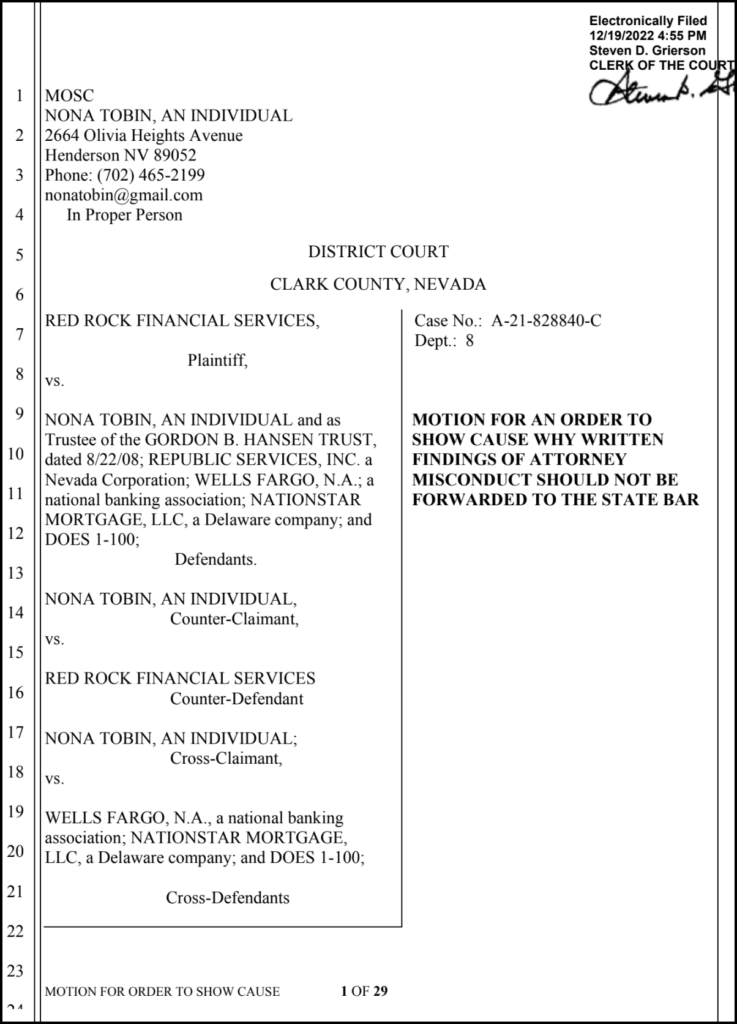

I am requesting your help to get some investigative assistance, and meaningful access to Nevada’s formal complaint procedures, to address this problem of HOA debt collectors and banks ripping us all off.

Tobin’s 2/14/19 email to investigative reporters & state legislators requesting help

Specifically, the two issues I am raising I also raised in a letter to the R-J “HOAs, foreclosures, and property rights” published on 9/18/16.

1. HOA debt collectors use abusive debt collection practices to foreclose for trivial delinquent assessments, and then unlawfully retain the proceeds of the sales.

2. Banks lie to the court in HOA foreclosure litigation for quiet title so they can foreclose on deeds of trust/mortgages that they don’t actually own.

Can you assist in ensuring that these possibly criminal complaints are addressed by the proper enforcement authorities?

