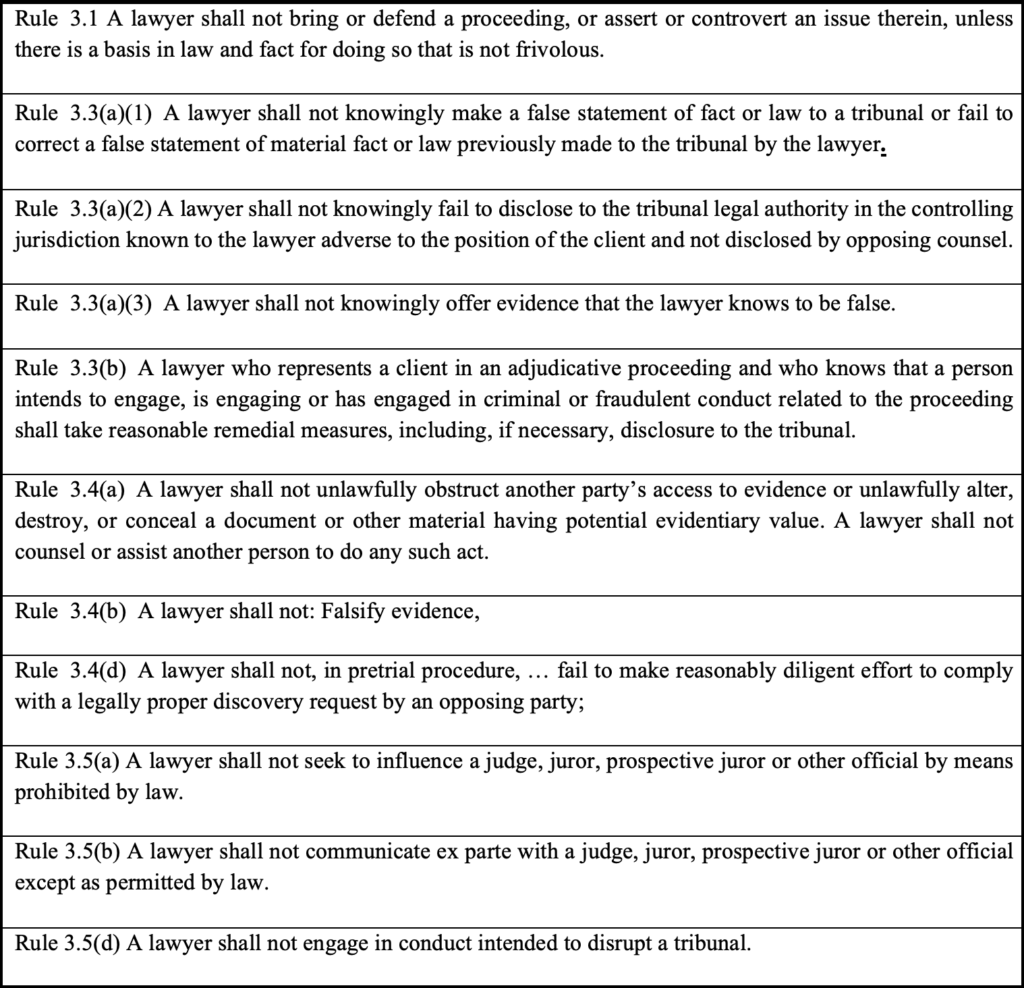

Multiple Nevada Rules of Professional Conduct were allegedly violated by the acts

Nationstar allegedly used amenable attorneys to violate multiple Nevada laws in pursuit of collecting on a debt it was not owed.

| NRS 111.175 Conveyances made to defraud prior or subsequent purchasers are void. |

| NRS 111.180 Bona fide purchaser: Conveyance not deemed fraudulent in favor of bona fide purchaser unless subsequent purchaser had actual knowledge, constructive notice or reasonable cause to know of fraud. |

| NRS 111.240 Acknowledgment of conveyances |

| NRS 111.340 Certificate of acknowledgment and record may be rebutted |

| NRS 111.345 Instrument not admissible until established by competent proof. |

| NRS 205.0832 Actions which constitute theft. |

| NRS 205.0833 Theft constitutes single offense embracing certain separate offenses; specification of charge in indictment or information |

| NRS 205.330 Fraudulent conveyances. |

| NRS 205.360 Knowingly receiving fraudulent conveyance. |

| NRS 205.372 Mortgage lending fraud; penalties; civil action. |

| NRS 205.377 Multiple transactions involving fraud or deceit in course of enterprise or occupation; penalty. |

