Comes now, Defendant NONA TOBIN, an individual, in proper person, hereby files her OPPOSITION TO RED ROCK FINANCIAL SERVICES’S MOTION TO DISMISS TOBIN’S COUNTER-CLAIMS AND PETITION FOR SANCTIONS. This opposition is based on the memorandum of points and authorities, the pleadings and papers on file in this case and any oral arguments made at the time of the hearing.

MEMORANDUM OF POINTS AND AUTHORITIES

INTRODUCTION

Red Rock’s 4/16/21 motion to dismiss Tobin’s 3/8/21 counterclaim is its seventh attempt to evade accountability for its fraudulent conduct of the secret, unauthorized 8/15/14 sale of 2763 White Sage and its failure to distribute nearly $60,000.

Red Rock’s motion to dismiss fails as it does not meet the NRCP 12(b)(5) standard.

A motion to dismiss must be granted where it appears to a certainty that the plaintiff is entitled to no relief under any set of facts that could be proved in support of a claim.

Buzz Stew, LLC v. City of N. Las Vegas, 124 Nev. 224, 228 (2008); Blackjack Bonding v. Las Vegas Mun. Ct., 116 Nev.1213,1217 (2000); Simpson v. Mars Inc., 113 Nev. 188, 190 (1997).

Red Rock reliance on claims preclusion also fails, as this opposition will show, as there was no full and fair opportunity for Tobin to litigate in previous actions, and that the other elements (same parties and same claims) are not met.

Red Rock’s arguments that Tobin’s claims are time-barred and were not pled with sufficient particularity are not supported by the facts or the law.

The Court must reject Red Rock’s attempt to prevent the imposition of sanctions as the evidence clearly shows it was culpable of secretly selling without authorization, and failing to distribute the proceeds of at least a dozen Sun City Anthem homes and then falsifying accounts, entering false evidence into the court record to cover it up.

Further, as neither Red Rock nor the cross-defendant banks filed a responsive pleading, and have not proffered any evidence to refute Tobin’s claims of fraud, racketeering and conversion, or cited any legal authority to support the notion that they acted lawfully, Tobin’s petition for sanctions should be granted.

STATEMENT OF FACTS

- Without proper authorization, notice and due process, Red Rock secretly sold the subject property, and about a dozen other Sun City Anthem properties, in 2014 and retained the proceeds in an unsupervised, unaudited, unauthorized account outside the control of the Sun City Anthem board of Directors.

- Red Rock, aided and abetted by others, covered up the fraud involved in the foreclosure by producing an unverified, uncorroborated, falsified, incomplete, and inaccurate set of accounts and records called the “Red Rock foreclosure file” and/or by misrepresenting or covering up the true facts six times into various Nevada courts before the instant motion to dismiss per NRCP 12(b)(5):

1) on 5/31/18 through Sun City Anthem disclosures (SCA 176-643);

2) on 2/5/19 though Sun City Anthem’s reliance of the falsified record in its unwarranted and harassing motion for summary judgment;

3) on 2/11/19 in response to Tobin’s subpoena (RRFS 001-425),

4) on 11/13/19 by nonresponsiveness in NRS 38.310 mediation;

5) 6/23/20 Red Rock motion to dismiss per NRCP 12(b)(5) & (6), and

6) 7/1/20 through Sun City Anthem response into Nevada Supreme Court case 79295.

- See “SCA Board secretly sold a dozen houses in 2014” and “SCA Board did not properly authorize any foreclosure conducted by Red Rock” and “Red Rock foreclosure file is false, falsified and fraudulent” and “Deceptive disclosures: 12/5/13 meeting vs. SCA 315 & RRFS 148” and “SCA Board did not comply with HOA meeting laws” and Ombudsman’s Notice of Sale records for 17 foreclosures ) and “Due process is required before a person’s property can be confiscated”.

- Tobin has suffered approximately $750,000 in actual damages as a result of opposing parties’ intentional conduct of recording false claims to title, entering false evidence into the court record, meeting ex parte with Judge Kishner, and knowingly misrepresenting material facts in papers filed with the courts.

- Tobin filed a motion for summary judgment vs. Red Rock, Nationstar & Wells Fargo on 4/15/21 as none of the defendants filed a responsive pleading to Tobin’s 3/8/21 AACC and also on 4/15/21, re-filed a motion to distribute the proceeds.

- Tobin filed a complaint vs. Judge Kishner with the Nevada Commission on Judicial Discipline on 1/28/21 (for ex parte communications and failure to hear and decide in the first proceedings).

- See NCJD complaint and the exhibits linked below that identify explicitly how there was no full and fair opportunity for Tobin to litigate these claims previously.

ATTACHMENT 1 NV CODE OF JUDICIAL DISCIPLINE EXCERPTS

ATTACHMENT 2 NCJD OUTLINE OF CLAIMS VS. KISHNER

ATTACHMENT 3 1/28/NCJD COMPLAINT VS. KISHNER

ATTACHMENT 4 UNHEARD MSJ VS. JIMIJACK

ATTACHMENT 5 UNHEARD MSJ VS. ALL

ATTACHMENT6 EVIDENCE STRICKEN EX PARTE

ATTACHMENT 7 NOTICE OF TOBIN- HANSEN TRUST COMPLETION OF MEDIATION

ATTACHMENT 8 4/14/19 NONA TOBIN DECL VS. NATIONSTAR

ATTACHMENT 9 3/14/19 COMPLAINT TO THE NV ATTORNEY GENERAL

ATTACHMENT 10 11/10/20 2ND COMPLAINT TO THE NV ATTORNEY GENERAL

ATTACHMENT 11 EX PARTE MINUTES

ATTACHMENT 12 EX PARTE TRANSCRIPT

ATTACHMENT 13 RECORDED FRAUD BY NATIONSTAR

ATTACHMENT 14 EX PARTE 001-005 KISHNER

ATTACHMENT 15 OBSTRUCTION OF FORCED LITIGATION

ATTACHMENT 16 EX PARTE STRICKEN NOT HEARD

- Tobin filed a recommendation to the Commission to hold filing formal public charges against Judge Kishner pending a determination in this case as the possibility that Judge Kishner was merely duped by the misrepresentations of opposing counsels or whether she was complicit. and 3/10/21 Recommendation to NCJD to postpone formal charges

- On 3/22/21 TPC, Tobin filed, but has not served, a third-party complaint against six of the attorneys who aided and abetted the criminal conduct of their clients.

- Tobin’s Request for judicial notice filed on 3/15/21 RFJN identifies the fraudulent recorded documents on the property record. The alleged fraud identified in the property record was in Exhibit 1 to Tobin’s 3/8/21 AACC.

- Tobin’s Request for Judicial Notice filed on 4/4/21 RFJN identifies the false evidence Red Rock produced in response to subpoena and other opposing parties produced or disclosed in discovery. The false evidence was delineated in the exhibits that are summarized herein below.

- The Request for Judicial Notice filed on 4/7/21 RFJN identifies the myriad laws, regulations and contract terms that were breached by Red Rock and other opposing parties in relation to the unlawful foreclosure sale and the subsequent fraudulent claims recorded and filed adverse to Tobin. These laws and regulations are listed and linked below in AACC summarized Exhibits 18 and 19.

- The Request for judicial notice filed on 4/9/21 RFJN provides links to Tobin’s multiple unheard administrative complaints and civil claims. See Exhibit 20 below.

LEGAL STANDARD AND ARGUMENT

Red Rock did not meet its burden of proof pursuant to NRCP 12(b)(5)

Pursuant to NRCP 12(b)(5), a motion to dismiss should be granted upon “failure to state a claim upon which relief can be granted.” A motion brought under NRCP 12(b)(5) tests the legal sufficiency of the claim as alleged by the moving party A motion to dismiss must be granted where it appears to a certainty that the plaintiff is entitled to no relief under any set of facts that could be proved in support of a claim. Buzz Stew, LLC v. City of N. Las Vegas, 124 Nev. 224, 228 (2008); Blackjack Bonding v. Las Vegas Mun. Ct., 116 Nev. 1213,1217 (2000); Simpson v. Mars Inc., 113 Nev. 188, 190 (1997). Dismissal is proper “where the allegations are insufficient to establish the elements of a claim for relief.” Stockmeier v. Nevada Dept. of Corrections Psychol. Rev. Panel, 183 P.3d 133, 135 (Nev. 2008). (emphasis added.

4/16/21 Red rock Motion to dismiss pursuant to NRCP 12(b)(5) page 7

Red Rock did not meet its burden of proof that Tobin’s five causes of action (distribute interpleaded funds to sole claimant Tobin; conversion/unjust enrichment; fraud; pierce the corporate veil; and racketeering) met the elements of claims preclusion.

Estate of Adams ex rel. Estate v. Fallini, 386 P.3d 621, 624 (Nev. 2016) (“issue preclusion requires, inter alia , that “the issue decided in the prior litigation must be identical to the issue presented in the current action.”

Five Star Capital Corp. v. Ruby , 124 Nev. 1048, 1055, 194 P.3d 709, 713 (2008) (internal quotation marks omitted).”)

Public policy favors adjudication on the merits.

“But, we also recognize that dismissal “is a harsh remedy to be utilized only in extreme situations” and should be “weighed against the policy of law favoring the disposition of cases on their merits.” Id. at 393, 528 P.2d at 1021. ”

McKinney v. Martinez, No. 60017, at *3 (Nev. Jan. 29, 2014)

“NRCP 15(a) (“[L]eave [to amend] shall be freely given when justice so requires.”); Moore v. Cherry, 90 Nev. 390, 393, 528 P.2d 1018, 1021 (1974) (“[D]ismissal with prejudice is a harsh remedy to be utilized only in extreme situations .”

