How to handle or screw up the most challenging HOA issues

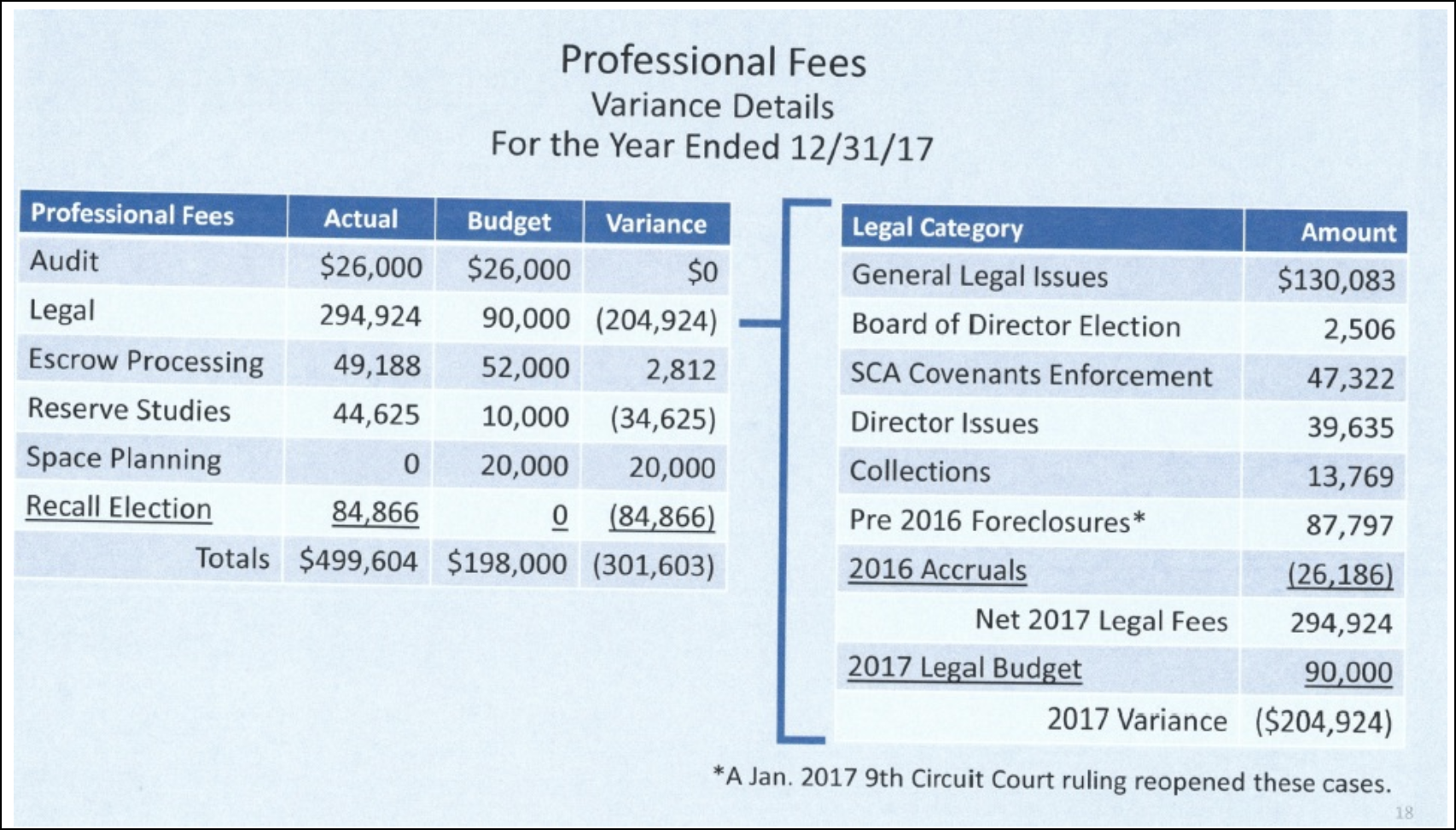

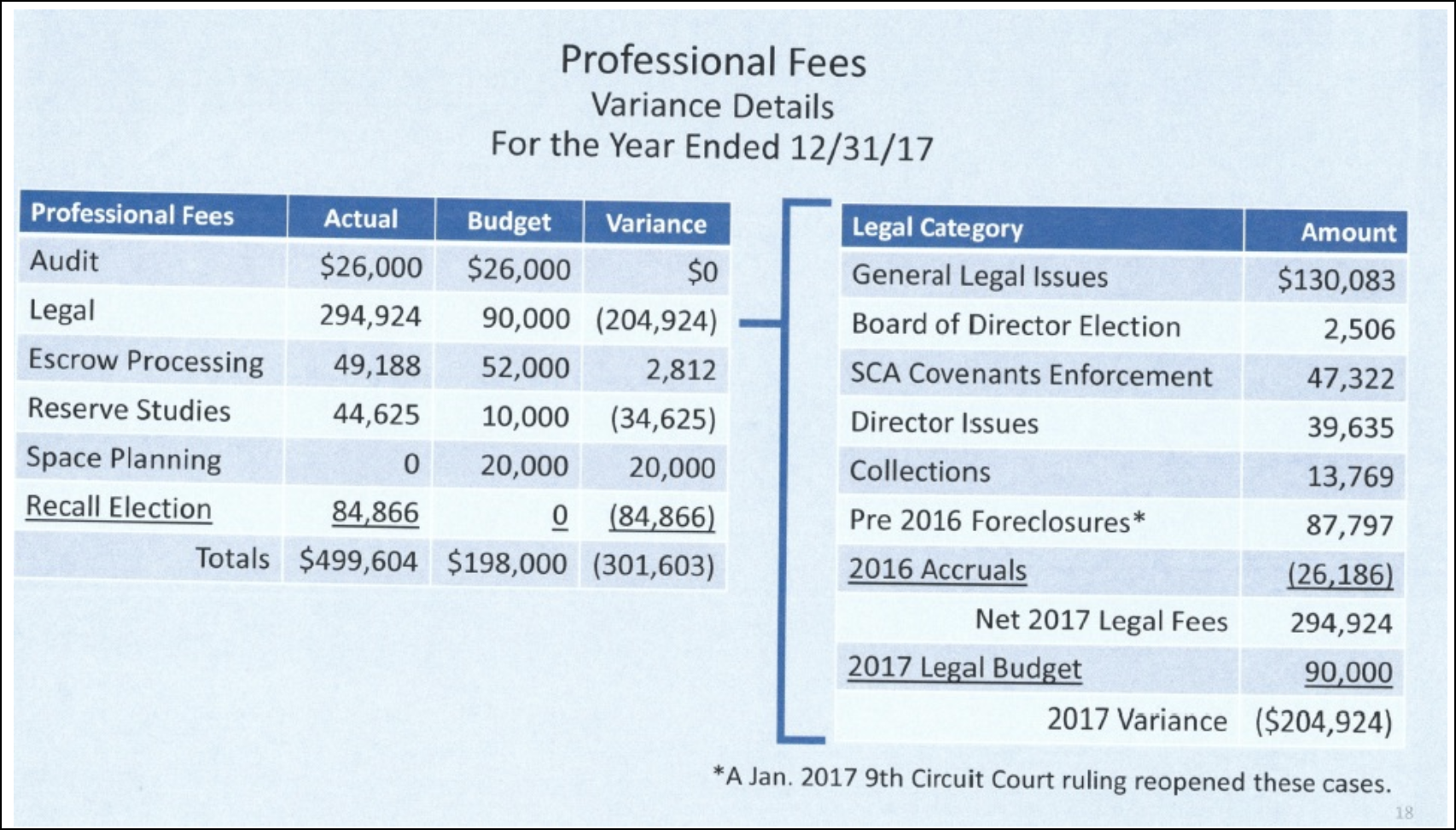

Attorney fees for 2017 Clarkson letters to me =$39,635 of $204,924 Clarkson billed over the 2017 $90K budgeted for legal services

Owners should ALWAYS come first!

Attorney fees for 2017 Clarkson letters to me =$39,635 of $204,924 Clarkson billed over the 2017 $90K budgeted for legal services

A big part of managing a homeowners association is dealing with HOA complaints. Homeowners tend to be very vocal about their concerns with the community and their neighbors, so it is unsurprising for an HOA board to be bombarded with them. A competent board, though, knows exactly how to handle complaints when they come their way.

Every community should have an HOA dispute resolution process in place. A dispute resolution process allows board members to professionally settle arguments in the community without needing to resort to litigation.

Frequently Asked Questions on Mediation and Dispute Resolution What is mediation, and why is it beneficial for resolving disputes? Mediation is a voluntary alternative dispute

by Mike Kosor, USAF Col Ret A single lobby, the Nevada chapter of the Community Associations Institute (CAI), is again hard at work this 83rd

The Nevada Electronic Legislative Information System (NELIS), is a useful tool during the legislative session. Here you can track bills and resolutions, find legislator contact

Legal fees have exploded since we went to self management. The primary causes of these costs are, if not avoidable, at least should be subjected

Link to Clark County Court to see any linked documents regarding this case. https://www.clarkcountycourts.us/Anonymous/CaseDetail.aspx?CaseID=12104285 On the site you must Click – District Civil/Criminal Records Then

1/11/16 Nationstar started by filing to quiet title vs. the wrong buyer. Opportunity Homes LLC was disinterested. Two others had recorded deeds on 6/9/15 1/11/16

Multiple Nevada Rules of Professional Conduct were allegedly violated by the acts Nationstar allegedly used amenable attorneys to violate multiple Nevada laws in pursuit of