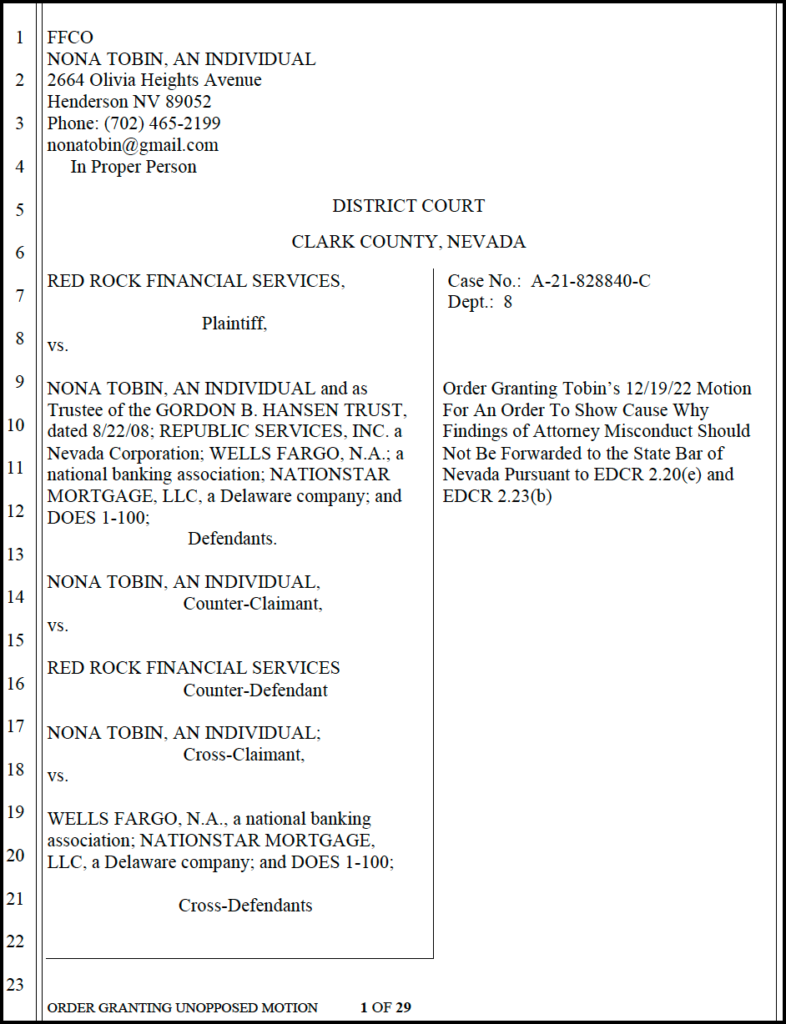

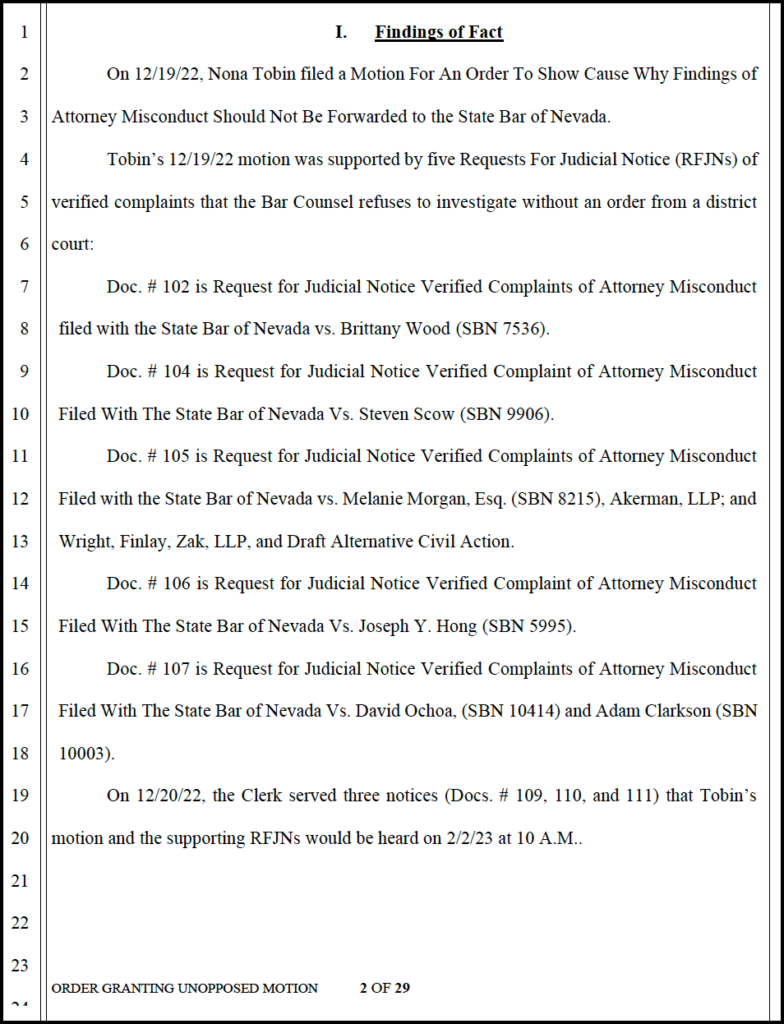

DEFENDANT NONA TOBIN, AN INDIVIDUAL, filed a motion to distribute on 4/12/21, but it was returned as a non-conforming document for failure to request a hearing. This amended motion corrects that error and other errors as well as removes from the caption the third-party defendants as the 3/22/21 third-party complaint will not be served until after this Court rules on COUNTER-CLAIMANT & CROSS-CLAIMANT NONA TOBIN’S MOTION FOR SUMMARY JUDGMENT VS. COUNTER-DEFENDANT RED ROCK FINANCIAL SERVICES & CROSS- DEFENDANTS NATIONSTAR MORTGAGE LLC & WELLS FARGO, N. A. AND MOTION FOR PUNITIVE DAMAGES AND SANCTIONS PURSUANT TO NRCP 11(b)(1)(2)(3) and/or(4), NRS 18.010(2), NRS 207.407(1), and/or NRS 42.005.

Defendant Tobin moves the court for an order to Plaintiff Red Rock Financial Services to distribute the excess proceeds plus interest and penalties in the amount of $91,855.11 to Nona Tobin, the sole defendant with a current recorded claim and the sole claimant.

MEMORANDUM OF POINTS AND AUTHORITIES

UNDISPUTED FACTS

On 5/8/14 Nona Tobin signed a purchase agreement to sell 2763 White Sage for $367,500. See 5/8/14 high bidder MZK Properties, LLC’s signed purchase agreement.

On 8/15/14, Red Rock Financial Services sold the same property for $63,100 without notice to Nona Tobin or to MZK Properties, LLC, or to any other party with a known interest. See 8/22/14 foreclosure deed.

