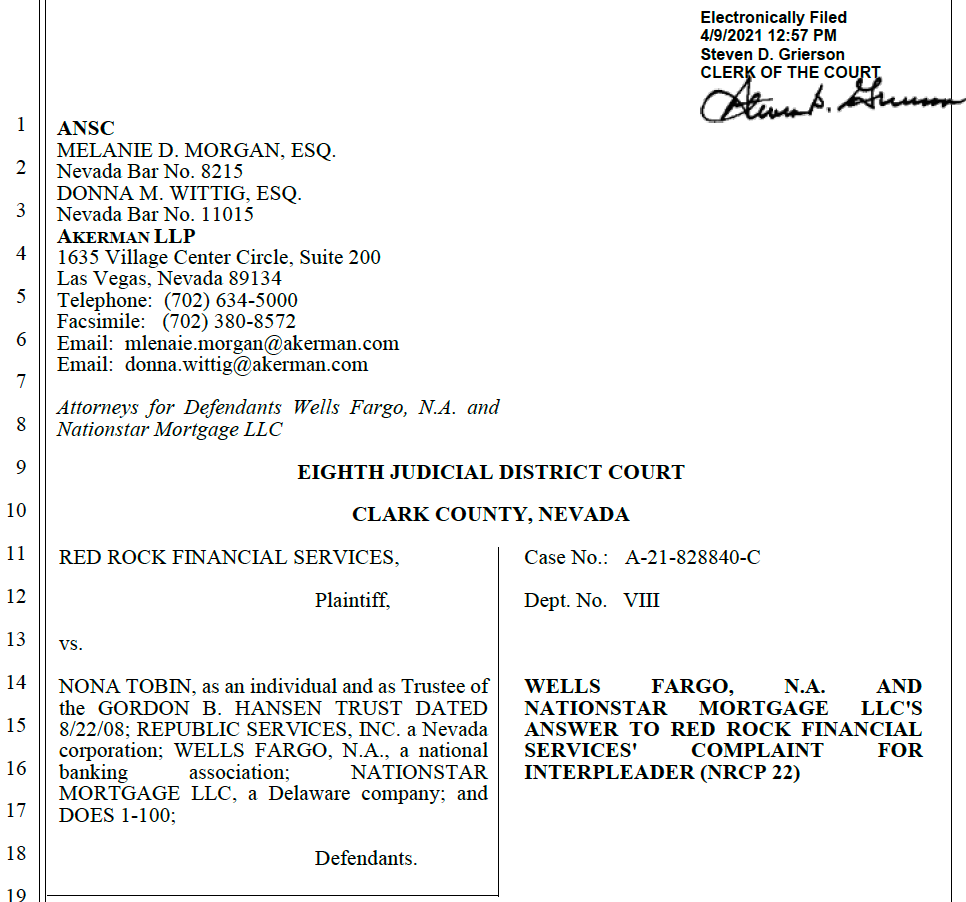

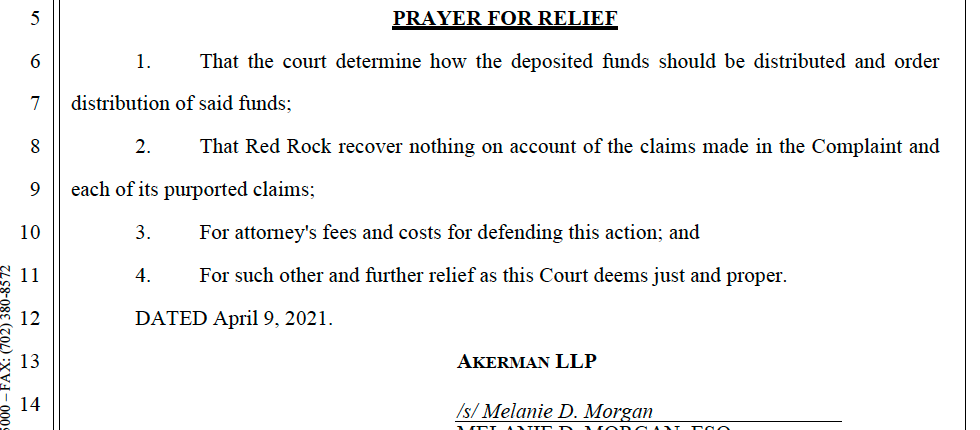

The facts of this case, considered within the context of the Nevada case law articulated below in the www.casetext.com AI-assisted legal research memo, show the A-21-828840-C case, was filed for an improper purpose.

The research memo lists three main ways of assessing if an interpleader action was filed in bad faith:

- delay in filing the action

- the stakeholder is not disinterested

- the filer knew, or should have known, the defendants don’t have valid competing claims