Marion v. Talecris Res. Plasma Ctr., No. 63018, at *3 (Nev. Feb. 27, 2015)

There was no valid judgment in the prior proceedings as the judgment in the first proceedings was based upon a fraud upon the court

“[W]hen a judgment is shown to have been procured by fraud upon the court, no worthwhile interest is served in protecting the judgment.” Id. at 653, 218 P.3d at 858 (internal quotation marks omitted). We have defined a “fraud upon the court” as “only that species of fraud which does, or attempts to, subvert the integrity of the court itself, or is a fraud perpetrated by officers of the court so that the judicial machinery cannot perform in the usual manner its impartial task of adjudging cases….” Id. at 654, 218 P.3d at 858 (emphasis added) (internal quotation marks omitted). “An attorney is an officer of the court”; as such, an attorney “owes a duty of loyalty to the court …, [which] demands integrity and honest dealing with the court.” Id. at 654–55, 218 P.3d at 858-59 (internal quotation marks omitted). “And when [an attorney] departs from that standard in the conduct of a case[,] he perpetrates fraud upon the court.” Id. at 655, 218 P.3d at 859 (internal quotation marks omitted). Even then, relief from a judgment based on fraud upon the court is rare and normally “available only to prevent a grave miscarriage of justice.”

United States v. Beggerly , 524 U.S. 38, 47, 118 S.Ct. 1862, 141 L.Ed.2d 32 (1998) ; see also Bonnell v. Lawrence , 128 Nev. 394, 400, 282 P.3d 712, 715 (2012).

“Zealous advocacy is the cornerstone of good lawyering and the bedrock of a just legal system. However, zeal cannot give way to unprofessionalism, noncompliance with court rules, or, most importantly, to violations of the ethical duties of candor to the courts and to opposing counsel.”

Thomas v. City of North Las Vegas, 122 Nev. 82, 96 (Nev. 2006)

Nevada law prohibits a court from granting quiet title without an evidentiary hearing (NRS 40.110). In five years of litigation, no Nevada Court has based any of its decisions in this case on an evidentiary hearing, including the quiet title decision.

“We first hold that each party in a quiet title action has the burden of demonstrating superior title in himself or herself.”

While the “burden of proof [in a quiet title action] rests with the plaintiff to prove good title in himself,” Breliant v. Preferred Equities Corp., 112 Nev. 663, 669, 918 P.2d 314, 318 (1996), abrogated on other grounds by Delgado v. Am. Family Ins. Grp., 125 Nev. 564, 570, 217 P.3d 563, 567 (2009), “a plaintiff’s right to relief [ultimately] . . . depends on superiority of title,” W. Sunset 2050 Tr. v. Nationstar Mortg., LLC, 134 Nev., Adv. Op. 47, 420 P.3d 1032, 1034 (2018) (internal quotation marks omitted).

And because “[a] plea to quiet title does not require any particular elements, . . each party must plead and prove his or her own claim to the property in question.” Chapman v. Deutsche Bank Nat’l Tr. Co., 129 Nev. 314, 318, 302 P.3d 1103, 1106 (2013) (internal quotation marks omitted).”

Res. Grp., LLC v. Nev. Ass’n Servs., Inc. 135 Nev., Adv. Opinion 8

All courts in prior and appellate proceeding have made erroneous decisions by relying on argument solely based on Red Rock’s falsified file and having no evidentiary hearings. See 4/12/21 Order of Affirmance in case 79295.

The court order, entered on 4/18/19, that granted Sun City Anthem’s motion for summary judgment as to the quiet title claim of the Hansen Trust and Nationstar’s 2/12/19 joinder thereto, was solely based on a fraud on the court.

“An attorney is an officer of the court”; as such, an attorney “owes a duty of loyalty to the court …, [which] demands integrity and honest dealing with the court.” Id. at 654–55, 218 P.3d at 858-59 (internal quotation marks omitted). “And when [an attorney] departs from that standard in the conduct of a case[,] he perpetrates fraud upon the court.” Id. at 655, 218 P.3d at 859 (internal quotation marks omitted). Even then, relief from a judgment based on fraud upon the court is rare and normally “available only to prevent a grave miscarriage of justice.” United States v. Beggerly , 524 U.S. 38, 47, 118 S.Ct. 1862, 141 L.Ed.2d 32 (1998) ; see also Bonnell v. Lawrence , 128 Nev. 394, 400, 282 P.3d 712, 715 (2012).”)

Estate of Adams ex rel. Estate v. Fallini, 386 P.3d 621, 625 (Nev. 2016)

Tobin’s 4/24/19 motion to vacate the 4/18/19 order pursuant to NRCP 60 (b)(3) and the attached motion for summary judgment against all parties were never heard or ruled on by Judge Kishner. See Exhibit 1 for 4/24/19 MVAC and MSJ.

Tobin’s 7/29/19 Tobin motion to dismiss per NRS 38.310(2) in Exhibit 2 was never heard or ruled on by Judge Kishner.

Tobin’s 7/22/19 motion for a new trial pursuant to NRCP 52(b) and NRCP 59(a)(1)(B)(C)(F) was never heard or ruled on by Judge Kishner. See Exhibit 3.

“counsel violates his duty of candor to the court when counsel: (1) proffers a material fact that he knew or should have known to be false, see generally Sierra Glass & Mirror v . Viking Indus., Inc. , 107 Nev. 119, 125–26, 808 P.2d 512, 516 (1991) (providing that counsel committed fraud upon the court “in violation of SCR 172(1)(a) and (d)” when he proffered evidence and omitted pertinent portions of a document to “buttress” his client’s argument, and that he “knew or should have known” that the omitted portion was harmful to his client’s position); cf. Seleme v. JP Morgan Chase Bank , 982 N.E.2d 299, 310–11 (Ind. Ct. App. 2012) (providing that under FRCP 60(b)(3),”)

Estate of Adams ex rel. Estate v. Fallini, 386 P.3d 621, 625-26 (Nev. 2016)

All courts in prior and appellate proceedings have made erroneous decisions by relying on argument solely based on Red Rock’s falsified file and having no evidentiary hearings.

There is no evidence in the record that refutes the evidence Tobin provided to the court in the four requests for judicial notice and the 22 exhibits to the 3/8/21 counter-claim and cross-claim and the 3/22/21 third-party claim

Red Rock, Nationstar and Wells Fargo did not timely file a responsive pleading to Tobin’s 3/8/21 answer, affirmative defenses and counter-claim (AACC) to refute her claims.

Red Rock’s introduction of 1000+ pages of exhibits and Tobin’s four requests for judicial notice and 22 exhibits to her AACC convert Red Rock’s motion to dismiss into an unsupported motion for summary judgment pursuant to NRCP 12 (d). None of Red Rock’s exhibits to its motions to dismiss, and none of its previous responses to subpoena include any verified evidence to refute Tobin’s claims.

Red Rock and Sun City Anthem entered no verified, unrefuted evidence in the court record to support their claims that the sale complied with all due process and notice requirements mandated by the U.S. and Nevada Constitutions, Nevada statutes and the HOA governing documents.

See 4/9/21 RFJN Request for Judicial notice of the NRCP 16.1 disclosures, responses to subpoenas, and disputed evidence in the court record.

Red Rock did not refute any of the factual allegations in AACC pages 22-23 quoted here below:

Plaintiff RRFS knows that all the liens recorded related to named Defendants other than Nona Tobin, i.e., Republic Services, Wells Fargo, and Nationstar have been released on 3/30/17, 8/17/04, 3/12/15, and 6/3/19, respectively. See Exhibit 1.

The HOA sale was void as payments and tenders after 7/1/12 were rejected, misappropriated, misrepresented and/or concealed. Default did not occur as described in the 3/12/13 Notice of default or as recited in the 8/22/14 foreclosure deed. See Exhibit 2.

The Default was cured three times, but RRFS kept pursuing the predatory path to unwarranted, unjustly profitable foreclosure. See Exhibit 3.

There was no valid authorization of the sale, but RRFS disclosed deceptive and falsified documents to create the misrepresentation of reality. See Exhibit 4.

Required notices were not provided, but RRFS falsified records to cover it up. See Exhibit 5.

SCA Board imposed the ultimate sanction against the estate of the deceased homeowner, but RRFS and SCA attorneys concealed and misrepresented material facts and the law to cover it up. See Exhibit 6.

Bank of America never was the beneficiary of the Hansen deed of trust, but committed mortgage servicing fraud, refused to let two fair market value sales close escrow, refused to take the title on a deed in lieu, took possession without foreclosing, and used attorney Rock K. Jung to covertly tender delinquent assessments to circumvent the owner’s rights under the PUD Rider remedies (f) to confiscate her property without foreclosing. See Exhibit 7.

Many examples of RRFS’s corrupt business practices exist of keeping fraudulent books, scrubbing page numbers from ledgers, combined unrelated documents to rewrite history, scrubbing dates from emails, not documenting Board actions, and much more. See Exhibit 8.

All opposing counsels in all the litigation over the title to this one property made misrepresentations in their court filings and made oral misstatements of materials facts and law at hearings. See Exhibit 9.

The proceeds of the sale were not distributed in 2014 and RRFS’s complaint for interpleader in 2021 was filed in bad faith. See Exhibit 10.

RRFS concealed the 4/27/12 debt collection contract that requires RRFS to indemnify the HOA and has been unjustly enriched thereby well over $100,000 in fees and considerably more in undistributed proceeds. RRFS did not participate in NRS 38.310 mediation in good faith. See Exhibit 11.

In case A-19-799890-C, Brody Wight knowingly filed a motion to dismiss Nona Tobin’s claims pursuant to NRCP (b)(5) and NRCP (b)(6) that was totally unwarranted, harassing, disruptive of the administration of justice, not supported by facts or law, and filed solely for the improper purpose of preventing discovery of the crimes of his law firm and its clients. See Exhibit 12.

None of the opposing counsels have acted in good faith in compliance with the ethic standard of their profession. All have failed in their duty of candor to the court, wasted millions of dollars in judicial resources, and have engaged in criminal conduct to further the criminal conduct of their clients. See Exhibit 13.