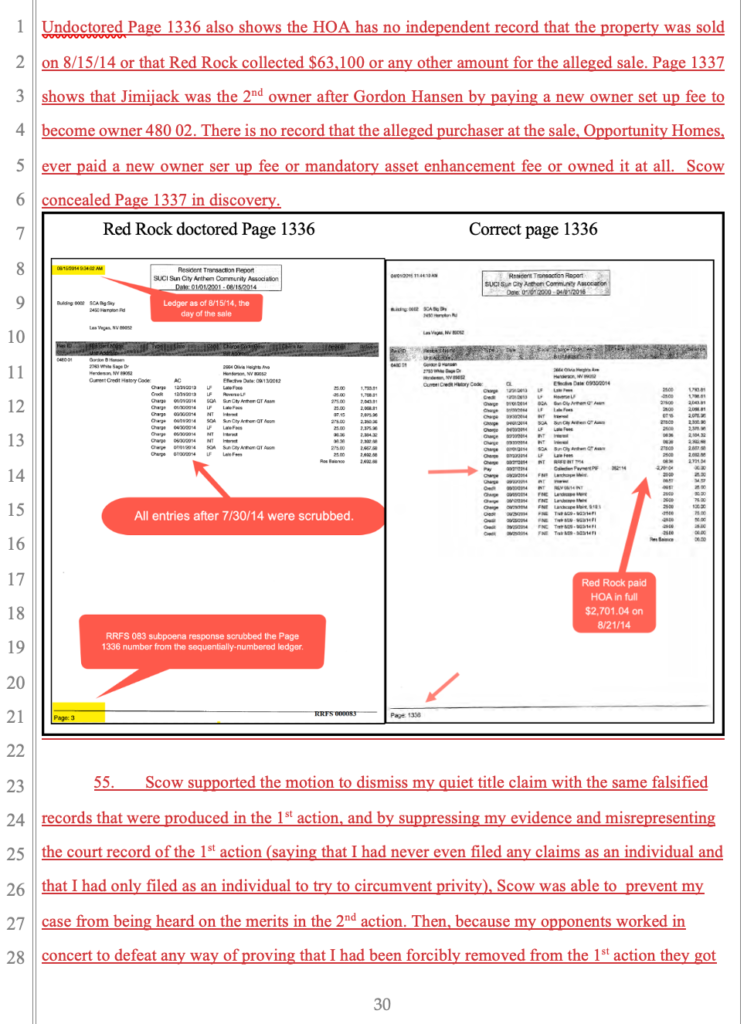

On 8/21/14 FirstService Residential recorded a ledger entry on Page 1336 of the Sun City Anthem Resident Transaction Report for 2763 White Sage that a “collection payment” of $2,701.04 was payment in full of the delinquent assessments, interest and late fines of the deceased owner, Gordon (Bruce) Hansen.