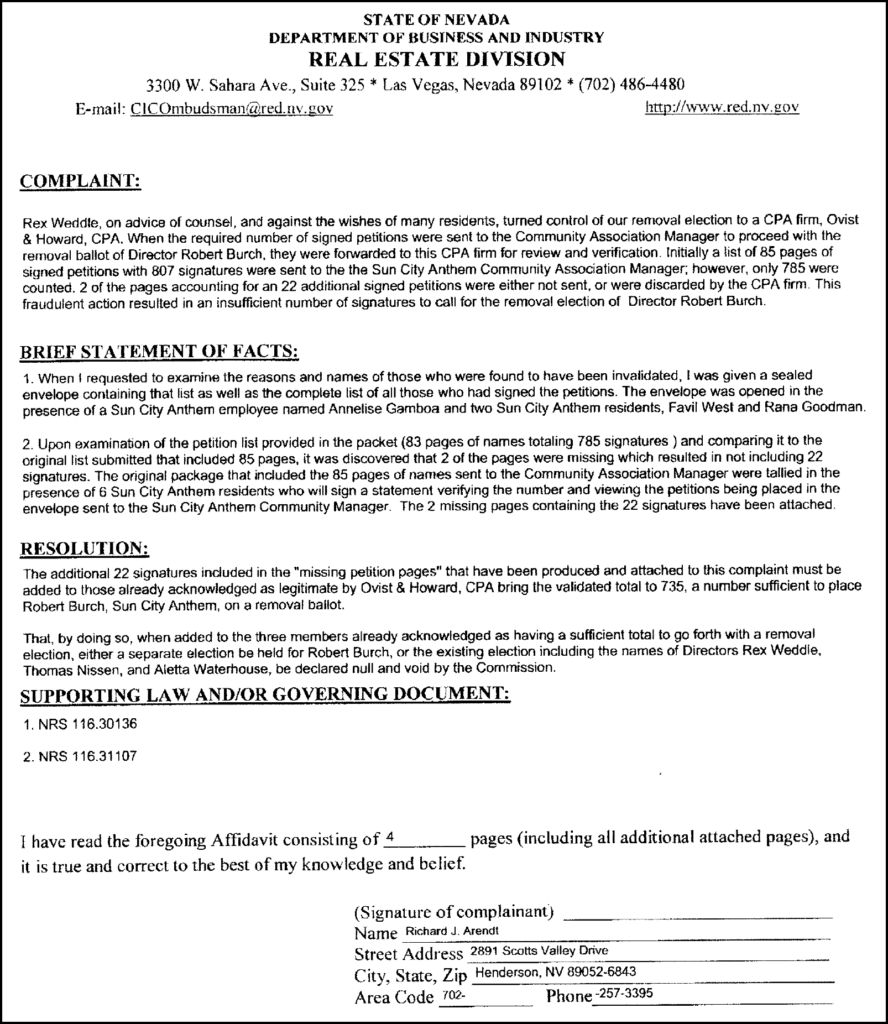

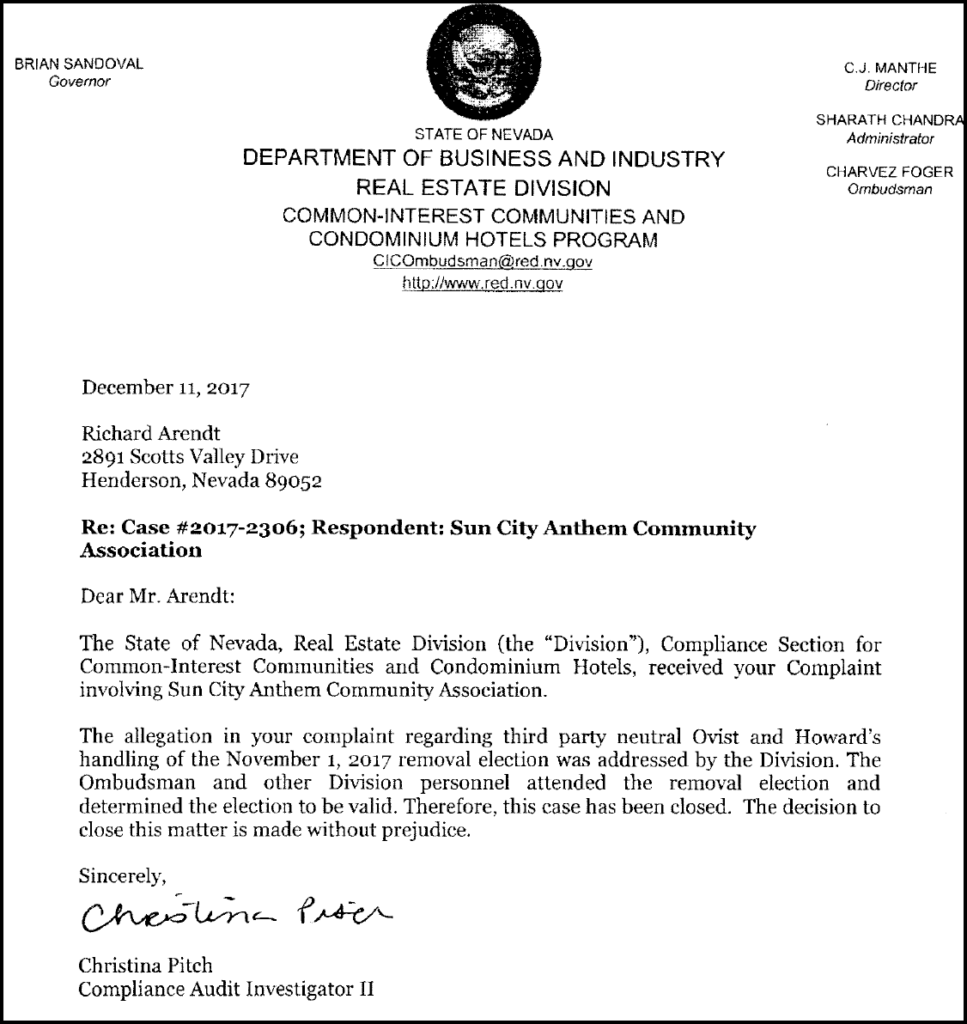

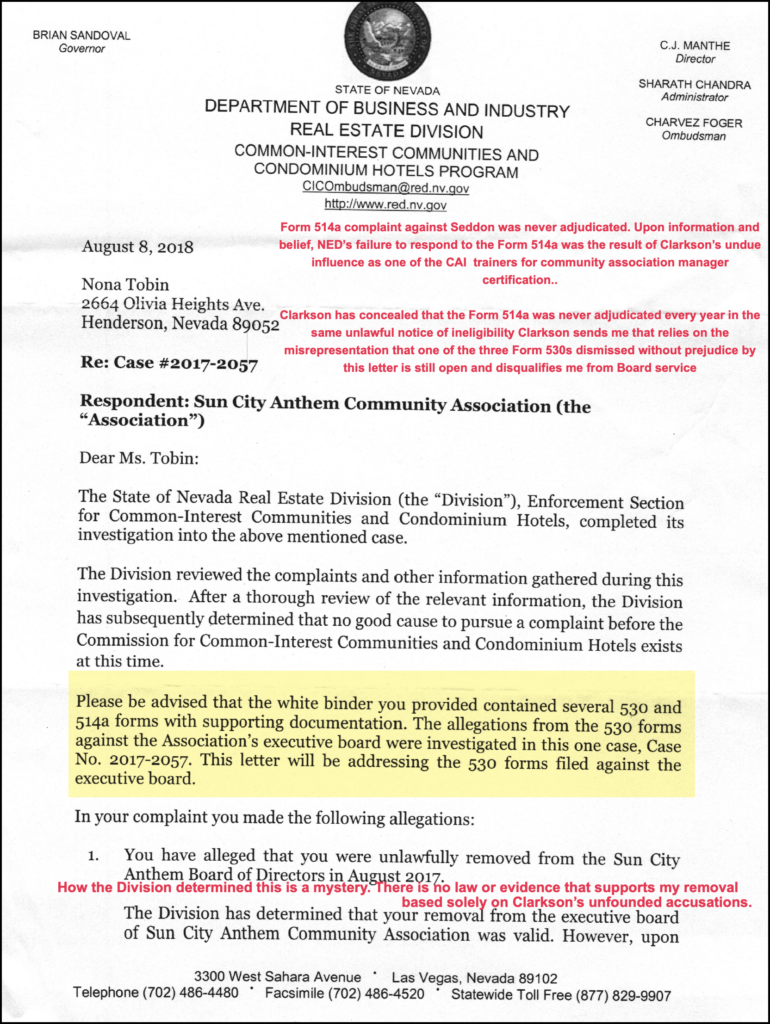

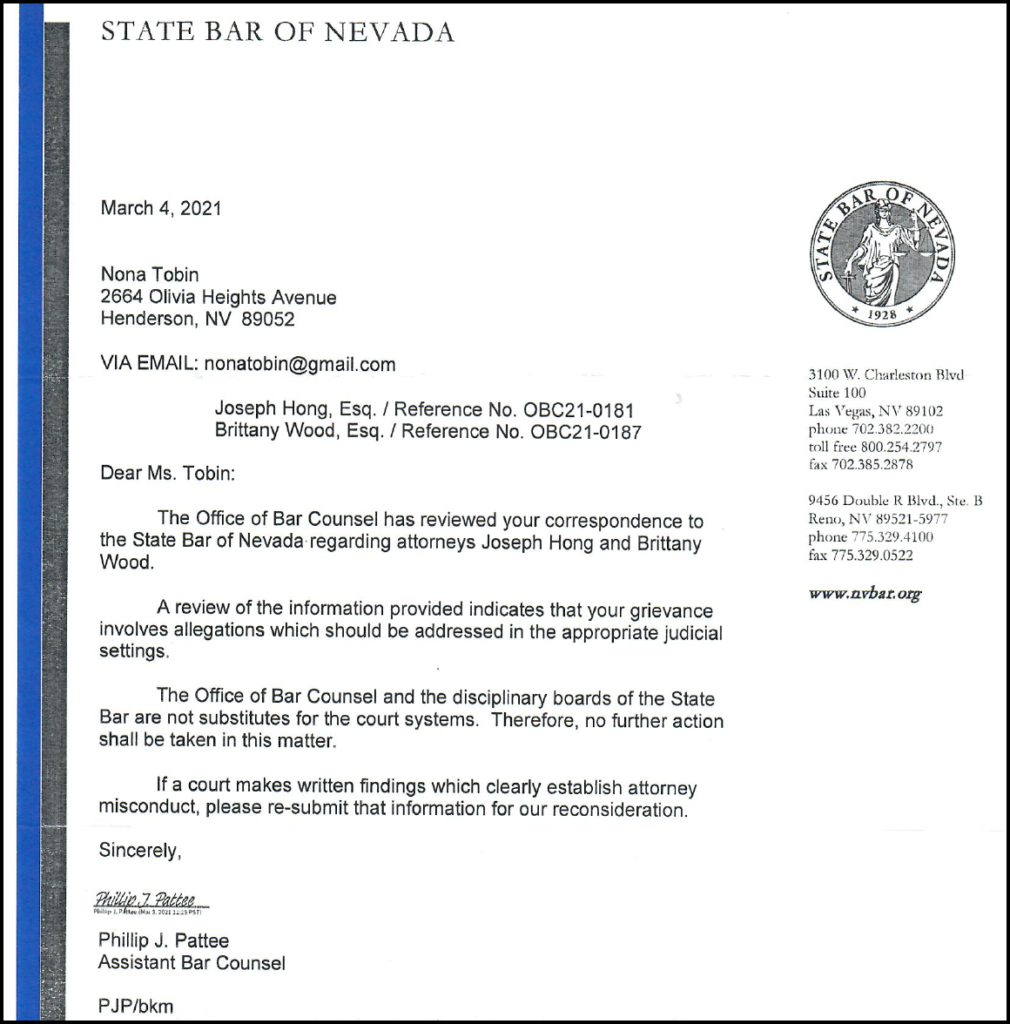

The NV Real Estate Division and CICC Ombudsman should ensure that HOA foreclosures are compliant with state law, but they have failed. Enforcement officials have been cowed, co-opted, or corrupted into being completely ineffective at any enforcement of NRS116, NRS116A, or NAC116, or NAC 116A.