| NRS 205.390 Obtaining signature by false pretense. |

| NRS 205.395 False representation concerning title; penalties; civil action |

| NRS 205.405 Falsifying accounts. |

| NRS 205.450 Personating another |

| NRS 205.455 Personating another same as stealing |

| NRS 207.360 “Crime related to racketeering” defined. 9. Taking property from another under circumstances not amounting to robbery 18. Grand larceny 28. Obtaining possession of money or property valued at >$650, or obtaining a signature by false pretenses 30. Offering false evidence 35. Any violation of NRS 205.377. |

| NRS 207.400 Unlawful acts; penalties. |

| NRS 207.470 Civil actions for damages resulting from racketeering. |

| NRS 42.005 Exemplary and punitive damages: the amount of award determination in a subsequent proceeding. |

| NRS 18.010(2) Award of attorney’s fees as special damages for frivolous meritless harassing claims |

| EDCR 7.60(b)(1)&(3) Sanctions for presenting frivolous unwarranted motion or opposition |

| NRS 41.1395 Action for damages for injury or loss suffered by older or vulnerable person from abuse, neglect or exploitation; double damages; attorney’s fees and costs. |

| NRS 116.31164 (3)(c(2013) ALL excess proceeds must be distributed AFTER the sale NO EXCEPTIONS |

| NRS116.31162(6)(2013) HOA foreclosure is prohibited if NOD had been recorded on 1st DOT |

| NRS 104.3301 Person entitled to enforce instrument. |

| NRS 155.165 Finding of vexatious litigant; sanctions; standing of interested party and vexatious litigant under certain circumstances. |

| NRS 116A.640 (8) Community manager is prohibited from applying assessment payment to fees first. |

| NRS 116A.640 (9) Community manager is prohibited from refusing assessment payment because there’s an outstanding payment due. |

| NRS 116A.640 (10) Community manager prohibited from charging fees not in the management agreement |

| NRS 40.050 Mortgage not deemed conveyance. |

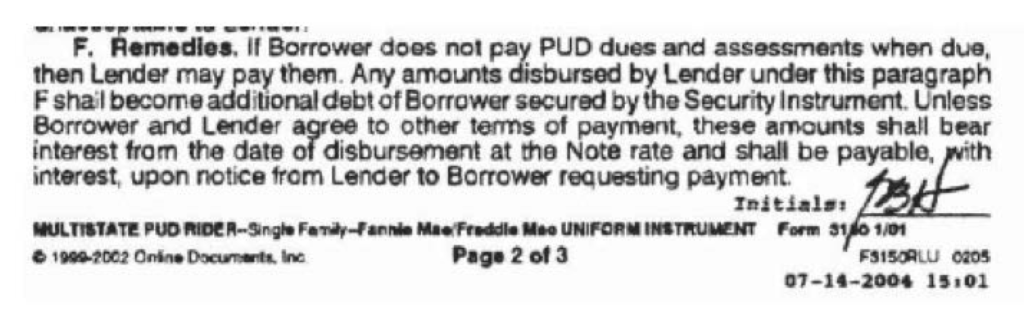

| Multi-State Planned Unit Development (PUD) Rider – Single Family Fannie Mae Freddie Mac Uniform Instrument limits a lender’s recovery to adding delinquent assessments paid to outstanding loan due plus interest at note rate; prohibits a de facto foreclosure |

| NRS 116A.630 (1)(a) Standards of practice for community managers |

| NRS 199.145 Statement made in declaration under penalty of perjury |

| NRS 199.480 Penalties. CONSPIRACY |

| NRS 357.040 Liability for damages and civil penalty for False Claims. (a) presents a false claim (b) makes a false record to support fraudulent claim (h) benefits from & conceals falsity of the claim (i) conspires to act |