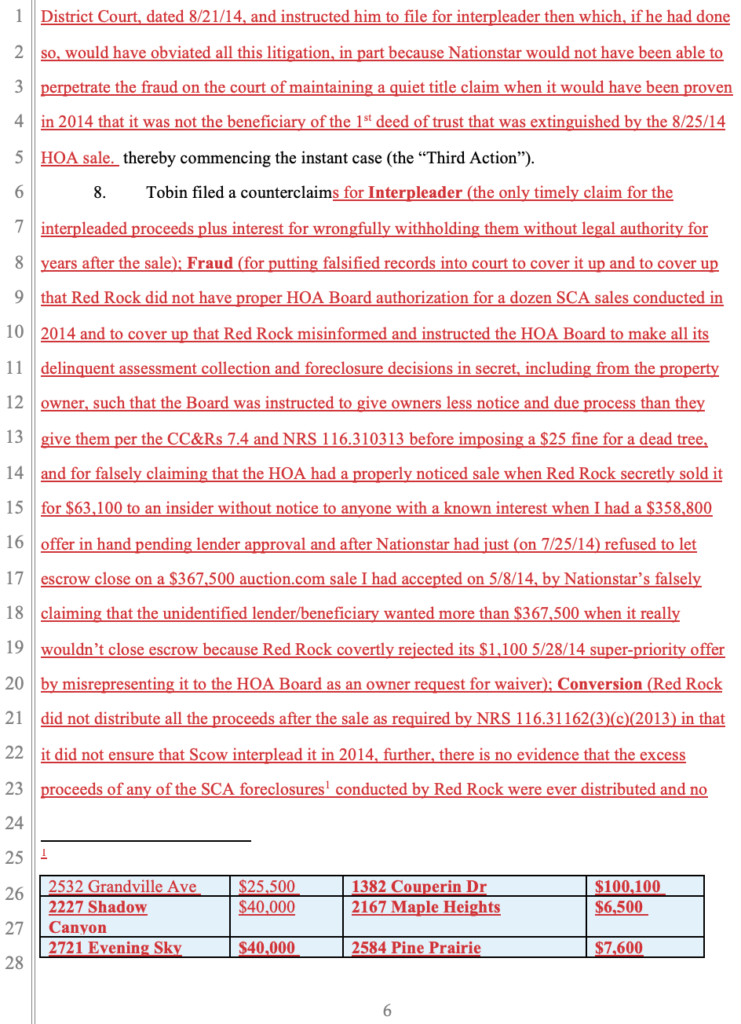

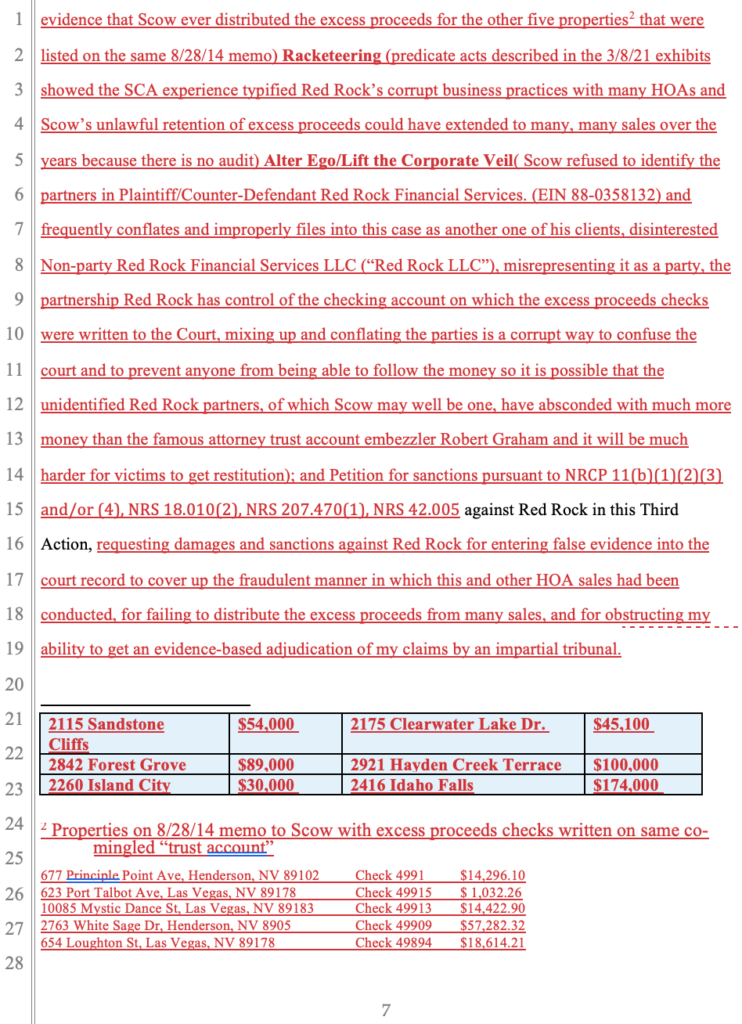

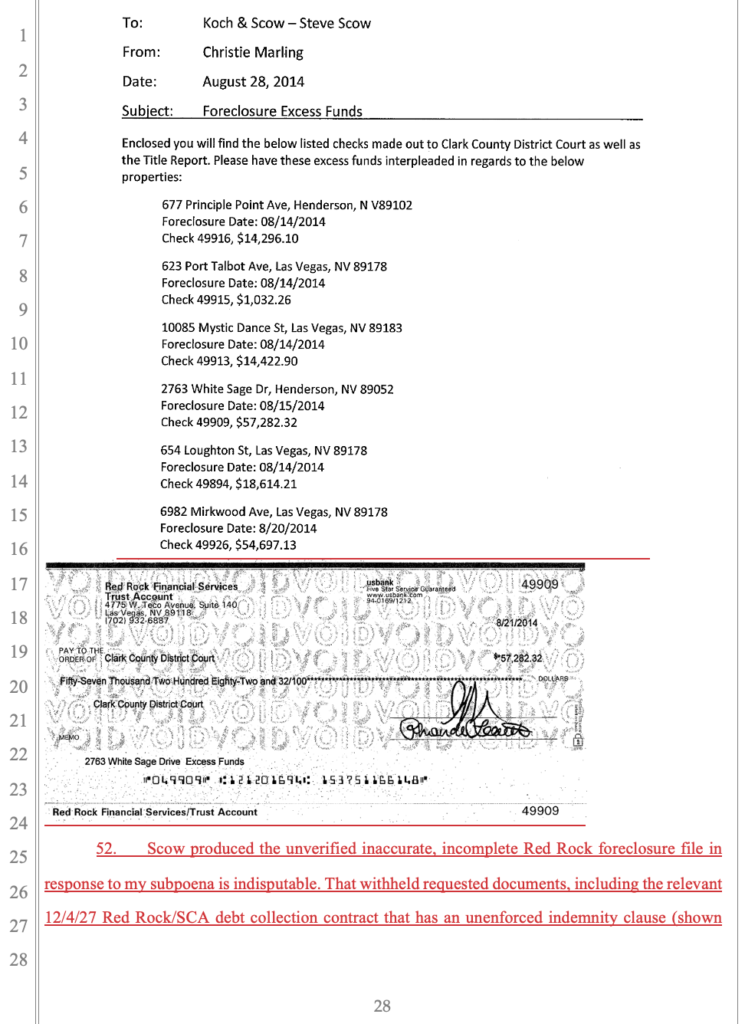

On 8/28/14, Red Rock directed attorney Steven Scow to interplead check 49909 made out the Clark County District Court $57,282.32 in excess proceeds. See RRFS 047 (8/28/14 RRFS memo to Steven Scow) and RRFS 048 (check 49909)

Steven Scow did not follow Red Rock’s instructions to deposit check made out to the Clark County District Court when he chose to retain, without legal authority, proprietary control over the funds in an unaudited, unsupervised account, allegedly for the benefit of Red Rock Financial Services.

Sun City Anthem bylaws prohibit Red Rock, FirstService Residential, Steven Scow or anyone else from depositing funds collected for the benefit of Sun City Anthem in an account not controlled by the Sun City Anthem Board of Directors. See SCA bylaws 3.20/3.18 adopted pursuant to NRS 116.3106(1)(d).

In September, 2014 Nona Tobin attempted to make a claim for the excess proceeds, but was rebuffed by Red Rock Financial Services. See 5/11/18 Craig Leidy Declaration with attached email.

On 1/31/17, in case A-15-720032-C, Nona Tobin filed a cross-claim against Sun City Anthem in which the fifth cause of action, Unjust Enrichment, sought to get the undistributed proceeds plus interest distributed to her.

1/31/17 CRCM, PAGES 18-19, relevant excerpt is quoted here below:

95. Cross-Claimant incorporates and re-alleges all previous paragraphs, as if fully set forth herein, and further alleges:

96. That HOA AGENTS unfairly deprived Cross-Claimant of the Subject Property and unjustly profited from excessive and unauthorized charges added to delinquent dues.

97. That HOA AGENTS unjustly and covertly failed to distribute the $63,100 proceeds of the sale as mandated by 2013 NRS 116.31164 (3)( c), in that:

a) There were no expenses of sale as the cost to conduct a foreclosure sale is limited to $125.00 by the April 27, 2012 RRFS Delinquent Assessment Collection Agreement, and the lien of $5,08l.45 already included erroneous, duplicative and unauthorized charges.

b) There WAS no expense of securing possession. The Subject Property was vacant, and the key just handed to the Buyer by TOBlN’s agent.

c) Satisfaction of the association’s lien. The HOA Resident Transaction Record for the Subject Property shows that the HOA AGENT credited the HOA with $2,701.04 on August 27, 2014. There is no indication that HOA. AGENTS paid the mandated asset enhancement fee (1/3 of 1 % of the price of every sales price) the HOA mandated for every transfer of title by CC&Rs section 8.12. (Exhibit 8)

d) Satisfaction of subordinate claims. None of the excess proceeds went to any of the entities who had recorded liens. Or, alternatively, if any of the lienholders did receive the excess proceeds, none of the lienholders properly accounted for receiving any funds, and none removed their liens.

e) Remittance of any excess to the unit’s owner.

Within a few months after the sale, TOBIN attempted to claim the excess proceeds since it was clear the HOA AGENTS were treating the bank loan as “extinguished”. In response to direct inquiries, HOA AGENTS were deceptive about their illegal retention of the proceeds of the illegally-conducted sale and refused to speak with TOBIN about her claim, stating at different times in late 2014:

1) that she had no standing, 2) that RRFS had no record of her in relation to the Subject Property, and 3) that RRFS had turned the money over to the court to distribute.

1/31/17 CRCM, PAGES 18-19

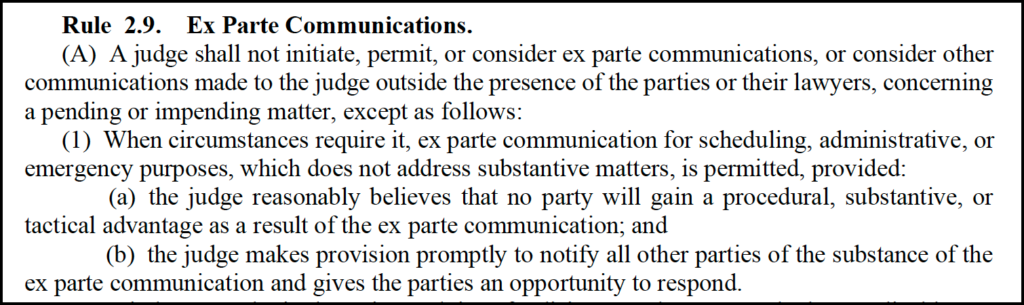

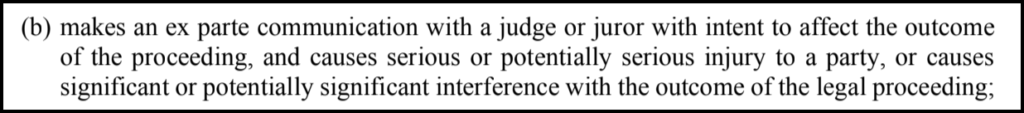

None of Nona Tobin’s claims were adjudicated in case A-15-720032-C as a result of Nationstar attorney, Melanie Morgan, and Jimijack Irrevocable Trust attorney, Joseph Hong, met ex parte with Judge Kishner on 4/23/19.

See Complaint to the Nevada Commission on Judicial Discipline.

On 8/7/19, Nona Tobin filed a new district court case to beat the five-year statute of limitations, in which she made another attempt to get the funds distributed. See 8/7/19 Tobin complaint A-19-799890-C.

Excerpt from page 20, Nona Tobin’s 8/7/19 A-19-799890-C complaint under Tobin’s third cause of action: Unjust Enrichment, is quoted here:

SCA bylaws prohibit the SCA Board from delegating certain functions, including the signatory control over bank accounts holding assessments collected for the benefit of the association.

