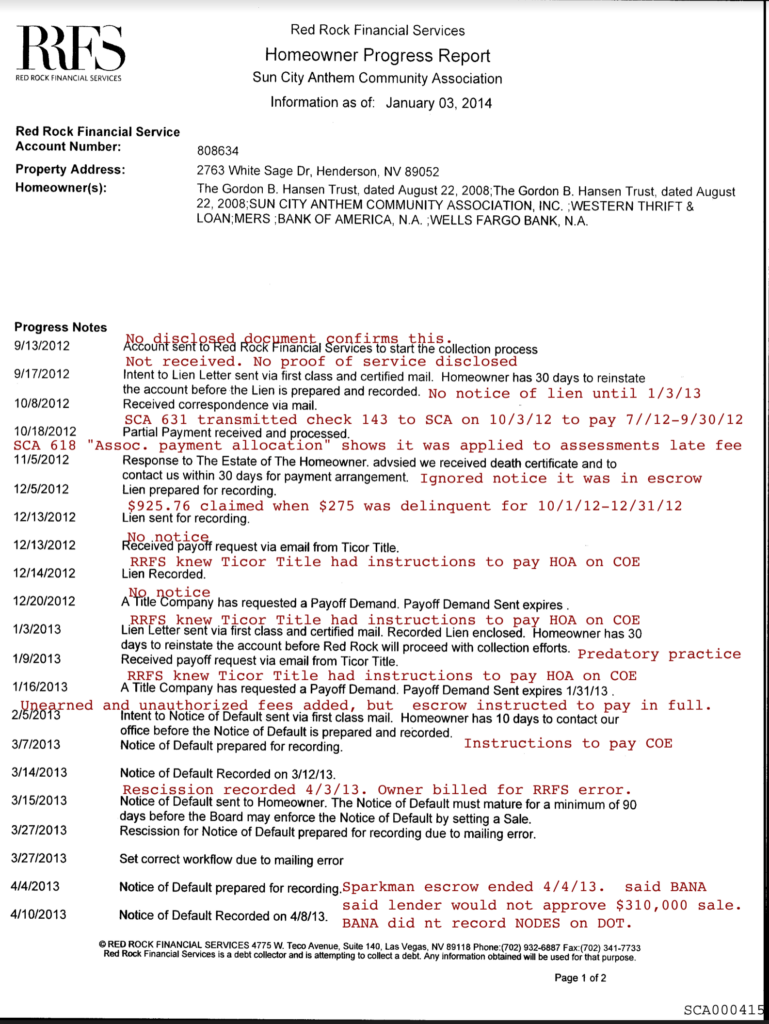

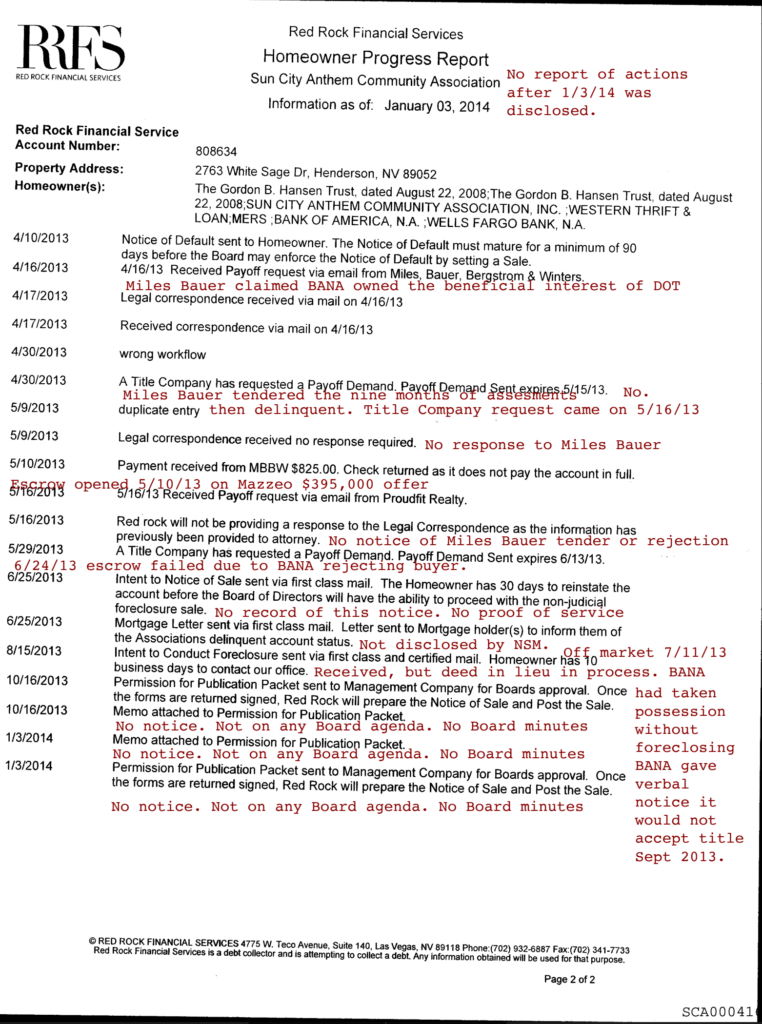

Link to bookmarked SCA 176-643 Red Rock Foreclosure File disclosed by Sun City Anthem in 2018.

SCA misrepresented the Red Rock foreclosure file to Judge Kishner as if it represented the true, accurate, and complete records of the foreclosure of 2763 White Sage, despite SCA attorneys knowing full well that the file was the debt collector’s unverified, uncorroborated version of revisionist history.

SCA attorneys were not representing the interests of the HOA when they disclosed Red Rock’s fraudulent documents. SCA attorneys presented to the court Red Rock’s fantasy version of reality that was explicitly contradicted by SCA’s official, verified records of the enforcement actions taken in secret by the HOA Board between 2012-2014.

SCA attorneys withheld, concealed, and/or misrepresented the HOA’s official records related to this foreclosure and a dozen other foreclosures in the same time period.

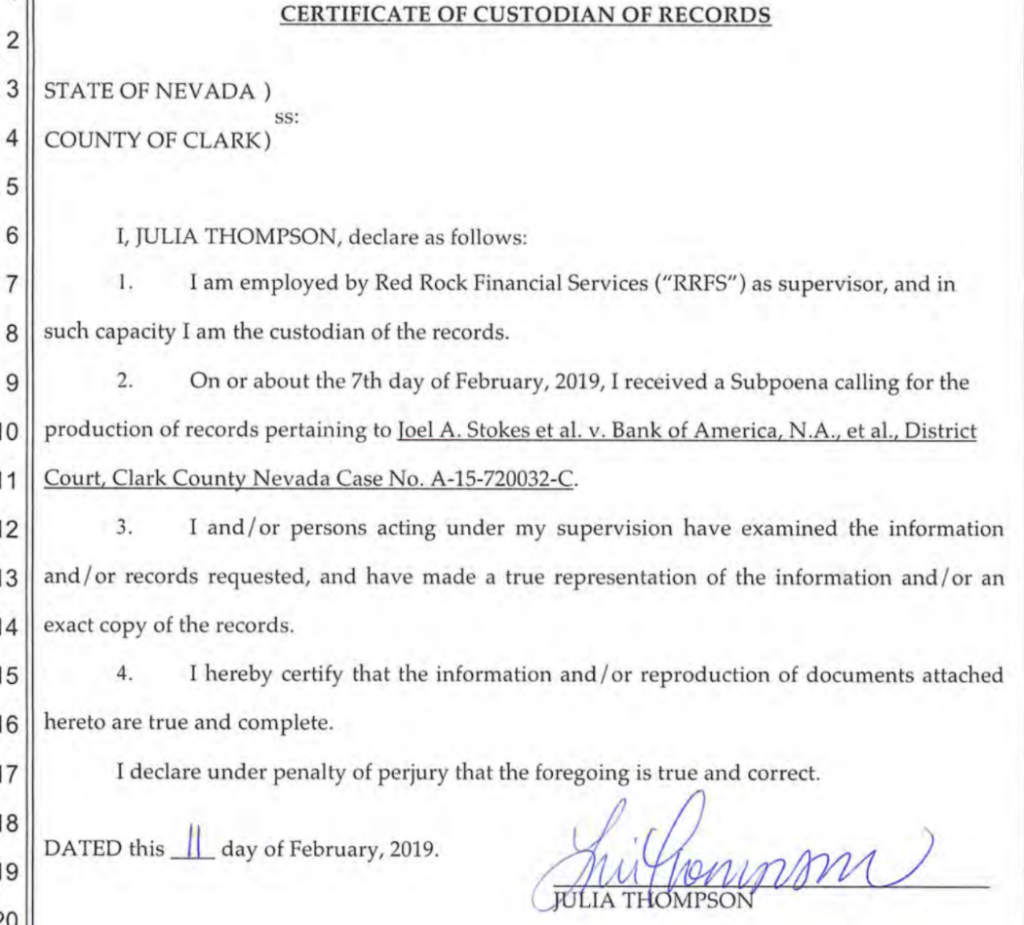

RRFS 001-425 Red Rock foreclosure file as Steven Scow produced it was not properly verified as being a true, accurate and complete record contemporaneously produced by a person in the normal course of her occupation.

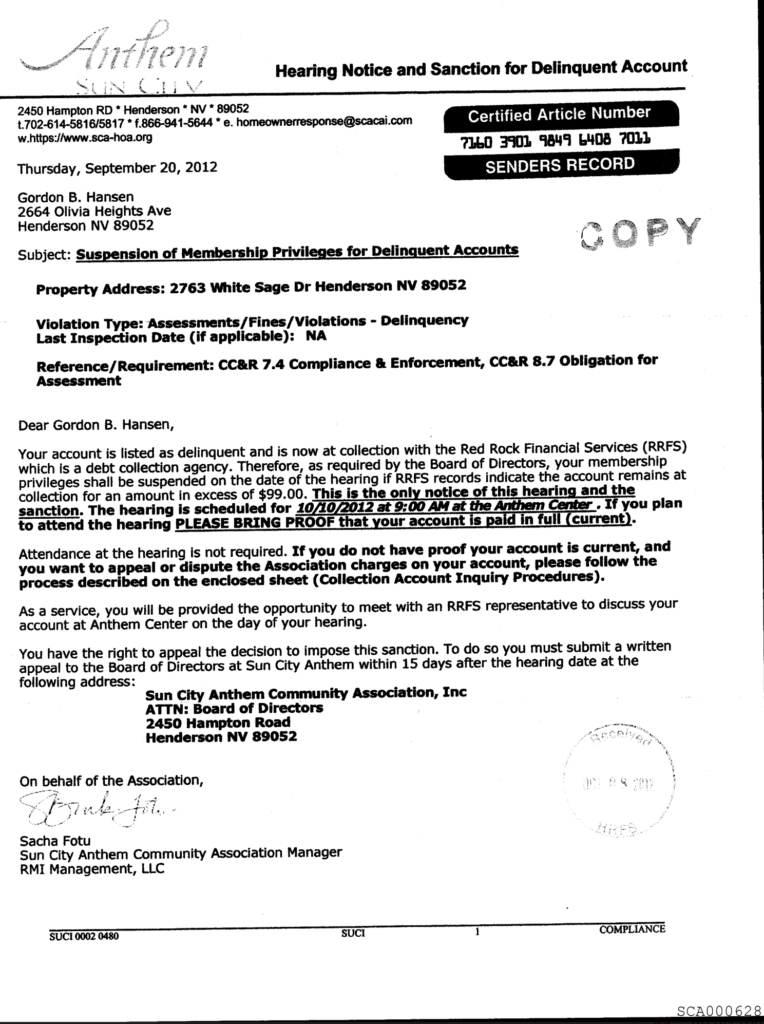

9/17/12 SCA 642 RRFS letter to 2664 OH SCA 643 to 2763 notice of intent to lien – Tobin has no recollection nor Proudfit any record of this. No proof of service though alleged to se sent certified. Demanded $617.94 when it is undisputed that the account was PIF on 6/30/14. See SCA 642 and SCA 643.