The Back Story

http://scastrong.com/tag/predatory-debt-collection/

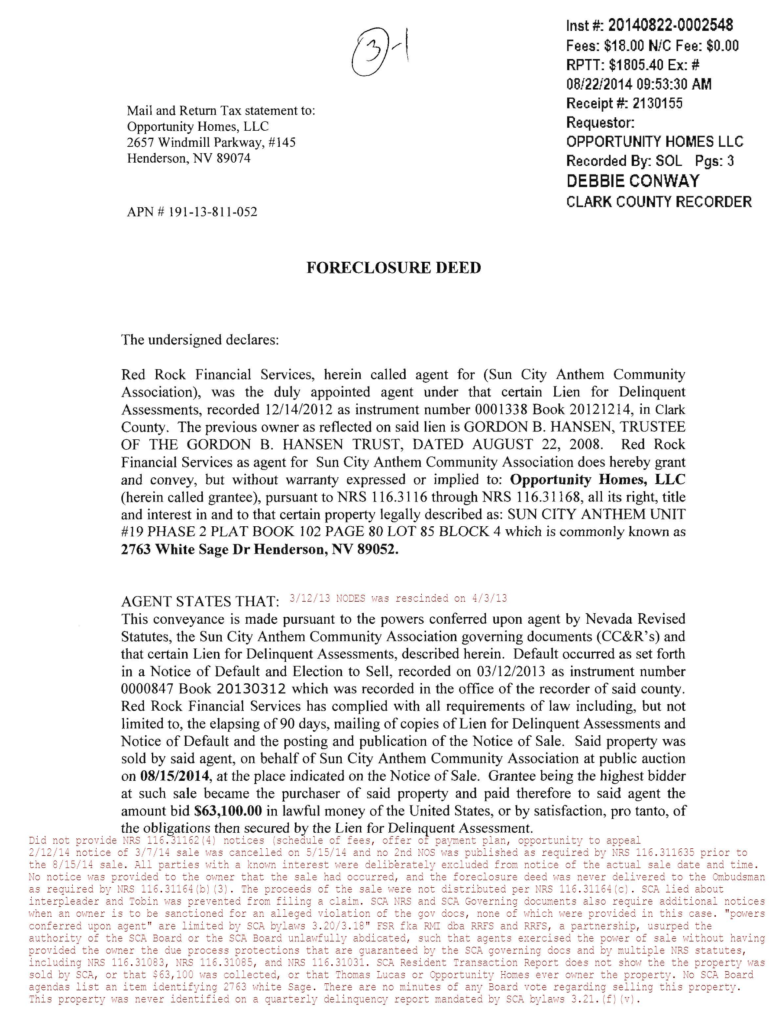

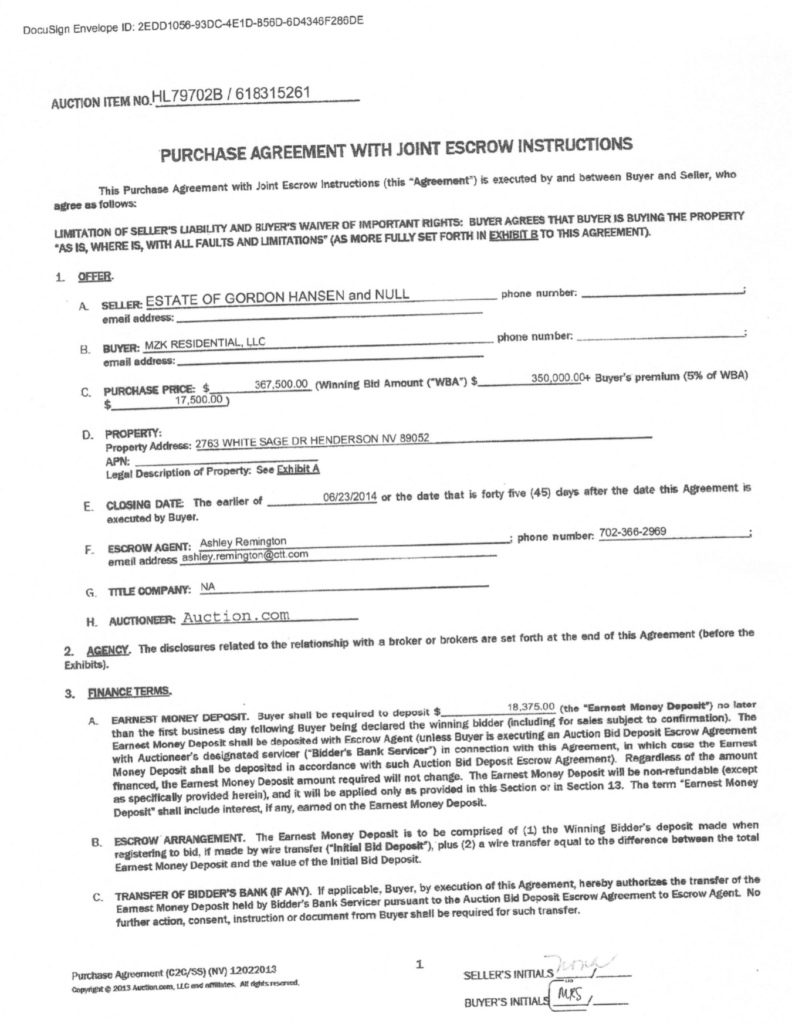

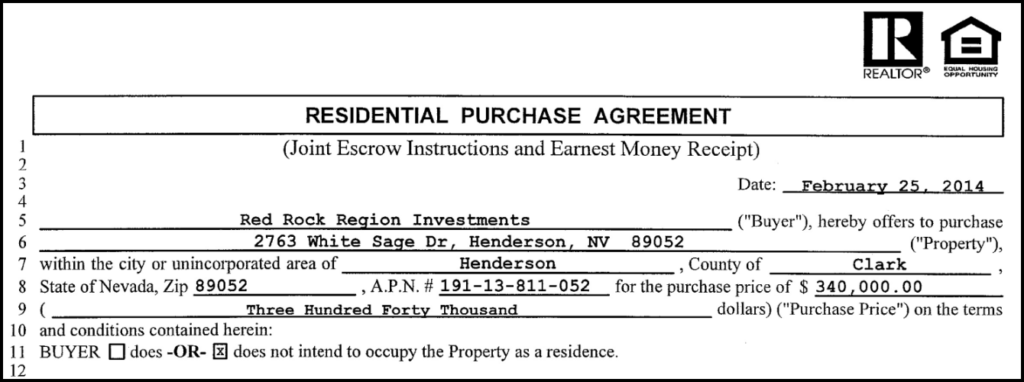

I accepted a $367,500 high bid from MZK Residential LLC to sell the property on auction.com on 5/8/14.

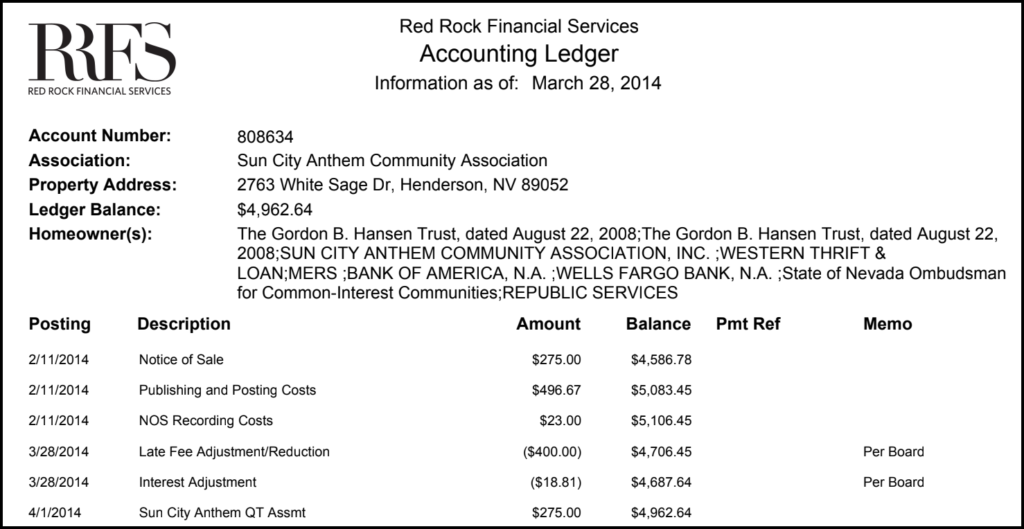

Red Rock’s most recent payoff demand for the HOA was sent to Chicago Title on 3/28/14 when I accepted a $340,000 cash offer from Red Rock Regional Investments that Nationstar rejected.

Servicer Nationstar didn’t pay $4,962.64 Red Rock demanded although arguably that’s what the PUD Rider Remedies F. required to prevent an HOA foreclosure since Nationstar had not foreclosed on the 1st deed of trust.

If servicer Nationstar, or its predecessor servicer BANA had recorded a notice of default on the 7/22/04 1st deed of trust, the HOA could not have foreclosed. Since they did not, BANA’s and Nationstar’s dirty tricks with tendering super-priority offers instead of paying the HOA assessments in full, is circumventing the PUD Rider to get a de facto foreclosure when they know that no lender has standing to foreclose. This is mortgage servicing fraud. They are covering up that there is no lender with standing to foreclose, and all the recorded claims to create the phony paper trail warrants felonies if convicted criminally, primarily under NRS 205.395 and NRS 205.377.

6. The association may not foreclose a lien by sale if:(a) The unit is owner-occupied housing encumbered by a deed of trust;(b) The beneficiary under the deed of trust, the successor in interest of the beneficiary or the trustee has recorded a notice of default and election to sell with respect to the unit pursuant to subsection 2 of NRS 107.080.