Link to outline of the corruption “HOA debt collectors wield an unlawful level of power”

This systemic problem can’t be effectively incorporated in my individual civil action, but must be addressed statewide.

This email describes a pattern of unjust enrichment and fraudulent concealment that (I have been told) cannot be addressed in the quiet title litigation I have over my late fiance’s house (also described herein) because my case is not a class action.

This fraud is larger than last big HOA corruption case where more than 40 were indicted and four died suspiciously.

This problem involves so much more money than the last HOA corruption scam by Benzar and Nancy Quon manipulating HOA board elections and channeling construction defect cases to themselves that it should not be ignored by authorities.

I need to know how to get the appropriate enforcement agency staff to talk to me personally and to prioritize reviewing the investigative research already done.

The scale of this fraud is astounding, but it is so big because it is one way banks are trying to dodge accountability for creating worthless securities that exist in the aftermath of the 2008 collapse of the mortgage securities market.

A lingering consequence of the market crash

Taxpayers bailed out the banks after the crash. The TARP program made banks virtually whole despite their misdeeds. None of the investment banker perpetrators went to jail for bringing down the world economy.

A new twist

The specific situation here is a new twist on the mortgage servicing fraud, robo-signing problem that led to Nevada’s 2011 anti-foreclosure fraud law AB 284 and the 2012 National Mortgage Settlement. Here, the un-indicted co-conspiritors that destroyed the entire housing market a decade ago are trying to cut their losses by getting title to HOA-foreclosed houses even though they don’t actually own the mortgages.

A bank pretends a debt is owed to it. Actually, the debtor’s IOU is to a different bank, perhaps now defunct, and there is no paper trail to the bank making the false claims.

It is very common for houses foreclosed by HOAs – in Nevada and nationwide – to have mortgages/deeds of trust that were securitized out of existence – broken up into synthetic derivatives, collateral debt swaps and tranched instruments, so esoteric and exotic that the ownership of the note is nearly impossible to accurately ascertain.

Any unscrupulous bank can step into the void and anoint itself the owner of a debt that belongs to someone else or belongs no one. And step in, they do!

Banks’ attorneys’ legal sleight of hand – razzle, dazzle ’em!

The banks, and their extremely high paid and competent, albeit ethically-challenged attorneys, have figured out one way to foreclose when they had no legal right to do so and have no legal way of proving who owns the mortgage. Getting quiet title after an HOA foreclosure is one way they pull this magic trick off.

Banks treat owner protections as optional, not mandatory

They (meaning either the banks or the banks’ attorneys on their own initiative, hard to say given all the smoke and mirrors) record false affidavits against the title (banned by AB284 in 2011) claiming that the owner of the home owes it a debt. Further, the bank’s Constitutional protections are abridged if the bank loses the owner’s home as security for a debt owed to someone, but the owner’s property rights and protections against seizure without due process can be abridged with impunity.

Silence means compliance – or acquiescence

Then, probably no one challenges the banks’ claim (the owner that lost the house for a trivial debt is usually either dead or devastated by debt).

The bank then is free to sue the purchaser at the HOA for quiet title. The bank blithely lies to the court, claiming falsely that it holds the debtor’s IOU, i.e., the original note where the debtor promised to pay back the mortgage to the originating lender.

Rabbit out of the hat

The court will probably buy the bank’s story because the documents produced seem very official and incomprehensible.

Brilliant, unscrupulous bank! The fraud is not obvious to the naked eye. A forensic examination is needed to discern it. Further, nobody is around to contradict the bank that’s pretending to be owed a debt.The bank can then foreclose on the property with impunity without ever having to prove that the debt was ever really owed to it.

Meanwhile…nobody knows what escheat means

The HOA debt collectors are rewarded by nobody noticing that they unlawfully keep nearly all of many HOA sale proceeds for years.

No worries.

The bank can’t make a claim for the proceeds if the HOA sale extinguishes the security instrument.

And, it’s really easy for the debt collector block owners who attempt to make a claim for a portion of the proceeds — as has been amply demonstrated iboth n my case and in the Spanish Trail case in the forwarded email below.

The scam works for HOA foreclosures between 2011-2015 before the 2015 law changes.

Who wins when an HOA forecloses on a minuscule debt – speculators, debt collectors, and fraudulent banks and attorneys

Speculators-in-the-know have bought almost all of Nevada’s HOA foreclosures. These clever guys have gotten huge windfalls by buying HOA liens for pennies on the dollar virtually without competition from bona fide, arms-length purchasers. The vulture investor rents the properties they got free and clear for years while the wrongful foreclosure is litigated.

Why doesn’t the HOA get the profits? Or the HOA membership at large?

Note: the HOA debt collectors unlawfully get approval for these sales from the HOA Boards in secret meetings so the HOA homeowners can’t buy houses in their own HOA by paying a few bucks to cover delinquent dues. These great deals are reserved for speculators. All SCA foreclosures have gone to parties who own multiple HOA foreclosures from two to over 600 house. For example, two Sun City Anthem properties sold in 2014 for under $8,000, and 11 of 12 SCA foreclosures that year sold for under $100,000. I estimate this averages at less than one-third market value.

Due process for the owner takes a back seat to the HOA debt collectors drive to high-profit foreclosure.

Real estate speculators bought HOA liens for delinquent assessments in the thousands after the market crash when the baks wouldn’t protect the properties from deterioration causing whole neighborhoods to be blighted. These cognoscenti bought often, sometimes in bulk, either directly from the HOA debt collector or at some poorly noticed “public” foreclosure sale. See Irma Mendez affidavit regarding Joel Just, former-President of red rock.

Link to one 2012 speculator’s description of how he did it.

Link to UNLV Lied Institute for Real Estate 2017 study , commissioned by Nevada Association of Realtors, documenting 611 HOA foreclosures and the super-priority lien, that shows a cost to the Nevada real estate market exceeding over $1 billion between 2011-2015.

Failure to distribute the proceeds of MANY HOA foreclosures is big bucks for a few financially-conflicted/ ethically challenged HOA debt collectors.

HOA debt collectors win by putting virtually ALL the proceeds of the sales in their attorney trust funds (except the actual delinquent assessments plus interest and late fees (chump change) that go to the HOA.

In my case, RRFS kept $57,282 in “excess” proceeds and paid the HOA $2,701.04 as payment in full. What a deal! Seems like a disproportionate sanction to me, but probably it’s in the bottom quartile of all the David Copperfield RRFS has conjured up to rip off HOA homeowners further after stealing their houses.

See forwarded email of RRFS holding $1.1 million on one HOA sale. I think the HOA got less than 1% of that windfall.

In this Spanish Trails case RRFS has been holding a whopping $1.1 million+ since 2014. One question is “Will the 90- year-old former owner get a fair shake in court to claim those proceeds or will the debt collectors and the banks (and maybe the judge) postpone until the bank wins by default?

What the law says the forecloser has to do with the sale proceeds

NRS 116.31164(3)(c) (2013) requires that the funds be distributed in a certain order – to pay reasonable foreclosure costs, pay the HOA delinquent assessments, then pay off liens, last, pay the owner. The owner only gets something if the sale extinguished the mortgage.

The debt collector’s attorney is not supposed to retain indefinitely the “excess” proceeds. The attorney is supposed to file a complaint in district court called interpleader and SHALL distribute the funds in the manner defined by NRS, but they just pretended to do it.

What happens in real life is the debt collectors just keep the money because they haven’t gotten caught.

It’s almost a state-sanctioned form of embezzlement.