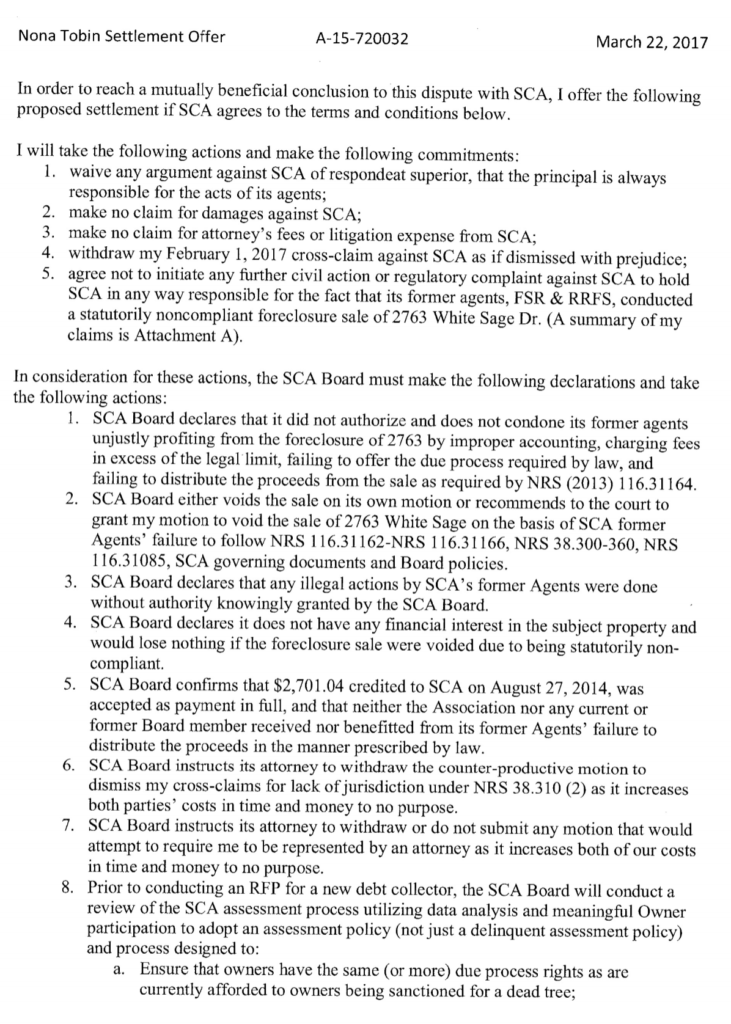

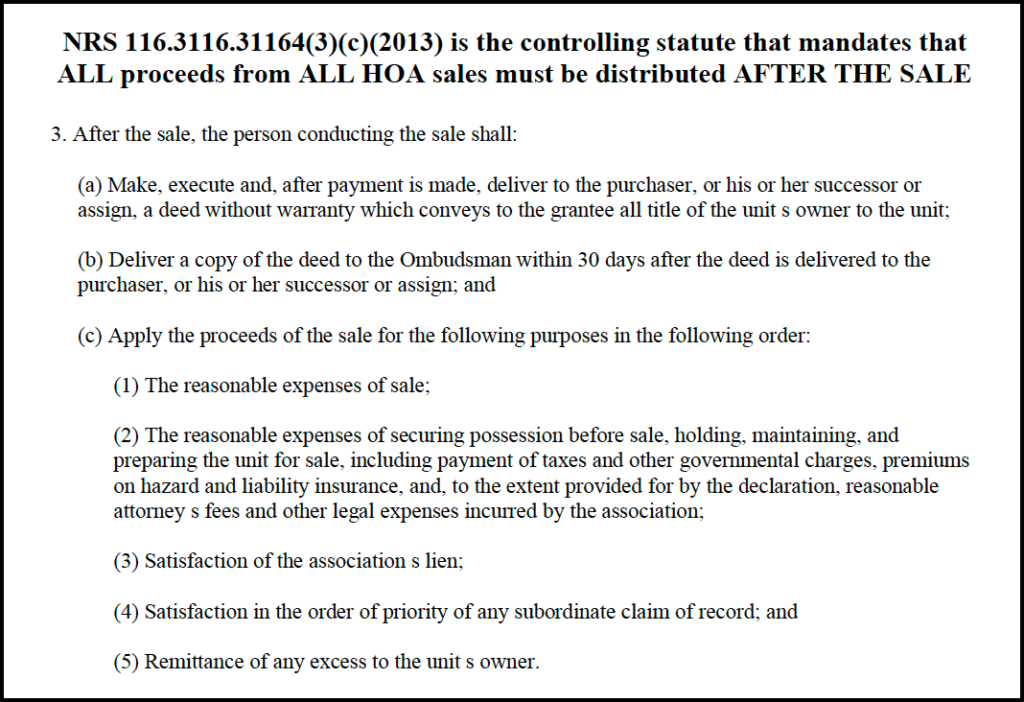

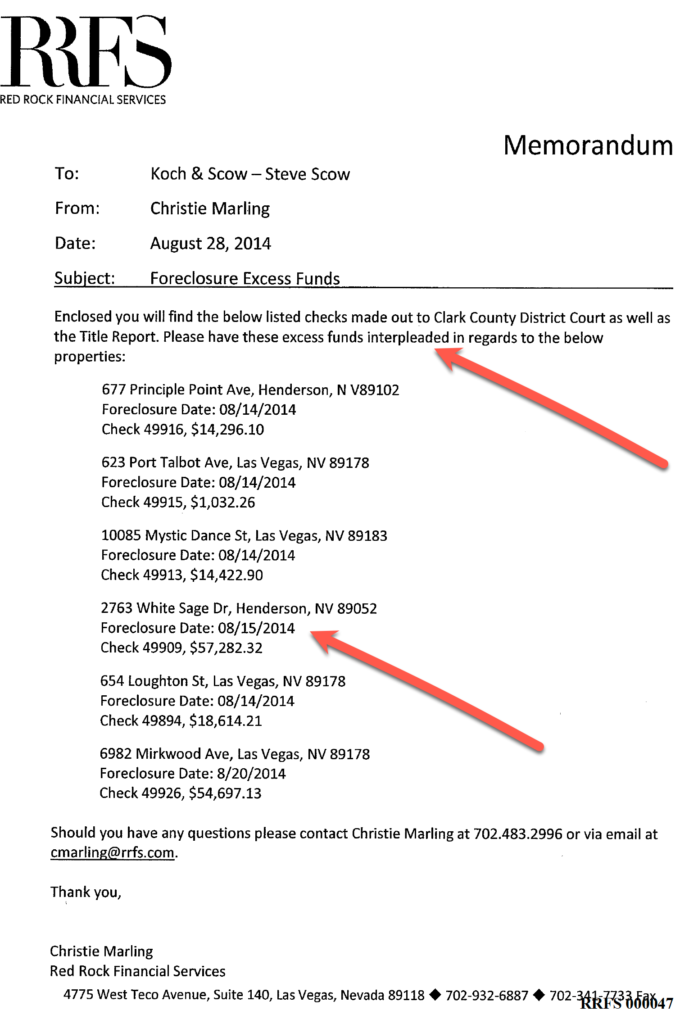

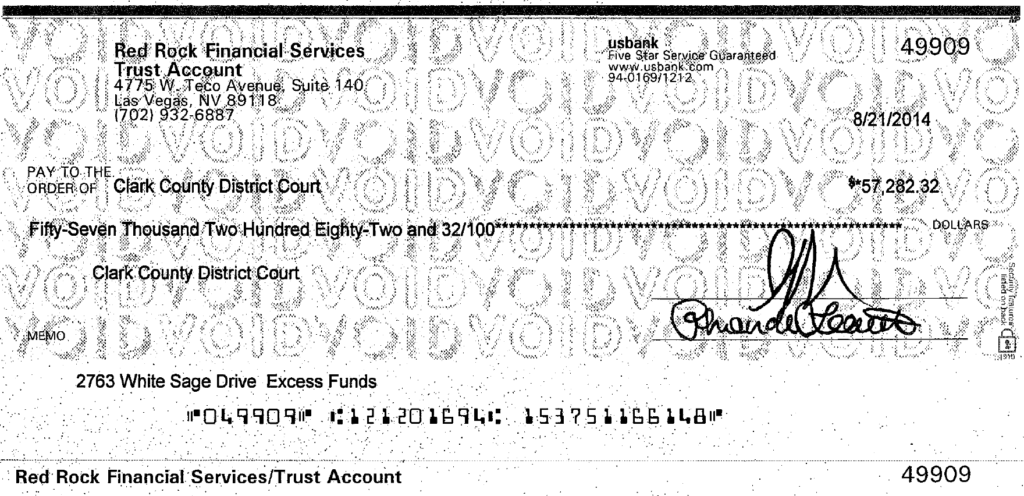

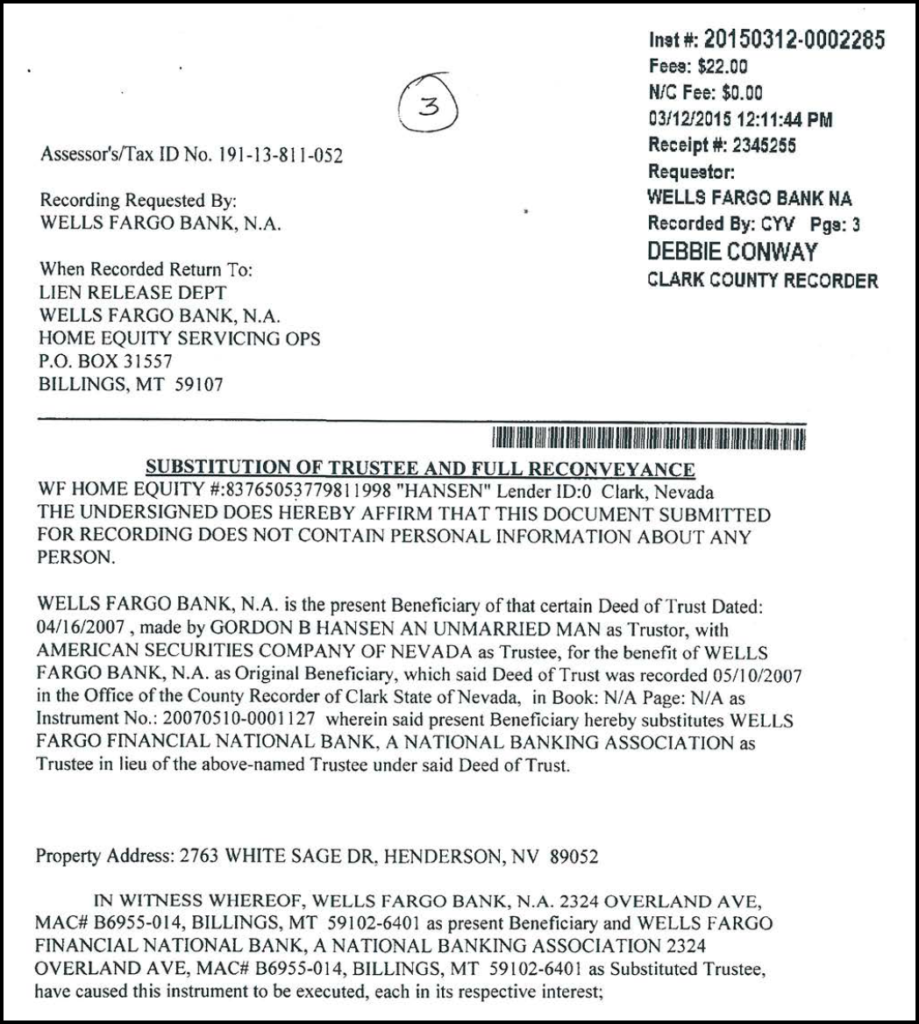

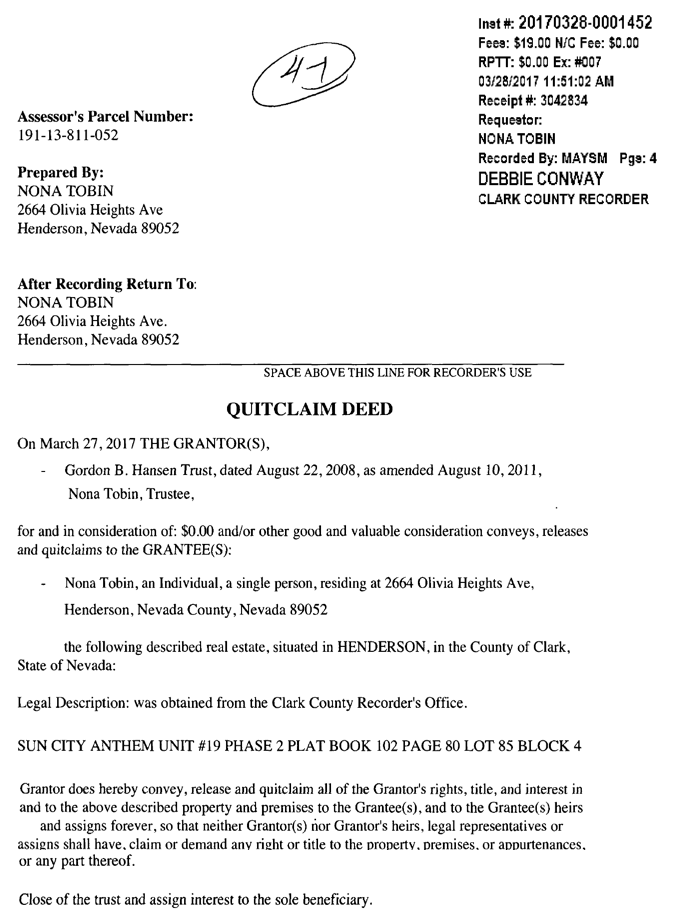

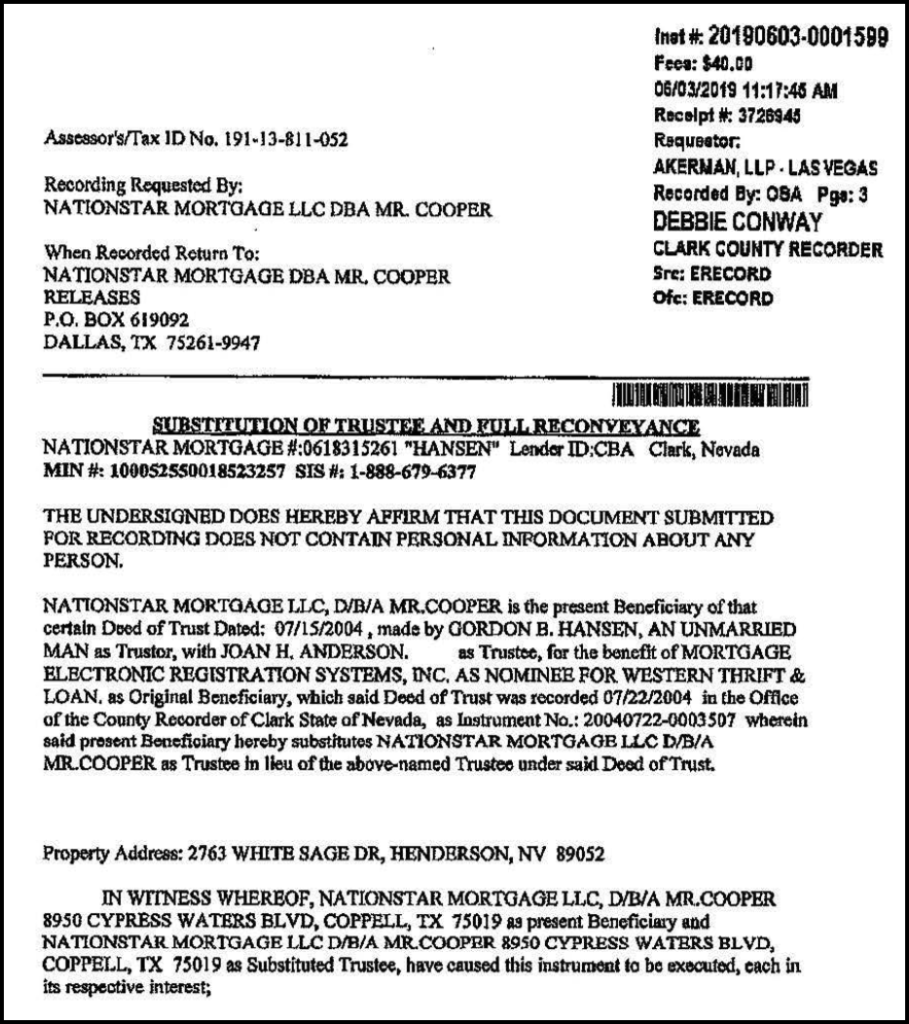

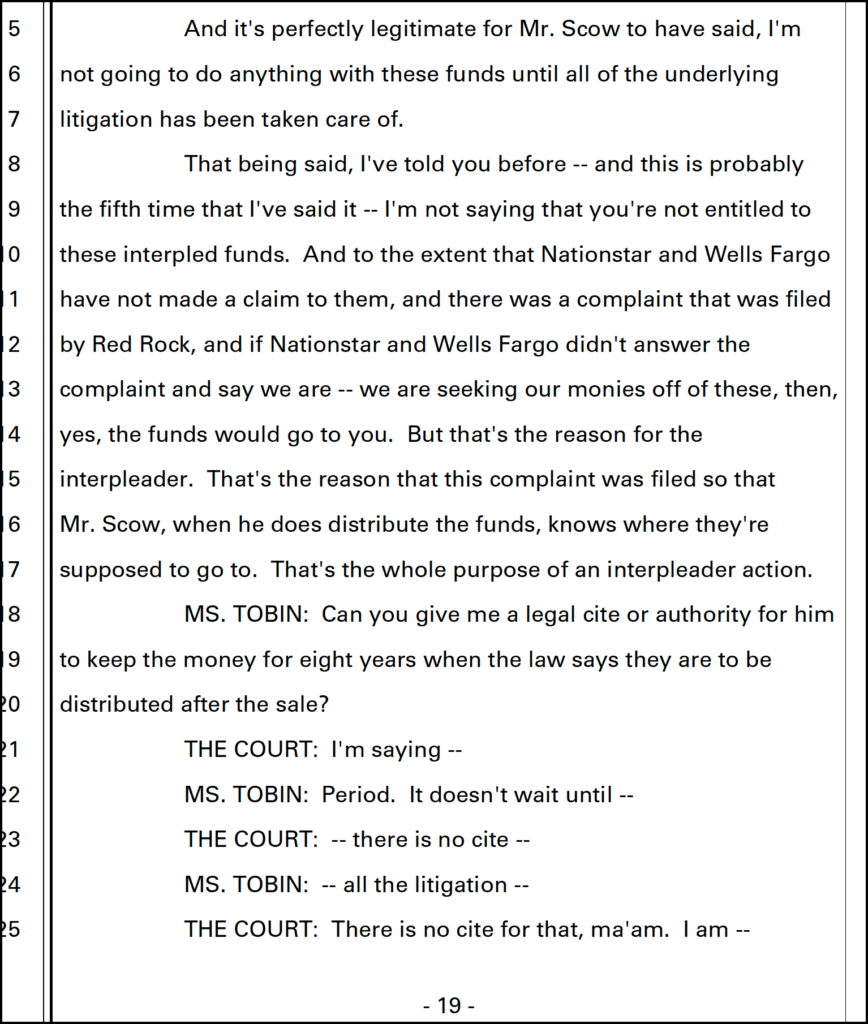

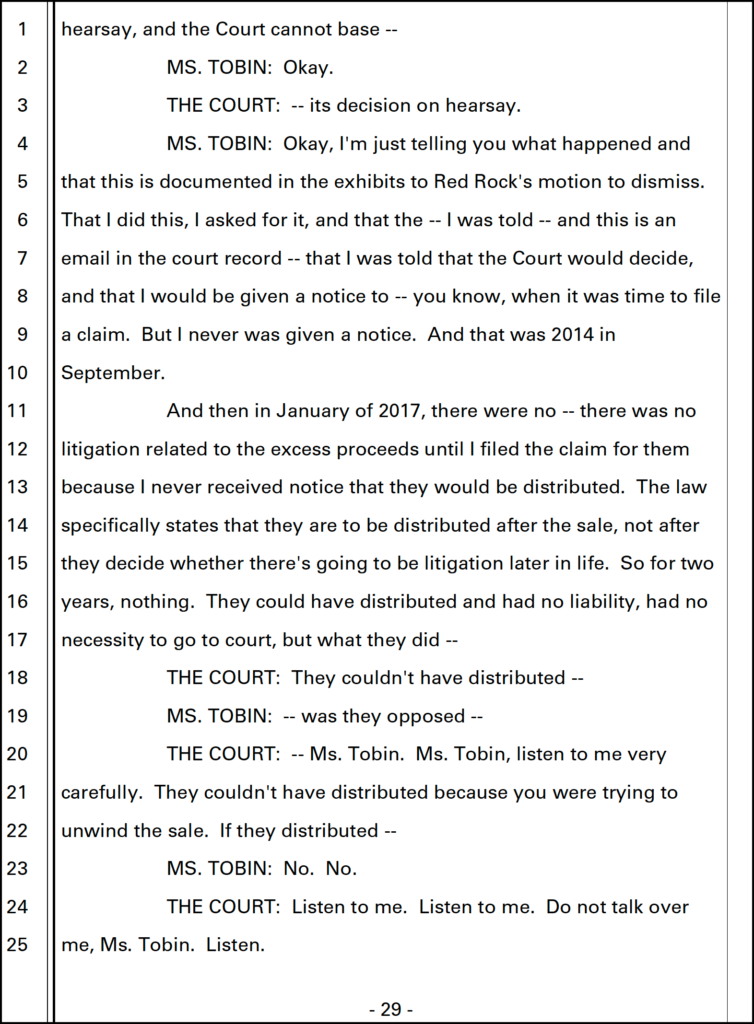

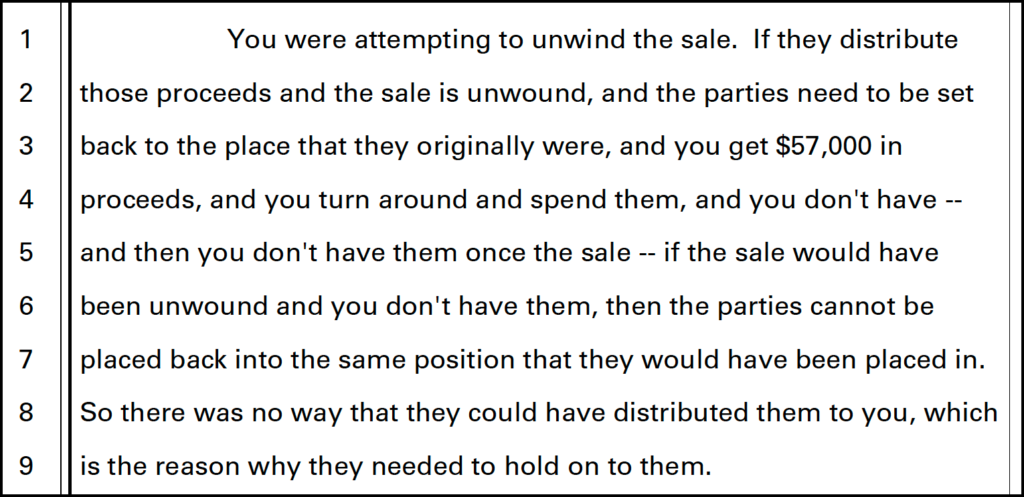

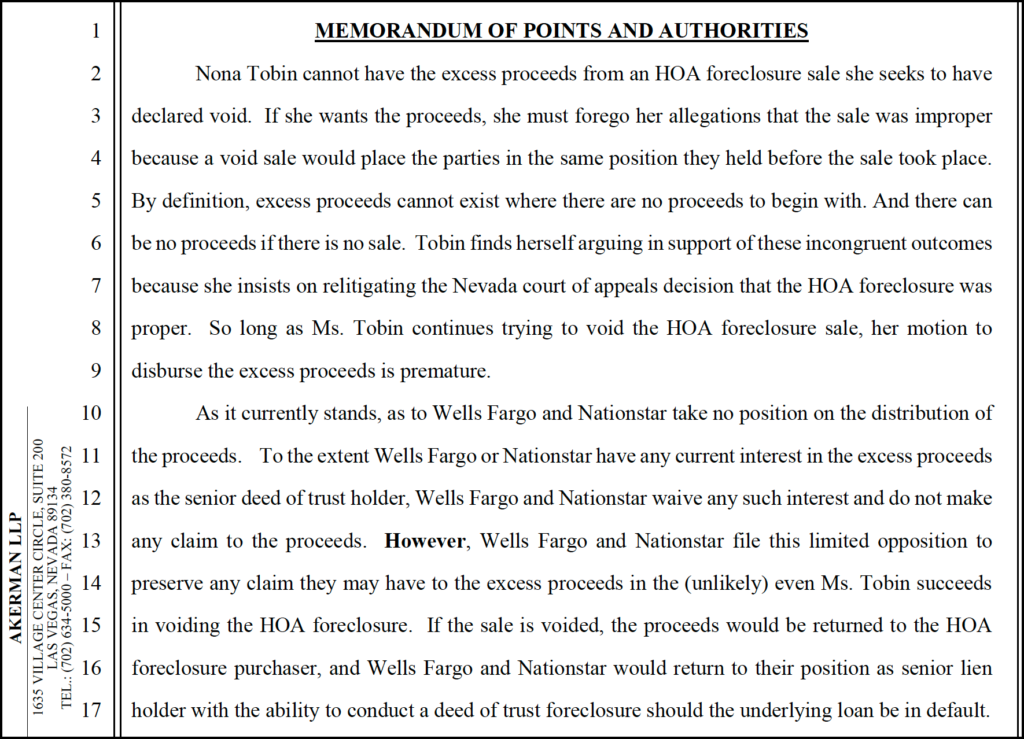

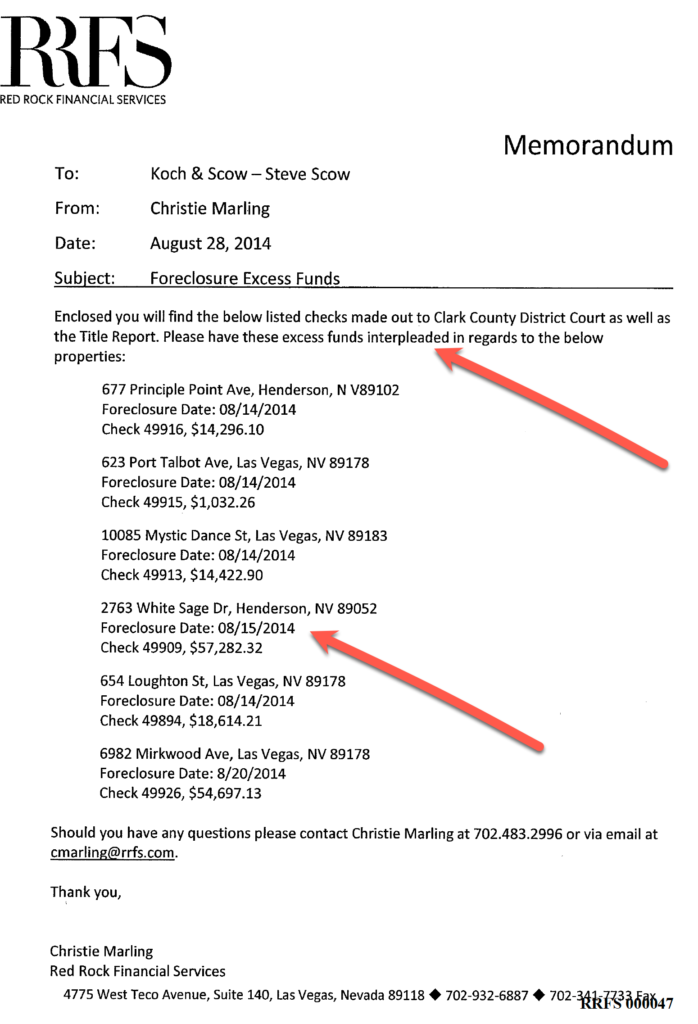

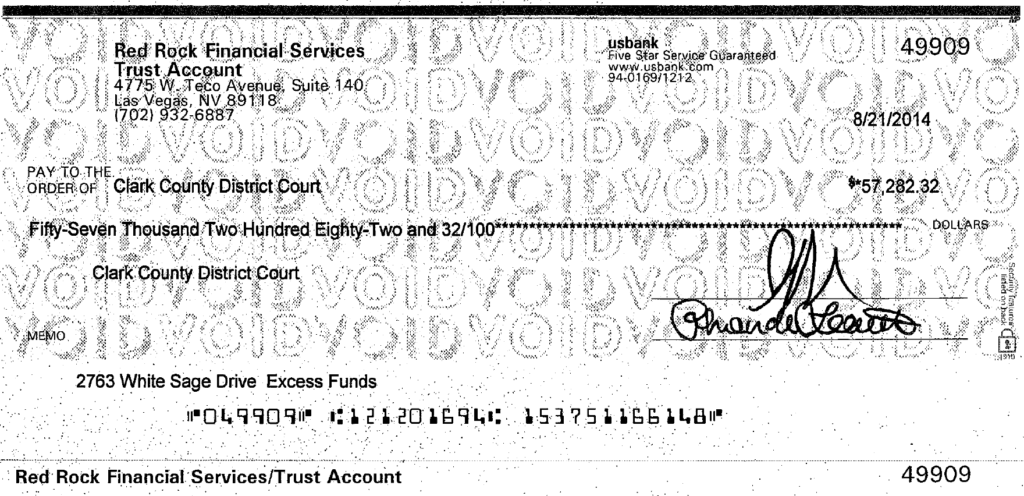

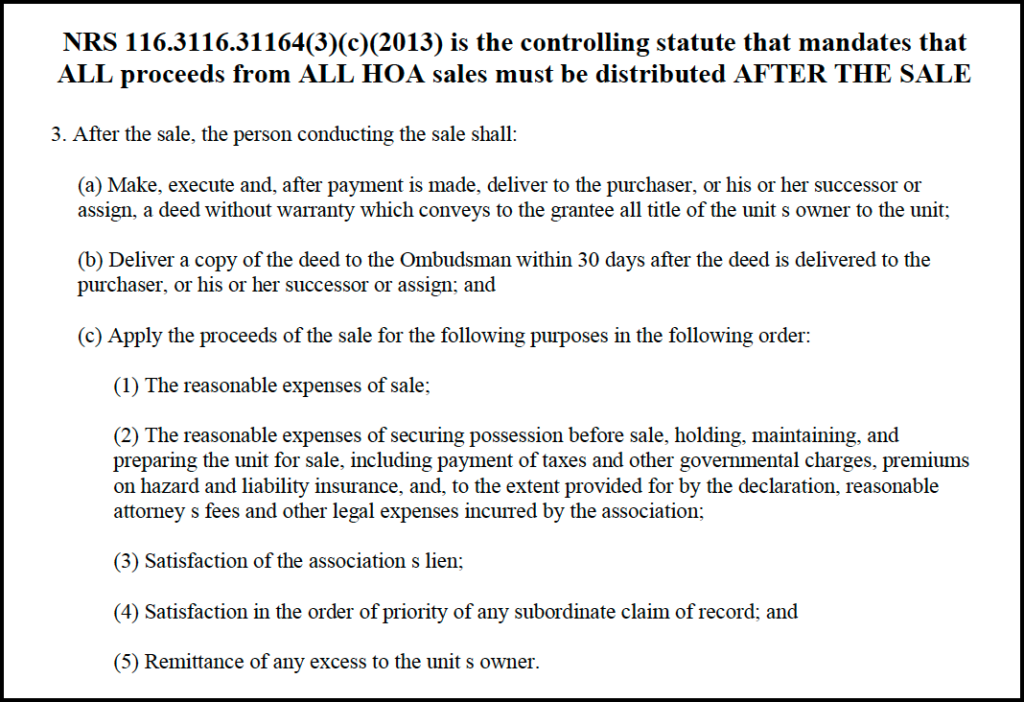

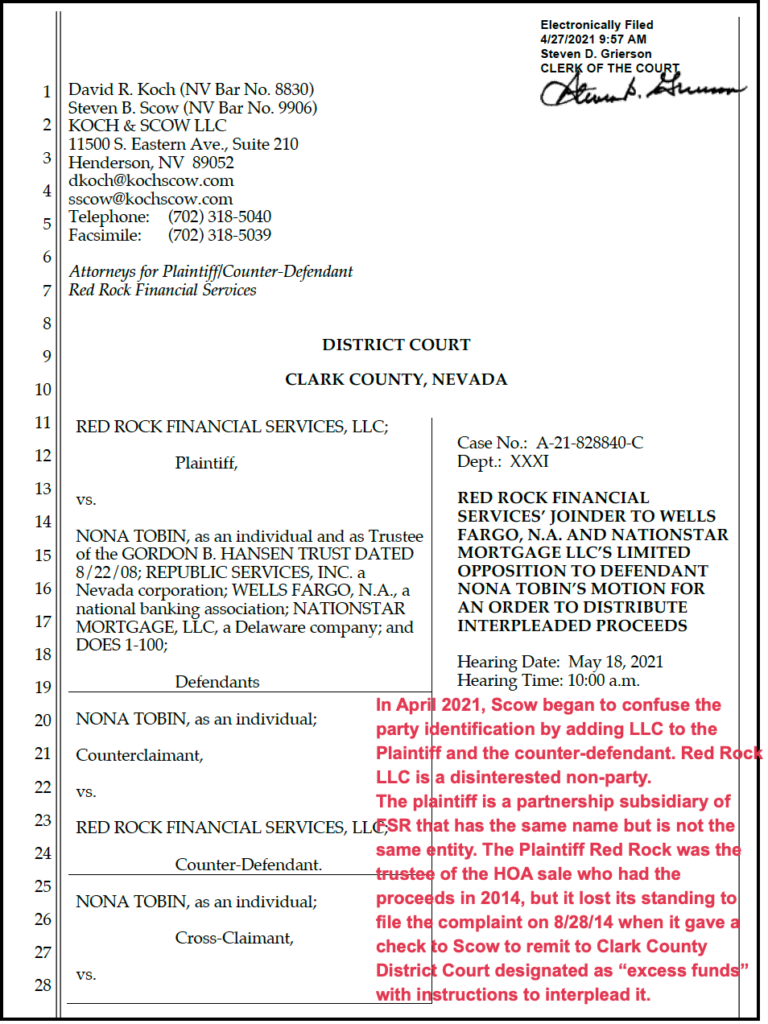

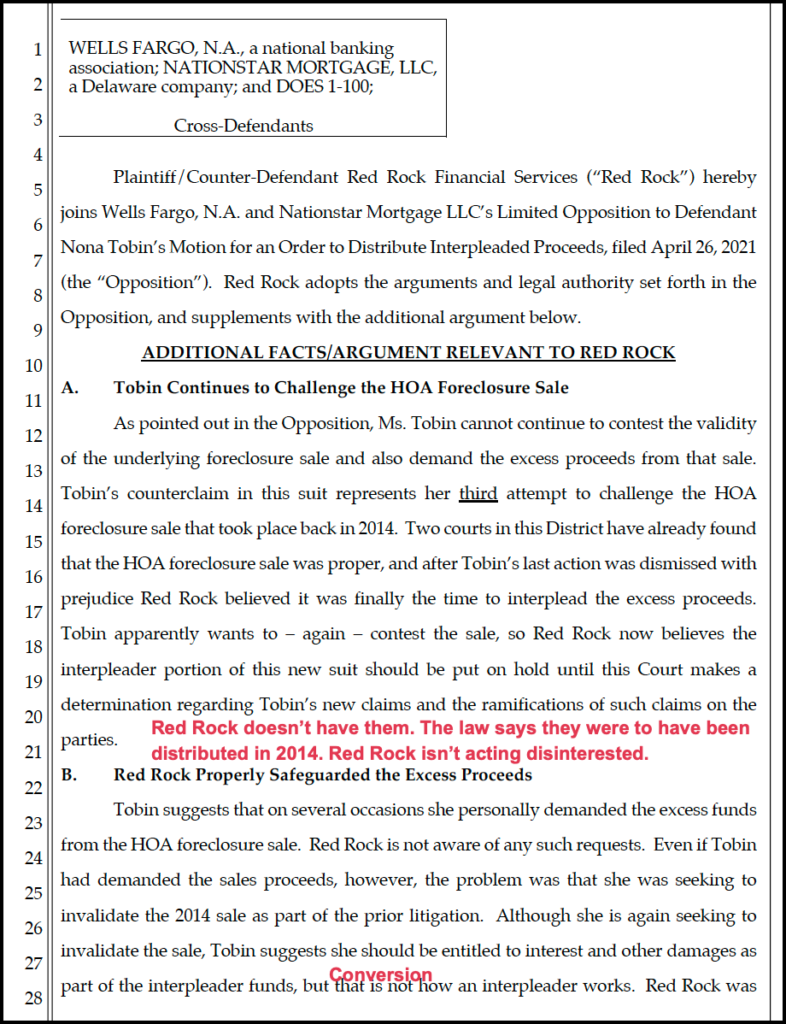

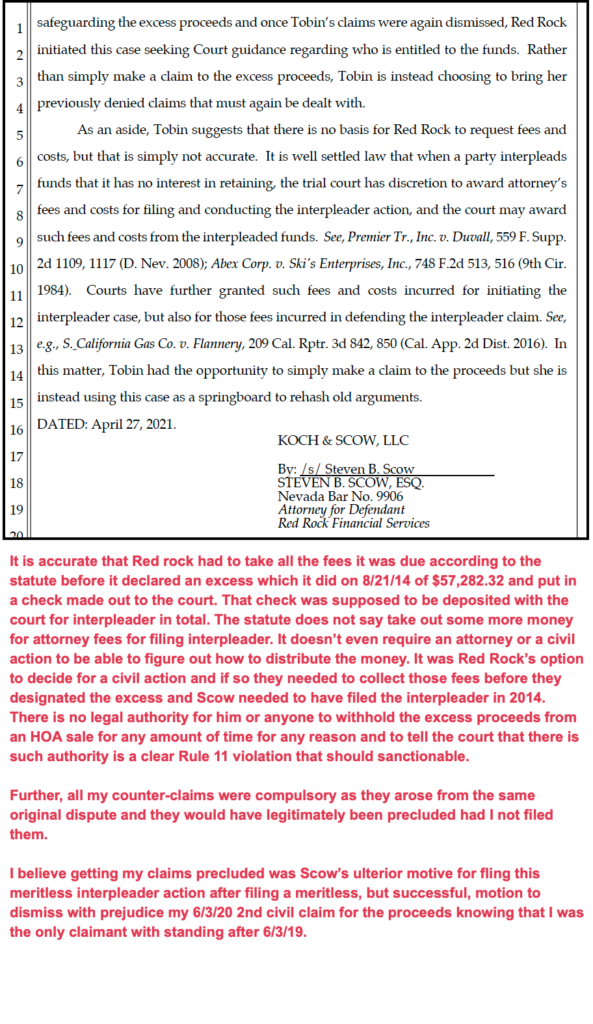

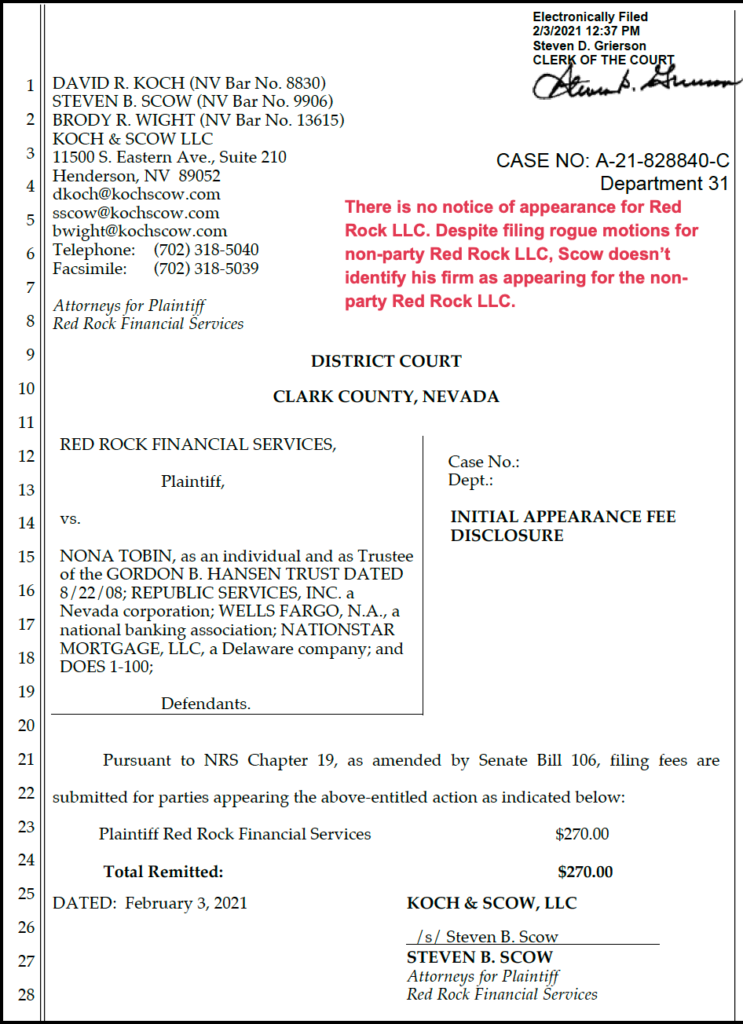

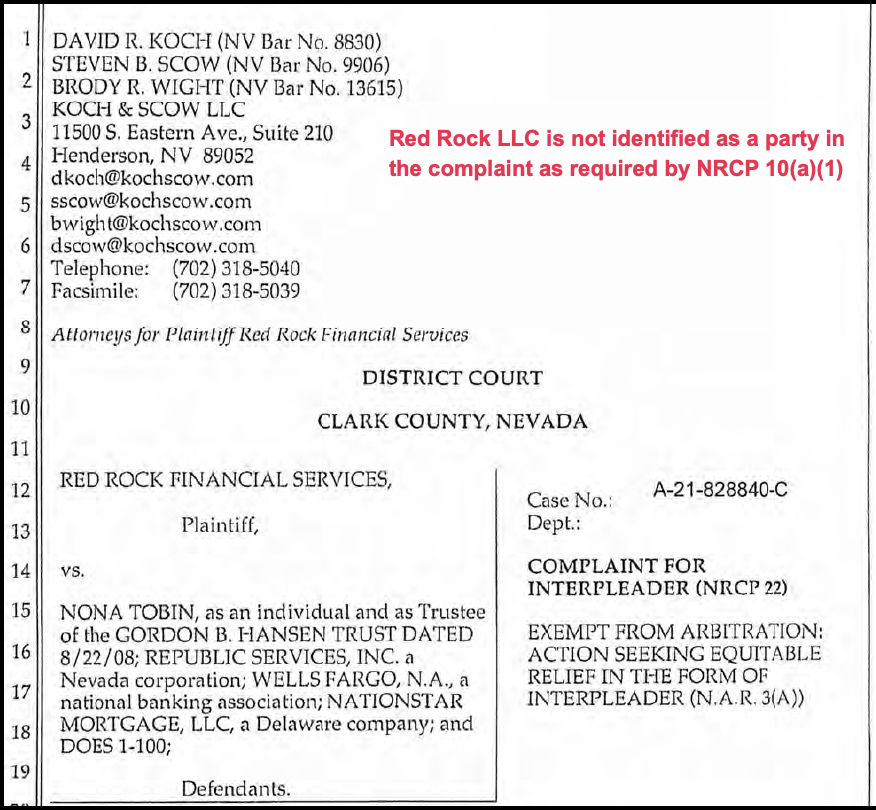

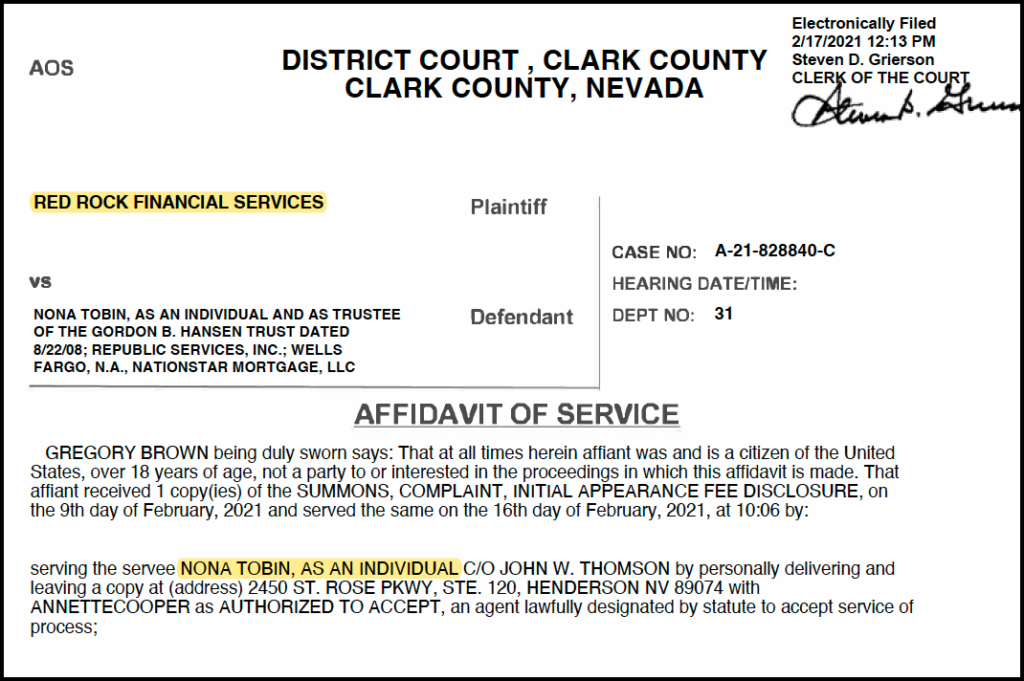

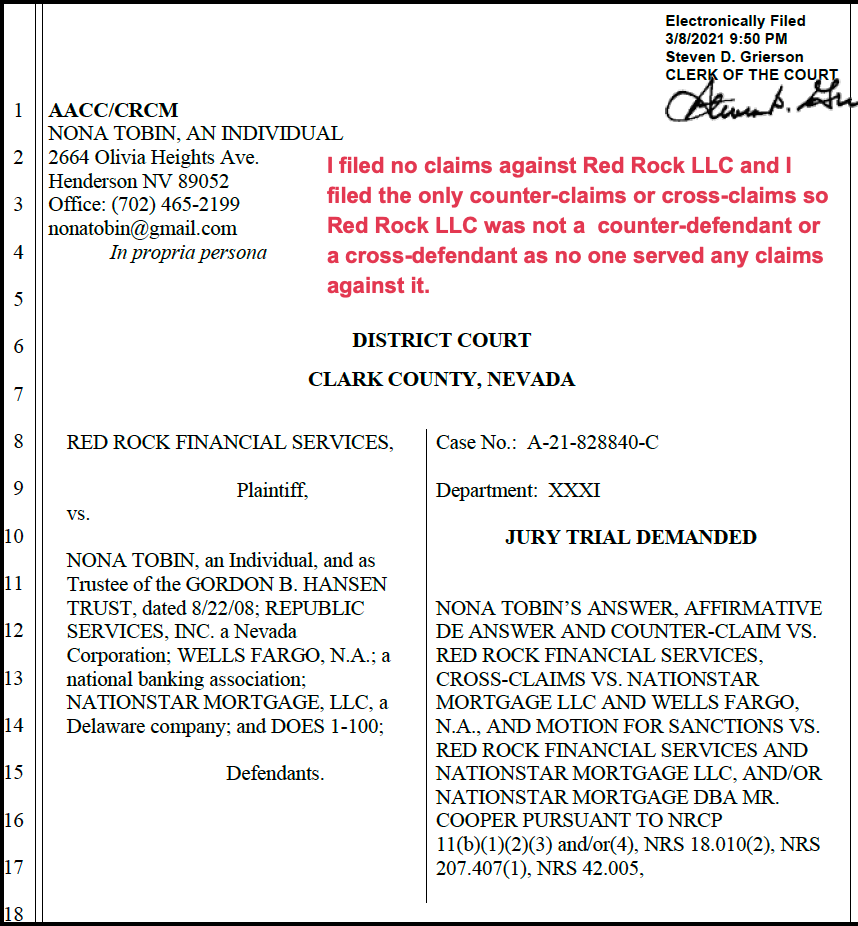

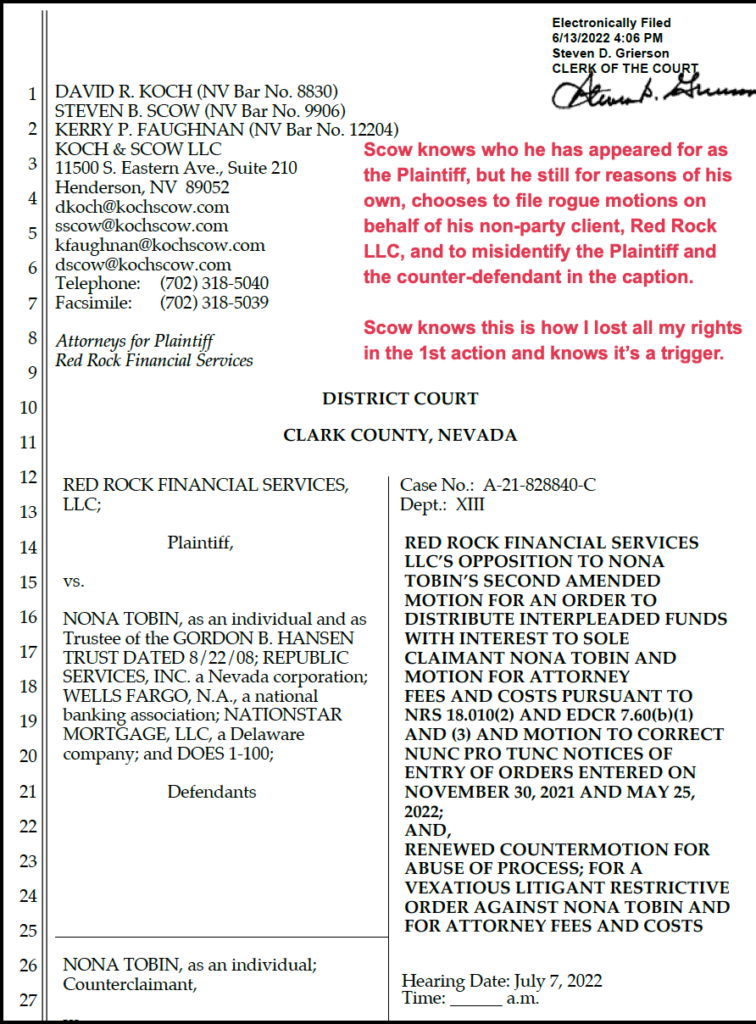

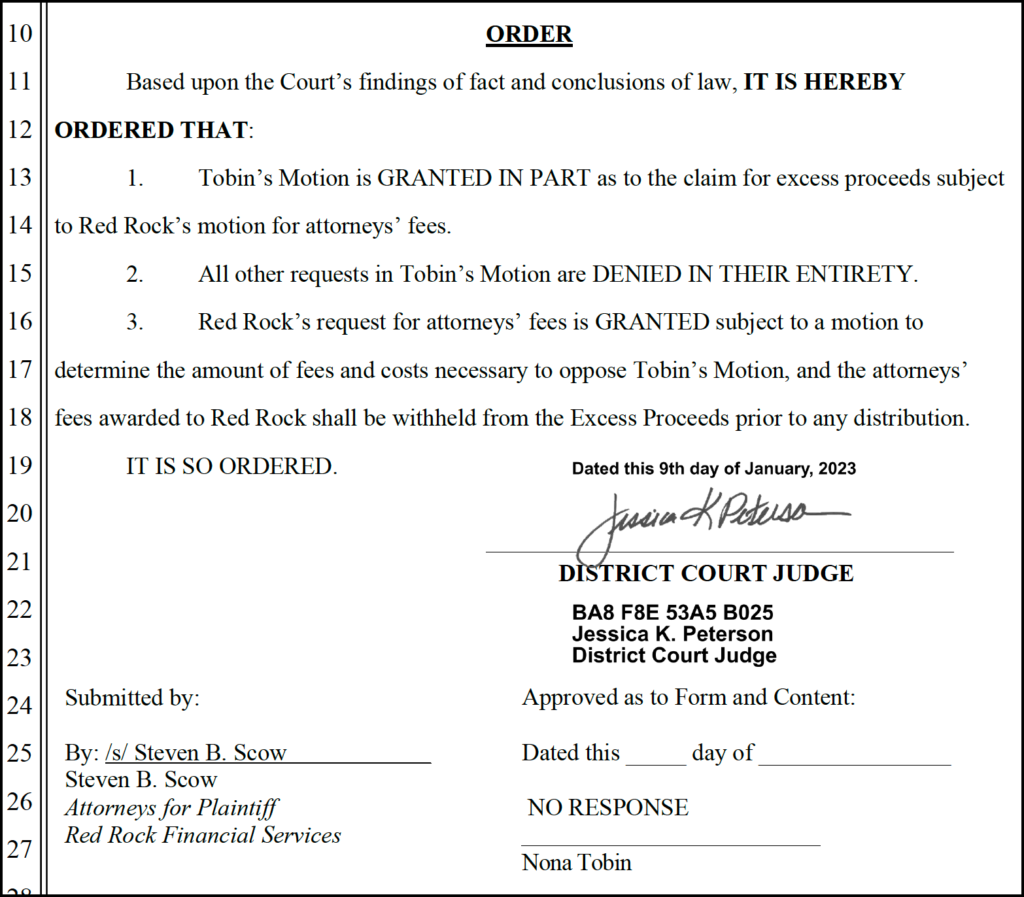

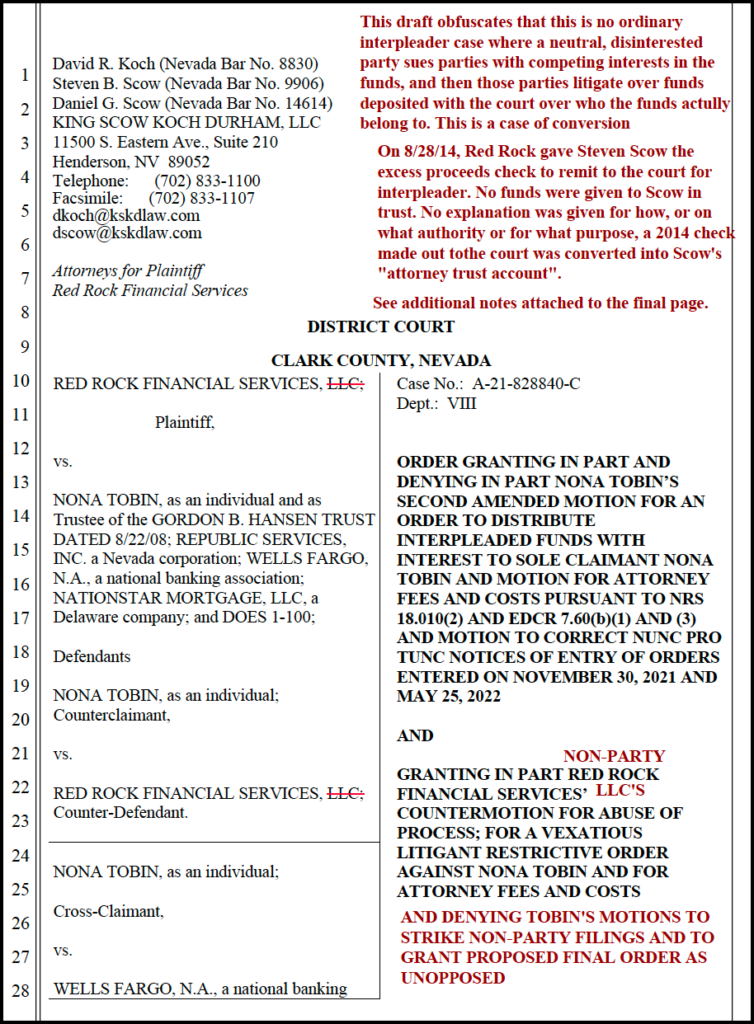

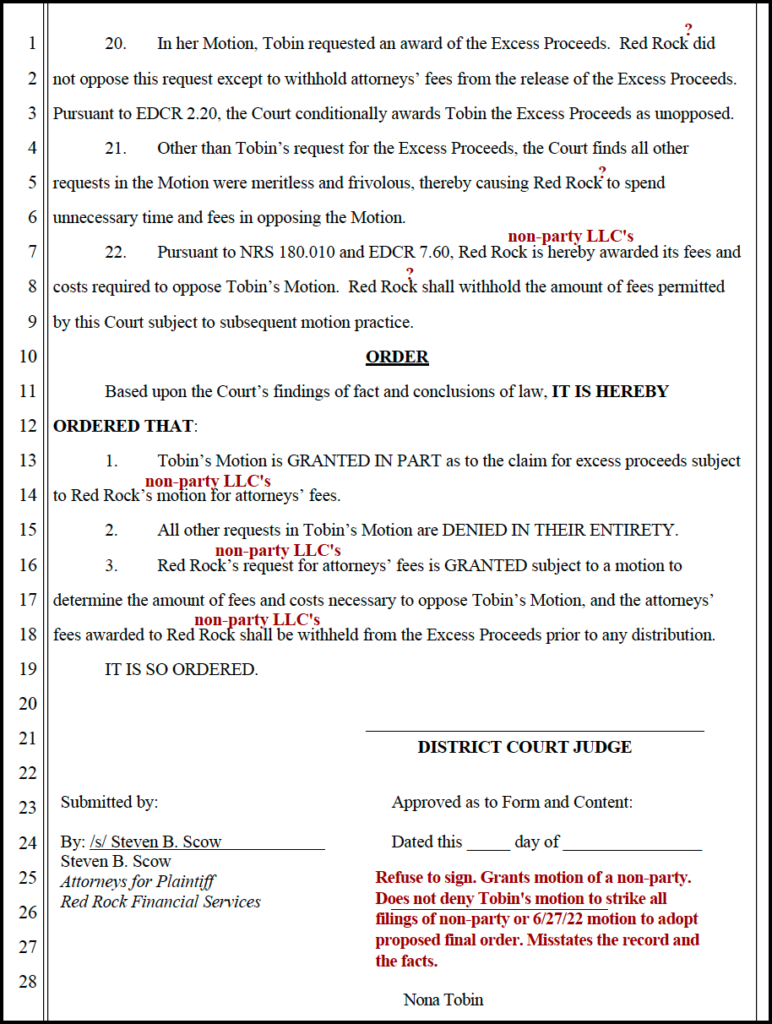