NRS116.31162(6)(2013)

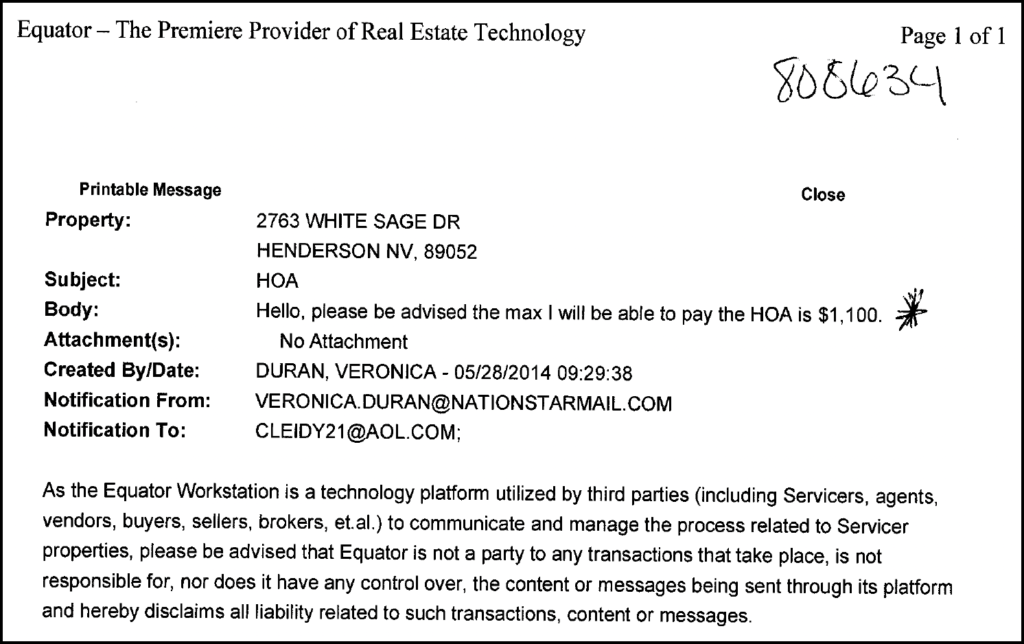

5/28/14 Servicer Nationstar offered to pay one-year assessments $1,100 to close the $367,500 auction.com sale