9/20/12 SCA 628 120920 SENDER’S copy of hearing notice SCA sent to 2664 Olivia Heights could not have been sent by Tobin to RRFS as alleged in 2/5/19 MSJ See SCA 628, SCA 635,

9/20/12 SCA 635 is duplicate of SCA 628 also alleged to be sent to 2664. No allegation that the notice was sent to 2763. No allegation that the hearing was actually ever held. See SCA 628, SCA 635,

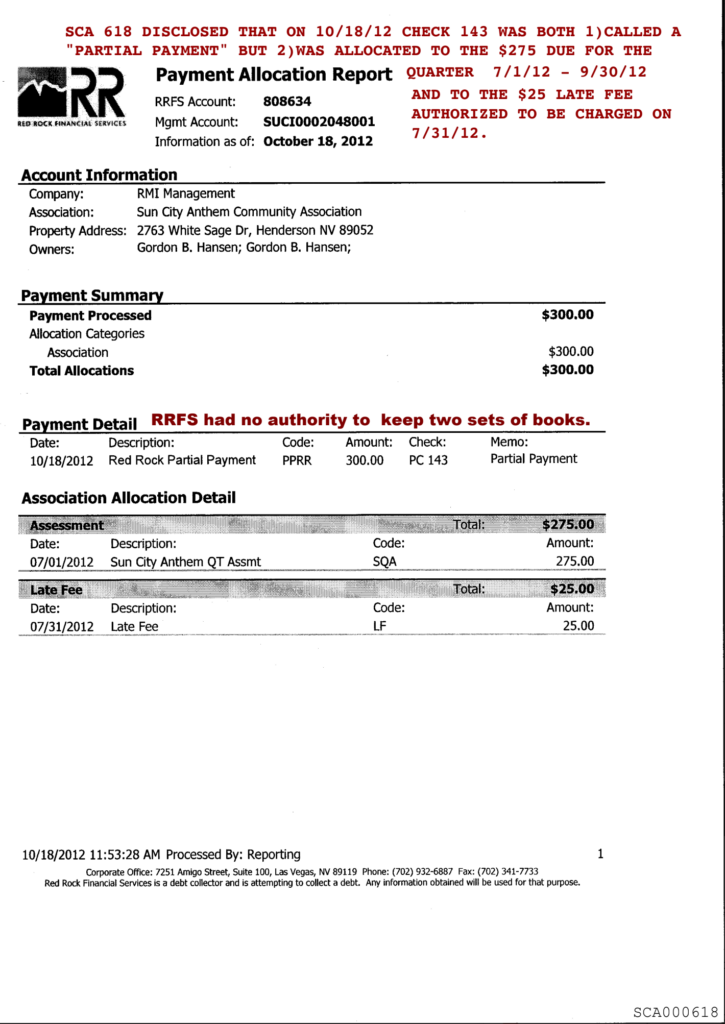

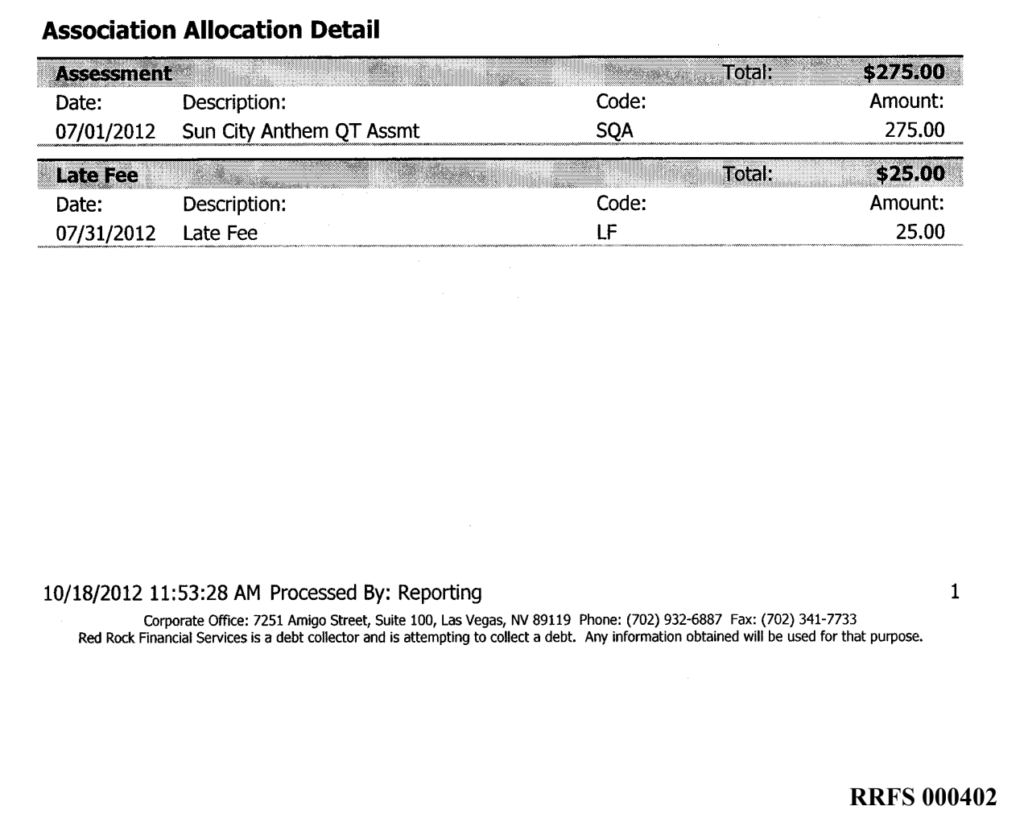

10/18/12 See SCA 618 Payment Allocation Detail. Check 143 was applied to pay assessments from 7/1/12-9/30/12, but also called a “partial payment”

10/8/12 SCA 626 “CORRESPONDENCE RECEIVED” SCA claimed the sender’s copy of the hearing notice was sent to RRFS by Tobin which is impossible.

SCA duplicated and misrepresented this document to falsely imply that SCA had complied with the notice requirements in SCA CC&Rs 7.4 prior to imposing the sanction of permanent revocation, rather than temporary suspension, of member benefits, for the alleged violation of the governing documents of delinquent assessments.

11/5/12 11/5/12 SCA 620 “Correspondence Response to Homeowner“

12/13/12 12/13/12 P/O DEMAND RECEIVED SCA 615

12/20/12 12/20/12 P/O DEMAND SENT See SCA 603

1/3/13 1/3/13 SCA 587 “LIEN SENT TO OWNER“. See annotated SCA 591-592

1/9/13 1/9/13 SCA P/O DEMAND RECEIVED See SCA 586

1/16/13 SCA 578 “P/O DEMAND SENT” See SCA 579

3/7/13 3/7/13 SCA 572 Send NOD to Title Company

4/2/13 SCA 378 Endorsement, effective 4/2/13, relates to 9/23/13 Republic Lien and “plant date of 2/5/14”?? Unclear

4/4/13 4/4/13 SCA SCA 552 NOD Notice of Rescission

4/16/13 4/16/13 SCA 525 “Payoff Demand Received”

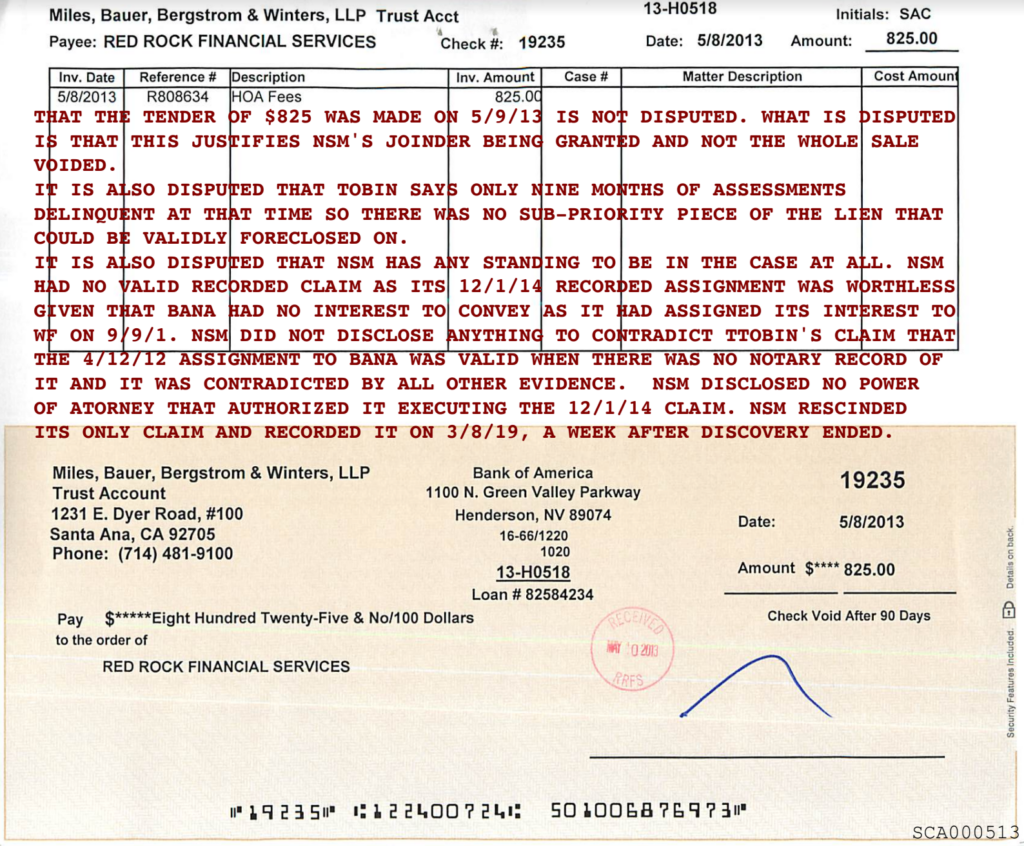

See SCA 513-530 to see how SCA handled the rejection of the Miles Bauer tender .

Note that check 143 paid the assessments from 7/1/12-9/30/12.

See SCA 618 “Association Allocation Detail” and #13 on Page 4 of 4/17/19 order that states “payment was applied to the July 1, 2012 Quarterly Assessment and the Late Fee due on July 31, 2012.“

Therefore, the Miles Bauer $825 tendered on 5/9/13 satisfied the debt of $825 assessment due and payable for the quarters from 10/1/12 to 6/30/13.

The only remaining debt at the time of the Miles Bauer tender were fines: $75 late fees authorized by the SCA Board as a fine for non-payment of installments within 30 days of their due date and whatever fines RRFS-added on their own initiative. An HOA cannot foreclose if the assessments are brought current and only fines, including collecting fees remain.

NRS 116.31162(5)(2013) prohibits the HOA from foreclosing on fines or penalties. See Nationstar Mortgage LLC vs. Saticoy Bay LLC series 2227 Shadow Canyon, 133 Nev. Advance Opinion 91, 405 P.3rd 641 cited in 4/17 order. See #1 irregularity cited by NSM, page 9.