Attorneys have knowingly presented false evidence into the court record in discovery. See Exhibit 14.

Nationstar and RRFS conspired to conceal the manner in which RRFS covertly rejected Nationstar’s $1100 offer to close the MZK sale. Civil Conspiracy. See Exhibit 15.

Fraud, racketeering and conversion were pleaded with particularity.

The voluminous 22 exhibits to the 3/8/21 AACC were reformatted and summarized in the remaining pages of this opposition for the Court’s convenience of quick review.

Exhibit 1:APN 191-13-811-052 Clark Co. Property Record & allegations of fraud vs. all opponents

| Record date | Document type description |

| 2/12/21 | 202102120001549 DEED of trust 12/28/20 quicken LLC $355,320 loan 2 Chiesi |

| 2/5/21 | 202102050000420 Substitution/reconveyance of quicken INC 12/27/19 $353,500 loan to switch 2 12/28/20 $355,320 dot quicken LLC 2 Chiesi |

| 12/4/20 | 202012040001097 Order to expunge 8/8/19 LISP, 8/14/19 LISP & 8/14/19 LISP Tobin LIS pendens and to dismiss Tobin’s claims with prejudice recorded by quicken attorney maurice wood while appeals 82094, 82234, 82294 and 79295 are pending. |

| 2/6/20 | 202002060000199 reconveyance of Joel Stokes’s $355,000 5/23/19 dot that masqueraded as Nationstar-Jimijack deal. 5/21/19 transcript Nationstar-Jimijack settlement docs status check. T Dixon v-p 1st American Title executed reconveyance 2/5/20, > 1 month after quicken recorded 12/27/19 $353,500 loan 2 Chiesi and Driggs title allegedly insured the Chiesi title. |

| 2/6/20 | Substitution of trustee on Joel Stokes 5/23/19 $355,000 dot. 2/4/20 Tyson Christensen, v-p of fay servicing as if Morgan Stanley’s attorney in fact. No recorded power of attorney. |

| 12/27/19 | 201912270001346 DEED of trust 12/26/19 $353,500 quicken loans INC 2 Brian & Debora Chiesi |

| 12/27/19 | 201912270001345 DEED grant, sale bargain (not quit claim) Joel Stokes, an individual, alleged he had a valid title to transfer to Brian & Debora Chiesi. Joel Stokes didn’t have a valid title. Jimijack had no valid title to transfer to Joel Stokes on 5/1/19. Driggs title agency, INC. 7900 w sahara #100 lv 89117-7920. Escrow #19-11-120779jh DECLaration of value |

| 12/27/19 | 201912270001344 DEED Sandra 2 Joel Stokes, as spouses, not as Jimijack trustees. Joel and Sandra Stokes as trustees of Jimijack transferred Jimijack’s defective title to Joel Stokes, as an individual, on 5/1/19, 201912270001344 RPTT exemption 5 |

| 12/3/19 | 201912030003152 On 12/3/19 Hong recorded notice of 11/22/19 a-15-720032-c order that erroneously expunged Tobin 8/8/14 LIS pendens re a-19-799890-c 8/7/19 complaint and 7/23/19 appeal and 7/24/19 appeal into 79295 8/8/19 sca motion to strike Tobin’s pro se 8/7/19 nolp was granted on 9/3/19 rtran, but sua sponte 11/22/19 order was wrongly written to both expunge 8/8/19 LISP (outside judge kishner’s jurisdiction) and to strike 8/7/19 nolp from the a-15-720032-c court record 11/22/19 order, recorded 12/3/19, was unappealable per order 20-13346 wherein the nv supreme court claimed 11/22/19 order was outside its jurisdiction. 9/10/19 nv supreme court order 19-37846 denied Nona Tobin all rights to appeal any decision made by judge kishner. |

| 8/14/19 | 201908140003084 LIS pendens Tobin recorded 39 pages with a-19-799890-c complaint attached. On 8/13/19 Tobin filed nolp into a-19-799890-c |

| 8/14/19 | 201908140003083 LIS pendens related to Tobin/Hansen trust appeals 79295 7 pages plus receipt for recording both 8/14/19 LIS pendens |

| 8/8/19 | 201908080002097 LIS pendens (7 pages) related to 7/23/19 Hansen trust appeal & 7/24/19 appeals & 8/7/19 a-19-799890-c |

| 7/24/19 | 201907240003355 Judgment Hong recorded 6/24/19 order vs GBH trust on 7/24/19 after he received notice of two appeals filed on 7/23/19 and 7/24/19. 6/24/19 order expunged 56/19 LIS pendens which related to the claims of both Nona Tobin, an individual, and the Hansen trust , but Nona Tobin, an individual, was excluded from the trial and removed as a party unfairly due to the misrepresentations joseph Hong made to judge Kishner at a 4/23/19 hearing held ex parte due to Hong serving notice that the hearing was continued to 5/7/19. |

| 7/17/19 | 201907170002971 Assignment Stokes 5/23/19 dot 2 Morgan Stanley No proper purpose, but served to cloud the title and attempted to cover the dirty money trail. |

| 7/10/19 | 201907100002352 Akerman recorded (cover sheet) release of Nationstar’s 1/13/16 LISP re NSM vs op homes (ROLP page 2). Akerman did not serve any notice of the release into a-16-730078-c where my 4/24/19 motion to vacate the HOA’s MSJ and NSM’s joinder (per NRCP 60(b)(3) fraud) and motion for summary judgment vs all parties was still unheard. |

| 6/4/19 | 201906040000772 Assignment of Joel Stokes DEED of trust had no proper purpose, but served to cloud the title and attempted to cover the dirty money trail. |

| 6/3/19 | 201906030001599 substitution/ reconveyance release of LIEN of Hansen DEED of trust to Joel Stokes |

| 5/28/19 | 201905280002843 LIS pendens release of Nationstar’s LIS pendens by Joel & Sandra Stokes as trustees of Jimijack |

| 5/23/19 | 201905230003531 DEED of trust Joel Stokes-$355,000 DEED of trust from civic financial services |

| 5/6/19 | 201905060001022 LIS pendens Hansen trust/Tobin |

| 5/1/19 | 201905010003348 DEED Joel a. Stokes & Sandra f. Stokes, as trustees of Jimijack irrevocable trust to Joel a. Stokes, individual. The Joel Stokes’ DEED was recorded five weeks before the 6/5/19 trial. The 6/6/19 trial allegedly adjudicated GBHt trustee Nona Tobin’s 2/1/17 counterclaim vs Jimijack for quiet title & equitable relief, fraudulent reconveyance (Jimijack’s DEED was inadmissible per NRS 111.345), unjust enrichment (collecting rent from 9/25/14, not 6/9/15 as Jimijack DEED claimed, after a fraudulent sale), civil conspiracy (bid suppression, selective notice of sale to speculators) and preliminary/permanent injunctions (prevent sale or transfer during pendency of proceedings). The 6/6/19 trial also allegedly adjudicated 2/1/17 cross claim vs. Yuen k. Lee dba f. Bondurant LLC. Jimijack did not have an admissible DEED. No Jimijack irrevocable trust instrument was ever disclosed so there is no reason to believe there was any legal authority for trustees to revoke a title from an irrevocable trust and put it in the name of Joel a. Stokes, one of the trustees. |

| 3/8/19 | 201903080002790 Assignment Wells Fargo 2 Nationstar by Nationstar Mohamed Hameed executed as v-p of Wells Fargo On 3/12/19, two weeks after the end of discovery, akerman disclosed the rescission as NSM 409-411. |

| 3/8/19 | 201903080002789 3/8/19 NSM rescinded the 12/1/14 assignment of the Hansen DEED of trust from Bank of American 2 NSM by NSM. Mohamed Hameed executed it as v-p of Bank of American. No recorded power of attorney On 3/12/19, two weeks after the end of discovery, Akerman disclosed rescission as NSM 412- 413 |

| 3/31/17 | 201703310003073 Interest disclaimer lee/f Bondurant filed 3/8/17 NSM 222-227 |

| 3/31/17 | 201703310003072 Interest disclaimer Lucas/ophomes filed 3/8/17 NSM 218-211 |

| 3/31/17 | 201703310003071 Interest disclaimer Steve Hansen filed 3/28/17 NSM 212-217 |

| 3/30/17 | 201703300003860 Republic services released its 2nd garbage LIEN concealed by RRFS & NSM |

| 3/30/17 | 201703300003859 Republic services released its 1st garbage LIEN recorded 9/23/13 |

| 3/28/17 | 201703280001452 DEED Gordon B. Hansen trust 2 Nona Tobin, individual, NSM 208-211 |

| 6/7/16 | 201606070001450 LIS pendens re NSM 6/2/16 AACC vs Jimijack NSM 203-207 |

| 5/23/16 | 201605230001417 Request notice by Tobin 4 Hansen trust not disclosed by NSM |

| 5/23/16 | 201605230001416 Certificate of Incumbency Nona Tobin 4 Hansen trust |

| 1/13/16 | 201601130001051 LIS pendens re 1/11/16 complaint Nationstar vs opportunity homes |

| 12/1/15 | 201512010003402 Judgment of default vs Bank of American 10/23/15 JDDF. No notice of entry of the default judgment was served. Instead, Joseph Hong recorded the 10/23/15 unnoticed default judgment. Joseph Hong who knew, or should have known, that NRS 40.110 “Court to hear case; must not enter judgment by default” “the court shall proceed to hear the case as in other cases and shall have jurisdiction to examine into and determine the legality of plaintiff’s title and of the title and claim of all the defendants and of all unknown persons, and to that end must not enter any judgment by default, but must in all cases require evidence of plaintiff’s title and possession and receive such legal evidence as may be offered respecting the claims and title of any of the defendants and must thereafter direct judgment to be entered in accordance with the evidence and the law.” Joseph Hong knew that had the court held an evidentiary hearing, it would have been detected that Joel & Sandra Stokes as trustees of Jimijack Irrevocable Trust did not have an admissible DEED per NRS 111.345 and therefore had no standing to assert a quiet title claim against any lender. Joseph Hong knew that had the court held an evidentiary hearing, it would have been detected that two other lenders, Wells Fargo (9/9/14) and Nationstar (12/1/14), held recorded claims to be the beneficiaries of the 7/22/04 Hansen DEED of trust as Bank of America’s sole successor-in-interest. Joseph Hong knew that had the court held an evidentiary hearing, it would have been detected that Bank of America did not hold any recorded claim to the Hansen DEED of trust after 9/9/14 and that Hong’s naming BANA as a defendant was for the corrupt purpose of getting a default by a lender who had no claim. Nationstar NSM 192-194, but NSM denied knowing in 1/22/15 req notice, 4/12/15 AFFD, 4/12/16 mot |