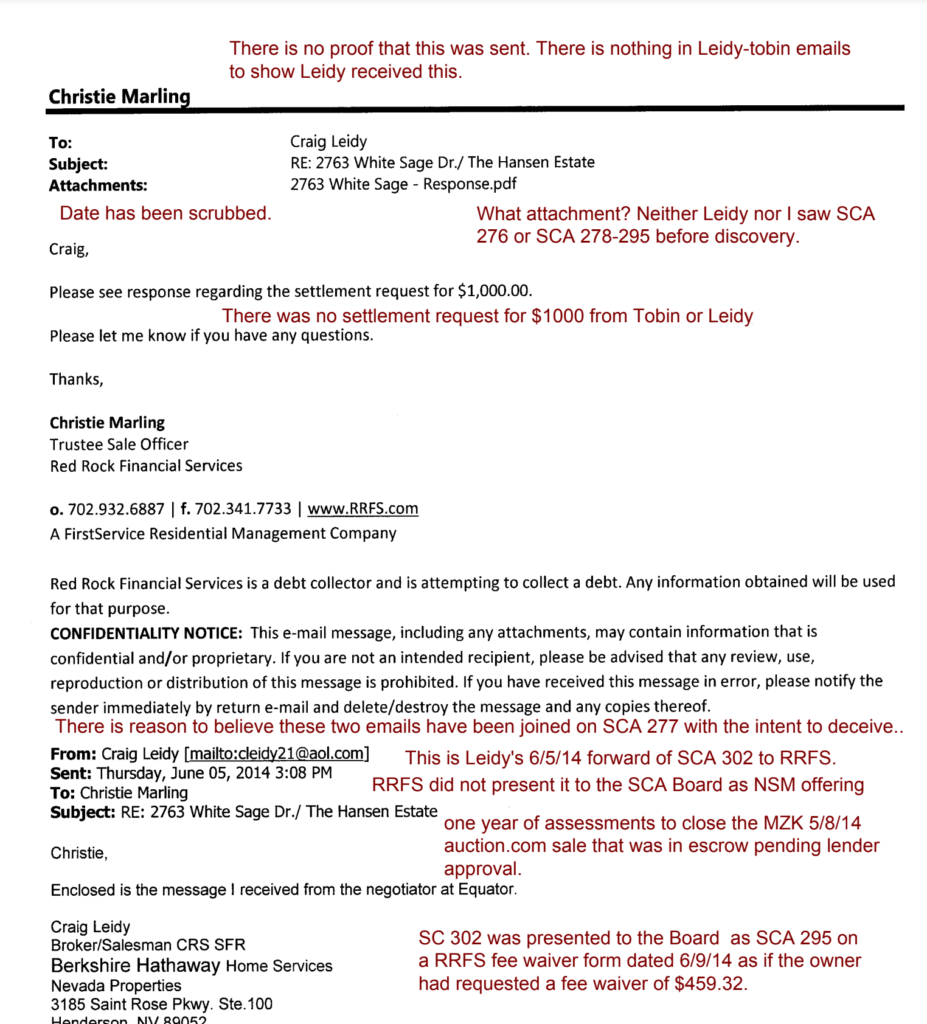

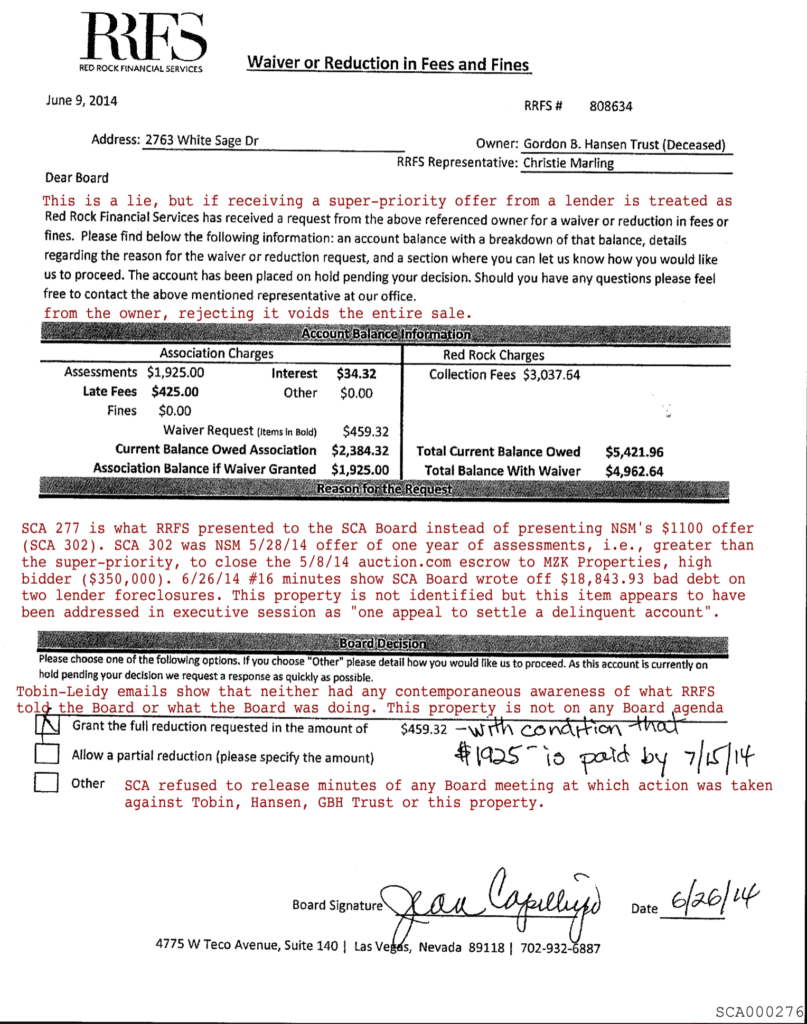

Red Rock covertly rejected Nationstar’s super-priority tender without telling the Sun City Anthem Board it ever came, but I didn’t find this out until five years later when I read the response to subpoena because all the Red Rock, Nationstar, and SCA attorneys agreed to cover it up. The scam will unfold from here.

Red Rock did not comply with NRS 116A.640A (9) that prohibits an HOA from rejecting assessment payments because other amounts are due.

NRS 116A.640 Community manager prohibited from engaging in certain acts; exceptions. In addition to the standards of practice for community managers set forth in NRS 116A.630 and any additional standards of practice adopted by the Commission by regulation pursuant to NRS 116A.400, a community manager shall not:

9. Refuse to accept from a unit’s owner payment of any assessment, fine, fee or other charge that is due because there is an outstanding payment due.