4/17/13 4/17/13 SCA 527 Request reviewed

4/30/13 4/30/13 SCA payoff Demand Sent

5/16/13 5/16/13 SCA Payoff Demand Received

5/29/13 5/29/13 SCA 504 payoff Demand See SCA 504

8/15/13 8/15/13 See SCA 491 for notice sent to 2664

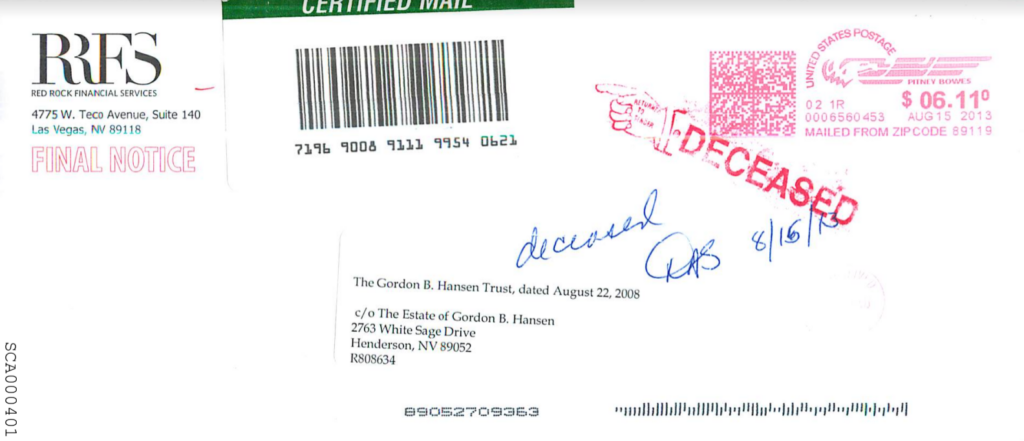

8/15/13 SCA 401 is an envelope addressed to 2763 White Sage that was stamped on 8/15/13 “deceased”. There is no such envelope for the letter RRFS alleged in SCA 287 was sent to 2763 White Sage on 7/2/14. This is the 7/2/14 letter that RRFS claims was sent to notify the owner that the waiver request RRFS sent to the SCA Board on 6/9/14 was denied.

See SCA 401-403

8/15/13 SCA 403 is an envelope addressed to 2763 White Sage that was stamped on 8/15/13 “Return to sender Not deliverable as addressed. Unable to forward.”. There is no such envelope for the letter RRFS alleged in SCA 278 was sent to 2763 White Sage on 7/2/14. This is the 7/2/14 letter that RRFS claims was sent to notify the owner that the waiver request RRFS sent to the SCA Board in SCA 295 on 6/9/14 was denied.

10/16/13 10/16/13 SCA 450 “Followed Up POP“

10/16/13 SCA 468 RRFS “Homeowner Progress Report” to 10/16/13 does not show any BOD approval. See 468 is duplicated in annotated SCA 415-416 Homeowner Progress Report to 01/3/14.

1/3/14 1/03/14 SCA 407 Followed Up POP

1/3/14 SCA 406 “Permission for publication of foreclosure sale and authority to conduct foreclosure sale”, RRFS form letter signed by Dan Folgeron on 1/9/14. According to this form, RRFS had the ability to move the sale date without specific instruction from the BOD.

Note that this contradicts SCA 377 and SCA 407.

By RRFS being able to unilaterally move a sale date, RRFS can suppress bidding, particularly when this is compounded by RRFS giving the SCA BOD the false instruction that

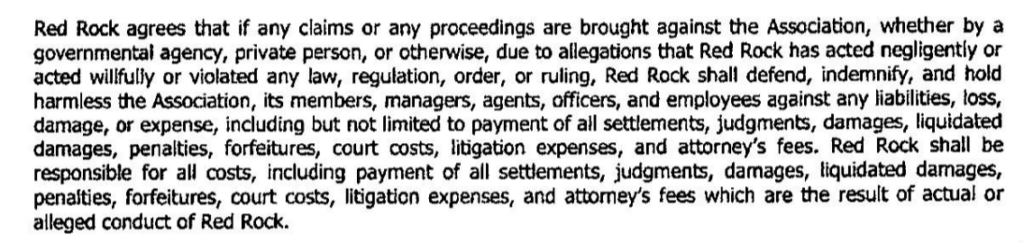

“The Board of Directors agrees that in the event that the homeowner makes any claim regarding the loss of its property through this foreclosure action, the association shall have the exclusive duty to defend and to pay all defense costs of all such claims...”.

More importantly, it violated the 4/27/12 RRFS debt collection contract Indemnity clause on page 3, #7 of the RRFS-SCA contract signed on 4/27/12. Both RRFS and SCA refused to produce this contract in discovery. SCA deceptively disclosed the inapplicable 2007 contract that does not contain the provision that RRFS must indemnify SCA.

1/3/14 RRFS transmittal memo to SCA, dated 1/3/14, gave Permission for Publication packet to SCA BOD which contained the sentence. “If the Board does not want to proceed with the foreclosure sale please return the packet unsigned.” Note that there are multiple unsigned documents in SCA 176-643. Note also that there is no Board decision to proceed or not in any Board minutes.

1/3/14 SCA 415 RRFS “Homeowner Progress Report” from 9/13/12 -4/10/13

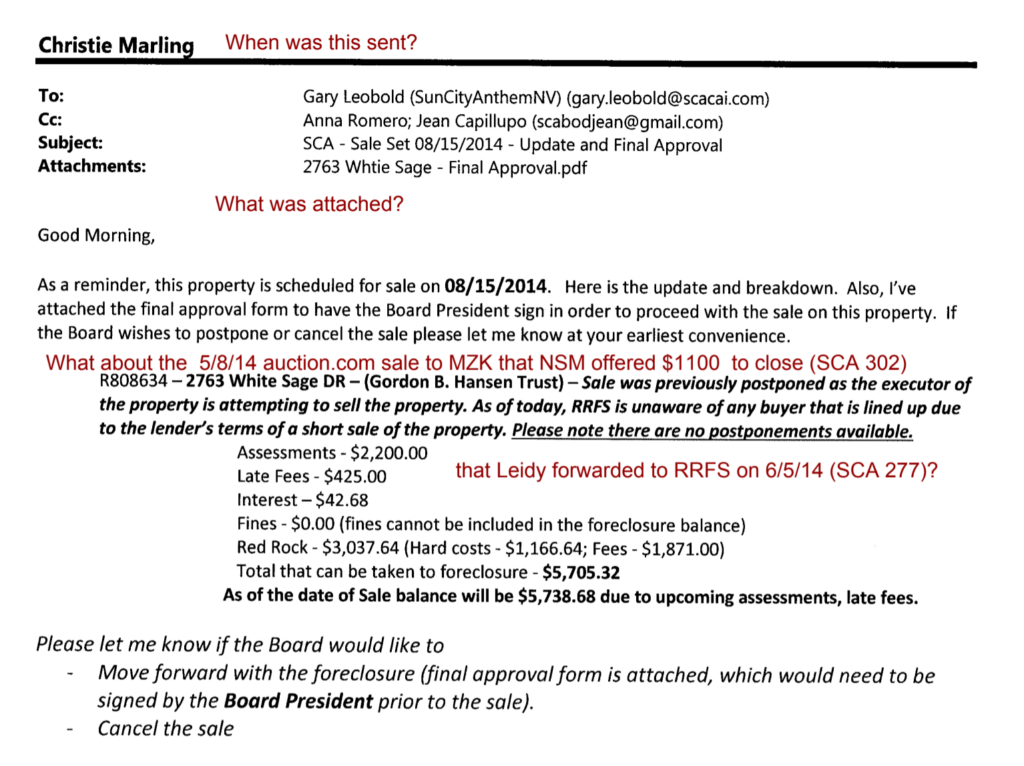

1/3/14 SCA 416 RRFS “Homeowner Progress Report” from 4/10/13 – 1/3/14. Note neither RRFS nor SCA disclosed this form for the period from 1/3/14 – 8/15/14 when RRFS sold the property without notice after the property had already been sold on auction.com on 5/8/14.

1/9/14 SCA 377 and SCA 407 Dan Folgeron signed RRFS form” Association Foreclosure sale Approval” for “Property Address” Dan wrote in “All twelve properties attached”. Neither SCA nor RRFS listed the properties nor was there any attachment.

NO SCA BOARD APPROVAL OF THE SALE IS ON ANY AGENDA.

1/9/14 SCA 407 Dan Folgeron signed RRFS form” Association Foreclosure sale Approval” for “Property Address” Dan wrote in “All twelve properties attached”. Neither SCA nor RRFS listed the properties nor was there any attachment. This is a duplicate of SCA 377. According to the box checked RRFS was not given authority to postpone the sale without discussing with the Board.

1/10/14 1/10/14 SCA 405 “Board Approved POP” is contradicted by the HOA records that were concealed in discovery.

1/29/14 1/29/14 SCA 389 “Supporting Documents“

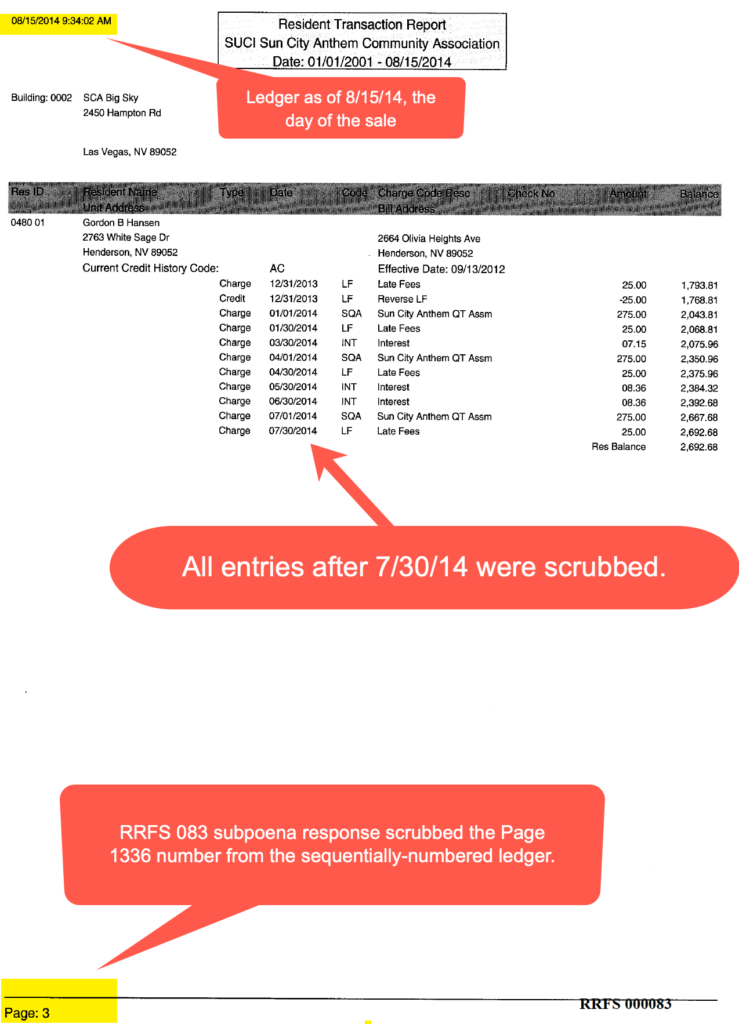

2/11/14 SCA 382- 384 disclosed the Resident Transaction Report from 1/1/6-2/11/14. SCA refused to disclose the Resident Transaction Report when requested in discovery. The part that shows the RTR does not include any indication that the property was foreclosed, that $63,100 was collected for the sale, or that there were any other owners between Hansen and Jimijack, shows in the time period after 2/11/14.

See Resident Transaction Report Page 1334-1339 that was provided in response to Nona Tobin’s records request to CAM Lori Martin in May 2016.

2/24/14 2/24/14 SCA 338 Invoice (Priority Posting)

2/27/14 See SCA 315 President signed that Board approved 3/7/14 sale on 12/5/13 by BOD resolution [R05-120213]. See pg. 2 12/5/13 SCA BOD minutes for [R05-120213].