| 8/17/15 | 201508170001056 Substitution of trustee Joan H. Anderson to NSM co-conspirator American Trustee Servicing Solutions by Nationstar, claiming without legal authority to be “attorney-in-fact” for Wells Fargo. No recorded Power of Attorney. Nationstar disclosed as NSM 270-272 is an unrecorded, inapplicable Wells Fargo Power of Attorney. Contradicted by NSM 6/3/19 sub/reconvey. |

| 6/9/15 | 201506090001545 DEED F. Bondurant LLC to Joel and Sandra Stokes as trustees of Jimijack Irrevocable Trust Inadmissible per NRS 111.345. 1/17/17 Tobin DECL re notary violations and exhibits re notary CluAynne M. Corwin’s involvement with several other questionable subsequent transfers of HOA foreclosures involving Joseph Hong, Joel Stokes, Pam at Linear Title, and Peter Mortenson No legal capacity to transfer title to Jimijack as notary CluAynne M. Corwin “witnessed” Yuen K. Lee’s signature but used her notary stamp to affirm that Thomas Lucas, manager of Opportunity Homes No notary record that CluAynne M. Corwin witnessed any deed executed on 6/8/15. No purchase agreement was disclosed to show how, when, from whom or for how much Joel and Sandra Stokes acquired the property. NRS 240.120, NRS 240.155, NRS 240.075 violations. Incompetent acknowledgment per NRS 111.125. Jimijack had no DEED with legal capacity to hold or transfer title, but transferred to Joel Stokes, an individual on 5/1/19. Jimijack’s defective deed was disclosed as NSM 189-191. Nationstar knew that the two deeds recorded on 6/9/15 alleged title claims that replaced Opportunity Homes LLC as an interested party. For unknown reasons, Nationstar chose not to name either F. Bondurant LLC or Jimijack, who both had recorded deeds on 6/9/15, when Nationstar sued disinterested Opportunity Homes in its 1/11/16 complaint in A-16-730078-C. Nationstar voluntarily dismissed its 1/11/16 claims against Opportunity Homes and its non-existent claims vs. F. Bondurant LLC by a stipulation and order entered on 2/20/19. Neither evidence nor trial were required to prevail. Nationstar never produced any evidence to support its filed claims against Jimijack and was excused from the 6/6/19 trial at the 4/25/19 pre-trial conference after Nationstar withdrew its 3/21/19 motion for summary judgment vs. Jimijack. Nationstar’s claims against Jimijack were dismissed by stipulation and order entered on 5/31/19. Again, neither evidence nor trial were required to prevail. |

| 6/9/15 | 201506090001537 DEED, from Opportunity Homes to F. Bondurant LLC, a sham entity controlled by Joseph Hong, was executed on 6/4/19, and witnessed by Joseph Hong’s employee, Debra Batsel. Batesel witnessed at the same time Thomas Lucas and some unknown party execute a purchase agreement to transfer title from Opportunity Homes. Joseph Hong did not participate in discovery and entered no evidence into the record at any time from 6/16/15. To the present to support any of his clients’ claims, but still won quiet title at the 6/6/19 trial from which all documentary evidence was excluded due to Hong’s misconduct. |

| 3/12/15 | 201503120002285 Substitution/ reconveyance Wells Fargo 2nd open-ended deed of trust |

| 2/23/15 | 201502230000608 RPTT refund 2 Thomas Lucas |

| 1/22/15 | 201501220001850 request notice Nationstar |

| 12/1/14 | 201412010000518 Nationstar’s assignment of the 7/22/04 Hansen deed of trust from Bank of America to Nationstar, was recorded three months after BANA had no interest to assign on 12/1/14. Nationstar refused to respond in good faith to Tobin’s interrogatories and requests for documents 12/1/14 was executed by Nationstar’s robo-signer in Nebraska and was rescinded by Nationstar’s robo-signer in Texas on 2/25/19, and recorded on 3/8/19. Nationstar disclosed the rescission two weeks after the end of discovery on 3/12/19. Because the sale was void by reasons of fraud, unfairness and oppression, neither the 8/27/08 Hansen Trust’s Deed nor the 7/22/04 Hansen Deed of Trust should have been extinguished by the fraudulent HOA sale. However, 4/18/19 order granted Nationstar’s fraudulent 2/12/19 limited joinder to order that the HOA sale was valid to extinguish the owner’s title rights, but it was not valid to extinguish Nationstar’s rescinded 12/1/14 claim to be Bank of America’s successor in interest. |

| 9/9/14 | 201409090000974 On 9/9/14, Bank of American recorded that it had assigned its interest in the Hansen deed of trust, if any, to Wells Fargo, effective 8/21/14, the day before the foreclosure deed was recorded. |

| 8/22/14 | 201408220002548 DEED HOA foreclosure 2 opportunity homes |

| 5/6/14 | 201405060004357 LIEN 2nd garbage was recorded on 5/6/14 and released on 3/30/17 |

| 2/12/14 | 201402120001527 notice of 3/7/14 HOA sale |

| 9/23/13 | 201309230001369 LIEN 1st garbage |

| 4/8/13 | 201304080001087 default 2nd HOA notice of default, |

| 4/3/13 | 201304030001569 notice of rescission of HOA 1st notice of default |

| 3/12/13 | 201303120000847 default HOA 1st notice of default |

| 12/14/12 | 201212140001338 LIEN $ 925.76 when $300 was due & owing |

| 4/12/12 | 201204120001883 assignment mers 2 Bank of American by Bank of American |

| 8/27/08 | 200808270003627 DEED Gordon Hansen B. Hansen Trust, dated 8/22/08, was recorded when the GBH Trust was created. Title was extinguished by the 8/22/14 recording of a foreclosure deed as was the 7/22/04 Hansen deed of trust. Neither the 8/27/08 Hansen Trust’s Deed nor the 7/22/04 Hansen Deed of Trust should have been extinguished by the fraudulent HOA sale. The 4/18/19 order granted Nationstar’s fraudulent 2/12/19 limited joinder to order that the HOA sale was valid to extinguish the owner’s title rights, but it was not valid to extinguish Nationstar’s rescinded 12/1/14 claim to be Bank of America’s successor in interest. |

| 5/10/07 | 200705100001127 DEED of trust 2nd open ended DEED of trust by Wells Fargo 2 Gordon Hansen, recorded on 5/10/07, was released on 3/30/17 |

| 9/1/04 | 200409010007297 Declaration of Homestead by Gordon B. Hansen, an unmarried man |

| 8/31/04 | 200408310007563 Sub trustee/reconveyance of paid in full 7/31/03 DEED of trust Gordon & Marilyn Hansen $310,600 1st dot assigned 2 Washington Mutual by City First Mortgage 7/31/03 lien was released on 8/31//04. |

| 8/17/04 | 200408170002284 Reconveyance of 11/20/03 Wells Fargo $55,000 2nd DOT To Hansen . The 11/20/03 lien was released on 8/17/04 |

| 7/22/04 | DEED OF TRUST is the disputed Hansen DOT. 200407220003507 Nationstar disclosed the Hansen deed of trust and the Planned Unit Development Rider as NSM 141-162 $436,000 loaned on 7/15/04 Due in full on 8/1/2034 Borrower: Gordon B. Hansen, an unmarried man Lender: Western Thrift & loan Trustee: Joan H. Anderson PUD rider remedies f. that lenders are contractually authorized only to add delinquent HOA assessments to the outstanding loan balance and add interest at the note rate (here 6.25%). Lenders are prohibited from using the tender of delinquent assessments, rejected or not, as a de facto foreclosure without due process. Nationstar disclosed the PUD Rider Remedies section was disclosed as NSM 160 so ignorance cannot be an excuse. Nationstar disclosed that it does not hold the origInal note by disclosing a copy as NSM 158-160. NSM’s copy of the note shows Nationstar, Wells Fargo and bank of Amercia are not in the chain of title of endorsements. |

| 7/22/04 | All recorded assignments of the Hansen DEED of trust that culminated in Nationstar reconveying the Hansen DEED of trust to Joel stoke, an individual, on 6/3/19, were false claims to title in the meaning of NRS 205.395. National banking associations’ corrupt business practices were revealed in 12/7/20 national settlement agreement and consent order, its 8/17/18 settlement and release, the 2012 National Mortgage Settlement and consent judgment for Bank of America, the 2012 National Mortgage Settlement and consent judgment for Wells Fargo. Violations of NRS 205.395, NRS 207.360, and other statutes in this particular case are documented in 11/10/20 complaint to the Nevada Attorney General (See TOC of AG exhibits), 12/16/20 complaint to the Mortgage Servicing Division (See TOC 12/16/20 complaint), NCJD 2021-026, |

| 6/11/04 | 200406110005547 DEED transfer from Marilyn to Gordon Hansen in divorce |

| 11/20/03 | 200311200004030 DEED of trust $55,000 Wells Fargo 2nd deed of trust to Gordon & Marilyn Hansen |

| 9/10/03 | 200309100000588 DEED of trust assign 7/31/03 dot city first mortgage 2 washington mutual |

| 7/31/03 | 200307310004444 DEED of trust Gordon & marilyn Hansen $310,600 1st dot from city first mortgage |

| 7/31/03 | 200307310004443 power of attorney Marilyn 2 Gordon Hansen for purchase documents “limited to executing loan documents for purchase of home located at 2763 white sage…power of attorney is null & void after execution.” Marilyn 2 Gordon Hansen Power of Attorney is the only recorded power of attorney in this property record from 2003 to the present. Nationstar did not record Power of Attorneys for the claims NSM recorded as “attorney-in-fact” on 12/1/14 (Bank of American), 8/17/15 (Wells Fargo), 3/8/19 (Bank of American), 3/8/19 (Wells Fargo) or 6/3/19 (American trustee servicing solutions) |

| 7/31/03 | 200307310004442 DEED Del Webb 2 Marilyn & Gordon Hansen |

| 7/31/03 | 200307310004441Del Webb Notice of Completion |

Exhibit 2 – the sale was void for rejection of assessments.