- the Plaintiff Red Rock partnership subsidiary of firstService Residential, Nevada LLC did not have standing as it had instructed its attorney, Steven Scow to file the action on 8/28/14 and had given him a check to Clark County district Court to deposit $57,282.32 designated as “excess funds 2763 White Sage” for interpleader

- the filer attorney Steven Scow was not disinterested as he concealed from the court that he had disobeyed his client Red Rock’s instructions to deposit $57,282.32 with the court on 8/28/14 and Scow concealed that Red Rock had taken all fees it was legally permitted pursuant to NRS 116.31164(3)(c )(1)(2)(2013) prior to the 8/21/14 date the check was made out to the court designated as “excess”

- the filer attorney Steven Scow, who may be one of the unidentified Red Rock partners, converted the funds to an account under his personal proprietary control rather than distribute them to the rightful owner six years earlier as required by law and as he had been instructed by his client

- the filer attorney Steven Scow knew there was only one defendant that had a valid recorded claim to the interpleaded proceeds after June 3, 2019, and the research memo lists filing an action when you know that there are no competing claims is an indicator of bad faith

Casetext.com Legal Research Memo

Question Presented

What would constitute direct evidence that an interpleader action was filed in bad faith?

Answer

There are a number of potential indicators of bad faith in filing an interpleader action, including: delay in filing the action, filing an action that does not meet the requirements for interpleader, acting in bad faith to create the controversy necessitating the interpleader, or lacking a good faith belief that there are competing claims to the stake.

Analysis

One potential indicator of bad faith in filing an interpleader action is delay in filing the action. As the court in Pruco Life Ins. Co. v. Killingsworth noted, a stakeholder’s delay in filing an interpleader action may show bad faith, even if the action is ultimately filed correctly. Additionally, as the court in Principal Life Ins. Co. v. Calloway discussed, an interpleader action must meet certain requirements in order to be proper, and a filing that does not meet these requirements could be evidence of bad faith.

Another potential indicator of bad faith is if the stakeholder acted in bad faith to create the controversy necessitating the interpleader. As the court in Raymond James & Assocs. v. Bassford noted, the stakeholder must have a “good faith belief” that there are competing claims to the stake in order to file an interpleader action, and the absence of such a belief could be evidence of bad faith. Additionally, as the court in Michelman v. Lincoln Nat’l Life Ins. Co. held, the stakeholder must have a good faith belief that there are or may be colorable competing claims to the stake in order to avail itself of the interpleader remedy.

Finally, as the court in Sun Life Assur. Co. v. Sampson discussed, a court may deny an award of fees and costs to a stakeholder in an interpleader action if the stakeholder has acted in bad faith. This could include contributing to the need for interpleader by acting in bad faith or by unduly delaying in seeking relief.

Cases (40)

Pruco Life Ins. Co. v. Killingsworth, CIVIL ACTION NO. 5:19-cv-55-DCB-MTP (S.D. Miss. Nov. 26, 2019)

The case discusses the possibility that a delay in filing an interpleader action may show bad faith, even if the action is ultimately filed correctly.

“A stakeholder’s delay in filing an interpleader action may show bad faith, even where the interpleader action is rightly filed. See Steinberg’s Dept. Store, Inc. v. Hartford Fire Ins. Co., 407 N.E.2d 124 (Ill. Ct. App. 1980).”