RRFS and/or Scow & Koch have unjustly profited from the retention and total proprietary control over of $57,282 undistributed proceeds of the sale and they should not be permitted to further profit by failing to pay interest or by charging unnecessary fees to distribute according to the mandates of NRS 116.31164;

All Nona Tobin’s claims in A-19-799890-C against all defendants were dismissed with prejudice on 12/3/20 when Judge Johnson granted Red Rock Financial Services motion to dismiss pursuant to NRCP (b)(5) and NRCP (b)(6) and all joinders thereto.

See 6/23/20 Red Rock Financial Services motion to dismiss pursuant to NRCP (b)(5) reliance on the legal doctrines of non-mutual claims preclusion and NRCP (b)(6) failure to join the HOA as a necessary party to protect its interest in the excess proceeds was not supported by the facts.

See 12/3/20 order to dismiss ALL Nona Tobin’s claims with prejudice that was entered without the strenuous objections in the letter attached to the order.

On Nona Tobin appealed from the 12/3/20 order that dismissed all her claims to the Nevada Supreme Court.

The parties were all referred to the Settlement Program, but all opposed Nona Tobin’s claims being heard and did not participate in good faith.

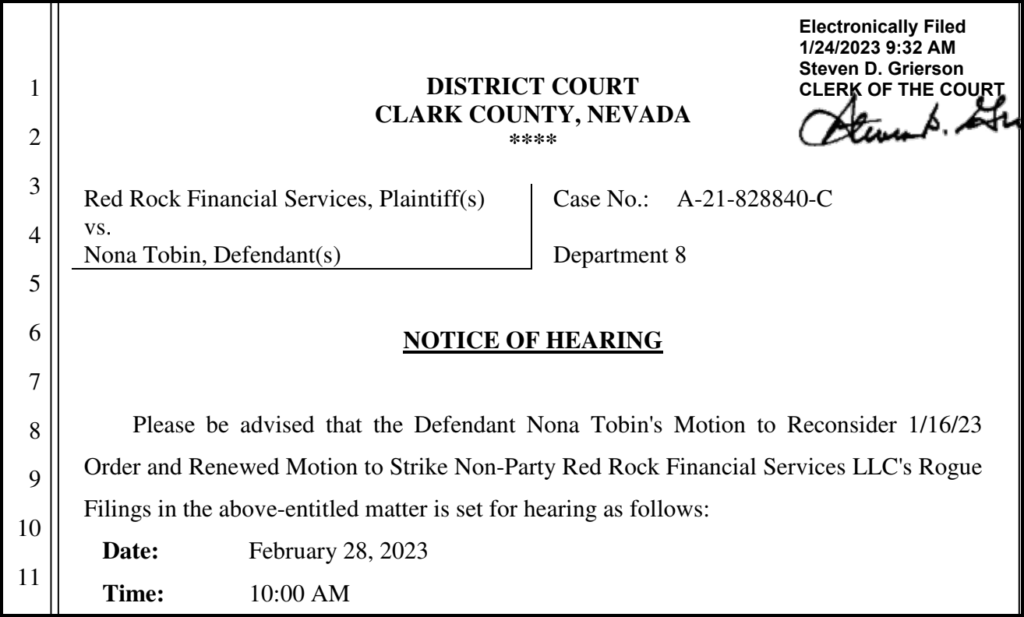

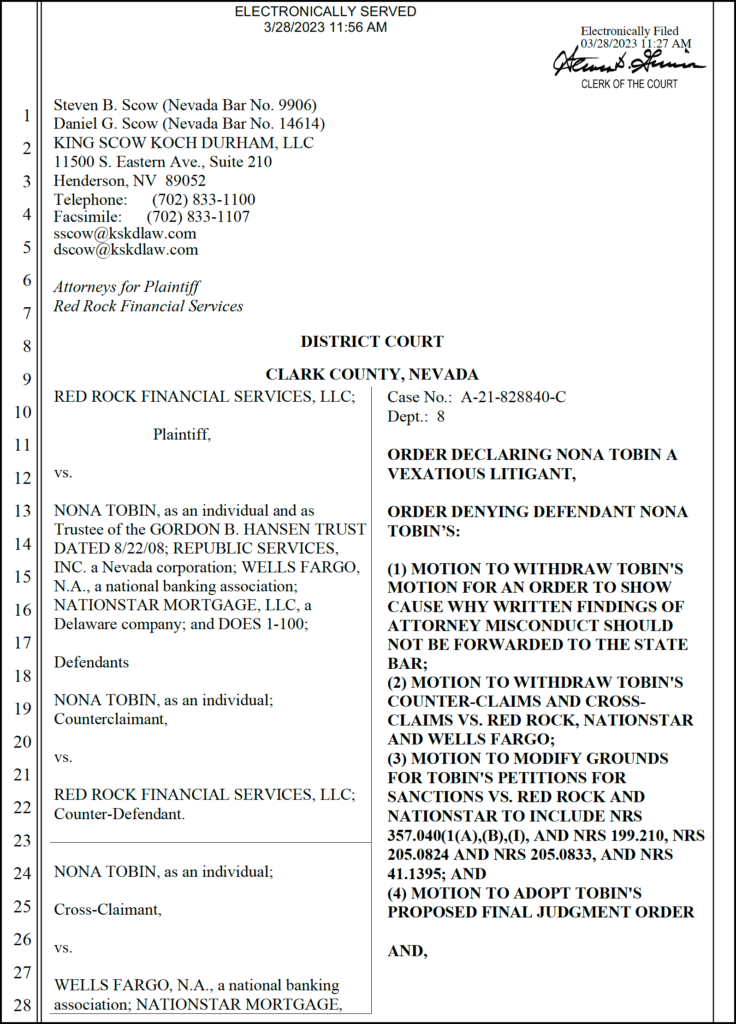

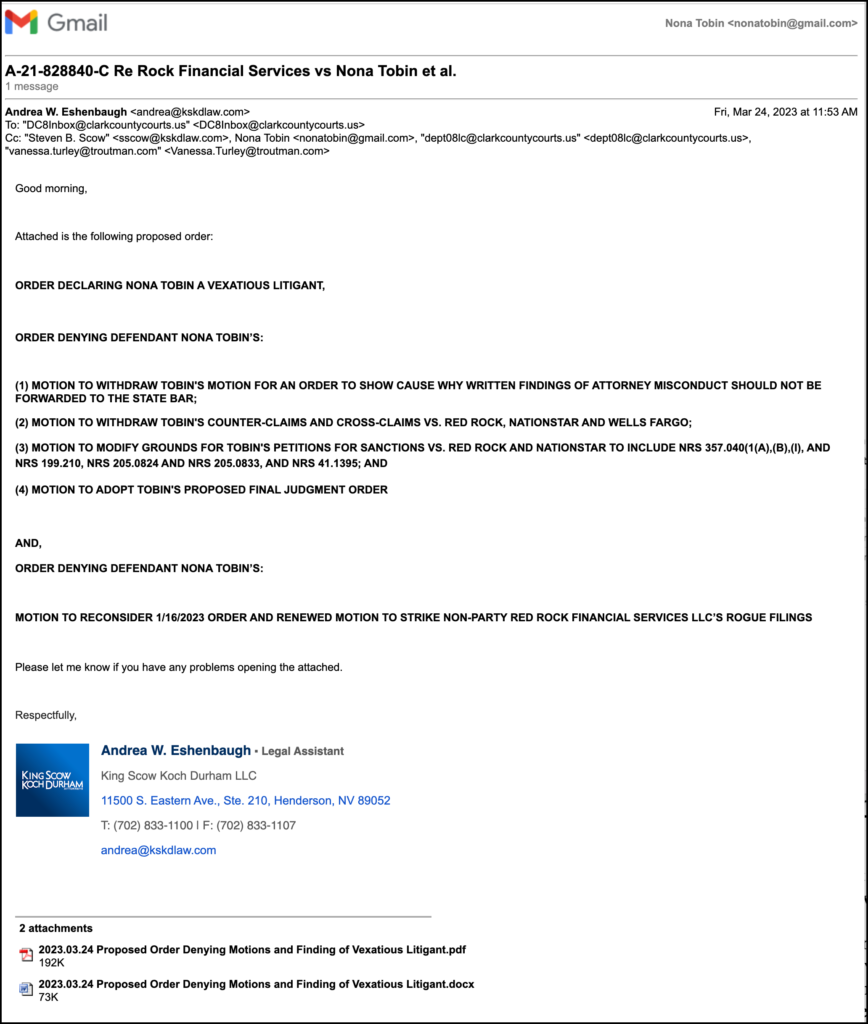

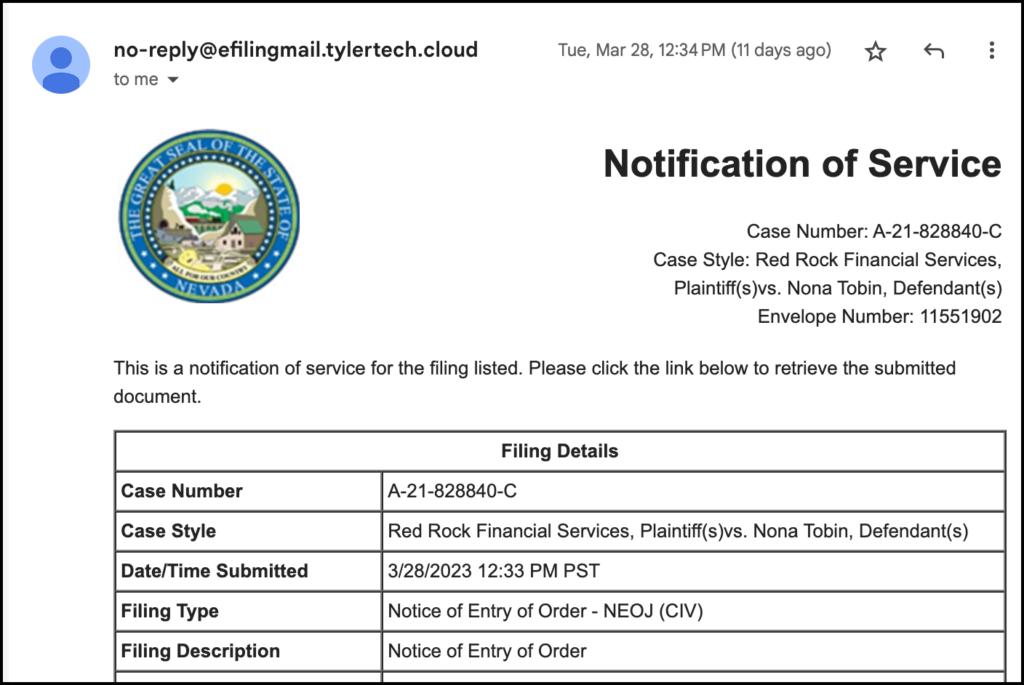

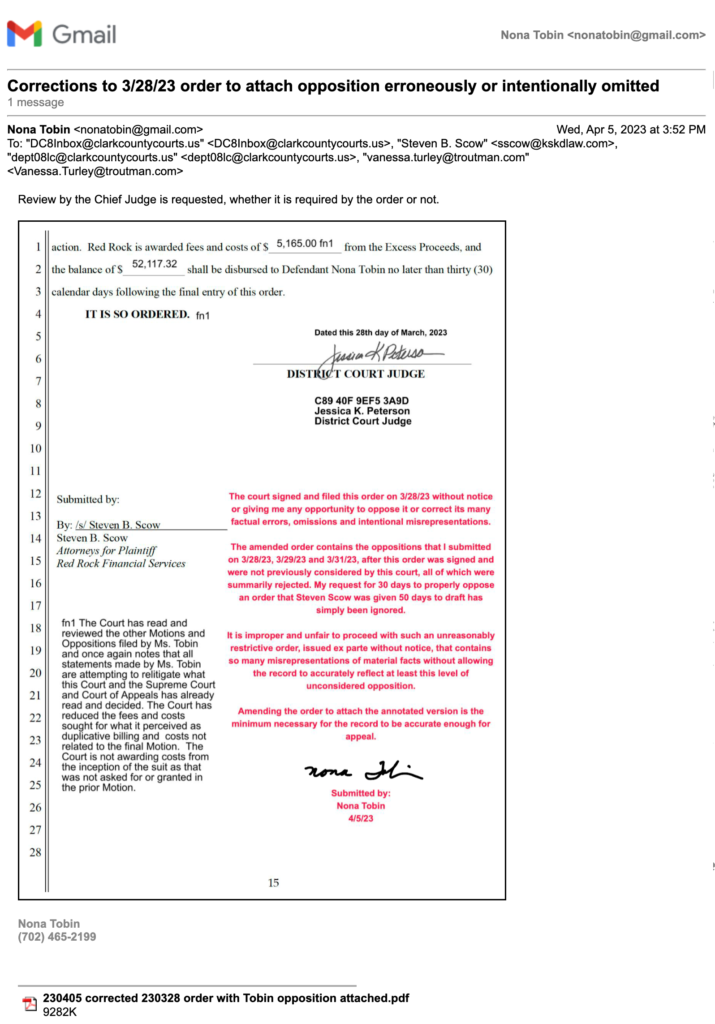

On 2/3/21 Red Rock electronically issued a summons to five defendants to initiate the instant unwarranted complaint for interpleader.

On 2/16/21 five defendants were served:

- Nona Tobin, as an individual

- Nona Tobin, as the trustee of the Gordon B. Hansen Trust, dated 8/22/08

- Republic Services, Inc.

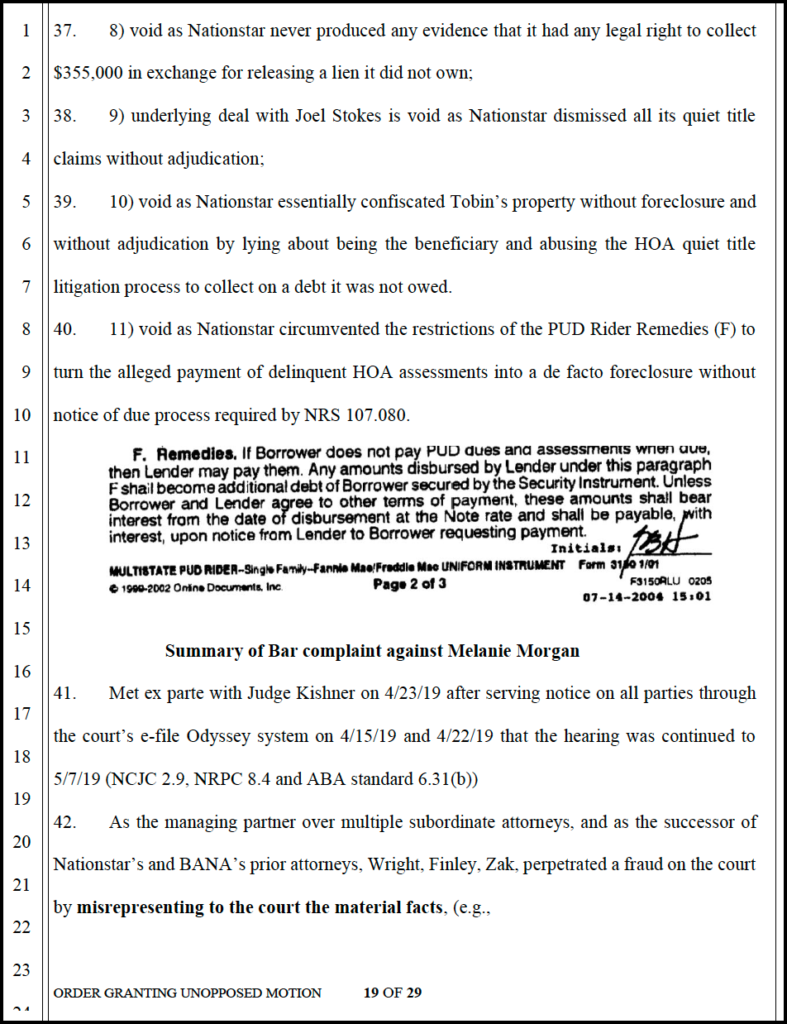

- Nationstar Mortgage LLC

- Wells Fargo, N. A.