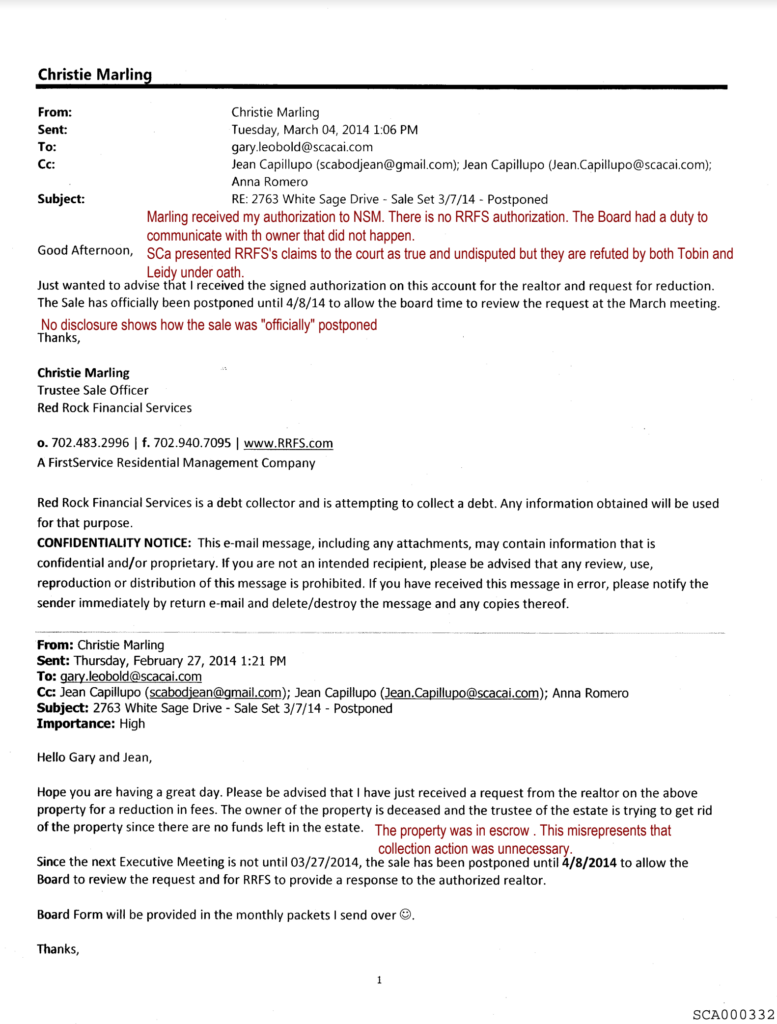

2/27/14 There is a 2/27/14 email on the bottom of SCA 332 that informs them that she received a request from the realtor for a reduction in fees because the owner is dead and there is no money left in the estate. See annotated SCA 332.

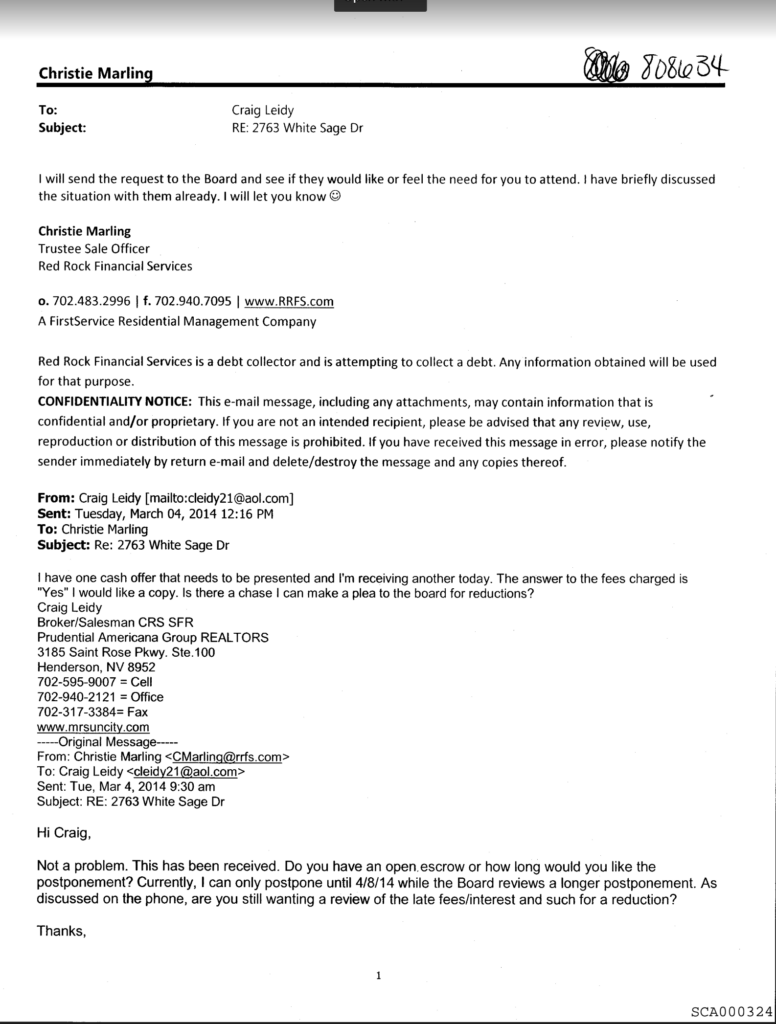

3/4/14 See SCA 324-325 email Leidy-RRFS Marling exchange where Leidy had asked for a copy of the fees and to speak to the Board about a fee reduction. Marling says she’ll let him know if they want him to attend.

3/3/14 3/3/14 SCA 336 priority posting confirmations

3/4/14 3/04/14 SCA 329 “Sale Postponed“

3/4/14 SCA 332 (top) is a 3/4/14 email from RRFS to Gary Leopold, FSR employee serving as the SCA CAM, to state that she had received a request from the 3/7/14 sale was postponed to 4/8/14. There is a 2/27/14 email on the bottom of the page that informs them that she received a request from the realtor for a reduction in fees because the owner is dead and there is no money left in the estate. See annotated SCA 332.

3/7/14 3/7/14 “Request Form sent to Board“

3/18/14 3/18/14 “Payoff Demand Received“

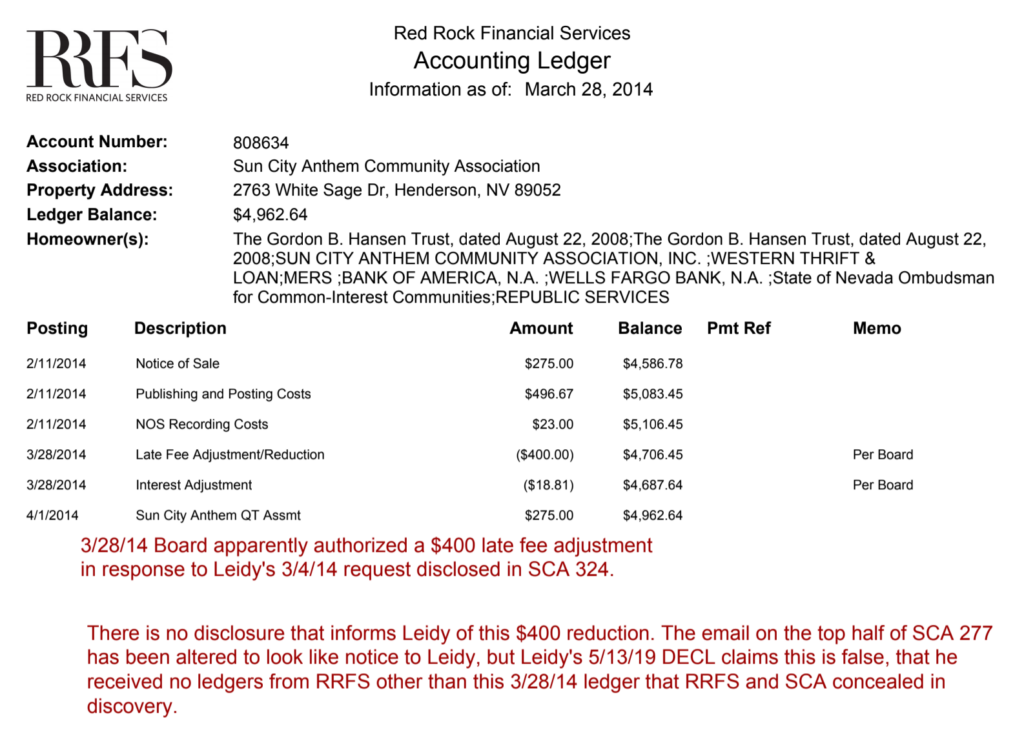

3/18/14 SCA 312-13 Chicago Title payoff request

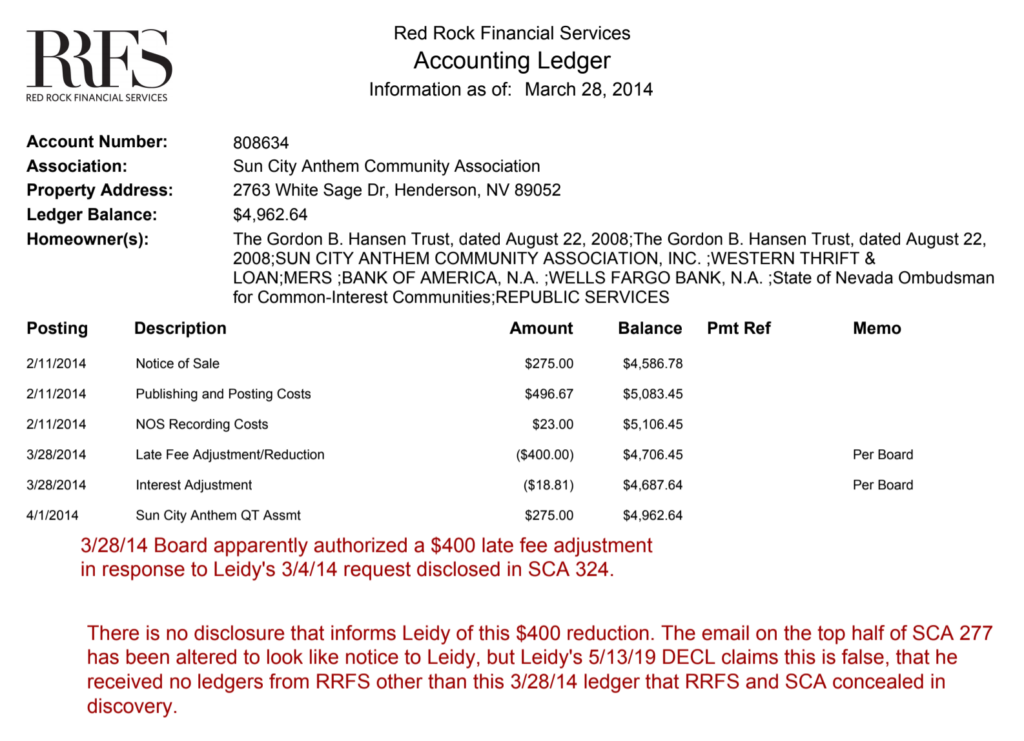

3/18/14 SCA 310 contains two emails dated 3/18/14 which clearly indicate RRFS received a request for payoff figure on 3/18/14, but the SCA BOD was scheduled to review Leidy’s requests at the 3/27/14 meeting. Note RRFS and SCA both failed to disclose the 3/28/14 RRFS response to Chicago title in which the ledger shows that the SCA BOD approved a $400 fee waiver on Page 6. This fee waiver is not included in SCA 255, RRFS account detail that allegedly was accurate and complete from 2/11/14-8/15/14.