NRS 116A.640 (9)

Red Rock did not comply with NRS 116A.630(a)(1) requirement to act as a fiduciary to the HOA always

NRS 116A.630 Standards of practice for community managers. In addition to any additional standards of practice for community managers adopted by the Commission by regulation pursuant to NRS 116A.400, a community manager shall:

NRS 116A.630(1)(a)

1. Except as otherwise provided by specific statute, at all times:

(a) Act as a fiduciary in any client relationship

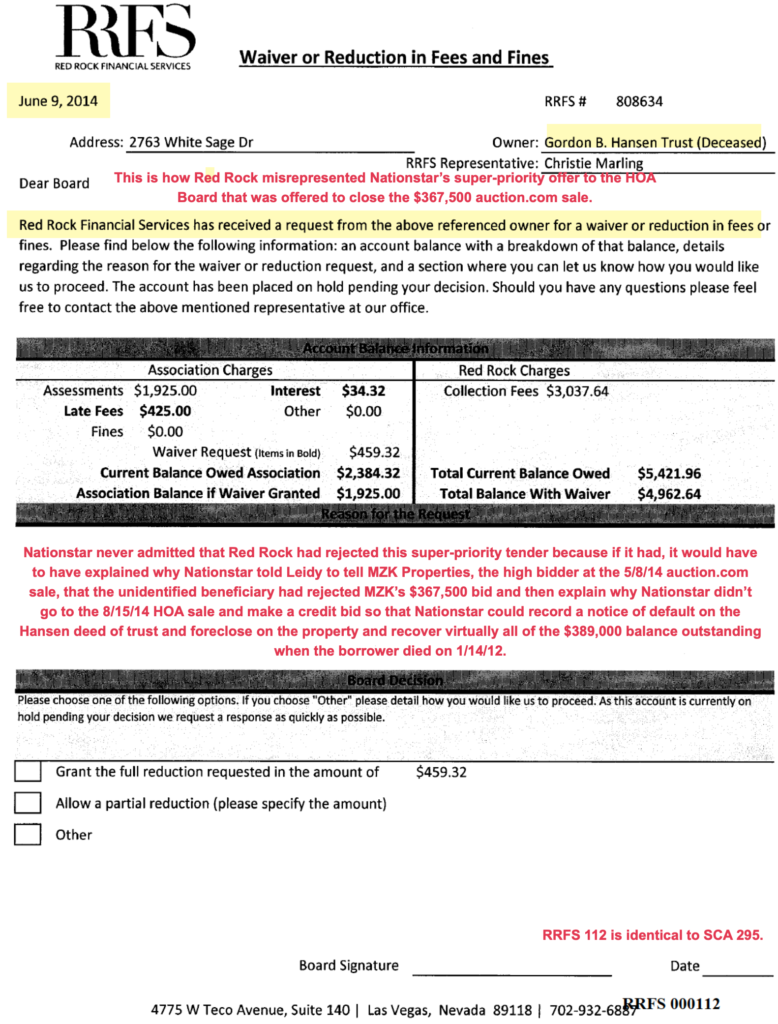

6/9/14 Red Rock fraudulently misrepresented the superpriority tender to the HOA Board as owner request for waiver

Red Rock then faked notices to me and to my agent that were never sent to say the nonexistent request was rejected.

SCA 276 shows the Board accepted it and gave a deadline of 7/15/14 that neither I nor my agent knew about in 2014.