On 2/17/21, Republic Services filed a disclaimer of interest.

On 3/8/21, Nona Tobin, an individual, filed and served on the parties in the Odyssey eFileNV service contact list, an answer, affirmative defenses, and counter-claim vs. Plaintiff Red Rock Financial Services and cross-claims vs. Nationstar Mortgage, LLC and Wells Fargo, N.A. See 3/8/21 Tobin AACC.

Tobin’s 3/8/21 AACC, Tobin identified that she was the sole defendant with a current recorded claim. See 3/15/21 Nona Tobin’s Request for Judicial Notice of the Clark County official property records for the subject property APN 191-13-811-052.

All other defendants’ liens have been released:

On 3/28/17, the Gordon B. Hansen Trust’s title claims were transferred to Nona Tobin, as an individual, when the transfer of Hansen Trust’s sole asset caused the Trust to be empty and closed. See 200705100001127 3/28/17 DEED Gordon B. Hansen Trust to Nona Tobin, an individual.

On 3/30/17, Republic Services released both its garbage liens that were recorded on 9/23/13 and 5/6/14. See 201703300003859 and 201703300003860 3/31/17 release of garbage liens.

On 3/12/15 Wells Fargo reconveyed and released the of Gordon Hansen’s second deed of trust. See 201503120002285 3/12/15 reconveyance release of Wells Fargo lien of 5/10/07 Hansen open-ended DOT

On 6/3/19, Nationstar Mortgage, LLC dba Mr. Cooper, released the lien of Gordon Hansen’s first deed of trust, recorded on 7/22/04. See 7/22/04 Western Thrift & Loan deed of trust (NSM 145-161) lien was released by 6/3/19 Nationstar reconveyance when Nationstar fraudulently reconveyed the property to Joel A. Stokes, an individual, instead of to the estate of the borrower.

On 3/22/21, Nona Tobin filed, but did not electronically serve, a third-party complaint vs. attorneys Steven R. Scow, Brody R. Wight, Joseph Hong, Melanie Morgan, David Ochoa and Brittany Wood that includes four causes of action: abuse of process, fraud, civil conspiracy, and racketeering. See 3/22/21 Third-party complaint vs. Steven R. Scow, Brody R. Wight, Joseph Hong, Melanie Morgan, David Ochoa and Brittany Wood includes four causes of action: abuse of process, fraud, civil conspiracy, and racketeering

On 4/4/21, Nona Tobin filed a Request for Judicial Notice of the unadjudicated administrative complaints and the unadjudicated civil actions related to this case. See 4/4/21 RFJN unadjudicated administrative complaints and civil claims.

On 4/7/21, Nona Tobin filed a Request for Judicial Notice of the Nevada Revised Statutes, Nevada Rules of Civ Procedure, Nevada Rules of Professional Conduct and Sun City Anthem governing documents germane to the instant action. See 4/7/21 RFJN of relevant laws & regulations.

On 4/9/21, Nona Tobin filed a Request for Judicial Notice of the NRCP 16.1 disclosures and subpoena responses from discovery in case A-15-720332-C and disputed facts in the court record. See 4/9/21 RFJN of evidence and false evidence in the court record.