The HOA sale was void as payments and tenders after 7/1/12 were rejected, misappropriated, misrepresented and/or concealed. Default did not occur as described in the 3/12/13 Notice of default or as recited in the 8/22/14 foreclosure deed.

Tobin paid Hansen assessments through 9/30/12 by checks 112, 127, & 143.

The rejected Miles Bauer tender of $825 cured the default of the nine months assessments then delinquent and paid assessments from 10/1/12 through 6/30/13.

NSM’s 5/28/14 offer to pay one year of assessments should have been paid through escrow to close the 5/8/14 $367,500 www.auction.com sale to high bidder MZK properties and prevent the 8/15/14 HOA sale.8/22/14 Foreclosure deed improperly relied on the rescinded 3/12/13 NODES

Exhibit 3 The alleged default was cured three times, but for Red Rock’s covert and unlawful rejections.

The Default was cured three times, but RRFS kept pursuing the predatory path to unwarranted, unjustly profitable foreclosure. See Exhibit 3.

First cure of the default was on 10/18/12 when RRFS applied $300 check 143 to pay the $275 quarterly assessments due for the 7/1/12 to 9/30/12.

Figure below found in RRFS 402 and SCA 618 both show assessments were paid until 9/30/12.

The default was cured a second time in 2013, but for RRFS’ misconduct.

RRFS fraudulently, covertly rejected the $825 Miles Bauer check, dated 5/8/13, intended to pay the $825 then delinquent for the quarters from 10/1/12 to 6/30/13.

RRFS concealed the rejection from all interested parties, including the owner and the HOA Board.

RRFS conspired with others to conceal this $825 tender as all conspirators knew that the PUD Rider Remedies Section F., disclosed as NSM 160, that lenders are contractually authorized only to add delinquent HOA assessments to the outstanding loan balance and add interest at the note rate (here 6.25%). Lenders are prohibited from using the tender of delinquent assessments, rejected or not, as a de facto foreclosure without due process.

The default was cured a third time by the 5/28/14 $1,110 offer of one year assessments, $275 over the super-priority.

RRFS fraudulently covertly rejected the offer, made to close escrow on the 5/25/14 auction.com sale, was disclosed as SCA 302 and RRFS 119. Nationstar conspired with RRFS do worse this time, because it allowed Nationstar to steal the house from Nona Tobin.

RRFS concealed the rejection of Nationstar’s 5/28/14 super-priority offer to close the MZK 5/8/14 auction.com sale from all interested parties, including the owner and the HOA Board, by misrepresenting Nationstar’s $1100 offer as an owner’s request for waiver. SCA 295

Exhibit 4 SCA Board did not authorize the sale by valid corporate action

All SCA Board decisions related to this foreclosure, and all other foreclosures done under SCA’s statutory authority, were done in closed meetings that SCA owners could not attend.

See “SCA Board secretly sold a dozen houses in 2014“

See post “SCA Board did not comply with HOA meeting laws”

NO SCA Board decisions were made in meetings with agendas, minutes or voting protocols compliant with NRS 116.31083, NRS 116.31085 or SCA bylaws 3.15 and 3.15A.

See “Links to 2013-2014 SCA BOD agendas & minutes”

See 11/15/12 NRED Advisory Opinion re Executive Session Agendas.

See also 5/12/17 SCA attorney opinion or voidable corporate actions

Exhibit 5 Required notices were not provided, but records were falsified

No quarterly delinquency reports were presented to the SCA Board and membership in 2012-2014 as FSR was mandated to do by SCA bylaws 3.21(f)(v).

No quarterly assessment statements were sent to SCA owners after 1/31/12 with no explanation for suddenly stopping the normal routine banking practice of providing periodic statements.

No notice of sale was in effect when the 8/15/14 sale was held as the Ombudsman logged it was notified that the 2/12/14 published notice of a 3/7/14 sale, and the sale postponed to 5/15/14, were both cancelled effective 5/15/14.

The Ombudsman notice of sale compliance record, authenticated in the figure below, has been filed into the prior court record on, including but not limited to, these dates: 9/23/16, 11/15/16, 1/31/17, 2/1/17, 11/30/18, 3/5/19,4/10/19, 4/17/19, 4/24/19, 5/23/19, and 8/7/19.

RRFS deleted from all its ledgers a $400 waiver authorized on 3/27/14 by the HOA Board the is shown on page 6 of RRFS’s response to Chicago Title. RRFS and Nationstar both concealed the 3/28/14 ledger for different fraudulent reasons of their own.

RRFS and Nationstar both concealed SCA 302, the super-priority tender than was falsely portrayed as an owner request for waiver.

No notice of the 8/15/14 sale was provided to any party with a known interest – not the owner Tobin, the listing agent Leidy, the servicing bank Nationstar, SCA homeowners at large, any recent or pending bona fide purchasers, i.e., Blum who had an 8/4/14 $358,800 offer pending, MZK properties high $367,500 bidder at the 5/8/14 internet auction was rejected on 7/24/14, RRRI whose 2/25/14 $340,000 cash offer had been rejected.

All of the facts listed above have been filed into the court record multiple times and supported by multiple declarations under penalty of perjury, e.g., Leidy 5/20/19 and 5/11/18 DECL.

Exhibit 6 SCA Board imposed ultimate sanction with NO due process

SCA Board’s power to impose sanctions for any alleged infraction is constrained by NRS 116.3102(m) and NRS 116.31031.

SCA Board imposed the ultimate sanction of selling the owner’s property, without following the steps delineated in NRS 116.31031., CC&Rs 7.4, and SCA bylaws 3.26, and 11/17/11 SCA Board Resolution Establishing the Governing document Enforcement Policy & Process

The Board’s decision to impose the sanction was based solely on the allegations made by the financially-conflicted debt collector in closed meetings without providing the owner notice, an opportunity to defend, or appeal. See also NRS 116.31085.

Attorneys at Koch & Scow conspired with David Ochoa of Lipson Neilson for Sun City Anthem, and others to conceal that Red Rock conducted secret sales of at least a dozen Sun City Anthem properties in 2014 without any authorization by the HOA Board in a meeting compliant with NRS 116.31083 or NRS 116.31085 or SCA bylaws 3.15 and 3.16.

Exhibit 7 Neither BANA nor NSM ever owned the disputed deed of trust

Bank of America never was the beneficiary of the Hansen deed of trust, but…

- committed mortgage servicing fraud,

- refused to let two fair market value sales close escrow, refused to take the title on a deed in lieu,

- took possession without foreclosing, and

- used attorney Rock K. Jung to covertly tender delinquent assessments of $825 when $825 was due immediately before escrow was given instructions to pay $3,055.47 to the HOA to close the Mazzeo $395,000 sale,

- attempted to circumvent the owner’s rights under the PUD Rider remedies (f) to confiscate her property without foreclosing. is no notary record of BANA’s 4/12/12 recorded claim to own the DOT. See 2/5/19 CA SOS notary complaint.

BANA admitted on 10/30/12 that it was the servicing bank and claimed that Wells Fargo was the note holder. See BANA 10/30/12 letter to Hansen estate.

See “Doug Proudfit 5/20/19 DECL“

See NSM 160 PUD Rider Remedies

BANA took possession of the property during Tobin’s failed attempt to get BANA to take the title on a “deed in lieu”. See 7/11/13 emails. See Tobin DIL notes. See 9/14/13 email. See 10/1/13 email

Wells Fargo did not claim to be the note holder and never claimed to hold the beneficial interest of the disputed DOT. See Wells Fargo’s 10/29/12 approval of the Sparkman short sale.

NSM refused to disclose the name of the beneficiary prior to the sale. See 7/30/14 Tobin-Leidy emails.

NSM did not have a recorded claim to own the DOT before the 8/15/14 sale. See 12/1/14 NSM recorded claim that BANA had assigned its interest to NSM three months after BANA assigned its interest, if any, to Wells Fargo. See 9/9/14 recorded BANA to Wells Fargo assignment

NSM recorded a rescission of its worthless 12/1/14 claim on 3/8/19, a week after the 2/28/19 end of discovery. See 9/13/18 ORSNJC

On 2/25/19, recorded on 3/8/19, NSM executed an assignment of the DOT from Wells Fargo to itself without disclosing a valid power of attorney. See NSM 412-413 disclosed on 3/12/19.

No financial institution holds Hansen’s 7/15/04 original promissory note. See NSM’s disclosed COPY of the Hansen note (NSM 258-260).

Exhibit 8 Examples of RRFS corrupt business practices

Many examples of RRFS’s corrupt business practices exist of keeping fraudulent books, scrubbing page numbers from ledgers, combined unrelated documents to rewrite history, scrubbing dates from emails, not documenting Board actions, and much more. See Exhibit 8.

The figure below shows that each page of the real HOA ownership record for the subject property, the Resident Transaction Report, is uniquely numbered. The page number can’t be changed, but as RRFS shows us, it can be scrubbed.

In SCA’s and RRFS’s disclosures of the Resident transaction report, ALL the page numbers were scrubbed.

