Legal fees have exploded since we went to self management. The primary causes of these costs are, if not avoidable, at least should be subjected to considerable control (by owners!):

- Use of attorneys for decisions or staff work that should be done by a Community Association Manager or the Board.

- Board using the attorney to give them “legal cover” for unlawful, or at least, inappropriate actions a majority wants to take.

- The Board abdicating to the GM excessive authority and allowing her to use the attorney for her own, sometimes unlawful, purposes.

- Board’s failure to prohibit concealing SCA records as required by law.

- Board’s refusal to allow appropriate owner oversight.

- Litigating foreclosure disputes between banks and debt collectors.

- Using managing agents or attorneys as debt collectors.

Cost of collection should NEVER exceed the amount collected

This article is focused on the legal costs generated by SCA’s debt collection and foreclosure history and methods. Hopefully, it will be easy to understand why these expenditures should be eliminated and how to do it.

I will also probably slide into how much money SCA homeowners are investing in, I mean, wasting by paying attorneys to hide financial and other SCA records from the owners since that is a VERY big number too.

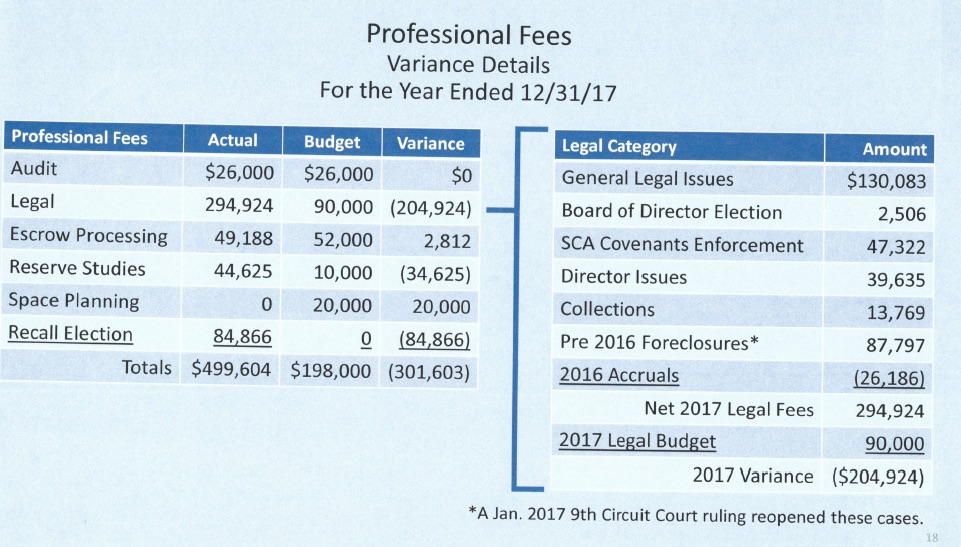

Remind me, how much is SCA paying for legal services?

In 2017, more than $320,000 – three times the budget.

What cost am I talking about is this article?

2017

$87,797 for “Pre-2016 Foreclosures”

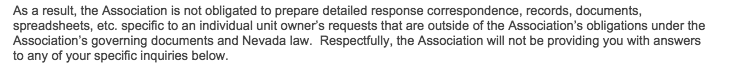

$39,635 for Director issues (meaning writing me “legal letters” telling me to shut up about collection issues and to stop asking about GM compensation or criticizing her performance, both of which the attorney claims are ways that I could have made a profit by sitting on the Board)

An unknown additional amount since the attorney has blocked access to the records and refused to answer my questions.

How does leaving questions unanswered serve owners?

2018 legal & collection fees?

For the first two months of 2018, the legal fees were astronomical, but I can’t analyze them because the attorney has ruled that it is okay for him to keep it a secret what he is being paid for.

- $43,022 – Write off bad debt (Allegedly bank foreclosures)

- $38,000 – January legal services (Unknown purpose, but guessing, half was for “legal cover” and denying owners access to information like cases and contracts to which SCA is a party

- $41,760 – February legal services (Unknown. Same guess.)