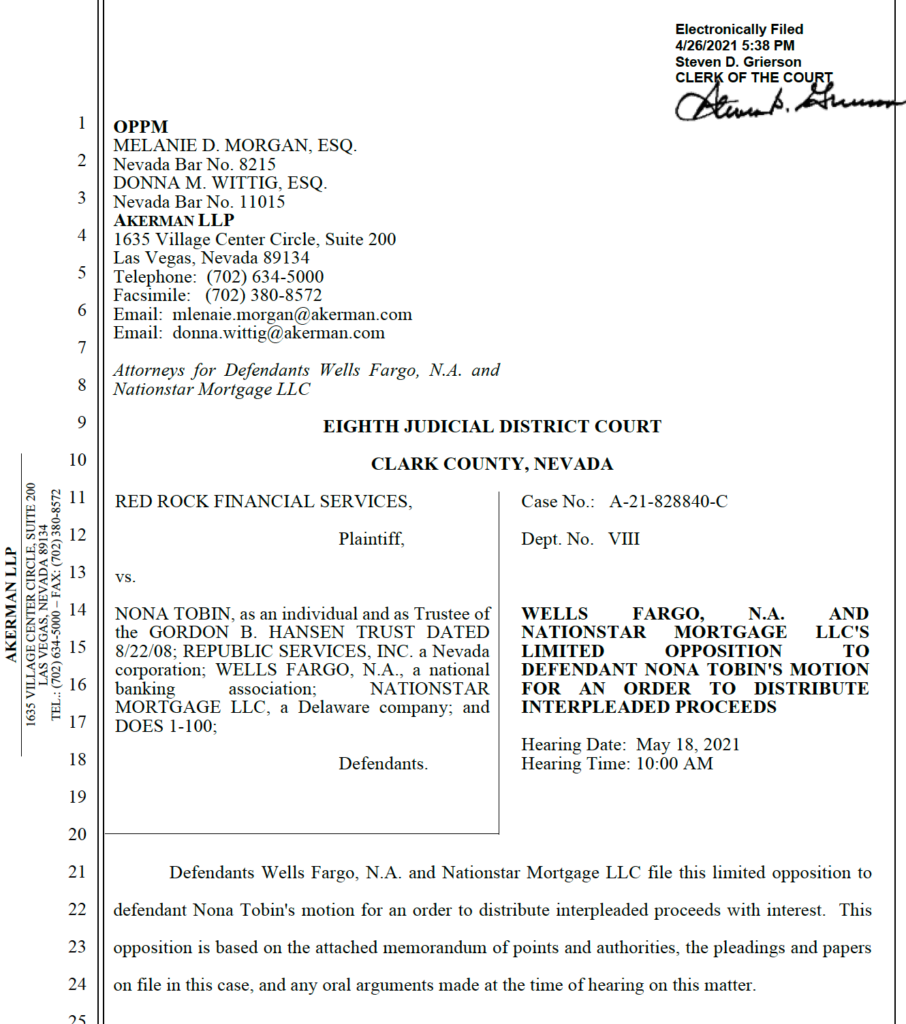

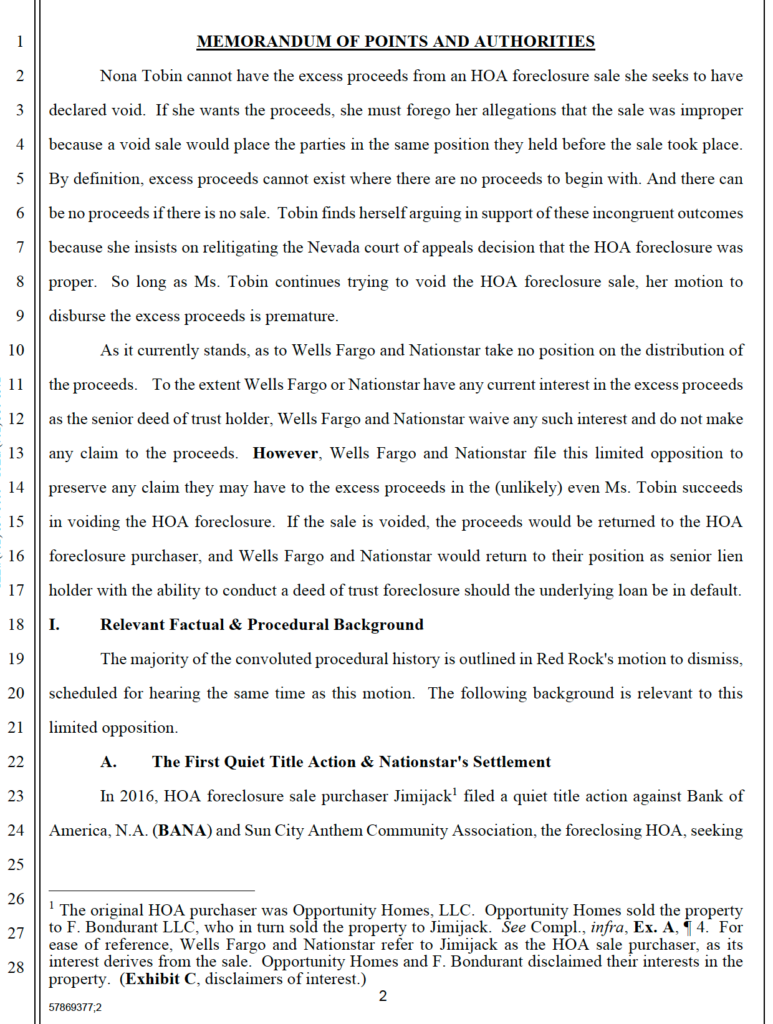

On 4/9/21, Melanie Morgan filed an answer to Red Rock’s 2/16/21interpleader complaint for Defendants Nationstar Mortgage LLC and Wells Fargo. See 4/9/21 Nationstar and Wells Fargo answer.

Nationstar Mortgage LLC’s and Wells Fargo’s 4/9/21 answer did not include any claim by either defendant bank for any of the proceeds.

Counter-defendant Red Rock Financial Services received service of Nona Tobin’s efiled and served 3/8/21 counter-claim through the Odyssey eFileNV system, but had not filed a responsive pleading as of 4/12/21.

Nona Tobin asserted five causes of action in her 3/8/21 counter-claim against Red Rock: 1) Interpleader: distribution of the proceeds plus penalties and interest; 2) Unjust enrichment and/or conversion; 3) Fraud; 4) Alter-ego piercing the corporate veil; and 5) Racketeering.

Nona Tobin efiled and served her 3/8/21 cross-claims Nationstar Mortgage LLC and Wells Fargo through the Odyssey eFileNV system on cross-defendants.

Cross-defendants Nationstar Mortgage LLC and Wells Fargo had not filed a responsive pleading as of 4/12/21 to Nona Tobin’s 3/8/21 counter-claim’s three causes of action: 1) Racketeering; 2) Unjust enrichment and/or conversion; and 3) Fraud.

On 4/11/21, Nona Tobin published the case details of this instant interpleader case A-21-828840-C on her blog www.SCAstrong.com. See Case Detail: A-21-828840-C Nona Tobin vs. banks, debt collectors & attorneys.

On 4/15/21 Tobin filed a motion for summary judgment as to her 3/8/21 counter-claims vs. Red Rock and cross-claims vs. Nationstar and Wells Fargo as no defendant filed a timely responsive pleading.

LEGAL STANDARD AND ARGUMENT

A. Proceeds SHALL be distributed after the sale.

The controlling statute for the distribution of proceeds is NRS116.31164(3) (2013) which defines the after-sale ministerial duties of the person who conducted the sale:

3. After the sale, the person conducting the sale shall:

(a) Make, execute and, after payment is made, deliver to the purchaser, or his or her successor or assign, a deed without warranty which conveys to the grantee all title of the unit s owner to the unit;

(b) Deliver a copy of the deed to the Ombudsman within 30 days after the deed is delivered to the purchaser, or his or her successor or assign; and

(c) Apply the proceeds of the sale for the following purposes in the following order:

(1) The reasonable expenses of sale;

(2) The reasonable expenses of securing possession before sale, holding, maintaining, and preparing the unit for sale, including payment of taxes and other governmental charges, premiums on hazard and liability insurance, and, to the extent provided for by the declaration, reasonable attorney s fees and other legal expenses incurred by the association;

(3) Satisfaction of the association s lien;

(4) Satisfaction in the order of priority of any subordinate claim of record; and

(5) Remittance of any excess to the unit s owner.

NRS 116.31164(3) (2013)

