The P.U.D. RIDER must be enforced to protect HOA homeowners from corporate corruption.

The banks deceived the Courts about the “F. Remedies” contract term in the Planned Unit Development Rider.

This is the same ploy that many, many banks have used to steal many, many houses from HOA homeowners.

It works because the HOA debt collectors conspired with the corrupt attorneys/lenders to conceal the existence of the PUUD Rider Remedies from the owners and from the courts.

Nationstar knew the PUD Rider remedy limits, but misrepresented it.

Nationstar disclosed the Hansen deed OF TRUST as NSM 141-162.

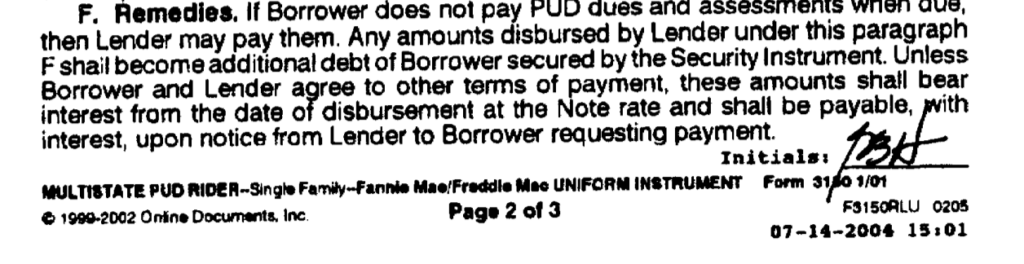

The Planned Unit Development Rider Remedies F was disclosed as NSM 160. In the 2004 Recorded documents, it is numbered 2004 021 RECORDED.

it is the featured image of this blog and it is pictured again below.

If a lender pays late HOA dues, the ONLY recovery is the amount paid with interest charged at the note rate.

PUD rider remedies f. provides that lenders are contractually authorized only to add delinquent HOA assessments to the outstanding loan balance and add interest at the note rate (here 6.25%).

Lenders are prohibited from using the tender, offer or payment of delinquent assessments, rejected or not, as a de facto foreclosure to confiscate an owner’s property without due process.

Nationstar disclosed the PUD Rider Remedies section so ignorance cannot be an excuse when Nationstar filed its duplicitous 2/12/19 joinder in order to get rid of the owner without foreclosing.

Nationstar was not ever owed Hansen’s debt

Nationstar disclosed that it does not hold the origInal note by disclosing a copy as NSM 158-160.

NSM’s copy of the note shows Nationstar, Wells Fargo and bank of Amercia are not in the chain of title of endorsements.

Criminal penalties must be applied.

All recorded assignments of the Hansen DEED OF TRUST that culminated in Nationstar reconveying the Hansen DEED OF TRUST to Joel Stokes, an individual, on 6/3/19, were false claims to title in the meaning of NRS 205.395.

Evidence in this case has been submitted to administrative enforcement agencies

Violations of NRS 205.395, NRS 207.360, and other statutes in this particular case are documented in 11/10/20 complaint to the Nevada Attorney General (See TOC of AG exhibits), 12/16/20 complaint to the Mortgage Servicing Division (See TOC 12/16/20 complaint), NCJD 2021-026,

The pattern of racketeering by financial institutions is well documented nationwide.

National banking associations’ corrupt business practices were revealed in :

- 12/7/20 national settlement agreement and consent order,

- its 8/17/18 settlement and release,

- the 2012 National Mortgage Settlement and consent judgment for Bank of America,

- the 2012 National Mortgage Settlement and consent judgment for Wells Fargo.