This windfall is potentially in the tens of millions, and there is a pretty small crew of individuals that do this – HOA debt collectors with NRS 649 licenses and attorneys who don’t need a license and so are even less regulated.

If there is no litigation, no one makes a claim for the proceeds.

There is no accounting of the sale proceeds by the HOA. In fact, the HOA has no record even that a property was foreclosed using the HOA’s power of sale or how much the house was sold for or any accounting. The attorneys and debt collectors tell the HOA -WRONGLY – that it is not the HOA’s money so they effectively block any independent accounting of the proceeds.

I haven’t found any interpleader filed for the court to distribute the proceeds of any of the Sun City Anthem foreclosures conducted in SCA’s name by any of SCA debt collectors, but it’s hard to be sure since they withhold, conceal or misrepresent any records they do have.

If there is litigation, like in this Spanish Trail case, it goes on for years,

and 99% of the time the homeowner who lost the house is not in the case. The court fight is usually just between the bank and the buyer at the sale. The attorneys try to keep the HOA out of it except for the HOA homeowners to pay the litigation costs.

A stunning example of why attorney trust funds can’t be trusted

Chapter 7 as an easy way to fraudulently abscond with all the proceeds from many HOA sales held indefinitely in attorney trust funds

The proceeds of these sales can just disappear in a morass of sham LLCs that Nevada is so good at producing while so poor at regulating.

SCA hired Alessi & Koenig, LLC after RRFS was fired.

David Alessi was not licensed to practice law in Nevada but passed himself off as an licensed attorney anyway so A&K didn’t have an NRS 649 debt collection license.

That was the least of their problems

A&K dissolved the LLC, hid its assets, filed chapter 7 bankruptcy and morphed into HOA Lawyers Group. Alessi only admitted in the bankruptcy proceedings as retaining $2.9 million after having conducted at least 800 HOA “public” auctions out of their offices between 2011-2015, 500 of which per David Alessi’s deposition, had named A&K as a party to wrongful foreclosure litigation. They had one racketeering, bid rigging judgment (Melinda Ellis) against them that they skipped on.

Generally, NV HOA Boards are ill-advised by financially conflicted agents who tell the BODs to do the wrong thing. SCA just pays more for it.

