What’s up with the Ombudsman?

Several people have told me that their NRED complaints of GM election interference were summarily rejected without satisfactory investigation or explanation. They feel the rejections were unfair as the complaints were rejected for reasons unrelated to the substance of the issue raised.

For example, they reported that NRED did not independently verify the accuracy of the allegation that two pages of valid petition signatures were not counted which caused Bob Burch to be wrongly left off the recall ballot. I was told that NRED’s rationale for the rejection was the unrelated reason that the Ombudsman had validated the vote counting process for the other three directors who were on the ballot.

Limitations of enforcement agencies

We have to educate the NRED investigators on the specifics of the violations alleged in SCA owners’ complaints so investigators can understand the complaints within the context of needed homeowner protections.

We must not get overly discouraged even if it appears there is “zero enforcement” rather than “zero tolerance”. As we’ve seen nationally with response to sexual harassment complaints, that can change in a heartbeat.

NRED has all the problems faced by other enforcement agencies, like you’ll see below were exhibited by the SEC, – an inability to see the forest for the trees. Even if there is no corruption in NRED, they have limited authority, limited funding, and have to balance competing interests between monied stakeholders (attorneys, management companies, debt collectors, etc.) and the people who are supposed to be served (homeowners). NRED’s problems are compounded in Nevada by historic complicity in HOA corruption by attorneys and judges and the fear people have to speak up and be whistleblowers.

But, just as Rana Goodman helped to expose how guardianship abuses depended on complicity between attorneys and judges and unscrupulous public guardians, we have to shine a light on what is happening at SCA because Board/GM misconduct too requires lack of transparency and complicity by legal authorities to be sustained.

Why I am publishing my complaints in full

While I haven’t seen the other owner complaints or the rejection notices they received, this action by NRED raises a red flag for me. So far, I have received no word from NRED about the status of my complaints, but I am not willing to leave NRED’s investigative thoroughness to chance.

In light of this disappointing development, I am going to emphasize the way I use this website to expose evidence substantiating my claims. I am doing this primarily so the allegations and supporting evidence are in a usable format to assist the investigators. I believe that will reduce the chance that my complaints will be dismissed without a full investigation and a fair hearing.

As far as the chance of influencing the beliefs of the readers of this blog, I have low expectations. I don’t believe people who think I deserved what happened to me will easily change their minds, and when you read below about cognitive dissonance, I think you’ll see why.

What happened to me sets a bad precedent for ALL Nevada HOAs.

Kicking me off the Board was based on false and defamatory accusations and was simply a continuation of their retaliation against me for speaking out.

Such flagrant disregard of homeowners’ right to vote and choose who represents them on the Board absolutely cannot be tolerated or ignored.

Throughout my days on the Board, I was harassed, defamed and retaliated against for my having:

- recommended that the attorney be terminated,

- warned them about the theft and fraud of SCA’s former agents,

- requested information about excessive management compensation and for

- complained about violations of NRS and SCA governing documents, particularly in the areas of GM/CAM threatening frivolous litigation, abuse of privilege, misuse of attorney, concealing information and recall election interference.

If my removal from the Board is upheld, it will set the unhealthy precedent in Nevada that ANY majority of ANY Nevada HOA Board can remove any HOA Board member whose views they don’t like simply by falsely accusing her and then deeming her position vacant.

-

Good-bye, due process.

-

Good-bye, owner control of Nevada HOA.

-

Hello, unjust enrichment by attorneys and other HOA agents.

-

Hello, corruption.

Bernie Madoff’s Ponzi scheme

The Securities and Exchange Commission (SEC) let Bernie Madoff’s fake hedge fund grow to over $50 billion over decades despite repeated credible complaints.

Let’s hope NRED is more responsive than the SEC was to warnings and does not allow SCA Board, GM and attorney to act unlawfully in ways which allow SCA agents to be unjustly enriched or which allow a majority of a HOA Board to act unfairly for personal political advantage.

Remember Bernie Madoff?

Probably everyone does. Bernie was the former chairman of the NASDAC securities exchange. He had an impeccable reputation that allowed him to operate a hedge fund that grew over decades to $50 billion by 2008. Although it was a just a low-tech Ponzi scheme, it was successful as an affinity scam among wealthy Jewish communities, Madoff remained untouched by the regulatory Securities Exchange Commission (SEC) for decades.