“However, an inadequate investigation of a claim or inaction may constitute bad faith. See James v. State Farm Mut. Auto. Ins. Co., 743 F.3d 65 (5th Cir. 2014)(finding evidence that an insurer was inactive or did nothing meaningful to investigate the claim for several months, including the period after the suit was filed, could support a jury finding of bad faith). When a company decides to pursue its equitable remedy in interpleader, it should act with a “reasonable degree of promptness and with reasonable diligence.” John Hancock Mut. Life Ins. Co. v. Doran, 138 F.Supp. 47, 49 (S.D. NY 1958).”

Principal Life Ins. Co. v. Calloway, Case No. 1:19-cv-00147-DAD-SKO (E.D. Cal. Feb. 23, 2021)

The case discusses the requirements for a proper interpleader action, which could be used to argue that a filing that does not meet these requirements was made in bad faith.

“Thus, interpleader is proper. 2. Propriety of Discharge and Dismissal If the court determines that an interpleader is proper, it may discharge the stakeholder from further liability.”

“”A court should readily discharge a disinterested stakeholder from further liability absent a stakeholder’s bad faith in commencing an interpleader action, potential independent liability to a claimant, or failure to satisfy requirements of rule or statutory interpleader.” OM Financial Life Ins. Co. v. Helton, No. 2:09-cv-01989 WBS EFB, 2010 WL 3825655, at *3 (E.D. Cal. Sept. 28, 2010).”

Great Am. Life Ins. Co. v. Hollick, Case No.: 17-cv-1288-AJB-WVG (S.D. Cal. Feb. 5, 2018)

The case discusses the possibility of bad faith in commencing an interpleader action, and provides a standard for determining whether the stakeholder is acting in bad faith.

“OM Financial Life Ins. Co. v. Helton, No. CIV. 2:09-1989 WBS EFB, 2010 WL 3825655, at *3 (E.D. Cal. Sept. 28, 2010) (citations omitted).”

“Auth., 700 F.2d 91, 96 (2d Cir. 1983) (holding that a disinterested stakeholder may be discharged unless the action was brought in bad faith).”

Great Am. Life Ins. Co. v. Brown-Kingston, Case No. 2:18-cv-02783-MCE-KJN (E.D. Cal. May. 13, 2019)

The case discusses the possibility of bad faith in commencing an interpleader action, and provides a citation to an authority that addresses the issue in more detail.

“OM Financial Life Ins. Co. v. Helton, No. 2:09-cv-01989 WBS EFB, 2010 WL 3825655, at *3 (E.D. Cal. Sept. 28, 2010) (citations omitted). GALIC argues it is a disinterested stakeholder who brought this action in good faith, thus should be discharged from liability. See New York Life Ins. Co. v. Connecticut Dev.”

State Auto Prop. & Cas. Ins. Co. v. Burnett, NO. 3:16-CV-73-DMB-JMV (N.D. Miss. Sep. 29, 2017)

The authority discusses the possibility of a court denying or delaying the discharge of a stakeholder in an interpleader action if there are “serious charges that the stakeholder commenced the action in bad faith.”

“A court may nevertheless delay or deny discharge of the stakeholder if there are “serious charges that the stakeholder commenced the action in bad faith.” Underwriters Grp., Inc., 2006 WL 1852254, at *5 (citing Mendez v. Teachers Ins. & Annuity Assoc., 982 F.2d 783, 788 (2nd Cir. 1992)).”

Sun Life Assur. Co. v. Sampson, 556 F.3d 6 (1st Cir. 2009)

The authority discusses the circumstances under which a court may deny an award of fees and costs to a stakeholder in an interpleader action, including when the stakeholder has acted in bad faith.

“The test is not satisfied if the stakeholder has contributed to the need for interpleader by acting in bad faith or by unduly delaying in seeking relief. Id. at 682 (footnotes omitted); see also Septembertide Publ’g, B.V. v. Stein Day, Inc., 884 F.2d 675, 683 (2d Cir. 1989); Ferber Co. v. Ondrick, 310 F.2d 462, 467 (1st Cir. 1962) (recognizing that fees in an inter-pleader action are “usually awarded . . . to compensate a totally disinterested stake-holder who [has] been . . . subjected to conflicting claims through no fault of his own”).”

“Sampson attempts to fit this case into two categories where the inter-pleading party is not usually allowed fees: (1) where the party acts in bad faith; and/or (2) where the interpleader is not disinterested, but benefits (beyond resolution of the issue) from the litigation. See Ferber, 310 F.2d at 467 (upholding the denial of fees where the “great bulk” of a party’s efforts were devoted to addressing a counterclaim as to which it was “in no way disinterested”); First Interstate Bank of Or, N.A v. United States, 891 F.Supp. 543, 548 (D.Or. 1995) (citing Schirmer Stevedoring Co. v. Seaboard Stevedoring Corp., 306 F.2d 188, 194-95 (9th Cir. 1962)) (noting that courts “routinely” award fees to a disinterested stakeholder “absent a showing of bad faith”); see also generally 7 Wright, Miller Kane, supra, § 1719, at 684-86.”

First Interstate Bancsystem, Inc. v. Afraid, CV 19-10-BLG-SPW (D. Mont. Feb. 14, 2019)

The case discusses the requirement that a stakeholder must have a “good faith belief” that there are competing claims to the stake in order to file an interpleader action, which implies that the absence of such a belief could be evidence of bad faith.

“Moreover, “in order to avail itself of the interpleader remedy, a stakeholder must have a good faith belief that there are or may be colorable competing claims to the stake.” Michelman v. Lincoln Nat.”

Steinberg’s Dept. Store v. Hartford Fire Ins. Co., 407 N.E.2d 124 (Ill. App. Ct. 1980)

The case discusses the question of whether an interpleader action was filed in good faith, and identifies factors that could suggest bad faith, such as the withdrawal of a claim and the potential for the interpleader to force a settlement.

“It is further argued that once the claim was withdrawn, Hartford was no longer justified in withholding payment of the $30,000, and the interpleader action was not, therefore, filed in good faith.”

“As indications of bad faith, Steinberg’s cites the June 22 letter from the Bank withdrawing its claim to the insurance proceeds and also contends that, under the law of Illinois, the named insured is the only party entitled to the proceeds of a fire insurance policy in the absence of a policy provision to the contrary. ( La Salle Extension University, Inc. v. B.F. Shaw Printing Co. (1965), 62 Ill.”

“Also persuasive is the fact that Hartford delayed payment for 13 months, allegedly to force Steinberg’s to settle with the Bank from its own funds without compensation from Hartford. Thus, even though the trial court ruled that interpleader was rightfully filed, Hartford’s delay could nevertheless have been in bad faith.”

Michelman v. Lincoln Nat’l Life Ins. Co., 685 F.3d 887 (9th Cir. 2012)

This case discusses the good faith requirement for filing an interpleader action, and provides guidance on what might constitute bad faith.

“See, e.g., Aaron v. Mahl, 550 F.3d 659, 663 (7th Cir.2008); CNA Ins. Cos. v. Waters, 926 F.2d 247, 251 (3d Cir.1991).”

“Therefore, we agree with the principle articulated in Lee and now expressly hold that in order to avail itself of the interpleader remedy, a stakeholder must have a good faith belief that there are or may be colorable competing claims to the stake.”

“Mack v. Kuckenmeister, 619 F.3d 1010, 1024 (9th Cir.2010) (quoting Ensley, 174 F.3d at 980).”

Maraist Law Firm, P.A. v. Coates, 21-CV-81467-AMC/BER (S.D. Fla. Jul. 6, 2022)

This case discusses the requirements for filing an interpleader action and the circumstances under which a court may impose sanctions for filing a frivolous claim. It specifically addresses the need for an identifiable res and the existence of multiple claimants, both of which are relevant to determining whether an interpleader action was filed in bad faith.

“I agree that Count VII was objectively frivolous. First, there was no adequate identifiable financial res to support an interpleader action against any of the Movants. See ECF No. 110 ¶ 57.”

“Persisting in this claim was frivolous and violated Rule 11 as to all Movants.”

“Maraist argues that it conducted proper diligence before filing the interpleader cause of action. ECF No. 113 at 5-6.”

“A reasonably diligent researcher would have uncovered these principles and realized that they precluded interpleading the funds and thumb drive in this case.”

Mendez v. Teachers Ins. and Annuity Ass’n, 982 F.2d 783 (2d Cir. 1992)

“New York Life Ins. Co., supra, 700 F.2d at 96.”

“In view of Mendez’ plain entitlement to the proceeds, TIAA-CREF’s delay in commencing an interpleader action clearly was unreasonable and impliedly was commenced in bad faith. TIAA-CREF has given us no reason for concluding that the district court’s decision denying TIAA-CREF’s motion for discharge was an abuse of discretion.”

Prudential Ins. Co. v. Hovis, 553 F.3d 258 (3d Cir. 2009)

“Faced with competing claims to the proceeds of a $100,000 life insurance policy, Prudential Insurance Company of America filed an interpleader complaint against the claimants, seeking to deposit the disputed sum with the District Court and withdraw from the proceedings. One of the claimants, Robert C. Hovis, then counter-claimed, alleging that Prudential had acted negligently and in bad faith in its handling of the policy changes that led to the dispute.”

“Prudential then decided to pursue an interpleader action, rather than resolve who was entitled to the funds.”

“Shortly thereafter, Hovis reached a settlement with Potter and Gerski for distribution of the insurance proceeds.”

“The Court also granted summary judgment to Prudential on Hovis’s counter-claims on the ground that the appropriateness of Prudential’s interpleader action shielded it from any liability relating to its failure to resolve the dispute over the interpleaded funds.”

QBE Specialty Ins. Co. v. Kane, CIVIL 22-00450 SOM-KJM (D. Haw. Jan. 27, 2023)

“Airborne Wireless Network, 2018 WL 6016994, at *3. That is not so here. Multiple adverse claims have already been filed against QBE.”

“This case differs significantly from Bierman, which involved a putative claimant the court concluded would never file a claim because it was a corporation owned by the interpleader-plaintiff. 246 F.2d at 203. This case is also distinguishable from Beardslee, in which the supposedly adverse claimant had never asserted a right to the stake and there was no readily apparent basis for such a claim. 216 F.2d at 461.”

“As a result, the court denied the request for interpleader, finding an absence of good faith.”

Raymond James & Assocs. v. Bassford, 2:21-cv-01825-DCN (D.S.C. Mar. 7, 2022)

“DISCUSSION Since Patricia’s motion to enjoin Scott under the interpleader statute depends on the existence of a valid interpleader action, the court first addresses Raymond James’s motion for interpleader before turning to the motion to enjoin. The court ultimately finds that Raymond James has instituted a proper interpleader action, and accordingly, the court enjoins Scott and Patricia from continuing or pursuing any claims related to the interpleaded funds. A. Motion for Interpleader 1. Subject-Matter Jurisdiction “Interpleader is a procedural device that allows a disinterested stakeholder to bring a single action joining two or more adverse claimants to a single fund.” Sec.”

“Fort Dearborn Life Ins. Co. v. Turner for A.R.Y., 2006 WL 8438341, at *5 (E.D. N.C. Dec. 19, 2006); see also Lee, 688 F.3d at 1012 (observing that “many courts have held that those who have acted in bad faith to create a controversy over the stake may not claim the protection of interpleader” and collecting cases); 44B Am. Jur. 2d Interpleader § 7 (“The equitable doctrine of ‘clean hands’ applies to interpleader actions. The party seeking interpleader must do equity, not have caused the conflicting claims, and be free from blame in causing the controversy.”).”

Wilton Reassurance Life Co. of N.Y. v. Engelhardt, Civil Action 21-09968 (D.N.J. Apr. 28, 2022)

“At the first stage, “the court determines whether the interpleader complaint was properly brought and whether to discharge the stakeholder from further liability to the claimants.” Prudential Ins. Co. of Am. v. Hovis, 553 F.3d 258, 262 (3d Cir. 2009).”

“Id. at 263 (alteration in original) (quoting Farmers Irrigating Ditch & Reservoir Co. v. Kane, 845 F.2d 229, 232 (10th Cir. 1988)). The Third Circuit had difficulty in seeing how Prudential was “in any way to ‘blame [for] causing the controversy.’” Hovis, 553 F.3d at 263 (alteration in original) (quoting Farmers Irrigating Ditch, 845 F.2d at 232).”

“Hovis, 553 F.3d at 263. The court in Hovis reasoned that even if Prudential had proceeded faster, there was every indication it would have been sued by Potter and Gerski for the funds.”

Sevelitte v. The Guardian Life Ins. Co. of Am., 55 F.4th 71 (1st Cir. 2022)

“Lee, 688 F.3d at 1012 ; see also, e.g., Hovis, 553 F.3d at 263 (“[A] party seeking interpleader must be free from blame in causing the controversy ….” (quoting Farmers Irrigating Ditch & Reservoir Co. v. Kane, 845 F.2d 229, 232 (10th Cir. 1988) )); Primerica Life Ins. Co. v. Woodall, 975 F.3d 697, 700 (8th Cir. 2020) (“[I]f the party asserting the right to interpleader[ ] … has acted unfairly to create the underlying conflict necessitating interpleader relief, then that party may not use the interpleader procedure as a shield ….”). Here, though, Renee has failed to plausibly allege any bad faith by Guardian. The Divorce Agreement, not Guardian, is responsible for creating the ambiguity as to the beneficiary designation, and Guardian never denied liability under the Policy; Guardian merely sought to resolve the ambiguity by making Robyn aware of the Estate’s potential claim and ultimately seeking interpleader.”