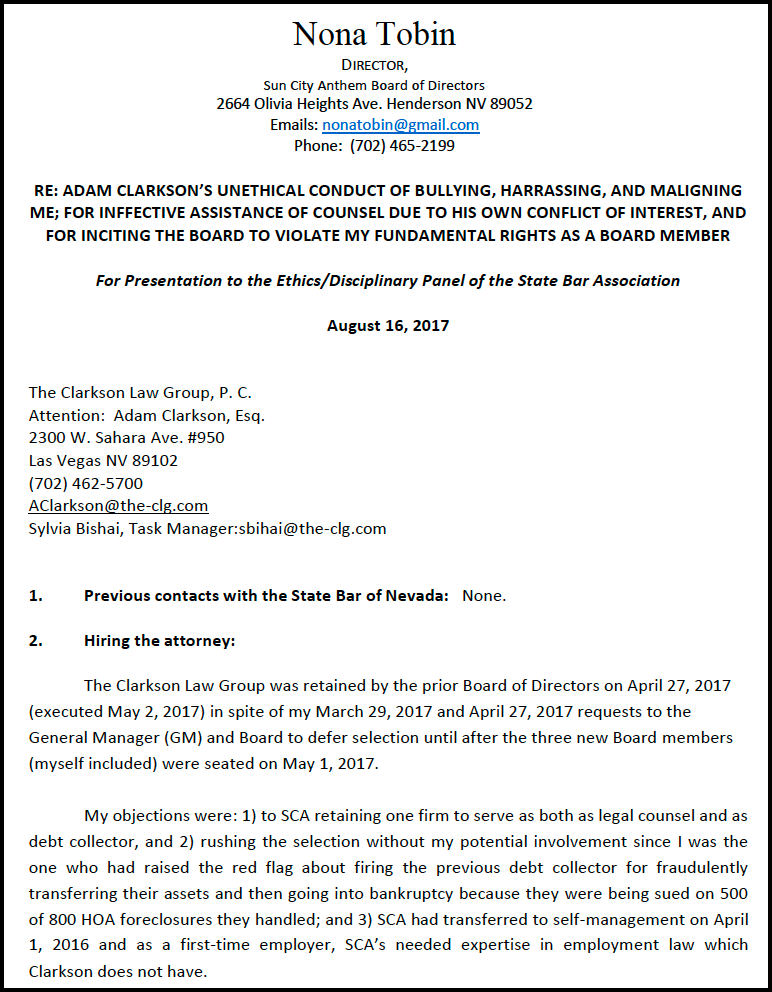

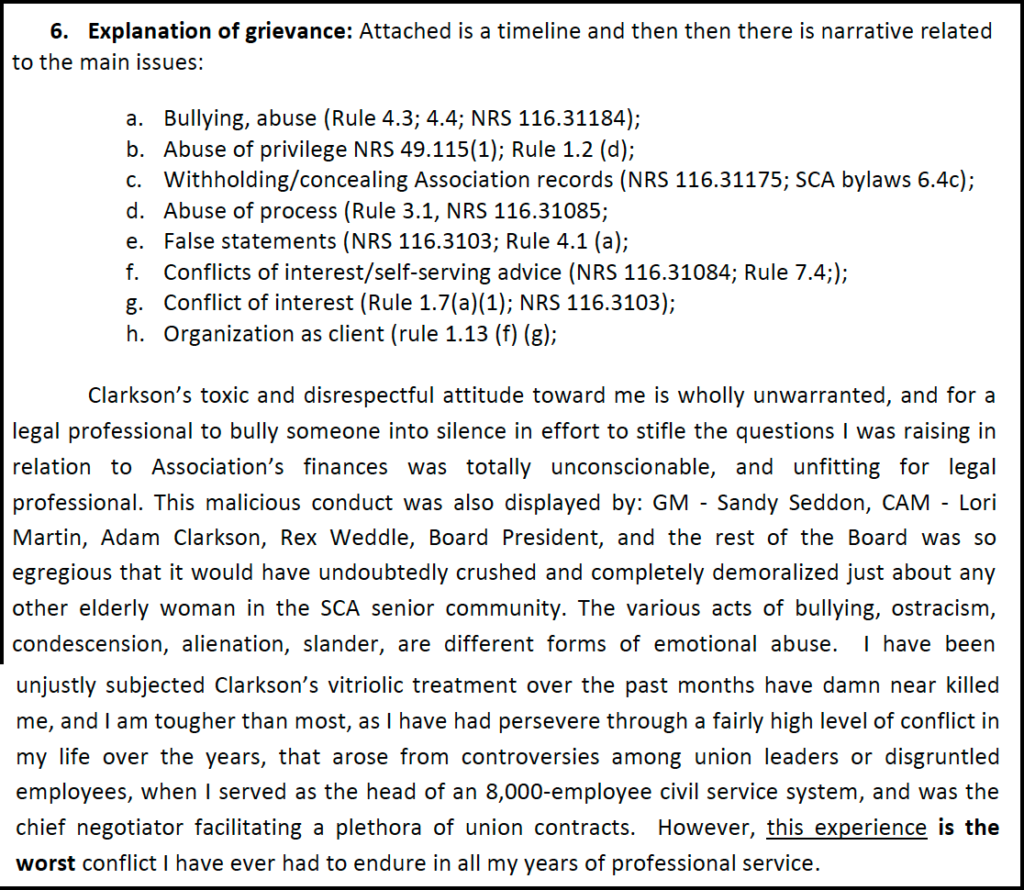

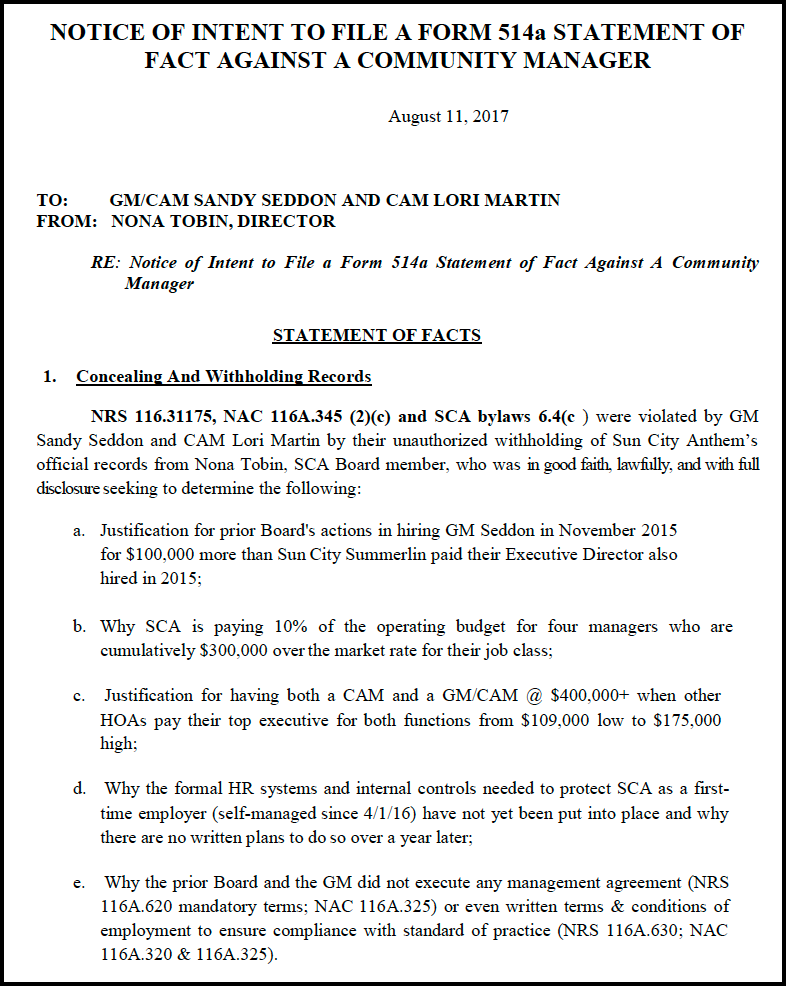

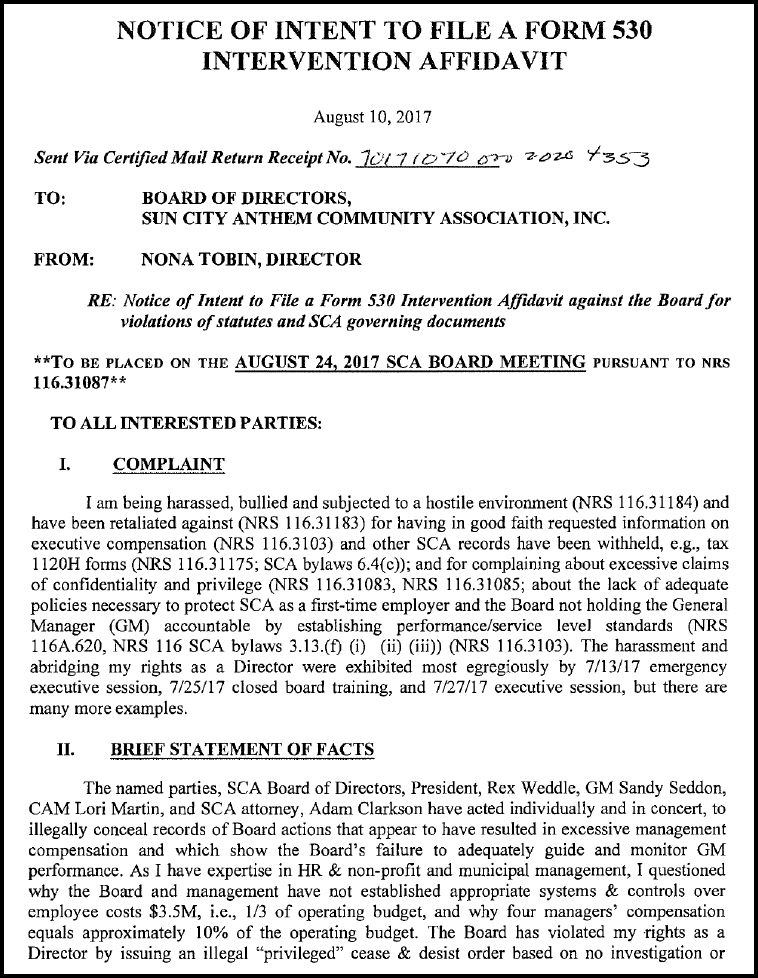

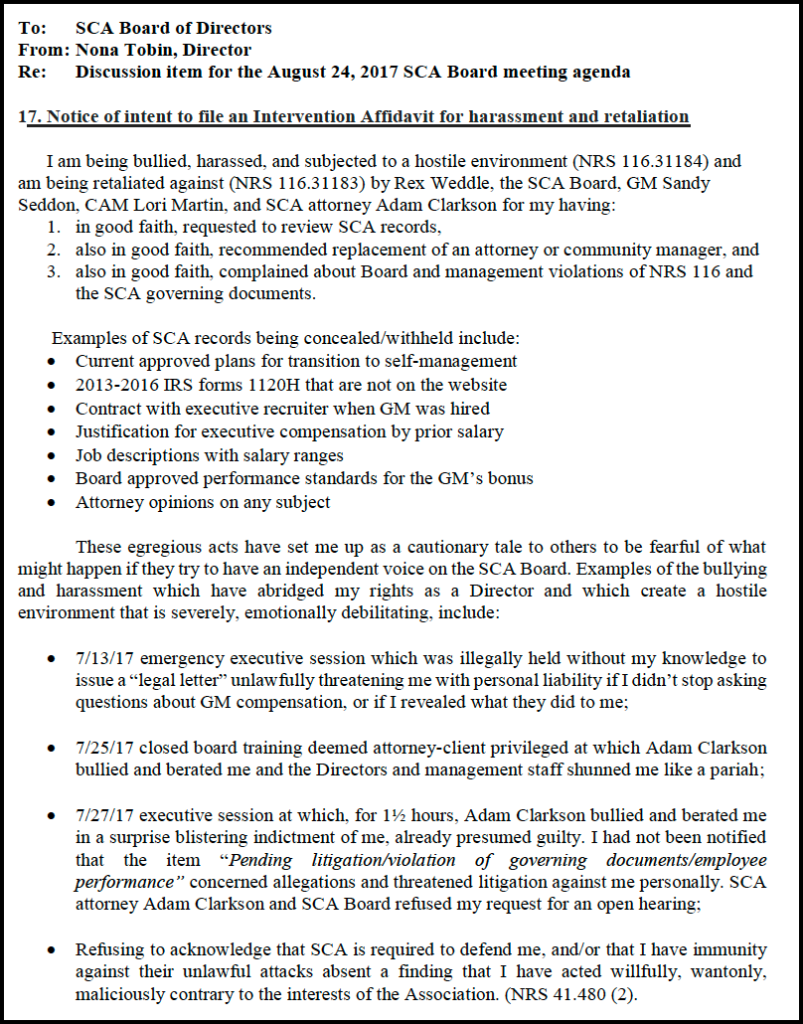

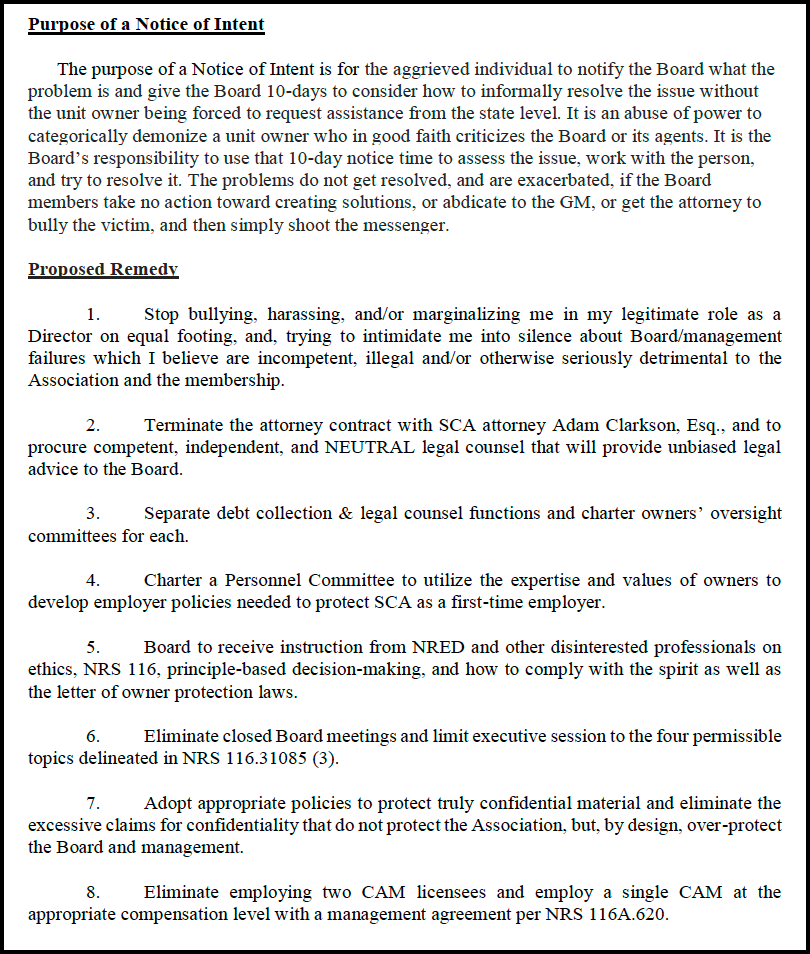

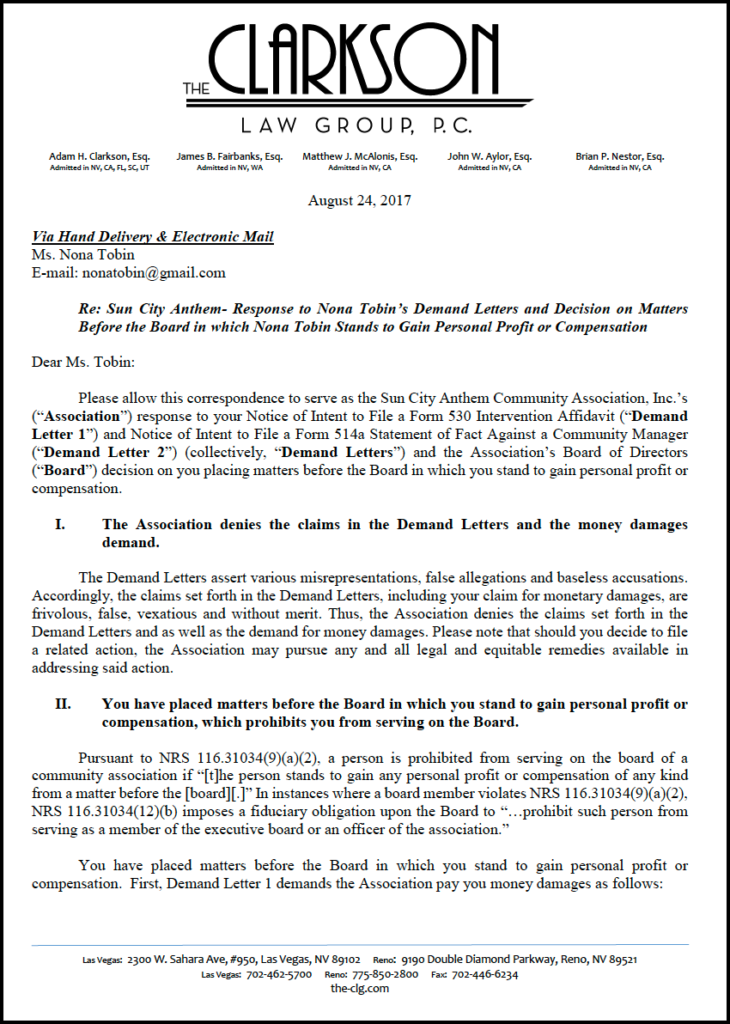

Link to the notice about this scam I sent on 1/25/17 that the SCA Board ignored. My reward came when the current SCA attorney/debt collector ordered me to recuse myself from all SCA collection matters after I was elected to the Board and prohibited me from accessing any SCA records without his approval.

The banks are far from blameless. Do not give them a free pass.

The banks are usually cheating as well because they are saying that they own the mortgage when they actually don’t own it any more than I do.

Since it is unlawful for an HOA to foreclose after a bank had issued a notice of default (NRS 116.31162(6), the prime pickings for HOA foreclosures were frequently ones that the bank did not foreclose on for 2-3 years of non-payment. These houses were ripe of HOA foreclosure primarily when the banks couldn’t prove they owned the mortgage after Nevada passed AB 284, its anti-foreclosure fraud law in 2011. So the banks in these HOA foreclosure litigations unfairly get a second bite of the apple

Catch-22 so the owner always loses and the bank wins

In my case, the homeowner died.

The HOA sold the house to a Realtor in the listing office after the bank blocked four legitimate sales of the property.

