Cause of Action: RICO Damages pursuant to NRS 207.470 Racketeering

The elements of a civil claim for damages caused by racketeering are: 1. Defendants, and each of them, engaged in conduct which constitutes a pattern

Owners should ALWAYS come first!

The elements of a civil claim for damages caused by racketeering are: 1. Defendants, and each of them, engaged in conduct which constitutes a pattern

The Elements of fraud apply to all the defendants being named in case A-21-828840-C that were opposing counsels to Nona Tobin in Nevada district court

The Elements of Abuse of Process apply to all defendants in all related cases Interpleader complaint was an abuse of process because Defendant Steven Scow

Link to all Nevada Revised Statutes TITLE 2 — CIVIL PRACTICE Chapter 10 General Provisions Chapter 11 Limitation of Actions Chapter 12 Parties Chapter 13

I, Nona Tobin under penalty of perjury, states as follows: I have personal knowledge of the facts stated herein, except for those facts stated to

I, Nona Tobin, under penalty of perjury, state as follows: I have personal knowledge of the facts stated herein, except for those facts stated to be

Link to 2020 court hearings Part 1 Link to 2/16/21 online complaint receipt to the Nevada Bar vs. Brittany Wood Link to Complaint OBC21-0187 vs.

What is the dispute with Nationstar? The dispute is over a $436,000 Western Thrift & Loan Deed of Trust (DOT) executed by Gordon Hansen on

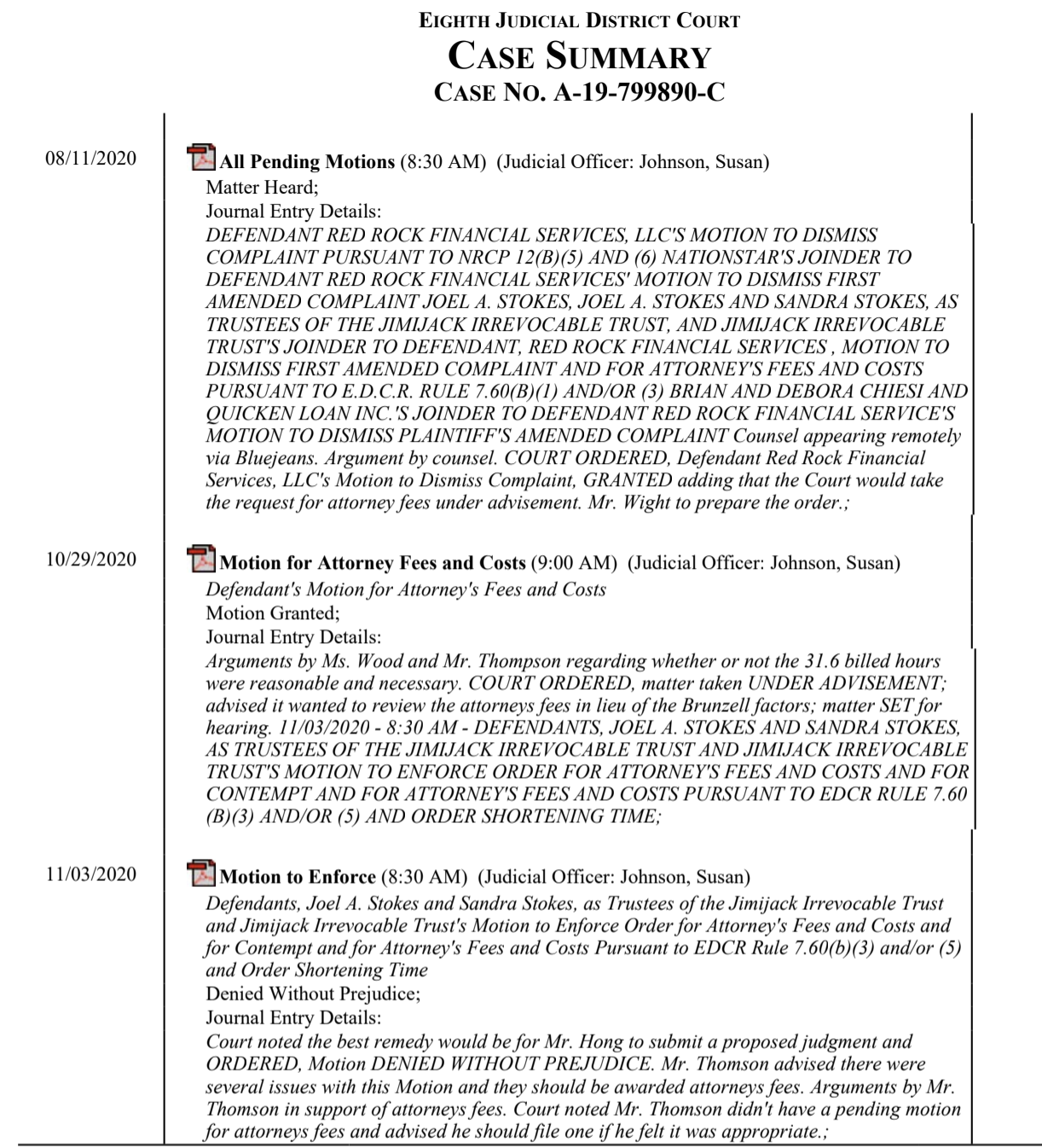

August 11, 2020 hearing before Judge Susan Johnson 12/3/20 NODP notice of dismissal with prejudice 12/3/20 order is being appealed in NV Supreme court case

2/3/21 Red Rock Financial Services Interpleader Complaint electronically issued without notice to defendants Case was assigned to Judge Kishner Dept 31 Judge Kishner immediately recused