Transamerica Life Ins. Co. v. Shubin, CASE NO. 1:11-cv-01958-LJO-SKO (E.D. Cal. Jul. 10, 2012)

“”In an interpleader action, the ‘stakeholder’ of a sum of money sues all those who might have claim to the money, deposits the money with the district court, and lets the claimants litigate who is entitled to the money.” Cripps v. Life Ins. Co. of N. Am., 980 F.2d 1261, 1265 (9th Cir. 1992). As such, the stakeholder forces the potential claimants to litigate who is properly entitled to the fund.”

“”Interpleader’s primary purpose is not to compensate, but rather to protect stakeholders from multiple liability as well as from the expense of multiple litigation.” Aetna Life Ins. Co. v. Bayona, 223 F.3d 1030, 1034 (9th Cir. 2000) (explaining that interpleaders are “governed by equitable principles”) (citations omitted). “Procedurally, an interpleader action encompasses two stages.”

“The second stage involves an adjudication of the adverse claims of the defendant claimants.””

Am. Gen. Life Ins. Co. v. Brown, DOCKET NO. 3:20-cv-00394-FDW-DSC (W.D.N.C. Feb. 12, 2021)

“Interpleader is appropriate when parties are engaged in a dispute about proceeds that remain in the hands of a third party who is willing to surrender such proceeds. See Equitable Life Assurance Soc’y. v. Jones, 679 F.2d 356, 358 n.2 (4th Cir.1982) (citations omitted).”

“Equitable concerns generally include the stakeholder acting in bad faith or unreasonable delay in bringing an interpleader action. Banner Life, 2011 WL 4565352, at *6.”

Lehto v. Allstate Ins. Co., 31 Cal.App.4th 60 (Cal. Ct. App. 1994)

“This is precisely what an insurer is required to do. (3) Plaintiff also theorized that Allstate’s conduct in filing and prosecuting the interpleader action constituted bad faith, relying on National Life Accident Ins. Co. v. Edwards (1981) 119 Cal.App.3d 326 [ 174 Cal.Rptr. 31] and Kelly v. Farmers Ins. Exchange (1987) 194 Cal.App.3d 1 [ 239 Cal.Rptr. 259].”

“It recognized, however, that the filing of an interpleader action will not sanitize a claim that is being prosecuted in bad faith.”

“While the filing of the interpleader action would not absolve Allstate of liability had it refused in bad faith to offer the policy limits to the Carbajals’ claimants, the filing of the interpleader, standing alone, cannot itself constitute an act of bad faith.”

“This situation is readily distinguishable from that of Allstate, which faced multiple bona fide claims against the Carbajals’ limited policy.”

“In fact, the interpleader action here had the intended result: It awarded plaintiff, the most seriously injured of the claimants, the $25,000 per person limit under the policy.”

Methven and Associates Professional Corporation v. Paradies-Stroud, No. C 13-01079 JSW (N.D. Cal. Jan. 21, 2014)

“The Stroud Defendants further argue that Plaintiff cannot maintain this interpleader action because it was brought in bad faith and because Plaintiff delayed too long before filing it. The authority to which the Stroud Defendants do not support these propositions.”

“Moreover, the Stroud Defendants have not demonstrated that filing the interpleader action, as opposed to giving the property directly to Ms. Stroud, was done in bad faith.”

Captain v. United Ohio Insurance Company, 2010 Ohio 2691 (Ohio Ct. App. 2010)

“Hoskins, supra, at 277, citing Hart, supra, at 188. Thus, to withstand United Ohio’s properly supported motion for summary judgment, the Appellants had to oppose the motion with evidence tending to show United Ohio arbitrarily or capriciously handled the claims against Willey. The term “arbitrary” means “without fair, solid, and substantial cause and without reason given; without any reasonable cause; * * * fixed or done capriciously or at pleasure; without adequate determining principle; not founded in the nature of things; nonrational; not done or acting according to reason or judgment; depending on the will alone; absolutely in power; capriciously; tyrannical; despotic.” 4D Investments, Inc. v. City of Oxford (Jan. 11, 1999), Warren App.”

“They essentially argue that the court utilized an improper legal standard to decide United Ohio’s summary judgment motion, i.e. it adopted a per se rule that filing an interpleader action is not bad faith. Instead, they argue the court should have considered whether the Appellants’ opposed the summary judgment motion with evidence tending to show United Ohio lacked a reasonable justification for its actions.”

Allstate Insurance v. Miller, 125 Nev. Adv. Op. No. 28, 49760 (2009), 212 P.3d 318 (Nev. 2009)

“Unless the policy says otherwise, an insurer does not have an independent duty to file an interpleader action on behalf of an insured. Nor is an insurer required to agree to a proposed stipulated judgment between the insured and the claimant if that stipulated judgment is beyond the policy limits.”

Cluck v. Mack, 489 S.W.2d 8 (Ark. 1973)

“In the answer she made the following allegations of bad faith: This interpleader action was filed in bad faith by the plaintiff for purposes of harassment and reducing the net amount of money which Margaret Ann Mack might obtain to go on her judgment of 10-7-70 against Charles Donald Cluck as evidenced by the following prior acts of this plaintiff: This plaintiff answered Margaret Ann Mack’s garnishment under her 10-7-70 judgment on Dec. 7, 1971, by claiming any money it held for or on behalf of Charles Donald Cluck was “contingent” on premiums being paid in full to 12-28-71 (when, in truth, said premiums were then fully paid to that date); and on any cash reserves under said policy not being depleted by loans to the insured (when, in truth.) the insured had never applied for any loan prior to service of the Writ); and on the insured being alive on 12-28-71 (a mere 21 days after the answer was filed). The answer of Charles Donald Cluck, filed April 7, 1972, asserted his claim to the fund and asked that both Blanche L. Cluck and Margaret Ann Mack be enjoined from the issuance of further writs of garnishment against the insurance policy proceeds.”

“The allegations in the complaint were not sustained by evidence — at least no evidence of any lack of good faith in the filing of the bill of interpleader was ever produced. The mere fact that an alleged claimant did not appear did not show lack of good faith on the part of the insurance company, and the fact that the claim of one or more of them turned out to be without merit, is not of controlling importance and is insufficient to furnish any basis for an inference that the filing was not in good faith, particularly in view of the fact that Blanche L. Cluck had, by one of the writs of garnishment asserted a claim to the proceeds.”

“Goad v. Goad, 238 Ark. 12, 377 S.W.2d 822.”

State Farm Life Ins. Co. v. Murphy, No. 2:15-cv-04793-DCN (D.S.C. Oct. 12, 2017)

“As explained in more depth in section III.2, the court finds that State Farm did not file its interpleader action without good cause or in bad faith.”

“The court can imagine a scenario where an insurer’s conduct in creating competing claims and delaying payments to a named beneficiary in the context of an interpleader action rises to the level of a viable bad faith claim. However, those facts are not present here.”

“Courts have been clear that where there is a reasonable ground for contesting a claim, and the court accepts the filing of the interpleader action, the insurer has not acted in bad faith by filing an interpleader claim. For example, in Minnesota Mutual Life Insurance Co. v. Ensley, 174 F.3d 977 (9th Cir. 1999), the Ninth Circuit upheld a district court’s determination that the insurer had acted reasonably in interpleading the policy benefits given its good faith belief that it faced the possibility of multiple claims.”

Nylife Distributors, Inc. v. Adherence Group, 72 F.3d 371 (3d Cir. 1995)

“Hence, one of two related questions we face is whether under section 1335, the district courts retain their traditional equitable discretion when deciding whether to hear a statutory interpleader case or defer to a state court; and the other is whether the district courts have a “virtually unflagging obligation” to exercise their section 1335 jurisdiction. In this regard, we find the Supreme Court’s decision in Weinberger v. Romeo-Barcelo, 456 U.S. 305 (1982), instructive.”

“See Bowles, 321 U.S. at 329. In support of their argument that the exceptional circumstances test set forth in Colorado River Water Conservation Dist. v. United States, 424 U.S. 800 (1976), should guide a district court’s decision to dismiss a federal interpleader action in favor of pending state proceedings, Gerasolo and Bleach rely heavily on section 1335(a), which states in pertinent part that “[t]he district courts shall have original jurisdiction of any civil action of interpleader or in the nature of interpleader. . . .” 28 U.S.C. §(s) 1335(a) (1993) (emphasis added).”

“On remand, the district court should determine, as a threshold matter, whether the state court action is indeed “parallel”; that is, whether it encompasses the competing claims to the Mainstay Mutual Fund monies that are raised here.”

Hicks v. Gabor, 354 Ga. App. 714 (Ga. Ct. App. 2020)

“On March 23, 2018, AOIC filed the instant Complaint for Interpleader and to Discharge Surety and Cancel the Bond. In the Complaint, AOIC stated that the claims against the Bond exceeded its remaining balance and asked the trial court to determine how to distribute the funds.”

“However, this is an interpleader action. The relevant interpleader statute, OCGA § 23-3-90 (a), states: Whenever a person is possessed of property or funds or owes a debt or duty, to which more than one person lays claim of such a character as to render it doubtful or dangerous for the holder to act, he may apply to equity to compel the claimants to interplead.”

“First, it must be determined whether the complainant had a right to interplead, and second, the interpleading defendants are required to litigate matters in dispute between themselves.”

Scruggs v. Merkel Cocke, 2000 CA 1370 (Miss. 2001)

“Since the claim filed by Merkel Cocke addressed the same parties and controversy as the action previously filed by SMBD in Jackson County Chancery Court, Merkel Cocke’s claim for interpleader should have been filed as a compulsory counterclaim in the Jackson County Chancery Court action pursuant to M.R.C.P. 13(a). In other words, we find that the interpled funds should have been pled as a compulsory counterclaim in the Jackson County Chancery Court litigation rather than filed as multiple litigation involving the same parties and controversies in another chancery court in another county.”

“As previously stated, we find that the Coahoma County Chancery Court erred in allowing Merkel Cocke to proceed with the interpleader and further erred in releasing Merkel Cocke from all liability in connection with the interpled funds. ¶ 26. The Coahoma County Chancery Court granted Merkel Cocke attorney fees against SMBD.”

“In Brown v. Hartford Ins. Co ., 606 So.2d 122, 127 (Miss. 1992), this Court stated: Sanctions are appropriate when a claim is either frivolous or filed for harassment value. . . . When a party espouses a viable legal theory, MRCP 11 sanctions are inappropriate.”

Midland Nat’l Life Ins. Co. v. Ingersoll, Case No. 13-C-1081 (E.D. Wis. Dec. 18, 2014)

“In recent years, several courts have held that a disinterested stakeholder should not obtain a fee award if filing the interpleader action could be viewed as part of the stakeholder’s normal or ordinary course of business. See, e.g., Minn. Mut. Life Ins. Co. v. Gustafson, 415 F. Supp. 615, 618-19 (N.D. Ill. 1976); Moore’s, supra; Wright et al., supra. These courts also hold that interpleader actions are generally part of the ordinary course of the insurance business. Chase Manhattan, 21 F.3d at 383; Gustafson, 415 F. Supp. at 618-19; Moore’s, supra; Wright et al., supra. This exception to the rule of awarding attorneys’ fees to a disinterested stakeholder appears to stem from Judge Friendly’s opinion in Travelers Indemnity Co. v. Israel, 354 F.2d 488 (2d Cir. 1965). In that case, the court held that a district court did not abuse its discretion in refusing to award fees to several insurance companies who initiated an interpleader action.”

Indianapolis Colts v. Mayor City Council, 775 F.2d 177 (7th Cir. 1985)

“The Second Circuit, interpreting the amended rule, declared that Rule 11 is violated where, “after reasonable inquiry, a competent attorney could not form a reasonable belief that the pleading is well grounded in fact and is warranted by existing law or a good faith argument for the extension, modification or reversal of existing law,” or “when it appears that a pleading has been interposed for any improper purpose.” Eastway Construction Corp. v. City of New York, 762 F.2d 243, 254 (2d Cir. 1985).”

“We must reiterate that in denying Baltimore’s motion for attorneys’ fees, the district court specifically found that Indianapolis had not acted with an improper purpose, and nothing in the record indicates that this conclusion was erroneous. Moreover, the above discussion establishing the justiciability of Indianapolis’ interpleader claim supports the district court’s finding that the claim was not filed for an improper purpose.”

“Clearly, the exercise of one’s legal rights to have a dispute resolved in federal court is not an abuse of the judicial process.”

Metropolitan Life v. Price, 501 F.3d 271 (3d Cir. 2007)

“MetLife stated that if the claimants did not resolve the matter amicably, it would bring suit. Price’s widow and the children negotiated, but they failed to reach an agreement.”

“The plaintiff in an interpleader action is a stakeholder that admits it is liable to one of the claimants, but fears the prospect of multiple liability. Interpleader allows the stakeholder to file suit, deposit the property with the court, and withdraw from the proceedings. The competing claimants are left to litigate between themselves.”

New York Life Ins. Co. v. Connecticut Dev. Auth, 700 F.2d 91 (2d Cir. 1983)

“Judgment discharging the stakeholder in an interpleader action may, of course, be delayed or denied if there are serious charges that the stakeholder commenced the action in bad faith.”

“In the present action, Sterling’s opposition to New York Life’s injunction motion charged that New York Life had listed CDA and MECCO as beneficiaries of the policies without Sterling’s knowledge or consent (Owens Aff. ¶ 7), for reasons of its own “greed and self-interest” ( id. ¶ 23). Had CDA or MECCO participated in the action and contested Sterling’s right to receive the cash surrender value of the policies, and had Sterling pursued his assertions as to New York Life’s bad faith, the district court would have been required to deal with these contentions in determining whether New York Life was entitled to any discharge from liability.”

