Tobin’s motion to distribute the proceeds

DEFENDANT NONA TOBIN, AN INDIVIDUAL, filed a motion to distribute on 4/12/21, but it was returned as a non-conforming document for failure to request a

Owners should ALWAYS come first!

DEFENDANT NONA TOBIN, AN INDIVIDUAL, filed a motion to distribute on 4/12/21, but it was returned as a non-conforming document for failure to request a

I am requesting your help to get some investigative assistance, and meaningful access to Nevada’s formal complaint procedures, to address this problem of HOA debt

Comes now, Defendant NONA TOBIN, an individual, in proper person, hereby files her OPPOSITION TO RED ROCK FINANCIAL SERVICES’S MOTION TO DISMISS TOBIN’S COUNTER-CLAIMS AND

The purpose of summary judgment is to identify and dispose of factually unsupported claims and defenses. See Celotex Corp. v. Catrett,477 U.S. 317, 323–24, 106 S.Ct. 2548, 91 L.Ed.2d

TABLE OF VIOLATIONS STATUTE PROVIDES VIOLATION RESULTING IN VOID HOA SALE NRS 116.3116 Super-priority Miles Bauer tendered $825 that SCA agents rejected NRS 116A.640 (8)

Jimijack & Nationstar did not meet their burden of proof (“We first hold that each party in a quiet title action has the burden of

According to Jay Young, on the Nevada Law Blog, in Nevada, the elements for a claim of quiet title are: Action may be brought by

Activity Time allowed Service of Summons and Complaint 120 days from filing of complaint. Rule4(e)(1) Dismissal For Failure to Serve Summons andComplaint 120 days from

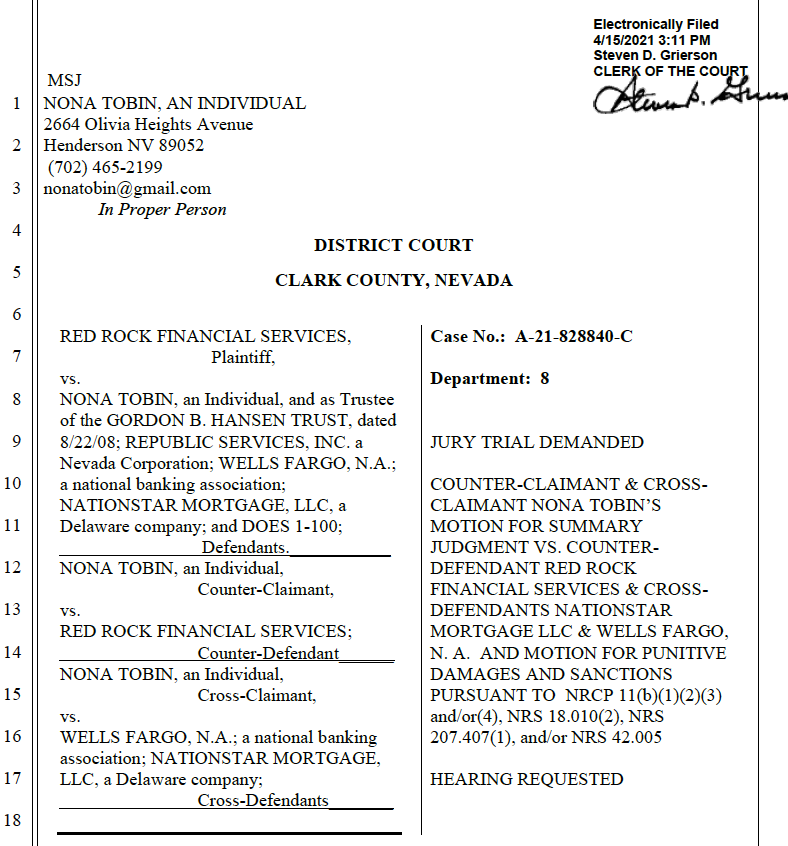

Link to downloadable PDF Comes now, counter-claimant/ cross-claimant Nona Tobin, an individual, in proper person, to hereby move for summary judgment vs. counter-defendant Red Rock

When a borrower signs a promissory note, he is agreeing to pay the lender a specific amount of money according to certain conditions. In order