SCA and RRFS concealed Pages 1336 and 1337 in discovery because RRFS falsified the records to evade detection of their foul play

RRFS 190 and RRFS 083 are two examples of what RRFS disclosed for page 1336

The figure above was provided to Nona Tobin on or about 5/9/16 by an IT transition employee in response to a records request to HOA community manager Lori Martin.

The figure above shows that RRFS 190 has scrubbed Page number 1336.

RRFS 083 is FSR dba RRFS’s final accounting on behalf of the HOA as of 8/15/14, the alleged day of the sale with no indication of any payment to the HOA and no page number 1336.

RRFS 083 in the figure above is FSR dba RRFS’s disclosure of Page 1336, alleging to be the final accounting, as of 8/15/14, the day of the alleged sale, on behalf of the HOA with no indication of any payment to the HOA and no page number 1336.

RRFS 083 account does not match the 2014 account found on page 6 of RRFS’s concealed 3/28/14 pay off demand.

Exhibit 9 Attorneys’ lack of candor to the tribunal

All opposing counsels in all the litigation over the title to this one property made misrepresentations in their court filings and made oral misstatements of materials facts and law at hearings. See Exhibit 9.

Brody Wight (NV Bar #13615) and/or Steven Scow (NV Bar #9906) for Red Rock Financial Services, a partnership (EIN 88-058132) conspired with, or acted in concert with, Joseph Hong (NV Bar #5595) for Joel A. Stokes, Joel & Sandra Stokes as trustees for Jimijack Irrevocable Trust, and Jimijack Irrevocable Trust; Brittany Wood (NV Bar #7562) of Maurice Wood (NV Bar #6412) for Brian and Debora Chiesi and (maybe) Quicken Loans; and Donna Wittig (NV Bar #11015) and/or Melanie Morgan (NV Bar #8215), of Akerman LLP for Nationstar Mortgage LLC and/or dba Mr. Cooper to conceal and misrepresent material facts to the court that resulted in the obstruction of a fair adjudication of Nona Tobin’s claims and to prevent ANY judicial scrutiny of the evidence.

Attorneys for Koch & Scow know that Nationstar’s false and conflicting filed and recorded claim judicially estop Nationstar from claiming to own now, or to ever have owned the disputed Hansen deed of trust, but have conspired with attorneys from Akerman LLP, Wright, Finley, Zak LLP to conceal it and support them in their fraudulent claims with the quid pro quo being that Koch & Scow gets to keep more of the undistributed proceeds for keeping the devil’s bargain.

Nona Tobin published warnings and filed administrative complaints about opposing parties and their role in a massive HOA foreclosure scam that has been used to mask mortgage servicing fraud on 3/14/19, 11/10/19, 12/16/20, and other dates that have heretofore been ignored by enforcement authorities and will be filed into this case as a Request for Judicial Notice.

“210116 We can learn a lot from this Spanish Trail HOA case” is one of Nona Tobin’s attempts to get law enforcement officials to address RRFS’s, Nationstar’s and others’ criminal misconduct.

Exhibit 10 the proceeds of the sale were not distributed pursuant to NRS 116.31164(3) (2013)

The proceeds of the sale were not distributed in 2014 and RRFS’s complaint for interpleader in 2021 was filed in bad faith. See Exhibit 10.

Koch & Scow unlawfully retained the proceeds of this HOA foreclosure in the Red Rock Financial Services Trust account when the Sun City Anthem bylaws 3.20 and 3.18 explicitly prohibit any funds that are collected for the benefit of Sun City Anthem to be under the proprietary control of anyone other than the HOA Board of Directors. Steven Scow deceptively disclosed a $57,282.32 check for this property

Koch & Scow refused to interplead the proceeds of the disputed 8/15/14 HOA foreclosure sale when I attempted to make a claim in September 2014 and then acted in bad faith in multiple ways to cover up the actual criminality involved in this.

Au contraire. On 8/27/14, RRFS paid the HOA, allegedly IN FULL, a whopping $2,701.04, identified as “collection payment PIF” which brought the HOA’s Resident Transaction Report account for Gordon Hansen to a zero balance.

RRFS kept $60,399.96, $57,282.32 of which was identified by RRFS as “excess proceeds”, but all of which remains in the RRFS Trust fund account under the total, exclusive, unsupervised, unaudited and unauthorized proprietary control of Steven Scow.

Exhibit 11 RRFS’s fraud, oppression & unfairness

RRFS concealed the 4/27/12 debt collection contract that requires RRFS to indemnify the HOA and has been unjustly enriched thereby well over $100,000 in fees and considerably more in undistributed proceeds. RRFS did not participate in NRS 38.310 mediation in good faith. See Exhibit 11.

Steven Scow did not participate in mediation in good faith pursuant to NRS 38.310 and knowingly misrepresented the law in his response to Nona Tobin’s 8/20/18 claim.

The 7/26/19 NOTC notice of Nona Tobin’s and the Gordon B. Hansen Trust’s completion of mediation shows that RRFS LLC, Joel Just, President of RRFS, a partnership (EIN 88-0358132), Steven Parker, President of FirstService Residential, Nevada (LLC3280-1996) were named as respondents’, but did not respond.

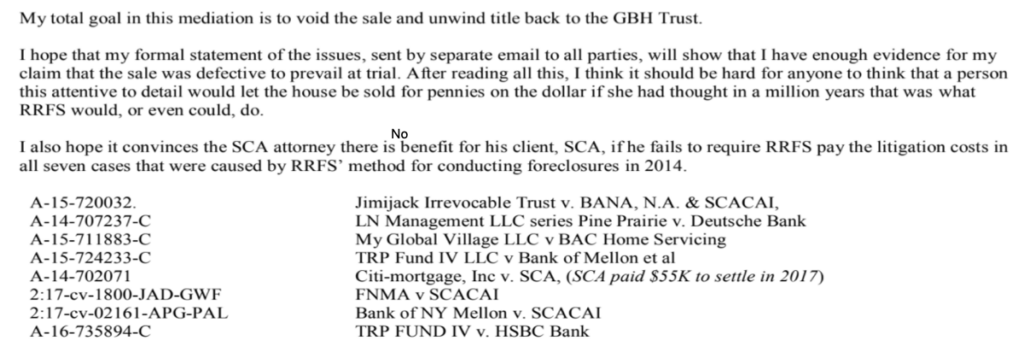

Steven Scow appeared but did not disclose who he was actually representing and did not participate in the mediation in good faith.The figure below is from page 20 of the stricken 7/26/19 NOTC. Scow’s only response to the complaint for mediation was the knowingly false statement that the unjust enrichment claim was time-barred by a three-year statute of limitations rather than addressing why he unlawfully retained the proceeds of this and other Sun City Anthem foreclosures.The figure below is an excerpt from page 21 of the stricken NOTC. Please note the word “no” needs to be added to the final sentence: “I also hope it convinces the SCA attorney there is NO benefit for his client, SCA, if he fails to require RRFS to pay the litigation costs in all seven cases that were caused by RRFS’ method of conducting foreclosures in 2014.”

Sun City Anthem attorneys have still not enforced the 4/27/12 RRFS-SCA debt collection contract indemnification clause that required RRFS to pay those litigation costs.

Exhibit 12 attorney interference in the administration of justice

In case A-19-799890-C, Brody Wight knowingly filed a motion to dismiss Nona Tobin’s claims pursuant to NRCP (b)(5) and NRCP (b)(6) that was totally unwarranted, harassing, disruptive of the administration of justice, not supported by facts or law, and filed solely for the improper purpose of preventing discovery of the crimes of his law firm and its clients. See Exhibit 12.

Instead of properly communicating with counsel for Nona Tobin regarding factual misrepresentations in the drafted order, Brody Wight ignored eight pages of written objections to the duplicitous wording of the order as drafted by Koch & Scow.

…page 1 of Tobin’s eight pages of objections that the page number of the 4/27/17 transcript wherein Judge Kishner reaffirmed Nona Tobin’s standing as an individual party was inadvertently omitted in the letter.

Since Koch & Scow did not make any attempt to ascertain the true facts of Nona Tobin’s standing to assert an NRS 40.010 quiet title claim as an individual, the relevant pages from the 4/27/17 hearing transcript are shown in the screenshots below.

Page 12 of the 4/27/17 transcript, lines 11-25

Figure below is 4/27/17 hearing transcript Page 13, lines 1 – 18Koch & Scow ignored eight single-spaced pages of evidence-backed objections and filed the order exactly as drafted for the sole purpose of obstructing judicial scrutiny of the evidence against the Koch & Scow law firm and preventing Tobin’s piercing the corporate veil from the Koch & Scow clients.

Nona Tobin was forced to appeal this totally improper 12/3/20 order of dismissal with prejudice and the expungement of three of Nona Tobin’s lis pendens in case 82294 due to the misconduct of the Koch & Scow attorneys.

Exhibit 13 lack of professional ethics and good faith

None of the opposing counsels have acted in good faith in compliance with the ethic standard of their profession. All have failed in their duty of candor to the court, wasted millions of dollars in judicial resources, and have engaged in criminal conduct to further the criminal conduct of their clients. See Exhibit 13.

When the three appeals that resulted from Koch & Scow’s and the other attorneys’ duplicity (82294, 82234, 82094) were combined and submitted to mediation, Koch & Scow for RRFS, and the other opposing counsels – Brittany Wood for Quicken Loans, Brian Chiesi and Debora Chiesi; Joseph Hong for Joel A. Stokes, an individual, and Joel and Sandra Stokes as trustees of Jimijack Irrevocable Trust; and Donna Wittig for Nationstar Mortgage LLC did not participate in good faith and predictably mediation failed.

Koch & Scow is responsible for the waste of judicial resources and the obstruction of the administration of justice in case 82294.