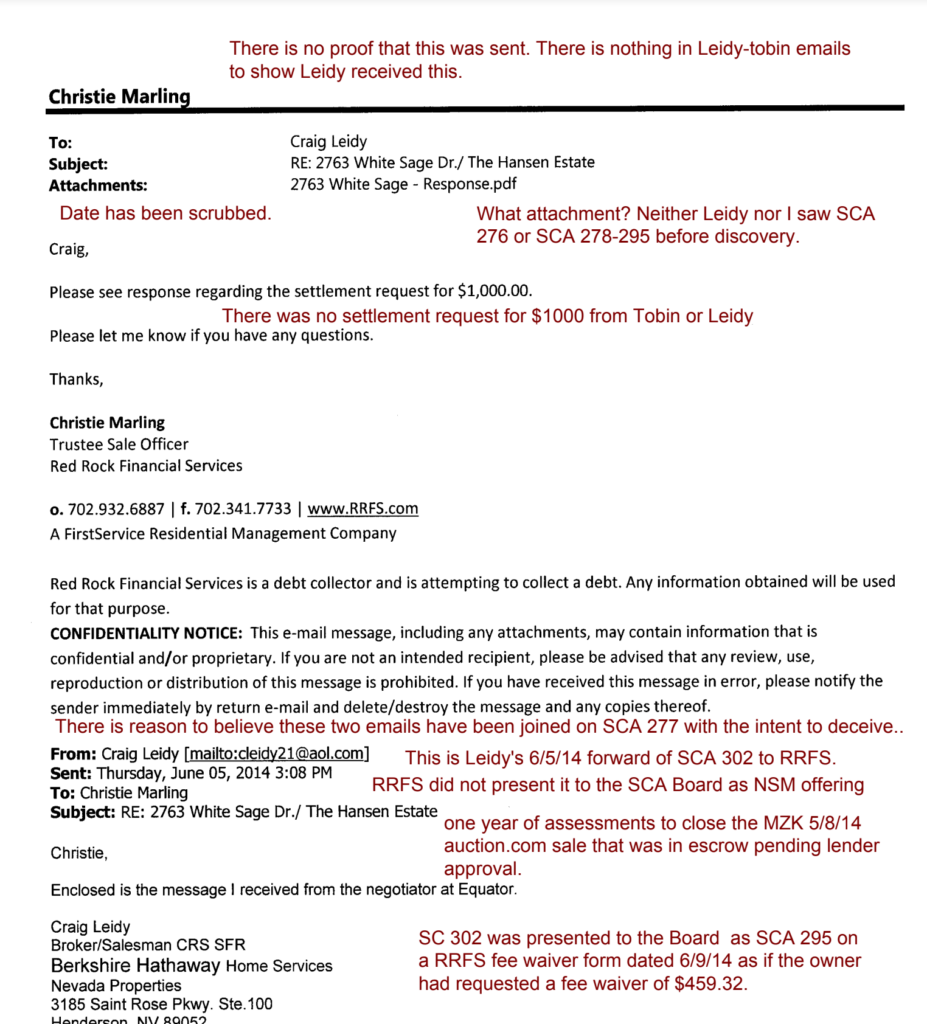

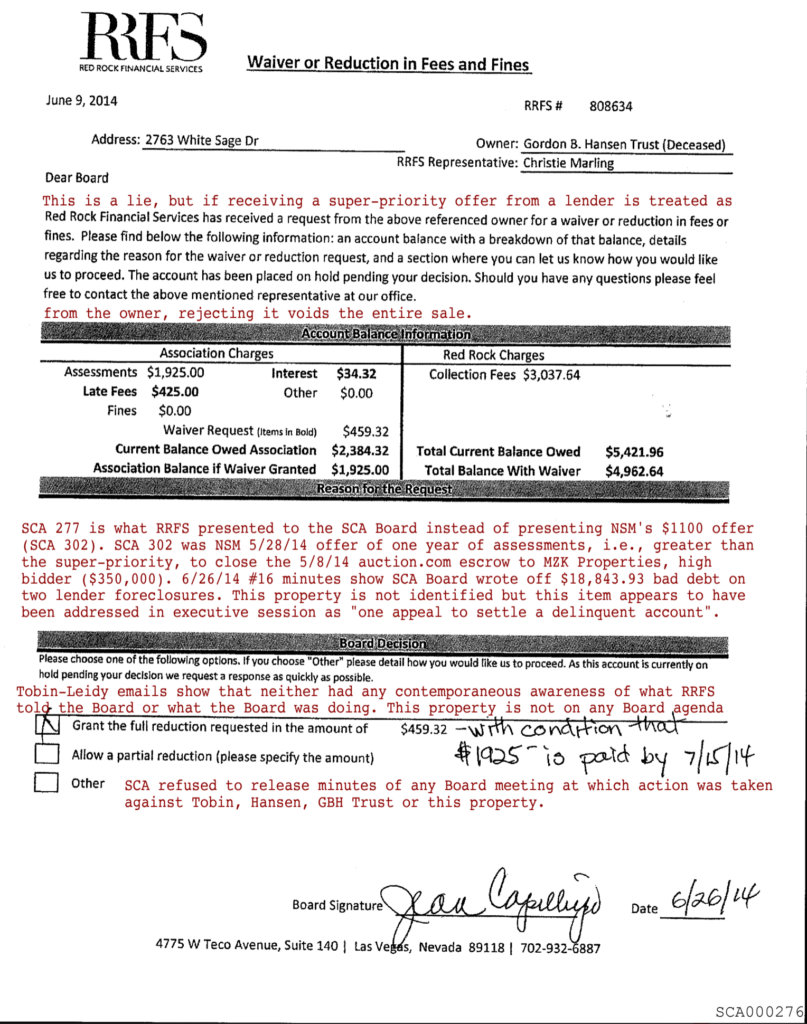

3/28/14 SCA 277 Undated email RRFS to Leidy “Please see response regarding the settlement request for $1000.00” (Note there was no settlement request for $1000. Leidy did not receive this. Not clear what was supposedly attached as it does not relate to the 6/5/14 email Leidy sent to RRFS to forward the NSM 5/28/14 offer.

5/6/14 5/6/14 “Supporting Documents“

5/13/14 5/13/14 “Sale Postponed“

5/15/14 SCA 307 is an unsigned approval form to conduct the sale on 5/15/14. Note there was no BOD approval in SCA 176-643 to conduct the sale on 5/15/14, the date that the Ombudsman received notice that the 5/15/14 sale was cancelled as the owner was retained.

5/15/14 SCA 308 is another email alleging final approval of the 5/15/14 sale from which the date has been scrubbed and there is no signature

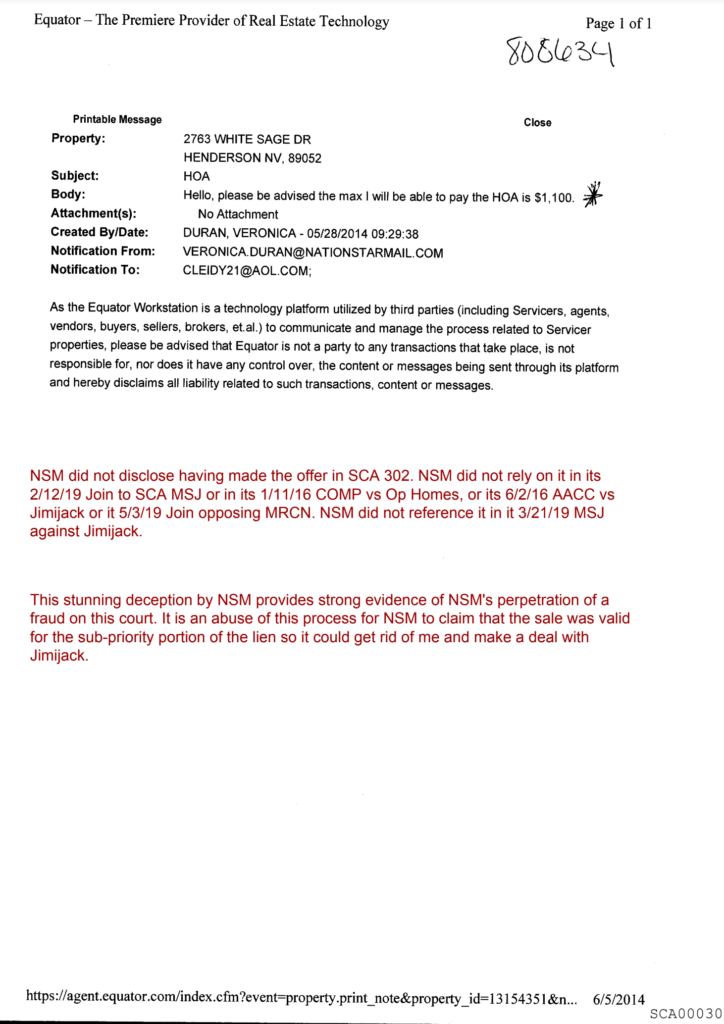

5/28/14 5/28/14 SCA 302 NSM Equator message to Leidy “please be advised the max I will be able to pay the HOA is $1100”

5/28/14 5/28/14 SCA 302 NSM Equator message to Leidy that was mischaracterized by SCA/RRFS as a non-existent new request from Leidy. See SCA 277. See also SCA 295 and SCA 276

6/5/14 SCA 277 Leidy forwarded NSM’s 5/28/14 offer (SCA 302) but SCA concealed it at the bottom of the page

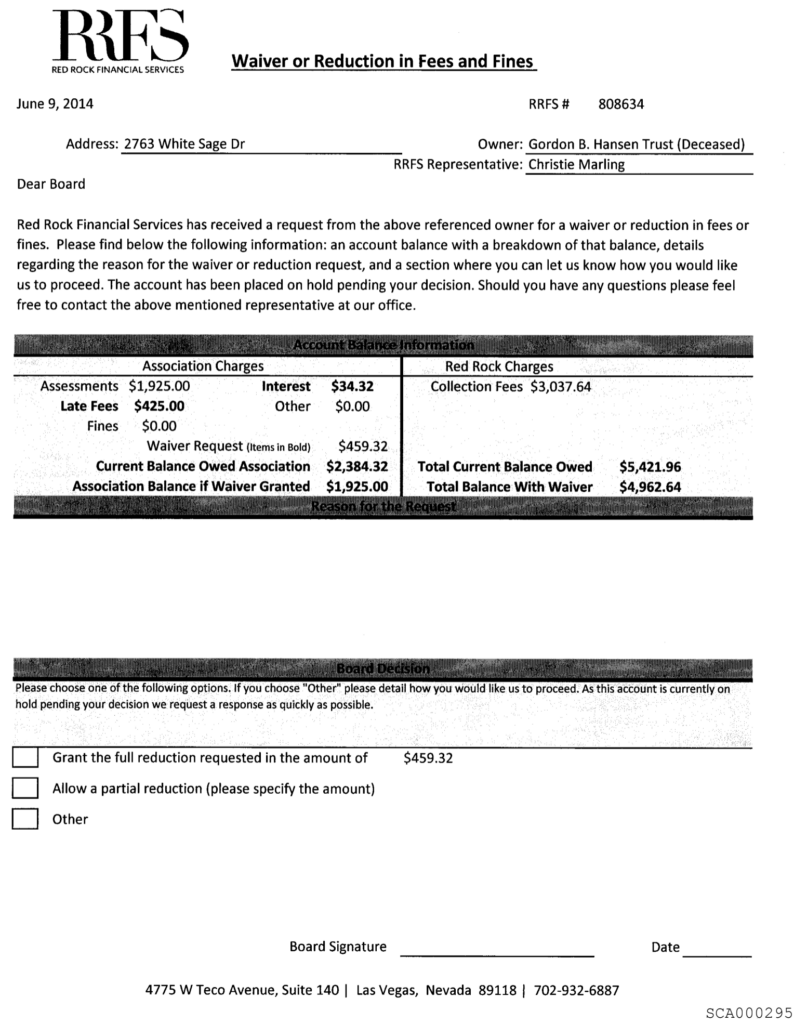

6/9/14 SCA 275 “Request Sent to Board“

6/26/14 SCA 276 Jean Capillupo signed the 6/9/14RRFS waiver form from SCA 295. 6/26/14 SCA 276 (Signed 6/9/14 RRFS Form “Waiver or Reduction in Fees” found in SCA 295. Note no BOD response to SCA 302 was disclosed.