The bank now claims the HOA sale was valid to get rid of my (the estate’s) property rights, but that the HOA sale was not valid to extinguish the deed of trust the bank is lying about owning.

Obviously, the highest priority to fraudulent banks is to get mortgages on their books that had been securitized out of existence. The proceeds of the HOA sale are second priority.

Two bites of the apple

So the banks in these HOA foreclosure litigations have a chance to get quiet title just by beating the speculator in court so they can foreclose without meeting the stringent stands of AB 284. Obviously it is much more worth it to those kinds of fraudulent banks to get mortgages on their books that had been securitized out of existence than to worry about the proceeds of the HOA sale.

Bottom line: who gets screwed? Easy — The HOAs and the homeowners lose 100% of the time.

The HOAs get nothing from a sale but the few assessment dollars they certainly could have gotten easier if they had taken title by deed in lieu or had offered the property up to their own HOA owners.

How can it be good business judgment to pay collection costs that are orders of magnitude larger than the minuscule debts collected?

Instead of the HOA (or some of its owners) getting the windfall of a house with no mortgage, the homeowners get a big, fat legal bill to pay for the fight between the HOA sale purchaser and the bank for wrongful foreclosure. In SCA’s dozen 2014 foreclosures owners have paid, several hundred thousand bucks in attorney fees, settlements, insurance deductibles, and other costs have accrued to collect because SCA has totally abdicated to the debt collectors and .