B. No legal authority exists to charge fees to distribute the proceeds.

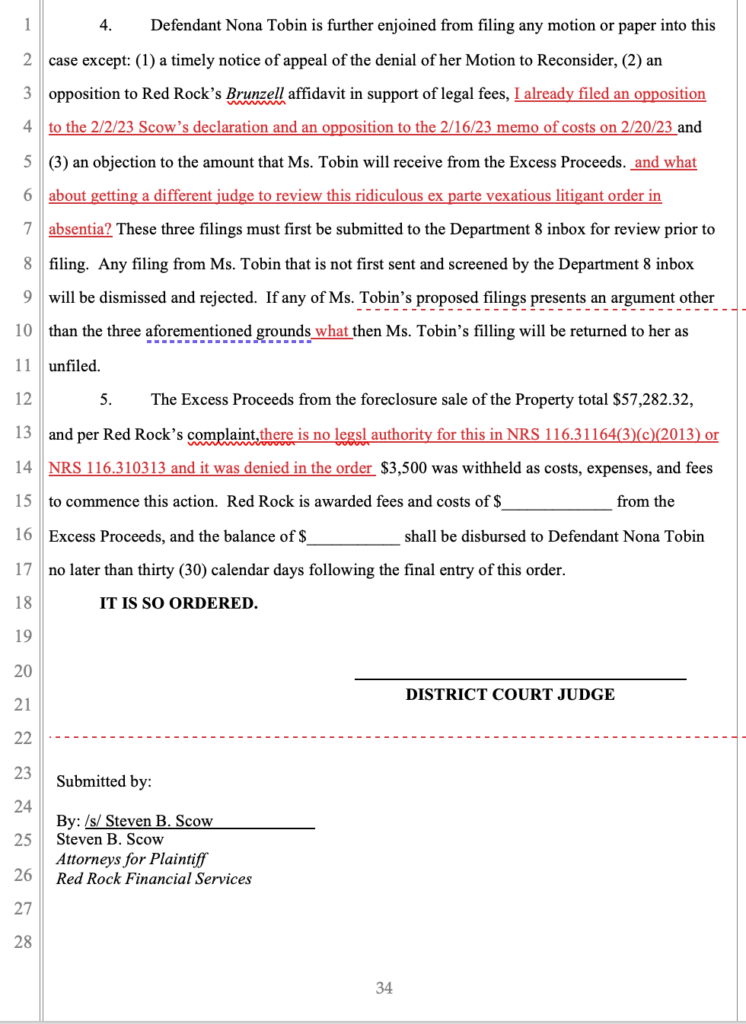

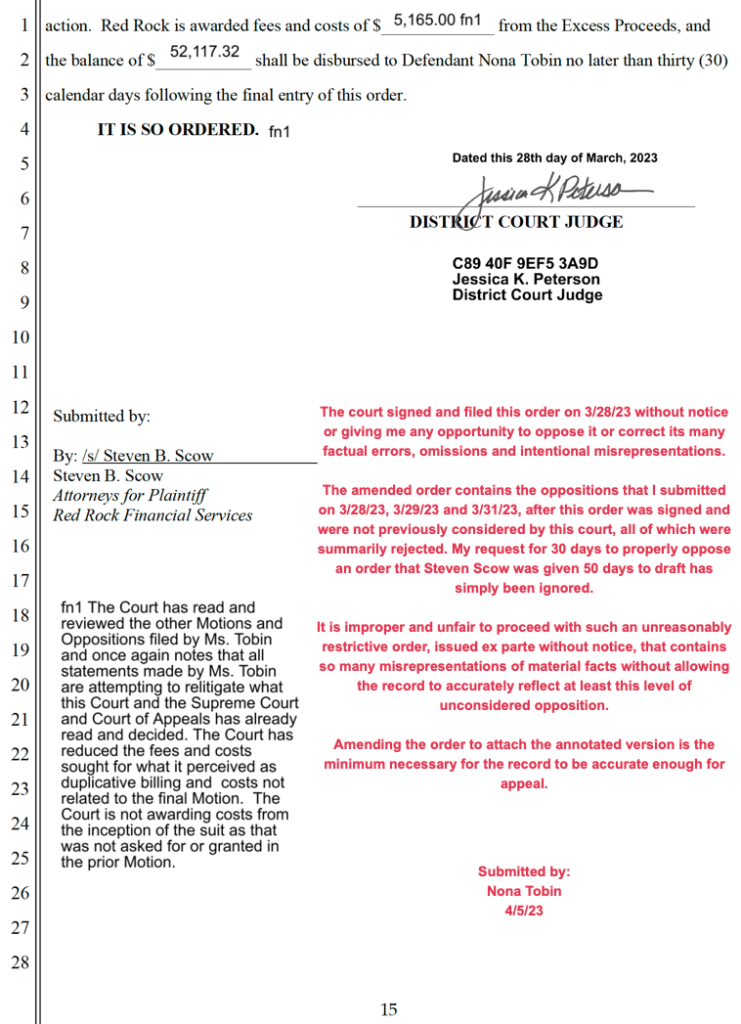

There is no legal authority in the controlling statute for Red Rock Financial Services to claim $3500 in fees for filing this interpleader action.

There was no legal authority for Red Rock, and/or its attorney Steven Scow, to retain the proceeds for over six years after the sale at all, let alone to charge for so doing.

There was no legal authority for Red Rock, and/or its attorney Steven Scow, to refuse to distribute the proceeds as requested by Nona Tobin personally to Red Rock in 2014, personally to Sun City Anthem in 2016, and by civil complaints in 2017 and 2019.

Red Rock should pay the proceeds to Nona Tobin with interest calculated at Nevada’s legal interest rate

- Pursuant to Senate Bill 45, the Nevada legislature and the Court Administrator established the legal interest rate to be applied in cases where there is no specific interest rate defined by contract, statute or judgment. See Nevada legal rate of interest table

- Using this table’s semi-annual rate changes and monthly compounding results in a total amount due to Nona Tobin is $87,115.31, of which $57,282.32 was the original principal that Red Rock identified as “excess proceeds”. See Interest calculation on both principal amounts.

- If the calculation is done based on the amount of the proceeds Red Rock actually unlawfully retained, the amount would be $91,855.11, of which $60,398.96 is the undistributed portion of the $63,100 proceeds from the 8/15/14 sale.

CONCLUSION

Red Rock Financial Services sold 2763 White Sage for $63,100 three months after Nona Tobin had sold it on auction.com for $367,500. Red Rock kept $60,398.96 without any legal authority for over six years while actively obstructing Nona Tobin’s ability to claim it.

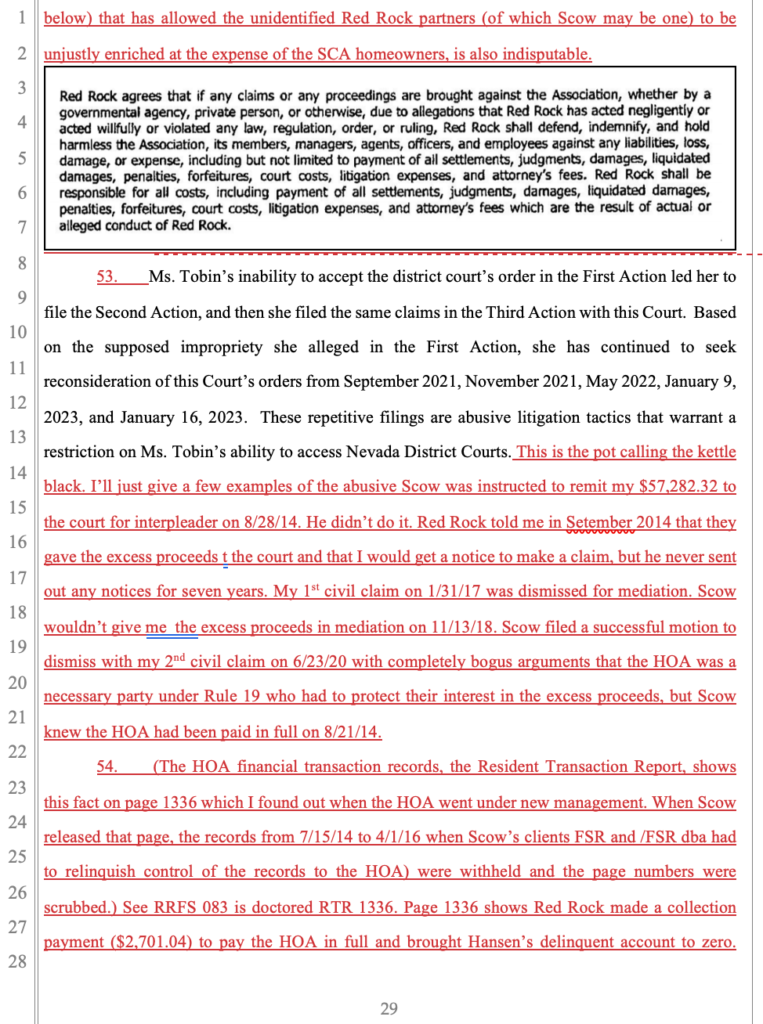

Red Rock’s egregious conduct in this case is part of a pattern and practice of corrupt business practices that has damaged many, many homeowners and Homeowners Associations in Nevada and other states in the nation.

Red Rock’s deceit was aided and abetted by multiple parties, two of which are named in Tobin’s 3/8/21 cross-claim and six who are named in her not-yet-served 3/22/21 third-party complaint.

Counter-claimant, cross-claimant and third-party plaintiff Nona Tobin will file separate motions to address the causes of action in the unanswered 3/8/21 counter- and cross- claims and in the as yet unserved 3/22/21 third-party complaint.

Nona Tobin will later move the court for an order to show cause why the relief requested should not be provided and why sanctions should not be imposed.

Defendant Nona Tobin respectfully requests in this instant motion that this Court address solely the issue of the distribution of proceeds by issuing an order for Plaintiff Red Rock Financial Services to pay Nona Tobin $91,855.11, of which $60,398.96 is the undistributed portion of the $63,100 proceeds from the 8/15/14 sale Red Rock alleges it received.

Such an order will completely resolve Plaintiff Red Rock’s interpleader complaint as there are no adverse claims and no “multiple liabilities” Red Rock could possibly face.