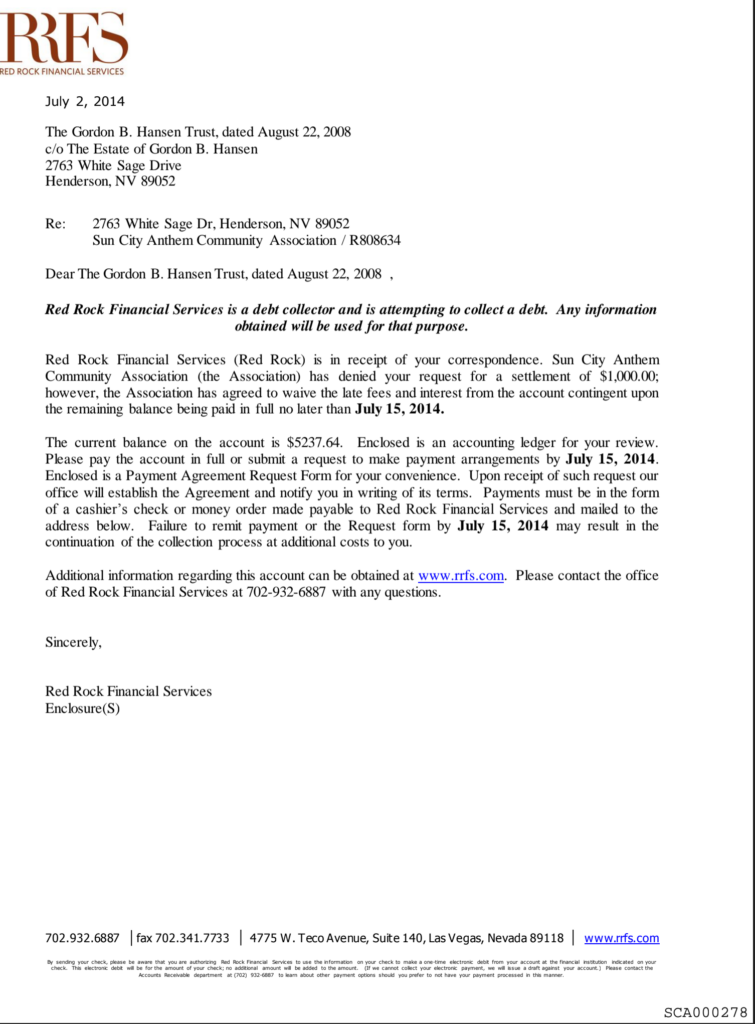

7/2/14 SCA 275 “7/2/14 Received Board response“

7/2/14 SCA 278 alleges RRFS sent a letter to 2763 stating the BOD “has denied your request for a settlement of $1,000.” SCA 279 is a blank owner request form. SCA 280-285 is a ledger. SCA/RRFS did not produce any proof of service. No RTS like in SCA 401-405. Tobin has said under oath she never received this. Tobin-Leidy emails never mention it.

See also SCA 286 alleges RRFS sent a letter to 2664 OH stating the BOD “has denied your request for a settlement of $1,000.” Tobin has said under oath she never received this. Tobin-Leidy emails never mention it or the ledger in SCA 287-292. Obviously, she never signed the blank owner request form in SCA 287 and SCA 279.

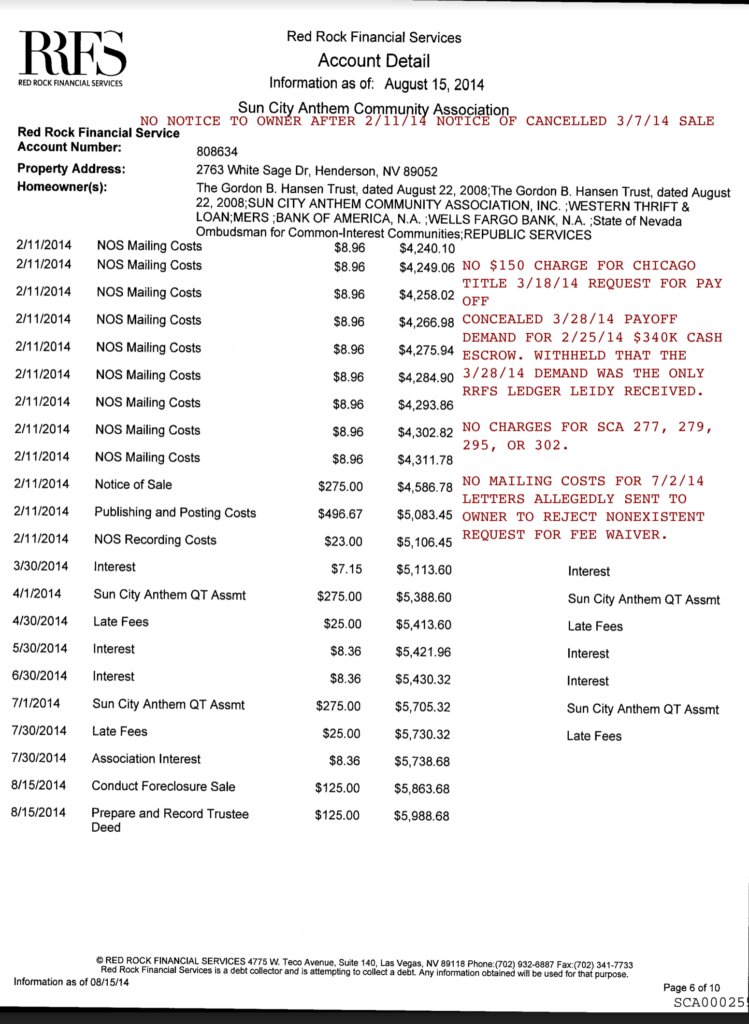

7/2/14 SCA 280-285 RRFS allegedly sent this ledger to Tobin at 2664 Olivia Heights Ave and to the vacant property at 2763 White Sage. There are no proofs of service. There are no returns to sender like RRFS got when a notice was sent to the vacant property on 8/15/13 (See SCA 401 and 403. Notably, RRFS does not charge for any collection activity, any mailings, any sale guarantee, nothing after 2/11/14.

See annotated SCA 275- SCA 293. There is no document that shows how NSM was informed that SCA 302 was rejected.

Also, see on SCA 285 RRFS did not charge $150 to produce pay off figures requested by Chicago Title on 3/18/14 (SCA 310). RRFS and SCA both concealed that RRFS demanded $3,055.47 in a letter to Chicago Title, dated 3/28/14. SCA 285 does not include the $400 fee waiver requested by Leidy and authorized by the SCA Board on 3/27/14 that is accounted for on pg 6 of the 3/28/14 demand.

8/1/14 8/1/14 Emails

8/5/14 SCA 271 Jean Capillupo signed to approve the sale of 2763 White sage subject to the conditions set forth in the permission for Publication of foreclosure Sale and Authority to conduct foreclosure sale. No record of any BOD action to authorize her signing this.

8/6/14 8/6/14 “Supporting Documents“

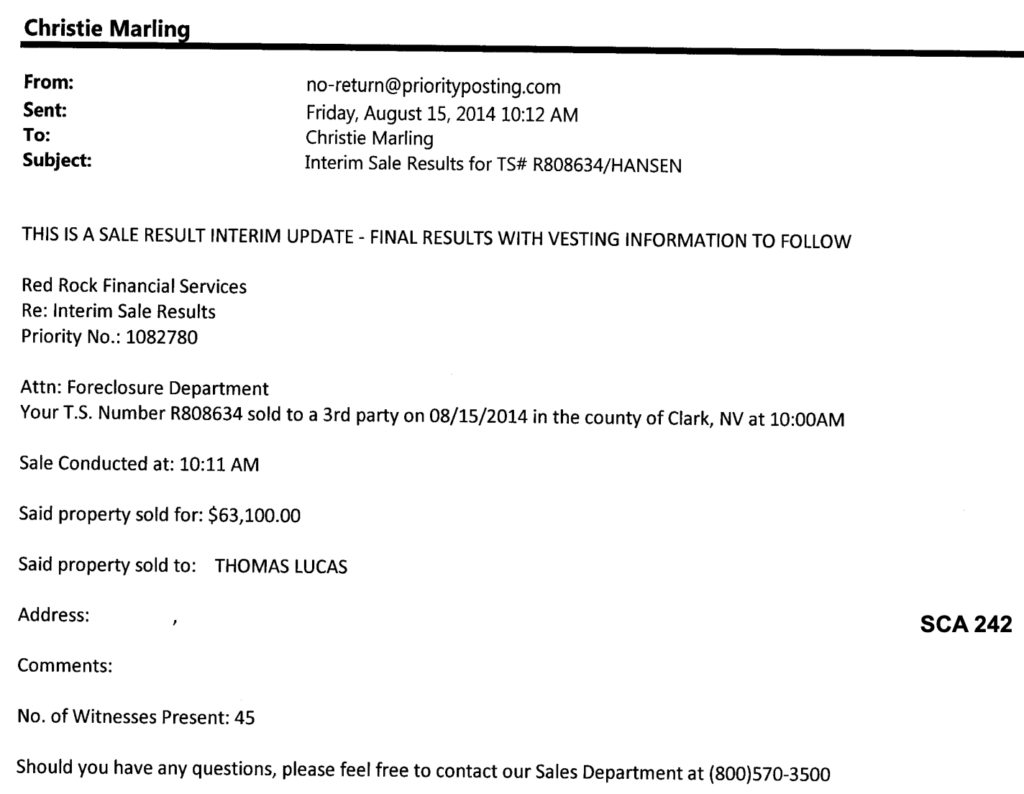

8/15/14 SCA 242 Sent at 10:12 AM to report to Christie Marling, RRFS, that the property had been sold at an auction conducted at 10:11 AM at which three people allegedly bid and 45 people were in attendance

See SCA 250-262 for RRFS account detail as of 8/15/14 (SCA 250-255), RRFS attempts to rectify the numbers (SCA 256-259) and Resident Transaction Report to 7/30/14 (SCA 260-262) all that fail to account for the $400 Board approved waiver)

8/15/14 SCA 250 RRFS account detail 1/1/06–6/25/08. not relevant

8/15/14 SCA 251 RRFS account detail 7/1/08-8/18/11 not relevant

8/15/14 SCA 252 RRFS account detail 10/1/11- 12/5/12

8/15/14 SCA 253 RRFS account detail 12/5/1 – 4/4/13

8/15/14 SCA 254 RRFS account detail 4/4/13 – 1/30/14

8/15/14 RRFS account detail 2/11/14 – 8/15/14. See annotated SCA 255 for major discrepancies with 3/28/14 RRFS demand pg. 6

8/15/14 SCA 274 is an email with the date scrubbed that alleges sale was approved and the amount due on 8/15/14 would be $5,738.68

8/18/14 8/18/14 SCA 228 deed sent to 3rd party

8/21/14 SCA 217 and SCA 224 $57,282.32 check #49909, made out to Clark County District Court on Red Rock Financial Services Trust Account 4775 W. Teco Ave suite 140 #121201694 153751166148. USBank 94-0169/1212

8/28/14 SCA 223 and SCA 224 RRFS memo to Steve Scow, Koch & Scow, from Christie Marlow re Foreclosure excess funds “please have these funds interpleaded in regards to the below properties“. See SCA 223, SCA 224, SCA 217, and documents showing RRFS pattern and practice of retaining excess proceeds.