Joseph Hong, Akerman attorneys for Nationstar, and Lipson Neilson attorneys for Sun City Anthem are responsible for the waste of judicial resources in the appeal 79295 and the obstruction of the administration of justice in case A-15-720032-C by virtue of their defiance of NRCP 11 (b)(1)(2)(3)(4), Nevada Rules of Professional Conduct 3.3 (candor to the tribunal), 3.4 (fairness to opposing counsel), 3.5A (relations with opposing counsel), 4.1 (truthfulness in statements to others), 4.4 (respect for the rights of third persons) and ABA (1992) Standards for Imposing Lawyer Sanctions 6.1 (False statements, fraud, and misrepresentation).

Joseph Hong and Akerman attorneys for Nationstar are additionally culpable for their improper ex parte communications with Judge Kishner on 4/23/19 in defiance of ABA (1992) Standards for Imposing Lawyer Sanctions 6.1 (False statements, fraud, and misrepresentation) and 6.31(b). ex parte communications

Exhibit 14 Presented false evidence to cover up crime

Answering the allegations contained in paragraph 1, Nona Tobin denies the allegations, allowing the documents to speak for themselves.

FirstService Residential, Nevada, LLC (FSR) fka RMI Management, LLC was Sun City Anthem’s community association manager during all times relevant. Simultaneously, FSR held the NRS 649 debt collector license, and did business as Red Rock Financial Services, a partnership (EIN 88-058132) with undisclosed partners. FSR and RMI had separate contracts for management for the HOA in 2010 and 2014.

The HOA’s debt collection contracts were with Red Rock Financial Services without disclosure of the financial entanglement of the community manager whose license is controlled by NRS 116A and NAC 116A and the debt collector whose license is controlled by NRS 649.

In the prior proceedings, A-15-720032-C, Nona Tobin requested all relevant management and debt collection contracts between the HOA and its managers and debt collectors in the prior proceedings by a 2/4/19 subpoena, served on Steven Scow, Koch & Scow, LLC.

The contracts RRFS withheld in its response (RRFS 001-425) to Nona Tobin’s 2/4/19 subpoena are:

1) 2010 RMI management contract, 2) 2014 FSR management contract and 3) 2012 RRFS debt collection agreement.

Sun City Anthem attorneys, for unknown reasons, aided and abetted the Plaintiffs fraudulent concealment when it disclosed the detrimental-to-the-HOA-beneficial-to-RRFS 2007 debt collection agreement.

The 2007 RRFS-SCA debt collection agreement lacks the 2012 requirement that RRFS indemnify and hold the HOA, and its members, harmless if proceedings are brought against the HOA due to allegations that RRFS negligently or willfully violated any law or regulation which is exactly what Nona Tobin alleges.

The 2007 contract was disclosed by the HOA attorneys as SCA 164-167, but was also withheld by Steven Scow who concealed all contracts his various unidentifiable clients had with Sun City Anthem in his subpoena response. (RRFS 001-425).

Attorneys at Koch & Scow knew that Red Rock Financial Services had conducted a unfair, unnoticed and fraudulent sale and provided false evidence (RRFS 001-425) in response to Nona Tobin’s 2/4/19 subpoena to cover it up.

Attorneys at Koch & Scow knew that the Red Rock Foreclosure file (RRFS 001-425) Steven Scow provided in response to subpoena was incomplete, inaccurate, and contained falsified documents and conspired with attorneys for Nationstar, for the HOA’s errors & omissions insurance policy, for Sun City Anthem and others to conceal or to misrepresent the true facts of how the HOA sale was conducted, where the money came from and where the money went.

Some examples of documents disclosed, concealed, falsified or misrepresented, include:

Nationstar negotiator Veronica Duran’s 5/28/14 Equator message to Craig Leidy saying she was authorized to offer $1100 to the HOA was disclosed as (SCA 302)

Nationstar did not admit it knew that RRFS had rejected its 5/28/14 super-priority offer that prevented the escrow of the MZK 5/8/14 $367,500 sale from closing.

Nationstar in concerted action, and/or by direct conspiracy, allowed SCA/RRFS to lie about it and call it an owner request for waiver or Leidy asking for “thousands of dollars of reductions” that the board approved (SCA 276) and falsely claim that Leidy was informed (SCA 277 is fraudulently doctored)

NSM concealed all of the Equator records (and other records to which Tobin is entitled) requested in discovery that would have shown the exact nature of its communications with Red Rock about the HOA sale and how the $100 tender was rejected. (2/21/19 RESP to RFDs) See also NSM’s 2/21/19 RESP 2 ROGs.

SCA attorney Ochoa claimed in his 8/9/19 AFFD for attorney fees (page 35 of 53) that he prepared RFDs, ROGs, and RFAs for NSM on 8/8/18, but no SCA to NSM RFDs, ROGs, or RFAs were served on the parties, and no NSM RESP to SCA ROGs, RFDs, or RFAs were ever served through the NVefile system.

SCA/RRFS/NSM concealed in discovery the 3/28/14 RRFS pay off demand to Chicago Title which on page 6 includes a $400 fee waiver approved by the HOA Board at its 3/27/19 meeting that Leidy did request.

SCA concealed in discovery the requested board minutes where the HOA sale was approved, because there are no minutes of any meeting at which the sale was approved. SCA lied about the minutes being contained in SCA 644-654 in its 2/26/19 RESP to RFDs (page 7, response 7), line 10). See also 2/27/19 RESP ROGs

SCA 315 claims that the sale was approved as item R-05-120513 at the 12/5/13 HOA Board meeting is false and deliberately deceptive.

RRFS 047-048 is the 8/28/14 memo from RRFS agent Christie Marling to Steven Scow requesting that he interplead the excess funds from the sale of 2763 White Sage and five other properties

Attorneys at Koch & Scow conspired with David Ochoa of Lipson Neilson for Sun City Anthem, and others to conceal the correct Sun City Anthem debt collection contract, dated 4/27/12, so that Red Rock or Koch & Scow, profited by the nonenforcement of the indemnification clause related to at least eight Sun City Anthem foreclosures.

Exhibit 15 Civil Conspiracy to cover up racketeering warrants punitive damages

Plaintiff RRFS and Defendant Nationstar acted in concert or conspired to conceal and/or misrepresent material facts in multiple court filings and/or recorded documents that the demonstrably provable fact that Nationstar never owned the beneficial interest of the Hansen deed of trust and is judicially estopped, to claiming it has standing in this case or any of the prior proceedings.

Plaintiff RRFS knew Nationstar was not the beneficial owner of the Hansen deed of trust, and their conspiracy gives rise to treble damages pursuant to NRS 207.407

Nationstar conspired with Plaintiff RRFS to perpetrate a fraud on the court.

Plaintiff RRFS has knowingly and intentionally aided and abetted Defendant Nationstar’s deception in this case since 2014.

Answering the allegations contained in paragraph 6 of the Complaint, Nona Tobin contends that the allegations in paragraphs are not factual statements, constitute statements of law, requiring no answer.

Answering the allegations contained in paragraph 7 of the Complaint, Nona Tobin denies the allegations contained therein as, upon information, and belief, Plaintiff knows, or should have known, that these allegations are false and Plaintiff has taken pains to obscure the misappropriation of funds by the use of sham corporate entities and misrepresentation of agency relationships.

Pages 1-3 of Nona Tobin’s 1/31/17 crossclaim vs. Sun City Anthem and DOEs & ROEs identifies the HOA Agents as not being named because their corporate identities had been conflated to evade accountability for their misdeeds.

“Plaintiff is informed and believes, and thereon alleges, that each of the defendants sued herein, including those named as DOES, are the agents, servants, employees, predecessor entities, .successor entitles, parent entities, totally owned or controlled entities, or had some legal relationship of responsibility for, the other defendants, and in doing the things herein alleged, acted within the course and scope and authority of such agency, employment, ownership or other relationship and with the full knowledge and consent of the other defendants or are in some other manner legally responsible for the acts as alleged herein.

Additionally, with respect to all corporate entity defendants, the officers and directors of such entities ratified and affirmed all contracts of its employees, agents, directors and/ or officers.”

Page 2, Paragraph 7, Red Rock interpleader complaint

Pages 2-3 1/31/17 (CRCM) of Nona Tobin’s and the Hansen Trust’s cross-claim vs Sun City Anthem shows why the RRFS’ statement on page 2, paragraph 7, is deceptive.

Answering the allegations contained in paragraph 8 of the Complaint, Nona Tobin denies the allegations contained therein for the reasons related to the improper contracts, the unpierceable corporate veil, and the misappropriation of funds set forth in answering paragraph 1, and because the non-judicial foreclosure action was not properly conducted pursuant to Nevada law or pursuant to the HOA’s governing documents.

Answering the allegations contained in paragraph 9, Nona Tobin denies the allegations contained therein as RRFS knows that RRFS made no attempt to collect the debt from Nona Tobin after 2/12/14 as there was no notice whatsoever from RRFS after that date. See 5/11/18 D. Craig Leidy declaration under penalty of perjury.

RRFS sold the property on 8/15/14 to a Realtor in the listing office for $63,100 without any public notice after RRFS explicitly withheld ALL notice of the sale from all parties with a known interest, including those whom RRFS owed a contractual or statutory duty to inform after Nona Tobin had already sold the property for $367,500 on auction.com on 5/8/14.

Further, “RRFS’s efforts resulted in a foreclosure sale” is duplicitous in that RRFS employed unfair and deceptive collection practices, conducted an unnecessary sale, that was unauthorized by any official HOA Board vote, after RRFS knowingly misappropriated payments, covertly rejecting two super-priority tenders, and falsified and concealed records to cover it up.

Answering the allegations contained in paragraph 7 of the Complaint, Nona Tobin denies the allegations contained therein as, upon information, and belief, Plaintiff knows that these allegations are false as the liens and claims of all named defendants, except for Nona Tobin’s 3/28/17 deed, have been released, on 3/30/17,

“Records in Clark County, Nevada indicate that there are several potential liens and other debts secured by the Subject Property belonging to the defendants in this action.”