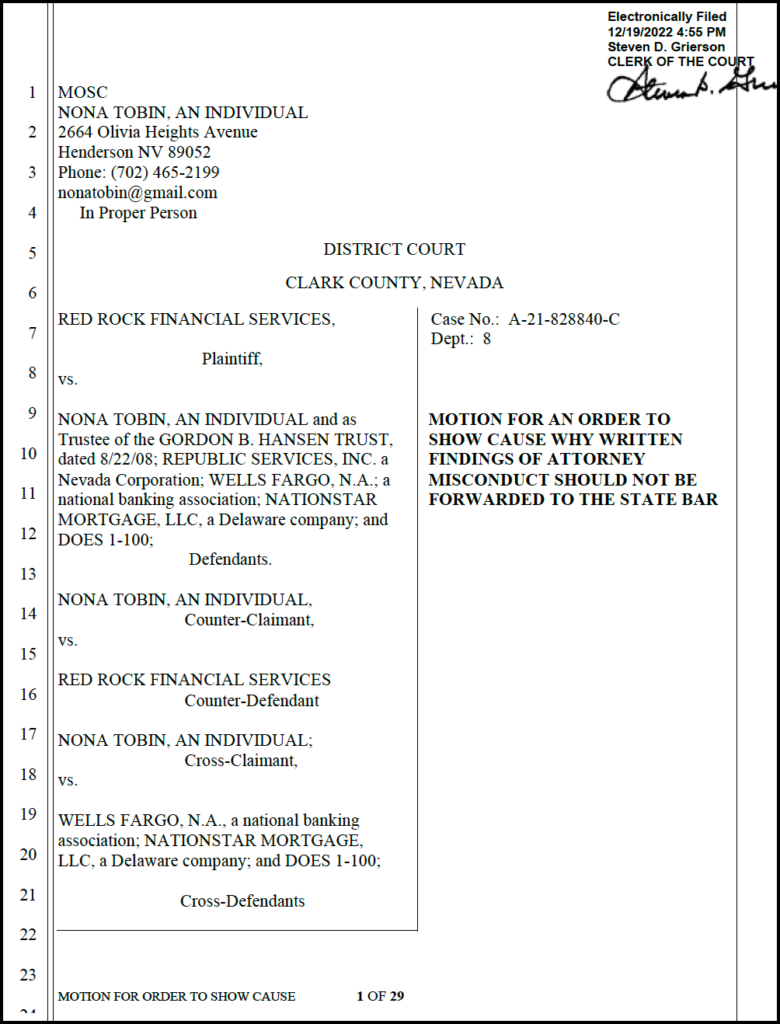

How the scam is working even now to screw me out of Bruce’s house

The homeowner, in this case, me, got screwed by losing the house at a surprise sale for a trivial delinquency, 8th amendment anyone?

What idiot would lose a $400,000 house for a $2,000 debt?

I, for one, would easily have corrected a $2,000 delinquency had I thought, in a million years , that the bank – the same bank, mind you, that claimed $389,000 was owed to it — wouldn’t stop the HOA from selling the house for $63,100 when a $358,800 offer from a bona fide purchaser was on the table.

Oh well…current status of my one little stolen house case

There will be a hearing on March 26 on motions for summary judgment. The trial is set for May 28, 2019.

Here is a link to a counter-motion I drafted yesterday that I am sure my attorney will choose not to file after because my draft is focused on the bank’s duplicity and not exclusively on the (considerable) statutory deficiencies of the HOA sale per se.

However, it shows how the banks’ attorneys are trying to use the HOA foreclosure quiet title proceeding to unfairly gain title to a property when its claim to be owed around $400,000 is provably false.

Abusive collection practices tip the scales against owners, especially dead owners

In this case, the debt collector should have stopped the HOA sale when the bank tendered nine months of assessments, the super-priority, but instead, it carried on in secret meetings (of which there are no agendas and no minutes) to get the SCA Board to approve an unnecessary sale without telling me. The debt collectors unlawfully refused the banks’ tender of the super-priority amount twice, and each one should have stopped the HOA sale, but the debt collector never told the Board what it did.

Why don’t more owners sue after losing their expensive house for a trivial debt?

It’s simply a low percentage game.

It has cost me over $30,000 in attorney fees already and trial isn’t until May in this four-year long case. My attorney has been very generous with reducing fees and looking at my work, but most attorneys won’t represent a homeowner because the chance of recovery is so small and the banks’ resources so formidable.

Spanish Trail case – no distribution of $1.1M yet for 90-year-old who lost his house in 2014, but who cares? He’ll be dead soon anyway.

Here’s the minutes of the February 5 hearing in the Spanish Trail case that was continued to March 5. Link to the March 1 minutes of the hearing that inexplicably occurred on March 1 and not March 5.

How this tome started: Forwarded email about Spanish Trail case shows how easy it is to steal when nobody is looking.

The email I am forwarding was my attempt to articulate the nuances of this scam to my attorney which he probably didn’t read. I don’t think he charges me for reading my long descriptions of the systemic deficits and scams because he is already not billing me for all the time it takes just to deal with trying to get quiet title to Bruce’s house,

Bank attorney boilerplate strategy doesn’t mean their fees are less

For the benefit of any potential investigator, the email below demonstrates the exact same legal sleight of hand used in the Spanish Trail case will be used to try to crush me later this month.

- Volunteer SCA Board violated their own CC&RS and sanctioned this owner by authorizing foreclosure in secret on the advice of counsel.

- HOA managers/debt collectors/attorneys usurp the HOA power to foreclose for their own unjust enrichment.

- Once the foreclosure is over, the attorney tells the HOA Board it’s not the association’s problem; it’s between the buyer and the bank.

All proceeds of HOA sales must be accounted for by SCA, but the SCA Board has been told that once the account goes to the debt collector it’s not their problem.

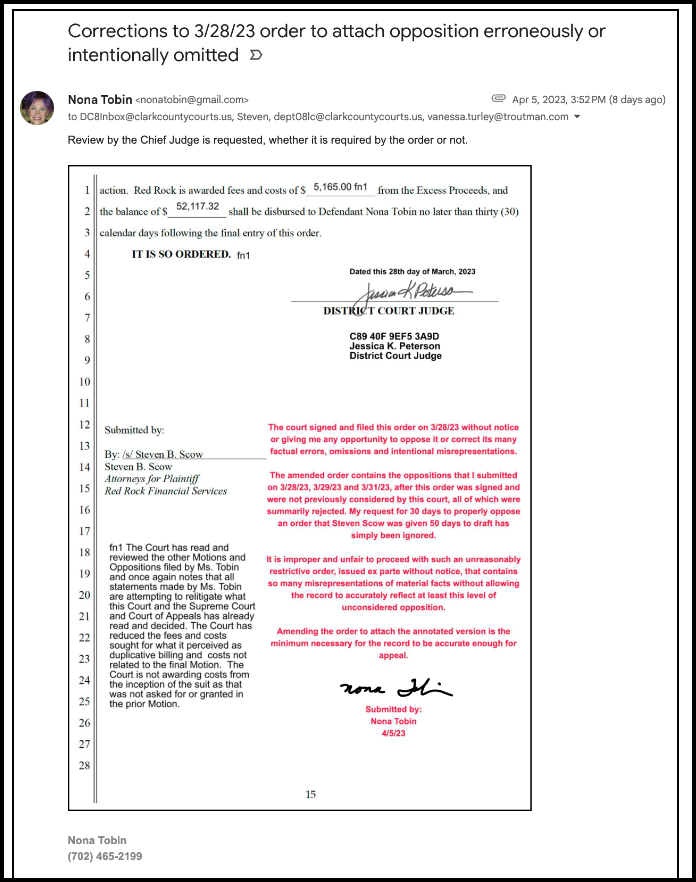

Attorneys Koch & Scow have held the sale proceeds for four years in both this Spanish Trail case and 2763 without filing for interpleader

….probably collecting the interest, not filing interpleader, and keeping what nobody notices. This is much more money, RRFS kept $1,168,865 is excess proceeds after the 11/10/14 sale.