7/1/14-10/15/14 Tobin-Leidy emails (31 pages – No attachments)

February-October 2014 Tobin-Leidy emails (201 pages including attachments)

5/20/19 Proudfit DECL with 20 exhibits

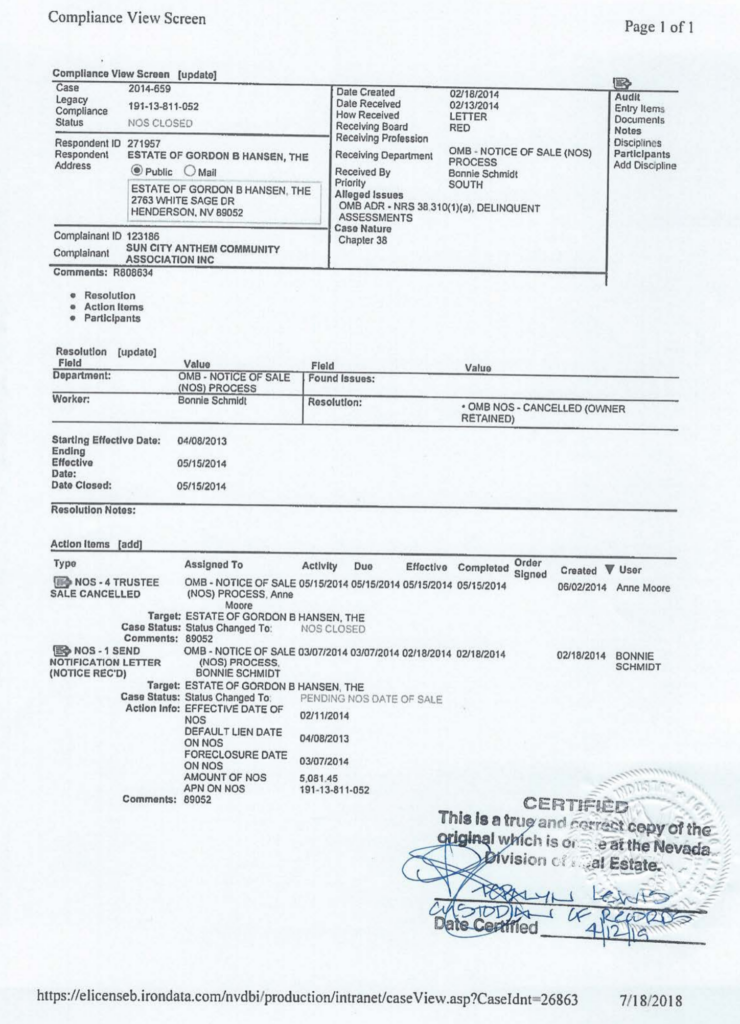

Ombudsman Compliance Record for 2763 authenticated 4/15/19

4/20/19 Tobin DECL in support of motion to reconsider (23 pages not filed vs 12 pages in attachment to 4/29/19)

4/29/19 Tobin/GBH Trust motion to reconsider NEO 4/18/19 order

5/23/19 TOC of Tobin Reply with links to 11 exhibits

5/13/19 Leidy DECL with exhibits (76-pages )

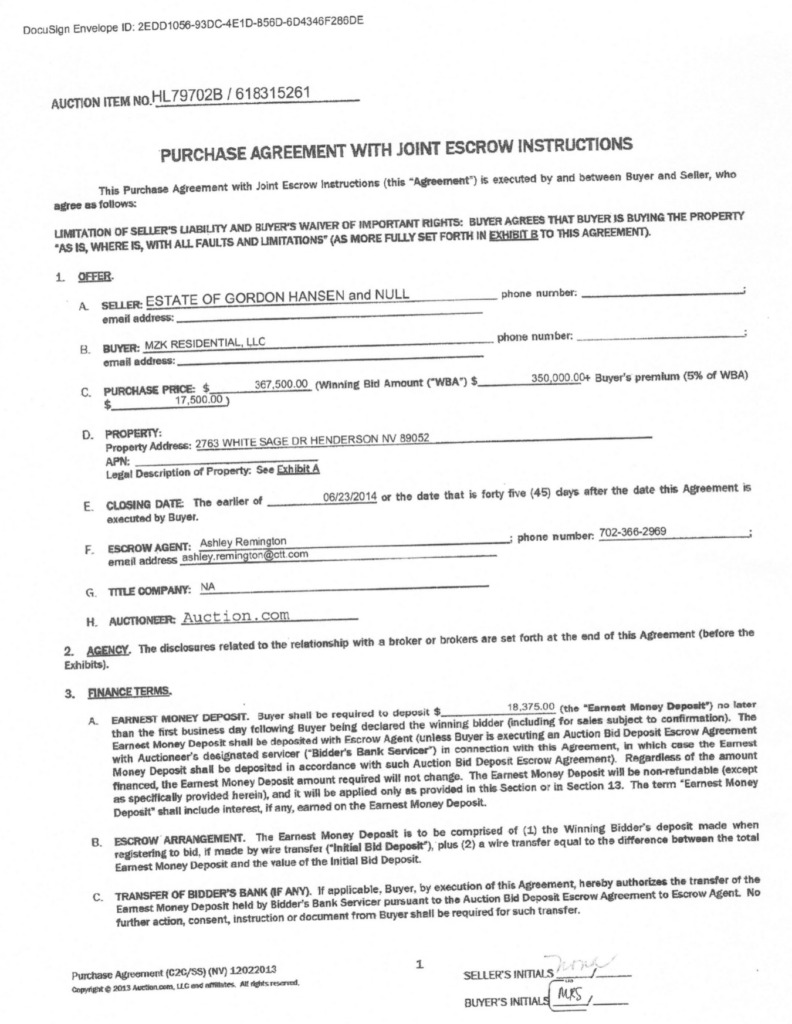

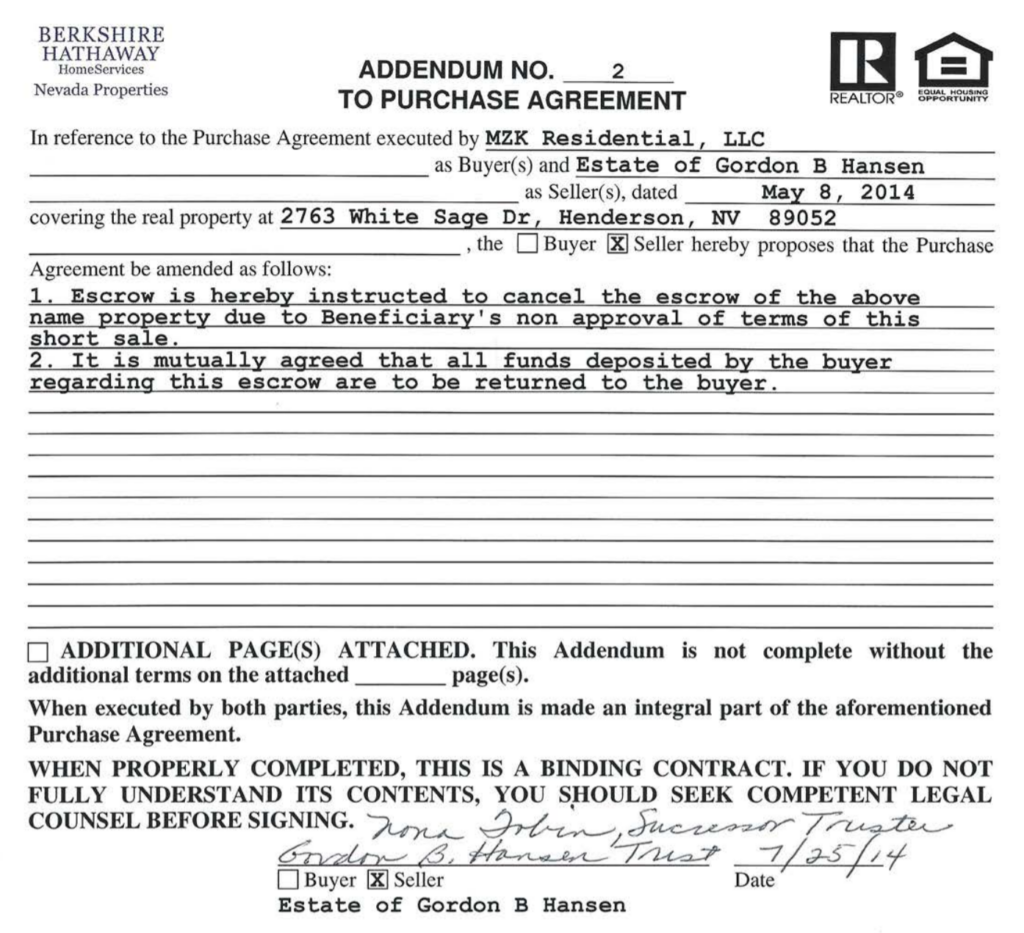

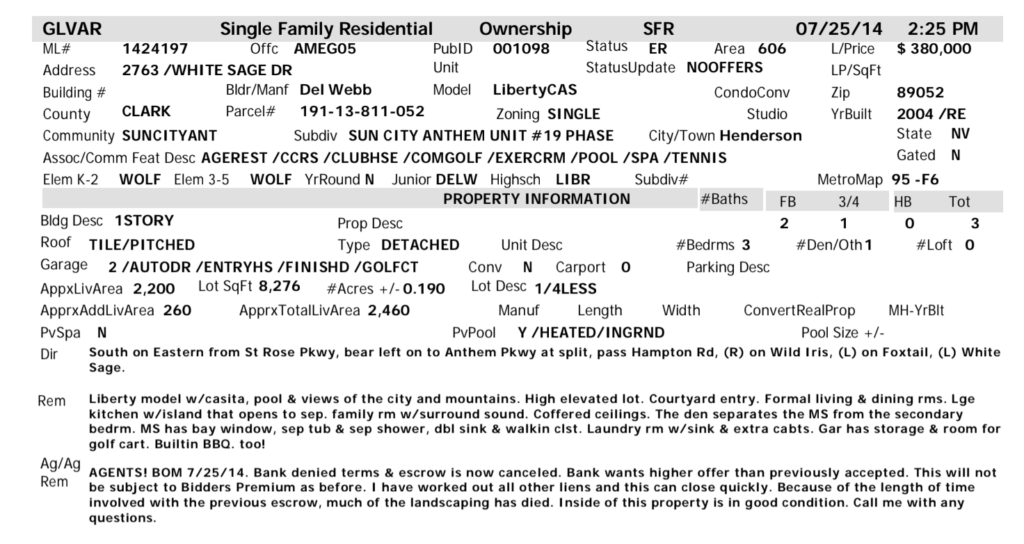

5/8/14 $367,500 sale to high bidder MZK.

7/25/14 Leidy post to MLS “I have worked out all other liens and this can close quickly”

3/28/14 RRFS $4,962.64 pay off demand to Chicago Title

3/28/14 ledger page 6 for $400 SCA BOD-approved $400 fee waiver that shows SCA 255 was falsified

SCA concealed this and all other compliance documents related to 2763 White Sage.

See 9/14/16 email exchange where the HOA manager said a court order was required to provide any documents.

| 12/31/11 | Balance due Dec 31, 2011 was zero. See annotated Resident Transaction Report Page 1335. |

| 1/1/12 | $275 Jan 2012 Qtr Assessment (1/1/12-3/31/12) |

| 1/31/12 | $25 Late Fee Assessed. See 1/31/12 RMI Quarterly statement. Upon information and belief, the 1/31/12 statement assessments due and late fees due was the last such statement distributed to owners. |

| 2/14/12 | Tobin’s Check 112, dated 2/14/12, paid $275 for quarter ending 3/31/12 plus $25 late fee |

| 4/1/12 | $275 Assessments due for 4/1/12-6/30/12 |

| 4/24/12 | Tobin’s Check 127, dated 4/24/12, paid for quarter ending 6/30/12, so no late fee became due on 4/30/12. |

| 6/30/12 | Page 1335 Resident transaction report shows assessments were current to 6/30/12. |

| 7/1/12 | Foreclosure deed recitals falsely claim that no payments were made after 7/1/12. See 8/22/14 annotated foreclosure deed. See 3/12/13 rescinded NODES, |

| 7/1/12 | $275 Assessments due for 7/1/12-9/30/12 |

| 7/31/12 | $25 Late fee assessed for 7/1/12-9/30/12 quarter |

| 8/17/12 | Tobin’s check 143, dated 8/17/12, paid $275 Assessments due for 7/1/12-9/30/12 and $25 Late fee assessed on 7/31/12, for 2763 White Sage Drive. See annotated Resident Transaction Report Page 1335. |

| 8/17/12 | Tobin’s check 143, dated 8/17/12, paid $275 Assessments due for 7/1/12-9/30/12 and $25 Late fee assessed on 7/31/12, for 2664 Olivia Heights. See Resident Transaction Report Page 12859 |

| 9/13/12 | SCA’s managing agent RMI referred the account to its subsidiary RRFS to initiate collections per RRFS log in SCA 415, RRFS’s log of “homeowner progress” |

| 9/17/12 | On unsent 9/17/12 RRFS notice of intent to lien, RRFS claimed $617.94 was due when only $275 assessments and a $25 late fee were authorized for 7/1/12-9/30/12 quarter. See SCA 642 and SCA 643. |

