Complaint vs. Brittany Wood

Link to 2020 court hearings Part 1 Link to 2/16/21 online complaint receipt to the Nevada Bar vs. Brittany Wood Link to Complaint OBC21-0187 vs.

Owners should ALWAYS come first!

Link to 2020 court hearings Part 1 Link to 2/16/21 online complaint receipt to the Nevada Bar vs. Brittany Wood Link to Complaint OBC21-0187 vs.

September 29, 2016 hearing Judge Kishner Nona Tobin & Steve Hansen 7/29/16 motion to intervene into A-16-730078-C 7/29/16 Tobin/Hansen MINV link to PDF 8/30/16 OPPM

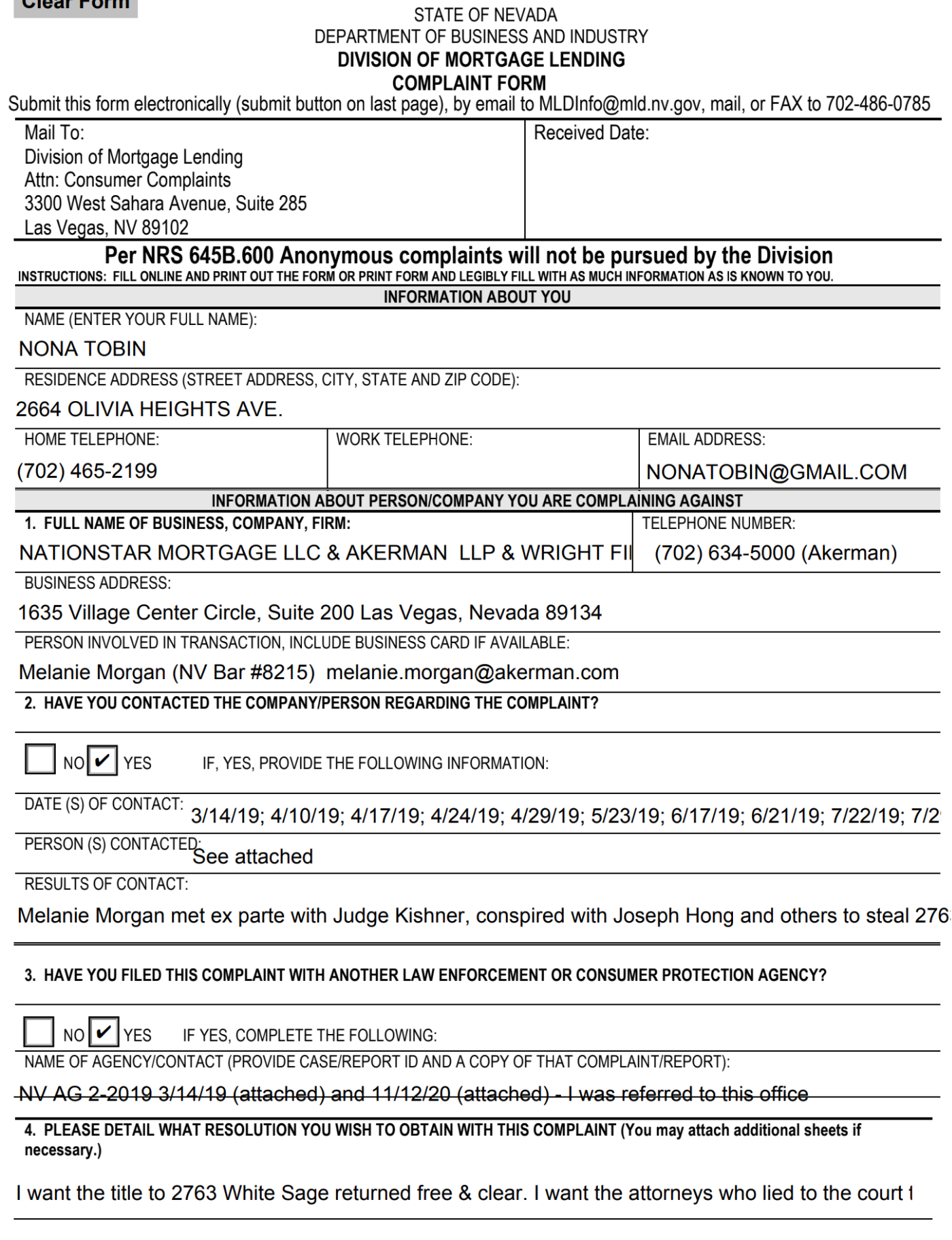

Links to Exhibits to 3/14/19 complaint to the NV Attorney General 2011 Certified fraud examiner Amicus curiae MA Supreme Court 7/15/2004 Western Thrift Deed of

Table of Contents of Exhibits

Immediate rejection without consideration NV Bar Receipts of online complaints 2/14/21 complaint vs. Joseph Hong (Reference OBC21-0181) 2/16/21 complaint vs. Brittany Wood (Reference OBC21-0187) “WHY

1. Lied to the court 2. Sued the wrong party 3. Met the judge ex parte 4/23/19 HEARING AFTER JUDGE KISHNER CALLED MELANIE MORGAN TO

3/4/21 Rejection of 2/14/21 complaint follows the State Bar’s pattern of refusing to investigate any member whose dues are paid 2/14/21 Complaint vs. Joseph Hong