It looks just like the RRFS trust fund check to the court for $57,282 excess proceeds check from excess proceeds after the 8/15/14 sale that Koch & Scow never filed for interpleader. When I attempted to make a claim for those funds in September 2014, I was rebuffed.

the 2/5/19 Spanish trail hearing is about proceeds from 11/10/14 sale

The owner, not in the case, gets the proceeds if the sale extinguished the loan

Here are the minutes of a 2/5/19 hearing where attorney Akin (not on efile list) was waiting for outcome so his 90-year-old client (former owner?) could see about the excess proceeds. Continued to 3/5/19. Will Akerman attorney even go to interpleader or will she let the old owner have it?

Ackerman got Spanish trail sale to be valid, but sale did not extinguish loan

Order granting MSJ to the bank 12/5/18

But the court finds that the HOA could only foreclose on the sub-priority portion of the lien This is what Ackerman is trying to do in the 2763 case, only representing a different bank.

Ackerman may be a front for bank fraud like attorneys for the mob

Ackerman got quiet title for Thornberg, the bank who I suspect is fraudulent and claims to have gotten the beneficial ownership from MERS. This is like 2763 DOT. I say this because in 10/1/11, Nevada legislature passed AB 284 which made it a felony for to banks to use robo-signers to execute notarized false assignments of mortgages.

In this case, the owner defaulted in 2011 on the DOT and the HOA filed a NODES in late-2011, why didn’t the bank foreclose for over three years until the HOA sold it in late-2014?

Bank MSJ: Foreclosure only sub-priority piece is valid

The Ackerman MSJ is what they will be arguing about 2763. Bank made super-priority tender. It was refused. Sale did not extinguish the loan because HOA only foreclosed on sub-priority portion. Argues that it doesn’t matter if Saticoy is a bona fide purchaser. Shadow Wood applies as sale was commercially unreasonable and unfair.

Banks were the proximate cause of the delinquency by blocking sales and refusing title by deed in lieu

The fact that both banks tendered the super-priority amount is supported by the RRFS/SCA disclosures, and it is a strong reason well briefed by Ackerman for protecting the DOT, so we have to show that because BANA and Nationstar were provably engaged in mortgage fraud, they were complicit in preventing the estate from paying the assessments by BANA’s refusing to close two escrows out of which the HUD-1s show the assessments would have been paid, and by Nationstar’s refusing to close two escrows from bona fide CASH purchasers at market value and not responding to the

$375,000 offer i signed on 8/1/14.

HOA OPPC to bank MSJ

John Leach was SCA’s attorney until 2017 when Clarkson took over. His OPPC shows the same attitude SCA has showed to me.

![]()

![]() The HOA doesn’t belong in the case. RRFS did everything right

The HOA doesn’t belong in the case. RRFS did everything right

![]()

![]() The fight is rightly just between the bank and purchaser in possession The owner is just a loser, not the HOA’s problem

The fight is rightly just between the bank and purchaser in possession The owner is just a loser, not the HOA’s problem

The SCA Board violated its duty to the homeowners by abdicating to self-serving agents

Here’s where our case has to differentiate itself. We have to hold the HOA Board accountable for letting the debt collector/manager/attorney use the HOA power to foreclose to screw the HOA and ALL the owners. Doing collections and foreclosures in secret keeps the chance of compliance low, keeps neighbors from helping a neighbor in trouble, or an out of state executor that doesn’t get proper notice from knowing what to do. Not publishing that a house is going to be foreclosed to the owners prevents any owner from bidding.

The Board can’t wash its hands. It’s wrong for them to blindly listen only to RRFS without having to listen to the owner. FSR/RRFS set the owner up to get the property into foreclosure for way more ways to make money than just charging usurious fees.

Undisputed facts about how SCA Board did as they were told (by debt collector) but it was wrong

The volunteer Directors have been tricked by self-serving agents into doing what the agents say they HAVE TO DO.

In this case, the Board was handling collections and foreclosures such that it made money for the agents, but were actually against the law or SCA governing docs: Here is a link to emails where the former Board President told me how the Board handled foreclosures in 2014 – all in closed BOD meetings under RRFS control.

- Give complete control over collections to the manager/debt collector of accounting with no checks and balances or any need to ever hear from the owner affected.

- Keep everything strictly confidential and

- trust that the manager and debt collector are doing it right

- Allow the manager to report after an account was sent to collections and never check what fees were charged or what the circumstances might be, like the owner died and it was in escrow

- assume that since the debt collector said they gave a notice and no owner ever filed an appeal, that everything is fine

- Make all decisions in executive session without specifying the name of the party or the proposed sanction

- Do not publish the quarterly delinquency report required by the bylaws even though that’s how delinquent taxes are publicly reported

- Adopt a fee schedule but do not give it to the homeowner who is subjected to them and don’t audit anything that RRFS charges to see if it’s right

- Listen only to the debt collector and never tell the owner when decisions are being made to sanction them

- Do not put specifically on the agenda or give the owner any requested minutes from BOD meetings in executive session where actions about the owner were decided:

- when the debt collector said that the owner requested a waiver of $459 and the owner was not permitted to be present why the debt collector said that the BOD could only waive assessments, late fees and interest, but could not waive the collection fees

- when a pay plan was offered, considered or rejected

- when it decided to post the property for sale, or

- when the BOD was asked to postpone or cancel the sale, or

- was told what the date of the sale was to be, or

- was told that the foreclosure occurred · the BOD discussed the owner’s delinquency and possible sanctions,

- when the BOD was told of the possible alternatives to aggressive collections, such as a deed in lieu, wait to collect out of escrow without charging or unnecessary collection charges, small claims, accept the bank’s tender of the super-priority and restart the clock on what the owner owes,

- Adopt a policy and procedure that defines how the governing documents will be enforced providing specific due process steps, but carve out an exception for predatory collections and foreclosure, the harshest of all penalties, and do that in secret, don’t tell the owner that you did it, make any appeal without litigation impossible and then treat the owner like a criminal if she tries to get the stolen house back.

Legal theory for the Board’s authority and why it can’t be delegated or agents be unsupervised.

- The Association exists to protect the owners’ common good.

- The Association is not the Board; it is the membership at large.

- The Board has the sole power to act.

- Agents can advise, not direct.

- Board’s fiduciary duty is act solely and exclusively for the association’s, i.e., all owners’ benefit. The Board owes no duty to its agents.

- The agents have no rights, only duties, to the Association, i.e., agents have fiduciary duty to protect the due process rights of the owners.

Our case is unique in arguing violations of due process guaranteed by NRS 116.31031 and NRS 116.31085, SCA CC&Rs 7.4.

This is not the way the agents act and it’s not the way they have trained the Board to act, but it’s the way the law and the governing documents say it is.

- The BOD has authority to maintain the common areas and other services funded by assessments.

- The Board has the authority to determine the amount of the assessments needed to cover the maintenance and protection of the common areas.

- The HOA is a mutual benefit, non-profit entity which exists solely for the purpose of maintaining the property values and quality of life in the community.

- The directors, attorneys and managing agents are all fiduciaries by law and they must act in good faith in a manner which is solely and exclusively in the best interest of the association and use good business judgment.

- The Board has the sole responsibility for adopting an annual budget to fund maintaining the common areas and programs and activities to support the community life.

- SCA bylaws 3.18a,b,e,f,g,i /3.20 prohibit the Board from delegating and abdicating control over any of SCA’s money: budgeting, levying and collecting assessments, setting up the bank accounts where the money collected goes, controlling the signatories, setting up the use rules and restrictions and enforcing them

- The Board is the sole authority on the enforcement of the governing documents.

- While managing agents and attorneys can advise and implement, the Board alone is the decider.

- NRS 116 and NRS 116A (for managing agents) has provisions which specifically define the authority and limits constraining the Board before it can sanction owners for alleged violations

- See the Table of Authorities.