| 9/17/12 | RRFS reported to the Board that the account was a potential write off of $321.51 SCA removed the RRFS collection reports from the SCA website after Tobin downloaded them in 2018. See RRFS potential write off as of 9/30/12 for 2763 White Sage, RRFS account #808634 |

| 9/20/12 | SCA 628 and SCA 635 are the sender’s copy of certified letters, item number 71603901984964087011. Both sender’s copies are stamped as received by RRFS on 10/8/12. SCA/RRFS did not disclose any proofs of service for SCA 628 and SCA 635. Tobin has no record or recollection of ever receiving it. SCA alleged in its MSJ that Tobin had sent it to RRFS with a 10/3/12 letter she sent to SCA transmitting check 143 and Hansen’s death certificate. No evidence supports this claim. All evidence supports that RMI sent SCA 628 and SCA 635 to RRFS at which time RRFS stamped them received. The effect of this was to unfairly impose unauthorized and unnecessary collection fees on the estate of a deceased homeowner without the executor’s knowledge. |

| 9/20/12 | SCA 628 and SCA 635 are the same notice of hearing on 10/8/12 for temporary suspension of Gordon Hansen’s privileges for the alleged violation of the governing documents of delinquent assessments. SCA may have sent this notice. However, Tobin did not receive it. There never was a hearing on 10/10/12. Tobin’s check 143, dated 8/17/12, paid assessments through 9/30/12 are rendered it moot. |

| 9/30/12 | $275 Assessments due for 7/1/12 – 9/30/12 quarter plus $25 late fee assessed on 7/31/12 were paid by $300 check 143 |

| 9/30/12 | In SCA 618, RRFS Allocation detail shows that check 143 was applied to pay the assessments and late fees due and payable through 9/30/12. |

| 9/30/12 | Check 143 paid the account in full for the quarter 7/1/12-9/30/12. See SCA 618 which shows |

| 9/30/12 | 9/30/12 RRFS reported to the SCA Board that as of 9/30/12, account 808634 was a potential write off of $351.21. See RRFS potential write off as of 9/30/12 for 2763 White Sage, RRFS account #808634 |

| 10/1/12 | $275 Assessments due for quarter 10/1/12-12/31/12 |

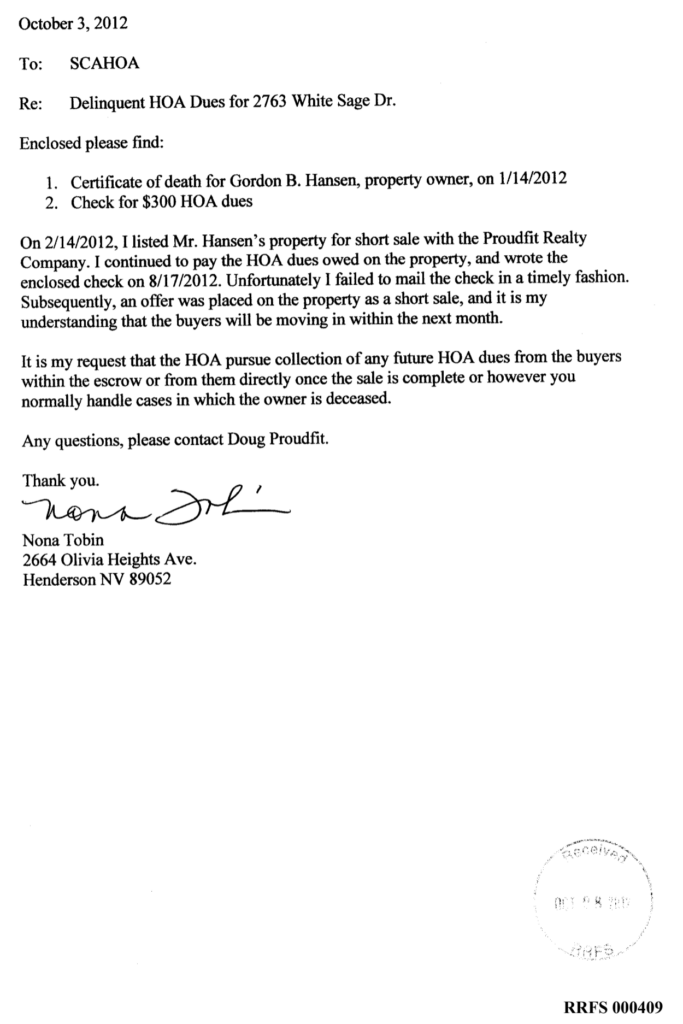

| 10/3/12 | Per SCA 631, Tobin gave notice to SCA that the owner had died. Enclosed were 1) 1/14/12 death certificate and 2) “Check for $300 HOA dues” Tobin’s notice was sent to the HOA. She indicated the late payment of the deceased owner’s assessments was an error, that the property was in escrow, that the prospective purchasers were moving in shortly, that further payments would be made out of escrow, and that the HOA should work with Doug/Proudfit Realty or new owners to collect future assessments. SCA’s claims that Tobin acted in bad faith, had “unclean hands” and that she was “barred by equitable principles from recovering” for not knowing or remembering that check 143 was not delivered on 8/17/12 when it was written. Tobin had no recollection of writing the 10/3/12 letter and only became aware of it on 12/26/18 when PDFs of documents disclosed by SCA on 5/31/18 as a picture of a CD, were given to her by attorney Joe Coppedge. |

| 10/3/12 | Page 1335 Resident Transaction Report does not have an entry to acknowledge that check 143 for $300 was submitted to pay the assessments for the quarter from 7/1/12 – 9/30/12 as was reported in SCA 618.. |

| 10/8/12 | RRFS stamped on a paper with a picture of check 143 as received by RRFS on 10/8/12. There is no date stamp on check 143 to indicate when SCA received it or when RRFS received it. It is more probable, given the many alterations/ misrepresentations of other documents RRFS/SCA disclosed, that Tobin’s recollection that she submitted check 143 with check 142 on 8/17/12 was correct. and RRFS altered the date on the transmittal letter from 8/17/12 to 10/3/12 to conceal that FSR forwarding the account to collections on 9/13/12 was an error. |

| 10/8/12 | SCA 628 and SCA 635 are the same SCA compliance letter, dated 9/20/12, to Gordon Hansen, at 2664 Olivia Heights. SCA/RRFS did not disclose any proofs of service for SCA 628 and SCA 635. Tobin has no record or recollection of ever receiving it. SCA/RRFS did not disclose any letter to 2763 White Sage which would have been required it this was supposed to be the first step of the due process required before imposing a penalty on the homeowner for delinquent assessments. |

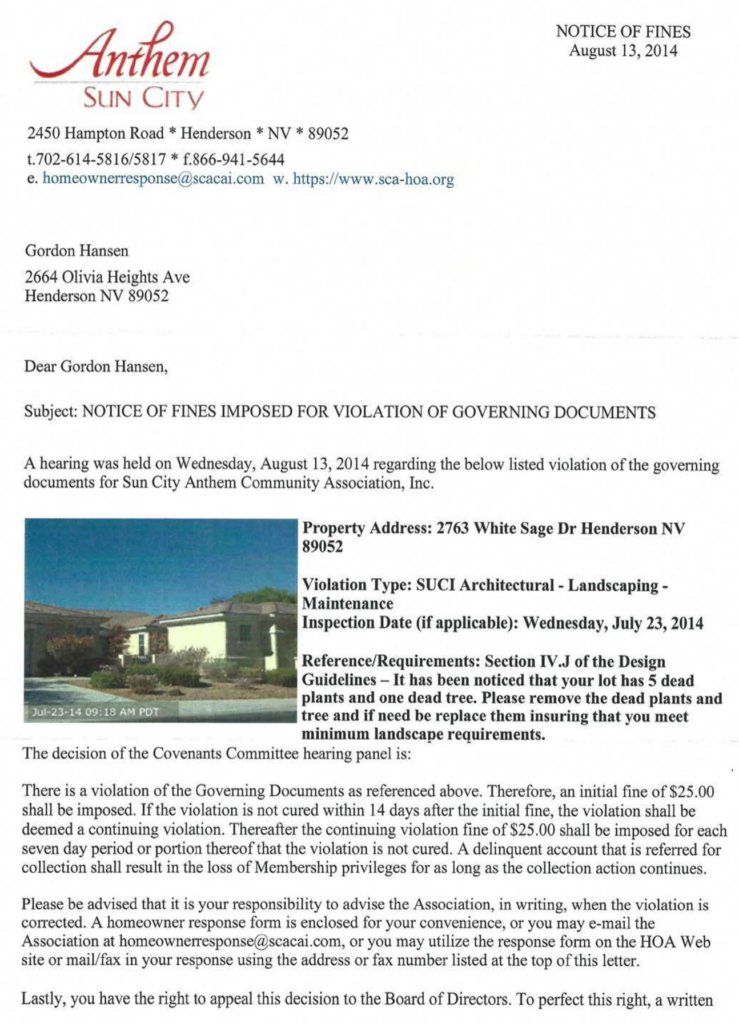

| 10/10/12 | The 10/10/12 hearing noticed allegedly by the 9/20/12 letter in SCA 628 and SCA 635 did not occur. No notice of sanction followed it equivalent to the 8/13/14 Notice of Fines Tobin received after a hearing was held to give notice of a $25 fine for dead plants. |

| 10/18/12 | RRFS ledger did not apply check 143 to pay the 7/1/12-9/30/12 quarter. On 10/18/12 RRFS ledger entered that check 143 left a balance $369.15 instead of the $275 that was actually due and payable for the quarter of 10/1/12-12/31/12 |

| 10/18/12 | SCA 618 PAY ALLOCATION shows check 143 was both allocated as payment of the quarter 7/1/12-9/30/12 or was a partial payment that left a balance as of 10/18/12 comprised of all RRFS-added charges. |

| 10/18/12 | RRFS ledger SCA 623-625 called check 143 a partial payment |

| 10/31/12 | $25 late fee for 10/1/12-12/31/12 delinquent installment was assessed. As of 10/31/12, amount due and owing was $300. |

| 10/31/12 | Balance due on 10/31/12 as listed in SCA resident transaction report instead of the $275 assessments and $25 late fee actually authorized and due and payable as of 10/31/12. |

| 10/31/12 | On 11/5/12 RRFS ledgeer sent to 2763 White Sage and forwarded by Proudfit Realty to Ticor Title claimed $495.36 was due when $300 would have paid through 12/31/12 the $300 assessment and late fee authorized for the quarter 10/1/12-12/31/12 |

| 10/31/12 | RRFS reported to the Board that account 808634, 2763 White Sage Dr. was a potential write off of $382.26 as of 10/31/12 |

| 11/1/12 | SCA Board published a schedule of fees that conformed to the NRS 116.310313(2) limits set by the CIC Commission except for the sentence “Fees and costs may change without notice. Schedule of fees may not be all inclusive.” |

| 11/5/12 | SCA 620 11/5/12 “Correspondence Response Sent to Homeowner” “(RRFS) is in receipt of the correspondence that the homeowner has passed away. Our records have been updated…” RRFS claimed $495.36 was due as of 10/31/12 instead of the $300 actually due. |

| 11/9/12 | Per 11/9/12 into SCA resident transaction report after a $300 collection payment was credited from check 143, there was a $351.21 balance reported on Page 1335 because two unauthorized monthly late fees had been added. $300 was due, $275 for assessments for the 10/1/12-12/31/12 quarter plus the $25 late fee due on 10/31/12.) |

| 11/9/12 | Page 1335 Resident Transaction Report has an entry, dated 11/9/13, that shows the HOA received a collection payment of $300 on 11/6/12. |

| 11/9/12 | SCA 617 “Payment Allocation 11/9/12” information as of 10/18/12. Check 143 for $300 was received as a “partial payment”. “Association Allocation detai”l: $300 check was allocated to $275 assessments due 7/1/12.and 7/31/12 to $25 late fee assessed.. |