Farmers Ins. Co. v. Romas, 947 P.2d 754 (Wash. Ct. App. 1997)

“On July 27, 1994, Farmers filed a complaint for interpleader on the grounds that Mr. Romas and the Paradiso Estate are both claiming that the other party was the driver at the time of the accident. Each is claiming entitlement to the $25,000 liability policy proceeds.”

“The complaint prays for declaratory relief asking the court to find that because Farmers deposited the funds with the court it has fulfilled its duty to defend either Mr. Romas as the named insured and/or the Paradiso Estate as the permissive insured.”

“In this case, Farmers would have a duty to defend both parties because both parties fit the definition of an insured person as established by case law.”

“However, the unilateral payment of policy limits into the registry of the court does not in and of itself relieve an insurer of its duty to defend. Viking, 57 Wn. App. at 349.”

AEG Westinghouse Transportation Systems, Inc. v. OEM Industrial Corp. (In re OEM Industrial Corp.), 135 B.R. 247 (Bankr. W.D. Pa. 1991)

“Furthermore, where the stakeholder has been dilatory in seeking judicial relief, and is thus culpable as to the difficulties encountered, an award may be denied. See John Hancock Mutual Life Ins. Co. v. Doran, 138 F. Supp. at 49 (“within one month after . . . realizing its predicament, [stakeholder] should have decided on a cause of action”). In the instant case, AEG did not seek to interplead for several months after the bankruptcy was filed. Although the parties were attempting to work out a settlement during this time, AEG was aware of all claims against it even before the bankruptcy was filed. The interpleader cause of action is designed specifically to limit a stakeholder’s exposure to liability.”

Trs. of the Elec. Workers Health & Welfare Trust v. F.A.S.T. Sys., Inc., 2:12-CV-148 JCM (CWH) (D. Nev. Jun. 27, 2013)

“Federal courts have the inherent power to punish conduct which abuses the judicial process, including accessing attorneys’ fees when a party has “acted in bad faith, vexatiously, wantonly, or for oppressive reasons.” Chambers v. NSDCO, Inc., 501 U.S. 32, 45-46 (1991) (citation omitted). When imposing sanctions under its inherent authority, a court must make an explicit finding of bad faith or willful misconduct.”

“An award of attorneys’ fees pursuant to the court’s inherent power is appropriate when plaintiff has acted in bad faith, has willfully abused the judicial process or has willfully disobeyed a court order.”

“Servs., Inc. v. Batarse, 115 F.3d 644, 648 (9th Cir. 1997) (“a finding of bad faith is warranted where an attorney ‘knowingly or recklessly raises a frivolous argument, or argues a meritorious claim for the purpose of harassing an opponent'”) (citation omitted).”

Shayne v. Discover Bank, C. A. 8:21–cv-03544-BHH-KFM (D.S.C. Jan. 26, 2022)

“There are seven motions pending before the court, including two by Discover and five by the plaintiff. Discover argues that this matter should be dismissed based upon res judicata as well as the pending New Jersey Interpleader Action (doc. 6). Discover also seeks sanctions pursuant to Rule 11 of the Federal Rules of Civil Procedure from the plaintiff for having to defend this lawsuit (doc. 16).”

“Discover asserts that the plaintiff’s lawsuit was filed for an improper purpose, because it was filed to harass Discover and violates the Interpleader Order (id.). For relief, Discover seeks to recover attorney’s fees and costs for defending this action as well as an order enjoining the plaintiff from filing future litigation regarding the Discover accounts in question in this court (id. at 5).”

Yonko v. W. Coast Life Ins. Co., CIVIL ACTION NO. 1:20-CV-00109-GNS-HBB (W.D. Ky. Apr. 15, 2021)

“B. Motion to Dismiss In both suits, Robert alleged breach of contract and bad faith claims against West Coast Life pursuant to O.C.G.A. § 33-4-6. In the Western District of Kentucky, West Coast Life moved to dismiss Robert’s bad faith claim. (Def.’s Mot. Dismiss, DN 39). Motions pursuant to Fed.”

“”[O]rdinarily, the question of good or bad faith is for the jury, but when there is no evidence of unfounded reason for the nonpayment, or if the issue of liability is close, the court should disallow imposition of bad faith penalties.” Amica Mut. Ins. Co. v. Sanders, 779 S.E.2d 459, 463 (Ga. Ct. App. 2015) (alteration in original) (internal quotation marks omitted) (citation omitted). Robert acknowledges failing to satisfy the sixty-day notice provision.”

“Even construing Robert’s allegations in the light most favorable to him, his counterclaim does not support a reasonable inference that West Coast Life’s refusal to pay under the Policy was frivolous and unfounded.”

Sun Life Assurance Co. of Canada v. Bew, 530 F. Supp. 2d 773 (E.D. Va. 2007)

“In order to avoid liability from conflicting claims, a disinterested stakeholder, such as the Plaintiffs, that had issued an insurance policy or managed an investment account, may interplead contested funds into a court’s registry to resolve the issue of proper distribution. The disinterested shareholder can then procure a judicial order for discharge from future liability. Fed.R.Civ.P. 22; Reliastar Life Ins. Co. of N.Y. v. LeMone, No. Civ.A. 7:05CV00545, 2006 WL 733968, at *10 (W.D.Va.”

“Furthermore, attorneys’ fees and costs may be awarded to a stakeholder in an interpleader action based on the rationale that the stakeholder, “by seeking resolution of the multiple claims to the proceeds, benefits the claimants, and . . . should not have to absorb attorneys’ fees in avoiding the possibility of multiple litigation.” Reliastar Life Ins. Co. of N.Y., 2006 WL 733968, at *9 (citations omitted).”

Wackeen v. Malis, 97 Cal.App.4th 429 (Cal. Ct. App. 2002)

“The plaintiff in this state interpleader suit was the law firm McIntyre, Borges Burns, LLP. The defendants were Torrance Management Company, Inc., REM Ltd., and The Foundation for Thoroughbred Sciences, Inc. The case settled when Torrance Management Company, Inc. waived a claim to the interpleaded trust deed and stipulated that the other two defendants in that case were entitled to sole possession of the deed. The plaintiff in the federal interpleader case was Torrance Management Company, Inc. The defendants were Moran, a William Malis, the United States of America, and others.”

The Bd. of Trs. of the Leland Stanford Junior Univ. v. Chiang Fang Chi-Yi, 13-cv-04383-BLF (N.D. Cal. Aug. 22, 2022)

“Life Ins., 2007 WL 4209405, at *2. The Court may also “enter its order restraining [all claimants] from instituting or prosecuting any proceeding in any State or United States court affecting the property . . . involved in the interpleader action” and “discharge the plaintiff from further liability.” 28 U.S.C. § 2361; see also In re 1563 28th Ave., San Francisco, CA 94112, 333 F.R.D. 630, 635 (N.D. Cal. 2019).”

Republic of the Phil. v. Pimentel, 553 U.S. 851 (2008)

Statutes (3)

Section 815 ILCS 340/8, 815 ILCS 340/8

“Any claim by a consumer which is found by the court to have been filed in bad faith or solely for the purpose of harassment, or in complete absence of a justifiable issue of either law or fact raised by the consumer, shall result in the consumer being liable for all costs and reasonable attorney’s fees incurred by the manufacturer or its agent, as a direct result of the bad faith claim. 815 ILCS 340/8 P.A. 85-894.”

Section 624.155 – Civil remedy, Fla. Stat. § 624.155

“The insurer files an interpleader action under the Florida Rules of Civil Procedure. If the claims of the competing third-party claimants are found to be in excess of the policy limits, the third-party claimants are entitled to a prorated share of the policy limits as determined by the trier of fact. An insurer’s interpleader action does not alter or amend the insurer’s obligation to defend its insured. (b) Pursuant to binding arbitration that has been agreed to by the insurer and the third-party claimants, the insurer makes the entire amount of the policy limits available for payment to the competing third-party claimants before a qualified arbitrator agreed to by the insurer and such third-party claimants at the expense of the insurer.”

Section 231:6F – Costs, expenses and interest for insubstantial, frivolous or bad faith claims or defenses, Mass. Gen. Laws ch. 231 § 6F

Regulation (1)

Section ATCP 1.33 – Costs upon frivolous claim, Wis. Admin. Code ATCP § ATCP 1.33

“The action, claim or defense was initiated or pursued in bad faith, solely for the purpose of harassing or maliciously injuring another. (b) The party or party’s attorney knew or should have known that the action, claim or defense was without any reasonable basis in law or equity, and could not be supported by a good faith argument for an extension, modification, or reversal of existing law. (3) If an administrative law judge issues an order under sub. (1) against a party other than a public agency, the administrative law judge may assess those costs against the party or the party’s attorney, or may allocate the cost assessment between the party and the party’s attorney. Wis.”

Analyses (9)

Sweeping Changes To “Bad Faith” In Florida

“Additionally, if two or more third-party claimants present competing claims arising out of a single occurrence, which when totaled may exceed the available policy limits of one or more of the insured parties, an insurer is not liable beyond payment of the available policy limits if the insurer, within ninety (90) days of receiving the claims, files an interpleader action and provides the policy limits to the court. The trier of fact then determines the amount of the policy limits to distribute to each claimant.”

Chris Lazarini Discusses Financial Institution’s Fiduciary Duty to Beneficiary

“UBS filed an interpleader action against Defendant and the person whom the client attempted to name as primary beneficiary on the accounts already distributed. Asserting her beneficiary status, Defendant counterclaimed and cross-claimed.”

“Upon the client’s death, UBS became a trustee, which is a fiduciary under New York law, holding the assets for Defendant’s sole benefit. As such, UBS owed Defendant at least a duty of due care, which it allegedly failed to meet in refusing to provide Defendant with information and in delaying distribution.”

“EIC: Interpleader actions, while casting the holder of the corpus as neutral, are fraught with liability issues for the actions taken by the holder.”

Florida Enacts Broad Insurance Reforms Focusing on Bad Faith

“The insurer will not be liable beyond the policy limit if, within 90 days after receiving notice of the competing claims in excess of the policy limit, the insurer either: Files an interpleader action in a Florida court for the policy limit. Upon agreement between the insurer and claimants, makes the policy limit available and submits the matter to binding arbitration. A third-party claimant whose claim is resolved in arbitration must execute and deliver a general release to the insured party whose claim is resolved by the proceeding.”

Florida Enacts Major Tort Reform and Bad-Faith Insurance Claim Legislation

“Under these safe harbors, an insurer can avoid bad-faith liability by making use of interpleader or arbitration procedures set forth in the bill. The bill also repeals sections of the Florida Statutes that previously allowed insureds to recover attorneys’ fees when prevailing in certain insurance coverage disputes.”

Florida’s Most Comprehensive Tort Reform in Decades and What it Means for Insurers and Bad Faith Law

“An insurer is not liable beyond the available policy limits for failure to pay all or any portion of a policy limit to the third-party claimants if, within 90 days after receiving notice of the competing claims, the insurer complies with one of the following: The insurer files an interpleader action under the Florida Rules of Civil Procedure. If the claims of competing third-party claimants are found to be in excess of an insurer’s policy limits, the third-party claimants will be entitled to a prorated share of the policy limits determined by a trier of fact.”

Interpleader with a Side of Motion for More Definite Statement

“In Meyer, the court found the facts did not support either statutory or rule-based interpleader. Meyer was not at risk for multiple or inconsistent judgments as the only parties claiming right to the funds in question were Defendants, who are clearly related and not adverse. As the court aptly noted, either the Defendants were entitled to the funds or they were not.”

The Wrong Way for a Trustee to Interplead Foreclosure Sale Proceeds

“The court ruled that an interpleader complaint must show that “the defendants make conflicting claims” to the disputed funds, and that the plaintiff “cannot safely determine which claim is valid.” The court found that these conditions were not present in this case.”

“Under section 2924k, a trustee must distribute proceeds from a foreclosure sale in the following order of priority: (1) costs and expenses of the sale; (2) payment of the debt secured by the deed of trust; (3) payment of any junior liens or encumbrances; and (4) payment to the trustor (who is normally the borrower). Placer applied the sale proceeds in accordance with numbers 1 through 3 on that statutory priority list, but failed to pay the remaining proceeds to Aflalo.”

“Lesson Under thePlacer Title opinion, interpleading surplus proceeds from a foreclosure sale is NOT appropriate where there are no competing recorded claims before the sale, and where section 2924k clearly requires the surplus proceeds be given to the trustor. [View source.]”

The Impact of Florida’s Tort Reform Bill on Insurance Litigation

“If two or more third party claimants have competing claims arising out of a single occurrence, which in total may exceed the insured’s available policy limits, the insurer does not commit bad faith by failing to pay if, within 90 days after receiving notice of the competing claims, the insurer either files an interpleader action or follows the arbitration procedures outlined in the bill.”

Key issues for policyholders under Florida’s new tort reform bill

“Also included are two new procedural devices for cases involving multiple completing claims against an insured (or insureds). Under new § 624.155(6), an insurer can now shield itself from bad faith exposure by either (a) filing an interpleader action to determine the claimants’ prorated share of the policy limits, or (b) entering into a binding arbitration proceeding agreed to by the insurer and the claimants, where a “qualified arbitrator” (paid for by the insurer) determines the claimants’ prorated share of the policy limits.”