Nona Tobin’s, Red Rock’s & Nationstar’s prayers for relief

Red Rock’s prayer for relief Nationstar’s prayer for relief Nona Tobin’s 3/8/21 prayer for relief vs. Red Rock & Nationstar This counterclaim has been necessitated

Owners should ALWAYS come first!

Red Rock’s prayer for relief Nationstar’s prayer for relief Nona Tobin’s 3/8/21 prayer for relief vs. Red Rock & Nationstar This counterclaim has been necessitated

3/15/21 Request for judicial notice of the Clark County APN 191-13-811-052 official property records 4/4/21 Request for judicial notice of unadjudicated administrative complaints and civil

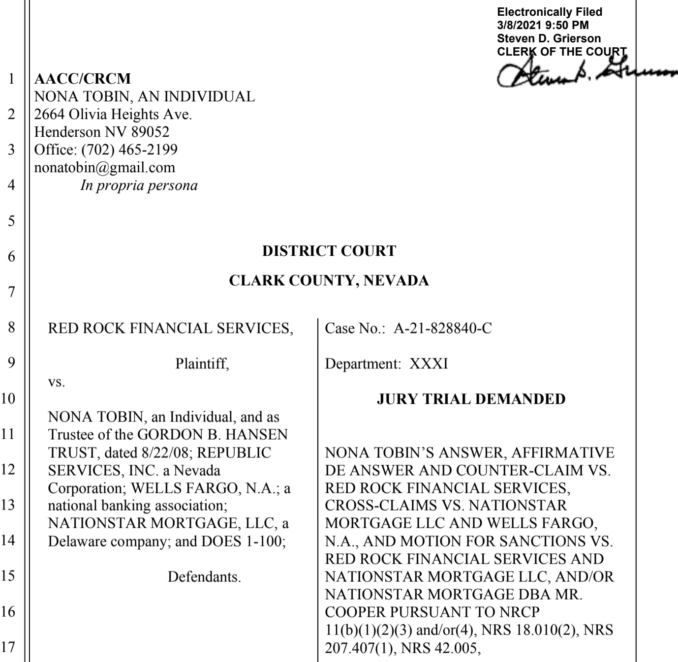

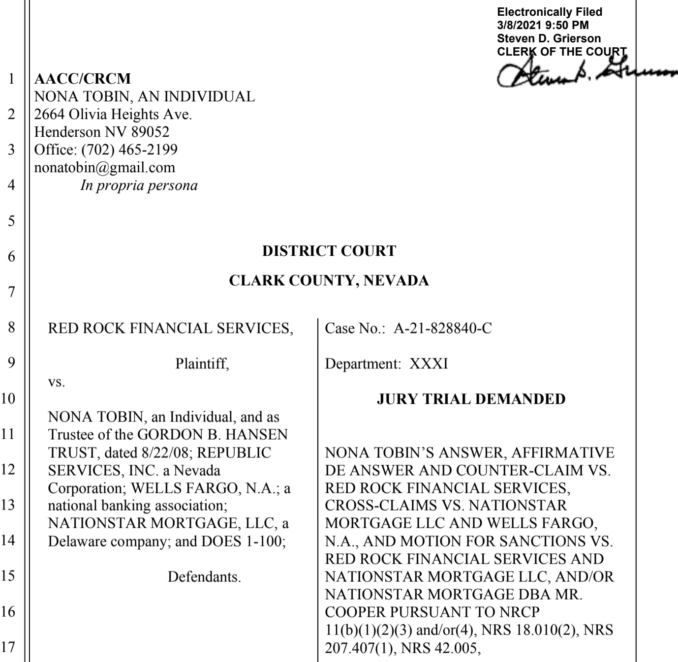

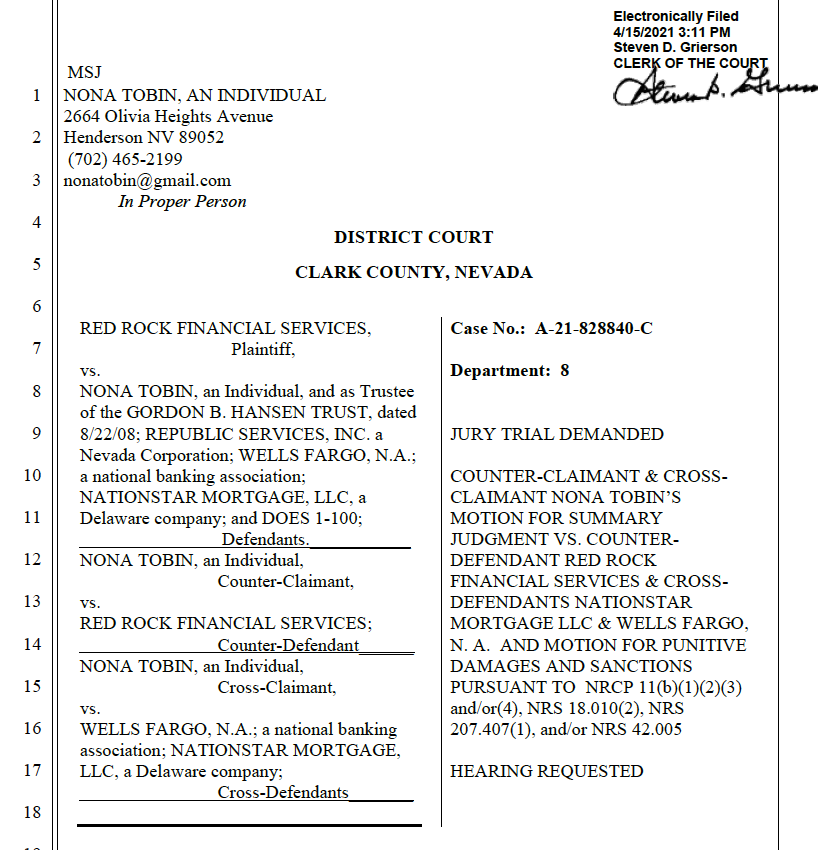

On 3/8/21, Nona Tobin filed an answer, affirmative defenses and counter-claims vs. Red Rock, and cross-claims against Nationstar and Wells Fargo. Link to NONA TOBIN’S ANSWER,