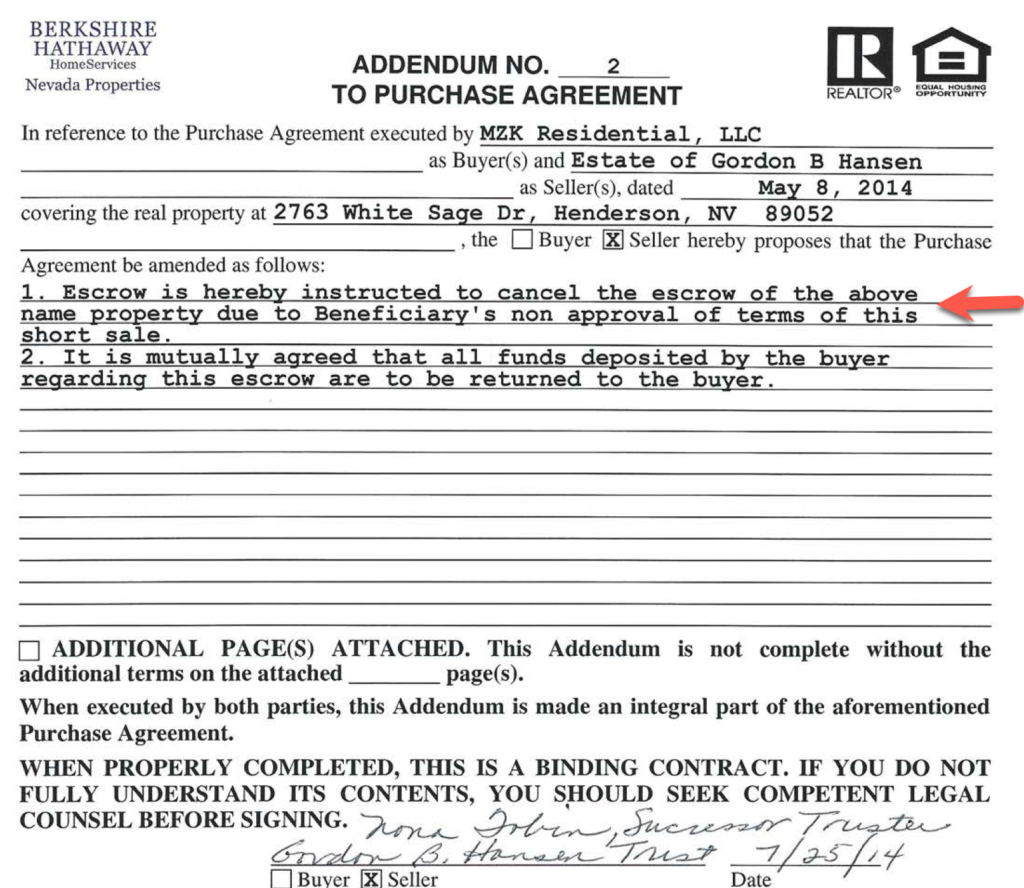

Nationstar said the beneficiary rejected the auction.com $367,500 offer and to put it back on the market at $390,000

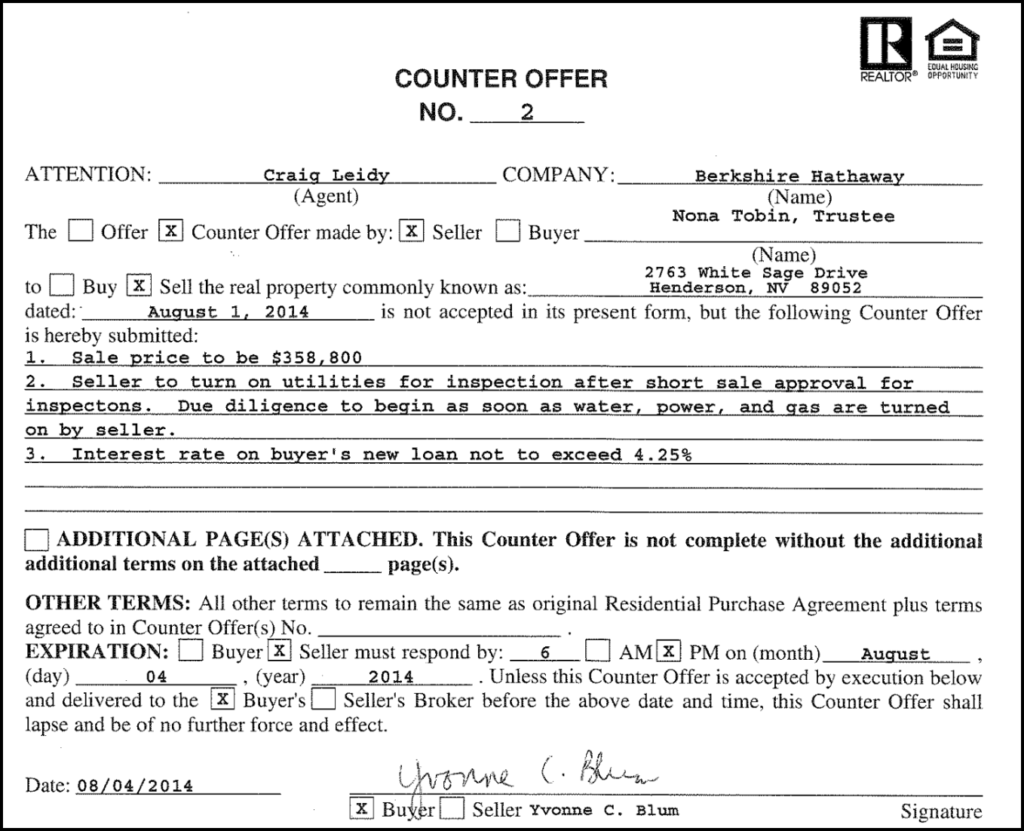

Another $358,800 offer was pending lender approval when without notice Red Rock sold it for $63,100 to an insider