Due process is required before a person’s property can be confiscated

Excerpt from page 2 of Nationtar’s 5/10/16 filing into A-15-720032-C According to Nationstar’s attorneys, Nona Tobin is NOT entitled to due process before her property

Owners should ALWAYS come first!

Excerpt from page 2 of Nationtar’s 5/10/16 filing into A-15-720032-C According to Nationstar’s attorneys, Nona Tobin is NOT entitled to due process before her property

Link to 2020 court hearings Part 1 Link to 2/16/21 online complaint receipt to the Nevada Bar vs. Brittany Wood Link to Complaint OBC21-0187 vs.

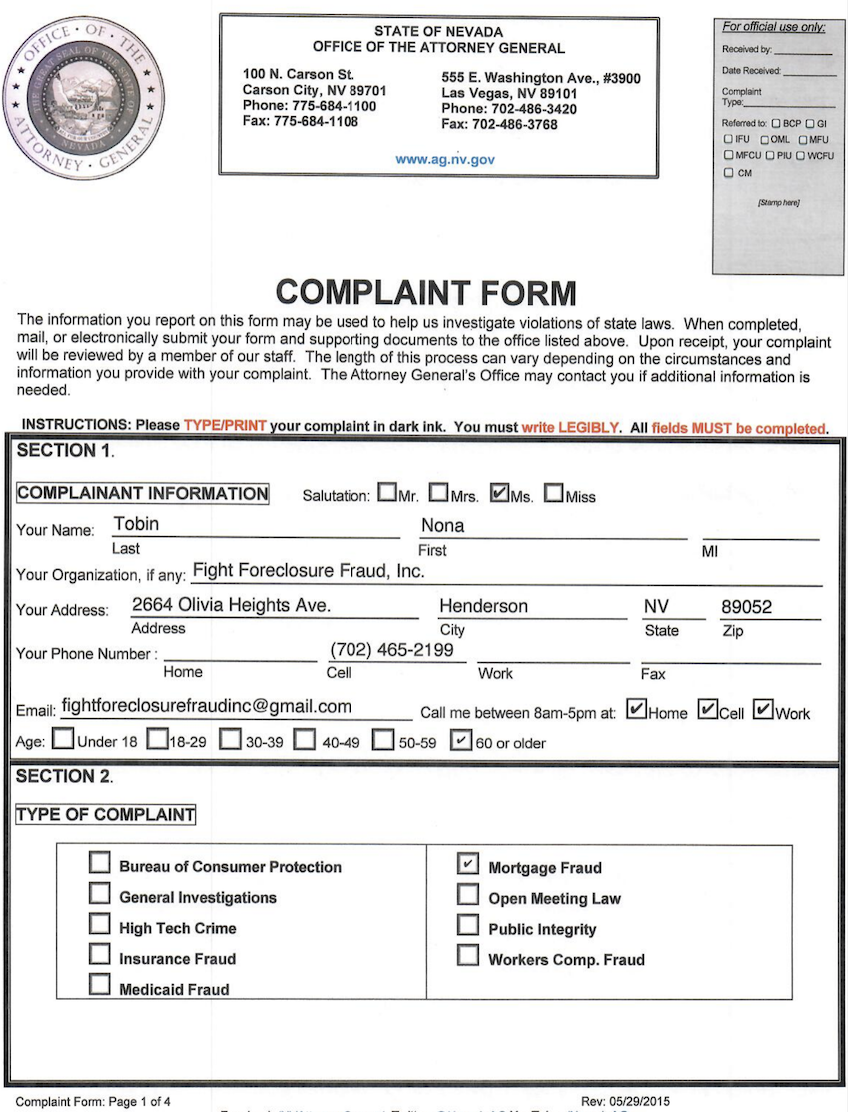

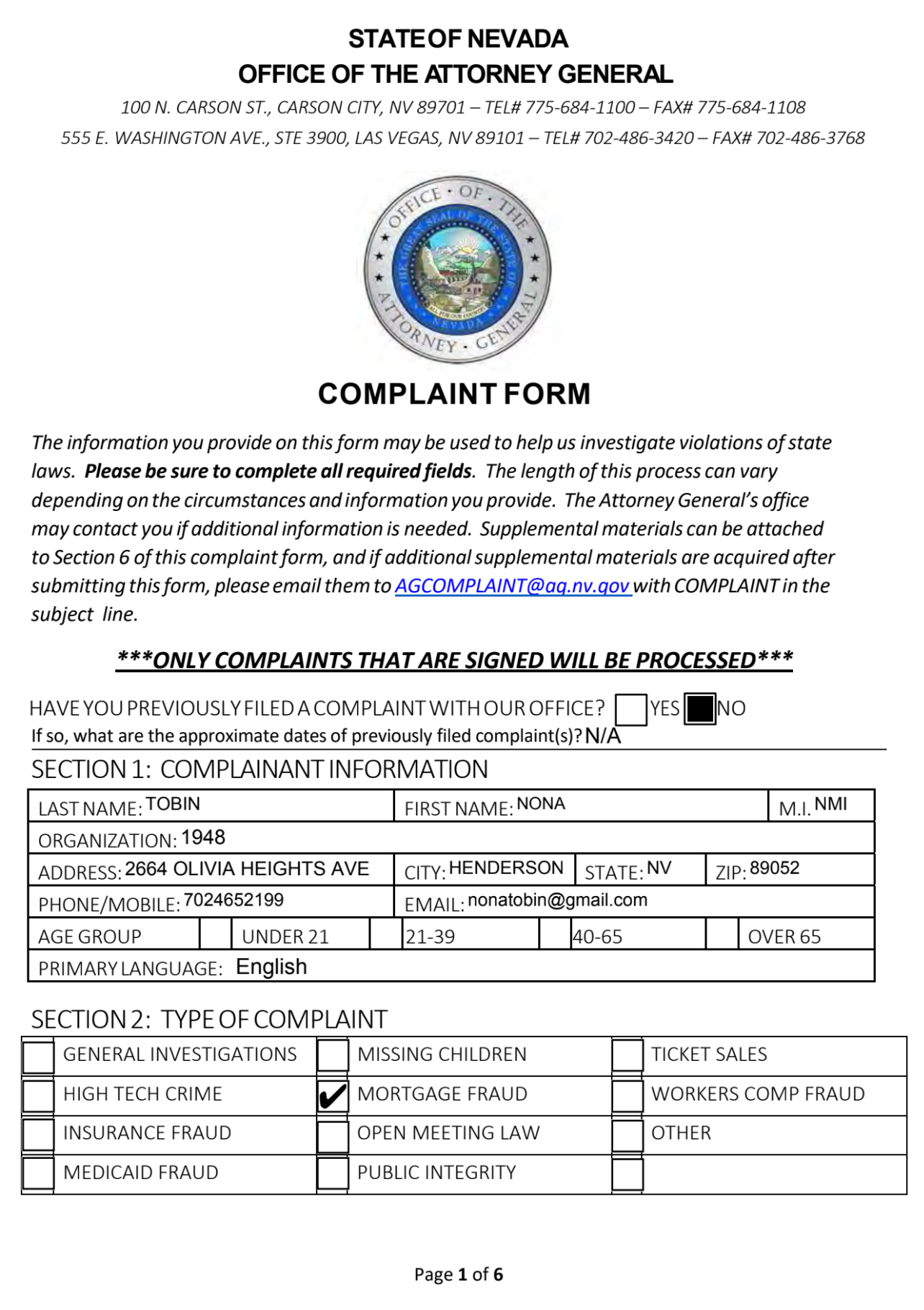

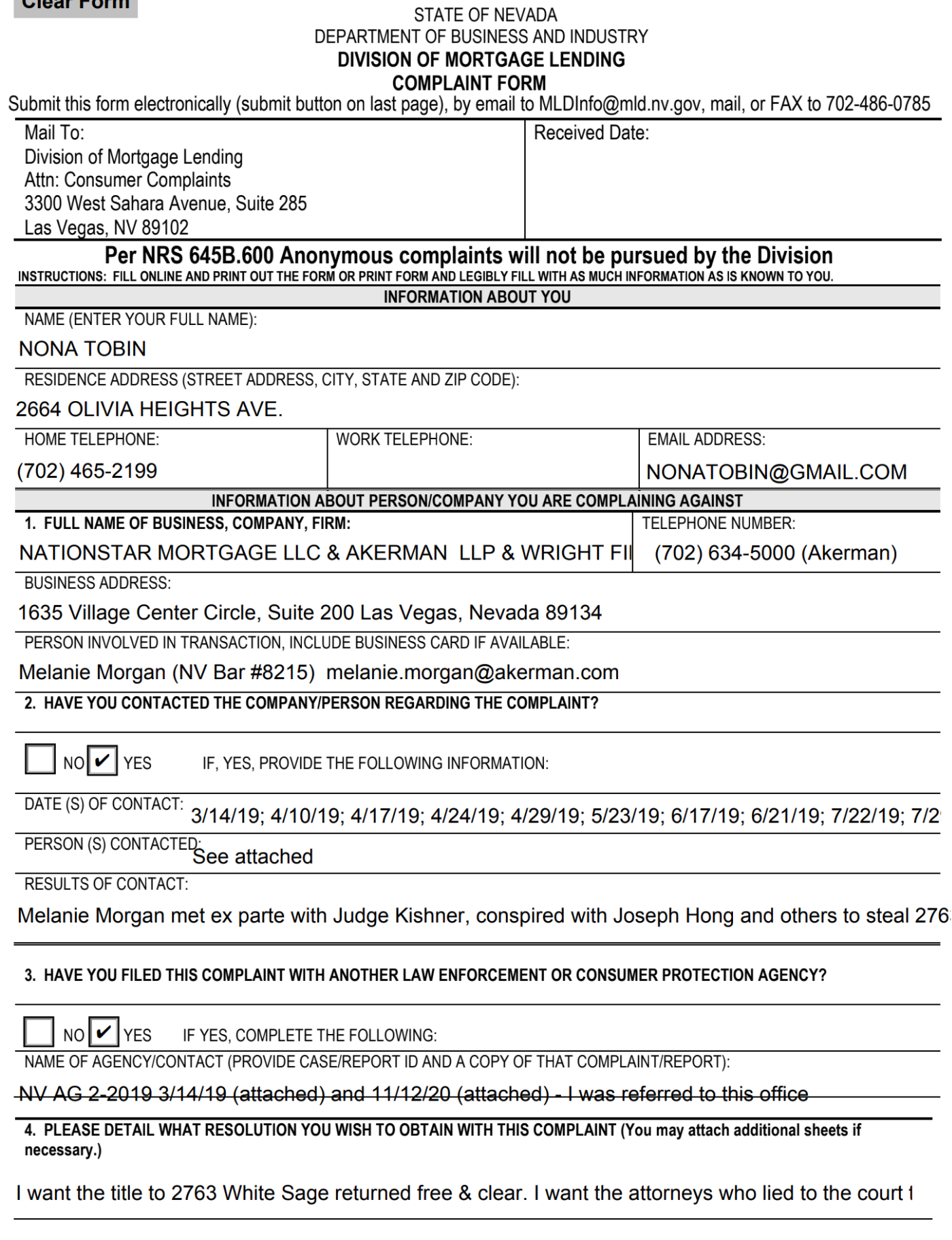

Links to exhibits to 2nd complaint to the Nevada Attorney General 12/1/14 Assignment Nationstar – no power of attorney – executed B of A to

Links to Exhibits to 3/14/19 complaint to the NV Attorney General 2011 Certified fraud examiner Amicus curiae MA Supreme Court 7/15/2004 Western Thrift Deed of

Table of Contents of Exhibits