Debt collection – SCA-style

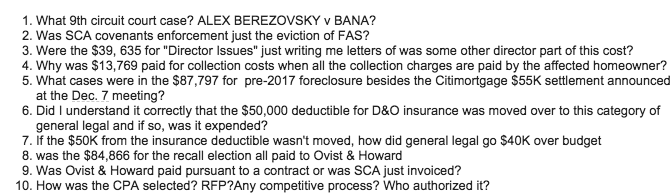

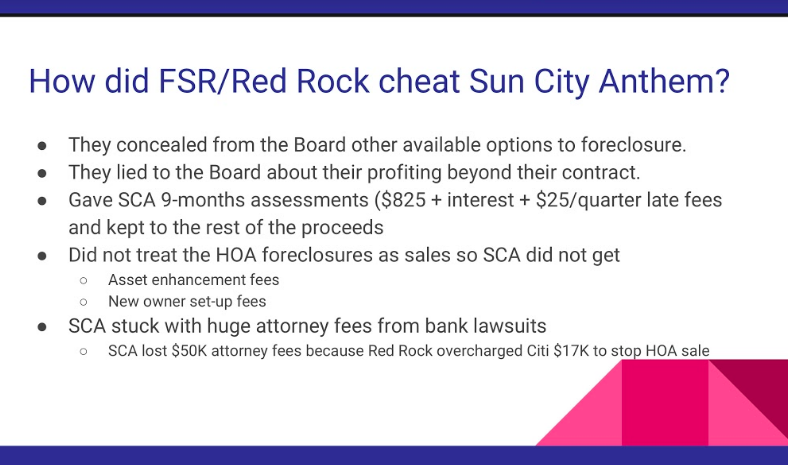

Ignore the period before the housing market crashed. Start with FSR as SCA’s managing agent. FSR was supposed to be a fiduciary, but it got complicated when FSR’s debt collector’s license was used by its “subsidiary”, Red Rock Financial Services, to handle collections and foreclosures for delinquent assessments.

Generally speaking,

What’s wrong with the managing agent having financial ties with the debt collector?

Well, after the housing market crashed, there were many homes in default, and there was lots of confusion about who owned what because of the way mortgage-backed securities and banks failed.

When the manager is, in a sense, on both sides of financial transactions, the controls to prevent fraud are absent. Within an environment were records are concealed and there are no audits, the temptation to cut corners and make a quick buck is pretty hard to overcome.

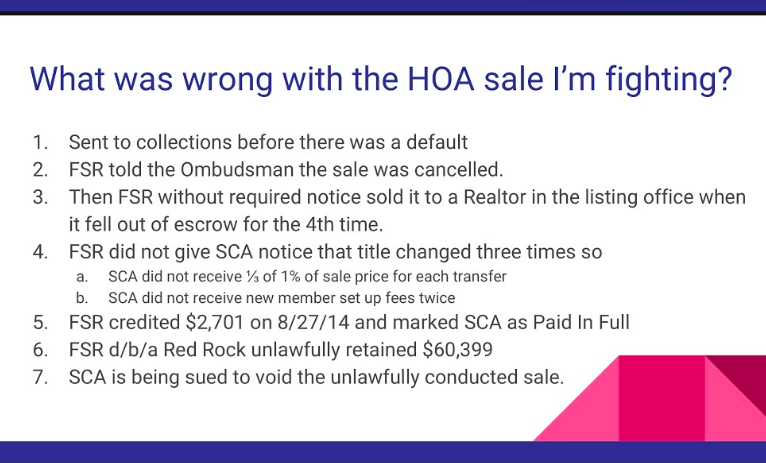

Use my late fiance’s house as an example

They simply didn’t follow the timelines or notice procedures required by law. And they didn’t tell the Board, the owner, the bank, or the Ombudsman what they were doing. Then, they falsified the records of what they did.

Bottom line

In at least this example, FSR marked in SCA records that the account was as paid in full, so SCA no longer had any financial interest in the property and didn’t write off any debt. No reason for anyone to question why SCA’s records don’t match the Ombudsman’s records nor the County Recorder’s or Assessor’s property records.

Red Rock Financial Services told the Ombudsman that the sale was cancelled in May 2014, but then held it anyway in August and allegedly sold it to a Realtor in the listing office for $63,100. Red Rock didn’t tell anybody that it had been sold and refused to distribute the proceeds as required by law. FSR didn’t record it as a sale, and there is no SCA record of a sale happening. There was no escrow so SCA did not collect the 1/3 of 1% asset enhancement fee that’s required on every sale.

This confusion or falsification of the transfer of title occurred three times on this property that I have documented, but because FSR didn’t keep track of the title transfers, SCA didn’t get any of the revenue. SCA didn’t get two out of the three new owner set up fees either.

Some conflicts of interest are real –

the conflict they accuse me of is NOT!

Transparent, accessible records would go a long way to prevent SCA from losing revenue caused by mistakes and fraud.

Or as in this case, restrict overlapping financial loyalties from shifting the allegiance of the association manager to align with the debt collector instead of aligning with the interests of the homeowners.

The GM did an RFP and replaced our debt collector, FSR d/b/a Red Rock Financial Services with attorneys to do debt collection.

From the frying pan into the fire

The new attorney/debt collector, Alessi & Koenig, was not a reputable bunch, and without telling SCA, dissolved the LLC corporation, filed for chapter 7 bankruptcy, hid their assets and morphed into HOA Lawyers Group.

Just as an aside, bankruptcy court records show that Alessi & Koenig kept $2.6 million out of the proceeds from $2.9 million from HOA foreclosure sales instead of distributing them as required by NRS 116.31164.

This failure to distribute proceeds is a common place dirty trick among debt collectors in HOA foreclosure sales. It is a BIG reason why HOAs all over Nevada are being stuck with horrendous attorney fees because the HOA is responsible for the acts of its agents. It is also what happened when my late fiance’s house was sold. SCA’s debt collector kept $60,200, paid off no liens, and gave SCA only $2,701.04.

For obvious reasons, they needed to be replaced by a new debt collector, but where the GM led the Board astray was to also get rid of the Leach law firm as legal counsel and to hire the Clarkson Law Group to be both SCA’s legal counsel and debt collector.