On 3/8/21, Nona Tobin filed an answer, affirmative defenses and counter-claims vs. Red Rock, and cross-claims against nationstar and wells Fargo. Link to NONA TOBIN’S

On 3/8/21 Nona Tobin filed an answer and counter-claim when Red Rock sued her over the money they stole from her in 2014. This blog

On 2/16/21, Red Rock Financial Services served a notice on Nona Tobin that Red Rock was suing her over the money Red Rock stole from

Links to PDFs of case file 2/16/21 summons Tobin served Red Rock interpleader complaint 2/17/21 AOS affidavit of service 3/8/21 Tobin AACC vs. Red Rock,

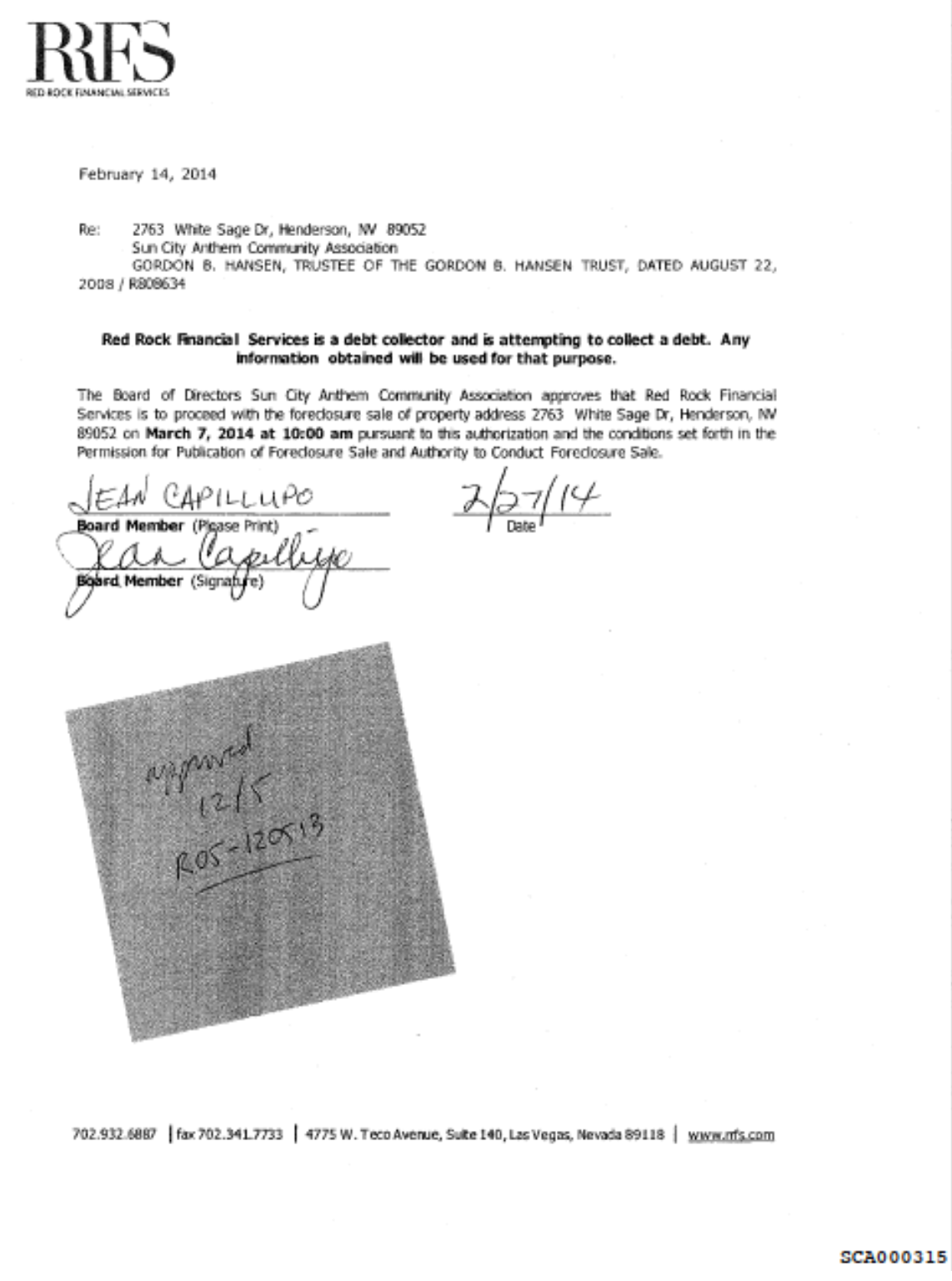

Sun City Anthem misrepresented the record Link to bookmarked SCA 176-643 Red Rock Foreclosure File disclosed by Sun City Anthem in 2018. SCA misrepresented the

EXCESSIVE, UNAUTHORIZED & UNEARNED “COLLECTION COSTS” = ABUSIVE & PREDATORY COLLECTION PRACTICES 12/31/11 Balance due Dec 31, 2011 was zero. See annotated Resident Transaction Report

12/5/13 Executive Session Agenda 12/5/13 Executive Session – Items related to the Board enforcing the governing documents “6. ACCOUNT REQUESTS, APPEALS & HEARINGS (Action May