“RRFS believes these debts exceed the amount currently in the possession of RRFS.”

False statements in Red Rock interpleader complaint

Exhibit 16 Republic Services lien releases

Answering the allegations contained in paragraphs 4 of the Complaint, Nona Tobin, admits that Defendant Republic Services, Inc. is a Nevada corporation doing business in Clark County, but denies that Plaintiff acted in good faith when it named Republic Services, Inc as a defendant, and denies the allegations by allowing the documents to speak for themselves.

Steven Scow’s 2/11/19 response to Nona Tobin’s 2/4/19 subpoena provided two Republic Services liens and withheld both Republic’s releases of their liens that occurred because RRFS’s failed to distribute the proceeds within the three-year statute of limitations on enforcement of statutory liens.

The first Republic Services lien was recorded on 9/23/13 as instrument number 201309230001369.

Republic’s first lien was identified as RRFS 185 in the subpoena response (RRFS 001-425).

Republic’s release of its 9/23/13 lien was recorded on 3/30/17 as instrument 201703300003859.

There is no BATES number as the release of Republic’s first lien was withheld in Steven Scow’s response to Nona Tobin’s subpoena.

The second Republic Services lien, recorded on 5/6/14 as instrument number 201405060004357 was identified as RRFS 070 in Steven Scow’s response to Nona Tobin’s subpoena.

Republic’s release of the 5/6/14 lien, recorded on 3/30/17 as instrument 201703300003860 has no BATES number as it was withheld in Steven Scow’s response to Nona Tobin’s subpoena.

Exhibit 17 Nona Tobin’s standing as an individual

Links to pro se filings stricken in absentia at ex parte 4/23/19 meeting of Melanie Morgan and Joseph Hong with Judge Kishner

Nationstar attorneys deceived the court regarding Nona Tobin’s standing to assert an NRS 40.010 claim as an individual holder of a 3/28/17 deed. NSM disclosed the 3/28/17 deed as NSM 208-211. NSM named Tobin individually as a party in all the captions. NSM did not remove Nona Tobin as an individual party when reforming the caption on 3/7/19 NTSO and 3/12/19 ANEO. Nationstar attorneys knew that Nona Tobin was a party with adverse interests and that to make a side deal with Jimjack in order to prevent Nationstar’s and Tobin’s adverse claims from being adjudicated was fraud.

Answering the allegations contained in paragraph 2 of the Complaint, Nona Tobin admits that she resides in Clark County, Nevada, but denies that she has a right to assert a claim solely in her capacity as a Trustee as Red Rock is obliquely implying. Nona Tobin admits she is a defendant here in two capacities:

1) as the sole successor Trustee of the Gordon B. Hansen Trust, dated 8/22/08, that held title to the property by virtue of a deed recorded on 8/27/08, as instrument 200808270003627, until Red Rock wrongly foreclosed on it and caused a foreclosure deed containing false recitals to be recorded on 8/22/14 as instrument number 20014008220002548, and

2) as NONA TOBIN, an individual, who became the successor in interest to the title claims of Gordon B. Hansen Trust, dated 8/22/08, when the Hansen Trust was closed pursuant to NRS 163.187, on 3/28/17.

NONA TOBIN, an individual, has a deed to the subject property, recorded as instrument number 201703280001452, that transferred the Hansen Trust’s sole remaining asset to its sole beneficiary NONA TOBIN, an Individual.

All parties to the prior proceedings knew, or should have known, that the interest of the Hansen Trust was transferred by a valid recorded deed to Nona Tobin, an individual, on 3/28/17, as Nationstar disclosed Nona Tobin, an individual’s, recorded deed as NSM 208-211

Nationstar also disclosed with Nona Tobin’s individual deed, the 3/31/17 recording of Steve Hansen’s 3/27/17 disclaimer of interest (NSM 212), that was recorded on 3/31/17.

Nationstar also disclosed the disclaimers of interest of Thomas Lucas, Opportunity Homes LLC, Yuen K. Lee, and F. Bondurant, LLC with Nona Tobin’s 3/28/17 deed as NSM 208-221.

Exhibit 18 – Relevant statutes and regulations

See also 4/7/21 RFJN Request for Judicial Notice exhibits linked below.

- Exhibit 1: 2013 Nevada HOA Lien & Foreclosure Laws

- Exhibit 2: Limits on HOA Board’s authority to impose sanctions

- Exhibit 3: Limits on HOA agents’ & managers’ authority to act

- Exhibit 4: Limits on conveyance of real property

- Exhibit 5: Limits on Fraud and Racketeering

- Exhibit 6: Sanctions & damages

- Exhibit 7: Victim access to remedies

- Exhibit 8: Documentary evidence

- Exhibit 9: Declaratory Judgments

- Exhibit 10: Actions to determine conflicting claims to real property

NRS 30.030 Scope. Courts of record within their respective jurisdictions shall have power to declare rights, status and other legal relations whether or not further relief is or could be claimed. No action or proceeding shall be open to objection on the ground that a declaratory judgment or decree is prayed for. The declaration may be either affirmative or negative in form and effect; and such declarations shall have the force and effect of a final judgment or decree.

NRS 40.010 Actions may be brought against adverse claimants. An action may be brought by any person against another who claims an estate or interest in real property, adverse to the person bringing the action, for the purpose of determining such adverse claim.

NRS 30.130 Parties. When declaratory relief is sought, all persons shall be made parties who have or claim any interest which would be affected by the declaration, and no declaration shall prejudice the rights of persons not parties to the proceeding.

NRS 38.310 Limitations on commencement of certain civil actions. (Judge Kishner had no jurisdiction)

1. No civil action based upon a claim relating to:

(a) The interpretation, application or enforcement of any covenants, conditions or restrictions applicable to residential property or any bylaws, rules or regulations adopted by an association; or

(b) The procedures used for increasing, decreasing or imposing additional assessments upon residential property,

Ê may be commenced in any court in this State unless the action has been submitted to mediation or, if the parties agree, has been referred to a program pursuant to the provisions of NRS 38.300 to 38.360, inclusive, and, if the civil action concerns real estate within a planned community subject to the provisions of chapter 116 of NRS or real estate within a condominium hotel subject to the provisions of chapter 116B of NRS, all administrative procedures specified in any covenants, conditions or restrictions applicable to the property or in any bylaws, rules and regulations of an association have been exhausted.

2. A court shall dismiss any civil action which is commenced in violation of the provisions of subsection 1.

NRS 116.31164 (3) (2013), NRS 116.3116-NRS 116.31168 (2013), NRS 116A.640 (8), (9), (10), NRS 116.31083, NRS 116.31085, NRS 116.31031, NRS 116.1113, NRS 116.31065, NRS 116.3102, NRS 116.31087, NRS 116.31175, NRS 116.31183, NRS 116.31184, NRS 116.4117, NRS 205.395 False representation concerning title; penalties; civil action. NRS 205.330 Fraudulent conveyances. NRS 205.377 Multiple transactions involving fraud or deceit in course of enterprise or occupation; penalty, NRS 207.360 “Crime related to racketeering” defined; NRS 207.400 Unlawful acts; penalties, NRS 207.470 (1)and (4) Civil actions for damages resulting from racketeering., NRS 207.480 Order of court upon determination of civil liability. NRS 42.005 Exemplary and punitive damages: In general; limitations on amount of award; determination in subsequent proceeding, NRS 116.3116-NRS 116.31168 (2013) are the controlling foreclosure statutes. NRS 116.31164(3)(2013) is the controlling statute regarding the ministerial duty of the person conducting the sale to deliver the foreclosure deed to the Ombudsman and to distribute the proceeds of the sale in the order proscribed by law.

AB 284 (2011) Nevada’s 2011 anti-foreclosure fraud amendments to NRS 107 and NRS 205 summary and legislative digest Robin Wright “Complying with AB284” for UTA Quarterly Winter 2011

The HOA sale is void or otherwise does not operate to extinguish the title rights of Nona Tobin, an individual, as the successor in interest to the Hansen Trust or of the Gordon B. Hansen Trust, dated 8/2/08, property owner at the time of the defective HOA sale as the due process and notices required pursuant to NRS 116.310313 and/or NRS 116.31162 – NRS 116.31164 were provided to Nona Tobin prior to or subsequent to the sale and non-compliance with applicable Nevada statutes, inter alia, NRS 116.3102, NRS 116.31083, NRS 116.31085, NRS 38.310, NRS 116.31162 -NRS 116.31168 (2013), NRS 116.1112, NRS 116.31031, NRS 116.31087, NRS 116.31175, NRS 116.31185, NRS 116.31187, NRS 116.4117

Exhibit 19 Relevant HOA Governing Document Provisions

1/17/11 SCA BOARD RESOLUTION ON THE PROCESS AND PROCEDURE FOR ENFORCEMENT OF THE GOVERNING DOCUMENTS, SCA 168-175 2013 Delinquent Assessment Policy

SCA Third Amended and restated CC&Rs (2008)

6.1 Function of the association -primary entity to enforce the governing documents; must perform in accordance with governing documents

7.4 Compliance & Enforcement: The Board may impose sanctions for violation of the Governing Documents after notice and a hearing in accordance with the procedures set forth in the By-Laws.

8.8 Lien for assessment may be enforced in the manner proscribed in act

8.12 Asset enhancement fee 1/3 of 1% due to the association on all but specifically exempted transfers of title.

XVI Dispute resolution and limitation on litigation

SCA Third Amended and Restated Bylaws, 2008

3.13(a, e, f) Compensation can’t appear to influence decisions, create a conflict; can’t relate to fines or violations; must conform to standards of practice

3.15 Open BOD meetings – must give owner minutes of hearing on violation of governing documents

3.15A SHALL hold hearing re violations Executive session

3.17 Powers of BOD business judgment benefits the association

3.18(a) Duties of the Board that SHALL NOT be delegated (a) adopt budget

3.18(b) Duties of the Board that SHALL NOT be delegated (b) levy and collect assessments