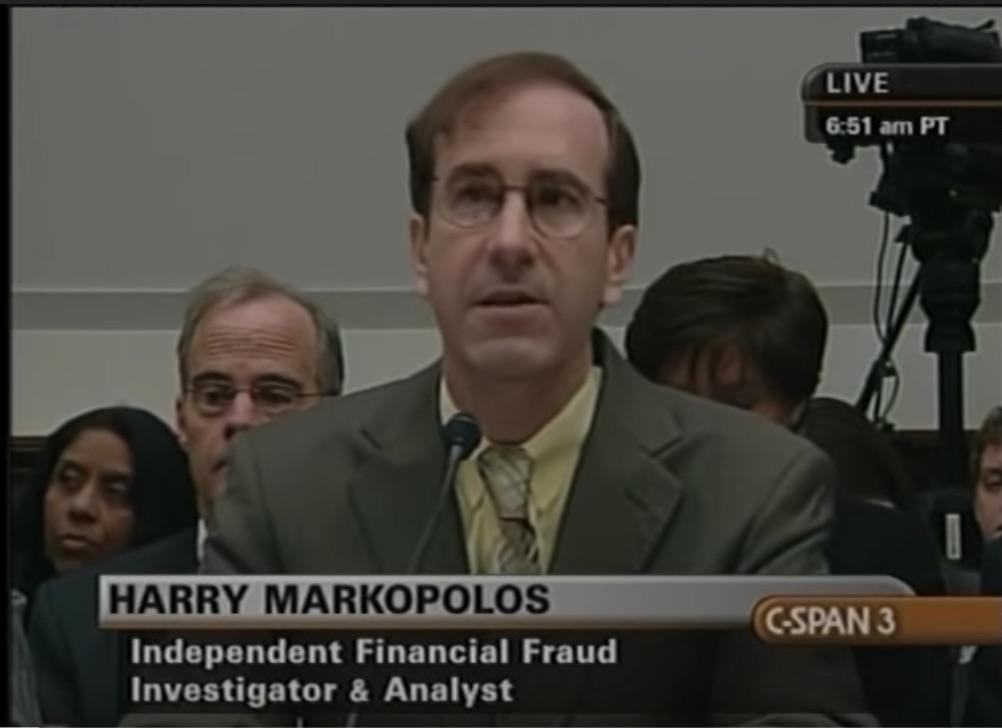

But you probably haven’t heard of Harry Markopolos, the financial analyst who figured out Bernie Madoff’s fraudulent hedge fund at least a decade before Bernie turned himself in. Marcopolis submitted at least five formal written complaints to the SEC which the enforcement agency failed to investigate.

Had SEC done its job in 2000 when Markopolos told them Madoff was a fraud, less than $7 Billion would have been lost, and many fewer people would have been victimized. SEC still didn’t listen in 2001 when the fund had doubled. SEC still didn’t listen in 2005 when Markopolos documented 29 red flags on the then-$25 Billion fund. In 2008 as the global economy was in meltdown, and the Madoff fund had ballooned to $50 Billion or more, Bernie turned himself in to spare his family, never having been investigated, much less found guilty, by the SEC.

Markopolos’ book is aptly entitled, “Nobody Would Listen: A True Financial Thriller” as the true story of how the regulatory agency SEC was over-lawyered and using lawyers in areas outside their expertise. SEC, therefore, did not have adequately trained investigators who knew diddly squat about financial markets.

The SEC failed to act repeatedly on Markopolos’ extremely precise directions on what sources to check or what single phone call to make and what question to ask to verify the accuracy of Markopolos’ analysis.

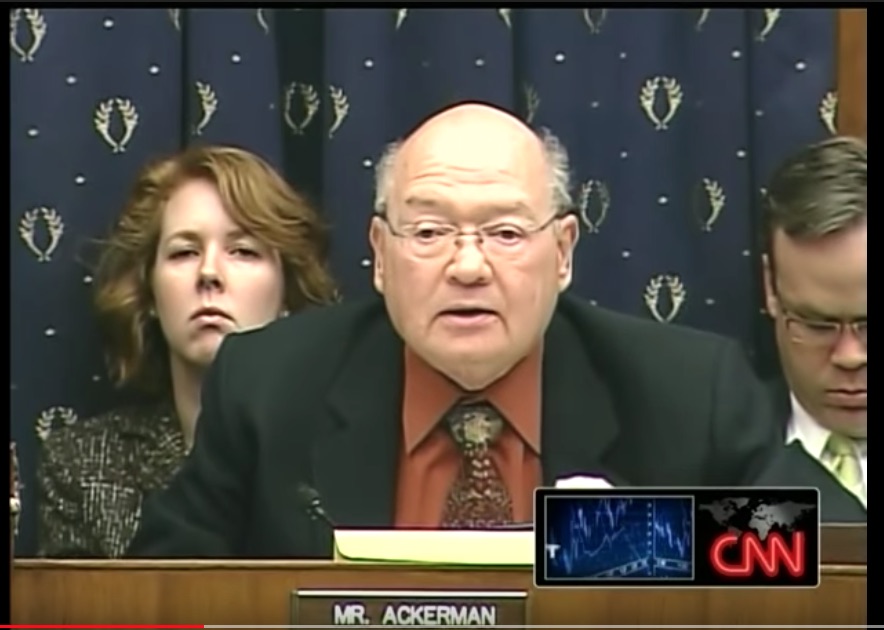

Why didn’t SEC investigate thoroughly? Congressman Gary Ackerman grilled SEC attorneys after Bernie turned himself in to find out why SEC blew off credible complaints for a decade in this interesting CNN clip of the Madoff Congressional hearings.

What were they thinking?

- Maybe lawyers were the wrong people were doing the job.

- Maybe it’s was the financial conflicts of interest regulators had with the industry they were regulating.

- Maybe the theory of cognitive dissonance explains why nobody could believe that Bernie Madoff was anything other than he appeared to be.

- Maybe Madoff’s reputation was so stellar and everybody was making money, no one wanted to question how he alone could get such stellar returns year after year.

- But, whatever the reason, SEC investigators couldn’t see what was right in front of their face.

How does all this about Bernie Madoff and the SEC relate to SCA owner complaints being given short shrift by NRED?

Remember SEC’s failures and expect to find similar problems with NRED investigations.

Remember the SEC’s failure to listen to Harry Markopolos for a decade cost victims $50 Billion, and the SEC attorney still tried to weasel out of it, claiming “executive branch privilege“.

Remember nobody believed Bernie Madoff was running a scam. If you find yourself not believing what I tell you is happening at SCA is true, it might be simply because it is unimaginable, or it might be because it creates a lot of cognitive dissonance to think I might be right.

Remember that, while there are limits on what we can expect enforcement agencies to accomplish, a lot can change if a critical mass of people speak up.

We’ve just seen nationally how the pendulum swings when a tipping point is reached. The way sexual harassment complaints are now addressed has gone from zero enforcement to zero tolerance seemingly overnight.

A critical mass of SCA homeowners must insist that at SCA, there will be zero tolerance of misconduct by SCA Board members or SCA Agents, and zero tolerance of their harassment of, or retaliation against, whistleblowers.

Comments are closed.